Open account and get free money

This checking account comes with a $12 monthly service fee that can be avoided if an account holder either makes a direct deposit of $500 or more to the account, keeps a minimum daily balance of $1,500 or more in the account, or maintains an average daily balance of $5,000 or more within any combination of chase checking, savings, and other qualified balances.

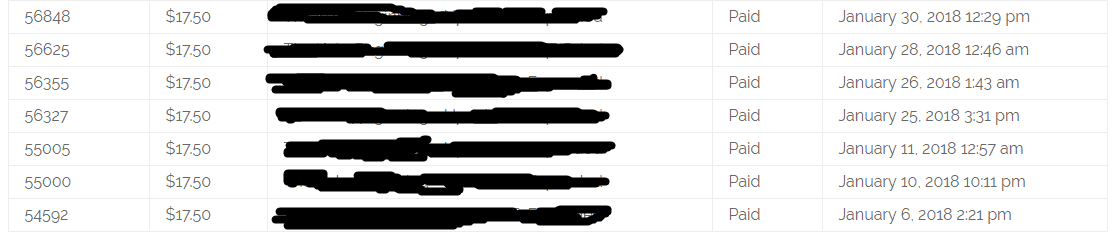

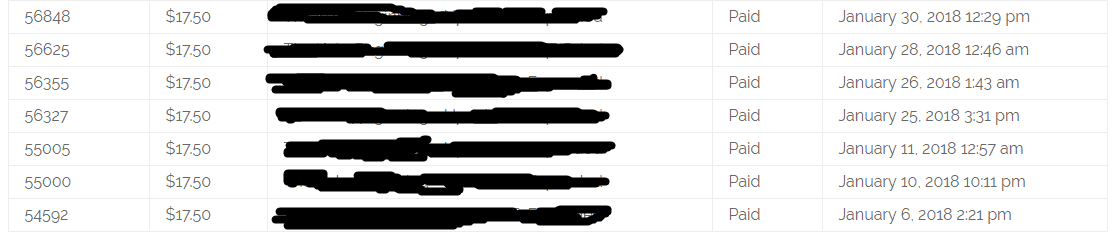

Actual forex bonuses

but consumers should be aware of the costs associated with closing and moving accounts. They must weigh the difference between the advertised cash incentive to open a new account and any fees to close or move their financial holdings.

8 bank promotions that pay you to open an account

Investopedia is committed to providing our readers with unbiased product recommendations. We may receive compensation when you click on links to products but this doesn't affect how we rate, review and rank them.

Like any industry working to pick itself up after the economic downturn, large and small banks have struggled to keep business coming through the door. Among the impacts of the great recession was the federal reserve's move to keep the interest rates artificially low, a maneuver that made it increasingly difficult for savers to earn yields on their deposit products and harder for banks to entice new account holders.

According to the 2018 world retail banking report, only half of the surveyed bank customers reported satisfaction with their retail banking services. that's because banks have been slow to move from traditional brick-and-mortar locations to digital channels. This doesn't mean financial institutions don't want new business. In fact, it's the opposite. This is why it's so important for banks to remain competitive, and find ways to attract more customers. But just how are they doing it? Easy: signup rewards, or cash for opening a new account. Read on to find out more about how this incentive works, and which banks are offering some of the biggest rewards for opening new accounts.

Key takeaways

- Banks remain competitive by offering new customers signup bonuses.

- Make sure the account you choose is right for you by reading the offer details as well as all the fine print.

- In order to qualify for bonuses, some banks may require you to open accounts online.

- You may need to make an initial deposit or arrange for direct deposits into your new account to qualify.

Rewards for opening new accounts

Competition between banks is still high, and cash back rewards are proving both scalable for banks and a much-needed windfall for customers. So, looking for an inventive way to grow business, banks and credit unions began offering cash rewards to new clientele for opening a checking account with them.

As an example of the type of rewards being offered, if a depositor put $100 into a new checking account and receives a $200 bonus in return, that creates a 300% return on investment (ROI). This return sounds like a wonderful idea, but as with anything that sounds too-good-to-be-true, this practice requires more examination.

The costs behind the rewards

Banks and other financial institutions earn money from many sources. One such source is the revenue they receive from—on-average—over 30 potential fees on checking accounts, according to the wall street journal. These fees include monthly maintenance, non-sufficient funds (NSF) charges, overdraft fees, paper statement charges, and dormant account fees among others. However, a cash back promotion can be a win-win for banks and consumers alike, as long as the latter remain aware of the pitfalls that could threaten their deposits.

But before you go and open up that account, remember to do your research. Make sure the account you open is the right one for you. You need to ensure you meet all the minimum requirements, so be sure to read all the details as well as the fine print before you accept the offer.

Calling all heads of households

Banks want to attract heads of households with these promotions. This type of customer is more likely to require a mortgage, credit cards, or other loans in the future, and will likely open new accounts where they hold their main checking accounts. They may also be more willing to move existing accounts and loans to the new institution. To encourage this, banks offer multiple product discounts to further sweeten the pot.

But consumers should be aware of the costs associated with closing and moving accounts. They must weigh the difference between the advertised cash incentive to open a new account and any fees to close or move their financial holdings.

Available new account bonuses

Bankrate conducted a study of cash back promotions available on the market by surveying some of the biggest banks by deposits in the united states, based on federal deposit insurance corporation (FDIC) data. The following banks currently offer new customers cash incentives for opening a deposit account. Even though some of the these banks may be physically based in certain parts of the country, offers may be nationwide, as most require online applications. These offers are current as of february 2020, and are listed in no particular order.

Most banks require new customers to maintain a balance, direct deposits and/or keep their accounts open for a specific period of time to qualify for a signup bonus.

Fifth third bank

Customers who open a fifth third bank essential checking account until april 30, 2020 receive a $250 bonus. But it doesn't come without a cost. In order to qualify, customers must reach a balance of $500 within 45 days of opening account and maintain that balance for 60 days thereafter. This offer is only available to brand new customers, and cannot be redeemed by existing fifth third clients. The bank deposits the bonus into the account within 10 business days of meeting the qualifications.

Fifth third bank has more than 1,110 branches across the united states in 10 states including florida, illinois, north carolina, michigan, and ohio.

Wells fargo

Customers who open a wells fargo everyday checking account on or before july 31, 2020 may qualify for a $400 bonus. in order to receive the signup bonus, the account must be open online. Customers must not have had a wells fargo checking account within the last 12 months.

Customers must have direct deposits going into the account totaling $4,000 or more during the first 90 days the account is open. These can include payroll deposits, or social security or other government benefit payments. The best part of this account is the low minimum deposit requirement—wells fargo only asks customers to deposit $25 to open the account.

TD bank

TD bank offers two different bonuses for new checking account customers. The first is a $300 bonus for a brand new TD beyond checking account. New clients qualify for the bonus after making $2,500 in direct deposits within the first 60 days of opening the account. There is no minimum deposit to open the account, but it comes with a hefty $25 monthly fee. This fee is waived if the customer maintains a $2,500 minimum daily balance. The account pays interest, and there are no charges for non-TD automated teller machine (ATM) transactions. The other ATM company may charge a fee, though.

If this isn't the account for you, you can earn $150 by opening a convenience checking account. Like the beyond checking account, there is no minimum deposit requirement. There is a monthly $15 fee, which is waived if the customer maintains at least $100 throughout the month. In order to get the signup bonus, customers must have a minimum of $500 in direct deposits within 60 days.

Chase bank

New customers who open a chase total checking account and set up direct deposit to receive a bonus of $300 from the bank. This deal is not available to current chase checking customers, those who have closed their accounts within 90 days, closed with a negative balance, or have fiduciary accounts.

This checking account comes with a $12 monthly service fee that can be avoided if an account holder either makes a direct deposit of $500 or more to the account, keeps a minimum daily balance of $1,500 or more in the account, or maintains an average daily balance of $5,000 or more within any combination of chase checking, savings, and other qualified balances.

The bank also offers a $200 bonus for customers who open a new savings account with a deposit of $15,000 or more within 20 business days. Customers must maintain that balance for at least 90 days. A $5 per month fee applies unless customers maintain at least $300 per day in the account.

The bonus increases to $600 total for anyone who opens both the checking and savings accounts.

PNC bank

Those who open a new account with PNC bank could earn up to $300 for opening a new PNC virtual wallet.

Opening a new, standard virtual wallet earns depositors $50. By opening a virtual wallet with performance spend, depositors get $200. Those who open a virtual wallet with performance select get $300 deposited into their accounts.

Direct deposits must be $500, $2,000 and $5,000 for the virtual wallet, performance spend, and performance select, respectively, to qualify for the reward. Customers must establish a qualifying direct deposit to the account and make at least five debit card purchases.

