100 lots forex

Most forex traders that you come across are going to be trading mini lots or micro-lots.

Actual forex bonuses

It might not feel glamorous, but keeping your lot size within reason relative to your account size will help you preserve your trading capital to continue trading for the long term. If you have had the pleasure of reading mark douglas' trading in the zone, you may remember the analogy he provides to traders he has coached, which he shares in the book. In short, douglas recommends likening the lot size that you trade and how market moves would affect you, to the amount of support you have under you while walking over a valley when something unexpected happens.

Choosing a lot size in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-483658563-5756fd9e5f9b5892e8e0da65.jpg)

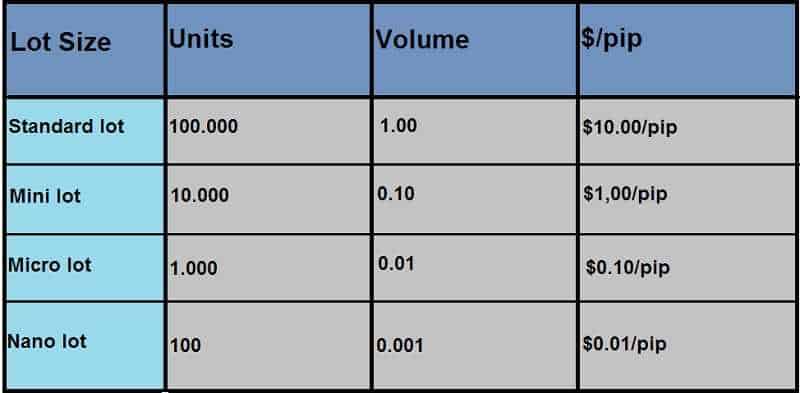

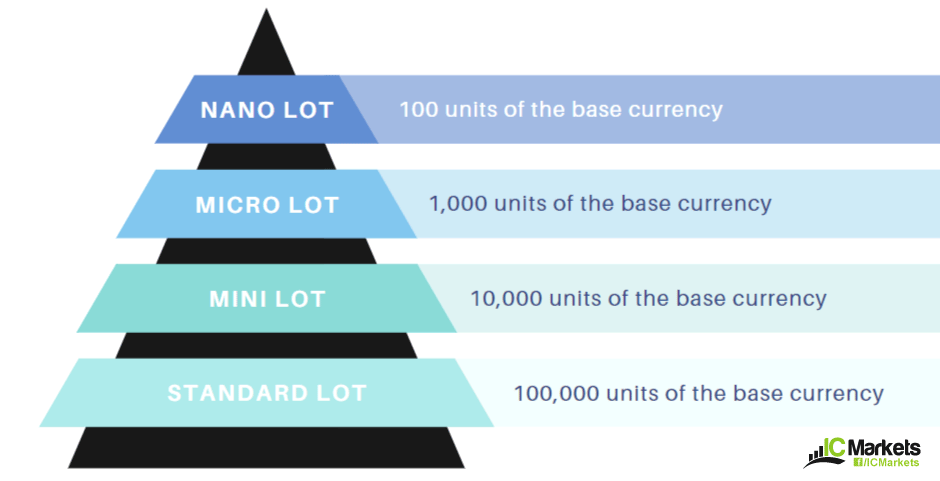

When you first get your feet wet with forex training, you'll learn about trading lots. In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. it is important to note that the lot size directly impacts and indicates the amount of risk you're taking.

Lot size matters

Finding the best lot size with a tool like a risk management calculator or something similar with a desired output can help you determine the best lot size based on your current trading account assets, whether you're making a practice trade or trading live, as well as help you understand the amount you would like to risk.

The trading lot size directly impacts how much a market move affects your accounts. For example, a 100-pip move on a small trade will not be felt nearly as much as the same 100-pip move on a very large trade size.

You will come across different lot sizes in your trading career, and they can be explained with the help of a useful analogy borrowed from one of the most respected books in the trading business.

Trading with micro lots

Micro lots are the smallest tradeable lot available to most brokers. A micro lot is a lot of 1,000 units of your account funding currency. If your account is funded in U.S. Dollars, this means that a micro lot is $1,000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents. micro lots are very good for beginners that want to keep risk to a minimum while practicing their trading.

Moving up to mini lots

Before micro-lots, there were mini lots. A mini lot is 10,000 units of your account funding currency. If you are using a dollar-based account and trading a dollar-based pair, each pip in your trade would be worth about $1.00. If you are a beginner and you want to start trading using mini lots, make sure that you're well-capitalized.

While $1.00 per pip seems like a small amount, in forex trading, the market can move 100 pips in a day, sometimes even in an hour. If the market is moving against you, that adds up to a $100 loss. It's up to you to decide your ultimate risk tolerance. But to trade a mini account, you should start with at least $2,000 to be comfortable.

Using standard lots

A standard lot is a 100,000-unit lot. that is a $100,000 trade if you are trading in dollars. Trading with this size of position means that the trader's account value will fluctuate by $10 for each one pip move. For a trader that has only $2,000 in their account (usually the minimum required to trade a standard lot) it means a 20-pip move can make a 10% change in account balance. So most retail traders with small accounts don't trade in standard lots.

Most forex traders that you come across are going to be trading mini lots or micro-lots. It might not feel glamorous, but keeping your lot size within reason relative to your account size will help you preserve your trading capital to continue trading for the long term.

A helpful visualization

If you have had the pleasure of reading mark douglas' trading in the zone, you may remember the analogy he provides to traders he has coached, which he shares in the book. In short, douglas recommends likening the lot size that you trade and how market moves would affect you, to the amount of support you have under you while walking over a valley when something unexpected happens.

To illustrate this example, a very small trade size relative to your account capital would be like walking over a valley on a very wide, stable bridge where little would disturb you even if there was a storm or heavy rains. Now imagine that the larger the trade you place the smaller and riskier the support or bridge under you becomes.

