Jp markets login problems

Your ref: MT4 number: (e.G. 554472). You can login to your client portal here.

Actual forex bonuses

Jp markets login problems

Deposits

Deposit funds via bank,

ATM or online gateways

Please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. Also, payment allocations can take up to 24 hours from mondays to fridays. For faster allocation please email all proof of payments to finance@jpmarkets.Co.Za.

Account name: JP markets SA (pty) ltd

Account number: 408 902 1536

Account type: current account

Currency type: south african rand account (ZAR)

Bank identifier code (BIC): ABSAZAJJ

Your ref: MT4 number: (e.G. 554472).

Nedbank

Nedbank details:

Account name: JP markets SA (pty) ltd

Account number: 113 6899 766

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Standard bank

Standard bank details:

Account name: JP markets SA (pty) ltd

Account number: 271 294 531

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

First national bank

FNB bank details:

Account name: JP markets SA (pty) ltd

Account number: 62638202432

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Snapscan

Step 1. Snap

Open snapscan and use your phone’s camera to scan the snapcode displayed at the checkout or on your bill.

Step 2. Pay

Enter the amount you want to pay and confirm payment with your 4-digit PIN.

Step 3. Go!

That’s it. You’re done! Make sure the merchant has received proof of payment – email to finance@jpmarkets.Co.Za with the MT4 number in the subject line

Online gateways

We accept payment through several online gateways. This is done through you client portal, the process is quick and easy, with an added benefit of being much faster than a bank deposit.

You can login to your client portal here.

Please note: when paying with skrill any amount below R200 may result in your deposit not being allocated due to associated fees.

Mpesa

Make use of mpesa to pay in the greater african area. (south africa currently unavailable)

Please follow this link and complete the regular checkout process.

On checkout be sure to choose the i-pay africa option and complete your payment using mpesa.

Please note: that all international payments and other currencies will be converted to the rate that of the SARB (south african reserve bank).

Risk warning: trading on margin products involves a high level of risk.

It is investors’ responsibility to maintain a prudent level of margin, pay their margin and also meet margin call payments on time and in cleared funds. Please keep in mind the possibility of delays in the banking and payments systems. If your payment is not credited by the time you are required to have the necessary margin or meet the margin call, you could lose some, or all of your positions.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : –

Cryptocurrencies: YES

Minimum deposit: R3000

Maximum leverage: 1:500

Spreads: low

My score: 2.2

JP markets is a global forex broker. JP market is becoming increasingly popular around the world. The broker established in 2016 and has its base in south africa. JP markets and its branches have been established in the south african cities of johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in swaziland, kenya, pakistan and bangladesh.

When I look at their website, jpmarkets.Co.Za, 30% of visitors are from south africa. The company’s focus is on helping traders on a local level, providing clients with the personalized customer service and tools required for them to succeed in a fast-paced and exciting industry that can make them very wealthy.

JP markets’ vision is to play an instrumental role in the creation of at least 30 african-owned forex brokerages across africa by 2020 and assist in the creation of 500 forex millionaires in the next 10 years.

Is JP markets scam or safe broker? Is JP markets regulated? Is JP markets ECN or STP? What is the JP markets minimum deposit? Is JP markets suspended?

In this JP markets review, I will introduce all details about the broker. If you are wondering about JP markets minimum deposit, jp markets account types, regulation, spreads, leverage, JP markets minimum withdrawal, platforms and bonuses, you are in the right place to find them all.

What is JP markets?

JP markets is an international online broker that started operations in 2016. Although the company has been in business for several years, it has communicated with a wide customer base. It started out as a small company with a small office and several employees, but today it has offices in various countries of the world.

It was founded by a local entrepreneur who comprehensively understands international financial markets. JP markets tries to establish long-term relationships and offers trading opportunities to local and global investors.

JP markets has a base in south africa, in many countries, with operations that offer innovative opportunities in the trading of forex, metal and other instruments on an STP basis. JP markets has set the vision to create at least 30 forex brokers in africa by 2023 and to help create 500 african forex millionaires in the next 10 years.

Who is the founder of JP markets?

JP markets founder justin paulsen is a south african economist who loves to deal with international finance. He studied economics and finance at the university of cape town then he dived into private banking sector. He became a leader in south african forex brokerage. He worked with traders, hedge fund managers, asset managers, portfolio managers and forex traders. This is how JP markets emerged.

He thought he could do this and he started his own business, he initially started JP forex investments, he passed RE5 AND RE1 exams. And all these things created jp markets at the end.

JP markets account types, spreads and leverage

JP markets offers its clients two account types. These are jp markets STP standart account and jp markets ECN account. However, before proceeding with jp markets real account you can start with jp markets demo account just to get a sense whether it’ll be worth it or not.

The standard account has variable spreads, no commission fees, STP (straight through processing) market execution and leverage up to 1:500. JP markets’ leverage can be considered high. But do not forget that higher leverage comes with higher risks of losses. There is also PAMM services. JP markets does not have a strict minimum deposit. However, the recommended minimum deposit for JP markets is around R3,000, particularly if you require training.

There is also jp markets ECN (electronic communications network) account. Traders benefit from lower spreads, but this account type charges as trades are executed. Eg. Spreads will reflect a charge of 1 pip on the platform and then a “commission” of $10 per standard lot on execution.

An ECN account stands for the electronic communication network. It means that your orders are executed directly in the market.

What is the difference between ECN and STP JP markets accounts?

The difference between ECN and STP jp markets is, on the ECN account, there is a commission per transaction; whereas on a standard account, you will be charged on spread. Both accounts work out similar in cost so it is all dependent on what you as a trader prefer.

However, JP markets offers average spreads in the market. On average you can get EUR/USD for about 2 pips. I think JP markets’ spreads are little higher compared to the other brokers.

| Account type | minimum deposit | spreads | leverage | minimum trade size |

|---|---|---|---|---|

| STP | R3,000 | 2 pips on EUR/USD | 1:500 | 0.01 |

| ECN | R3,000 | 1 pip + $10 com. Per lot | 1:500 | 0.01 |

Trading platforms

JP markets MT4 (metatrader 4) is available as a trading platform. The MT4 is still preferred by most brokers and experienced traders. JP markets’ platform features advanced charting package, trading and analysis tools, alerts, signals, and customizable indicators. MT4 allows you to see the marketplace you are dealing with.

You can use JP markets login to enter your MT4 account and start trading. It is at the top right of the site called JP markets client login. If you are a partner of the company you will enter as a partner near the client login.

Trading products

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform. There is no other option.

You can enter and trade the markets manually or automatically with copy trader or copy master accounts. This means that with just a simple order copy, you can profit from the main accounts and the transaction without any information or deduction. Or, as a master trader, to gain extra exposure to the markets and management of larger capitals.

What are JP markets fees?

JP markets spreads are variable and worse than many forex firms in the market. It is about 2 pips for the average EUR / USD STP account. As I mentioned earlier, the ECN account has a $ 10 commission per lot, which is a better option for professionals, but can be used for anyone as a reference.

This spread determined for EUR / USD is quite high. There are many forex brokers that offer lower rates. JP markets fees seem to be unfavorable in this respect. So, there is no lucrative side to opening an account and trading.

What is the minimum deposit for JP markets?

JP markets minimum deposit is R3,000 which is around $200. It is high when we compare to the other forex brokers. The average minimum deposit is $ 100 in forex market, while JP markets requires twice that.

JP markets withdrawal and deposit methods are limited. The broker does not offer a wide range of deposit options. JP markets’ offers the possibility to send withdrawal requests via whatsapp, which are not seen on other platforms.

Withdrawals take approximately 24 hours. Withdrawals can be made on official working days from 09:00 to 17:00. There is no possibility to withdraw money on weekends and holidays. Before making a withdrawal request, for example, scanned copies of your identity, bank statements and proof of address are required.

JP markets bonuses and promotions

JP markets offers its clients some bonuses and promotions. One of them is ‘%200 deposit bonus’ aka jp markets welcome bonus. There are terms and conditions you can see them on their website. The second one is earning interest. The interest rate of approx. 7.2% per annum allocated weekly, means you’re earning interest like a savings account. You can see the details on their website. The last one is JPM card. You can be a VIP mastercard client by taking the card. Unfortunately, JP markets no deposit bonus is not available. Your bonuses are earned and you receive 5 dollars per lot. E.G.: if you receive a bonus of $50, you need to trade 10 lots in order to earn the full $50 bonus which you can then withdraw.

JP markets deposit and withdrawal methods

JP markets deposit are credit/debit cards, bank wire transfer, payfast, skrill, i-PAY, payfast.

Withdrawals on JP markets are now quick and easy, available to you through the client portal. This is the fastest way to submit a withdrawal.

Is JP markets suspended?

South africa, one of the most developed countries in africa, has a substantial financial market potential. JP markets also wants to be considered as a reliable broker in this market in order to gain a place in this market. The regulator is not one of the most reputable in the world, but it still has a certain level of reliability.

Subject to a qualified standard of how the broker operates, customers are protected by regulatory obligations that maintain trade security as well as other security rules related to money management and market integration.

