Forex xm

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Actual forex bonuses

Why are cookies useful?

Members area access

Use your MT4/MT5 real account number and password to log in to the members area.

New to XM?

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Change settings

Please select which types of cookies you want to be stored on your device.

XM review and tutorial 2021

XM.Com offer a range of account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service.

XM.Com deliver ultra low spreads across a huge range of forex markets. Flexible lot sizes, and micro and XM zero accounts accommodate every level of trader.

XM review; touted as the next generation broker for online forex and commodity trading, XM global webtrade is suitable for beginner and seasoned traders alike. Traders can get started with the trading software real account, or test the waters with a demo account platform with $100,000USD of virtual currency.

Highlights of this particular broker service include auto trading, no hidden fees or commissions and fast order executions, with 99.35% taking place in under 1 second.

Company details

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

The platform boasts over 1.5 million clients with traders in 196 countries. The XM ethos is all about being big, fair and human. The company prides itself on things like excellent customer service and a personalised approach for every client, no matter their investment goals.

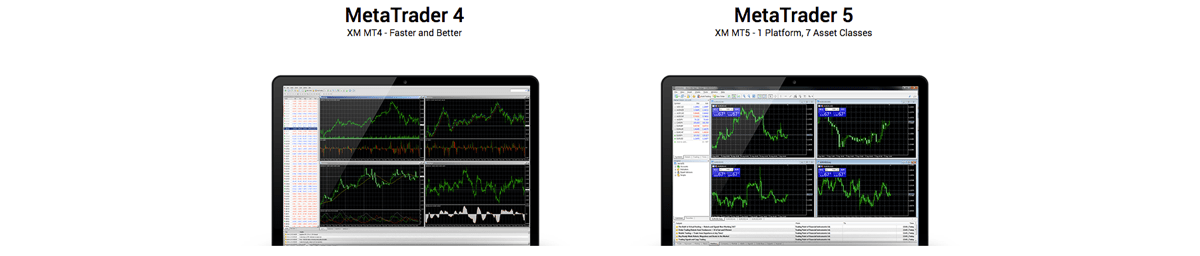

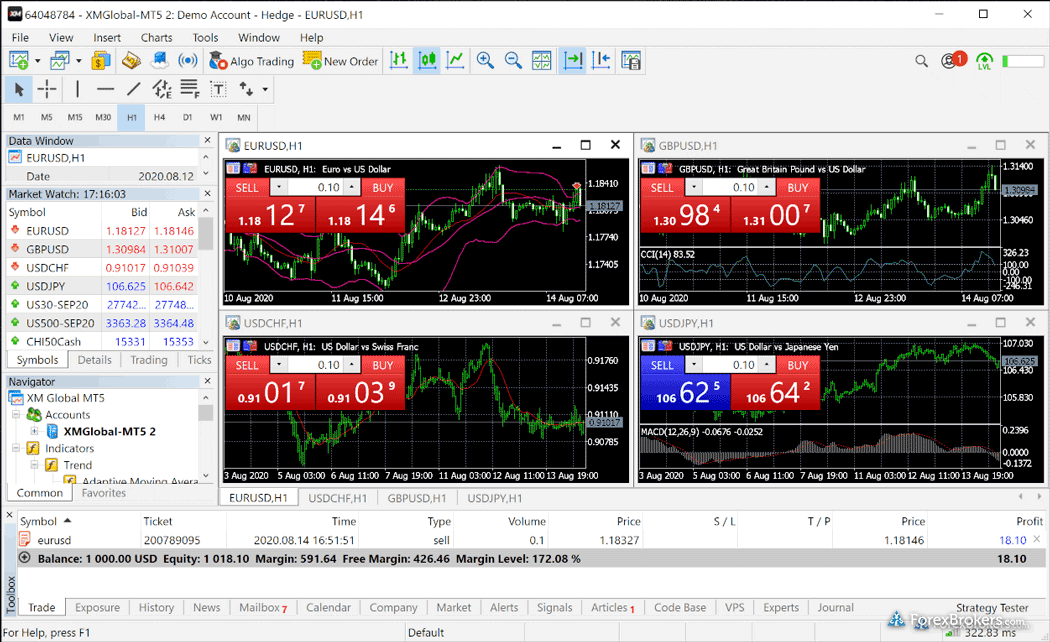

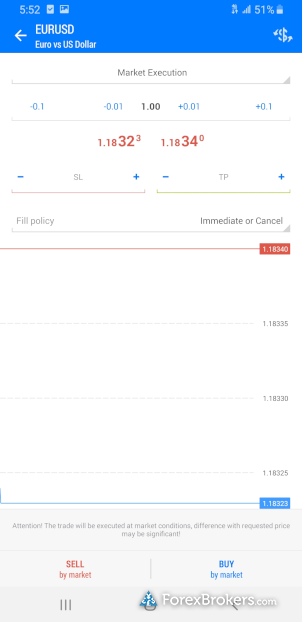

XM trading platform

XM offers 2 trading platforms which are accessible from both real and demo accounts. The multi-award winning metatrader 4 is predominantly a forex trading platform that supports stop, limit, market and trailing orders.