Santander bank

Santander bank is offering a $225 bonus to customers who open a simply right checking account. with a minimum opening deposit of $25, and direct deposits totaling $1,000 or more within the first 90 days, customers can earn $225 paid within 30 days. There is no minimum balance requirement to earn the bonus.

Huntington national bank

Until april 7, 2020, new huntington bank customers can qualify for one of two different bonuses after opening up a new checking account. Those who open the asterisk-free checking account may receive a $150 cash bonus. There is no minimum balance requirement and this account comes with no monthly maintenance fees. For the $200 cash bonus, customers must open the huntington 5 interest checking account. this account has a $5 fee which is waived with a minimum $5,000 monthly balance.

In order to qualify for either bonus, customers must make cumulative deposits of $1,000 within the first 60 days and accounts must remain open for at least 90 days. Once all the requirements are met, the bank deposits the bonus into the account.

Brand new HSBC customers can choose from two different checking account offers. The first promises $475 with the opening of an HSBC premier checking account. In order to quality, customers must make direct deposits of at least $5,000 into the account each month for three full months from the second month that the account is open. The second offer is for up to $350 with the advance checking account. This bonus is earned over 12 months and requires setting up direct deposit. You'll earn 2% cash back on the amount of your direct deposit each month, up to $30 per month. This offer is good for the first 12 months of account opening and is capped at $350 for the year.

Both offers end on march 29, 2020, and applications for the accounts must be completed online.

Best bank accounts to join for benefits, freebies and cash rewards - revealed

The battle to attract current account customers has heated up, but what's up for grabs? Here's what you need to know

The battle of the bank accounts has heated up with lenders desperate to win over customers amid falling sign-up rates.

The growth of digital rivals such as starling and mozo has sparked a current account war - and high street lenders have launched a host of perks and benefits to win you back - for a limited time only.

Natwest is currently leading the pack with £175 in cash when you open a reward account - plus you get 2% back on bills.

Elsewhere, first direct is offering £125 in cash - and potentially a £250 interest free overdraft on top.

The rewards follow a spate of banking letdowns over the past year led by TSB's IT failures that left 1.9 million without access to their money - and others fearing they'd been hacked.

We've run through all of these perks and more top payers, below. For best savings accounts, click here.

Read more

Related articles

How do switching rewards work?

Various banks and building societies are offering cash rewards to win over your custom - and if the offer is right, they can be a win, win.

To get the perk, you'll have to switch using the free current account switch service (CASS). In most cases you'll also be asked to transfer over a minimum of two direct debits and have a minimum monthly income of at least £500.

If you join but don't meet the criteria, it's unlikely the bank will pay out.

Which is why it's important to.

Do your homework before you join

Switching for money is great - but before you do so, always read the small print to make sure it's the right move for you.

That's because if you don't meet the eligibility criteria, you may not get the reward. Likewise, if there's a hidden monthly fee that you're not aware of, it may hit you further down the line.

Check what the bank is offering on top of the cash perk - ie travel insurance- ask about overdraft fees, any monthly fees, and check that you meet the minimum requirements.

"switching incentives are a great enticement for consumers looking to move their current account, but this shouldn't be the sole reason for switching," explains moneyfacts expert, rachel springall.

"customers need to make sure that they weigh up all the elements of a current account before they move, which includes any fees or additional benefits.

"there isn’t much point switching to an account offering free cash if someone expects to use the overdraft on a frequent basis. Not only that, but opening an account which hosts tonnes of benefits and costs in a fee each month is a bit pointless if the customer doesn’t make use of them."

Get a better bank account

The banks paying you money to join them

Here are moneysupermarket's top paying cash-reward accounts right now - to find out more, click on one of the links below.

1. £170 with RBS/natwest

Bill payers can earn 2% cashback on utilities through natwest (and RBS's) reward account right now.

Switch through CAS and grab a £125 bonus, plus another £50 if you stay until 30 june 2020.

It comes with a £2 a month fee but you get 2% cashback on most bills paid by direct debit, ie, council tax and energy.

Natwest and RBS say those with average bills will earn around £59 after the fee. To get the bonus, you'll have to switch by 11.59pm on friday 7 june for natwest or friday 28 june for RBS. Then, pay in £1,500+, complete your switch and log in to online banking by 12 july 2019 (natwest) or 2 august 2019 (RBS). Finally (and for the maximum reward) you'll have to make sure you use the debit card each month until 1 jun 2020.

2. £125 with first direct

First direct's cash perk is back and customers can get a lump sum they switch via the current account switching service.

New joiners to its 1st account will get a £125 welcome when they switch, providing they deposit at least £1,000 within three months of opening the account. You'll also get a £250 interest-free overdraft and a further £100 if you decide the account is not right for you.

The account usually has a £10 a month fee, however there is no cost for the first six months. After that you can avoid paying the fee by:

Paying at least £1,000 into the account every month

Maintaining an average monthly balance of £1,000

Or also having a mortgage, credit card, personal loan, savings (except regular saver), first directory or home insurance with first direct.

The money will be paid within 28 days of account opening, and if you pay in £1,000 a month and decide to switch after six months, you'll receive a further £100 for the inconvenience.

3. £180 with M&S bank

Open a M&S bank current account and switch within three months (along with four or more active direct debits) and you'll get a free £100 M&S gift card and access to its 5% regular saver.

You can get an extra £80 gift card (£120 if you've an M&S bank credit card) after a year if you deposit £1,250 a month, keep at least four direct debits active, and register for online banking and statements.

4. £135 with halifax

Switch to the halifax reward account and you'll get £50 before your switch completes, plus a further £85 after six months if you pay in £1,500 a month, use your debit card at least once and go paper-free.

You can also get ongoing rewards of £2 a month when you pay in £750 or more, remain in credit, and pay out at least two direct debits. In total, if you keep the account for a year you could earn £159 in total.

To qualify for the initial £50 there's no minimum monthly pay-in, however for £85, you'll need to deposit £1,500 a month plus £750 for the £2 monthly payment.

New and existing customers can join and qualify, as long as you haven't had a halifax switch bonus since january 2012 and are not switching from bank of scotland.

5. Free cycling perks with HSBC

Not quite a cash perk, but as part of its partnership with british cycling, HSBC UK is offering current account holders free membership to british cycling.

The move, which is now available to existing customers as well as those switching their current account to HSBC UK, gives you a 12 month ‘fan’ membership, worth £24, for free.

The benefits for HSBC UK current account customers include:

· A year’s fan membership for free

· upgrade to a race/ride/commute membership and get a £24 discount on this (equivalent value of fan membership)

· if already a member, on renewal they can get a free gift as an HSBC UK customer

Customers who are already members of british cycling can get £24 off their next membership renewal instead.

Luke harper, HSBC UK’s head of the partnership with british cycling, said: “our partnership with british cycling is particular focused on grassroots participation, encouraging and supporting customers, communities and colleagues to get back on their bikes. Some customers will already get on their bike regularly, but we hope this free british cycling membership will encourage people to dust down their bike and get back in the saddle and contribute to a greener, fitter, healthier britain.”

5. Refer a friend to santander for a £50 amazon voucher

Santander customers who refer a friend to a range of the bank’s current accounts can currently earn a £50 amazon.Co.Uk gift card for themselves and a second £50 amazon gift card for their friend (or up to five of them).

The offer is open to all santander UK customers whose referral goes through the current account switch service.

Accounts which qualify for the refer a friend offer include the 1|2|3current account, select and private current accounts all of which also offer cashback on selected household bills and 1.5% interest on credit balances up to £20,000.

The refer a friend offer is also available on the 1|2|3 lite account, which offers cashback on selected household bills, and the bank’s everyday current account.

"it’s important that people shop around for a bank account that can give them good ongoing value and the 7-day current account switch service makes switching easy," explained hetal parmar at santander.

The top bank promotions that will get you free money

The best new bank account sign up bonuses

Bank promotions are offered by banks as an incentive to get you to sign up for their checking or savings accounts and try out their services such as direct deposit or automatic bill pay.

These bank promotions will pay you cash, gift cards, or give you gifts as a way to get you to sign up for their services. It's their hope that you'll sign up for these services and then like them enough to keep using them.

This is a great way to get free money or gifts but these banks don't make it easy. You'll have to spend some time taking the steps necessary to get your bonuses or cash back.

Tip: be sure to read all of the fine print before signing up for these bank promotions so you know the terms and restrictions before signing up for an account. The descriptions below only serve as a summary of each bank promotion and may change without notice.

