Minimum deposit for globex360

We do not recommend globex360. In addition, while globex360 states that withdrawals are free, we have received multiple claims that deposits do not reflect to trading accounts and withdrawals do not reflect to bank accounts.

Actual forex bonuses

Clients have also complained that customer service is extremely poor, or non-existent when it comes to funding issues.

Globex360 review

Summary

We do not recommend globex360 due to the numerous complaints and high cost of trading. We encourage traders to check out plus500 & avatrade as possible alternatives.

Globex360 minimum deposits start at 100 USD, but trading costs are expensive. Spreads are wide, starting at 2 pips on the basic account. A large commission per trade is also charged on all accounts, which is unusual for a broker with such wide spreads. Full spreads are not published.

In addition, while globex360 states that withdrawals are free, we have received multiple claims that deposits do not reflect to trading accounts and withdrawals do not reflect to bank accounts. Clients have also complained that customer service is extremely poor, or non-existent when it comes to funding issues.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for globex360

Is globex360 safe?

Globex360 was founded in 2017 in johannesburg and has been regulated by the south african FSCA since 2019 under FSP #50130. The FSCA has brought in a new licence for south african brokers called the ODP licence, but it is unclear if globex360 has applied for this yet.

Globex360 is an STP broker and operates without a dealing desk – though trade execution on basic accounts is instant, insinuating an automated dealing desk of some kind. Standard and professional accounts are both market execution.

Globex360 does not offer negative balance protection, stating that “negative balance protection is not guaranteed. The general practice is that we cover the negative balance, but all cases are reviewed on a case-by-case basis.”

We have received many complaints from south african traders with a globex360 login regarding deposit and withdrawal issues. We cannot prove that any of these allegations are true, but traders should be very careful when choosing a forex broker.

Should I trade with globex360?

We do not recommend globex360.

Even if the allegations of funding problems are untrue, globex360’s trading costs are unreasonably high and its forex education is poor. Even though globex360’s minimum deposit is quite low at 100 USD, it does not publish its complete spreads and the only platform available is MT4.

We recommend choosing another broker from one of our lists:

We only recommend well-regulated, honest brokers with good trading conditions.

Frequently asked questions

Find our answers to the most popular questions which concerns globex360°.

DEPOSIT AND WITHDRAWALS

Deposit and withdrawals questions

How do I deposit funds to my account?

You can make a deposit inside your client area using any funding option that suits you best.

What is the minimum deposit?

The minimum deposit for all account types is $25. However, to get a VIP account, you have to reach a balance of minimum $50,000.

How do I withdraw funds from my account?

Log in to your client area and fill in the respective withdrawal form. There are no fees on withdrawals.

Do you have any charges on deposits and withdrawals?

How fast do you process my withdrawals?

We process all withdrawal requests within one working day.

How long does it take for funds to reach my bank account?

We process all withdrawal requests within 24 hours on business days. The time necessary for the funds to reach your bank account depends on your bank’s policy. Bank withdrawals can take 3-7 working days to be seen on the client’s account. Credit/debit card withdrawals can take up to 8 working days to be seen on the client’s account.

Can I withdraw via a different payment method from the one I used for depositing?

Globex 360 policy is to process withdrawals via the same method that you used to deposit. For example, if you deposited using a credit card, the card will be credited with the amount equal to the deposit amount minus fees and upon your request we can send any profits via other payment methods under your name.

Can I withdraw my money if I have open position(s)?

Yes, you can. However, at the moment of payment, your free margin must exceed the amount specified in the withdrawal instruction including all payment charges. Free margin is calculated as equity minus the necessary margin (which is required to maintain an open position).

If you do not have sufficient free margin on your trading account, we will not carry out the withdrawal request until you submit a corrected withdrawal form and/or close the open positions on your account.

TRADING CONDITIONS

Trading conditions

What are the minimum and maximum position sizes?

The minimum trade size is 0.01 lot and the maximum trade size is 50 lots. The maximum amount of orders you can open on an MT4 account is 50.

What is your order execution speed?

