Xm fbs

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering.

Actual forex bonuses

Learn more here. All information collected from www.Xtb.Com. Last updated on 01/01/2021.

XM group vs FBS inc

If you're choosing between XM group and FBS inc, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, XTB, as another alternative to consider.

What would you like to compare?

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

XM group is regulated by the IFSC, cysec and ASIC. XM have provided forex, commodities, equity and indice trading services since 2009.

FBS inc is regulated by IFSC, CRFIN. FBS inc have provided forex, indices trading services since 2009.

XTB is regulated by the financial conduct authority. XTB have provided forex, CFD, and social trading services since 2002.

TRADING SERVICES OFFERED

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

Arabic, chinese, english, french, german, greek, hindi, hungarian, indonesian, italian, japanese, korean, malay, polish, portuguese, russian, spanish, swedish, thai, and turkish

English, spanish, portuguese, arabic, chinese, japanese, indonesian, malaysian, thai, urdu, and vietnamese

English, spanish, czech, chinese, german, french, italian, polish, portuguese, romanian, slovenian, turkish, arabic, and russian.

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by XM group and FBS inc

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

FUNDING METHODS

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

All information collected from www.Xm.Com. Last updated on 01/01/2021.

All information collected from https://fbs.Com/. Last updated on 01/01/2021.

All information collected from www.Xtb.Com. Last updated on 01/01/2021.

Since starting in 2009, XM group has opened over 300,000 trading accounts, establishing itself as an industry leader with a focus on customer service it offers support in over 20 languages. With its size and resources, its users have access to a wide range of expert advice to hep everybody in the trading world.

XM has oppened accounts in over 190 countries and is regulated by multiple regulators including cysec, ASIC, and IFSC. With 99.35% of trades executed in under a second and strictly no requotes and no rejections policy you can trade confidently with XM.

For more information about trading with XM, we have put together an indepth XM review with all the pros and cons about this broker.

Since starting in 2009 FBS have amassed over 700,000 traders located all around the world in over 120 countries. FBS attribute their growth to listening to their traders and providing them with what they asked for including 100% regular contests, 24 hour customer support five days a week, deposits and withdrawals in any currency, low minimum deposits, no requotes and split second execution of trades. FBS have quickly become world leading broker you can trust.

XTB provides hyper fast execution and facilitates seminars with external professional traders, providing personalised education depending on your individual circumstances.

XTB operates with two factors in mind; to provide traders with the fastest execution speeds and to be the most transparent broker on the market, which is reflected by the services and products they provide.

XTB also have a dedicated education area - the trading academy - which contains material to help you become a better trader, including video tutorials, trading courses, articles and much more to improve your skills at every step of your trading journey.

If you are looking for a broker that is regulated by the financial conduct authority and focuses on transparency, fast execution speeds and customer service, XTB is a great option.

For more information about trading with XTB, we have put together an in-depth XTB review covering the pros and cons of this broker.

Popular comparisons feat. XM group

Popular comparisons feat. FBS inc

Popular comparisons feat. XTB

Broker XM vs. FBS

When choosing a broker, it becomes quite tough as it has to be as per your unique requirements and how well they suit you with their services. You should consider many points before opting for a broker, like – if the broker is regulated? From how many years they are providing the services? Is the broker renowned? Are there any restrictions or penalties levied? Do they have a website? Is the broker listed publicly? What is the registered location for the broker? The list goes on.

We have answered all these questions for you in this article for the very famous brokerage houses, XM group and FBS inc.

Broker XM vs. FBS

XM group has 55 currency pairs, compared to 28 offered by FBS inc. However, FBS offers bigger leverage up to 1:3000 and XM up to 1:888. If you are looking out for a broker to satisfy your desires for having a vast range of instruments, you may opt for XM group. In contrast, if you are looking for a broker offering VIP accounts, FBS inc can be a good choice for you.

1. Regulations XM vs. FBS

If we compare broker XM vs. FBS, ASIC, cysec, and IFSC regulate the XM group, whereas ESMA and cysec, IFSC regulates FBS . The regulation part makes both the traders reliable and trustable among the traders.

2. Years in the market XM vs. FBS

It is always good to opt for a broker providing services in the market for a long time, as it increases their reliability, and you can be assured with quality services. Many brokers claim to give assured returns in a short period, but as a trader, you must apply your senses and choose the renowned one.

The broker should also have the services to provide a good risk management process to its clients; it helps clients save their money in crisis times. If we talk about XM vs. FBS, XM, and FBS, both have been in this business for the last eleven years, making both of them a lucrative choice.

3. Holding money account XM vs. FBS

While choosing a broker, you should be aware of the account where you are depositing the money; it should be different from how the broker uses itself for daily expenses and paying its staff.

Most of the brokers have a separate bank account to deposit clients’ money. In the case of XM vs. FBS, both follow this regulation and segregate bank accounts for clients.

4. The choice of investment bank XM vs. FBS

The investment banks that your broker chose to play an important role. If they are using goldman sachs, barclays, HSBC, JP morgan, etc., which are tier one banks, it is impressive and beneficial. Most of the tier one banks like HSBC are in the market for more than a century, in addition to that, they manage assets worth more than trillions; thus, they are trustable. Both FBS and XM use tier one investment banks.

5. Penalties or fines XM vs. FBS

It is a big red flag if the broker you are about to opt for has been involved in any illegal activities and has been penalized or fined. So, it becomes important to verify the background before choosing a broker, as it would affect you.

6. Popularity XM vs. FBS

People choose brokers that they think are reliable, so the more the popularity, the better it is in most cases.

7. Public listing XM vs. FBS

If a broker is registered publicly on a stock exchange platform, it is considered reputable and trusted. The reason behind it is the fact that in those cases, the broker would have to disclose the financial and company data to the public from time to time. However, XM and FBS are private companies.

8. The official location XM vs. FBS

If you notice, renowned brokers mostly have their headquarters situated in a significant capital city where there is a financial hub, for example, cyprus. The XM group is located at level 13, 333 george street sydney, NSW 2000, australia and no.5 cork street, belize city, belize, C.A, and the FBS inc vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus.

Features offered by the broker XM vs. FBS

The primary goal of choosing a broker is to have the features you want to ease your trading. Though if you are confused about it, here are three things that you can check on while selecting a broker.

- Instruments and services

If you are into forex trading, you can have this service at XM and FBS. At XM group, you can have more than 55 currency pairs, while FBS has around 28 currency pairs.

If you also want to trade other assets such as commodities (silver, gold, oil, etc.) or cryptocurrencies, XM can be a better choice as FBS does not have services for trading commodity products.

- Account type and selection of platform

At present, MT4 is a very famous trading platform, and if you are choosing a broker, you would obviously want to avail yourself of the facility to trade on such popular platforms. Well, XM group and FBS inc offer the facility to trade on this popular trading platform. They even have the latest MT5 platform.

Along with accounting platforms, account type is a crucial point, too. The account type you chose should accommodate your needs and preferences. There are various account types offered by FBS and XM.

You could choose from a standard account, mini account, or a VIP account if you chose FBS, while XM gives unique options such as an islamic account for muslim investors and traders. The reason behind this separate islamic account is the fact that it is prohibited to have interest or trade swaps points as per shariah law, which is taken care of here.

- Risk management, trading tools, and funding

Different traders have different trading styles like hedging, scalping, etc. Thus, you need to know before choosing a broker to let you trade in your trading style. Both XM group and FBS inc provide hedging and scalping trading styles. You can also have the services of expert advisors (eas) on both of these broker platforms.

For risk management, XM gives negative balance protection to prevent more debt towards the broker than the deposited amount. FBS does not have this facility. Other risk management tools include stop loss, price alerts, limit orders, etc.

The last thing on this list is funding, for which both XM and FBS use neteller.

The fee structure XM vs. FBS

Like the trading tools, the fee structure should also be analyzed to profit in the end, and it does not pay your broker. Many a time, there are separate fees for various tools and instruments.

The XM applies 0.10 points to trade EUR/USD, whereas FBS has lower charges for this instrument, making it more affordable. Many brokers charge for inactive accounts, deposits, and withdrawals, along with charging a commission. So, it would help if you did your own research before opting for a broker.