In simple terms, legal obligations, which are subject to a qualified standard on how the broker works, serve the trade conditions, as well as maintaining a number of other security rules specifically for money management and market integration. Thus, there is negative balance protection, while merchants segregation provides the highest level of security, it is accompanied by the protection of the interests of all customers.

There is a question that worries the clients about the broker: is JP markets license suspended? The answer is yes and no. FSB suspended the license earlier but it’s been reissued recently. It means that you have to be careful if you want to open an account with this broker.

Customer services

How JP markets complaints is dealt with? In the unlikely event of you having any reason to feel dissatisfied with any aspect of their services, in the first instance you should contact their jp markets customer services department on +27(0) 87 828 0576 or email support@jpmarkets.Co.Za, as the vast majority of complaints can be dealt with at this level.

If customer services is unable to resolve the matter you may refer to it as a complaint to jp markets compliance department. Please set out the complaint clearly, ideally in writing. The compliance department will carry out an impartial review of the complaint with a view to understanding what did or did not happen and to assess whether they have acted fairly within their rights and have met their contractual and other obligations. A full written response will be provided with six weeks of receiving the complaint.

The broker has live chat but it was offline when I try to reach. JP markets contact details: black river office park 2 fir street observatory, cape town gatehouse building, 2nd floor.

What is jp markets whatsapp number? As of now, you can contact them at +27 71 559 9457 via whatsapp.

What is jp markets office telephone number? Their tel number is +27 010 590 1250

what is jp markets email address? It is support@jpmarkets.Co.Za

what is jp markets facebook page? Its link is www.Facebook.Com/jpmarketssa

Investors need to be sure that the broker they choose will provide support and assistance as needed, to help them easily find the exact answers to their customers’ questions and provide them with the best user experience. Phone call, e-mail, online chat and whatsapp are the options.

If you’re unsure about their reliability go ahead and try to contact them through the channels I mentioned above. Maybe you can act like an old client of them at first since some companies take better care when it comes to a new client or a prospect. At the end, you can take everything into consideration when deciding whether you invest with them or not.

Conclusion

JP markets is an south african forex broker. The broker has limited account types and does not allow scalping, hedging and eas. And you don’t have the chance to choose trading platforms. JP markets support only MT4 platform, making them easy to use for many traders.

JP markets was regulated by FSB but the regulator entity suspended their license earlier due to miscommunication as their CEO says. JP markets license has been reissued.

Although they have a valid license now, I suggest you to consider investing in there wisely since suspensions occur frequently in this market. On the upside, they have various awards, I attach their screenshots below

If you wanna try and check them out, you can reach jp markets login page by clicking the button below. Hope you informed with this review.

Sign in to browse your offers

We've selected offers just for you.

Sign in above to explore

We're here to help you manage your money today and tomorrow

Checking accounts

Choose the checking account that works best for you. See our chase total checking ® offer for new customers. Make purchases with your debit card, and bank from almost anywhere with your phone, tablet or computer and at our 16,000 atms and more than 4,700 branches nationwide.

Savings accounts & cds

It’s never too early to begin saving. Open a savings account or open a certificate of deposit (see interest rates) and start saving your money. See chase savings offer for new customers.

Prepaid card

The starbucks ® rewards visa ® prepaid card is the only reloadable prepaid card that allows you to earn stars everywhere you shop, with no monthly, annual or reload fees. Other fees may apply.

Credit cards

Choose from our chase credit cards to help you buy what you need. Many offer rewards that can be redeemed for cash back, or for rewards at companies like disney, marriott, hyatt, united or southwest airlines. We can help you find the credit card that matches your lifestyle. Plus, get your free credit score!

Mortgages

Home equity line of credit

You might be able to use a portion of your home's value to spruce it up or pay other bills with a home equity line of credit. To find out if you may be eligible for a HELOC, use our HELOC calculator and other resources for a HELOC.

Car buying & loans

Chase auto is here to help you get the right car. Apply for an auto loan for a new or used car with chase. Use the payment calculator to estimate monthly payments.

Planning & investments

Whether you choose to work with a financial advisor and develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. Check here for latest you invest℠ offers, promotions, and coupons.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Chase private client

Ask us about chase private client, a unique level of service that combines concierge banking from chase and access to J.P. Morgan’s investment expertise.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NO BANK GUARANTEE • MAY LOSE VALUE

Business banking

With business banking, you’ll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses.

About chase

Chase bank serves nearly half of U.S. Households with a broad range of products. Chase online lets you manage your chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If you have questions or concerns, please contact us through chase customer service or let us know about chase complaints and feedback.

Sports & entertainment

Chase gives you access to unique sports, entertainment and culinary events through chase experiences and our exclusive partnerships such as the US open, madison square garden and chase center.

Other products & services:

“chase,” “jpmorgan,” “jpmorgan chase,” the jpmorgan chase logo and the octagon symbol are trademarks of jpmorgan chase bank, N.A. Jpmorgan chase bank, N.A. Is a wholly-owned subsidiary of jpmorgan chase & co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan wealth management is a business of jpmorgan chase & co., which offers investment products and services through J.P. Morgan securities LLC (JPMS), a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through chase insurance agency, inc. (CIA), a licensed insurance agency, doing business as chase insurance agency services, inc. In florida. Certain custody and other services are provided by jpmorgan chase bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of jpmorgan chase & co. Products not available in all states.

"chase private client" is the brand name for a banking and investment product and service offering.

Jp markets login problems

Products

Asset class capabilities

Investment approach

College planning

Defined contribution

Market insights

Portfolio insights

Retirement insights

Portfolio construction

Defined contribution

Economic & market update

Welcome to the 1Q 2021 J.P. Morgan asset management market and economic update. This seminar, presented by dr. David kelly, highlights the major themes and concerns impacting investors and their clients, using just 11 guide to the markets slides.

There are 75 pages in the guide to the markets. However, we believe that the key themes for the first quarter can be highlighted by referencing just 11 slides.

Dr. David kelly

Chief global strategist

ECONOMIC & MARKET UPDATE: USING THE GUIDE TO THE MARKETS

TO EXPLAIN THE INVESTMENT ENVIRONMENT

1. The pandemic continues to surge

Any discussion of the economic and investment outlook must start with an understanding of the human toll of the pandemic itself. This page looks at the 7-day moving average of new confirmed cases and fatalities of COVID-19. The path of the pandemic impacts the level of economic activity, and fluctuations cause a lot of uncertainty. After surging and retreating in the spring and the summer, the pandemic has worsened in recent months and will likely continue to surge in the first quarter. However, the approval of several very effective vaccines in the U.S. Should allow for the inoculation of roughly 150 million people in the first half of 2021, allowing life to largely return to normal by the fall of 2021.

2. The economic recovery should accelerate in 2H21

After suffering the most severe recession since WWII resulting in the worst quarterly GDP print on record in 2Q20, economic growth surged in the third quarter, notching the best quarterly GDP print on record in 3Q20. However, despite this strong surge, economic activity has only partially recovered from the collapse and remains far below the trend suggested by economic growth at the end of the last decade. This reflects the dominance of the service sector in the economy and the inability of it to recover fully in a pandemic.

The renewed pandemic will put further pressure on these industries and this, combined with a delay in getting extra fiscal support to the U.S. Economy, is leading to a sharp deceleration in economic activity with growth likely slowing to a very low single-digit pace in early 2021. Thereafter, however, growth should surge due to both pent-up demand and pent-up supply in those sectors that have been most impacted by the pandemic.

3. Job gains should slow until broad vaccine deployment

After reaching a 50-year low in february of 3.5%, the unemployment rate spiked to 14.7% in april, as 22 million people lost their jobs. Although there has been a sharp recovery in jobs thus far, the second half of the labor market recovery is likely to be much more gradual, as the pace of job gains has already slowed. Much of the remaining employment decline from the pandemic is in sectors that will have a hard time reopening while the pandemic continues, including the leisure, hospitality, travel, retail and food services industries. In addition, state and local government cutbacks could weigh on payroll employment. However, once the vaccine is broadly deployed, service-sector jobs could have a healthy rebound.

