Robo forex 2021

2) in the table, you will see the indicators of all trading advisors who have worked for several months or years.

Actual forex bonuses

This will help you to understand which of the robots is the safest or which program you need to connect for aggressive trading and getting quick results. For the convenience of search, you can use a filter that will sort the algorithms according to the following criteria: drawdown, initial deposit, number of days worked and total profit. The better the ratio of these indicators, the greater the assessment assigned to the robot in the overall rating. For clarity, you will see a graph giving a visual assessment of the performance of each robot. Best forex robots table is regularly updated and completed with new forex eas, software & platforms. Therefore, if you do not want to miss anything – add the page to your bookmarks and from time to time come back here for new information. Good luck ��

Best forex robots

Real trading results are important for us, so we are ready to publish online statistics of profitable trading robots designed to make money on the forex market online. This is a handy tool for users who prefer automated trading.

Best forex robots table is regularly updated and completed with new forex eas, software & platforms. Therefore, if you do not want to miss anything – add the page to your bookmarks and from time to time come back here for new information. Good luck ��

| № | forex robot | trading account | started | deposit | profit | chart |

|---|---|---|---|---|---|---|

| 1 | ROFX | review | real [myfxbook] | jul 30, 2018 | $10000000 | $63735526 | |

| 2 | fxcharger | review | real [myfxbook] | mar 09, 2016 | $2000 | $38254 | |

| 3 | forex fury | review | real [myfxbook] | oct 03, 2017 | $30000 | $15792 | |

| 4 | incontrol reborn | review | real [myfxbook] | feb 12, 2018 | $1000 | $8672 | |

| 5 | the skilled trader | review | real [myfxbook] | oct 16, 2019 | $5000 | $7555 | |

| 6 | fxrapidea | review | real [myfxbook] | jul 21, 2020 | $2000 | $3422 | |

| 7 | fxhelix | review | real [myfxbook] | jul 02, 2018 | $2100 | $18167 | |

| 8 | wallstreet 2.0 | review | real [myfxbook] | may 22, 2018 | $2200 | $5657 | |

| 9 | fxstabilizer | review | real [myfxbook] | apr 04, 2016 | $500 | $9889 | |

| 10 | GPS forex robot | review | real [myfxbook] | oct 08, 2019 | $50000 | $116141 | |

1) random robots that have just appeared and have not proved their effectiveness are not added to the table. Therefore, you will only work with proven algorithms and get more chances for a positive result. We believe that a quality best forex robot should be tested by time – this is the main factor that is taken into account before including the program in the overall rating.

2) in the table, you will see the indicators of all trading advisors who have worked for several months or years. This will help you to understand which of the robots is the safest or which program you need to connect for aggressive trading and getting quick results. For the convenience of search, you can use a filter that will sort the algorithms according to the following criteria: drawdown, initial deposit, number of days worked and total profit. The better the ratio of these indicators, the greater the assessment assigned to the robot in the overall rating. For clarity, you will see a graph giving a visual assessment of the performance of each robot.

3) if in the process of studying a trading robot, any questions arise or the published information is not enough, then you can click on the additional link and see a detailed overview of the program you like. In the review, you will find trading account statements and a link to the official website, where developers add all the available data.

2021: market euphoria continues

The first trading day of 2021 began with the S&P 500 hitting its all-time high. This means that investors remain optimistic and are ready to go on investing their money in stocks. Playing short would be too risky but explicable.

Demand for gold, bitcoin, and stocks is growing

I would like to draw your attention to two financial instruments that threaten further growth of the index, which are gold and the BTC.

What do you do if the stock market is prone to a crisis and many companies are struggling to survive, losing up to 50-90% of their stock price?

In such cases, market players tend to invest in protective assets, which has always been gold and buy insurances against defaults of companies. Insurances are more complicated to check and track while with gold, it is simpler: there is a chart we can consult at any time.

Mortgage crisis

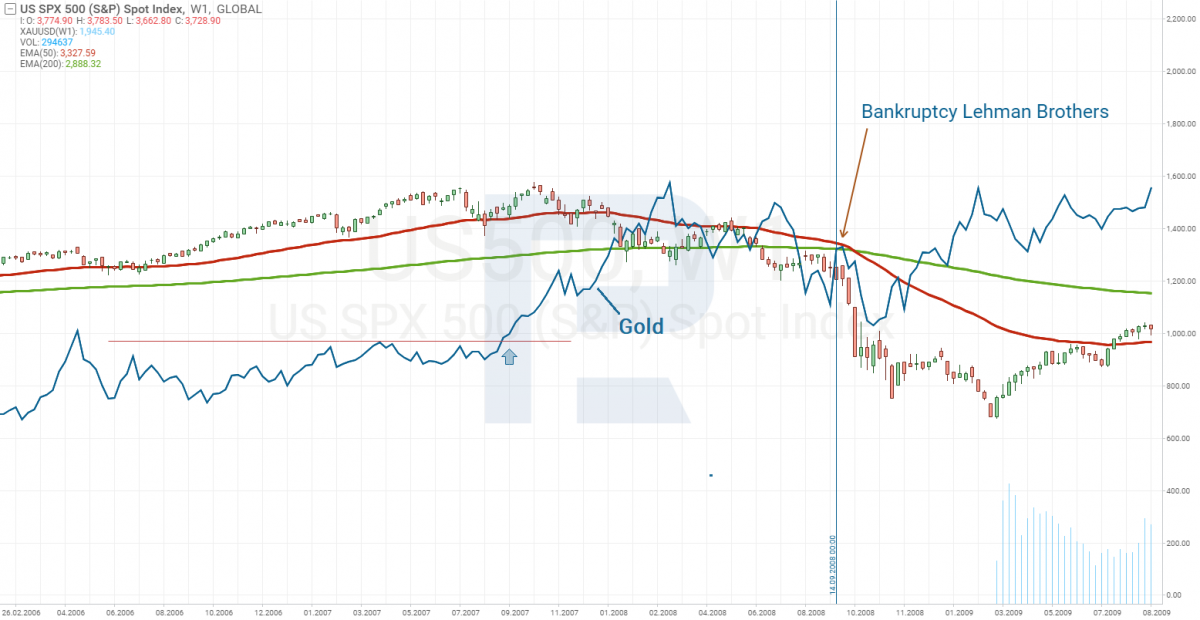

In 2007, a year before the financial crisis began, gold quotations aimed up high, which means many investors had been suspecting a bubble growing in the mortgage market. To protect their finance, they started buying gold (see the big short movie if you are interested in the 2008 crisis).