Our average execution speed is around 200 milliseconds.

What are your margin call/stop out levels?

Our margin call / stop out levels are – 100/30%. Your account may be subject to a margin call if your account equity falls to a level that is equal to the margin of your existing positions. For example, you have an open position of 1 lot on EURUSD. The margin to hold that position is 200 USD.

When you opened the account, you had a 400 USD equity on your account. When the position starts to move against you and your account equity falls to 200 USD, you will have a margin call. But your position will not be closed yet. When your account equity falls to 30% of the required margin, then the system starts to close your positions immediately.

Taking the above example, if you open a position with 200 USD of margin and your account equity falls to 60 USD, then the system starts to close your position. If you have several positions opened, then the system closes them starting from the one with the biggest loss.

If, while closing the positions, your account equity reaches a level of more than 30% of the required margin, all other positions will remain open.

What are the minimum and maximum account leverage you offer?

The minimum leverage is 1:100 and it is available on basic accounts. The maximum leverage is 1:400.

Are hedging and scalping allowed?

Hedging is allowed (arbitrage trading). The required margin for hedging positions on classic, ECN pro, and VIP accounts is 0. Scalping is also allowed. There are no time limitations for keeping the positions open.

What is a slippage?

Globex360 is an STP broker, which means that we just clear our clients’ trades and retranslate quotes we get from our liquidity providers. Orders in the real market are always executed at current market prices, which is why a slippage may occur in the case of a sharp movement. Please note, that during market-moving news or high volatility, the risk of slippage is higher than during normal conditions. With us, you will get both positive and negative slippages.

What is globex 360 execution model?

Order execution model: DMA (direct market access), NDD (no dealing desk), STP (straight-through processing). ECN stands for electronic communication network. NDD stands for no dealing desk. DMA stands for direct market access. STP stands for straight-through processing.

Do you offer negative balance protection/cover negative balance?

Traders who use the maximum leverage available face the risk of a negative balance.

For example: let’s assume that you have 200 USD on your account and you open 1 lot on USDJPY on friday evening, with 1:500 leverage and 200 USD margin.

On sunday night, the market opens 30 pips away from friday’s closing price in a direction against you, so your position will immediately have a loss of 30 pips x 10 USD = 300 USD loss, while you have only 200 USD on your account.

The position will be automatically closed and your account would have a negative balance of -100 USD. This situation is 100% impossible when a trader uses 1:1 leverage. The higher leverage a trader uses, the more risks they take. Please also note that a negative balance may occur due to a slippage during high volatility.

Our risk department is constantly monitoring our clients’ risk-taking and if we see that a client trades irresponsibly, then we will notify the client via e-mail and ask them to reduce risk exposure. Also, we might reduce the leverage on the client’s account.

Negative balance protection is not guaranteed. The general practice is that we cover the negative balance, but all cases are reviewed on a case-by-case basis.

Do you offer FIX API connection?

We offer FIX API connection to our large private clients and institutional clients. The minimum account balance required is 25,000$ and the minimum monthly trading volume required is 500 lots. There are no other requirements or fees. We are not offering a demo version. If a client trades 500 lots per month, then we do not charge any fees for using it. However, if a client does not reach 500 lots, then a 1,000$ fee applies.

What are the limits of setting SL, TP, and TS?

You can set stop loss and take profit orders with no limits on all account types. SL and TP orders will still be active, even if your computer is switched off. The minimum trailing stop level is 1.5 pips or 15 points. It is possible to set only 1 trailing stop per order. You need to have the MT4 platform open to keep the trailing stop active.

What are your trading hours?

FX trading is available 24 hours a day, 5 days a week. You can trade from monday 00:00 to friday 24:00 (server time, GMT + 2). For cfds, we have specific trading hours listed here.

Do you have a dealing desk?

We don’t have a dealing desk because we are an STP broker and all our procedures are automated. We have no conflict of interest with our clients as 100% of the orders are cleared with liquidity providers.

Does slippage occur in your platform?

At globex360, slippage can occur during big news announcements, depending on the market conditions and volatility. There can be both positive and negative slippage.