When you place an extremely large trade size relative to your account balance, the bridge gets as narrow as a tightrope wire, such that any small movement in the market would be like a gust of wind in the example, and could send a trader the point of no return.

Lot size in forex – what is it and how to calculate it?

A lot is the smallest trade size that you can place when trading the forex market

What is a lot? A lot is the smallest available trade size that you can place when trading the forex market. The brokers will point to lots by parts of 1000 or a micro lot. You have to know that lot size directly influences the risk you are taking.

Hence, finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size. It has to be based on the size of your accounts. No matter if you exercise or trade for real. You must understand the amount you would able to risk.

In the stock market, lot size refers to the number of shares you buy in one transaction.

In options trading, lot size signifies the total number of contracts contained in one derivative security. The theory of lot size allows financial markets to regulate price quotes.

It basically refers to the size of the trade that you make in the financial market. With the regulation of prices, investors are always aware of exactly how many units they are buying an individual contract. Hence, they can quickly evaluate what is the price they are paying for each unit.

As it is already written in our previous post, currency movements are measured in pips and depending on your lot size a pip movement will have a different monetary value.

How much is 1 lot?

In forex, 1 standard lot refers to the volume of 100.000 units. So when you buy 1 lot of a forex pair, that means you purchased 100.000 units from the base currency.

Assume that you want to buy EUR/USD and let’s say that the EUR/USD exchange rate is 1.10.

When you buy 1 lot of EURUSD you will be making $110.000 worth of purchase.

If you are using leverage on your broker you don’t need to have $110.000. With 1:100 leverage, you will only need $1.100 (110.000 / 100 = $1.100) in order to be able to execute the order.

When the leverage goes higher, the margin you need to open the trade goes lower.

For example, if you are using 1:500 leverage, you need only $220 (110.000 / 500 = $220) to buy 1 standard lot of EUR/USD.

For 1 lot or standard lot, worth of one pip is equal to $10 if USD is on the counter currency in that pair. Therefore, if EUR/USD goes upwards for 100 pips after you buy, you will make $1000 of profit.

Every trader must define the volume of the trades based on own risk perception. The bigger lot means bigger the profit/loss from the trades.

Of course, it is reasonable sometime to open trades under 1 lot using the mini lot, micro lot and nano lot.

Mini lot size

Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses.

Mini lot is equal to 10% of standard lot (100.000 x 0.10 = 10.000 units). Thus, when you open 0.10 lot, you will trade 1 mini lot. With every mini lot, the worth of 1 pip for EUR/USD equals to $1.

If you are a novice and you want to start trading using mini lots, be well capitalized.

$1 per pip seems like a small amount but in forex trading, the market can move 100 pips in a day, occasionally even in an hour. If the market moves against you, that is a $100 loss. To trade a mini account, you should start with at least $2000.

Micro lot size

Micro lot is equal to %1 of standard lot (100.000 x 0.01 = 1.000 units).

When you trade 0.01 lot of EUR/USD, you buy or sell 1.000 units of EURUSD.

The worth of every 1 pip for EUR/USD is $0.10 if you use a micro lot (0.01).

Micro lots are the smallest tradable lot.

A micro lot is a portion of 1000 units of your accounting funding currency.

If your account is financed in US dollars a micro lot is $1000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents.

Micro lots are very good for beginners.

Nano lot size

Nano lot, named cent lot by some forex brokers, is equal to either 100 or 10 units. In some forex brokers, nano lot refers to 10 units while in some other brokers, it may refer to 100 units.

Nano lot is not offered by many forex brokers.

Truly, only a few brokers offer this option as an account type such as FXTM and XM.

Nano lot is the safest way to trade if you are a novice trader or if you want to test a new trading strategy.

You can go through the training process with much less risk and loss.

Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks. Just in order to avoid big losses.

The bottom line

It is smart to likening the lot size that you trade and how a market move would affect you to the amount of support you have when something suddenly happens.

When you place an extremely large trade size relative to your accounts, you can be faced with many troubles.

Even small movement in the market could send a trader the point of no return.

What is a lot size in forex?

In this article we will see what a lot in forex is and how a lot size in forex can be classified.

For instance there are different lot sizes in forex, each of them with a different value.

When trading, each selected lot size in forex involves a different amount of money.

This can range from a micro lot which is equal to 0.01, to a standard lot (1).

What is a lot in forex?

A lot represents a unit of measure in a forex transaction. Thanks to this it’s possible to know how much money a trader needs to use for a single trade.

The smallest lot size in forex is called a microlot and it’s worth 0,0. There’s then the minilot which is 0,1 and it’s the medium size.

However, there’s no limit to the highest amount – even if some brokers set a maximum of 20 lots for every single trade position.

A standard lot size forex (1) represents 100.000 units, but this doesn’t mean that a trader should have $100.000 in their account.

Let’s explain this better with an example.

Example of lot size in forex

In forex trading, a very important factor is the leverage.

In fact, if the chosen leverage is 1:200, it’s just necessary to have $500 to open a position of 1 lot.

We know that this concept can sound a bit complicated, but to keep it simple when trading just remember what the starting leverage is.

Tutorial:

Once you have the starting leverage, you just need to divide 1 lot (so 100.000) for the leverage (200 in this case). The result represents the amount of money you’re going to invest for that position if you decide to open 1 lot.

So this would be $500 in our example.

If $500 is too much for a single investment, it’s possible to select a lower amount of lots, for example 0,1 lot and invest just $50.

How to set up the lot size on metatrader 4

When trading on the MT4 or metatrader 4, setting up the size is essential.

To trade, it’s necessary to press the F9 button and the trading window will open.

There in the volume window (as you can see in the picture), it’s possible to set up the desired lot size.

Finally, to complete the trade, you just need to enter the stop loss and take profit values. You must also decide if you want to sell or buy.