The metatrader 5 platform is a multi-asset trading platform which also offers access to stocks, stock indices and precious metals. Both platforms are available on apple and android devices, which makes for a smooth and easy-to-use mobile trading experience.

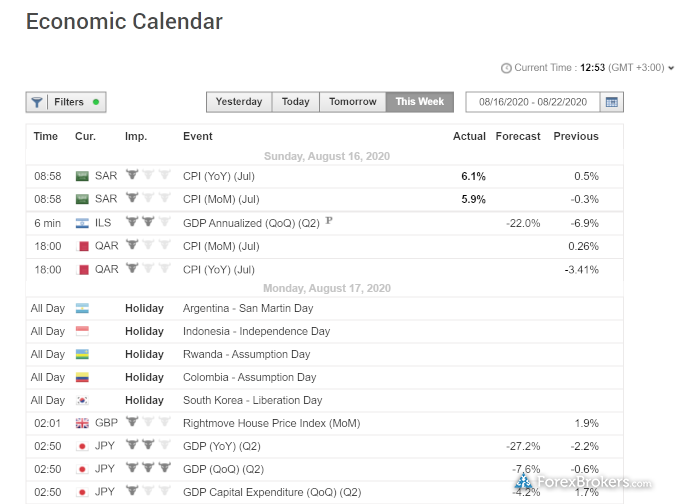

The trading area offers additional, optional tools, such as economic calendar or trade volume stats.

Assets / markets

This broker has more than 1000 financial instruments which can be traded on the MT4/MT5 platforms and this includes forex trading, stocks cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

Forex trading is available on over 55 pairs, including the major USD, GBP, EUR and JPY pairs.

XM does not offer binary options or futures.

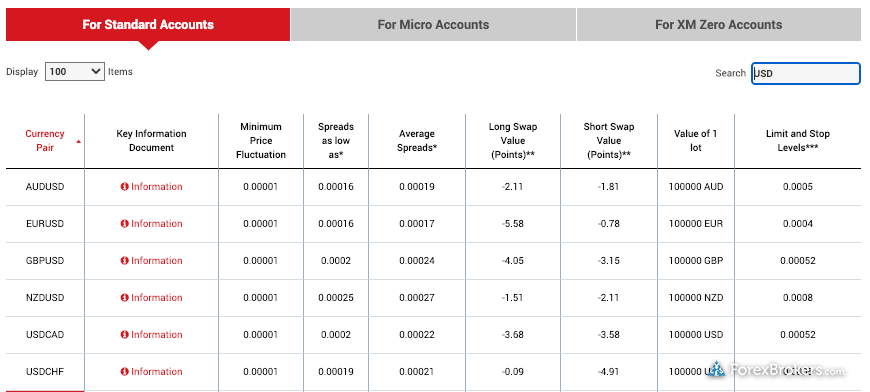

Spreads & commission

Spreads vary depending on the kind of account opened. It’s possible to open a micro account, standard account and XM zero account. The minimum spread across all accounts is 0.1 pips, and the average spread for a major pair such as EUR/USD is 0.1 pips.

XM operates a strict “no hidden fees or commission” policy. As such, commission is only given for XM zero accounts. XM covers all transfer fees and same-day withdrawals are guaranteed.

Leverage

Depending on the instrument, the leverage can range from 2:1 to 30:1. This is completely flexible and XM offers its clients the chance to manage their own leverage risk. Margin requirements remain constant throughout the week and never widen at weekends or at night.

This leverage applies to clients registered under the EU regulated entity of the group.

XM mobile apps

XM is available on a number of android and apple devices, including apple iphone, apple ipad and android tablets and android phones. Login is super-easy and can be done via fingerprint. You can download their apps from the apple app store or the google play store.