The S&P 500 quotations also went down gradually, and by the time we heard of the bankruptcy of lehman brothers (which news was the starting point of the crisis), they were trading 18% below their all-time highs.

The BTC as a safe-haven asset

The coronavirus crisis of 2020 also started with the growth of gold, but unlike 2008, gold keeps growing, and so do stock indices.

This can be explained as follows. A part of investors is afraid of keeping money in stocks solely because they suspect a new bubble forming in the market, hence they invest some of their capital in gold. Anyway, in 2020, investors noticed another asset that they started using as protection from fiat money, and this asset is the bitcoin cryptocurrency.

Since december 2020, its price has doubled: one BTC costs over 30,000 USD. It is no more an instrument of minor speculators that could influence its price by 100 USD. Large market players invest in the BTC.

Gold is heading for the all-time highs, and bitcoin is trading at its all-time highs, i.E. Two protective assets are enjoying increased demand. Meanwhile, the S&P 500 index is also trading at its all-time highs. This situation demonstrates that some investors are preparing for a disaster while others are closing their eyes to everything and are ready to buy stocks at any price. Time will show who is right.

Why so optimistic?

The explanation is simple. At the end of 2020, people started getting vaccinated against the coronavirus, which is a hope for the recovery of the economy.

The next explanation is the unprecedented support of the economy by pouring in money. Joe biden will only enhance the support as soon as he becomes president.

When might the growth in the stock market stop?

Europe and the US take support measures, pouring trillions of the USD and EUR into their economies. Low interest rates that allow cheap crediting also sustain businesses.

Now imagine a runner participating in a marathon. To help them, the team paved the road and got a huge fan to blow in their back.

What happens when the support is taken away? The runner’s feet get heavy, and the wind in their face might knock them down.

This comparison means that rumors about the support being wound up might fall as the first blow on the market, while an increase in interest rates will become the second one. This will make those who have bought stocks at a lower price take the profit, while those who have bought at the highs will become very long-term investors, expecting the price to get back. Those who used leverage will be the most vulnerable because a correction might trigger a margin call, which will even push the stock prices further down.

However, while money is poured in, stocks will keep growing. A part of investors will go on buying gold, diversifying risks, but this will be the smallest part. The larger part will continue investing in stocks, noticing smaller companies with stocks trading far from their all-time highs due to rather unstable financial performance. However, the euphoria will cause investors to buy anything.

Central banks are not planning to increase interest rates

Experts say that in the first half of 2021, neither europe nor the US will increase interest rates (goldman sachs even forecast the fed to lift the rate in 2024 only) or wind up the bond-buying program. Hence, stocks will go on growing. Hence, it is not the best of ideas to stay aside and watch them grow.

There are two ways of behavior in this situation. The first one is to invest in gold to protect your capital, while the second one is to try and find stocks that might grow further.

Electric cars makers reported sales

The beginning of 2021 was marked by not only the growth of the S&P 500 but also by good reports of electric car producers.

Tesla, inc.

Say, tesla (NASDAQ: TSLA) reported selling 189,750 electric cars at the end of the 4th quarter, exceeding forecasts by 15,750 cars. The report pushed the stock price 7% up, and the stocks keep trading at their all-time highs.

Tesla is the leader among electric car makers, and its report somewhat predicts subsequent reports of its rivals, i.E. If tesla sales grow, other electric car makers will also enjoy increased demand for their products.

NIO limited

This is exactly what has happened. NIO (NYSE: NIO) reports showed that sales of electric cars doubled in december 2020; they sold 17,353 cars in the 4th quarter, which exceeds the boldest expectations.

According to william bin lee, the director-general of the company, sales were significantly supported by the new “battery as a service” option, which means that electric cars are sold without batteries, which are leased to the client. This solution decreases the prices for electric cars noticeably, making them competitive.

NIO stocks keep trading in an uptrend at their all-time highs.

Li auto inc.

Li auto (NASDAQ: LI) also cheered its investors up with good sales results in the 4th quarter of 2020. In december, electric car sales grew by 530%, and quarterly sales – by 67%, to 14,464 cars. Li auto started mass production in november 2019 and managed to near NIO in such a short term, though NIO has been selling electric cars since 2017.

Li auto stocks grew along with the stocks of other electric car makers, but they currently seem to be the weakest, too far from their all-time highs. On the other hand, this might be interpreted as a potential for growth.

Xpeng inc

Another chinese maker of electric cars xpeng (NYSE: XPEV) also demonstrated results of the 4th quarter that exceeded expert expectations. In december, its sales grew by 326%, while quarterly sales – by 303%, reaching 12,964 cars. As with li auto, xpeng stocks are also far from their all-time highs, which makes them appealing for investments.

Anyway, the two latter companies have just entered the market and have not yet reached the sales volumes of tesla or NIO, they have all the way ahead.

The growth of sales could be noticed in every electric car selling company, which indicates an obvious trend in the future. Hence, the whole of 2021 will be marked by favorable reports of electric car producers, which means you can choose a company for investments in this sector that has such growth potential.

Anyway, I would like to single out tesla stocks. Many market participants think them to be overbought, and volatility in them is huge, so investments will entail increased risks.

Vaccination will restore passenger flow on airlines

Another sector that you should look at is air transportation. The vaccination is expected to stop the pandemics and open up borders, restoring the economy and the income of citizens. People, hungry for goof travel, will help the tourist sector recover and increase the passenger flow. Hence, the situation in airlines will get better, and so will their stock prices do.