The bottom line: XM vs. FBS

According to diverse needs, you can choose a broker that fits you, and as a result, there is nothing like an ideal broker.

Overall, if we compare, XM definitely has more bonus points compared to FBS as it has more trading instruments, products, and risk management in place. Though both the brokers provide traders with a demo account to help them understand their services, you can try them before opting for one.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

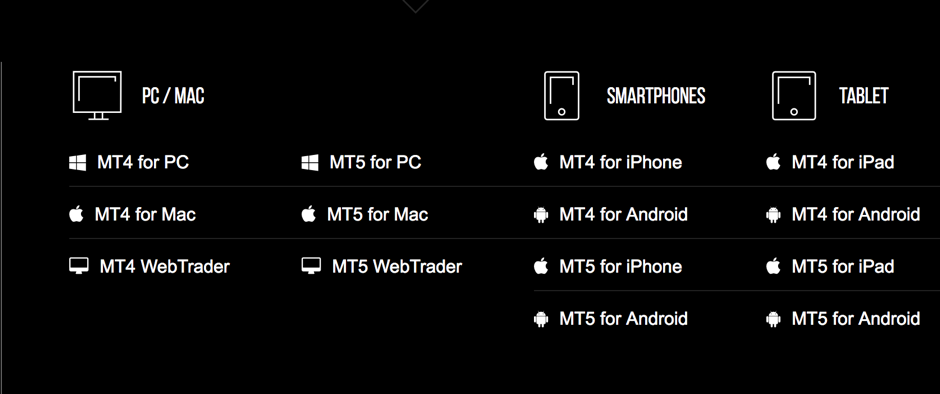

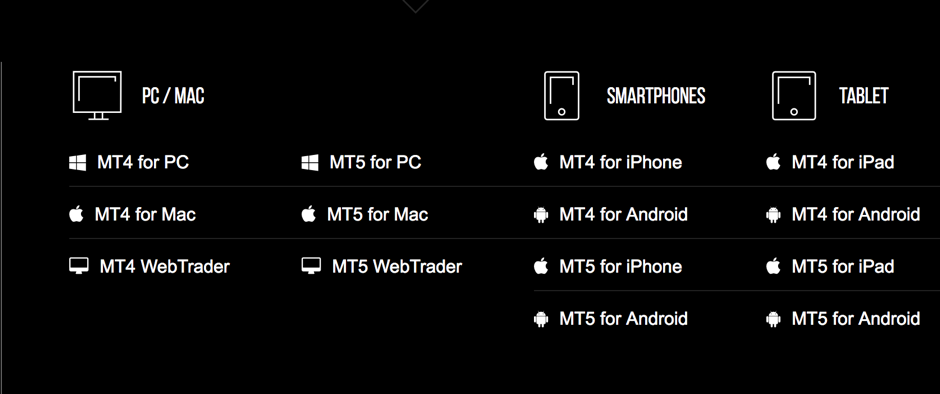

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

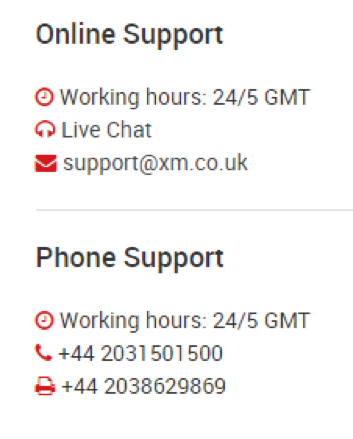

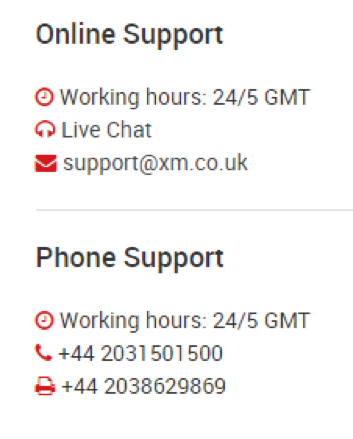

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM vs FBS 2021

Overview

FBS was founded in 2009 and since then has become one of the leading belize based brokers with more than 190 countries of presence, 16 000 000 traders, and 410 000 partners. XM was founded in 2009 as a cyprus-based forex and CFD broker, and it is regulated by cysec, and the british financial conduct authority (FCA). This broker was formerly known as XE markets and had several thousand traders around the world. The range of products offered by these forex brokers varies, and you’ll need to know more before choosing a broker that provides a wider range of tradable offerings, including currency pairs, indexes, commodities, shares, and cryptocurrencies, among others. Our comparative review of XM and FBS will help you choose the forex broker best suited to you.

XM

Features

- XM group was established in 2009. With a presence in 195 countries, XM group is one of the most popular online brokers registered by trading point holdings ltd.

- XM is a broker based in cyprus and provides excellent services for trading foreign exchange. It offers a wide choice of instruments, which include cfds on commodities, indices, currency trading, energies, precious metals, and stocks on metatrader 4 and metatrader 5. 99.35% of XM’s trades are executed within one second. It also provides attractive bonuses and promotions for its traders.

- XM is regulated by the cyprus securities and exchange commission (cysec). XM global limited was founded in 2017, and it is regulated by the international financial service commission (IFSC).

- XM is an award-winning broker backed by excellent research. It provides educational tools for all types of traders, starting from beginner, advanced, and intermediate users who have different expertise in trading, and it offers features that are up to date. XM publishes research, market overview, XM TV, trade ideas, technical summaries, and forecasts on its website for traders.

- At XM, all clients receive the same quality services, the same execution, and the same level of support regardless of net capital worth, account type, or size of the investment. All our

- This broker provides over 1000 instruments that cover forex, indices, commodities, stocks, energies, 55+ currency pairs, and precious metals. XM offers trading platforms that are globally recognized, like metatrader 4 and metatrader 5 for mac, PC, ios, web, and android systems.

- XM offers dow jones (US30) as cash and futures cfds. There is a 0.1% commission on the UK, french and german markets and a 0.04% commission on US markets.

- Cfds on over 100 US, UK, and germany shares are available to trade on the XM platform.

Awards

- Best customer service experience – global- awarded by global business awards 2020

- Best FX service provider for 2020 – awarded by city of wealth management awards 2020

- Best customer service global 2019 – awarded by capital finance international magazine (CFI.Co)

- Best market research and education global 2019 – awarded by capital finance international magazine (CFI.Co)

- Best FX service provider – awarded by city of london wealth management awards 2019

- Best forex customer service – awarded by shares magazine

- Best market research & education – awarded by capital finance international magazine (CFI.Co)

- Best trading support for 2017 – awarded by capital finance international magazine (CFI.Co)

- Best FX service provider for 2017 – awarded by city of london wealth management awards 2017

FBS

Features

- FBS inc is one of the most popular online brokers with a presence in more than 190 countries. This broker has more than several million clients across five continents and is a prominent name in the trading industry.

- FBS inc uses state-of-the-art technology on its website. FBS provides great trading conditions on both metatrader 4 and metatrader 5 trading platforms.

- Like many leading brokers who operate in the international markets, FBS is regulated in the european union through the cyprus securities and exchange commission. This allows clients flexibility in leverage and other benefits, which include loyalty programs and trading bonuses.

- Clients are provided maximum leverage of up to 1:30, and if you are a professional trader, you qualify for 1:500. By having an international subsidiary, FBS provides leverage as high as 1:3000 to its retail and professional traders.

- To provide the best customer experience FBS organizes seminars and special events, providing its clients with training materials, cutting-edge trading technologies and latest strategies on the forex market.

Awards

- Best FX IB program

- Best FX broker indonesia

- Best forex broker southeast asia

- Best international forex broker

- Best customer service broker asia 2016

- Best forex brand, asia 2015

- Best safety of client funds asia 2015

- Best broker in asia-pacific region 2015

- Best broker in the middle east

- Best forex trading account 2018

- Best copy trading application global – 2018

- Best forex broker asia-2018

- Best investor education – 2017

- Best FX IB program – china 2017

- The most progressive forex broker europe 2019

- Best forex broker vietnam 2019.