How many platforms are available for trading?

We offer one of the most popular and easy-to-use platforms,MT4 which is available for windows, OS X, ios and android.

What is the margin call procedure for MT4?

Negative price movement can potentially lead to a margin call and the subsequent triggering of an automated margin close-out of positions. In the event that market conditions are unfavourable to you, we will set a stop-out level to reduce your maximum loss. This means that we will set a threshold of margin value, below which positions are automatically closed. This stop-out is set at 30% of the margin. For example, based on a margin of 100, the position would be automatically closed if the net equity** reaches 30 or lower.

In a nutshell, once your account net equity drops below 100% of the initial margin required to establish the open position(s), MT4 changes colour to red to indicate that you are close to or on margin call, and once your account net equity drops below 30% of margin requirements, your open positions will get closed automatically.

(**net equity: defined as the sum of the client’s net profit and loss on an open position(s) and client’s deposited funds.)

Do you offer swap-free accounts?

Yes, we offer muslim faith traiders all our accounts with a swap-free option

INFORMATION REGARDING IB

IB program

Do you offer remuneration for introducing brokers?

We do offer an IB programme. Here is how it works:

1. Open an account in the client area. If you are an existing client, please insert your account number.

2. Agree to the terms and conditions in the client area – IB room.

3. Promote our services to potential clients who may wish to open an account and start trading with us.

4. Start receiving IB commissions.

If you want to share your IB link with your clients, then please note that the URL link contains cookies. Cookies will save your IB information. When your client completes the registration form in the client area and opens an MT4 account, then your IB code will be provided by default as main IB.

How to attach clients to my IB account?

There are two ways a client can be attached to your IB account:

1. You provide your clients with a unique IB referral link. Whenever a new client goes to our website using that link, registers his client area and opens a live account, you immediately see him being attached to your IB account.

2. We can add an existing client under your IB account upon a written request from the client.

How is the IB commission added to my account?

Whenever your client makes a trade, it will be automatically shown in your IB room with the calculated commission. The weekly IB commissions are added to your IB balance every weekend after what you can immediately withdraw them.

How can I withdraw my IB commission?

You can withdraw your IB commission anytime you want by filling in a withdrawal form inside the client area you can transfer the funds to your globex360 live account or withdraw them to your bank account, skrill, neteller or any other available payment solution.

Globex360

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Alternatives

Forum, user reviews and feedbacks

Alternatives

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Globex360 review

"> updated: october 26, 2020

Summary

We do not recommend globex360 for south african traders due to the high cost of trading and the numerous complaints we have received. If you are looking for a good south african forex broker we recommend blackstone futures or khwezitrade instead.

Globex360 minimum deposits start at 100 USD, but trading costs are expensive. Spreads are wide, starting at 2 pips on the basic account. A large commission per trade is also charged on all accounts, which is unusual for a broker with such wide spreads. Full spreads are not published.

In addition, while globex 360 states that withdrawals are free, we have received multiple claims that deposits do not reflect to trading accounts and withdrawals do not reflect to bank accounts. Clients have also complained that customer service is extremely poor, or non-existent when it comes to funding issues.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for globex360

Is globex360 safe?

Globex360 was founded in 2017 in johannesburg and has been regulated by the FSCA since 2019 under FSP #50130. The FSCA has brought in a new licence for south african brokers called the ODP licence, but it is unclear if globex360 has applied for this yet.

Globex360 is an STP broker and operates without a dealing desk вђ“ though trade execution on basic accounts is instant, insinuating an automated dealing desk of some kind. Standard and professional accounts are both market execution.В

Globex360 does not offer negative balance protection, stating that вђњnegative balance protection is not guaranteed. The general practice is that we cover the negative balance, but all cases are reviewed on a case-by-case basis.Вђќ

We have received many complaints from south african traders with a globex360 login regarding deposit and withdrawal issues. We cannot prove that any of these allegations are true, but since the collapse of JP markets traders should be very careful when choosing a forex broker.

Should I trade with globex360?

We do not recommend globex360 for south african forex traders.