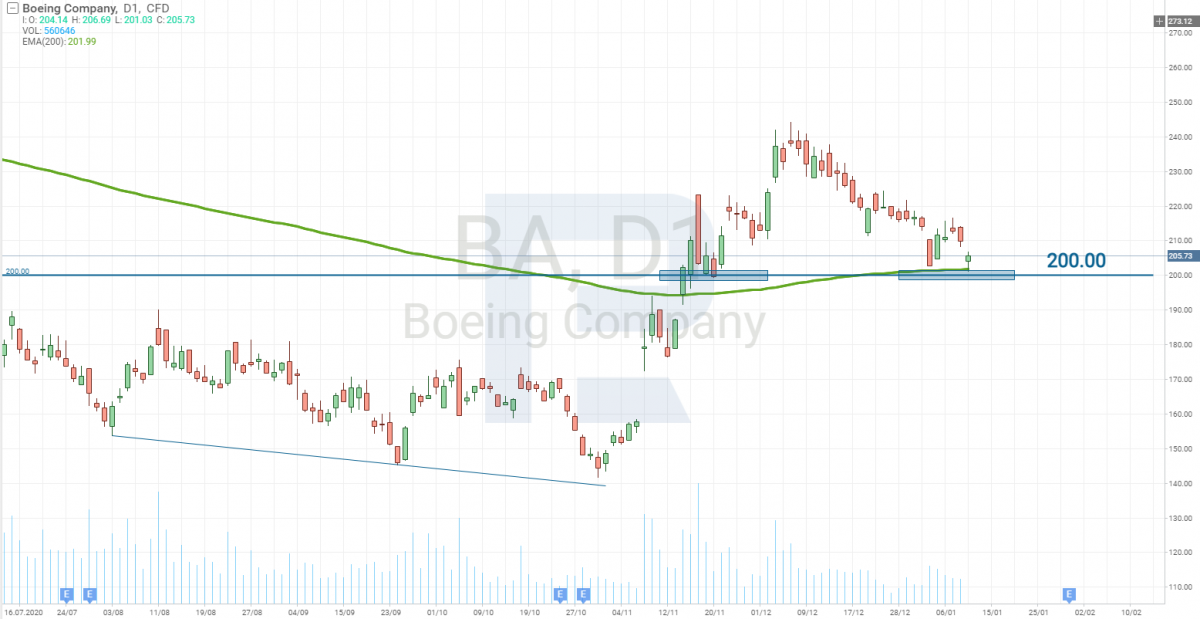

Boeing orders might recuperate

Of course, the main beneficiary will be the boeing company (NYSE: BA) for which the inflow of orders must restore after the slump of 2020. It is the first company for you to pay attention to this sector. Its stocks are completing the correction that started a month ago. The stock price might start growing from these levels.

You can also consider for investments the following airlines: american airlines group inc. (NASDAQ: AAL), southwest airlines co. (NYSE: LUV), delta air lines, inc. (NYSE: DAL), united airlines holdings, inc. (NASDAQ: UAL).

Among them, the financial situation is most stable in southwest airlines. It owns 14 billion USD of free money, and most of its income is generated by domestic flights. Moreover, southwest airlines suffered a lot from the ban imposed on boeing 737 MAX 8 in 2019, losing 435 million USD. And now boeing 737 MAX 8 is allowed to fly again, which is yet another factor of growth for the company.

The weakest airline is american airlines. A surge in its debt load made it reduce its expenses and fire a significant part of employees. Though it has paid off current debts and has no more large payments in 2021, investors tend to avoid its stocks, judging by the chart.

All in all, vaccination is expected to rescue airlines and enhance their financial performance.

Closing thoughts

2020 was packed with negative events, and 2021 is expected to be quite the contrary. The vaccination should make a noticeable impact.

However, there is one detail that can spoil everything. Currently, the stocks of many issuers are trading at their pre-crisis levels or higher. When the fuss around COVID-19 dies out, market participants will shed a look at the economy and find it in a worse state than before the crisis.

Then many will try to realize why stocks are so expensive. Hence, stay vigilant and never miss the time to take the profit.

Investing in proshares VIX short-term futures ETF (AMEX: VIXY), also called “the index of fear”, will be a great idea. When panic kicks off, its quotations will leap up by hundreds of percent.

As for now, look for undervalued stocks and buy them. The first half of 2021 is promising generous profits.

Exploring the top five forex robots of the year in 2021

There are some forex robots that have proven to be a trader’s best friend, helping them amass fortunes through automated trading.

The forex robot space can be a tough space to navigate through. There are of course other forex robots that promise substantial profits, only to disappoint their users in the end. The worst-case scenario is when users use their invested amount altogether in the pursuit of profits using such fraudulent forex robots.

Luckily there’s a wealth of information available online that can point in the right direction. If you are one who is looking for the best forex robot to increase your chances of profitability and passive income generation, you need to select the right trading robot and you need to know how to do it.

Factors to choose to make sure you get the right forex robot

You need to consider the following factors before choosing the right forex robot.

1. Thorough testing: the expert advisor or robot you choose has to be tested against variable spreads and real slippage before they can be usable. You should also consider backtesting to get the results. It should be available to you before making the final judgment. In this case, third party data from authoritative sites such as myfxbook can help evaluate these robots.

2. Using a demo account: testing a robot in a virtual environment before taking it to the real market and risking your money, should be another consideration when selecting robots. You should note that test environments do not always mimic real conditions. Regardless, it still helps you give a measure of what the fx robot has to offer.

3. Drawdown: A low drawdown is always preferable. It refers to the reduction and decline of capital. Conversely, higher drawdowns can mean higher gains, but can also expose an account to unnecessary levels of risk.

Avoiding scams of forex robots

When looking for forex robots, always be aware of products that claim to produce a significant gain or those who cannot provide any real-time based evidence. User reviews are a good source, but you have to make sure that they are genuine. There are many scam products on the market. So you should always lookout for the red flags. These include things like, withdrawal problems once you have deposited, profits not adding up, the robot behaving in a way not advertised, and others.

Luckily there are services such as myfxbook available, which work well to evaluate the effectiveness of forex trading robots. Always go for forex robots from developers you can trust and whose background has been clearly mentioned. Developers should always be transparent with the fees involved, the services offered and past trading results, if they want to win the confidence of their clients.

2021’s top forex robots

Below are some of the best forex robots for 2021.