Comparison of pros and cons

Let’s take a look at the pros and cons of these brokers:

| XM | FBS | |

| pros | ||

| regulated by top-tier authorities like cysec, ASIC, IFSC | regulated by top-tier regulatory bodies like IFSC and cysec | |

| the minimum deposit is very low and provides demo account for its traders | minimum deposits are low and provide a demo account for its members | |

| offers attractive bonus and promotions | offers a variety of promotions | |

| provides negative balance protection | provides negative protection, and traders can use stop orders for minimizing the trading risks | |

| provides excellent trading platforms | FBS provides great live support | |

| cons | ||

| does not accept traders from the US, canada, and israel | provides limited trade instruments | |

Comparison – general features

| features | XM group | FBS |

| established in | 2009 | 2009 |

| headquartered in | cyprus | belize |

| minimum deposit | $5 | $1 |

| fees | ||

| inactivity fee | Y | Y |

| commission | N | N |

| deposit fee | N | N |

| withdrawal fee | N | N |

| minimum trade | 0.01 lot | 0.1 lot |

| maximum trade | 50 lots | none |

| account types | ||

| VIP account | N | Y |

| micro account | Y | Y |

| standard account | Y | Y |

| zero spread account | Y | Y |

| demo account | Y | Y |

| islamic account | Y | Y |

| funding methods | ||

| bank transfer | Y | Y |

| american express | N | N |

| credit card | Y | Y |

| neteller | Y | Y |

| skrill | N | N |

| paypal | N | N |

| bitcoin | N | N |

| trading instruments | ||

| forex | Y | Y |

| indices | Y | Y |

| majors | Y | Y |

| dow jones | Y | N |

| penny stocks | N | N |

| IPO | Y | N |

| FTSE | Y | N |

| energy | Y | N |

| metals | Y | Y |

| etfs | Y | Y |

| agricultural | N | N |

| bitcoin | N | N |

| other features | ||

| social trading | N | N |

| forex variable spreads | Y | N |

| price alerts | Y | N |

| scalping | Y | Y |

| fixed spreads | N | Y |

| hedging | Y | Y |

| limit orders | N | Y |

| stop-loss orders | Y | N |

| one click trading | Y | Y |

| trailing stops | Y | N |

| expert advisors | Y | Y |

| virtual private server | Y | Y |

| market maker | Y | Y |

| direct market access | N | N |

| trading signals | Y | Y |

| ECN broker | N | N |

| STP broker | N | Y |

Comparison – regulation and safety

XM

- XM is regulated by the australian securities and investment commission and also by the international financial services commission of belize.

- This broker is regulated by cysec, which provides a guarantee to clients funds. Clients funds are covered through compensation schemes. All their deposits with regulated brokers in cyprus are covered with 20,000 euros per client, and they are guaranteed by the investor compensation fund.

Risk warning – your capital is at risk. Between 74-89% of retail investor accounts lose money when trading cfds.

FBS

- FBS is regulated in cyprus by the cyprus securities and exchange commission(cysec) and the international financial services commission (IFSC) in belize. These licenses help this broker to service clients throughout the european union and around the world. FBS does not service a few countries like the US, japan, UK, canada, malaysia, israel, myanmar, brazil, and the islamic republic of iran.

- FBS provides european traders negative balance protection since it has obtained a cysec license in 2017.

XM brokers vs FBS – commissions and spreads

XM

Not all of XM’s trading accounts are available for fixed spreads. XM provides variable spreads; it offers commission-free accounts that are 1.7 pips on currency pairs like EUR/USD. Zero account spreads are averaged to 1.1 pips on currency pairs like EUR/USD. Trading costs on zero spread account amount to 0.8 pips, which includes commission. You can open a zero trading account with a minimum deposit of $100. As a market maker, XM group may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements, and no commission on trades.

FBS inc

This broker offers the following types of spreads –

- Fixed starting from 3 pip

- At FBS, the average spread for one of the most popular currency pairs, the EUR/USD, is 1 pip.

- Floating starting from 0.2 pip

- Trading without spread – the fixed spread of zero pip

- The value and the spread are determined by the account type used by the user

Comparison of XM and FBS – trading instruments

- XM has a wide range of CFD instruments that are available to trade on their platform. It offers 6 asset classes that can be traded in more than 1000 instruments. Some of the trading costs like spreads, overnight swap rates, and commissions vary depending upon the instrument being traded and the account type.

- FBS provides users around 75 trading instruments that include forex, energies, indices, stocks, and metals. Some of the trading costs like spreads, overnight swap rates, and commissions vary based on the instrument and the account type of the user.

Risk warning – your capital is at risk. Between 74-89% of retail investor accounts lose money when trading cfds.

Comparison of XM and FBS – account types

- XM provides the investors with 4 types of accounts, micro, zero, standard, and ultra-low, with low spreads. The micro account and standard account minimum deposit are $5. The zero accounts minimum deposit is $100 with the lowest spreads. A commission of $3.5 is charged for every $100,000 traded. Ultra-low account minimum deposit is $50 and allows the user to trade with micro or standard lots, and it also offers a lower spread.

- FBS provides five account types: standard account, cent account, micro account, ECN account, VIP account, and zero spread accounts for international investors.

- The standard account is for experienced users, and the cent account for beginners in the forex trading markets.

- Both FBS and XM offer an islamic account service.

FBS account types

XM brokers vs FBS – mobile trading platforms

- XM users can download trading platforms MT4 and MT5 from the google play store and apple app store.

- FBS also provides its users access to mobile trading through metatrader 4, metatrader 5; FBS trader mobile trading apps are available for both IOS and android devices. Links to the app can also be found on the broker’s website client portal area.

XM brokers vs FBS – leverage

Brokers provide leverage to customers so they can trade larger amounts than they have on deposit. Many people who start trading tend to go with brokers with the biggest leverage possible. They ultimately lose money when trading because of over-leveraging their accounts blowing them in a short space of time.

Leverage can be good in forex, though, so it just needs to be used wisely.

- XM provides flexible leverage of 1:1 to 1:500. By using leverage, the user can trade positions larger than the amount in the trading account. The leverage is always expressed in ratios like 1:50,1:100, and 1:500.

- FBS offers of up to 1:3000, and the user can execute orders by using this amount exceeding initial deposits that can make more money as profit with smaller investments.

Risk warning – your capital is at risk. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you can afford to take the high risk of losing your money.

Comparison of XM brokers vs FBS – trading platforms

XM

XM trading platforms

- XM provides both trading platforms MT4 and MT5. Metatrader 4 offers technical indicators, expert advisors(eas), advanced charting packages, and extensive backtesting options.

- According to various XM reviews , XM also provides a free virtual private server (VPS) for both existing and new users of XM. With a minimum deposit of $5,000 and they need to trade a minimum of 5 round turn lots a month. It allows VPN hosting 24 hours, 5 days a week.

FBS

FBS trading platforms

- FBS inc is an STP broker and offers its users metatrader 4, metatrader 5, and the mobile trading platform. Metatrader 4 is one of the most popular trading platforms because of its technical indicators, extensive backtesting environment, advanced charting tools, expert advisors. These features allow users to automate their trading. Metatrader 4 is available on desktop and mobile.

- FBS trader is the proprietary trading platform app available on android and IOS devices for all types of accounts.

Risk warning – your capital is at risk. Between 74-89% of retail investor accounts lose money when trading cfds.

XM brokers vs FBS – bonus and promotions

XM

Welcome bonus

- XM provides a deposit bonus of 15% as a welcome bonus account of up to $500 or currency equivalent

- The bonus is credited automatically and instantly

- Users can deposit more to maximize their bonus amount

- Available in metatrader 4 and metatrader 5 accounts

- This is a non-withdrawable bonus.

XM loyalty program

XM loyalty program offers rewards and incentives to users. It also offers a special seasonal bonus a few times a year available for a limited period. It also provides a highly exclusive bonus available only on an invitation basis.

Refer a friend

XM has a “refer a friend program” where you can invite your friends to start trading on the platform. You can earn up to $35 for each reference.

Free VPS services

XM provides free 24×7 VPS services. This eliminates downtime when you are trading on the platform. It also helps speed up trades ideal for eas.