They are both fully functional and allow for monitoring and trading on-the-go. The desktop platforms for PC and mac both support one-click trading.

XM global trading platforms

Payment methods

In line with conventional KYC regulations, users need to provide a colour copy of an official identification document such as a passport or a driver’s license. They also need to provide a recent utility bill dated within the last three months as proof of address.

Once registered, the minimum deposit amount is $5 for micro and standard accounts, while zero accounts require a minimum deposit of $100.

Deposits can be made using most major credit cards, electronic payment methods, wire transfer, local bank transfer and more.

Deposits can be made in any currency and it will be automatically converted into the currency you select as your base currency when opening the account.

All withdrawals are processed in 24 hours and there are no fees to take your money out of your ewallet.

Demo account

XM excels in its demo account offering. Users can set up a demo account with just a few details and then get trading with a virtual balance of $100,000USD. The XM demo account is unique in that it offers exactly the same trading conditions as the real thing.

There are no time limits on how long you can use your demo account.

Bonus deals and promotions

XM also offers a free VPS (virtual private server) service to help increase the speed of trades. This VPS is accessible from anywhere and available 24/7. They claim to eliminate downtime and are available across the globe.

XM are also offering commission and fee free withdrawals and deposits.

As an EU regulated brand, XM comply with the ESMA ban on bonuses, and the $30 deposit bonus is no longer available to EU traders.

Regulation and licensing

As noted above, XM group has a range of brands covered by different regulators.

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

Additional features

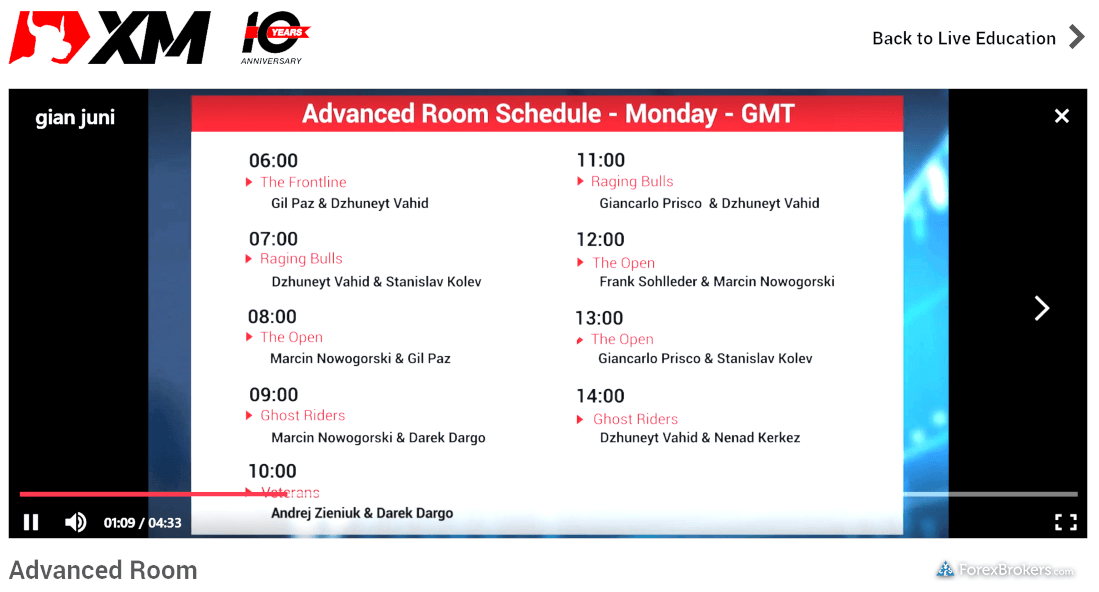

One of the biggest perks available on the XM platform is the wealth of training and educational materials available. The platform hosts regular webinars aimed at newcomers and seasoned professionals alike.

The platform is inherently social, encouraging users to learn from their team of instructors. The company also published research and technical analysis.

XM MT4 and MT5 forex trading

XM account types

There are four levels of trading account, micro, standard and zero. All accounts allow up to 200 open/pending positions per client.

- Micro accounts: micro accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and can get started with a minimum deposit of $5USD. 1 micro lot is 1,000 units of the base currency.

- Ultra low accounts: XM ultra low accounts, can use EUR, USD, GBP, AUD, ZAR, SGD as the base currency and traders will require a minimum deposit of $50 USD. 1 standard ultra lot is 100,000 units of the chosen base currency, whereas, 1 micro ultra lot is 1,000 units of the base currency. XM ultra low accounts are not applicable to all entities of the group.