1. ROFX: developed by a team of expert developers and forex traders, rofx has carved a reputation over a decade as being one of the most consistent forex robots in the market. Its main driving force is its artificially driven neural network that adjusts with ease of changing market conditions. Another striking feature of this robot is their compensation plan which is facilitated by the robot’s reserve fund. Its verified myfxbook page of one of their accounts shows a gain of 811.29% with a mere 0.35% drawdown. This suggests that the AI-driven strategy is one of the safest in the market.

Minimum deposit: $1000

2. GPS forex robot 3: GPS forex robot is a user-friendly forex robot, with its 3rd version currently in operation. It constantly updates itself to changing market conditions, using innovative algorithms. It allows users to select from twelve different trading styles and strategies, each catering to a specific style or trading level.

Win/gain rate: their website claims that they produce 300% gains, which is backed up by live verified records.

Minimum deposit: $100

3. Wallstreet forex robot: the wallstreet forex robot is a forex robot that comes with an amazing feature called “broker spy module” which was developed after 2000 hours of testing. The robot also provides a verified myfxbook account which indicates a profit in the region of 155% with a drawdown of 21.17%. Users actually get 4 robots for the price of one, which includes wall street 2.0, asia 2.0, pro 2.0, and gold trader.

Minimum deposit: $1000

4. Perfect trend system: the perfect trend system is a forex robot that focuses on profiting from trends. The robot first retraces and then rides the continuation of strong trends the system selects. The robot’s myfxbook page indicates a gain of 840.53% and a drawdown of 58.30%, making it one of the highest advertised gains on this list. Since the drawdown is high, the strategy in use may be inherently risky.

Minimum deposit: $1000

5. Forex cyborg: this is a professionally developed forex robot that allows users to trade on multiple currency pairs with default settings. It also lets them adjust risk per trade and lot size to an amount suitable to their trading style. It is backed up by ten years of historical testing. One of their verified myfxbook accounts shows a gain of 310% with a drawdown of 29.27%.

Minimum deposit: $1000

Final thoughts

It should be remembered that no forex robot performs at the same level in different market conditions. Because of the vast availability of forex robots, the number of scams in the market has increased. This means that traders have to be diligent more than ever. They must conduct research using the wealth of information available in the market, as well as based on testimonials and hard evidence from other users. Picking the right forex robot can change the fortune of many traders, especially novice traders and individuals looking for passive income. A good monthly gain of 10 to 15% is an achievable profit level which some good forex robots maintain. But always steer clear of forex robots that promise unachievable gains under all market conditions.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.

Join our newsletter and

be the first to know!

Thousands of subscribers are already getting their news

fresh, FREE, and delivered directly to their inbox. THE BEST WRITERS, THE HOTTEST STORIES, ONCE A WEEK

We value your privacy, your email address is safe with us.

The best forex robots in 2021

In this article skip to section

If you are looking to become a more profitable forex trader, or if you are a beginner in need of guidance, then our review of the best forex robots will help you find the right one for you.

Forex robots use an algorithm to look for profitable trades. You can usually set them to trade automatically (within agreed parameters) or enter a trade manually.

To become an effective trader, you will need to be able to keep up with movements of the currency markets, world economics and news – as well as use historical knowledge and data to predict when the best time to enter and leave a trade will be.

Using a forex robot automates this and takes the emotional bias out of trading. Some of the best robots operate with trade settings that can be as simple or complex as required, and take total control of the trade process, creating a passive income possibility from trading 24/7.

Forex robots do not need you to have extensive knowledge and experience of trading – most are ready to use from installation and offer everything from basic trading functionality to fully programmable settings – so even the most experienced trader can benefit from the automation involved.

How to avoid a scam product

In forex trading there are no guarantees of profit – the market can be volatile and even the most sophisticated robots (or the most experienced human forex trader) can lose a lot of money.

If you are looking for a forex robot, watch out for products that claim huge profits and cannot provide real-time examples of how they are performing. User reviews are always a good bet, as are reliable review websites.

Aside from user reviews, look for real-time usage on brokers – third party verification sites like myfxbook.Com are a good way to see how they are performing.

Robots should be tested; using historical data to see how they are performing (known as backtesting) will show where they struggle to predict trends and where they perform well.

There are, of course, many scam products available online and avoiding these can seem difficult. Although every care has been taken to ensure the products we are listing are not scams, we can take no responsibility for any financial losses.

At wikijob, we are not financial advisors and any information provided throughout this article is for educational purposes only. We would always recommend that you conduct your own thorough research and due diligence before making your own personal choice.

Things to consider when choosing your forex robot

There are a few things to think about when choosing a good forex robot, other than avoiding the scam products:

- Look out for a low drawdown rate. This is a measure of decline and reduction of capital, and although high drawdowns can mean higher gains, they can also cause an account to go broke.

- The best robots are thoroughly tested, against real tick data, variable spreads and real slippage. This backtesting should be available for you to view before you purchase, and real-time data from third party sites like myfxbook can help inform you how the robot is performing today.

- Be wary of product reviews from unverified sources. The developers will only want to show positive reviews, and people who have lost money while using a particular robot will be likely to give it a bad review. Compare reviews from genuine users before investing.

- Use a demo account. Before deciding to use a robot, try it in a test environment first. This will allow you to see how it performs under test conditions – although, be aware that test conditions can not fully simulate a real trade situation. If the robot you are considering does not offer a demo or test version, it might be too risky to invest capital in it. During the demo, you can see what settings and parameters are used by the robot too, and get used to how it works.

- Make sure that you remember all robots will require some supervision. System failures, problems with internet signal and catastrophic loss can happen, so although these robots are designed to work autonomously, you will have to intervene at some point.

The most important thing to remember when choosing a product is that there are no guarantees when it comes to gains from forex and cryptocurrency trading. Products that guarantee financial gains without any form of money-back guarantee should be avoided; many of the most popular robots offer at least 60 days trading and a full refund, which makes them seem less likely to be a scam.

Top forex robots

These are some of the robots that we think are the best in the industry for 2021.

Suitable for use by beginners and experienced traders, they are available as instant downloads and all work with most brokers.

1. GPS forex robot 3

This robot uses newly developed, innovative technology and algorithms. Constantly monitoring the market in the background, it has 12 selectable trading styles and strategies, so you can choose the one that suits your needs.