FBS

FBS deposit bonus

Bonus and promotions

- Get a car from FBS

- FBS trader parties

- 100% deposit bonus

- Trade 100 bonus

- Cashback

FBS loyalty program

FBS provides “FBS loyalty program” whereby joining this program the traders have a chance to get silver, gold, platinum, or green status prices which includes rolex watches, a brand new car, or a trip to FBS headquarters. The users get the prices in exchange for the points earned by attracting new clients or by trading.

Free VPS

FBS inc provides free VPS, if the trader deposits $450 and trades 3 lots in the first month, they get a free VPS (virtual private server), and they can use it for free if they continue to trade three lots each month.

Comparison of deposit and withdrawal methods

- XM accepts several local payment methods, including credit card, debit card, neteller, skrill, bank transfer, and several more. The website accepts deposit and withdrawal transfer fees that are made through moneybookers, neteller, skrill, and all major credit cards like visa, visa electron, mastercard, maestro, and china unionpay. All withdrawals and deposits more than $200 are processed by a bank transfer, which is included in the zero fees policy

- FBS inc website provides a wide choice of deposit methods such as bank transfer, neteller, skrill, visa, sticpay, bitwallet, perfect money, and several more. All deposit methods are free of charge with the exception of instant deposits with sticpay, which charges commission. Withdrawal charges are based on commission, neteller withdrawal has a commission of 2%, skrill withdrawal has a commission of 1% plus $0.32 commission. Withdrawals through e-wallets are processed in 48 hours.

Risk warning – your capital is at risk. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you can afford to take the high risk of losing your money.

Comparison of education

- XM provides live education, platform tutorials, and videos. Webinars are offered seven days a week in 18 languages by several webinar instructors. The live education room is divided into basic and advanced rooms. They cover the trading session analysis, trading fundamentals, and a Q&A section. Users can access these rooms for free.

- FBS inc offers a wide choice of educational resources, including guide books, webinars, tips for traders, seminars, glossary sections, and video lessons. Online training courses guide new, intermediate, and advanced traders. Video lessons cover a wide range of topics for traders with different levels of expertise. It also hosts webinars that help users register for an online program.

Comparison of customer care

- XM provides customer support 24×5, and they can be contacted from monday through friday via email, phone, and live chat. They also offer customer support in english, simplified chinese, greek, traditional chinese, german, russian, french, spanish, italian, polish, arabic, portuguese, and romanian.

- FBS inc. Customer support can be contacted 24X7 through online live chat, call back service, facebook, telegram, and messenger in english, french, spanish, portuguese, malaysian, and arabic. Support covers issues regarding verification and registration, recovering and changing personal data, trading conditions, financial operations, trading platform, etc.

Wrap up

When it comes to forex brokers, you want to make sure that the broker you’re looking at is transparent and trustworthy. A market maker has information that is not available to anyone else in the general public, so aligning yourself with them will ensure the validity of the information you receive. Both XM and FBS are market makers and provide several features like different types of trading accounts, demo accounts, and excellent customer care. If you are an experienced trader, you can sign up with XM that offers low variable spreads, and choose to trade with metatrader 4 or metatrader 5.

FAQ’s

1. Which broker has lower trading costs and fees?

Both brokers provide low-cost trading opportunities equally. FBS charges withdrawal and deposit fees, while XM group charges inactivity fees but has lower non-trading fees.

2. Which broker is more reliable, XM group or FBS inc?

XM is the more reliable broker since it is regulated by the financial conduct authority, ASIC, IFSC, and cysec, and provides negative balance protection; FBS is regulated by IFSC, cysec and also provides negative balance protection.

3. What trading platform does each broker host?

FBS inc. And XM group host both metatrader 4 and metatrader 5. Features include one click trading, mobile trading, pending orders, and trailing stop-loss.

Investment advice – your capital is at risk. Trade with caution. These products might not be suitable for everyone, so make sure you understand the risks involved.

Risk warning – your capital is at risk. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you can afford to take the high risk of losing your money.

Xm fbs

Considering that spread is a trading cost, the lower the spread, the better it is for traders. However, spread information among brokers is not easy to get, as not every broker transparently publishes their spreads data.

However, traders can still choose their ideal brokers by the type of their spreads. The most two popular types of spread are fixed and variable. The pros and cons between the two spreads can vary for every trader. In this case, FBS provides their pricing with fixed while XM offers variable.

FBS vs XM: who hosts the best trading platform?

The trading platform is essential as you can't execute a trade without it. Additionally, trading platforms provide price charts and an assortment of analytical tools to help traders with their strategies.

To support their clients, FBS enables trading with metatrader 4 (limited with 45 days of inactivity). The offer is supported with mobile trading, one-click trading, trailing stop, pending orders. In comparison, XM provides trading with metatrader 4, metatrader 5 with the support of mobile trading, one-click trading, trailing stop, pending orders.

Is FBS or XM better in providing the trading instruments?

It is widely known that forex brokers offer other trading instruments other than currency pairs. The offer gives interesting choices for traders to explore other markets that may be proven beneficial for them and to diversify their trading portfolios.

In this case, FBS supports trading with forex, gold & silver, CFD, futures, while XM presents the ability of trading with forex, gold & silver, CFD, oil, cryptocurrencies.

In conclusion, deciding the better broker eventually comes down to your consideration. If you are an active trader, it is better to choose a broker with a variable spread that is generally lower than the fixed one. For the trading platform, metatrader 4 is the standard choice for every trader. But if you want to have a different experience with a more advanced platform, choose the broker that provides alternative platforms. The same goes for trading instruments; if you want to try delving into different markets, seek for a broker with more options on trading instruments.

Looking for more references? Here are other comparisons related to FBS and XM:

To add more insights in your exploration, we have gathered the most popular broker comparisons in our site, chosen by our visitors:

FBS or XM: which forex broker is better for beginners?

Choosing the best forex broker for a beginner is no trifling matter. A beginner trader should choose a forex broker that provides educational resources, low fees, and a user-to-user trading platform. The trader also should not underestimate the importance of legalities. Even the most beginner-friendly broker may take away all of your money needlessly if you are unaware.

Two of the most popular forex broker for beginners are XM and FBS. Due to legal constraints, they are not preferred by US traders. But the two are commonly chosen by beginners across asia and have quite a lot of fans in europe and africa as well.

So, how does the two forex broker compare? Which forex broker is better for a beginner? Let's examine their facilities and services in detail.

Educational resources

In terms of educational resources, XM wins hands down. Its learning center is full of live training, educational videos, forex webinars, and platform tutorials for beginner stage, intermediate, and beyond. Trader may choose to study at their own pace or following scheduled live webinars with XM experts, or both.

FBS provides a relatively simpler form of educational resources, consists of a guidebook and tutorials that focus on how to start trading with the broker's platform. There are also webinars and seminars that are usually held in cooperation with local ibs.

Forex trading fees

Forex trading fees comparison is rarely straightforward. One of the most pressing matter is that different forex brokers offer different account types. In the case of FBS and XM broker, this is even more prominent.

XM broker offers four account types: micro account, standard account, XM ultra-low account, and shares account. FBS provides five account types: cent, micro, standard, zero spread, and ECN account. Obviously, each account bears different spreads and commission fees.

Since this article aims to examine which forex broker is better for beginners, we will compare XM micro account against FBS cent account.

| Broker | XM micro account | FBS cent account |

| base currency | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | US cent |

| minimum initial deposit | $5 | $1 |

| forex spread | floating, starting from 1 pip | floating, starting from 1 pip |

| commission per lot | $0 | $0 |

| leverage | tiered, up to 1:888 | non-tiered, up to 1:1000 |

The main difference between both accounts is in the base currency of each account. By using US cent as the base currency, FBS enable account opening for lower deposit requirement. However, this difference is moot because you will need between $100-$500 to actually profit from forex trading. Trading fees between both forex brokers are also approximately similar.

Forex trading platform

Both XM and FBS equally rely on metaquotes-produced metatrader4 and metatrader5. Each is available for desktop, web, and mobile, with the addition of powerful multiterminal for metatrader4.

Metatrader4 and metatrader5 are quite standardized, so there is nothing that can be said better or worse here. As long as you could use metatrader, you will be able to trade with any broker without looking for tutorials again.