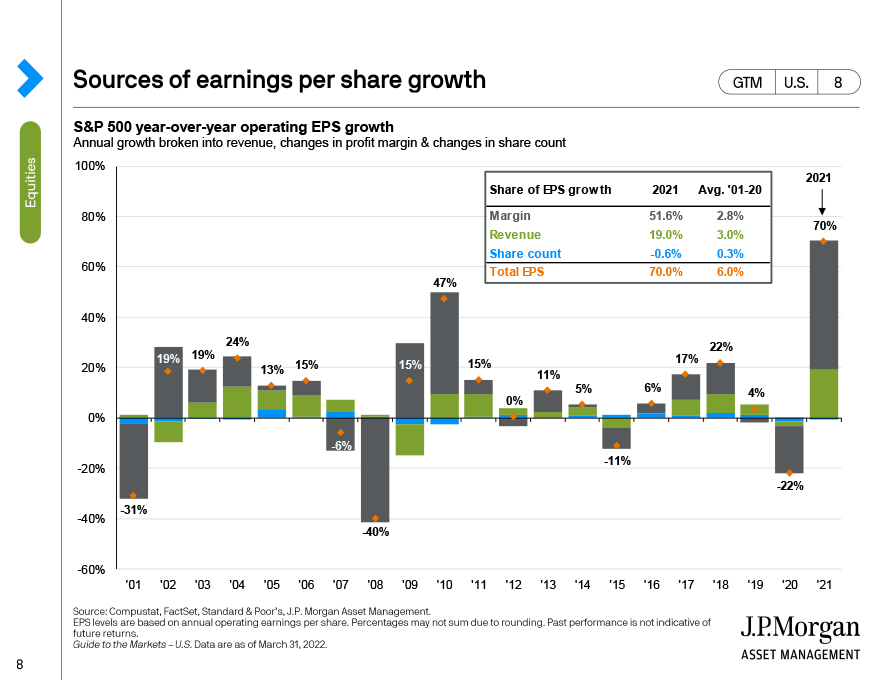

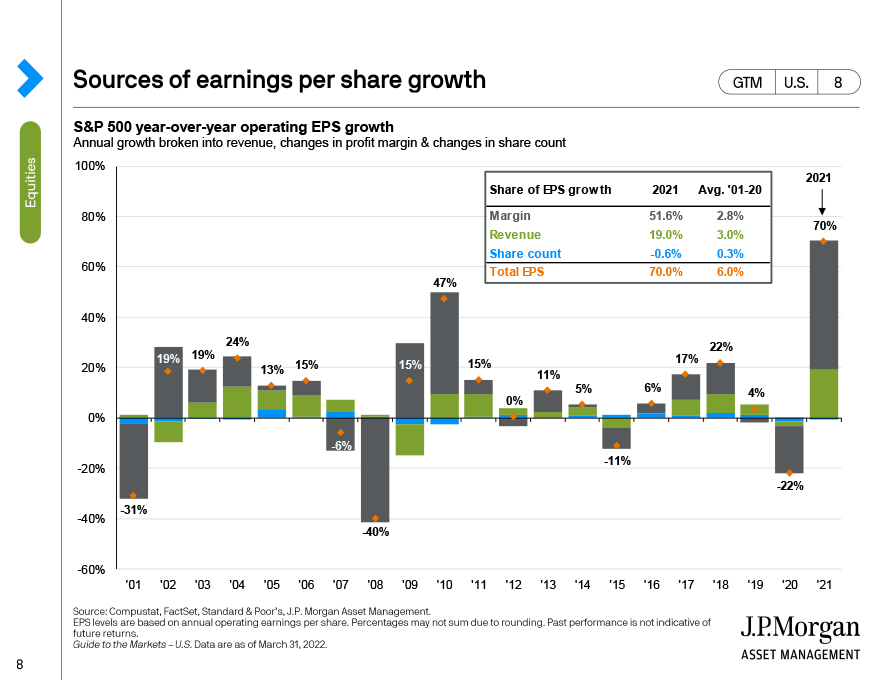

4. Profits have turned a corner

The deep recession in the economy was mirrored in big declines in S&P500 operating earnings in early 2021, pushing profits into recession. Analysts are expecting profits to recover in 2021, but past earnings recessions have typically lasted 2-3 years, and given the severity of the plunge in profits and the gradual economic recovery, it is likely that profits will not surpass their 2019 peak until 2022. However, in 2021, areas hardest hit by the pandemic, like energy, financials, and industrials, could experience solid earnings rebounds, while areas like technology and health care should continue to hold up well.

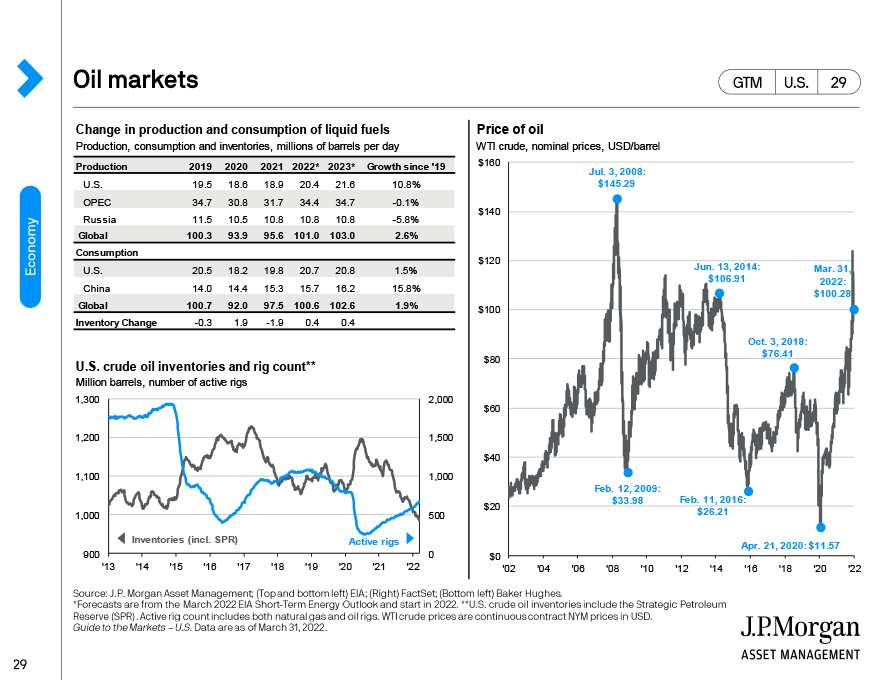

5. Higher inflation is a risk down the road

The onset of the recession, combined with a collapse in oil prices, triggered a decline in already low inflation. Although inflation normally troughs after the end of a recession, things may be a little different this time around, particularly given the potential for further fiscal stimulus, the continuing extra costs of operating during a pandemic and the likelihood of an economic surge following the distribution of a vaccine. Consequently, we expect inflation, using both CPI and personal deflator measures, to edge over 2% by the middle of 2021 and stay at close to this pace into 2022.