Even if the allegations of funding problems are untrue, globex360вђ™s trading costs are unreasonably high and its forex education is poor. Even though globex360вђ™s minimum deposit is quite low at 100 USD, it does not publish its complete spreads, trading accounts are not offered in ZAR, and the only platform available is MT4.В

We recommend choosing another broker from one of our lists:В

We only recommend well-regulated, honest brokers with good trading conditions.В

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Globex360 review

Globex360 is a forex CFD broker in south africa, that opened for business in february of 2019. They are licensed and regulated in south africa by the FSCA. Customer support email is: [email protected] . Official website site is: https://globex360.Co.Za/.

Traders with withdrawal problems & complaints should read this.

Globex360 review

Investors at globex360 are given access to the MT4 trading platform, which has a desktop trading app, or a web-based trading app. For mobile trading, globex 360 developed their own custom trading apps for android & ios. They offer a wide variety of assets to trade including; forex / currency pairs, commodities (oil, gold silver), indices and CFD’s for shares trading.

The maximum leverage / margin rate offers is 300:1, and the starting spreads range from 1.3 pips to 1.6 pips. You can create multiple demo trading accounts to test out the platform and your trading strategies. The minimum required deposit for a the standard account is $100, and $200 for the copy trading account. At a broker like fortrade, you can start trading with just $100.

Social / copy trading

Once you have created your account, and logged in, you will see that globex360 provides you will access to their copy trading system. Copy trading is a popular feature for new forex investors because they are hoping another forex trader will do the hard work for them.

When choosing the right copy trader, it is important to closely analyze the performance, and even more so, understand the terminology. Instead of looking at the traders with this highest returns, dig deeper, and check their drawdown stats. See the screenshot below.

Warning! Do not use an automated trading app, until you read this!

Is globex360 a legit broker?

Yes, globex360 is an FSCA regulated CFD broker, holding license number 50130, since july 10th 2019. You can see their official license on the FSCA website.

Officially owned and operated by: globex360 (PTY) LTD, their corporate address is; 67 mountain road, somerset west, cape town, western cape, 7130 south africa. Their offices are located at: 158 5th street, 3rd floor, sandton office towers, sandhurst, sandton, 2196, gauteng. Contact phone number is: +27 11 568 3097.

The way day traders know if their broker is legit and not a scam, is by verifying their license at the government regulator. When you see that they have a valid license, from your government financial regulator, then you will know that they are a legal broker.

What was your trading experience like with the brokers at globex360? Write your review in the comment section below.

Compare popular brokers

There are many forex brokers online, and they are all vying for your business. You should test out a few different brokers, and see which one is the best for your trading needs. Always verify that your broker is licensed by your local financial regulator (i.E. FCA united kingdom).

Fortrade is a popular broker, that is licensed and regulated in the united kingdom, europe, canada and australia, see here.