However, FBS might be more suitable if you are looking to explore copy trading (copying trades from professionals with a certain fee). FBS offers copy trading services directly from their proprietary mobile app. XM does not provide similar services on its platform.

Fund safety

In terms of legal guarantee for your fund safety, XM might be more reliable. The broker has received licenses from australian ASIC, UK FCA, cyprus cysec, dubai DFSA, aside from several other offshore licenses. On the other hand, FBS has registered under cyprus cysec and IFSC belize only (both are known as less reliable offshore regulatory agencies).

It also needs to be said that XM has a relatively better reputation among forex traders. FBS has repeatedly suffered under criticism of late withdrawal and treacherous bonus program. XM rarely award freebies and roadshow, but their long-time loyalty program has long hooked a lot of experienced traders.

So, which forex broker will you choose? If you are looking to play it safe, then XM might be the better option. But if you need the convenience of copy trading, then FBS should be more attractive. In either case, it is better if you start low. Make sure you could navigate around your chosen broker's services easily before making large deposits.

See more about them in extensive reviews about XM broker and FBS.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM indonesia, FBS, dan instaforex: rekomendasi broker untuk pemula

Tim edusaham

EDUSAHAM.COM — bagi sebagian trader XM indonesia tentu sudah tak asing lagi di telinga. Namun, bagi kamu trader pemula, kehadirannya mungkin terasa baru untuk kamu. Mencari seluk beluk dan mengetahui lebih banyak soal broker-broker trading dapat membantu kamu memperoleh banyak informasi serta referensi dalam memilih broker terbaik untuk trading. Berikut ini beberapa hal yang bisa kamu jadikan rujukan tentang broker tersebut.

Asal usul broker XM

Broker XM ini diketahui dikelolah oleh trading point of financial instrument company dan pertama kali diluncurkan pada tahun 2009. Layaknya beberapa broker lain, broker XM bermarkas di siprus, timur tengah. Meski begitu, broker XM sudah diakui keberadaannya dna legalitasnya oleh CYSEC yakni badan hukum lokal setempat sebagai platform resmi transaksi broker berbarengan dengan uni eropa. Ini berarti broker xm telah mengantongi izin dan transparan dalam pengelolaan uang klien melalui sistem mereka.

Tak hanya itu, broker xm juga memiliki program yang transparan, perlindungan terhadap data dan transaksi klien yang masuk ke sistem mereka. Hingga kini broker xm sudah memiliki lebih dari 100.000 akun yang menggunakan jasanya.

Pelayanan konsumen (customer service)

Selain aman dan terpercaya, broker xm menyediakan layanan konsumen yang aktif selama 24 jam dan 5 hari kerja selama seminggu. Dengan layanan ini, kamu bisa bertanya, berkonsultasi, dan meminta bantuan apapun dan kapanpun yang kamu butuhkan mengenai akun kamu. Layanan konsumen ini pun mudah dijangkau. Kamu bisa menghubungi layanan konsumen ini melalui email, online chat, atau telepon.

Profil perusahaan

Profil perusahaan penting untuk diketahui karena menyangkut legalitas izin dan profesionalitas perusahaan. Selain itu, mengetahui profil perusahaan juga berguna bagi kamu untuk memilih jenis akun mana yang akan kamu beli sebelum mulai trading.

#1. Memiliki izin dan regulasi yang lengkap

Kehadiran broker XM telah mendapatkan izin dan pengawasan dari lembaga-lembaga hukum serta keuangan secara global. Beberapa di antaranya ialah komisi keamanan dan pertukaran timur tengah cysec (cyprus securities and exchange commission), FIN lembaga keamanan finlandia, mifid (pasar instrumen keuangan directive), FSA (UK), FI (swedia), bafin (jerman), dan CNMV (spanyol).

Sehingga kamu tak perlu khawatir dana deposit kamu akan disalahgunakan oleh oknum yang tak bertanggung jawab. Karena selalu ada audit berkala dari badan keuangan tersebut untuk memastikan tidak ada kecurangan yang merugikan konsumen.

#2. Memiliki layanan dalam 18 bahasa

Keberadaan broker XM yang menyebar hampir di seluruh dunia ini tentulah dilengkapi dengan pelayanan yang mumpuni misalnya layanan konsumen dalam 18 bahasa. Mulai dari arab, bulgaria, cina, belkamu, ceko, inggris, perancis, yunani, jerman, indonesia, jepang, italia, polandia, melayu, rumania, portugal, slovakia, rusia, hingga spanyol.

#3. Transaksi di bank lokal

Selain keamanan dalam bertransaksi, broker XM juga menyediakan kemudahan dalam bertransaksi yakni dengan menyediakan kartu kredit sebagai alat mentransfer deposit ke akun kamu, misalnya deposit IB, neteller, fasapay, visa, mastercard hingga webmoney.

#4. Terdiri dari 3 jenis akun

Di broker XM juga menyediakan 3 jenis akun yang sudah disesuaikan dengan kebutuhan dan keinginan kamu sebagai trader pemula maupun profesional. Pilihan 3 akun itu ialah mikro, standard, dan eksekutif.

#5. Tipe broker

Tak hanya itu, broker XM juga menyediakan tipe broker ECN yang bisa dengan mudah dan cepat menyalurkan trading kamu ke pasar uang sehingga kamu bisa meraup keuntungan lebih cepat. Broker XM juga dikenal fleksibel dalam menggunakan strategi maupun teknik trading yang dikuasai oleh masing-masing trader tak terkecuali robot forex atau scalping.

Jenis-jenis akun broker XM

Berikut ini tiga jenis akun yang ditawarkan oleh broker XM indonesia sehingga bisa menjadi referensi atau rujukan bagi kamu dalam memilih akun broker. Ketiga akun ini ditunjang dengan bonus deposit sebesar 50% + 30%. Tentu sangat menggiurkan bagi kamu trader pemula.

#1. Akun mikro

Akun mikro ini memiliki ukuran lot mencapai 1.000. Lalu, XM indonesia deposit yang ditawarkan minimal 5 dolar AS. Selain itu, leverage-nya mencapai 1:888 dan tersedia pula pip mulai dari 1 pip.

Sementara itu, untuk pending order bisa mencapai hingga 200 posisi. Pada pembukaan lot setiap transaksi bisa mencakup hingga 100 lot. Akun ini juga tersedia versi bagi para pemula yang baru belajar trading.

#2. Akun stkamur

Untuk level trader profesional disarankan menggunakan akun stkamur, sebab, akun eksekutif ini menyediakan lot hingga 100.000, dengan deposit minimal 5 dolar AS. Sedangkan leverage yang disediakan mulai dari 1:100 dengan spread minimal 1 pip. Untuk open dan pending order mencapai 200 posisi dan maksimal 50 lot. Bagi kamu yang sudah mahir dan berpengalaman di forex akun ini cocok untuk melengkapi kebutuhan kamu saat trading.

#3. Akun eksekutif

Sama halnya dengan akun stkamur, akun ini ditujukan bagi kamu yang profesional dan mahir di trading. Dengan ukuran lot mencapai 100.000, leverage mulai dari 1:100, spread 1 pip, pending order dan open order minimal 200 posisi dan maksimum open lot 50. Sedangkan untuk minimal depositnya, akun ini dibuka mulai 100.000 dollar AS.

Keuntungan menjadi partner IB XM indonesia

Broker XM indonesia juga membuka kesempatan bagi kamu yang ingin menjadi partner setia broker XM. Keuntungannya, kamu bisa mendapatkan komisi dari usaha kamu mengajak orang lain untuk menjadi partner broker XM. Berikut ini keuntungan bergabung sebagai partner XM.

#1. Komisi yang menjanjikan

Untuk setiap usaha yang kamu berikan saat mengajak orang lain untuk bergabung menjadi bagian dari partner XM maka kamu akan mendapatkan komisi 25 dolar AS per klien yang kamu kenalkan ke XM. Selain itu, kamu juga akan mendapatkan hadiah sebesar 10% komisi dari setiap hasil yang didapatkan oleh klien kamu. Karenanya, semakin besar kamu memperkenalkan XM ke trader maka semakin banyak pula kesempatan kamu untuk meraup keuntungan melimpah.