Each forex broker platform will have a different trading window layout. So you can take your time getting to know all the features and how to set up the stop loss etc.

Many brokers offer free forex demo account versions, so new clients can practice trading for free with a set amount of virtual funds. This practice can include opening positions and trying out different combinations of lot sizes and leverage.

How to set up the lot size in a forex platform

The minimum lot size which can be selected is the microlot, so 0.01 lots. To set up the lot size, you need to open up the trading window on your selected forex platform.

Some brokers offer you the chance to trade whilst deciding directly the amount of money you wish to invest in each position.

This might be a big help for beginners who have some difficulties understanding the amount of money invested on lots.

Another big help some trading platforms offer, is the margin call.

What is the margin call

The margin in forex represents a minimum quantity of money which must be in the trading account before a trade can be opened.

Every broker has a different margin requirement, usually between the 1% and 2%.

This means that to open a position with 1 lot (100.000 units) a trader needs to have at least $1000 funded in their account.

Because the 1% of 100.000 units are 1.000 units which represent $1000.

An alternative for the trader can be to open a position with 0.01 which is exactly 1.000 units.

A margin call will happen in the case the trader does not have enough money in their forex account to trade.

If this happens the broker will send a message or an email asking for a new deposit. Alternatively they could also stop the trade automatically.

Click here to learn more about how to trade forex: https://tradingonlineguide.Com/what-is-forex-trading/how-to-trade-forex/

Author of this article and founder of tradingonlineguide.Com

My aim is to help you increase your trading knowledge with helpful content. I come from an economic background and have a strong passion for forex trading. With more than 6 years in the online trading world, I want to share my financial knowledge so that anyone can develop their investment skills.

In my spare time I enjoy cooking and travelling.

Here you can learn more about our review methodology.

Lot (securities trading)

What is a lot (securities trading)?

A lot in the financial markets is the number of units of a financial instrument bought on an exchange. The number of units is determined by the lot size. For example, in the stock market, a round lot is 100 shares. However, investors do not have to buy round lots, where a lot can be any number of shares.

Key takeaways

- A lot is the number of units of a financial instrument that is traded on an exchange.

- For stocks, a round lot is 100 share units, but they can also be traded in any number of shares.

- A bond lot can vary, where sometimes they are $100,000 or $1 million, but face values may be as low as $1,000 that individual investors can purchase.

- A trader can buy or sell as many futures as they like, although the underlying amount that a contract controls is fixed based on the contract size.

- One option represents 100 shares of the underlying stock, while forex is traded in micro, mini, and standard lots.

How a lot (securities trading) works

When investors and traders purchase and sell financial instruments in the capital markets, they do so with lots. A lot is a fixed quantity of units and depends on the financial security traded.

For stocks, the typical lot size was round lots of 100 shares for many years, until the advent of online trading. A round lot can also refer to a number of shares that can evenly be divided by 100, such as 300, 1,200, and 15,500 shares.

However, now odd lots, which is an order for less than 100 shares, and mixed lots—a number of shares above 100 but not divisible by 100—are more common. Similar to stocks, the round lot for exchange-traded securities, such as an exchange-traded fund (ETF), is 100 shares.

Types of lots (securities trading)

Bonds

The bond market is dominated by institutional investors who buy debt from bond issuers in large sums. A round lot for U.S. Government and corporate bonds in some circles is considered $1 million. However, it can also be $100,000, such as the case with municipal bonds.

That doesn't mean a trader or investor needs to buy bonds in that quantity. Bonds typically have a face value of $1,000 to $10,000 (some are even lower). An investor can buy as many bonds as they like, yet it still may be an odd lot.

Options

In terms of options, a lot represents the number of contracts contained in one derivative security. One equity option contract represents 100 underlying shares of a company’s stock. In other words, the lot for one options contract is 100 shares.

For example, an options trader purchased one bank of america (BAC) call option last month. The option has a strike price of $24.50 and expires this month. If the options-holder exercises their call option today when the underlying stock, BAC, is trading at $26.15, they can purchase 100 shares of BAC at the strike price of $24.50. One option contract gives them the right to purchase the lot of 100 shares at the agreed strike price.

With such standardization, investors always know exactly how many units they are buying with each contract and can easily assess what price per unit they are paying. Without such standardization, valuing and trading options would be needlessly cumbersome and time-consuming.

Typically, the smallest options trade an investor can make is for one contract, and that represents 100 shares. However, it is possible to trade options for a smaller amount with mini-stock options which have an underlying share amount of 10.

Futures

When it comes to the futures market, lots are known as contract sizes. The underlying asset of one futures contract could be an equity, a bond, interest rates, commodity, index, currency, etc. Therefore, the contract size varies depending on the type of contract that is traded.

For example, one futures contract for corn, soybeans, wheat, or oats has a lot size of 5,000 bushels of the commodity. the lot unit for one canadian dollar futures contract is 100,000 CAD, one british pound contract is 62,500 GBP, one japanese yen contract is 12,500,000 JPY, and one euro futures contract is 125,000 EUR.

Unlike stocks, bonds, and etfs in which odd lots can be purchased, the standard contract sizes for options and futures are fixed and non-negotiable. However, derivatives traders purchasing and selling forward contracts can customize the contract or lot size of these contracts, since forwards are non-standardized contracts that are created by the parties involved.

Standardized lots are set by the exchange and allow for greater liquidity in the financial markets. With increased liquidity comes reduced spreads, creating an efficient process for all participants involved.

Forex lots

When trading currencies, there are micro, mini, and standard lots. A micro lot is 1,000 of the base currency, a mini lot is 10,000, and a standard lot is 100,000. While it is possible to exchange currencies at a bank or currency exchange in amounts less than 1,000, when trading through a foreign exchange broker typically the smallest trade size is 1,000 unless expressed stated otherwise.