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

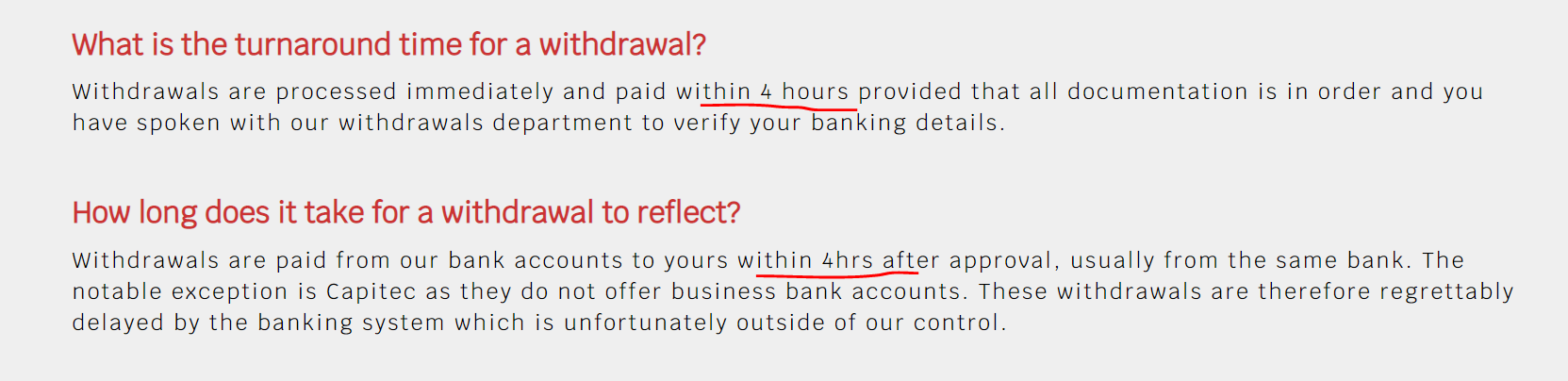

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

Range of markets

Range of markets

Forex

Forex, commonly known as foreign exchange or FX, is the world’s most widely traded market, with an estimated daily turnover exceeding $5,5 trillion. Currencies are traded around the clock 24 hours a day, 5 days a week. Globex360° is offering covers over 50 spot instruments, with attractive leverage and financing costs. As the most liquid market in the world, high volume trades can be executed with no slippage, and stop-loss orders are guaranteed for mini accounts during trading hours.

- Spreads from 0.28 pips

- Leverage up to 1:500

- Ultra-fast execution

Why trade FX with globex360°?

Over 50 spot forex cfds

globex360 offers trading access to major, minor, and emerging pairs 24 hours a day, 5 days a week. From GBP/USD to USD/HUF, your positions held overnight are rolled over to the next day, with the cost being built in to swap points. These can be positive or negative depending on the currency pair traded.

Leverage up to 1:500

gain a much larger market exposure with a relatively smaller initial deposit. Remember, with leveraged trading, the potential for profits or losses from your initial outlay of capital is much higher than in tradition trading. We offer leverage of 1:500 on accounts with a balance under $10,000 for FX instruments.

Spreads from zero pips

we offer an extremely competitive spread range, with spreads on EUR/USD from zero pips on our PRO account (STP). All of our other instruments are also quoted at the best possible prices from our liquidity providers.

Ultra-fast execution

we’re constantly improving our platform to bring you the best execution speeds in the business. With an average execution time of 85 milliseconds, your trades are routed directly to our servers and executed automatically, with no dealer intervention.

No requites

because of our ultra-fast execution and price feeds, there are no re-quotes when trading with us whatsoever. Your order will always be executed at the requested price – instant orders, every time.

Deep liquidity

we are currently using a number of renowned liquidity providers. This allows us to offer you the best possible prices, execution and market depth. Even high volume trades can be executed with the lowest possible slippage, thanks to our advanced market solutions.

Guaranteed stop loss, free of charge

as part of our basic account, we offer you guaranteed stop losses with fixed spreads. We guarantee that your stop losses will be executed at the price you requested, free of charge – even in times of significant slippage.

Trade your way – choose an account to suit your trading style

- Mini: suited for beginners who are at the start of their trading journeys. Enjoy fixed spreads, no additional commission and guaranteed stop losses. Trades are executed instantly, and leverage goes up to 1:500 on FX instruments. Micro lots trading is also available, with simple functionality that allows you to focus on shaping your skills and placing your first trades.

- Standard: for the more experienced traders. Instruments are quoted at market prices with floating spreads, and spreads are tighter during more active hours. Trades are executed instantly, and leverage also starts from 1:500.

- ECN: for the most sophisticated investors. Market spreads are pure and every trade is charged an additional commission. You can benefit from interbank pricing from the FX market with this account. Leverage starts from 1:200

Globex360 review

Globex360 is a forex CFD broker in south africa, that opened for business in february of 2019. They are licensed and regulated in south africa by the FSCA. Customer support email is: [email protected] . Official website site is: https://globex360.Co.Za/.

Traders with withdrawal problems & complaints should read this.