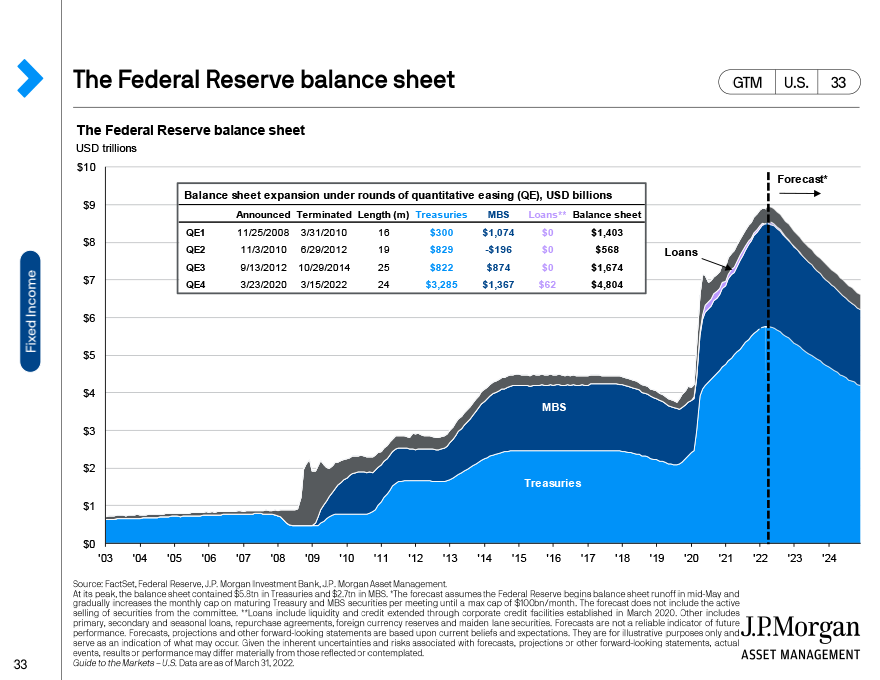

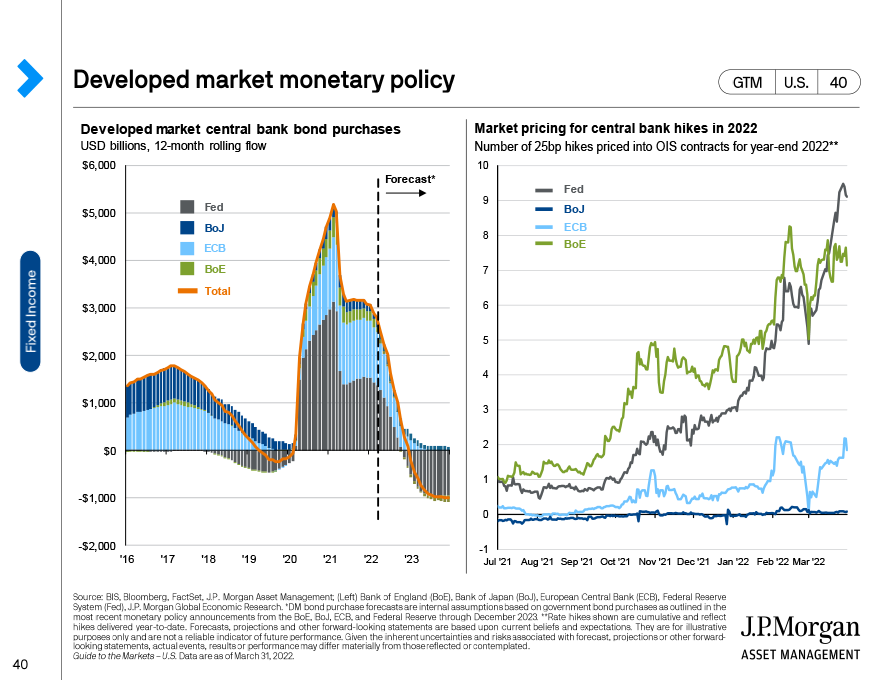

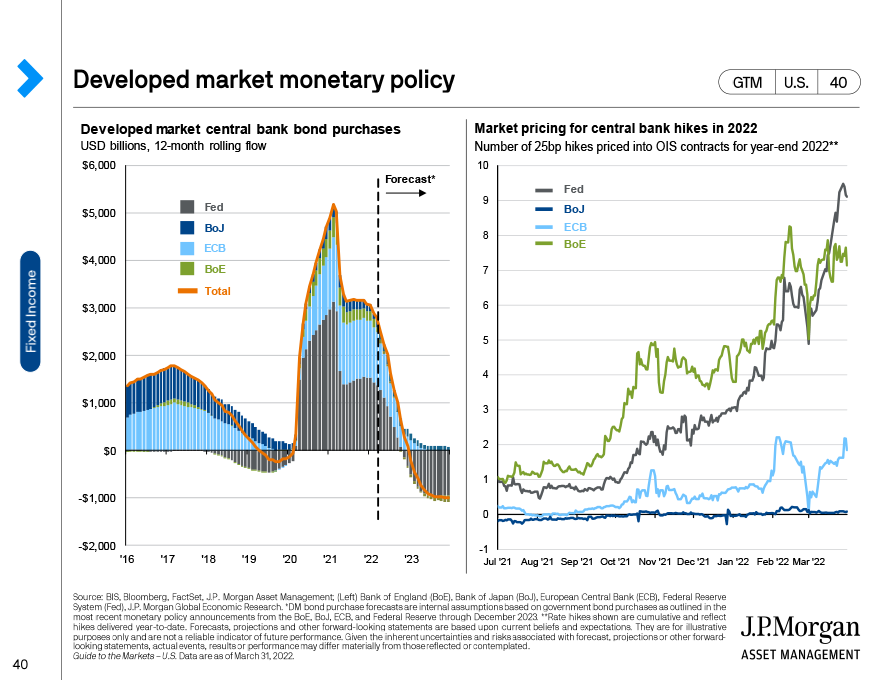

6. The federal reserve remains accommodative

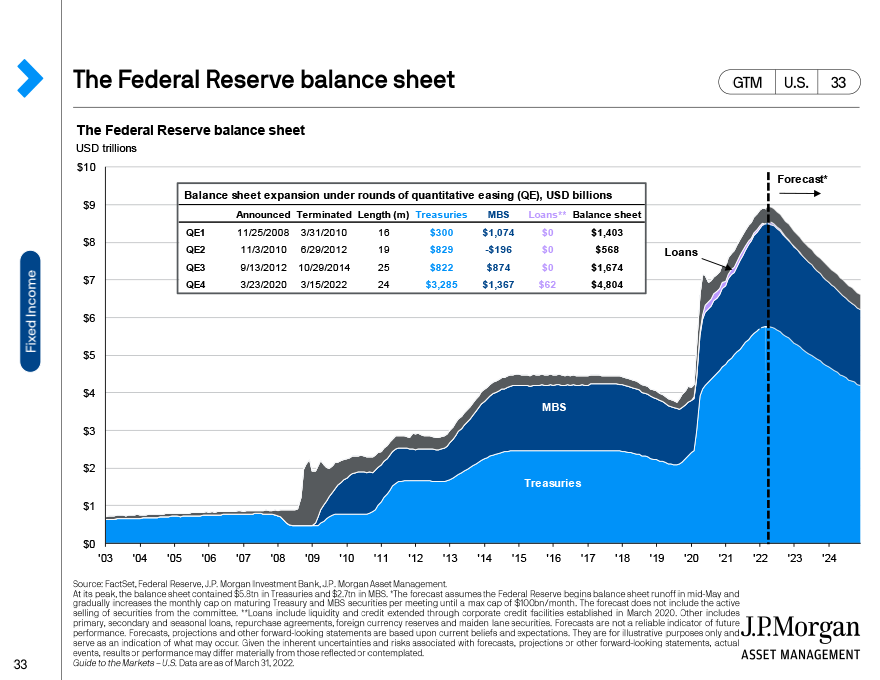

In the first half of 2020, the federal reserve took very strong action to support the economy including cutting the federal funds rate to a range of 0-0.25%, opening or expanding a very wide range of facilities designed to support different parts of the bond market and adding dramatically to its balance sheet.

In addition, in august, the fed adopted an “average inflation targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. In order to achieve this they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for some time.

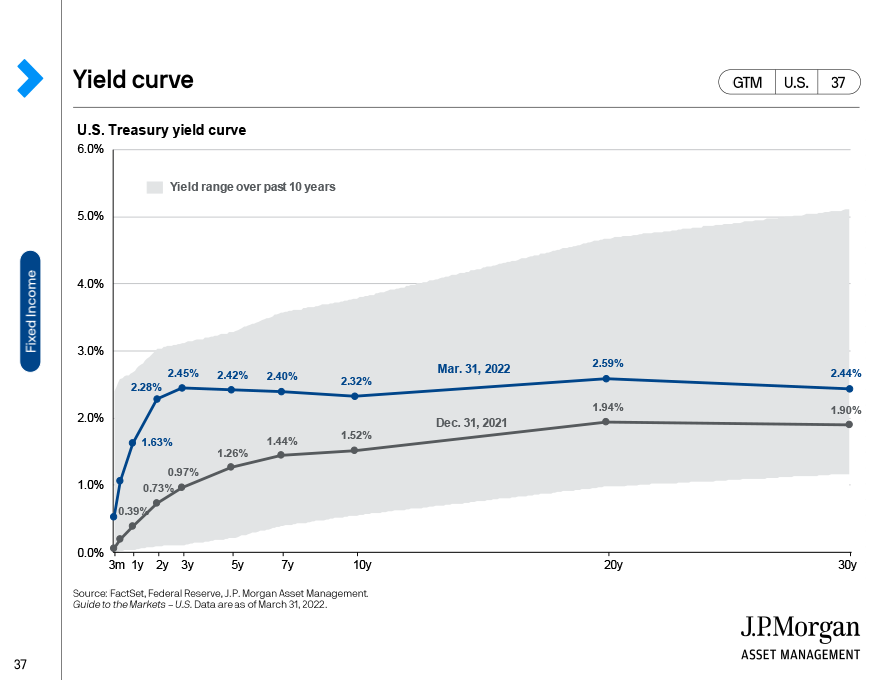

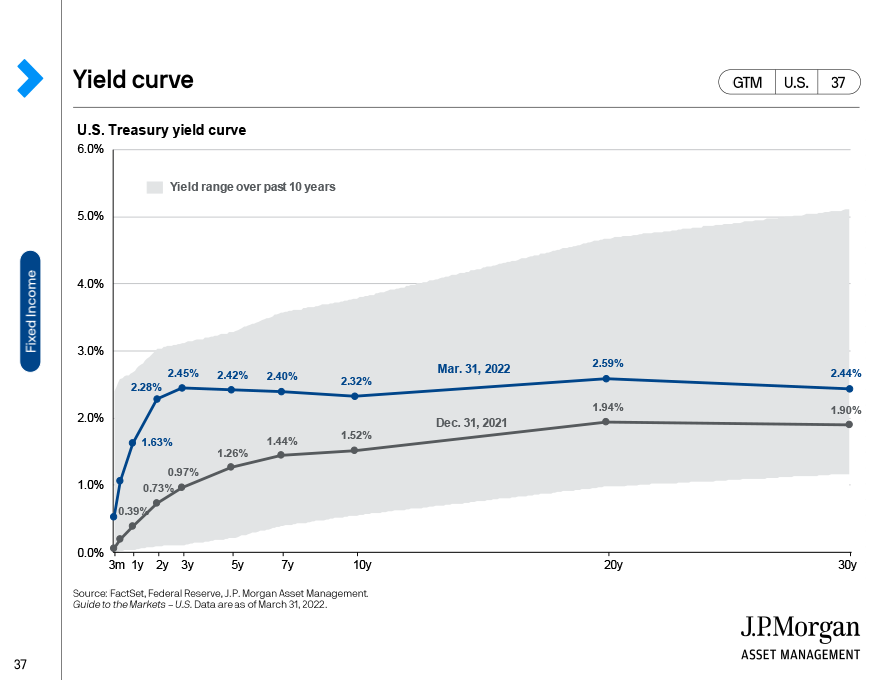

Although the fed pledged to maintain its current asset purchases until “substantial further progress” has been made to achieving its inflation and employment goals, it is important to note that this timetable suggests that the fed will reduce its bond purchases well in advance of any increase in short-term interest rates. This, in turn, suggests a steepening of the yield curve as the economy continues to recover in 2021.