Chase $250 bonus for opening a checking and savings account

:max_bytes(150000):strip_icc()/chase-bank-logo-26468-579be8083df78c32768a0439.jpg)

You can choose to get $150 when you open a chase total checking account with direct deposit, $100 when you open a new chase saving account, or $250 for both.

With the savings account you'll need to deposit a total of $10,000 or more within 10 business days and maintain that balance for 90 days.

This offer expires july 18, 2016.

U.S. Bank $100 bonus for opening a checking and monkey market account

:max_bytes(150000):strip_icc()/us-bank-promotions-579be8115f9b589aa98a9d2e.jpg)

You can get up to a $100 bonus from U.S. Bank by opening up both a checking and money market savings account.

A minimum deposit of $25 is required when opening the checking account and a minimum of $25 is required when opening the money market savings account.

You'll need to schedule and maintain a qualifying reoccurring transfer from your checking account to your savings account.

When your savings balance reaches $500, U.S. Bank will deposit $50 into your account and also give you a $50 debit card for gas and groceries.

This bank promotion is ongoing.

Discover $135 in rewards for opening an NBA checking account

:max_bytes(150000):strip_icc()/discover-card-logo-2015-579be8105f9b589aa98a9bd8.png)

Open an NBA checking account at discover and you'll get $100 nbastore.Com gift card, $15 amazon gift card, and $10 itunes gift card.

A $25 minimum opening deposit is required.

Citizens bank $1,000 bonus for opening a college savings account

:max_bytes(150000):strip_icc()/citizens-bank-logo-579be80f3df78c32768a0b4e.png)

Open a citizens bank collegesaver savings account for your child's college and you'll get a $1,000 bonus plus interest added to your account after your child turns 18.

To get your bonus, you'll need to open the account before your child's 6th birthday and make net deposits of $25 minimum each month or before the 12th birthday with net deposits of $50 per month.

There's a minimum opening balance of $25 for children under 6 or $500 for children between 6 and 12.

This bank promotion is ongoing.

Suntrust $100-$200 checking accounting bonus with new account

:max_bytes(150000):strip_icc()/SunTrust_Logo.svg-579be80d5f9b589aa98a982d.png)

You can earn a $200 bonus from suntrust bank when you open a new selecting checking account. This requires a $100 deposit within 14 days of opening and $2,000 in additional direct deposits within the first 60 days.

Alternatively, you can get a bonus of $100 when you open a suntrust essential checking account. You'll need to deposit at least $100 in the first 14 days and make $500 or more in direct deposits within the first 60 days.

How to get free money fast: need money now?

Get free money

Wondering how to get free money mailed to me?

If you are looking for ways to earn FREE MONEY you will love how easy it is to accumulate $500 in cash right now.

These are money-making opportunities that work and will help you make money fast, whether you are looking to pay off debt or just in urgent need of it.

These are not one-time cash making opportunities, but you can use these ideas to earn and save money EACH month – like how to get free starbucks!

Most of the options listed send you money into your paypal account, so make sure you have it set up. It’s easy and free to open one, and can be used for both personal and business purposes.

If you are thinking I need money now for free and fast – listed below are over 20 websites that pay you for doing the smallest things.

Some examples are scanning barcodes, installing apps on your phone and a research site that pays you up to $140/hr for helping with online research work. All these ideas and more are listed below.

Ready to learn ways to get free cash now?

This is your chance to get free money on paypal.

*this post may contain affiliate links, which means we may receive a commission if you make a purchase using our links below at no extra cost to you. Disclosure .

HOW TO GET FREE MONEY

1. Play and earn with pinterest

This is on top of my list as its the best way to get money in your bank account for free!

You can now make money on pinterest by sharing affiliate pins. And if someone clicks on your affiliate pin image to make a purchase you earn a commission.

How do I know for sure this works?

Because I put it to test and earned over $120 sharing a pin image of a recipe ebook in just one month.

If this is how much I made with ONE affiliate pin, can you imagine how much more one can make by share a few more affiliate pins.

Note: I wouldn’t recommend you pinning a huge range of affiliate pins. Try not to do over 3 – 4 affiliate pins a day.

I would also recommend not repeating the same pin image for your affiliate links. Creating new pin images for the same affiliate link will gain more traction on pinterest – as the platform prefers new images.

Here is a step by step post that explains it better, using this technique.

2. Survey junkie – free money on paypal

This is one of the most reputed and reliable survey sites in the market that is well paying.

Survey junkie is 100% legit when compared to the rest of the survey sites in the market. They have gained a good reputation from survey takers with over 6 million members that have joined them. While you can usually average $15 a survey, some surveys can go up to $50 a survey.

Completing surveys earn you points redeemable for paypal cash, or gift cards. You can cash out with as little as $10.

3. Get paid to spot an empty property

This one is for those that live in the UK.

You can earn a £20 amazon gift card just for spotting an empty or derelict property, through the youspotproperty website. That’s not all, you also get 1% of the purchase price if they bring the house back into use. Not bad at all right?

4. Swagbucks – free money to search the internet

Swagbucks is one of the easiest ways to get free money. This is your answer if you are looking to get free money on paypal instantly, because with swagbucks you get to earn daily.

We all use the internet to search for topics, whether its recipes, news, travel destinations, jobs and a ton of other things.

Get paid to search the internet with swagbucks.

So next time instead of searching the web with yahoo or google – sign up to swagbucks and use them for your internet search to earn points. Redeem the points for paypal cash or gift cards at amazon, walmart, target and thousand other retailers.

3 other ways to earn with swagbucks:

– daily surveys up to $35 each

– watch cooking shows and videos

– earn cashback while shopping at target, walmart and hundreds of retailers.

==> here is a list of ways you can receive free amazon gift cards for your shopping!