#2. Komisis tanpa batas

Selain itu, dalam program ini tidak ada batasan komisi yang diberikan kepada kamu untuk setiap klien yang berhasil bergabung bersama xm. Selama klien masih menggunakan layanan XM saat trading maka XM akan memberikan komisi kepada kamu. Tidak bergantung pada batasan jumlah komisi.

#3. Penarikan setiap minggu

Untuk memberikan kenyamanan dan profesionalitas pada kamu, XM memberikan batas maksimal komisi yang bisa ditarik setiap minggunya. Pembayaran pun dilakukan tepat waktu sesuai dengan perjanjian dan ketentuan dari XM.

Rekomendasi 3 broker terpercaya untuk para trader indonesia

Selain XM, berikut ini tiga broker terpercaya lainnya yang bisa kamu pertimbangkan sebagai pilihan dalam bermain trading.

#1. FBS indonesia

Financial broker success (FBS) pertama kali diluncurkan pada tahun 2009 dan hingga kini telah tersedia di 190 negara. Financial broker success dinaungi oleh pengawasan regulator dengan nomor IFSC (international financial services commission) belize (nomor IFSC/60/296/TS/14) dan cysec siprus (nomor lisensi 331/17).

Hingga kini, financial broker success memiliki 13 juta trader dan bermitra dengan 370 developer dari berbagai negara. Setiap harinya, ada lebih dari 7.000 trader yang mendaftar menjadi mitra barunya. Maka tak heran financial broker success berkembang dengan cepat dan dikenal oleh hampir seluruh trader di dunia.

– perbedaan FBS dan XM

FBS dan XM adalah dua broker kamulan trader baik secara nasional maupun internasional. Sebagai pemula tentu kamu dibingungkan untuk memilih antara FBS atau XM, mengingat keduanya adalah broker paling direkomendasikan untuk para trader pemula. Berikut ini beberapa keunggulan yang dimiliki FBS dan XM sebagai perbandingan dalam memilih akun broker yang sesuai dengan kebutuhan kamu.

A. Transaksi bank

Pada broker FBS, mereka menyediakan transaksi yang mudah untuk trader di indonesia yakni dengan menggaet bank-bank lokal seperti BCA, BRI, BNI hingga mandiri sebagai alat pembayaran yang praktis. Sementara itu, jika pada broker XM kamu harus memiliki kartu kredit visa atau mastercard untuk bertransaksi.

B. Sistem keamanan

Broker XM indonesia memilih keamanan dan audit keuangan yang dilegalisasinya bisa dipercayakan di berbagai negara karena terbukti telah memiliki lisensi yang lengkap seperti komisi keamanan dan pertukaran timur tengah cysec (cyprus securities and exchange commission), FIN lembaga keamanan finlandia, mifid (pasar instrumen keuangan directive), FSA (UK), FI (swedia), bafin (jerman), dan CNMV (spanyol). Sementara itu, pada broker FBS hanya menggunakan lisensi dari satu lembaga keuangan saja yakni cysec.

C. Fix rate

FBS memiliki akun fix rate yakni rp10.000/dolar AS yang menjadi keunggulan tersendiri dibandingkan broker lainnya. Sedangkan broker XM tidak memiliki fasilitas tersebut. Meski begitu, broker XM memiliki konten riset yang lengkap dan edukatif. Seperti berita harian, riset kondisi pasar, seminat, hingga live streaming yang edukatif dilengkapi dengan 20 bahasa.

Hal ini tentu menguntungkan trader pemula yang masih membutuhkan waktu untuk untuk trading. Baik FBS maupun XM memiliki keunggulannya sendiri, kamu bisa memilih yang sesuai dengan kebutuhan dan kemampuan modal serta skill yang kamu miliki.

#2. Exness indonesia

Broker exness ini diluncurkan pada tahun 2008 sebagai penyedia layanan perdagangan forex, futures, dan CFD. Keunggulan exness dibandingkan broker lainnya ialah ia memiliki spread yang ciamik yakni mulai dari 0,8 pips. Broker asal rusia ini saat ini sedang mengembangkan peluangnya ke beberapa negara di asia seperti cina, malaysia dan indonesia. Hal ini sesuai dengan fokus pasar yang ingin mereka tuju yakni asia dan eropa timur.

#3. Instaforex

Berbeda dengan xm, broker yang satu ini merupakan bagian dari instaforex companies group rusia sebagai penyedia layanan trading online dari berbagai negara dan mulai diluncurkan sejak tahun 2007.

Saat ini para klien broker ini telah tersebar di 50 negara di dunia dan memiliki lebih dari 2 juta trader.

Selain itu, broker ini juga memberikan banyak kemudahan bagi trader pemula. Mulai dari deposit gratis, register yang mudah, hingga bonus-bonus lainnya yang tak didapatkan di broker-broker lain.

Ketiga broker ini bisa menjadi rujukan untuk kamu selain XM indonesia. Meskipun keempatnya memiliki keunggulan masing-masing, kamu bisa memilih salah satu di antaranya yang sesuai dengan minat dan skill kamu.

Well, itulah review tentang XM indonesia, mulai dari asal usul, layanan yang disediakan, profile perusahaan, jenis akun hingga keuntungan menjadi partner dari XM indonesia. Broker ini memang dianggap menjadi salah satu broker terbaik yang ada saat ini. Namun, pemilihan broker tetap ada di tanganmu. Sara kami, pilihlah broker sesuai dengan kebutuhan kamu. Semoga bermanfaat, ya.

FBS FX

海外FX会社 FBS FX

・FBS fx口座タイプ

・FBS fx入金・出金・・・確認済み。2021年の出金の記事もあります。

・FXのアフィリエイト報酬についてどれくらい?(2020年度の記事もありますので参考に)

・今まで使ったことのある口座(2021年)・・・管理人が実際に使ったことのある口座です。

・fbs fxで出金してみた

・一万円チャレンジまとめ(2021年度もチャレンジ中)

・FBS.Comのホームページへ

・他の海外FX会社(EXNESS おススメ、IS6FX)

fbs fxでロイヤリティプログラムが始動しました。記事で進捗も書いているのでサイト検索してみてください。(2019/7/21)2019/10/3より日本円の口座開設できるようになりました。スタンダート、マイクロ、ゼロスプレッドのMT4、MT5ご利用可能です。2020年度よりパートナーのティア報酬システムが廃止となりました。2020年も一万円チャレンジ口座でfbsfxの口座を使っているので取引結果なども載せていてビットウォレットを使って出金もできています。もう二年以上も使ってますが今のところ問題なし。

概要

【運営会社】parallax incorporated

【設立日】2009年

【国】ベリーズ

【ライセンス】IFSC(ベリーズ国際金融サービス委員会)、cysec(キプロス証券取引委員会)

※ベリーズのライセンスの方は比較的緩いです。キプロスは信頼できるので二つもあるのは評価できます。

【最大レバレッジ】3000倍(条件あるので気をつけましょう。FBS口座タイプに記載してきます。)

【日本語対応】あり(ありですが、HPでの日本語表記は少し分かりにくく、完全対応しているとは言えないと思います)

ゼロカット採用、信託分別管理(信託保全)を採用してます。

※これもXM(XMページで確認してください)と同じで日本人口座に対応しているかは定かではありませんので今後サポートセンターに聞く必要があります。下記に書いている通りFBSのなかにすべて含まれているなら対応してそうですが含まれていないなら信託保全されないケースも考えられますね。

こちらはHPの引用となりますが重要な情報です。

ホームページはFBSが運営をしております。

FBSは、FBS markets inc(登録番号119717)、parallax incorporated(VC0100)tradestone limited(353534)の取引名の三つから成り立っている。

規制:IFSC; ライセンスIFSC / 60/230 / TS / 17、no.1 orchid garden street、belmopan、belize、C.A.Cysec(キプロス証券取引委員会)、ライセンス番号:331/17。

ミャンマー、ブラジル、タイ、および日本の住民には、サービスはparallax incorporated(cedar hill crest、villa、kingstown、 st. Vincent and the grenadines、VC0100)によって提供されます。本サービスはFBS markets incによって提供されません。