7. Massive fiscal support has boosted debt and deficits

The heart of the economic damage is with consumers and businesses, so the U.S. Government delivered a multi-trillion dollar fiscal package to mitigate permanent economic damage at the onset of the pandemic. Pending further fiscal support and possibly infrastructure spending, the budget deficit could further increase in 2021, but will likely still be below 2020 levels. However, the national debt as a share of GDP will continue to grow to the highest levels since WWII. While we do not believe this will result in a fiscal crisis in the next couple of years, a failure to rein in deficits and debt monetization once the economy accelerates in the wake of a vaccine could lead to significant problems. This suggests that eventually, the government will have to make some tough choices on tax hikes and spending cuts.

With the federal funds rate at 0-0.25%, nominal treasury yields have fallen to near-historic lows and real yields are negative. In this low rate environment, investors will continue to hunt for yield. Although spreads had widened in riskier fixed income, they have come in meaningfully, making risk-return dynamics less attractive. However, despite unattractive yields, high quality fixed income will continue to play an important role in providing investors with downside protection and diversification.

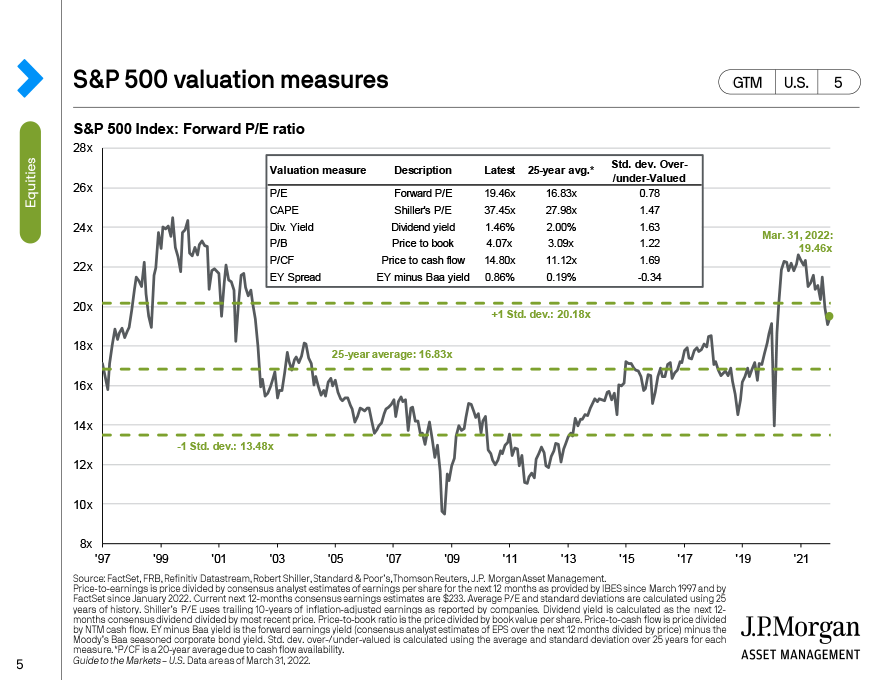

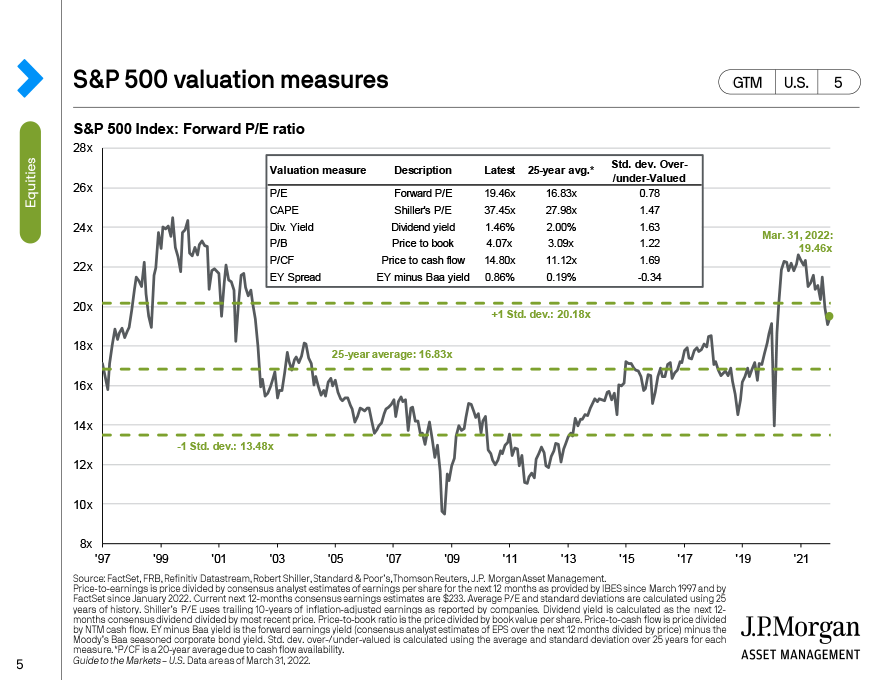

9. Valuations are high for U.S. Equities

U.S. Equities have recovered significantly from the march lows, and at record speed. However, as markets look through the virus and the downturn to the recovery, valuations are well above historical averages. Investors should recognize that earnings are likely to continue to grow quickly in the year ahead which should lead to some compression in these ratios. Moreover, a continuation of relatively low interest rates likely justifies some elevation of valuation measures above their historical averages. Still, rich valuations may constrain equity returns over the long-run. Consequently, investors may want to consider diversifying their equity exposure adding more to value stocks as well as reducing weightings to the very largest companies in the stock market.

10. International stocks offer long-term opportunities

Both U.S. And international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. And international stocks that persisted throughout the recent expansion still persists today. However, this dynamic could shift in the next expansion.

The long-term growth prospects of EM economies still look better than for the U.S., valuations remain cheaper overseas, and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