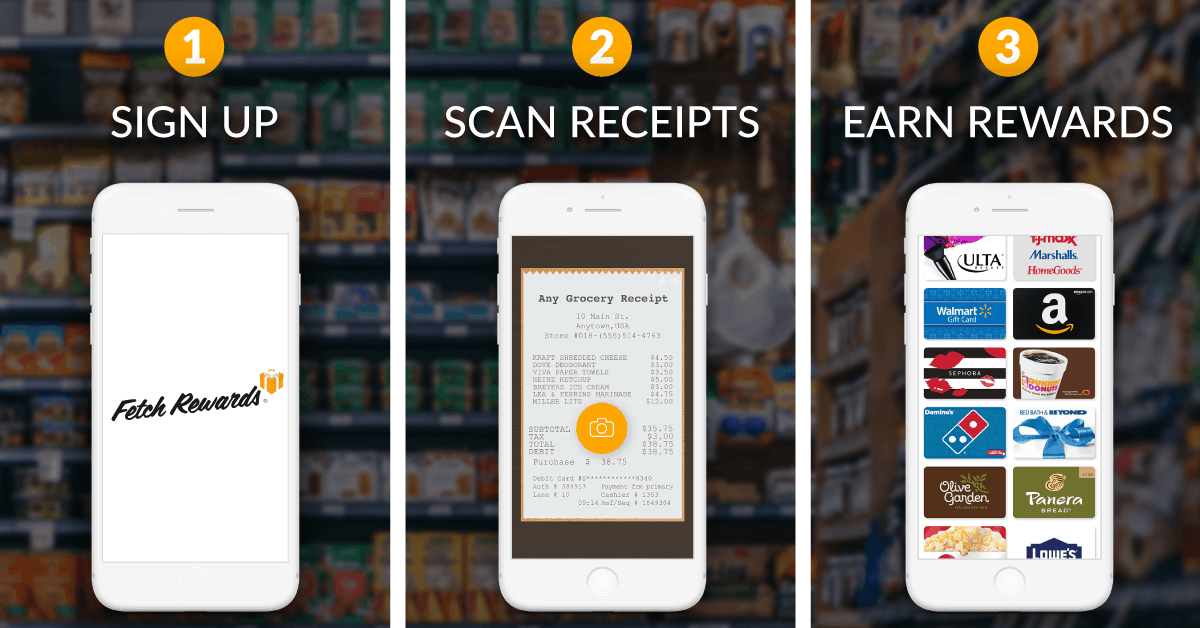

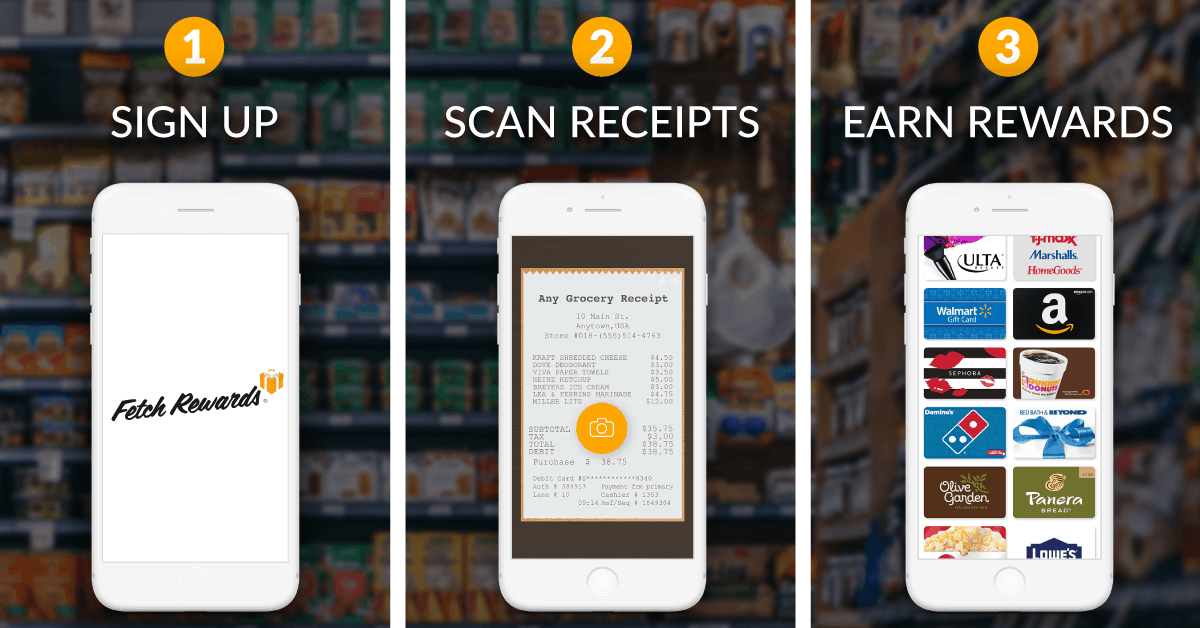

5. Free money for scanning your grocery receipts

Fetch reward is an app that pays you to scan your shopping receipts.

No couponing, no scanning barcodes, no surveys and no ads. Once you finish shopping, just scan your receipt to earn rewards in the form of e-gift cards from target, amazon, kohl’s, sephora and hundreds more.

You are allowed to scan up to 14 receipts in a 7 day period. Just keep in mind that the receipts should not be more than 14 days old.

Withdraw your rewards with as little as $3 in your account. Download fetch rewards for free on your phone to start getting free rewards.

6. Pinecone research – $3 flat rate/survey

This is one of the best research sites that pay free money for your opinion.

You get points for answering questions that are redeemable for cash via paypal or gift cards.

These questionnaires usually take under 10 minutes to complete and have a minimum earning potential of $3 and can go up to $10 for some surveys. This is good because you know you will be paid at least $3 for your effort, unlike some survey companies that pay less than a dollar.

You can sign up with pinecone research through invite-only. You can use the relevant links below to sign up based on your location.

7. Cut monthly bills – trim app

Trim is a free to use app that cuts the cost of your monthly bills.

Featured in major publications like fortune and the new york times, this app uses bank-level security when you connect your accounts to check for recurring subscriptions that can be eliminated to save you money.

The trim app will either cancel unwanted subscriptions or negotiate your bill down for you. Their website shows trim users are saving up to $400 on bills and subscriptions every year.

8. Download neilson digital – get $50 free money

Download the neiison digital app and get rewarded for having it installed.

Neilsen digital is a highly reputable company that allows you to download their app, so they can understand internet usage and behaviour to improve their products and services.

Their app is non-invasive, safe and secure and won’t impact the performance of your device.

They give away up to $10,000 in rewards each month and $50 every year, but you need to have the app installed to be eligible to earn.

9. Shoptracker – $39

Shoptacker is an app you download on your windows PC and share your amazon purchase history. Remember they do not have access to your bank details, but only to your purchase history. And in return, you earn $39 each year you have the app installed.

Just like paribus, once you download the app, you will need to connect your email account to view your amazon purchase history. This helps them with E-commerce research.

You earn $3 each month for participating and can cancel at any time.

Join shoptracker $3/month

10. Ready to invest spare change? $5 bonus

Acorns is an investment app that saves you money for your retirement.

When you sign up with acorns, every time you do your shopping, acorn will take the spare change and invest it for you. So say you buy a burger for $4.50, acorns will round it up to the closest dollar and take the $0.50 and invest it.

I have a lot of loose change lying around in my bag and the car. But investing them and keeping them untouched is such a neat idea to save in the long run. Its never too early to start investing and not a bad idea to start with small money- they all add up!

Sign up for a $5 bonus and set up a free account.

11. Rakuten (previously ebates) – $25 per referral

Ebates is not only one of the biggest cashback apps that will give you free money for your shopping, but it also boasts one of the highest referral pay.

By referring your family and friends to rakuten (ebates), you earn $25 per referral. Once your friend joins and spends at least $25 when shopping with their favourite brands on rakuten you earn $25.

You need to be 18 years and above to be eligible and get paid via paypal or check.

Here is a coupon link for a $10 walmart gift card, when you sign up here.

If you enjoy using cashback sites, another generous american cashback site is topcashback.

Topcashback, gives you money back from your online purchases at amazon, walmart, macy’s, GNC live well and 3,500+ brands. And the best part, there is no minimum payout threshold.

12. Vindale research ( earn $5-$50)

You can earn $50 for surveying and reviewing each product, which can be a nice side hustle to do in your spare time or over the weekends.

Once you sign up (free) and confirm your email, you receive information via email regarding products and surveys that are available. On completion of your task, you get rewarded cash that is paid through paypal.

13. Respondent app – $300

This is one of the most rewarding ways to make money fast – perfect for those saying I need money desperately. Respondent is a free platform for researchers looking to find people to help with their study. You can earn $150-$300 an hour for helping with research work, which can be done as a one-on-one call or through an online questionnaire.

You can be a professional, a stay-at-home parent or a student to apply.

Here is a full review of respondent if you are looking for a high paying side job.

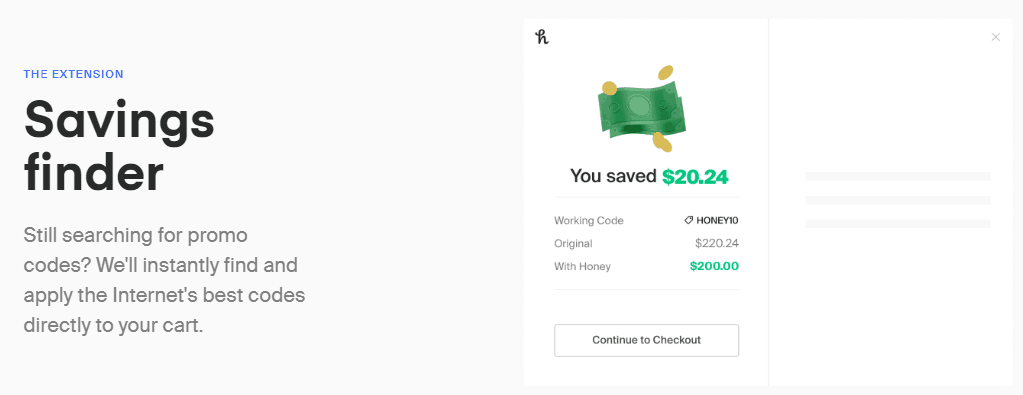

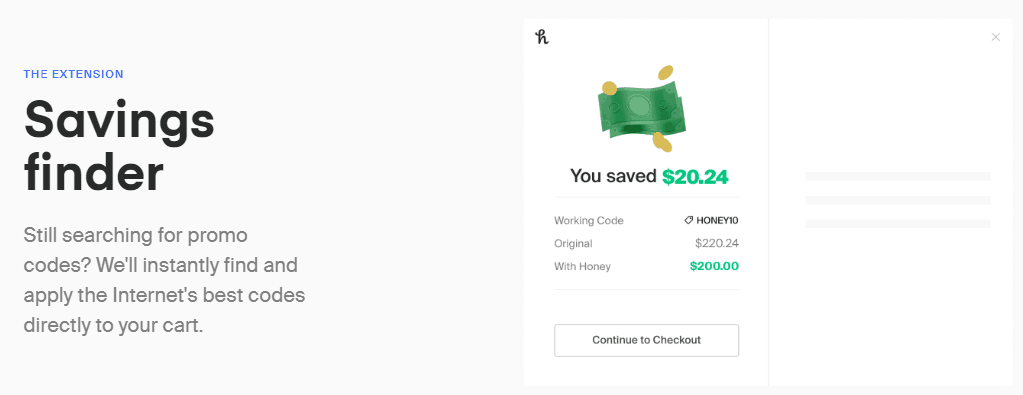

14. Coupon code finder – free extension

Honey is a free browser extension that automatically finds and adds coupons to your online checkout. So whether you shop at amazon or 28,000 other participating merchants you can save money on your online shopping.