Ready to go out of the box, GPS forex robot is simple to use. Set to receive automatic updates whenever the programming needs to be tweaked, it is constantly updated – allowing you to take advantage of developments straight away.

Minimum deposit – $100

Win/gain rate – website shows live, verified gains of 300%+

2. Coinrule

Fee: free with a starter account or from $29.99 per month

With its simple, intuitive design, coinrule is a good choice for those who are new to trading as well as more advanced traders.

Users don’t need to know any code to set their trading rules.

Coinrule is web-based and works across several cryptocurrencies as well as supporting some of the most widely-used exchanges, such as bitmex and coinbase pro.

3. 1000pip climber system

This forex system is based on an algorithm that analyses the market and provides signals through visual, audio and email notifications.

The free guide makes it simple for beginners to follow and it has clear signals giving information about entry, stop loss and take profit rules.

It is a ‘slow and steady’ forex robot, with minimum risk – but perhaps less reward than high-risk strategies.

It closes trades based on the algorithm, although changes can be made to the minimum and maximum limits.

Minimum deposit – no minimum noted

Win/gain rate – the creator claims that this system has targeted 20,000 pips over three years

4. Forex trendy

This expert advisor is an automated analysis system that helps users avoid trading during any uncertain trading times.

It is capable of looking at charts on 34 forex pairs, from minutes to monthly, and is a browser-based EA which means there is nothing to download or install.

Although it will not place the trade for you, it will advise when the best time to buy or sell would be.

Minimum deposit – $250

Win/gain rate – the creator claims 90% accuracy if trades are made as directed

5. EA builder

The EA builder allows every trader to create their own indicators and strategies without any programming knowledge.

It has a simple interface that establishes rules and algorithms so you can trade anything with several features in just a few clicks.

This web-based program does not need any installation and works effectively with metatrader 4 + 5, as well as tradestation.

Minimum deposit – depends on platform

Win/gain rate – depends on strategy used

6. Forex diamond

Forex diamond combines three independent trading systems to offer a self-updating algorithm that has a profitable 40+ recovery factor.

With the option to run trend retrace, countertrend or countertrend scalping independently or in combination, this EA offers real-time calculation that helps trades be more successful.

Minimum deposit – $1,000

Win/gain rate – according to results, between 75% and 80% depending on currency pair

7. FX-agency advisor

This is a manual tool that is simple to use for beginners and comes with a comprehensive and detailed instruction manual to help newbies navigate their trades.

FX-agency advisor uses unique technical analysis indicators suitable for both scalping and long-term trading and is suitable for use on all currency pairs.

Minimum deposit – depends on platform

Win/gain rate – not known

8. Wallstreet forex robot 2.0 evolution

The wallstreet forex robot has the longest, fully verified performance according to myfxbook, and it works on any currency market.

The 2.0 evolution is based on the original configuration of low-risk scalping following short and medium-term trends, with the addition of the broker spy module which allows you to protect your capital from unethical brokers.

Minimum deposit – $1,000

Win/gain rate – demonstrated monthly gain of 2.98%

9. FX pattern pro

This beginner-friendly pattern indicator is an EA that alerts users to the best times to buy and sell through alerts.

The user-friendly interface makes it simple to see when the alerts have been sent, and the buy/sell signals do not repaint thanks to the unique algorithm.

FX pattern pro is an all-inclusive solution that sends alerts through telegram, so you can perform trades on the go.

Minimum deposit – depends on platform

Win/gain rate – 80% win rate claimed by creator

10. Trademiner

Trademiner is an indicator that scans market data to identify historical or seasonal trends.

Creating easy to read reports based on custom search parameters, it is a great way to back up or inform trading strategies and decisions based on the cyclical nature of the trading system.

This effective backtesting tool works on forex, futures and stocks.

Minimum deposit – depends on platform

Win/gain rate – historical trading is known to be 80% accurate but will depend on what actions the user takes

11. X trend premium

This is a forex indicator that, according to the creator, uses algorithms that adjust to real-time market fluctuations.

Indicators can be sent to you via email or even as push notifications on your phone, but as this is just an indicator, you need to be in a position to physically make the trades yourself, unlike some of the automated robots.

Minimum deposit – $100

Win/gain rate – according to reviewers, the risk/reward ratio is 1:3

12. Forex gump

This forex robot runs on nine currency pairs and monitors trends, prices and news.

You can set your trading preference to high, medium or low risk – and this will affect the outcome of your trades.

It comes with full instructions and support, and even offers a money-back guarantee.

Minimum deposit – $4,000 regular account, $400 on a nano account

Win/gain rate – some report gains of over 1,000%

13. Auto ARB

Created by leap-FX, this is an arbitrage-based robot that takes advantage of slow connections against faster markets, reacting to make a profit in the time lag.

It works on all currency pairs, cryptocurrency, stocks and indexes, as it uses the speed of the broker connection to the market.

With the automatic trading, it makes it simple for anyone to use, and the creators say that it is almost risk-free.

Minimum deposit – depends on your broker and platform, works on demo accounts

Win/gain rate – although the creators claim it is almost risk-free, reviewers seem to think it doesn’t work well on live accounts, and no information about the win rate is available.

14. Centobot

This is a robot that deals with forex and cryptocurrency; you can use it to trade across both.

The software is easy to use, and if you have the knowledge, you can use it as a platform to create your own robot with your preferred settings.

Minimum deposit – $250

Win/gain rate – reported profit of 297%

Final thoughts

There are hundreds of forex robots available today. They were developed using the latest technology to ensure that they can look for the most profitable trades, and are created to help both complete novices and experienced traders.

You don’t need to have prior knowledge of forex trading to use these robots – with predefined settings, most can be operated with a simple start/stop button press. For the experienced trader, the robots with adjustable settings allow you to adopt a riskier strategy by adjusting the stop loss to take profit points.

When you are looking for a forex robot to automate your trades, it is worth deciding on a strategy that you prefer before selecting your forex robot. Different robots have different trading styles – and finding the one that will gain you the most while protecting your bottom line is sometimes difficult.

Whether you prefer the security of hedge trading – buying and selling during the same trade to protect your bottom line – or you are interested in a news-based strategy, there is a robot to suit you.