Lot examples

In the options and futures markets, trading in lots isn't as much of a concern since you can trade any number of contracts desired. Each stock option will represent 100 shares, and each futures contract controls the contract size of the underlying asset.

In forex, a person can trade a minimum of 1,000 of the base currency, in any increment of 1,000. For example, they could trade 1,451,000. That is 14 standard lots, five mini lots, and one micro lot. In a stock trade, a person can trade in odd lots of less than 100 shares.

How to calculate a lot on forex?

Liteforex traders’ blog — www.Liteforex.Com/blog/

Aug 3, 2019 · 12 min read

What is a lot and how to calculate a lot on forex: calculation methods and an example of building a model in excel, trader’s calculator

Lot is a unit of measure for position volume, which is a fixed amount of the base currency on the fo r ex market. The volume is always indicated in lots, and the size of lots directly affects the level of risk. The greater the volume of one lot on forex, the greater the risk. Risk assessment (risk management) includes a model that allows you to calculate the optimal amount of standard lot on the foreign exchange markets based on the estimated risk level, volatility (stop loss level), and leverage. Read the article to find out about this model, how to use it and how a trader’s calculator can help.

Lot on forex: a model for building an optimal risk management system

In the usual sense, a lot is a standard unit for measuring the volume of a currency position that a trader opens. I.E. This is the amount of money that a trader invests by buying a currency for the purpose of later selling it at a more favorable price. Lot calculation is one of the components of the risk management system recommended for those who approach trading in a balanced and structured way.

In this review you will learn:

- What a lot is

- How to calculate the lot size on the forex market. Calculation methods and examples of building a model in excel.

- How to use the trader’s calculators and build a strategy with it.

What is a lot

On forex, positions can only be opened in certain volumes of trading units called lots. A trader cannot buy, for example, 1,000 euros exactly, they can buy 1 lot, 2 lots or 0.01 lots, etc.

The standard lot in forex is 100,000 units of base currency. For example, if the EUR/USD rate is equal to 1.1845, then the position with a volume of 1 lot will be opened for 118,450 units of the base currency, i.E. This is how many US dollars you need to buy 100,000 euros.

- Mini lot (minilot) = 0.1 standard lot.

- Micro lot = 0.01 standard lot.

Most traders set minimum and maximum lot volume for different types of accounts. The top limit is often at 100 lots, the bottom limit is 0.01 lots. If we take the example above, the minimum investment will be $ 1.184. If you use the leverage 1:100, then a minimum deposit of $11.84 will be enough to start, though provided that 100% of the money (which is unacceptable from the point of view of risk management) will be invested in the position. There is a second option — to use cent accounts (if the broker has them). The only difference of cent accounts is that the calculations are in cents, not in dollars, so $11.84 in this case is enough to buy the minimum micro lot without using leverage.

This is a screenshot of an order in MT4. The trader specifies the lot size as per the settings and can increase the trade volume only in steps, which are indicated in the account settings. For example, the classic account has a minimum step of 0.01 lots. In the drop-down list in the screenshot, lot 0.05 is followed by lot 1.00. This is only for convenience, the trader can enter the position volume 0.06, 0.07 lots or any other manually.

Important: despite the classic terms, some brokers can use them differently. For example, one of the brokers has 1 lot equal to 10,000 basic units of currency. Perhaps this is intended to reduce the minimum amount of deposit without leverage. In any case, before commencing trade, carefully read the offer, account specification and contracts.

The value of one point is also determined based on the unit (lot, mini or micro lot).

Example. A trader buys euros at the rate EUR/USD = 1.1845. Estimated position volume — 0.01 lot. After the rate grows by 10 points (to 1.1855), the trader sells the euros. Their income will amount to 1,000 (0.01 lot in basic units) * 0.0001 (1 point) * 10 (profit). Result: the income of the trader — $1, i.E. Having invested $10 with a leverage of 1:100 and a rate increase of 10 points, the trader would earn $1.

Value of one point for a standard lot:

- Full lot: 1 point makes a profit of 10 US dollars.

- Mini lot: 1 point — $1.

- Microlot: 1 point — 10 cents.

However, if the lot is equal to 10,000 base currency units, then the value of one point for 1 lot will be $1, for a mini lot — 10 cents, etc.

Managing the volume of open positions includes the following:

- Identifying the optimal ratio of the volume of open trades and risk level. High volatility can deplete the deposit quickly, the trader’s task is to choose the optimal ratio of the volume of open trades to the deposit, taking into account the risk. On markets with a strong trend, the management of trade volumes should involve the use of lot increase coefficients (an element of the martingale strategy).

- Evaluation of the viability of the overall position on the market. “should I close unprofitable trades or wait out?” this is a classic forex problem that can be solved by managing the volume of trades. The risk management strategy includes a model that would allow to select the optimal resistance and support levels without reaching stop out by adjusting the position volume and leverage. In other words, there is a stop-out level, and there is a strong level where the price will change direction with a high probability. The model will allow you to choose the optimal position volume at which the deposit will withstand the drawdown to the main level without reaching stop out.

How to calculate the lot size in forex

The easiest way to calculate the value of the lot on forex is to use a calculator.

Why calculate the lot size:

- Optimization of the position volume in relation to the deposit amount, taking into account the risk and the desired return on investment, allows you to balance the trade.

- Proper selection of the lot and position increase process will allow you to choose a trading mode in which the general position of the trader will be resistant to drawdowns, corrections, rollbacks, and volatility.

Above, I have given an example of what a lot on forex is and how its volume is formed. One of the forums has an interesting example of calculating the lot “by contradiction”, based on the risk level. As I have already said above, 1 point in one standard lot gives an average of $10 profit or loss, depending on which way the price goes. Analysis of statistics shows that the correction of the currency pair can reach 20 points, i.E. Loss can reach $200. There are two approaches:

- Taking average volatility value as a basis. It allows you to increase the volume of the lot within the estimated risk. The trader assumes that the average (most probable) loss can only amount to 10 points, for example, because they open a position with a larger volume (uses a larger leverage). But then the deposit remains unprotected from anomalous volatility — a loss of 20 points can lead to a stop-out.