Use our exclusive honey sign up link to begin.

Add their extension and get discount coupons automatically added the next time you shop online.

15. Global test market – $5 for surveys

Another well-paying survey site that averages $5 per surveys related to questions on food and consumer products.

You get rewarded points for each survey you complete and you can redeem these points for rewards from amazon, paypal, macy’s, kohls and even an option to donate to charity.

==> if you are looking for more survey sites that will make you an extra $400 a month you must read this.

16. Get paid to lose weight – up to $10,000

This is a popular website where you get paid to lose weight. Their site shows hundreds of success stories of both men and women that have lost weight and made money.

You join either a personal or a group challenge on the app and earn money when you lose weight. You can make small bets too.

Danielle was a healthywager that got paid $1,323 for her weight loss success, and there are many more that have earned thousands from healthy wage-read success stores here.

They have a prize calculator that will help you determine how much you can earn on reaching your weight loss goal. But this is not entirely a free way to earn, as you pay your bet each month, but once you succeed you can earn up to $10,000.

For example:

Say I bet $10 a month for 8 months to lose say 10 pounds that means I spend a total of $80 for the challenge. But if lose that 10 pounds within the 8 month period I could earn anything up to $10,000 in prize money. Not bad at all right?

Check out their weight loss calculator here to see how much money you can earn for your weight loss.

What a motivating idea to lose weight and make money right?

17. Gogokid- free $300 bonus

If you enjoy spending around 30 minutes to an hour a day tutoring kids online, there are many companies here that will pay you from $18 an hour to do this.

Here are a few companies that are currently hiring.

Gogokids is one such company that not only pays you to teach but also gives you an extra $300 bonus for new teachers. This is a limited time opportunity so don’t miss out.

18. Pay your selfie

This is an app that is available on google play and the appstore.

You will be given a list of surveys and asked to take a selfie of travel, workout, group selfie or even shopping. Most selfies are worth $1. Once you reach $20 you can cash out for a check.

They have been listed by big-name companies and is a reliable app. Sign up for free and click away!

19. Sell or rent

If you are looking to make some extra money selling things you don’t need anymore, you will love this post. It also shows you ways in which you can make money fast doing short tasks.

These are just a few ways to make money quick. Doing a little of everything can easily make you at least $1,000 a month.

If there are some personal favourites that have not been listed, please leave them in the comments below so I can add it to the list.

20. Improve credit score:

Nothing beats paying a lower interest rate when buying a house, and the best way to do this is by improving your credit score. Having a good credit score can help you save money on the interest you pay for mortgage and loans.

One of the best online tools to check your credit score for free is credit sesame.

21. Increase the interest on your savings

Using a high yielding savings account will help increase the amount of interest you earn. CIT is an online bank that allows you to earn up to 1.85% APY with their savings builder account. You will need to deposit at least $100 each month to be eligible for high-interest rates.

Final thoughts on free money:

There are many ways to get free money, like saving $500 a month following a not-so-strict frugal lifestyle. Or earn yourself free money on paypal instantly by using swagbucks for your internet searches.

And finally, make sure to use cashback sites like rakuten to get up to 40% money back when you shop online at big-brand retailers. Install rakuten’s chrome extension, so you remember to avail the cashback offers when you shop online.

Get free money — 12 steps to collect $3,700 from these companies

Free money online? Here are real ways to earn money from home. You sure haven't heard of a few of these ways to get free money fast.

Free money? Who says there’s no such thing as a free lunch? Every year businesses (and the government) give away thousands of dollars in free money and free paypal money as a way of promoting their websites or products.

It’s true and I’ve put together a list of my favorites that will give you more than $3,700 in free cash right now. Some of them only require filling out a form or downloading a free money app. Some of them take a bit more effort, but you can easily knock out all of these in a weekend to get free money online.

How to get free money

1. Get free money from the government

If you are in need of assistance then you can look to get free money from the government. Here’s how with these legitimate free money earning sites:

Unclaimed.Org – your first stop should be checking out unclaimed.Org for “missing” money that you may be owed. This site is endorsed by the NAUPA and would typically include old security deposits that you’ve paid in the past and those sorts of things. This would be a great way to get free money sent by mail that is owed to you.

Missingmoney.Com – this is a similar site to unclaimed.Org and is also endorsed by the NAUPA. Missingmoney.Com featured collective records from all states of all residents unclaimed property. You don’t even have to sign up to get free money all you do is a free search to see if you’re owed anything.

Want free money?

Child care and development fund – the child care and development fund (CCDF) plan serves as the application for the child care and development block grant (CCDBG) funds by providing a description of, and assurance about, the grantee’s child care program and all services available to eligible families that need free cash and funds as aid.

Low income home energy assistance program – the low income home energy assistance program (LIHEAP) helps keep families safe and healthy through initiatives that assist families with energy costs. If you legitimately need money today for free then it is worth checking out.

Federal pell grant for education – federal pell grants are usually awarded to undergraduates. The amount depends on financial need and the cost of attendance at the college. You can learn more at the federal student aid website.

2. Join sites that give you free money to invest in stocks (up to $1,000)

There are several companies that offer free stocks online through their services and apps. You can then choose to hold for the long-term or sell for a quick profit. Some companies may even pay dividends.

If you are looking for ways to earn free money, you can try to see how you can get free stocks from the best investment apps:

Robinhood – robinhood offers you a chance of earning a free stock valued between $2.50 and $200 by playing their pick-a-card game of chance. There are no minimum balance requirements to open an account and it’s completely free (must submit the application to claim free stock). We are an affiliate partner of robinhood and may receive compensation when you click on their links.

App at a glance download robinhood

★★★★★

open a new account in the next 24 hours and you could get up to $200 in free stock. CLAIM FREE STOCK

Webull – currently, webull offers the opportunity to get a free stock worth between $8 and $1,600 if you open your account and deposit at least $100. You can trade efts, stocks and options for free through webull app or their site.

M1 finance – M1 finance offers the opportunity to get a free stock worth $10 when you sign up for an account. After creating an account for free and depositing money, you set your stock and index selections and have M1 finance automate your investments on your behalf.

Acorns – acorns is a financial app available via ios and android phones. This app rounds up your purchases on linked credit cards to the nearest dollar and invests that amount for your future. You will get $5 when you sign up for a new account with acorns. Acorns also allows you to earn cash back on your everyday purchases at select stores. You can set up your cash back earnings as recurring investments.

Public – public is another investment app that will give you a $10 free sign-up bonus for creating a new account.

3. Earn credit card signup bonuses

One of the best ways to make some serious extra cash is to take advantage of credit card signup bonuses.

My favorite credit card is the discover it® credit card which has no fees at all and because you can earn 5% cash back on everyday purchases at different places each quarter like amazon.Com, grocery stores, restaurants, gas stations and when you pay using paypal, up to the quarterly maximum when you activate.

You can also get a 0% intro APR for 14 months on purchases and balance transfers, so if you have any credit card debt with high-interest rates, it’s worth switching over so you save on interest. Then you can find ways to pay off the credit card debt while saving on interest.

Also, this card is beneficial if you wanted to claim a $50 bonus after you make any purchase with your new card in your first 3 months. You will receive the $50 back in the form of a statement credit.

4. Get free money from bill negotiation apps

Finding hidden money is one of the best ways to make free money. There are several price drop apps and sites that help you lower your bills automatically and find hidden ways to save money on your everyday online purchases.

Here are the best online services (apps and sites) that help you lower your bills automatically and find hidden money:

Truebill – are you overpaying on your ills? Then truebill can help you save money by cancelling your unwanted subscriptions and lowering your bills. You can use it to cancel your unwanted subscriptions and get better rates on your bill. Their fee is 40% of your savings.

Trim – trim is another money-saving app that negotiates your cable, internet, phone and medical bills and cancels your old subscriptions and more. Also, trim can negotiate with your bak and credit card provider to lower your credit card interest rates (aprs), waive interest charges, and get refunds on unfair bank fees. For more details on how to stop getting ripped off, check out our complete trim review.

Paribus – paribus will help you get your money back by monitoring your online purchases. Paribus acts as a price drop app that will let you know if the price of something you bought online drops and will help you get refunded for the difference. Also, paribus tracks your shipments from select online retailers like amazon and can help you get you compensated for late deliveries. Paribus offers its services free of charge. Note: paribus compensates us when you sign up for paribus using the links we provided.