Forex robots can make it simple to trade when you lack experience or time, if you invest in the right product.

Wikijob does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Roboforex

Broker roboforex is a group of companies robotrade ltd and roboforex (CY) ltd, are engaged in the provision of the following services:

- Trade on forex;

- Providing analytical information to traders;

- Service auto copy trades copyfx;

- Investment in the RAMM account;

- The program "rebates" to return to the spread;

- Webtrader mobile trading;

- Learning the trade;

- Package improved trading conditions for VIP clients;

- Best affiliate programs;

- Personal consultations;

- Round the clock technical support.

The business model of roboforex

There are two generally accepted models of work brokerage firms:

Straight-through-processing (STP), according to which the broker is an intermediary between the trader and the liquidity provider and receives a certain commission for the successful brokerage. The broker does not bear losses in case of a successful trade traders, as losses are allocated between liquidity providers, but thanks to the security protocols ensured anonymity of traders, therefore, there can be conflicts between the traders, broker and liquidity providers. On the contrary, the broker is interested in the profitability of the trader, because the increasing of the yield curve and increase the lots, along with the increase of the commission goes to the broker;

Market maker (market maker), according to this model a trader enters into transactions through its broker without the interbank market, in which broker acts as the counterparty in the case of a successful transaction, the trader he loses his profit and vice versa. It is not profitable to the broker, so he tries a variety of ways, including non-market to make the trader a profitable. Fryes there are requotes that the trader entered into a transaction at a less attractive price, studs, knocks stop-loss players, various failures of the trading terminal, cancellation of profitable trades, delays in the payment of profits. Many novice traders don't know about it, so, faced with such unfair dealing centers, disappointed in forex.

The roboforex group of companies does not use in their practice the model of a market maker. Roboforex (CY) ltd operates the STP model, providing access to liquidity providers. And robotrade ltd uses a hybrid model: for cent accounts broker acts as a dealer and handle the transaction inside the company, and for standard and ECN accounts, the STP technology is used. This is a special feature of the liquidity providers, because they do not work with small volumes. Liquidity providers of the broker roboforex are the TOP FX, citi FX, CMSFX UK ltd, SAXO bank and sucden financial. They provide access to liquidity through the current ECN system, integral, currenex and citi, which serves as a direct confirmation of the fact that roboforex is a reliable and transparent broker, not the kitchen.

Regulation of roboforex

The company robotrade ltd is an international broker that is regulated by IFSC (license IFSC/60/271/TS/15). In addition, robotrade ltd is member of the financial commission, an organization engaged in the resolution of the disputed financial issues between brokers and traders. Roboforex (CY) ltd is a european broker that is regulated by the cypriot regulator cysec (license no. 191/13) and is registered in the UK FCA number 608962. Also roboforex (CY) ltd is part of ICF – cyprus the investor compensation fund providing insurance investment investors up to 20,000 euro. In addition, roboforex in ukraine is regulated by the UCRFIN.

Offices of roboforex

Broker roboforex has the following law offices pabout the world:

Roboforex (CY) ltd, limassol, cyprus – the central office;

Automated trading software

Forex robot trading is the use of pre-programmed software which allows you to automate forex trades. There are many different versions of this software in operation all designed to help you to make money from forex trading without having to trade manually. For many they allow you to trade in higher volumes, 24 hours a day, no matter where you are or what you are doing.

While there are many forex robots in operation, it is essential to choose the right one. To do this you need to know what you are looking for and ascertain what exactly you want from the software. Do you wish to trade automated currency pairs while continuing to trade manually or would you instead that the robot takes all of the risks for you?

Once you have decided what you want from a robot, how do you choose? We have teams of experts that are well versed in all things forex and come from strong trading backgrounds themselves. They use their expertise to research and review every forex autopilot trading robot available presenting the information in a concise and comprehensive format.

In this article, you will learn:

Exactly how robots work and how they help the different types of robot that exist how we research and review the software

Top rated forex sites

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

How forex robots work

First of all, it is essential to understand how forex robots work. Forex auto trading robots are a piece of software that you can use to automate your trades along-side the main trading platform. But why use automated robot trading and how does it perform?

Efficient and effective

By using a set of trading systems and rules to calculate when to purchase or sell a particular pair, robots can scan the data available rapidly, much faster and much more accurately than a human is capable of doing. In addition to this they have also been programmed to work to a particular set of criteria so that they can execute effective trades directly via the metatrader platform.

Round the clock trading

24 hours a day, 7 days a week, robots can carry out trades as long as the markets are open. A human simply can't do this. It is hard to conduct round the clock trading in all of the different markets when you need to eat and sleep. With markets across the world active around the clock and in different time zones, you can't be online 24 hours a day, 5/6 days a week.

More trust in the robot

Some people prefer to trust in the robot and automate their trades as opposed to manually trading as well, which is not uncommon. If you know that a piece of software can carry out trading when you can't, and can process the volumes of data that would take you much longer, then it becomes an attractive prospect for many.

Higher success rates

If a robot program is using the most accurate and up to date information, as well as analysing trends of specific pairs, it stands to reason that they have more accurate information than you can process. Often this leads to more successful trades and higher profits for you.

Of course, there is a fee for using a robot software, but this should be recouped in the increased success that you see. Choose a robot that you can trust and one that has a reliable name. Our reviews and recommendation can help you with this. Also, always test your robot using a free demo account before you risk your own real money.

I'll find you an awesome forex site in seconds. Ready to go?

What type of device do you trade on?

What style of financial bonus suits you best?

How fast do you want to withdraw profits?

What amount are you thinking to deposit?

I'm checking 75+ sites to find your best match.

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Different types of robot

There are many kinds of forex robot companies offering their software to new and experienced traders alike. While they all do the same job, there are many differences between them, starting with the cost. There is a fee to use the robot trading software, how else do they make their money? Often the price can vary, requiring deposits/fees that range from the ridiculously cheap to quite substantial amounts.

Then there are the various types of account available. There are basic accounts then more enhanced accounts which generally follow the principles of gold, silver and bronze. With the multiple levels of account comes the availability of different forex pairs. The higher-grade your account, the more currency pairs you have available to you to trade. In addition to the robotics type software, there is another form of automated trading. This is called "trading signals". Instead of the robot executing the trades for you, trading signals or rather, expert advisors, produce the trading advice for you to make the final decision manually.