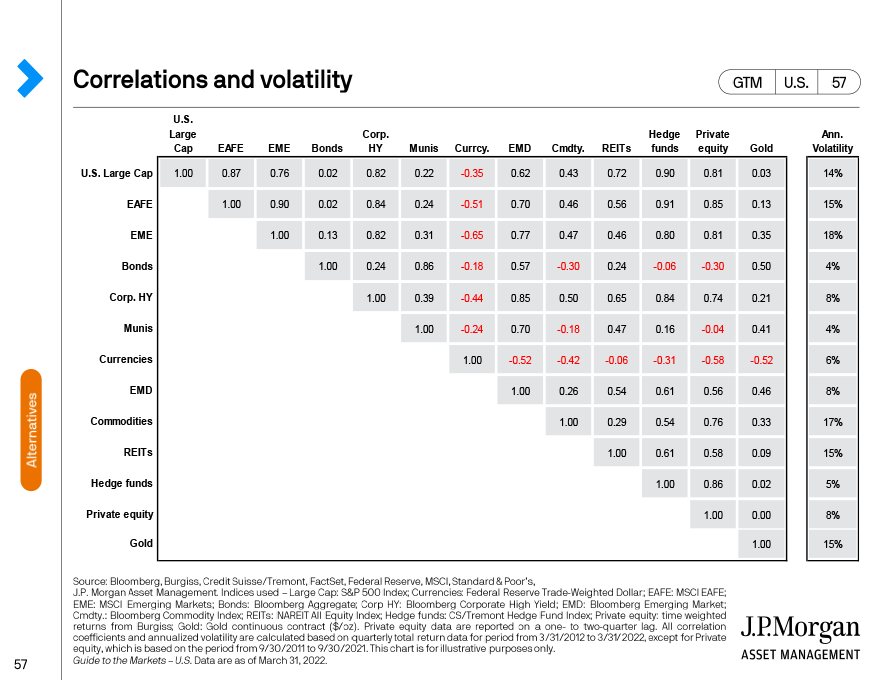

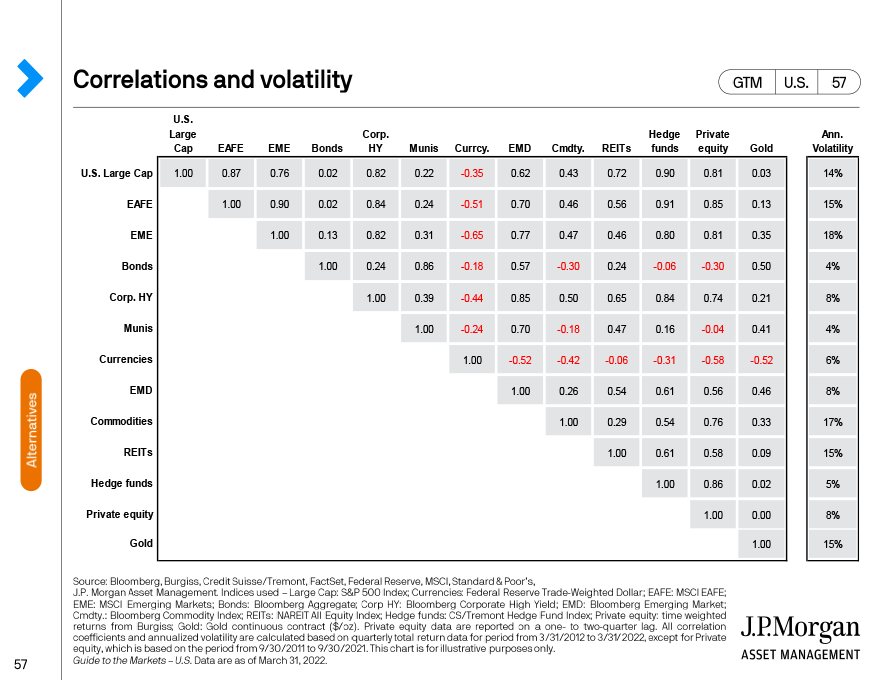

11. Risks ahead call for diversification

Given the extraordinary disruption to the U.S. And global economies in 2020, it is remarkable how resilient financial markets have proven to be.

However, investors should recognize that the blessing of strong performance brings with it the challenge of higher valuations. The next few months should answer many questions with regard to our collective success in ending the pandemic as well as the pace and shape of the U.S. And global recoveries from the social distancing recession. Given all the uncertainties surrounding these and other questions investors would be wise to maintain a somewhat defensive and very diversified stance after one of the most difficult and unusual years in modern history.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan asset management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

INFORMATION REGARDING MUTUAL FUNDS/ETF:

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for mutual funds: contact jpmorgan distribution services, inc. At 1-800-480-4111 or download it from this site. Exchange traded funds: call 1-844-4JPM-ETF or download it from this site.

J.P. Morgan funds and J.P. Morgan etfs are distributed by jpmorgan distribution services, inc., which is an affiliate of jpmorgan chase & co. Affiliates of jpmorgan chase & co. Receive fees for providing various services to the funds. Jpmorgan distribution services, inc. Is a member of FINRA FINRA's brokercheck

INFORMATION REGARDING COMMINGLED FUNDS:

For additional information regarding the commingled pension trust funds of jpmorgan chase bank, N.A., please contact your J.P. Morgan asset management representative.

The commingled pension trust funds of jpmorgan chase bank N.A. Are collective trust funds established and maintained by jpmorgan chase bank, N.A. Under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing.

INFORMATION FOR ALL SITE USERS:

J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan asset management in accordance with our privacy policies at https://www.Jpmorgan.Com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved

Why jpmorgan's ballooning balance sheet could become a problem

The growing balance sheet will push the bank's supplementary leverage ratio lower if an exclusion currently in place is not soon extended. That could force the bank to issue preferred stock, retain capital, or turn away deposits.

Typically, investors reward banks for significantly growing their deposit base, especially if they can get those deposits without having to pay out too much interest on them. But jpmorgan chase's (NYSE:JPM) growing deposit base and ballooning balance sheet could quickly turn into a headache for the bank due to capital regulations the bank must follow. If the regulations are not changed, or certain exclusions are not extended, the bank may be forced to take actions that will not benefit shareholders.

Massive influx of deposits

All banks, not just jpmorgan, are dealing with a flood of deposits. On jpmorgan's most recent earnings call, CFO jennifer piepszak attributed the issue to the federal reserve's quantitative easing program, in which the central bank has purchased government bonds and other securities in order to inject money into the economy and boost activity. There has also been unprecedented government stimulus adding money into the system. As a result, piepszak notes there has been $3 trillion of domestic deposit growth across U.S. Commercial banks.

Image source: jpmorgan chase.

Normally, this would be good for jpmorgan, in the sense that it has helped the bank's deposit base and funding costs. Interest-bearing deposits at the bank grew 32% in 2020, and because the fed's benchmark federal funds rate is practically at zero right now, those deposits are very cheap. Additionally, non-interest-bearing deposits grew 41% in 2020. That's the best kind of deposit for any bank because they don't cost anything, and they tend to stick around when the fed raises interest rates.

The cost of jpmorgan's interest-bearing liabilities at the end of last year fell to 0.23%, down nearly a full percentage point from the end of 2019. The problem is that this influx of deposits has played a major role in jpmorgan growing its balance sheet roughly 22%, from $2.78 trillion in assets at the end of 2019 to nearly $3.4 trillion in assets at the end of 2020.

Regulatory issues

Regulators have always required banks to retain a certain amount of capital so they can absorb unexpected loan losses in times of duress and still continue to lend to individuals, families, and businesses. For obvious reasons, these capital rules got much more complex following the great recession. As a result, banks now have many capital requirements and ratios they must maintain or stay above in order to comply with the regulations.

Jpmorgan's ballooning balance sheet has begun to put stress on one of these ratios called the supplementary leverage ratio (SLR), which looks at a bank's capital compared to its total leverage exposure. Total leverage exposure includes total assets and off-balance sheet items such as derivatives, repurchase agreements, and other lending commitments or exposure. The equation is a bank's tier 1 capital divided by total leverage exposure.

The problem with deposits began in early 2020. Regulators saw the issue, and in order to make sure that banks were not impeded during the pandemic, approved an exclusion that would allow banks to exclude U.S. Treasury securities and deposits held at federal reserve banks from the total leverage exposure. This would prevent the denominator in the SLR equation (total leverage exposure) from far exceeding the numerator (tier 1 capital) and therefore the ratio from falling too fast.

Jpmorgan must maintain an SLR of 5% or higher. With the exclusion in place, its SLR easily meets this criteria, and it ended 2020 at 6.9%. However, the bank noted in its earnings materials that without the exclusion, the SLR would have been 5.8%.

What could happen

The exclusion is currently set to expire on march 31, and jpmorgan's leverage exposure has continued to grow. Between the third and fourth quarters of 2020, total leverage exposure grew from $3.25 trillion to nearly $3.4 trillion. Piepszak said that management expects the bank's balance sheet to stay elevated for some time.

If the exclusion is not extended, then jpmorgan could soon be faced with some very difficult decisions to avoid falling under the 5% SLR threshold. Piepszak said these options include reducing or flat-out turning away deposits, issuing preferred stock, or retaining more common equity than the bank would normally need to.

Having the bank turn away deposits is not good for its business, especially as it's still expanding and growing its presence in new states. Issuing preferred stock could dilute shareholders, or at the very least dilute dividends. And retaining more equity means that more of the bank's capital will not be generating any return, and could slow the pace of share repurchases or dividend increases. As piepszak noted, retaining equity or issuing preferred stock are a "negative ROE [return on equity] proposition in today's ultra-low rate environment."

Ideal scenarios

Hopefully, bank regulators will extend the SLR exclusion or simply implement a new way to calculate it. Jpmorgan CEO jamie dimon has continually expressed frustration with how many of the capital ratio requirements are calculated based on the bank's size and are not risk-weighted. Even though jpmorgan's balance sheet has ballooned, the bank has had very little loan growth due to the uncertain economic outlook, and therefore has plenty of capital and liquidity.

Also frustrating for the bank is that despite its strong performance in the great recession and through the pandemic thus far, outperforming its main competitors on both occasions, its regulatory capital requirements have increased more so than its competitors'. While regulations seem to have done their job in keeping the banking system safe, they also seem to have a more outsized and negative impact on jpmorgan than the rest of the industry.

Jpmorgan's billionaire boss jamie dimon was again paid $31.5 million in 2020, having warned in 2019 that income equality was a 'huge problem'

- Jpmorgan's CEO jamie dimon earned $31.5 million from the baking giant in 2020, it announced on thursday.

- He received a $1.5 million salary, $5 million cash bonus, and $25 million of restricted stock tied to performance.

- Dimon has repeatedly said that income inequality is a massive problem in the US.

- Visit business insider's homepage for more stories.

Jpmorgan's CEO jamie dimon, who in 2019 decried income inequality, was paid $31.5 million in 2020, the bank announced on thursday.

Jpmorgan paid dimon a salary of $1.5 million, as well as a $5 million cash bonus and $25 million of restricted stock tied to performance, according to a regulatory filing. He was also paid $31.5 million in 2019, reuters reported, which was a 1.6% increase from the $31 million he received in 2018.

The company smashed past analyst predictions for its 2020 fourth-quarter earnings and revenue per employee surged 22% during the year - but it spent an average of only 1% more on each employee in 2020, bloomberg reported. Wall street banks increased average pay per employee by just $271 over the year, the report said.

Jpmorgan's fourth-quarter earnings, released january 15, showed a revenue of $30.2 billion versus analysts' estimates of $28.7 billion. The banking giant's net income rose by 42% to $12.14 billion, driven by its release of $2.9 billion in credit reserves.