5. Shopping and cash back apps can help

Did you know that you can get some of the money you already spend back? That is where cash back apps come in. There are several reputable cash back apps out there that will give you cash back when you make a purchase using one of these apps.

Here are some popular apps that will help you get paid to shop:

Capital one shopping – this is a chrome extension that automatically finds coupon codes while you are shopping online. It automatically applies the coupon at checkout, saving you money instantly.

Dosh – you can earn free cash by using dosh which will give you cash back offers when you shop, dine or travel. Simply download the app, create a free account, and link your everyday card(s) to the app to start earning cash back from brands. No coupons or receipt scanning. Once you accumulate $25, you can withdraw your funds via bank transfer, paypal or venmo.

Rakuten – rakuten is one of the most well-known apps that will let you earn cash back at more than 2.500 stores. Simply make your planned purchases at your favorite stores using the rakuten app to earn some money back. You will earn a $5-$10 bonus when you sign up with them.

Fetch rewards – fetch rewards is another money-making app that pays you to scan your receipts, no matter where you shop. Fetch rewards works directly with hundreds of brands. When you shop with any of these brands through fetch rewards app, you will also earn points. You can redeem your points for rewards, including gift cards from the most popular stores and retailers.

Getupside – this cash back gives you cash back whenever you shop using your linked debit or credit cards to getupside app. You will get a $5 bonus when you register your account.

6. Survey websites and apps

You can earn cash by participating in market research through many survey sites. This is an easy way to earn some extra cash. While you will probably not make $100 fast overnight by completing surveys, it can help you reach your goal if you combine it with other money-making methods.

Here are some of the top-paying surveys sites that will pay you to complete online surveys:

Swagbucks – swagbucks is a popular rewards site that pays you to perform a variety of online activities, including participating in market research, or online surveys. Swagbucks is one of the best and highest-paying survey sites you can join to make money online by taking paid surveys. You can earn anywhere from $0.05 to $2.50 per survey with swagbucks. Some surveys can pay as much as $25-$35.

Survey junkie – survey junkies is one of the best legitimate survey sites out there. You can earn virtual points by completing surveys with them. You can then redeem your points for paypal cash or e-gift cards.

Inboxdollars – inboxdollars is a popular cash rewards and survey site that will pay you to perform various tasks online. One of the best ways to make money from inboxdollars is to complete online surveys. Once you accumulate $30 in your account, you can cash out your earnings with a check or gift card.

Lifepoints – lifepoints is one of the high-paying survey sites you can join to make money on a daily basis by completing surveys. The more surveys you complete, the more money you can earn.

7. Get paid to get in shape

Want a way to walk for money? There are a few apps that allow you to get paid for walking. I thought to myself, these apps that pay you to exercise must be a scam, right? I decided to download the apps that reward you for walking to see if you can actually make money by walking or working out. Yes, you heard that right.

If walking is something you enjoy everyday, then there are apps that will pay you to walk:

Healthywage – healthywage will pay you to lose weight. Simply sign up with the app and make a bet on how much weight you want to lose, how long you will take to lose that weight, and how much you would like to bet. Then healthywage prize calculator will determine your winnings amount. If you then lose the weight, you will get paid to reach your weight loss goal. You can redeem your coins for paypal cash, or merchandise like apple devices, sports gear, etc.

Sweatcoin – sweatcoin is an app that pays you to walk. They will pay you in cryptocurrency. Once you sign up for the app, you will be able to earn 5 sweatcoins per day for 5,000 steps. But if you choose a higher membership level that is charged monthly in sweatcoins, you can increase the number of sweatcoins you can earn per month. You can use your sweatcoins earned to buy goods and services from brands in the app’s marketplace.

Achievement – once you sign up for an account with achievement, then you will have to connect your desired fitness apps to achievement. Then you can start earning points and rewards by performing a variety of exercises, including walking that improve your health. The more active you are, the more you warn. Once you have earned 10,000 points, you can redeem your points for a $10 reward via paypal or direct deposit to your bank account.

8. Get free money playing games

Playing games on your smartphone is a fun way to make money in your spare time. You will not make a stable income with game apps to win real money, but if you enjoy playing games on your smartphone, this can be a nice way to earn real cash.

You can earn real money by playing games online via several game apps and sites:

Want free money?

Mistplay – mistplay is an app that pays you to play games online on your android and ios devices. You earn points that can be redeemed for amazon gift cards, itunes, nintendo, and visa prepaid gift cards. You can earn anywhere from 20 to 200 points per game, depending on the amount of time spent playing and other factors. One thousand five hundred points are equivalent to around $5.

Lucktastic – lucktastic is a free app that allows you to win real cash and prizes and earn tokens by playing scratch-off games. You can earn tokens as you play and redeem your tokens for gift cards from over 30 major brands and retailers or use tokens to enter contests to win a prize.

Solitaire cube – if you are interested in only playing the classic solitaire game online, then playing solo card games using solitaire cube is a fun way to earn real money. It is free to download the app and create an account. But you will have to make a minimum deposit of $10 into your account to play for real money.

Boodle – boodle is a free app that will reward you boodle coins every time you try out a new app and game. Boodle will also give you coins for doing other activities such as answering questions, completing special offers, discovering deals and referring friends. You can redeem the coins you earn for gift cards to retailers like amazon, nike, chipotle and more.

Inboxdollars – you can earn extra cash online by playing games on inboxdollars. When you sign up for inboxdollars, you get a $5 welcome bonus. Some arcade games available on inboxdollars are mahjong, solitaire, sudoku, and word chess.

Swagbucks – one of the ways you can make money on swagbucks is to play games online. It is free to join swagbucks. When you sign up and complete your profile, you get a $5 welcome bonus.

9. Get free money by downloading an app

Do you have a laptop, tablet or mobile device? If so, follow me on a quick trip to some free money.

By downloading a free app to your mobile device, you can improve the products and services you use online today. Nielsen computer and mobile panel combines your unique internet usage and uses it for market research.

By using the internet as you do every day, they invite you to make a difference – and you can make a quick $50 per year just for installing this app that anonymously collects information from your favorite web-surfing device.

You don’t really have to do anything other than initially registering your computer or phone. If you are at all interested, you can get more information here .

10. Earn free money for reading emails

You could get free money for reading emails. It is one of the easiest ways to earn some extra cash online while doing something that you already do online. Many sites will pay anywhere from 1 to 5 cents for opening the email and reading it. Here are some sites that allow you to get paid to read emails.

Inboxdollars – if you sign up for an account with inboxdollars, they will pay you just to read the emails they will send to your inbox. Inboxdollars send special offers through these emails. All you have to do is to open these emails and read them to earn some extra cash.

Swagbucks – swagbucks is a popular online rewards program that pays you cash and gift cards for doing a variety of tasks online, including reading emails. Swagbucks will send you promotional emails. If you simply click on those emails to read, you will earn SB points that can be redeemed for free gift cards to your favorite retailers like amazon or walmart, or paypal cash.

Inboxpays – inboxpays is another site that will pay you to read emails. When you sign up for inboxpays, you can earn through reading emails. The maximum amount you can request per payout is $25. All earnings are deposited to your paypal account.

Vindale research – vindale research is an online market research panel that allows you to sign up for a free account to become a member. There are a few ways to earn extra cash on vindale research site, including getting paid to read emails.

11. Earn passive income with a high-yield savings account

Yes, I wouldn’t think of a savings account as a good source of passive income but your cash shoul d be getting something in return instead of just sitting in a checking account.

Online banks can offer over 20X more in interest — and consumers are missing out. The best high yield savings accounts offer a higher interest rate and there is absolutely no risk to your money (you’ll actually earn 1% or more on your cash).

Select - open our everyday bank account

Make banking simple with our most popular everyday bank account

Easily use our mobile banking app

Multiple ways to pay: apple pay, google pay™ and contactless visa debit card. Limits apply.

Arranged overdraft available (subject to eligibility)

No monthly fee

To apply, you need to be 18+ and a UK resident.

Budget better, spend less

Available to customers aged 16+ who hold a personal or premier current account.

Check your credit score for free

Available once opted in via the app (to customers aged 18+ with a UK address - provided by transunion)

View your accounts with other banks

You need to be registered for online banking with other banks.

App available to customers aged 11+ with a compatible ios and android devices and a UK or international mobile number in specific countries.

Save up to £50 each month with our digital regular saver

We've just added digital regular saver to our range of savings accounts. You'll get our highest interest rate when you save between £1-£50 by standing order each month, on balances up to £1000. What are you waiting for?

Specific account eligibility criteria and conditions apply.