Fbs fxは海外FXなので基本的には日本人に提供はしてないので自己責任ですね。

【取引時間】取引時間はメタトレーダーの時間で月曜0時に始まり、金曜23時59分に終わります。メタトレーダー時間は東ヨーロッパ時間(EET)です。東ヨーロッパ時間と日本時間の時差は約7時間です。EET2時(日本時間午前)9時に東京株式市場が開きます。そして、アジアの取引が始まります。

FBSのメリット・デメリット

- 複数の口座があり自分に合った口座を見つけやすい。全部で5口座あります。口座についてはこちらへ。

- 高レバレッジ(口座によって変わりますが500倍、1000倍、2000倍、3000倍)※レバレッジ 3000倍や2000倍には制限 あります。制限の説明は口座タイプの記事を読んでください。3000倍の制限は範囲が狭いので基本的に2000倍と思っておきましょう。

- ライセンスがあるので安全取引。(HP上では記載しているので二つ確認済み)

- 入金額が少なくてむ。bitwallet(ビットウォレット)も使用可能で即時反映(口座によりますが1万円から可能、100円でも可)

- 入金ボーナスなどが豊富(入金に対して100%を二回(最大20,000ドル))

- 追証なしの ゼロカットシステム を採用

- NDD方式(直接インターバンクに流れる)を採用( まだ約定が滑るとかは確認してません、 公式サイトでは約定は「95%以上のオーダが0.4秒以内」に行われると書いてました。)

2019/10/12現在では昔より約定がスムーズになったと実感してます。

2020年度パソコンでの取引ですがかなりスムーズです。 - 信託保全のはず。(日本人口座に対応は不明の為「はず」にしてます。XMのページで理由は記載してます。)確認対象ですね。

- リクオートなし(希望する価格での取引を拒否して、新たな価格を出すことです。)リクオートとは約定拒否と覚えて起きましょう。

- ロスカットは20%となってます。

- 日本語対応が完全ではないこと( まだサポートにメールなどしたことないのではっきりとは言えません )日本人スタッフは少なそうですね。※サポートにチャットしましたが日本語対応して頂きました。完璧な日本語ではないですが問題なく会話できました。英語ができるなら英語の方が円滑です。2018/3/1に確認済み

- 通貨ペア数は少ないです。2020年現在では少ないとは感じません。

- 入出金が海外送金のみ。国内銀行送金は非対応。しかしbitwalletあるので今のところは問題ありません。

- 円口座がない 。(円口座が2019/10に作られました)ドル、ユーロ口座のみです。(ドル口座の場合円で入金しても勝手に両替されて、為替手数料かかる)

※mybitwalletにて送金し円からドルの両替レート見ましたが、その時の為替レートかな?かなり良心的だと思います。 - 他の海外FXとの比較になりますが、ポジションを約定するときは他の海外FXより少し遅い印象です。2020年度現在は昔より約定も早くなっています。

- スワップ金利での持越しはマイナスであれば結構持っていかれます。

2019/10現在でも使ってますがマイナススワップが少し大きい感じはあります。

2020年度でも通貨によってはスワップ大きいので通貨をしっかり確認すべきです。 - 約定は遅め。検証済み(2018/5/10)昔より早くなった気がします(2020年度)

- マイページがたまに重たくなる時がある。もう少しサクサク動いてほしいですね。(2019/7/21)

2020年度マイページも一新されてます。

FBS FX口座開設方法

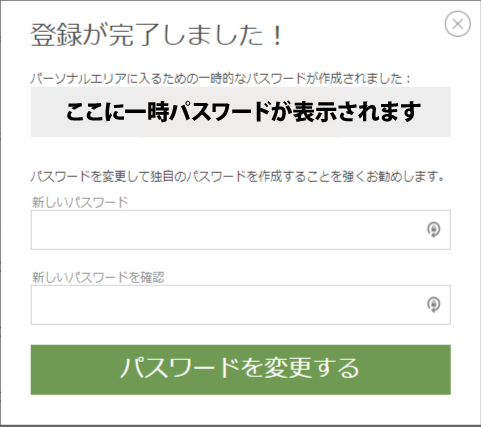

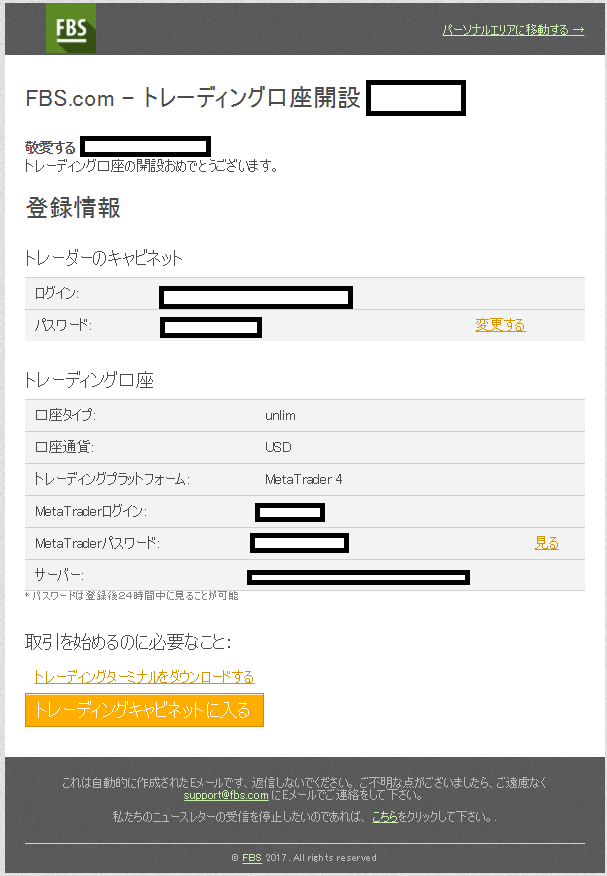

FBS FXの【公式サイト】を開きます。(※2018年時の口座開設方法ですので最新だと少し違う可能性がありますのであくまで参考程度に。)

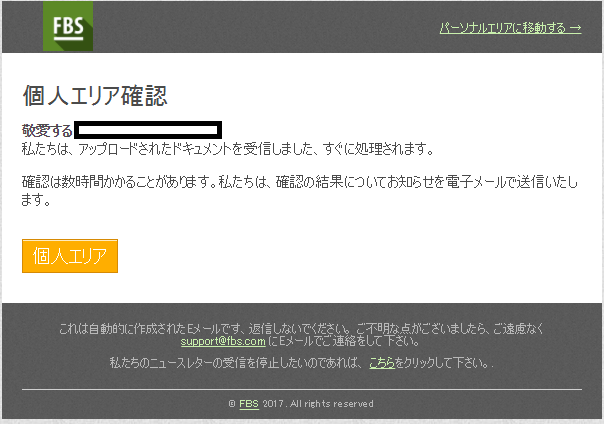

【登録】をクリックすると下記の画像になります。口座タイプは選択。口座作った後でも一つずつ口座を作ることも可能ですので気にしなくても大丈夫です。管理人の私はとりあえず四つ作りました。口座の種類を参照。フルネームは「ローマ字」で入力。通貨は円口座がないのでUSDかEURになります。

例:田中 太郎/taro tanakaとなります。Eメールに連絡が来ますのでしっかりと打ち込みましょう。

「登記の手続きを完了してください」をクリックします。所在国の確認ポップアップでます。「私たちはあなたの国を正確に判断しましたか?」みたいな文が出ます。正解なら「正解」をクリック

クリック後にマイページ(個人エリアに進みます)

マイページの設定で住所の登録をしておきます。

さらにFBS FXはボーナス、キャンペーンも豊富

2020/8/8 更新

現在行っているのは「trade 100 bonus」「キャッシュバック」「100%入金ボーナス」です。新たなキャンペーンや情報はFBSのホームページで確認してください。キャッシュバックについてですが1ロットあたり最大15ドルで利用期間、キャッシュバック額、実施期間は無期限です。キャッシュバックが付くのは一日の終わりに一気に付与される模様。個人エリアから可能ですがパートナー設定がされている方はメッセージを送る必要があります。パートナー設定している方は使えないのでどちらか選ぶ必要ありますね。