- Taking average volatility value as a basis. It allows you to increase the volume of the lot within the estimated risk. The trader assumes that the average (most probable) loss can only amount to 10 points, for example, because they open a position with a larger volume (uses a larger leverage). But then the deposit remains unprotected from anomalous volatility — a loss of 20 points can lead to a stop-out.

Remember to add the spread to the calculated stop loss level.

Risk management strategy should also provide for maximum position risk. The strategy recommends keeping the risk lower than 5%. If we assume that in our example the potential loss of $200 is 5%, then in order to trade 1 lot within the acceptable risk for the forecasted volatility up to 20 points, you will need a deposit of $4,000. If you don’t have so much — reduce the volume of the lot.

Another benchmark is the amount of margin reserved by the broker when using leverage. In theory, it should not be more than 10–15%, but this landmark is secondary. First, the more leverage, the less margin. Lower margin forces the trader to open trades of larger volume, thus increasing risks.

I think that the principle of calculating the lot should be clear from the examples above. The trader evaluates their deposit, decides whether to use leverage, determines the target volume in accordance with risk management (permissible risk level per trade and in general), and converts it into lots. It is somewhat more complicated in reality, since currency pairs are different and sometimes it is necessary to calculate the value of a point in non-USD pairs. Most companies offer calculators on their websites, which have the same principle: the trader indicates the currency pair, lot size, position direction, and the calculator calculates the value of one point and the profit (loss) based on the current quotes.

Let us consider the liteforex calculator as an example. It is as convenient as other calculators, but not without flaws. It allows you to calculate the amount of loss or profit based on the following data: currency pair, position volume, trade direction, account type, and leverage.

Keep in mind that for one standard micro lot the value of one point is $0.01, not 0.1, as I said above. This is because of 5 decimal places in the quote instead of 4 usual ones.

The calculator cannot calculate the risk, you will have to do it manually. Another minor inconvenience — you cannot set a 1:1 leverage. Let me remind you that the amount of leverage does not affect the risk if there is a clearly defined target for the position volume. If the lot size remains unchanged, the change in leverage only affects the amount of the deposit.

When calculating the value of the point, you should pay attention to the currency pair. For example, the price of one point in EUR/USD is $10 for a standard lot on forex. For USD/JPY, the value of the point will be less than $9. The calculation formula in this case will be as follows: (1 point * lot size) / market price. An example of the calculation is given below.

Nearly all trader’s calculators have the same problem: you cannot calculate the lot volume with regard to the risk level, although this is precisely the point of planning trading volumes. I suggest that you use the following formula for calculating the lot with regard to the risk level:

Lot volume = (% risk * deposit) / А * (рrice 1 — рice 2)

% risk is the amount of the deposit that the trader is willing to allocate for the trade (the notorious recommended 5%, which I have mentioned above). A is a coefficient equal to 1 for a long position, and -1 for a short position. Price 1 and price 2 — the opening price and the stop loss level. The stop loss level in this case is one of the options for averaged or maximum volatility, which I also mentioned above.

How to calculate the lot on forex. Example. We have the following data:

- Deposit: $3,000.

- Risk — 5% per trade.

- Leverage — 1:100.

- Stop loss — 50 points.

The position amount will be 3000 * 100 = $300,000. If we are going to invest 100% of the money in one trade, then the maximum volume of the lot will be 2.4 lots given the EUR/USD rate at 1.2500. But we are going to stick to the risk management rules. Allowable risk per trade will be 3000 * 0.05 = $150. Since we can afford a maximum drawdown of 50 points, the maximum allowable price of one point is 150/50 = $3. Let me remind you that for 1 standard lot, the cost of one point is $10. Hence the maximum permissible lot is 0.3. The minimum lot size is 0.01. Since for 0.3 lots we need $37,500, we invest $375 (12.5% of the deposit, which is in accordance with the risk management rules) and use a leverage of 1:100.

Thus, the lot volume depends on the drawdown the trader allows in the calculations. Here, the simple model in excel will show the dependence of the lot on the drawdown (or stop loss).

The second calculation method using leverage says that the maximum risk of all open positions should be no more than 15%. 3000 * 0.15 = $450, which with a leverage of 1:100 is $45,000. We divide the position by the current rate (say, 1.2500 for the EUR/USD). 45,000/125,000 = 0.36 lots. The result is almost the same as the previous one, but I don’t like this method. It does not take the drawdown into account.

If the trader adheres to the hard rule “a fixed percentage of the deposit per transaction” and “a fixed percentage of the deposit for all transactions in the market”, then the leverage is not important. The greater the volume of the lot, the higher the value of the item and the faster the deposit will melt in case of price reversal.

Conclusion. Lot volume depends on:

- The volatility of the asset and its assessment method (stop loss level).

- The acceptable risk level for all open trades, which each trader determines for themselves.

- Deposit amount.

- Leverage (depending on the calculation method).

In trading advisors, the initial lot size is set in the “lots” parameter. You can also use the automatic lot calculation system by turning on the “usemoneymanagement” parameter, indicating the risk level and the maximum lot size.

What is a lot on other markets?

In other markets, the definition of a lot is fundamentally different from forex terminology:

- Binary options. The lot here is the bet that the trader makes by predicting the price movement in one direction or another. This is not a lot as such, but there is a step for the bet.

- Stock market. Since the price of shares may be in the corridor from a few cents to thousands of US dollars, the approach to the terminology of the lot is different here. At the moscow exchange, for VTB securities one lot is 1 thousand shares, for securities of some oil companies 1 lot is 1 share. NYSE and NASDAQ in most cases set the value as “1 lot = 100 shares”, and it is almost impossible to buy a fraction of a lot.