Switch to natwest

The current account switch service will do all the work when it comes to switching, moving everything across from your old account to your new account all within 7 working days, including direct debits and standing orders. All you need to do is tell us the details of your old bank account and when you want the switch to start.

Overdraft details

How do overdrafts work?

How overdrafts work - details

There are two different types of overdraft:

- An arranged overdraft, which allows you to go overdrawn up to an agreed limit. This is the type of overdraft you could apply for here. During your application for an arranged overdraft, we'll run a full credit check to determine how much we can offer you.

- An unarranged overdraft. This is when you spend more money than you have in your current account without already having an arranged overdraft, or when you exceed your current arranged overdraft limit.

We charge interest on both types of overdraft. Going in to an unarranged overdraft limit can lead to payments being rejected.

How much will an overdraft cost?

How much does my overdraft cost in pounds and pence?

This account offers an overdraft facility (subject to eligibility). You can check if you're likely to be accepted for an overdraft using our eligibility tool.

As an example, the interest cost of using a £500 arranged overdraft is:

Time period 7 days 30 days 60 days interest cost £3.24 £13.87 £28.13

This is a specific illustrative example representing the interest cost of using a £500 arranged overdraft over periods of 7, 30 and 60 days.

Looking to understand the costs of an overdraft of more or less than £500 over different periods of time? Use our handy cost calculator.

If you don't pay it back, it could have an impact on your credit score.

Representative example: effective annual rate: 39.49% EAR (variable). Representative APR: 39.49% APR (variable). Assumed credit limit: £1,200.

£100 for opening bank account

Compare latest current account deals

Why we like it: no minimum monthly funding or monthly fee to maintain the account. Earn up to 15% cashback with retailer offers. Stress-free account switching in 7 days with the current account switch service. £300 ATM withdrawal per day, arranged overdraft facility (subject to status). Online and mobile banking with text and email alerts. Must be 18 or older and live in the UK permanently. 39.94% EAR overdraft charge. Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

Why we like it: everyday current accout. No monthly account fee. Access to flexclusives - select credit card and low personal loan rate. Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

Why we like it: free current account. Pays 0.05% AER interest on balances up to £85,000. Get set up in minutes. Send money abroad: fast and secure money transfers to bank accounts in 38 countries worldwide. No fees when you pay with your card abroad or withdraw money. Get a spotlight on your spending: see what you’ve spent instantly with real-time payment notifications. 3 month interest holiday on the first £500 of an arranged overdraft. Best british bank and best current account in 2020 at the british bank awards. Awarded 5 stars by defaqto. Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

Why we like it: earn 0.60% AER (variable) interest on balances up to a maximum of £20,000. Up to 3% CASHBACK on various household bills. Monthly fee of £5. Cashback capped at £5 for each cashback tier each month. Must pay in £500 pm. Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

Why we like it: *2.00% interest for 12 months on balances up to £1,500 for the first year. You must pay in £1,000 or more each month to receive interest (excluding transfers from any nationwide account held by you or anyone else). 12 month fee-free arranged overdraft available. No monthly fee. Access to flexclusives - select credit card and low personal loan rate. Must be aged 18 or older. Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

Why we like it: UK & europe breakdown cover, worldwide family travel and mobile phone insurance, and commission-free cash withdrawals and card payments abroad. Free mobile banking app, text alerts and secure online banking. Access to flexclusives - select credit card and low personal loan rate. £13 monthly account fee. Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

Why we like it: can be opened by or on behalf of any child up to the age of 18. Debit or cash card available for those aged between 13 and 18. Monthly interest. No monthly fee. For children under age 13, the account must be opened in trust and managed by an adult (trustee). If you’re aged between 13 and 18 years old and live permanently in the UK you can apply online by telephone or in branch. No overdraft facility. 1% interest on the entire balance once the balance is £100, 2.00% AER/1.98% gross (variable) on the entire balance once the balance is £1,500, 3.00% AER/2.96% gross (variable) on the entire balance once the balance is £1,500 or over (up to a maximum of £2,000). Bank is registered with the financial services compensation scheme (FSCS), so any money you keep will be fully protected, up to £85,000

How to earn £100 for opening a bank account

If you are looking to move your current account to a different provider, there are various factors to consider when making your choice. Issues like what interest rate you will pay on your overdraft and earn on your savings will be important, but for many switching incentives are a key decider.

Many providers now make current account switch offers, which include cash when you change accounts and cashback for things like having direct debits coming out of your account or paying household bills from the account. These benefits can swiftly add up and make a real difference to which account offers the best deal for you.

Between the various switching bonuses and cashback offers available on some of the most popular current accounts, it is possible for savvy switchers to earn £100 or more when they change account. The follow accounts will earn you at least £100 for opening a bank account either upfront or within the first year the account is open.

Is it worth opening a new bank account for a good switching offer?

When thinking about opening a new bank account, switching offers can be a good deciding factor, but it is also important to think about your long term needs. For example a santander 1|2|3 current account offers interest of 0.60% AER on your entire balance up to £20,000, plus cashback of between 1-3% on a range of household bills.

This may not be the most attractive offer upfront, but it means if you are likely to keep a large balance in your account and pay a number of household bills out of your account, the interest and cashback you earn can soon add up and outweigh most switching offers.

It is therefore a good idea to think about exactly what you need from a current account and how you are likely to use it before making a decision about opening a new bank account. This can help to ensure you get the most out of your account on an ongoing basis.

Find the best bank accounts to switch to

Whatever your reasons for opening a new bank account, it is a good idea to spend some time researching your various options before making the switch. Check out the range of current accounts on offer from across the market to see which offers the best deal for you.

Compare online bank accounts

Find an online bank account that makes it easier to keep track of your money and make payments whenever you need to.

- Most popular

- Current accounts

- Business

- Online

- Joint

- For teenagers

- More from current accounts

- 7 day switch

- Charity

- High interest

- Overdraft

- Packaged

- Prepaid

- Current account guides

- Who we compare

Our website is completely free for you to use but we may receive a commission from some of the companies we link to on the site.

How money.Co.Uk works.

What are online current accounts?

An online bank account allows you to access your current account and conduct transactions through the internet.

Whether it's checking your balance, making a payment or transferring money between accounts, online banks lets you do it all using your computer, smartphone or tablet. These days, most banks and building societies offer online banking as a standard service.

How to open an online bank account

Opening a bank account online is simple and you can apply online in just a few minutes. You can do this by visiting the website of the bank of your choice, and filling out the application form. Typically, you'll have to provide your personal details such as your name, age, nationality and address, as well as supporting documents as proof of these.

In most cases, you'll be asked to provide the following documents:

Proof of ID: typically this can be your passport or driving licence

Proof of address: this can be a recent utility bill, council tax bill, or rental agreement

Some banks may also ask for additional details such as your occupation, income and expenses. Though this is not legally required, many banks often use this information to provide you with offers about other products and services in the future, such as credit cards.

How to choose the best online bank account

You can use this comparison to find a lot of current accounts that include online banking and check:

If there is an annual or monthly account fee

Requirements for having the account, e.G. Pay in Ј500 or more each month

Details of the overdraft limit, fees and interest rate

The interest rate you can earn on your balance.

Cheap online current accounts will likely have no annual or monthly fee, and will typically offer the most basic features.

What features do you need?

Nearly all current accounts now offer free online banking, so you could compare accounts that offer other features such as:

Extra benefits like insurance or breakdown cover packaged with the account

Interest paid when you have money in your account

You can find out more about what you need from your bank account here. Once you have found accounts that offer these features, check what their internet banking service includes.

App-based banking

App based banking, or digital banking, is a recent and growing trend where the bank has no physical branches that you can visit. Instead, the bank exists as an app on your smartphone, which you can use to conduct most of your usual banking, making them solely online banks. These banks also offer several unique features such as:

Spending notifications: every time you spend money using your debit card you receive a notification on your phone tell you where and how much you spent.

Ring fencing savings: you can set aside a sum of money as savings

Free cash withdrawals overseas: you can withdraw cash abroad without being charged foreign transaction fees. Different banks set different limits how much you can withdraw for free.

Budgeting: you can set budgets to make sure you don't overspend. For example, if you only want to spend a certain amount on dining out every month.

What is open banking?

Open banking is a set of regulatory reforms that were put in place by the competition and markets authority (CMA) in january 2018. These reforms made it a legal requirement for UK-regulated banks to let you share your financial information with third parties, such as budgeting apps or other banks.

This is to help consumers have a better understanding of their finances, as well as bring in more competition and innovation in the industry.

The top bank promotions that will get you free money

The best new bank account sign up bonuses

Bank promotions are offered by banks as an incentive to get you to sign up for their checking or savings accounts and try out their services such as direct deposit or automatic bill pay.