Globex360 review

Investors at globex360 are given access to the MT4 trading platform, which has a desktop trading app, or a web-based trading app. For mobile trading, globex 360 developed their own custom trading apps for android & ios. They offer a wide variety of assets to trade including; forex / currency pairs, commodities (oil, gold silver), indices and CFD’s for shares trading.

The maximum leverage / margin rate offers is 300:1, and the starting spreads range from 1.3 pips to 1.6 pips. You can create multiple demo trading accounts to test out the platform and your trading strategies. The minimum required deposit for a the standard account is $100, and $200 for the copy trading account. At a broker like fortrade, you can start trading with just $100.

Social / copy trading

Once you have created your account, and logged in, you will see that globex360 provides you will access to their copy trading system. Copy trading is a popular feature for new forex investors because they are hoping another forex trader will do the hard work for them.

When choosing the right copy trader, it is important to closely analyze the performance, and even more so, understand the terminology. Instead of looking at the traders with this highest returns, dig deeper, and check their drawdown stats. See the screenshot below.

Warning! Do not use an automated trading app, until you read this!

Is globex360 a legit broker?

Yes, globex360 is an FSCA regulated CFD broker, holding license number 50130, since july 10th 2019. You can see their official license on the FSCA website.

Officially owned and operated by: globex360 (PTY) LTD, their corporate address is; 67 mountain road, somerset west, cape town, western cape, 7130 south africa. Their offices are located at: 158 5th street, 3rd floor, sandton office towers, sandhurst, sandton, 2196, gauteng. Contact phone number is: +27 11 568 3097.

The way day traders know if their broker is legit and not a scam, is by verifying their license at the government regulator. When you see that they have a valid license, from your government financial regulator, then you will know that they are a legal broker.

What was your trading experience like with the brokers at globex360? Write your review in the comment section below.

Compare popular brokers

There are many forex brokers online, and they are all vying for your business. You should test out a few different brokers, and see which one is the best for your trading needs. Always verify that your broker is licensed by your local financial regulator (i.E. FCA united kingdom).

Fortrade is a popular broker, that is licensed and regulated in the united kingdom, europe, canada and australia, see here.

So, let's see, what we have: globex360 review summary we do not recommend globex360 due to the numerous complaints and high cost of trading. We encourage traders to check out plus500 & avatrade as possible at minimum deposit for globex360

Contents of the article

- Actual forex bonuses

- Globex360 review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for globex360

- Is globex360 safe?

- Should I trade with globex360?

- Frequently asked questions

- Deposit and withdrawals questions

- How do I deposit funds to my account?

- What is the minimum deposit?

- How do I withdraw funds from my account?

- Do you have any charges on deposits and...

- How fast do you process my withdrawals?

- How long does it take for funds to reach my bank...

- Can I withdraw via a different payment method...

- Can I withdraw my money if I have open...

- Trading conditions

- What are the minimum and maximum position sizes?

- What is your order execution speed?

- What are your margin call/stop out levels?

- What are the minimum and maximum account leverage...

- Are hedging and scalping allowed?

- What is a slippage?

- What is globex 360 execution model?

- Do you offer negative balance protection/cover...

- Do you offer FIX API connection?

- What are the limits of setting SL, TP, and TS?

- What are your trading hours?

- Do you have a dealing desk?

- Does slippage occur in your platform?

- How many platforms are available for trading?

- What is the margin call procedure for MT4?

- Do you offer swap-free accounts?

- IB program

- Do you offer remuneration for introducing brokers?

- How to attach clients to my IB account?

- How is the IB commission added to my account?

- How can I withdraw my IB commission?

- Globex360

- Alternatives

- Forum, user reviews and feedbacks

- Alternatives

- Globex360 review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for globex360

- Is globex360 safe?

- Should I trade with globex360?

- Forex minimum deposit

- Trading with a small deposit

- Globex360 review

- Globex360 review

- Social / copy trading

- Is globex360 a legit broker?

- Compare popular brokers

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- Range of markets

- Range of markets

- Forex

- Globex360 review

- Globex360 review

- Social / copy trading

- Is globex360 a legit broker?

- Compare popular brokers

No comments:

Post a Comment