- Derivatives market. Here, the approach to determining the lot and calculating its volume is even more complicated. It takes into account the price step indicated in the specifications, the stop loss and the risk levels, and the result obtained is expressed in the number of contracts. If you are interested in details, please ask in the comments.

Conclusion. Assessing the risk level and calculating the maximum allowable lot volume is one of the foundations of the risk management system. Deviations are acceptable. On volatile markets, it makes sense to lower the risk level for each new trade, but at the same time increase the length of the stop loss. On trend markets, on the contrary, it makes sense to put short stop signalss and use the method of increasing the position. Before the start of trading, it will be useful to calculate the minimum, average and maximum length of stops in the historical period (separately for each instrument) and prepare a model that will allow you to quickly change the input data and adjust the trade volume in case of changing market conditions. If you have questions, please ask them in the comments. Good luck in your trading!

P.S. Did you like my article? Share it in social networks: it will be the best “thank you” :)

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

How to calculate lot size in forex? – lot size calculator

How to determine position size when forex trading

For a foreign exchange (forex) trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex. Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money. Some tips on how the trader should determine position size are provided.

Lot size in forex trading

What is lot size in currency trading?

What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of 1000 units of currency, a mini-lot 10.000 units, and a standard lot has 100,000 units. The risk of the forex trader can be divided into account risk and trade risk. All these factors are considered to determine the right position size, irrespective of the market conditions, trading strategy, or the setup.

Now let us define a standard lot.

What is the standard lot size in forex?

The standard forex size lot is 100,000 units of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are 500 000 currency units.

In this video, we will see lot size forex trading example:

How to calculate lot size in forex?

Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size (number of units) for currency pair in the last step.

Determine the risk limit for each trade

Most traders consider specifying the dollar amount or percentage limit risked on each trade as the most crucial step in determining the forex position’s size. Lot size forex calculation is simply because professional and experienced traders will usually risk a maximum of 1% of their account in trade; usually, the amount is lower. While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, though the amount risked for the trade may be reduced if it exceeds the 1 percent limit.

(max risk per trade position should be 1%-2%)

Determine dollar per pip

A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for which the currency price will change. When currency pairs are considered, the pip is 0.0001 or one-hundredth of a percent. However, if the currency pair includes the japanese yen, the pip is one percentage point or 0.01. Some brokers show prices with an additional decimal place, and this fifth decimal place is called a pipette. In the case of the japanese yen, the third place is the pipette. M the pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point.

A stop-loss will close a trade when it is losing a specified amount. Traders use this to ensure that their loss does not exceed the account’s loss risk. The stop-loss level also depends on the pip risk for a specific trade. The volatility and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

Determine forex lot size position

In a currency pair that is being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes are fixed at 0.0001 of the lot size. Usually, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

What information do we need to make a forex position size calculator formula?

Let us repeat all steps once time more:

Account currency: USD

account balance: $5000 for example

risk percentage: 1% for example

stop loss: 200 pips, for example

currency: EURUSD

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

Step 1: calculate risk in dollars.

Calculate risk percentage from account balance: 1% for $5000 is : $5000/100=$50.

$50 is 1% of $5000.

Step 2: calculate dollars per pip

(USD 50)/(200 pips) = USD 0.25/pip

Step 3: calculate the number of units

USD 0.25 per pip * 10 000 = 2,500 units of EUR/USD

For 5 digits brokers, we use 10 000 as a multiplicator.

2.5 micro lots or 0.25 mini lots is the final answer. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In the end, here, you can use the position size calculator.

Lot size calculator

The lot size forex calculator is represented below. You can use to calculate forex lot position size:

The risk you can define either using % or either using risk in dollars.

What is a lot in forex?

1e07b/w:150/h:150/q:90/https://www.Securities.Io/wp-content/uploads/2020/07/anthony-gallagher.Jpg" alt="mm" width="46" height="46" />

One of the key terms that you are bound to come across time and again in forex trading is “lot”. Here we will take a look in more detail about what exactly a lot is in forex so the next time you are trading lots, you will understand exactly what is entailed.

Beyond that, we will also look at the various types of forex lots you can encounter when trading with your top forex broker. Some of these will be more ideally suited to new traders or those who many want to steer a little on the safer side when it comes to risk management in trading.

Forex lot types explained

In the simplest of forms, the forex lot as you know it in forex trading, is simply a measurement of currency units and a way of determining how many currency units are required for a trade.

Forex lots and the terminology around lot trading is widely used still among almost all of the top trading brokers in the sector. Even though a few now allow for more flexible trading styles, mention of forex lots is still very prevalent. You will also hear plenty of mention of forex lot, and lot trading if you are choosing a new broker and checking out some of the best forex broker reviews.

With that in mind then, there are typically 4 forex lot sizes that you will come across when trading forex.

Standard lot – 100,000 currency units

The standard forex lot is what you will see most commonly when trading with the standard account types of many forex brokers. The standard lot is 100,000 currency units, so typically has a value of $100,000 if we take trading in US dollars as an example.

The majority of experienced forex traders are accustomed to trading at this level and it is worth noting that due to leverage in forex, you do not need to have a full $100,000 in your account to trade a standard lot. When most refer to a lot in forex trading, this is also the typical value they are referring to.

Mini lot – 10,000 currency units

A mini forex lot is a great choice for those who may want to trade with a lower, or perhaps no leverage at all. This type of lot is again very common with most top forex brokers offering these types of lots that contain 10,000 currency units which would have a typical value of $10,000 if trading USD.

Even though they are referred to as “mini” lots traded at this level still represent a very significant investment for many traders.

Micro lot – 1,000 currency units

A micro lot in forex is the next smaller step on the trading ladder again. Coming in at just 1,000 currency units means that this value in the case of our USD trading example would be just $1000. While micro lots and forex micro trading accounts are available with some brokers, they are not always accessible. They do however provide another ideal platform for new forex traders to get a good,value for money taste of the industry. This level can provide an excellent stepping stone for those who may have already tried out a nano account or wanting to move straight from demo account trading without committing 100%.