入金ボーナスについて

そしてFBS FXでは入金100%ボーナスも行っておりますので入金すればボーナス100%ゲットです。2019/8/14に初めて使ってみました。記事はこちら。

条件は以下の通りです。結構ややこしいです。(HPより引用&分かりやすいように書き加えてます)

- 100%入金ボーナスは、顧客の個人エリアでの要請(100%入金ボーナスボタンあります)に応じて自動的に顧客口座に入金され、ボーナスは顧客の最新の入金に付与されます。ボーナス資金は、取引プラットフォームの「クレジット」に反映されます。

- ECN口座は100%入金ボーナスを使う事はできません。

- BTCUSDの取引ツールはプロモーションに参加できません。

- この100%入金ボーナスは必要なロット数が取引された後、取引口座から引き出すことができます。

パートナー(IB)がない顧客の場合、取引することが必要なロットの数は次の計算になります。

米ドル換算の入金額(=ボーナス額)/3=出金の必要取引数(ロット)

(セント口座の場合は、1ロット=0.01スタンダードロット)。

例えば:900ドルの入金の場合

100%入金ボーナスは900ドルとなります。

900/3=300ロットパートナー(IB)がある顧客の場合、取引することが必要なロットの数は次の計算になります。

米ドル換算の入金額(=ボーナス額)/1=出金の必要取引数(ロット)

(セント口座の場合は、1ロット=0.01スタンダードロット)。

例えば:900ドルの入金の場合

100%入金ボーナスは900ドルとなります。

900/1=900ロット - 複数の口座で100%入金ボーナスが受け取られた場合、すべてのボーナスが合計され取引できます。

- ボーナス資金はマージンコール(40%未満)とストップアウトレベル(20%)の計算に含まれていません。

- 取引口座の残高または評価預託残高がボーナス額の30%未満の場合、ボーナスはキャンセルされます。

- 取引口座がパートナー(IB)から切り離されている場合、現在のボーナスはすべて自動的にキャンセルされます。

- 必要なロット数が取引されると、顧客は個人エリアでボーナス資金の引き出しを申請することができます。

- ボーナスの最高額は2万米ドルまでとなります。

- ボーナス口座の最大レバレッジは最高500倍となります。

- FBSは、当社の一方的な規定に基づいて、事前の通知なしてプロモーションの条件、賞品の種類と名称の一部の変更、または完全にキャンセルをする権利を有します。当社は、顧客が賞品獲得に係る違反行為又は違反行為の疑いがある場合、事前の通知なしに、参加者を失格とする権利を留保しています。

- 当社は、直接的または間接的に顧客のプロモーションへの参加に影響を及ぼす可能性がある、顧客側および第三者側のサービスにおける技術的な混乱若しくはインターネット接続の切断などについて、責任を負いません。

サポート、スプレッド、ロイヤルティプログラムについて

サポートについて。2018/2/28

ライブチャットさせて頂きました。(ちなみに私は英語が全くできません。)

英語がおぼつかない感が出ていると日本語の担当の方へ変わりますと言われ丁寧な対応してくれました!!その方の日本語はとても丁寧です。丁寧過ぎてこっちが「すみません」となるくらいです。日本語でのコミュニケーションは十分です。今回は私のミスがあり入金についてだったんですが即対応。信頼できるように感じました。

スプレッドに関して。2018/12/19更新

グットフライデーの時に少しだけXMと比べさせて頂きました。ドル円はほとんど同じですが私が見ていたNZDUSDは2銭ほど差がありましたね。約FBSが5.0~6.0、XMがその瞬間6.5~8くらい。閑散相場なのとあまり手を出さない通貨を見たつもりでしたが、ここまで違うとは思いませんでした。ドル円のスプレッドはXMの方が上でした。ですが、比較したときは一瞬ですので、ちゃんとしたスプレッドチェックできるものを使い見る必要がありそうです。一瞬での話なので。それでもスプレッドは全体的にXMに有利か。

2018/8/24 スプレッドがXMと同じくらいになってる気がします。(日常のチャート時)、12/19ユーロドルのスプレッドは低く感じます。

2019/6/2 やはりユーロドルを取引するならFBSを使った方がいいです。

FBSロイヤルティプログラム

ロイヤリティプログラムについて 2020/12/16更新

・一年間取引したロイヤルティプログラム結果についての記事

・2019/10月時点の途中経過

投稿でも進捗を書いてますので検索をかけて頂ければと思います。

2020/12/16現在 今年もランクは上がらずグリーンのままで更新

2020/8/8 ランクはグリーンのままです。

2019/10 ランクはグリーンです。

FBSにて本格的に取引をしてみようと今回思い、改めて公式ホームページにて情報を見てみると新たにロイヤリティプログラムというのを行っているのですぐに参加してみました。簡単に説明すると「取引するときなどにポイントを獲得できる」そのポイントを使いいろいろな商品やサービスの質を上げることができるというものです。ステータスは四つ「グリーン・シルバー・ゴールド・プラチナ」からなってます。ランクを上げるには「総計入金額/顧客の売上高を増やす事によりステータスポイントを獲得!」とのことです。シルバーランクになるのにステータスポイントを300ポイント、15000ドル(1,650,000円(一ドル110円で計算した場合))の入金またはパートナー売り上げが4万ドルとなってます。ステータスポイントはlot毎(開始価格と決済価格の差は59ポイント以上必要)につくのでそのうちなりますが基本的に一年でリセットされる感じなようなことを書いてましたので一気に入金しても取引は必須です。今後はこれを使ってどうなるか見ていきたいです。

so, let's see, what we have: is XM or FBS inc better? Well, it depends on whether you trade forex, crypto, indices or stocks, and what features matter to you. Compare XM and FBS inc (and another popular alternative) in this up-to-date comparison of their fees, platform, features, pros and cons, and what they allow you to trade in 2021 at xm fbs

Contents of the article

- Actual forex bonuses

- XM group vs FBS inc

- What would you like to compare?

- TRADING SERVICES OFFERED

- PLATFORM & FEATURES

- ACCOUNT INFORMATION

- TRADING CONDITIONS

- RISK MANAGEMENT

- FUNDING METHODS

- DETAILED INFO

- Broker XM vs. FBS

- 1. Regulations XM vs. FBS

- 2. Years in the market XM vs. FBS

- 3. Holding money account XM vs. FBS

- 4. The choice of investment bank XM vs....

- 5. Penalties or fines XM vs. FBS

- 6. Popularity XM vs. FBS

- 7. Public listing XM vs. FBS

- 8. The official location XM vs. FBS

- Features offered by the broker XM vs. FBS...

- The fee structure XM vs. FBS

- The bottom line: XM vs. FBS

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM vs FBS 2021

- Overview

- XM

- FBS

- Comparison of pros and cons

- Comparison – general features

- Comparison – regulation and safety

- XM brokers vs FBS – commissions and spreads

- Comparison of XM and FBS – trading...

- Comparison of XM and FBS – account types

- XM brokers vs FBS – mobile trading platforms

- XM brokers vs FBS – leverage

- Comparison of XM brokers vs FBS – trading...

- XM brokers vs FBS – bonus and...

- Comparison of deposit and withdrawal...

- Comparison of education

- Comparison of customer care

- Wrap up

- FAQ’s

- Xm fbs

- FBS vs XM: who hosts the best trading platform?

- Is FBS or XM better in providing the trading...

- FBS or XM: which forex broker is better for...

- Educational resources

- Forex trading fees

- Forex trading platform

- Fund safety

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM indonesia, FBS, dan instaforex: rekomendasi...

- Asal usul broker XM

- Pelayanan konsumen (customer service)

- Profil perusahaan

- #1. Memiliki izin dan regulasi yang lengkap

- #2. Memiliki layanan dalam 18 bahasa

- #3. Transaksi di bank lokal

- #4. Terdiri dari 3 jenis akun

- #5. Tipe broker

- Jenis-jenis akun broker XM

- Keuntungan menjadi partner IB XM indonesia

- Rekomendasi 3 broker terpercaya untuk para trader...

- FBS FX

- 海外FX会社 FBS FX

- FBSのメリット・デメリット

- FBS FX口座開設方法