Some robots are more effective than others. Some are more sophisticated and use highly developed trading systems. Some will promise the earth for $20. The trouble with something this cheap that promises the earth is that sometimes it can be misleading and not deliver. If it looks too good to be true often it is. That's why it is so important to review each of the robots available and choose one that is genuine and will offer you the best chance of successful trading.

The best forex robots 2021 – your ultimate guide to forex auto trading

The best forex robots have come a long way since public automatic trading systems were released in 2008. With technological advancements and competitive research driving the market forward, a lot has changed. Combined with new platforms, new brokers, and new strategy methods, finding the right forex robot for your trading requirements can seem like a difficult task.

This page highlights what the best forex auto trading robots are, how to select the best forex eas, and explains everything you need to know about forex robots too. Read on to learn:

- Our criteria for selecting the best forex eas

- How to optimize a forex EA

- What the best forex bot is for your account type

- Pricing information

Try one of our recommended forex trading robots and enhance your trading performance today.

How we find the best forex auto trading robots

The best forex eas listed above were all handpicked by our trading experts after rigorous testing under pre-set performance metrics. Only those that passed our high standards are featured on this page. We do this so that you can trust our best forex robots for 2020 reviews to be unbiased and honest.

Below you can learn about all of the criteria we consider for our list of the best forex auto trading robots. This will not only help you to choose the right robot for you, but it’ll also help you to avoid making simple mistakes when utilizing trading robots.

Each robot on our list has performed well in the following categories:

- Backtesting – backtesting is a process where the forex robot is subjected to historical price data and market conditions to see how well it would have stood up to previous trade scenarios. The first step towards knowing if the automated forex-trading robot has a chance of being successful is by subjecting it to backtests. We’ve listed only those robots that have undergone the best forex bot backtests available in the market today. Therefore, you can be sure that you are looking at forex robots which would have performed well over time.

- Live trading results – forward tests involve testing out the best forex auto trading robots on the present market conditions. This allows them to replicate in real-time what the backtests have shown they could do historically. Forward tests involve introducing these forex robots to live accounts with real money, as well as virtual accounts that feature simulated trades. Simulated trades in a demo account offer controlled conditions for forex EA use. Real-time trading allows the robots to work on a live account in real market conditions. While there is capital risk associated with this type of testing, it is the ultimate test to see if an automated trading system can function in live environments. A mantra of the forex market is that past results are not always indicative of future performance. Therefore, future performance with a live account is a relevant part of the robot testing process.

- Drawdown – the drawdown is the difference between the highest value of your trading account and the next lowest point the trading capital gets to. The essence of measuring the drawdown of a forex robot is to know whether it subjects the account to too much risk in its quest to achieve its profit goals. On a per-trade basis, a properly functioning forex robot should not place a position that forces an account to go too negative before the market turns and puts a trade back in profit. If a trader’s account size is too small to handle such wide dip-recovery cycles, then losses could occur. Trades could end up being closed prematurely as there is no capital to give the trades room to recover. Consecutive drawdowns negate the principles of lesser risk, greater reward. The risk-reward ratio (RRR) for every trade should ideally start from 1:3. This translates to 1 pip risked for a reward of 3 pips. At this ratio, it takes 3 losing trades to wipe off profits from a winning trade. The best forex robots should be able to enter trades only when the minimum RRR is met. If consecutive drawdowns are huge, then this target will not be met, and the trader’s account will suffer. In our table, only robots with the lowest drawdowns find their way into this list.

- Limitations on order size – some robots out there only work well with certain order sizes. We believe that a forex robot should be able to reproduce the same outcomes no matter the order size. However, the approach we use is to ensure that a robot has proper position sizing algorithms within it. Should a forex trading robot not be able to handle a variety of order sizes, it will not make it to our recommendation list.

- Reputation and reviews – every robot listed here undergoes a background check. These checks involve getting reviews from verified users. We check things like how long it has been on the market, user experiences, and other information about the robot. We also check the originality of the product to ensure it is not a remake of a decompiled robot.

- Trading strategy – A good trading robot will either come equipped with a pre-programmed trading strategy or allow you to custom input a strategy based on your trading requirements. In terms of strategy, we further check to see how many strategies can be employed, which platforms the forex robot is compatible with and how many assets it can trade. We also check to see if the robot incorporates hedging or scalping strategies. The trading systems should be adaptive, being able to utilize studies or signal-finding data and be adaptive with charting packages in combination with other indicators. You should also be able to set stop loss and take profit parameters in combination with the default settings.

- Risk settings – we also check the risk settings of every forex robot. The best forex robots typically have risk classifications: conservative, balanced or aggressive. Every robot has a spectrum of operation and we check to see where each robot is on the available risk spectrum.

- Price and refund policy – A robot’s performance cannot be truly assessed by the cost of the software. An expensive robot is not necessarily a good one. We check to see if the price offered by the robot’s vendors provide value for the purchasing cost. We also check to see if a free trial is offered and if there is a refund policy in place for unsatisfied customers.

How we test forex robots

All robots are tested fairly and objectively without preference for one or the other. The same testing conditions are used as much as possible to make our rankings reliable and transparent. We un tests using a VPS on different platforms for at least 30 days for each forex EA. Some of the best forex brokers offer a free forex VPS for live account holders.

What will the best forex robots do for you?

Forex robots work by placing trades automatically without human input. They can be programmed to set the lot size, stop loss and take profit parameters. They can also be made to work on a forex account round-the-clock when they are attached to a forex VPS. Here is a list of what you can expect from the best forex eas in terms of function.

- Initiate trades

- Manage positions

- Exit trades

- Generate signals for trade signals services

- Generate and replicate signals from master to slave accounts as part of a copy trade service.

- Be attached to a forex VPS for 24/5 trading.

Learn more about forex robot functions

Now that we’ve covered the basics, let’s look at what the best forex trading robots do when trading on an account.