- Standard: standard accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and traders can get started with just $5USD. 1 standard lot is 100,000 units of the chosen base currency.

- Zero accounts: zero accounts can use USD, JPY and EUR as the base currency and traders will require a minimum deposit of $10USD. Like the standard account, 1 standard lot is 100,000 units of the chosen base currency.

Benefits

XM offers a full-service education package on forex, ideal for those making their first steps into trading.

However, this isn’t at the expense of the more seasoned professional, who also have access to expert analysis and unparalleled tracking tools. As a company that prides itself on solid customer service, their users are well-served with support available in many different languages.

Drawbacks

While the support may be strong, some users dislike that customer support is only available monday to friday. Another disadvantage is the lack of diversity between the different account types makes for a less personalised feel.

Other brokers offer more a distinct offering in their accounts, but the micro, standard and zero accounts are almost identical. And finally, paypal deposits are not currently supported, which can be problematic for some.

Traders from certain regions are also forbidden to open an account due to licensing laws, these include canada and the united states.

Trading hours

In line with worldwide forex market hours, XM is available 24 hours a day. For phone trading, the XM trading hours are sunday 22:05 GMT through to friday at 21:50 GMT.

Contact details / customer support

The easiest way to contact XM is through their live chat feature found on the contact page of their website.

You can also email support on: support@xm.Com

Safety and security

There are no obvious security concerns with the website. Users are required to confirm their email address in order to open a demo account but signing up for email updates is not a requirement. In order to open a trading account, identification documents are required.

According to the company privacy policy, XM has organisational procedures in place to ensure that personal data is kept secure.

Overall verdict

XM offers a comprehensive broker service to traders of all levels. Whether you are just starting out and learning the ropes, or if you’re a seasoned trader looking for a reliable and efficient platform, XM is a solid choice.

Despite the shortcomings with the different account options, the platform is easy to use and simple to navigate.

Accepted countries

XM accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use XM from united states, canada, israel, iran, portugal, spain.

XM broker review

XM brokerage company was created as a coproduct of trading point financial instruments ltd., which has a reputation of one of the world's largest providers of internet trading services. Forex broker XM started its activity in 2009. The company was founded in cyprus, called initially xemarkets, but after rebranding its name was shortened to XM.

XM in 2020 is a significant and globally recognized investment company with a leading position in the industry. The broker has the knowledge and resources to allow traders with any experience and from any country in the world to implement their investment plans successfully. And by tracking the latest trends in the industry and incorporating the latest technologies into its operations, the company is continuously improving to meet the growing and more sophisticated needs of its clients.

The results of the company's work for ten years: 2 500 000+ clients; traders from 196 countries; support of 30+ languages; 25+ payment systems; 16 multifunctional trading platforms; 450+ specialists with rich experience in finance.

Regulation

The british regulation of the FCA (trading point of financial instruments UK limited) is the most powerful advantage of a broker. It means that the company's activity meets all the regulatory rules and regulations. A licensed broker is a reliable broker, and if he has a license from the most significant regulated body, the integrity of his work is beyond doubt.

Also, XM group is licensed by ASIC in australia (trading point of financial instruments pty limited) and cysec in cyprus (trading point of financial instruments ltd).

Feedback

One of the most important indicators of the broker's work is the feedback of traders who already have experience working with the platform and are ready to share it. Reading the feedback from XM clients, you realize that a broker tries to work for a client, always goes to a meeting, providing high-quality services and excellent service. Traders are happy to work with a broker and do not need to use other similar services, the reliability of most of which is in considerable doubt. They highly appreciate XM and leave a lot of positive feedback.

First of all, users are impressed by the principles on which the work of the broker XM is built. Excellent, attentive attitude to the client and his needs, quick problem solving, favourable conditions for profitable trading and all this is accompanied by the highest service.

Among the advantages of the service, clients note a modern multi-language interface, stable operation of the software, timely payments, fast registration and simple verification, a large number of instruments for trading, low spread, fast order execution, frequent bonuses, reliability, competent support service.

"I like this broker, and I have been working closely with him for a long time. Always payments are timely, and I am satisfied with them. You can count on it, and what else do you need?"

"thank you, XM for its quality service! One of the few companies that warn about trade risks."