Dimon, who has a net worth of $1.7 billion, warned in an interview on CBS' 60 minutes in november 2019 that the wage gap between the rich and the poor was a "huge problem" and that people were being "left behind."

After being asked whether his salary was too high and if he would return some of it, dimon responded: "I could. Is that gonna solve any of those problems?"

In march 2019, dimon said income inequality had "bifurcated the economy" in america, CNBC reported. His comments came just after jpmorgan pledged $350 million to help people in poorer communities.

"I don't want to be a tone deaf CEO," dimon said at the time. "while the company is doing fine, it is absolutely obvious that a big chunk of [people] have been left behind.

"40% of americans make less than $15 an hour. 40% of americans can't afford a $400 bill, whether it's medical or fixing their car. 15% of americans make minimum wages, 70,000 die from opioids [annually]," he told CNBC.

Dimon, who had emergency heart surgery in march, was reportedly floated for the position of treasury secretary in president joe biden's administration before the election.

Speaking at an event in 2018, dimon claimed that he could "beat trump" in an election. He also took a stab at president donald trump's personal wealth.

"and by the way, this wealthy new yorker actually earned his money," dimon said, referring to himself. "it wasn't a gift from daddy."

Insider has approached JP morgan for a comment from dimon.

Commodities trading on execute

Electronic trading solutions available on J.P. Morgan markets

J.P. MORGAN’S FX, COMMODITIES AND RATES TRADING PLATFORM

On desktop, web, API and mobile*

Access fast and reliable electronic market making and order placing across every commodity class.

* API and mobile available for precious metals and base metals

Learn more about our commodities offering on execute

- Two-way streaming of J.P. Morgan prices on base metals, precious metals (including vanilla and exotic options), energy, agriculture, and commodity indices

- Tradeable J.P. Morgan prices in multiple currencies and units

- Choose from a comprehensive suite of OTC instruments

- Click-to-trade or place orders (including exchange referenced orders, fixing and timed orders)

- Customizable notifications

Underlying products

Base metals

- LME major metals

- LME minor metals

- Comex copper

- Aluminium premiums

Precious metals

- Gold

- Silver

- Platinum

- Palladium

- CME precious metals

Energy

- Crude oil

- Lights

- Distillates

- Natural gas

- Cracks/diffs

Ags & softs

- Softs

- Grains

- Oilseeds

- Dairy

- Cocoa arb

- Wheat arb

Precious metals options

- Comprehensive vanilla and exotic instruments and structures

- Streaming prices with RFS for longer tenor and larger sizes

Indices

- Aggregate

- Agriculture

- Energy

- Industrials

- Livestock

- Precious metals

- Custom indices

24-hour access to your activity with commodities trading on mobile

Precious metals and base metals

Trade and place orders on precious metals and base metals against J.P. Morgan’s own liquidity with a single touch.

Trade blotter and order blotter show all activity via both desktop and mobile.

Tap to view and amend ticket.

Cancel, suspend and edit working orders.

Awarded commodities platform e-FX excellence in the 2020 digital FX awards for the third year running

Learn more*

SG: +65 6882 2290/91/92

HK: +852 2800 0457/6375/7057

*for institutional clients only

Let us contact you

Related insights

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY – NOT INTENDED FOR RETAIL CUSTOMER USE

Sign in to browse your offers

We've selected offers just for you.

Sign in above to explore

We're here to help you manage your money today and tomorrow

Checking accounts

Choose the checking account that works best for you. See our chase total checking ® offer for new customers. Make purchases with your debit card, and bank from almost anywhere with your phone, tablet or computer and at our 16,000 atms and more than 4,700 branches nationwide.

Savings accounts & cds

It’s never too early to begin saving. Open a savings account or open a certificate of deposit (see interest rates) and start saving your money. See chase savings offer for new customers.

Prepaid card

The starbucks ® rewards visa ® prepaid card is the only reloadable prepaid card that allows you to earn stars everywhere you shop, with no monthly, annual or reload fees. Other fees may apply.

Credit cards

Choose from our chase credit cards to help you buy what you need. Many offer rewards that can be redeemed for cash back, or for rewards at companies like disney, marriott, hyatt, united or southwest airlines. We can help you find the credit card that matches your lifestyle. Plus, get your free credit score!

Mortgages

Home equity line of credit

You might be able to use a portion of your home's value to spruce it up or pay other bills with a home equity line of credit. To find out if you may be eligible for a HELOC, use our HELOC calculator and other resources for a HELOC.

Car buying & loans

Chase auto is here to help you get the right car. Apply for an auto loan for a new or used car with chase. Use the payment calculator to estimate monthly payments.

Planning & investments

Whether you choose to work with a financial advisor and develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. Check here for latest you invest℠ offers, promotions, and coupons.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Chase private client

Ask us about chase private client, a unique level of service that combines concierge banking from chase and access to J.P. Morgan’s investment expertise.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NO BANK GUARANTEE • MAY LOSE VALUE

Business banking

With business banking, you’ll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses.

About chase

Chase bank serves nearly half of U.S. Households with a broad range of products. Chase online lets you manage your chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If you have questions or concerns, please contact us through chase customer service or let us know about chase complaints and feedback.

Sports & entertainment

Chase gives you access to unique sports, entertainment and culinary events through chase experiences and our exclusive partnerships such as the US open, madison square garden and chase center.

Other products & services:

“chase,” “jpmorgan,” “jpmorgan chase,” the jpmorgan chase logo and the octagon symbol are trademarks of jpmorgan chase bank, N.A. Jpmorgan chase bank, N.A. Is a wholly-owned subsidiary of jpmorgan chase & co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan wealth management is a business of jpmorgan chase & co., which offers investment products and services through J.P. Morgan securities LLC (JPMS), a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through chase insurance agency, inc. (CIA), a licensed insurance agency, doing business as chase insurance agency services, inc. In florida. Certain custody and other services are provided by jpmorgan chase bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of jpmorgan chase & co. Products not available in all states.

"chase private client" is the brand name for a banking and investment product and service offering.

Jp markets login problems

Products

Asset class capabilities

Investment approach

College planning

Defined contribution

Market insights

Portfolio insights

Retirement insights

Portfolio construction

Defined contribution

Economic & market update

Welcome to the 1Q 2021 J.P. Morgan asset management market and economic update. This seminar, presented by dr. David kelly, highlights the major themes and concerns impacting investors and their clients, using just 11 guide to the markets slides.

There are 75 pages in the guide to the markets. However, we believe that the key themes for the first quarter can be highlighted by referencing just 11 slides.

Dr. David kelly

Chief global strategist

ECONOMIC & MARKET UPDATE: USING THE GUIDE TO THE MARKETS

TO EXPLAIN THE INVESTMENT ENVIRONMENT

1. The pandemic continues to surge

Any discussion of the economic and investment outlook must start with an understanding of the human toll of the pandemic itself. This page looks at the 7-day moving average of new confirmed cases and fatalities of COVID-19. The path of the pandemic impacts the level of economic activity, and fluctuations cause a lot of uncertainty. After surging and retreating in the spring and the summer, the pandemic has worsened in recent months and will likely continue to surge in the first quarter. However, the approval of several very effective vaccines in the U.S. Should allow for the inoculation of roughly 150 million people in the first half of 2021, allowing life to largely return to normal by the fall of 2021.

2. The economic recovery should accelerate in 2H21

After suffering the most severe recession since WWII resulting in the worst quarterly GDP print on record in 2Q20, economic growth surged in the third quarter, notching the best quarterly GDP print on record in 3Q20. However, despite this strong surge, economic activity has only partially recovered from the collapse and remains far below the trend suggested by economic growth at the end of the last decade. This reflects the dominance of the service sector in the economy and the inability of it to recover fully in a pandemic.

The renewed pandemic will put further pressure on these industries and this, combined with a delay in getting extra fiscal support to the U.S. Economy, is leading to a sharp deceleration in economic activity with growth likely slowing to a very low single-digit pace in early 2021. Thereafter, however, growth should surge due to both pent-up demand and pent-up supply in those sectors that have been most impacted by the pandemic.

3. Job gains should slow until broad vaccine deployment

After reaching a 50-year low in february of 3.5%, the unemployment rate spiked to 14.7% in april, as 22 million people lost their jobs. Although there has been a sharp recovery in jobs thus far, the second half of the labor market recovery is likely to be much more gradual, as the pace of job gains has already slowed. Much of the remaining employment decline from the pandemic is in sectors that will have a hard time reopening while the pandemic continues, including the leisure, hospitality, travel, retail and food services industries. In addition, state and local government cutbacks could weigh on payroll employment. However, once the vaccine is broadly deployed, service-sector jobs could have a healthy rebound.

4. Profits have turned a corner

The deep recession in the economy was mirrored in big declines in S&P500 operating earnings in early 2021, pushing profits into recession. Analysts are expecting profits to recover in 2021, but past earnings recessions have typically lasted 2-3 years, and given the severity of the plunge in profits and the gradual economic recovery, it is likely that profits will not surpass their 2019 peak until 2022. However, in 2021, areas hardest hit by the pandemic, like energy, financials, and industrials, could experience solid earnings rebounds, while areas like technology and health care should continue to hold up well.