- Order placement – pre-set parameters will allow the automatic trading system to place orders based on user input. The forex robot will then select a trade size, set a stop loss and take profit target, and execute a trade on the instrument chart that the robot has been enabled. A good forex robot should have a built-in algorithm that enables the forex EA to have a rapid execution speed with ultra-low latency and be able to weigh the RRR before it takes on a trade.

- Analysis and indicators – A trading strategy is what is encoded into a forex robot’s algorithm to define the basis for setting entries and exits. The analytical tools are not random; they must be clearly defined. For instance, a forex robot can be programmed to spot divergences between price and an oscillator such as the RSI. Robots can also be given the ability to use a candlestick pattern to define the precise entry price and use the recent highs and lows to set a stop loss or a take profit parameter. Some advanced robots can even be made to analyze news articles to make trading decisions. The best forex auto trading robots should be adaptive and be capable of using a variety of tools to execute several strategies.

- Position and risk management – the protection of your bottom line using the correct position size and risk-reward ratio is integral to the success of any trading venture. A forex robot must be programmed with the ability to deliver on these mandates. Not more than 3% of an account should be risked on total exposure in the market, especially if you have a small account. As an account grows, a forex robot should be able to detect this growth and scale up (or scale down) the position size according to the risk profile of the trader. Conservative traders may want a robot to scale down on the position sizes as their accounts grow, while those with risk appetite may want to scale up with a growth in the account. When selecting a robot, you should select one which matches your risk profile as a trader. Backtesting is a good way to see how a robot will react in account growth scenarios.

Why should you use a forex robot?

The best forex trading robots provide you with several benefits. Some of these include removing emotional stress from trading decisions, improved time management from reduced monitoring of trades, and the ability to explore multiple asset classes at the same time. With such a wide range of trading robots on the market, there are suitable options for everyone regardless of your trading requirements or experience. Below you will find a list of some additional advantages you will gain by using an fx trading robot.

- The chances of missing trading opportunities due to physically being indisposed are eliminated. This is especially true when using a VPS.

- The robot does all the analysis, which saves you the stress and time of doing it yourself.

- A robot can interact with large amounts of data within a short period. If the coding is done correctly your auto trading system can do some truly amazing things.

- If you want to run a copy trade service, a forex robot is indispensable to the entire arrangement.

- A well-programmed trading robot can execute trades based on nanosecond information, creating profit opportunities that might otherwise be impossible.

Are there any downsides to using forex robots?

Naturally, there are downsides to using an automated forex trading robot. Here are some common disadvantages you might experience when using one.

- Usage can be expensive. The expense comes with the cost of acquiring a robot and maintaining a forex VPS connection.

- They require a 24/7 internet connection. This can be offset by a VPS.

- Forex robots still require some monitoring. Lesser quality software or poorly coded algorithms could fail unexpectedly.

- There is always the risk that changing market conditions can alter the performance of a forex robot. The standard market conditions of one day may be completely different from another day. This can be offset by continuous testing and re-testing to optimize performance metrics.

- If programmed improperly, the automatic trading system may not function as intended and could lead to losses.

One glaring concern with utilizing an automatic trading system is that there are a lot of forex robot scams out there. Vendors of such robots claim a 100% success rate or tout their products as being “no-risk” robots. Claims such as these should be taken with caution as they could often be an indication of fraudulent services.

This is why we have taken the time to present reviews of each forex robot listed on our table so you know exactly what each one can give you and what each cannot provide. Be sure to read our reviews and our recommendations to see what the best forex robots have to offer you.

Do forex robots actually work?

Forex robots work. Institutional traders and hedge funds use advanced algorithmic software to execute some of the most profitable trades on the market daily. Qualified professionals have dedicated years of research to perfect the functions of trading robots, and the results speak for themselves.

We use a combination of academic research, expert testimonials, and real user feedback to provide you with a reliable and trustworthy source for the best forex auto trading robots. Our selection process is rigorous and built to screen out the bad products while bringing the best software to the spotlight. We do not do a one-time investigation process: we always screen and re-screen the forex robots on our list to ensure that only the most impressive forex robots are displayed at any given time.

No forex trading strategy or robot can promise 100% success. Due to the ever-changing nature of forex markets, there are always risks associated with trading. Therefore, we’ve dedicated our time to finding the most adaptive forex robots available. Whether being capable of utilizing multiple trading strategies, functioning with several trading platforms, or being subject to frequent updates, our recommendations represent the best auto trading robots on the market.

Visit the table at the top of this page and enhance your trading performance today by using one of our recommended trading robots.

So, let's see, what we have: discover forex robots top picks from market experts. Compare trading systems, read our reviews, and choose your favorite software. At robo forex 2021

Contents of the article

- Actual forex bonuses

- Best forex robots

- 2021: market euphoria continues

- Demand for gold, bitcoin, and stocks is growing

- Mortgage crisis

- The BTC as a safe-haven asset

- Why so optimistic?

- When might the growth in the stock market stop?

- Central banks are not planning to increase...

- Electric cars makers reported sales

- Vaccination will restore passenger flow on...

- Closing thoughts

- Exploring the top five forex robots of the year...

- Factors to choose to make sure you get the right...

- Avoiding scams of forex robots

- 2021’s top forex robots

- Final thoughts

- The best forex robots in 2021

- How to avoid a scam product

- Things to consider when choosing your forex robot

- Top forex robots

- 1. GPS forex robot 3

- 2. Coinrule

- 3. 1000pip climber system

- 4. Forex trendy

- 5. EA builder

- 6. Forex diamond

- 7. FX-agency advisor

- 8. Wallstreet forex robot 2.0 evolution

- 9. FX pattern pro

- 10. Trademiner

- 11. X trend premium

- 12. Forex gump

- 13. Auto ARB

- 14. Centobot

- Final thoughts

- Roboforex

- The business model of roboforex

- Regulation of roboforex

- Offices of roboforex

- Automated trading software

- How forex robots work

- Different types of robot

- The best forex robots 2021 – your ultimate guide...

- Try one of our recommended forex trading robots...

- How we find the best forex auto trading robots

- How we test forex robots

- What will the best forex robots do for you?

- Learn more about forex robot functions

- Why should you use a forex robot?

- Are there any downsides to using forex robots?

- Do forex robots actually work?

No comments:

Post a Comment