"quite a good broker with excellent, just great execution. Of course, the spreads are a bit large, but due to the excellent execution of trades, this is not felt. The website has a great bonus program and loyalty program".

“positive broker, the main advantage of technical support of the client on the questions, timely, accurately, withdrawal of money on the day of the order on the conclusion that pleases, not everyone has it: traditional trading conditions, plus bonuses. I continue to trade with XM”.

As for negative reviews, of course, they also exist, but they are rare. The deal was cancelled, long waiting for withdrawal of funds, too secure password, etc.

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Advantages and disadvantages

International focus: 2.5 million clients from 196 countries;

Licensed and regulated broker: FCA (UK), ASIC (australia), cysec (cyprus);

Intuitive and straightforward interface, characterized by the smooth operation;

Multilingualism: customer service in more than 30 languages;

Seven asset classes: trading currencies in forex, stock indices, commodities, stocks, metals and energy;

Three types of accounts with different trading conditions, as well as the possibility to open a demo account;

The minimum deposit to open an account is $5;

100% order execution and 99.35% of transactions are opened within 1 second;

100% order execution and 99.35% of transactions will be unlocked within 1 second;

Fast implementation of orders on cent accounts;

Narrow spreads: from 0.6 pips for all trading accounts;

55+ popular currency pairs;

300+ cfds on shares, indices, commodities, metals, energy;

Zero commissions for input and output;

Personal account managers;

Free daily technical analysis of the forex market;

A huge amount of training materials, free webinars;

Issue of mastercard bank cards with your logo and the ability to withdraw funds to them without commission pay for goods and services on the internet;

Fast and qualified technical support;

Bonuses: welcome bonus (up to 5000$), a loyalty program.

Weak password protection for your account: you cannot use special characters when compiling a password;

Lack of two-factor authentication;

Not regulated by the central bank of russia;

No ECN-accounts (electronic communication network).

Forex xm

An impressive organisation putting their money into some big brand exposure activity, sponsoring the worlds fastest man, usain bolt. A lot of bonuses and competitions to take part in, making XM one of the highest recommended brokers on our list. Very friendly for new traders with an extensive education / learning section.

Sleek, modern appeal for the “new age” trader

I stumbled across XM forex trading by way of a banner advertising a million dollar forex trading competition. After visiting the website, I was impressed by the very modern feel, they look very much like a forex broker targeting the younger generation.

On their website they also proudly display their sponsorship of usain bolt which couldn’t have been cheap. I always take notice of companies that engage global superstars as brand ambassadors because the truth is, these types of relationships are very much controlled and dictated by the celebrity. A personality like usain bolt has a huge reputation to uphold, countless sponsorship offers and is a mega brand in itself so they would have taken great care in only selecting reputatble businesses to promote. Therefore, XM receives a big boost of credibility in my books.

Opening my account

Very straight forward. Enter details, confirm an e-mail, login and I was requested to upload ID documents through their website. All went smoothly. Within 24 hours, I had a call from my account manager who introduced herself and let me know that I can get in touch with her at any time for assistance. Within another 24 hours, my documents were all verified and I was ready to go.

The million dollar competition

In truth, I signed up so that I could take part in the million dollar trading challenge. Of course I must open an account at many brokers so that I can report here for this website.

The competition details can be found at www.Xm.Com/forex-world-championship/overview but in short, there are 10 rounds of play, each round lasting a calendar month. You start with $10,000 virtual currency and try to make it into the top 5. There are cash prizes for finishing in the top placings each month and the top 5 places gain entry into the semi finals. The winner of the grand final wins a cool $150,000. Not bad for a free game based on skill as well.

Newbie friendly

XM have done everything so well to attract what I would call “new age” traders (people in their 20’s, disposable income, looking for a challenging investment) and ensure that the biggest hurdle for any new trader, education, is covered from top to bottom. The market is tough to grasp so a lot of people need some guidance in understanding all those terms, the charts, the patterns, etc. Sure you can have random fun with a $100,000 demo account but at the end of the day, discplined trading follows a strategy and without anything to learn from, it makes it difficult to want to jump in to real money trading.

Traders of any level should feel extremely comfortable working through the extensive education section at XM.