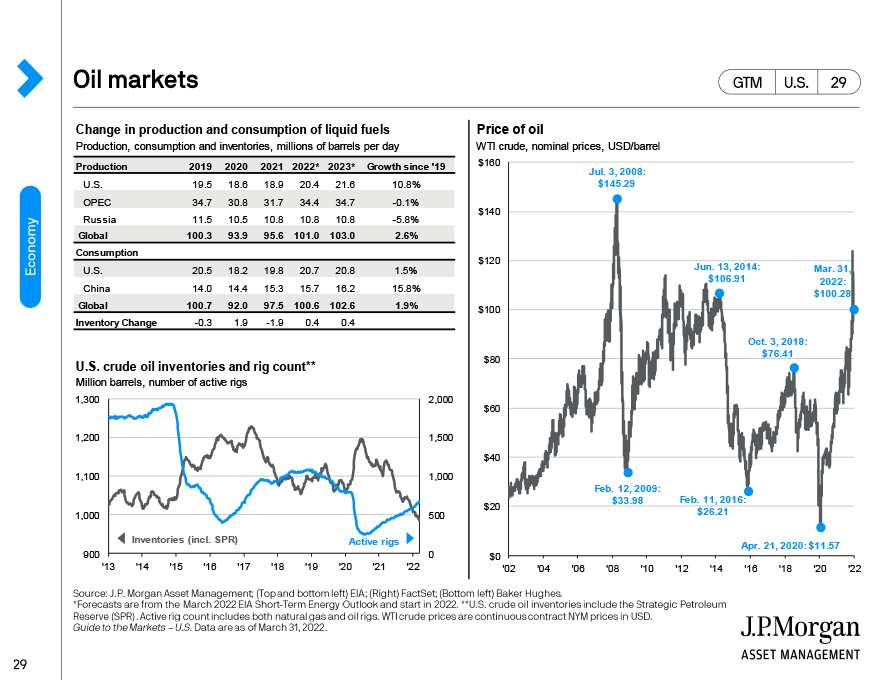

5. Higher inflation is a risk down the road

The onset of the recession, combined with a collapse in oil prices, triggered a decline in already low inflation. Although inflation normally troughs after the end of a recession, things may be a little different this time around, particularly given the potential for further fiscal stimulus, the continuing extra costs of operating during a pandemic and the likelihood of an economic surge following the distribution of a vaccine. Consequently, we expect inflation, using both CPI and personal deflator measures, to edge over 2% by the middle of 2021 and stay at close to this pace into 2022.

6. The federal reserve remains accommodative

In the first half of 2020, the federal reserve took very strong action to support the economy including cutting the federal funds rate to a range of 0-0.25%, opening or expanding a very wide range of facilities designed to support different parts of the bond market and adding dramatically to its balance sheet.

In addition, in august, the fed adopted an “average inflation targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. In order to achieve this they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for some time.

Although the fed pledged to maintain its current asset purchases until “substantial further progress” has been made to achieving its inflation and employment goals, it is important to note that this timetable suggests that the fed will reduce its bond purchases well in advance of any increase in short-term interest rates. This, in turn, suggests a steepening of the yield curve as the economy continues to recover in 2021.

7. Massive fiscal support has boosted debt and deficits

The heart of the economic damage is with consumers and businesses, so the U.S. Government delivered a multi-trillion dollar fiscal package to mitigate permanent economic damage at the onset of the pandemic. Pending further fiscal support and possibly infrastructure spending, the budget deficit could further increase in 2021, but will likely still be below 2020 levels. However, the national debt as a share of GDP will continue to grow to the highest levels since WWII. While we do not believe this will result in a fiscal crisis in the next couple of years, a failure to rein in deficits and debt monetization once the economy accelerates in the wake of a vaccine could lead to significant problems. This suggests that eventually, the government will have to make some tough choices on tax hikes and spending cuts.

With the federal funds rate at 0-0.25%, nominal treasury yields have fallen to near-historic lows and real yields are negative. In this low rate environment, investors will continue to hunt for yield. Although spreads had widened in riskier fixed income, they have come in meaningfully, making risk-return dynamics less attractive. However, despite unattractive yields, high quality fixed income will continue to play an important role in providing investors with downside protection and diversification.

9. Valuations are high for U.S. Equities

U.S. Equities have recovered significantly from the march lows, and at record speed. However, as markets look through the virus and the downturn to the recovery, valuations are well above historical averages. Investors should recognize that earnings are likely to continue to grow quickly in the year ahead which should lead to some compression in these ratios. Moreover, a continuation of relatively low interest rates likely justifies some elevation of valuation measures above their historical averages. Still, rich valuations may constrain equity returns over the long-run. Consequently, investors may want to consider diversifying their equity exposure adding more to value stocks as well as reducing weightings to the very largest companies in the stock market.

10. International stocks offer long-term opportunities

Both U.S. And international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. And international stocks that persisted throughout the recent expansion still persists today. However, this dynamic could shift in the next expansion.

The long-term growth prospects of EM economies still look better than for the U.S., valuations remain cheaper overseas, and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

11. Risks ahead call for diversification

Given the extraordinary disruption to the U.S. And global economies in 2020, it is remarkable how resilient financial markets have proven to be.

However, investors should recognize that the blessing of strong performance brings with it the challenge of higher valuations. The next few months should answer many questions with regard to our collective success in ending the pandemic as well as the pace and shape of the U.S. And global recoveries from the social distancing recession. Given all the uncertainties surrounding these and other questions investors would be wise to maintain a somewhat defensive and very diversified stance after one of the most difficult and unusual years in modern history.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan asset management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

INFORMATION REGARDING MUTUAL FUNDS/ETF:

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for mutual funds: contact jpmorgan distribution services, inc. At 1-800-480-4111 or download it from this site. Exchange traded funds: call 1-844-4JPM-ETF or download it from this site.

J.P. Morgan funds and J.P. Morgan etfs are distributed by jpmorgan distribution services, inc., which is an affiliate of jpmorgan chase & co. Affiliates of jpmorgan chase & co. Receive fees for providing various services to the funds. Jpmorgan distribution services, inc. Is a member of FINRA FINRA's brokercheck

INFORMATION REGARDING COMMINGLED FUNDS:

For additional information regarding the commingled pension trust funds of jpmorgan chase bank, N.A., please contact your J.P. Morgan asset management representative.

The commingled pension trust funds of jpmorgan chase bank N.A. Are collective trust funds established and maintained by jpmorgan chase bank, N.A. Under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing.

INFORMATION FOR ALL SITE USERS:

J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan asset management in accordance with our privacy policies at https://www.Jpmorgan.Com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved

so, let's see, what we have: please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. At jp markets login problems

Contents of the article

- Actual forex bonuses

- Jp markets login problems

- Deposit funds via bank, ATM or online...

- Forex brokers lab

- What is JP markets?

- JP markets account types, spreads and leverage

- What is the difference between ECN and STP JP...

- Trading platforms

- Trading products

- What are JP markets fees?

- What is the minimum deposit for JP markets?

- JP markets bonuses and promotions

- JP markets deposit and withdrawal methods

- Is JP markets suspended?

- Customer services

- Conclusion

- Sign in to browse your offers

- We've selected offers just for you.

- Checking accounts

- Savings accounts & cds

- Prepaid card

- Credit cards

- Mortgages

- Home equity line of credit

- Car buying & loans

- Planning & investments

- Chase private client

- Business banking

- About chase

- Sports & entertainment

- Other products & services:

- Jp markets login problems

- Products

- Asset class capabilities

- Investment approach

- College planning

- Defined contribution

- Market insights

- Portfolio insights

- Retirement insights

- Portfolio construction

- Defined contribution

- Economic & market update

- Dr. David kelly

- Chief global strategist

- Why jpmorgan's ballooning balance sheet could...

- The growing balance sheet will push the bank's...

- Massive influx of deposits

- Regulatory issues

- What could happen

- Ideal scenarios

- Jpmorgan's billionaire boss jamie dimon was again...

- Commodities trading on execute

- J.P. MORGAN’S FX, COMMODITIES AND RATES TRADING...

- Underlying products

- 24-hour access to your activity with commodities...

- Learn more*

- J.P. MORGAN’S FX, COMMODITIES AND RATES TRADING...

- Let us contact you

- Sign in to browse your offers

- We've selected offers just for you.

- Checking accounts

- Savings accounts & cds

- Prepaid card

- Credit cards

- Mortgages

- Home equity line of credit

- Car buying & loans

- Planning & investments

- Chase private client

- Business banking

- About chase

- Sports & entertainment

- Other products & services:

- Jp markets login problems

- Products

- Asset class capabilities

- Investment approach

- College planning

- Defined contribution

- Market insights

- Portfolio insights

- Retirement insights

- Portfolio construction

- Defined contribution

- Economic & market update

- Dr. David kelly

- Chief global strategist

No comments:

Post a Comment