These bank promotions will pay you cash, gift cards, or give you gifts as a way to get you to sign up for their services. It's their hope that you'll sign up for these services and then like them enough to keep using them.

This is a great way to get free money or gifts but these banks don't make it easy. You'll have to spend some time taking the steps necessary to get your bonuses or cash back.

Tip: be sure to read all of the fine print before signing up for these bank promotions so you know the terms and restrictions before signing up for an account. The descriptions below only serve as a summary of each bank promotion and may change without notice.

Chase $250 bonus for opening a checking and savings account

:max_bytes(150000):strip_icc()/chase-bank-logo-26468-579be8083df78c32768a0439.jpg)

You can choose to get $150 when you open a chase total checking account with direct deposit, $100 when you open a new chase saving account, or $250 for both.

With the savings account you'll need to deposit a total of $10,000 or more within 10 business days and maintain that balance for 90 days.

This offer expires july 18, 2016.

U.S. Bank $100 bonus for opening a checking and monkey market account

:max_bytes(150000):strip_icc()/us-bank-promotions-579be8115f9b589aa98a9d2e.jpg)

You can get up to a $100 bonus from U.S. Bank by opening up both a checking and money market savings account.

A minimum deposit of $25 is required when opening the checking account and a minimum of $25 is required when opening the money market savings account.

You'll need to schedule and maintain a qualifying reoccurring transfer from your checking account to your savings account.

When your savings balance reaches $500, U.S. Bank will deposit $50 into your account and also give you a $50 debit card for gas and groceries.

This bank promotion is ongoing.

Discover $135 in rewards for opening an NBA checking account

:max_bytes(150000):strip_icc()/discover-card-logo-2015-579be8105f9b589aa98a9bd8.png)

Open an NBA checking account at discover and you'll get $100 nbastore.Com gift card, $15 amazon gift card, and $10 itunes gift card.

A $25 minimum opening deposit is required.

Citizens bank $1,000 bonus for opening a college savings account

:max_bytes(150000):strip_icc()/citizens-bank-logo-579be80f3df78c32768a0b4e.png)

Open a citizens bank collegesaver savings account for your child's college and you'll get a $1,000 bonus plus interest added to your account after your child turns 18.

To get your bonus, you'll need to open the account before your child's 6th birthday and make net deposits of $25 minimum each month or before the 12th birthday with net deposits of $50 per month.

There's a minimum opening balance of $25 for children under 6 or $500 for children between 6 and 12.

This bank promotion is ongoing.

Suntrust $100-$200 checking accounting bonus with new account

:max_bytes(150000):strip_icc()/SunTrust_Logo.svg-579be80d5f9b589aa98a982d.png)

You can earn a $200 bonus from suntrust bank when you open a new selecting checking account. This requires a $100 deposit within 14 days of opening and $2,000 in additional direct deposits within the first 60 days.

Alternatively, you can get a bonus of $100 when you open a suntrust essential checking account. You'll need to deposit at least $100 in the first 14 days and make $500 or more in direct deposits within the first 60 days.

So, let's see, what we have: find out which banks are running cash promotions and will pay you when opening a new account. At open account and get free money

Contents of the article

- Actual forex bonuses

- 8 bank promotions that pay you to open an account

- Rewards for opening new accounts

- The costs behind the rewards

- Calling all heads of households

- Available new account bonuses

- Best bank accounts to join for benefits, freebies...

- Read more

- Related articles

- How do switching rewards work?

- Do your homework before you join

- Get a better bank account

- The banks paying you money to join them

- 1. £170 with RBS/natwest

- 2. £125 with first direct

- 3. £180 with M&S bank

- 4. £135 with halifax

- 5. Free cycling perks with HSBC

- 5. Refer a friend to santander for a £50 amazon...

- The top bank promotions that will get you free...

- The best new bank account sign up bonuses

- Chase $250 bonus for opening a checking and...

- U.S. Bank $100 bonus for opening a checking and...

- Discover $135 in rewards for opening an NBA...

- Citizens bank $1,000 bonus for opening a college...

- Suntrust $100-$200 checking accounting bonus with...

- How to get free money fast: need money now?

- HOW TO GET FREE MONEY

- 1. Play and earn with pinterest This is on...

- 3. Get paid to spot an empty property

- 4. Swagbucks – free money to search the internet

- 5. Free money for scanning your grocery receipts

- 6. Pinecone research – $3 flat rate/survey

- 7. Cut monthly bills – trim app

- 8. Download neilson digital – get $50 free money

- 9. Shoptracker – $39

- 10. Ready to invest spare change? $5 bonus

- 11. Rakuten (previously ebates) – $25 per referral

- 12. Vindale research ( earn $5-$50)

- 13. Respondent app – $300

- 14. Coupon code finder – free extension

- 15. Global test market – $5 for surveys

- 16. Get paid to lose weight – up to $10,000

- 17. Gogokid- free $300 bonus

- 18. Pay your selfie

- 19. Sell or rent

- 20. Improve credit score:

- 21. Increase the interest on your savings

- Final thoughts on free money:

- Get free money — 12 steps to collect $3,700 from...

- How to get free money

- 1. Get free money from the government

- Want free money?

- 2. Join sites that give you free money to invest...

- 3. Earn credit card signup bonuses

- 4. Get free money from bill negotiation apps

- 5. Shopping and cash back apps can help

- 6. Survey websites and apps

- 7. Get paid to get in shape

- 8. Get free money playing games

- 9. Get free money by downloading an app

- 10. Earn free money for reading emails

- 11. Earn passive income with a high-yield savings...

- Select - open our everyday bank account

- Make banking simple with our most popular...

- Budget better, spend less

- Check your credit score for free

- View your accounts with other banks

- Save up to £50 each month with our digital...

- Switch to natwest

- Overdraft details

- How do overdrafts work?

- How overdrafts work - details

- How much will an overdraft cost?

- How much does my overdraft cost in pounds and...

- £100 for opening bank account

- How to earn £100 for opening a bank account

- Compare online bank accounts

- What are online current accounts?

- How to open an online bank account

- How to choose the best online bank account

- App-based banking

- What is open banking?

- The top bank promotions that will get you free...

- The best new bank account sign up bonuses

- Chase $250 bonus for opening a checking and...

- U.S. Bank $100 bonus for opening a checking and...

- Discover $135 in rewards for opening an NBA...

- Citizens bank $1,000 bonus for opening a college...

- Suntrust $100-$200 checking accounting bonus with...

Get free money

Wondering how to get free money mailed to me?

If you are looking for ways to earn FREE MONEY you will love how easy it is to accumulate $500 in cash right now.

These are money-making opportunities that work and will help you make money fast, whether you are looking to pay off debt or just in urgent need of it.

These are not one-time cash making opportunities, but you can use these ideas to earn and save money EACH month – like how to get free starbucks!

Most of the options listed send you money into your paypal account, so make sure you have it set up. It’s easy and free to open one, and can be used for both personal and business purposes.

If you are thinking I need money now for free and fast – listed below are over 20 websites that pay you for doing the smallest things.

Some examples are scanning barcodes, installing apps on your phone and a research site that pays you up to $140/hr for helping with online research work. All these ideas and more are listed below.

Ready to learn ways to get free cash now?

This is your chance to get free money on paypal.

*this post may contain affiliate links, which means we may receive a commission if you make a purchase using our links below at no extra cost to you. Disclosure .

HOW TO GET FREE MONEY

1. Play and earn with pinterest

This is on top of my list as its the best way to get money in your bank account for free!

You can now make money on pinterest by sharing affiliate pins. And if someone clicks on your affiliate pin image to make a purchase you earn a commission.

How do I know for sure this works?

Because I put it to test and earned over $120 sharing a pin image of a recipe ebook in just one month.

If this is how much I made with ONE affiliate pin, can you imagine how much more one can make by share a few more affiliate pins.

Note: I wouldn’t recommend you pinning a huge range of affiliate pins. Try not to do over 3 – 4 affiliate pins a day.

I would also recommend not repeating the same pin image for your affiliate links. Creating new pin images for the same affiliate link will gain more traction on pinterest – as the platform prefers new images.

Here is a step by step post that explains it better, using this technique.

2. Survey junkie – free money on paypal

This is one of the most reputed and reliable survey sites in the market that is well paying.

Survey junkie is 100% legit when compared to the rest of the survey sites in the market. They have gained a good reputation from survey takers with over 6 million members that have joined them. While you can usually average $15 a survey, some surveys can go up to $50 a survey.

Completing surveys earn you points redeemable for paypal cash, or gift cards. You can cash out with as little as $10.

3. Get paid to spot an empty property

This one is for those that live in the UK.