Nano lot – 100 currency units

The smallest trading lot size available is the nano lot. This trading lot is comprised of 100 currency units which have a total value of $100 in the case of our USD trading example. The nano lot is again more rare to see, but is certainly still available with many top forex trading brokers. This is a very ideal starting lot size for those who wish to try out forex trading for the first time. It offers real money trading beyond a demo trading account, but with a much smaller level of risk involved.

Forex lot differences between brokers

As with everything, there is some room for variation within the forex trading sector. The terms described above are generally used by both traders and brokers across the board. You will sometimes see lots described in decimal terms in comparison with a standard forex lot as follows:

Mini lot: 0.1 standard lots

micro lot: 0.01 standard lots

nano lot: 0.001 standard lots

This is exactly the same thing in the majority of cases. Many brokers also make “cent accounts” available that often cater for the smaller lot sizes in micro lots and possible nano lots. There are also a few brokers that will allow trading with as little as 1 currency unit ($1).

Which lot size is best?

The forex lot size that works well for you is really dependent on a number of factors based on how you want to trade. Among these is how much you have to risk, and how much of your capital you actually want to risk. Once you have decided this, you will be better placed to choose the ideal lot size for you. You should also remember that you can still engage leverage when trading with smaller lot sizes, though the ratio will not increase.

Typically, as you gain more experience in the forex trading industry, your attitude and willingness to take on slightly more risk lends itself well to increasing lot size. With this in mind then, many would recommend graduating from demo account use to a nano or micro lot size. Once you have learned the ropes with these, you can move on up to the next levels.

If you are dealing with a top forex broker, you will also note that many of them may have loyalty, active trader, or rebate programs in place. These often reward traders based on the number of standard lots they trade. Considering that then, it may be one point to think of when choosing your forex lot size.

What are lots in the forex market?

Newer traders often enter trading with exaggerated dreams, void of accurate education.

To trade the forex market successfully, understanding the dynamics behind how trades are measured is a necessity.

Currency pairs

A base currency is the primary currency in a currency pair quotation – the euro in EUR/USD, for example. The quote currency, or counter currency, is the US dollar, the second currency in the quotation.

Should you enter long (buy) EUR/USD, you buy the base currency and sell the counter currency; it’s always the base currency of the two currencies that is bought or sold. The quote currency is in place to determine the value of the base currency.

Some forex brokers display quantity in lots; others express size in currency units.

A trading lot

Trading lots vary between four key units.

A standard lot is the equivalent to 100,000 units of the base currency.

A mini lot, 10% of a standard lot, is the equivalent to 10,000 units of the base currency.

A micro lot is the equivalent to 1,000 units of the base currency – popular with newer retail traders.

A nano lot is the equivalent to 100 units of the base currency, also common among newer traders with smaller account sizes.

The question then arises, is it necessary to have $10,000 in the account to trade 1 mini lot? No. This is where leverage comes in.

Leverage

Leverage is defined as having the ability to control larger sums of capital using little of your own funds. Contrary to popular belief, leverage in spot foreign exchange does not involve borrowing any money from the broker.

For every $1 in your account you can control $X amount where X is greater than 1. 100:1 leverage, for example, means you can control $100 for each $1 in your account. If you have $1,000 in your account, you have the ability to control $100,000 in positions.

You must also recognise what margin is. Margin is the amount of money a broker requires you to commit to cover potential future losses on a trade, before a position can be opened.

This article explores leverage in depth and highlights why leverage is not a loan in FX.

Position sizing

Position sizing is an important aspect, and can make or break a trader if not understood. Traders are risk managers, first and foremost.

Depending on the currency pair traded and account denomination, additional steps may be required.

Account denomination set the same as the counter currency:

Calculate risk to the account, which in this case is 2% (10,000 * 0.02 = $200).

Divide the amount risked ($200) by the stop-loss order distance to find the value per pip ($200 / 50 = 4 [a value of 4$ each pip]).

The final stage involves multiplying the pip value by the fixed unit value for EUR/USD.

If your trading account currency is in USD and the USD is listed as the second in a pair, the unit value of lots remain unchanged: $0.10 per pip for a micro lot (1,000 units), $1 per pip for a mini lot (10,000 units) and $10 per pip for a standard lot (100,000 units).

Therefore, you can use the following calculation:

$4 each pip * 10,000 units (mini lot) = 40,000 units of EUR/USD – 4 mini lots using a 50-pip stop distance.

Using a micro lot in the calculation, the position size is less, 4,000 units, or $0.40 per pip, equating to $20 risk over 50 pips.

Using a standard lot, trade risk is too high at 400k units, or $40 per pip – a risk of $2,000.

Account denomination set the same as the base currency:

Account currency: EUR 10,000

Calculate risk to the account, which in this case is 2% (10,000 * 0.02 = EUR 200).

Convert the EUR value to USD as the value of a currency pair is calculated by the counter currency. The EUR/USD exchange rate, in this example, is $1,1280.

Multiplying $1.1280 by EUR 200, the trade risk, gives approximately $225.60. This is the USD risk equivalent on the trade, as of the current exchange rate.

Next, divide the USD risk by the stop-loss distance, 50 pips: (USD 225.60) / (50 pips) = $4.51 per pip.

Finally, multiply the value per pip by the lot value.

$4.51 * (10,000/1) = approximately 45,000 units – 4 or 5 mini lots, depending on risk appetite. Or 4 mini lots and 5 micro lots. This is based on a 50-pip stop distance.

Account denomination differing from both the base and quote currency:

Account currency: USD 10,000

Calculate risk to the account, which in this case is 2% (10,000 * 0.02 = USD 200).

To find the correct position size, you need to find the value of risk in GBP. Remember, the value of a currency pair is in the counter currency. To convert the risk amount from USD to GBP, you need the GBP/USD exchange rate.

In this example, GBP/USD trades at 1.29011. You then multiply the trade risk $200 by the inverted exchange rate (1 GBP / 1.29011 USD) = 154.00 risk in GBP.

Convert GBP risk to pip value by dividing by the stop-loss distance in pips: (GBP 154.00) / (50 pips) = GBP 3.08 per pip.

Finally, multiply the value per pip by the lot value:

3.08 * 10,000 = 30,800 units – approximately 3 mini lots.

Knowing the above, the trader can sell no more than 31,000 units of EUR/GBP, with a 50-pip stop distance, to stay within the pre-determined risk parameters set in USD.

Forex calculator

While knowing the dynamics behind how trades are calculated is important, consider using our pip value calculator. This takes most of the leg work out of the calculation, giving you the freedom to focus on trading.

Recent posts

- Tuesday 26th january: technical outlook jan 26, 2021

- Monday 25th january: asian markets mostly higher, fed announcements on wednesday jan 25, 2021

- Monday 25th january: weekly technical outlook and review jan 24, 2021

- Friday 22nd january: markets mostly lower as investors cash in profits jan 22, 2021

- Friday 22nd january: technical outlook jan 22, 2021

Live spreads

Archives

Categories

- Company news

- Education

- Ex dividends indices

- Ex dividends stocks

- Featured

- Forex news: daily

- Forex news: weekly

- Forex trading 101

- Fundamental analysis

- Fundamental analysis 101

- Market analysis

- Press releases

- Recent

- Risk management 101

- Technical analysis

- Technical analysis 101

- Trading plan 101

- Trading psychology 101

- Uncategorized

- US election 2020

- Webinars

Trade with

A market leader you can rely on

Forex trading

Trading specifications

About IC markets

Disclaimer: this material is marketing material where all marketing material is published for informational purposes only. This material does not contain and should not be considered as containing - investment advice and recommendations, or suggestions for performing any actions with financial instruments. The built-in widgets belong to their external independent authors, and IC markets is not responsible for their content and their impact on trade.

All content rights reserved. Opinions of the authors may not coincide with the opinion of the blog editors. When copying materials from this site or connecting to an RSS feed to republish our articles, a link to IC markets or attribution in the format ‘IC markets blog’ is required. For general questions, please contact the editorial office via the form on the contact us page.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. A product disclosure statement (PDS) should be considered before entering into a transaction with us.

The contents of this page are general information only and does not take into account your personal situation, financial objectives or needs. It is up to you to make sure the products that we offer suit your specific needs. You should not trade with us unless you understand the features and risks of the products that we offer. This means that you might need to seek independent advice before you start trading with us.

Forex pips and lots

A pip is the smallest amount of movement a price quote can make. In other words, each tick of the price quote is a pip. When EUR/USD moves from 1.2786 to 1.2787, for example, it has moved by one pip. You could also call it a point or a tick, but in forex traders’ jargon, pip is the word.

It’s a good idea to measure your profit or loss in pips rather than in the amount you actually lose or earn, since the trader’s performance can only be valued through his success in gathering pips. For instance, supposing trader A has a beginning capital of 100 USD, and trader B has only 10, it would take trader B ten times as much in terms of pips to achieve the same gain that was acquired by trader A in absolute dollar terms. In terms of their prowess in the market, however, if trader B were to make just 1/10 of what trader A makes, they’d still be equal, due to the the difference between their starting capital. This same logic can be utilized when assessing one’s own prowess, and if a diary is kept, it’s always better to note the loss or profit in pips, rather than cash, so as to keep a better track of performance.

It must also be remembered that one pip in the currency pair that is traded may not be the same amount in the trader’s base currency, that is, the currency with which he funds his account. For instance, if your currency is the british pound, and you’re trading the EUR/USD, one pip movement in the currency pair would be a different amount in your base currency, depending on the quotes.

Another important term in trading forex is the lot, which is the smallest amount of currency you can trade at a particular level of leverage, and the standard lot size is 100,000 USD. Among today’s forex brokers, there are those who allow traders to enter bids without the use of lots (sometimes called mini lots), and the inexperienced trader may seek them before gaining enough confidence to start trading with a higher volume.

Risk statement: trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.

So, let's see, what we have: finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size based on the size of current accounts. At 100 lots forex

Contents of the article

- Actual forex bonuses

- Choosing a lot size in forex trading

- Lot size matters

- Trading with micro lots

- Moving up to mini lots

- Using standard lots

- A helpful visualization

- Lot size in forex – what is it and how to...

- A lot is the smallest trade size that you can...

- How much is 1 lot?

- Mini lot size

- Micro lot size

- Nano lot size

- What is a lot size in forex?

- What is a lot in forex?

- Example of lot size in forex

- How to set up the lot size on metatrader 4

- How to set up the lot size in a forex platform

- What is the margin call

- Lot (securities trading)

- What is a lot (securities trading)?

- How a lot (securities trading) works

- Types of lots (securities trading)

- Lot examples

- How to calculate a lot on forex?

- What is a lot and how to calculate a lot on...

- Lot on forex: a model for building an optimal...

- What is a lot

- How to calculate the lot size in forex

- What is a lot on other markets?

- How to calculate lot size in forex? – lot size...

- Lot size in forex trading

- Lot size calculator

- What is a lot in forex?

- Forex lot types explained

- Standard lot – 100,000 currency units

- Mini lot – 10,000 currency units

- Micro lot – 1,000 currency units

- Nano lot – 100 currency units

- Forex lot differences between brokers

- Which lot size is best?

- What are lots in the forex market?

- Currency pairs

- A trading lot

- Leverage

- Position sizing

- Forex calculator

- Recent posts

- Live spreads

- Archives

- Categories

- A market leader you can rely on

- Forex pips and lots

No comments:

Post a Comment