Key benefits of trading with XM

- Real-time market execution with no re-quotes and no rejection of orders

- 16 MT4- and MT5-based platforms for seamless trading operations

- The same fair trading conditions for every client

- Personal account managers in over 30 languages

- Free trading signals in over 25 languages

- Free live webinars in over 16 languages

- Daily technical analysis and market reviews in multiple languages

- Regular on-site seminars in various countries in the world

All XM bonuses and promotions are subject to terms and conditions, including different bonus amounts and limited availability in some countries. Please check the eligibility rules on the website for more information.

| Deposit | bonus amount | bonus code |

|---|---|---|

| $0 | $30 | none required |

| up to $1000 | up to $500 | none required |

| up to $23,500 | up to $5000 | none required |

$30* no deposit bonus

Open a new account with XM and receive $30 or the equivalent in your chosen currency without making a deposit. The money is automatically credited to your account. The bonus can’t be withdrawn but any profits you make can be withdrawn. An excellent way to get started trading real money without having to put up your own. Highly recommended.

Up to $5,000* in deposit bonuses

You can receive up to $5,000 (or your currency equivalent) in additional bonus funds through a 2 tier deposit bonus system. You will receive a 50% bonus on your deposit up to a maximum of $500, then 20% on any amount over to make up to another $4,500 in bonuses. In other words, if you deposited $5,000 you would receive:

- 50% bonus on your first $1,000 which would give you $500 bonus funds and reach the limit of the first tier

- 20% bonus on your remaining $4,000 which would give you $800 bonus funds

- Your total account balance therefore would be $6,300 (your $5,000 deposit + $500 bonus + $800 bonus)

So this means to receive the maximum $5,000 bonus you would need to deposit $23,500 which is broken down as follows:

- The first $1,000 gives you a 50% bonus which is $500

- The remaining $22,500 gives you a 20% bonus which is $4,500

- Together, the bonus amount is $5,000 on your deposit of $23,500

Our opinion is that this is the best value bonus available right now from the reputable brokers.

Loyalty reward points

You can earn loyalty points through every trade and convert them to bonus funds. Points can be earned from even the smallest micro lot transactions so this is a great way to build up additional credit as you trade.

This ensures that as a client of XM you are consistently rewarded for trading, regardless of whether you are winning or not.

XM regulation & licenses

Where is XM regulated?

XM is authorised and regulated in 3 countries: australia (ASIC), cyprus (cysec) and the united kingdon (FCA).

You can view the licenses: ASIC, FCA, cysec

With australia and the UK both having very strong reputations as stable, first world countries, you can be assured that your dealings with XM are safe and secure.

Furthermore, XM is registered in 10 european countries including germany, spain, italy and france.

Our opinion is that XM is undoubtedly one of the leading forex brokers in the global market.

Minimum & maximum deposits / withdrawals

XM deposits summary table

| deposit method | minimum | maximum | fees |

|---|---|---|---|

| credit card, neteller, skrill | 5 USD | varies by method | XM |

| bank wire | 200 USD | varies by bank | sender pays bank wire fee |

XM minimum deposit

The minimum deposit at XM is 5 USD or the equivalent in any other currency when depositing via credit card or electronic payment (neteller or skrill). All fees are covered by XM. If you are depositing by bank wire, the minimum is 200 USD or the equivalent in any other currency. Fees in this case are only covered on the receiver’s side. You will have to pay whatever your bank charges you for a wire transfer.

XM maximum deposit

The maximum deposit at XM will generally be limited by your deposit source. Bank transfers are the best option if you wish to deposit a large sum of money for your trading account.

Please note that deposits can only be made from account in the same name as your trading account.

Paypal does not appear to be an option for depositing at XM.

XM withdrawals summary table

| withdrawal method | minimum | maximum | fees |

|---|---|---|---|

| credit card, neteller, skrill | 5 USD | varies by method | XM |

| bank wire | 200 USD | varies by bank | XM pays bank wire fee |

XM withdrawals

The minimum withdrawal methods and amounts are exactly the same as deposits. Once again, XM cover fees and do not charge any fees for withdrawals. This is why we believe that XM are one of the best forex brokers.

XM bad reviews

Is XM a scam?

Our verdict is NO. We found that XM representitives were very prompt in replying to all claims made through popular online forex forums. The result of most cases involved customer fraud – people opening multiple accounts, claiming multiple bonuses or not understanding the terms and conditions of trading. We also saw some cases where XM appeared to be at fault, but they were all resolved properly by XM.

We are satisfied that XM handles complaints efficiently. There are no obligations for any forex broker to participate in 3rd party forums but XM make an effort to be available and that’s a very big positive.

What is trust score?

This is a rating out of 100 which we calculate for each broker based on a combination of factors, all of which you will find below on the scorecard.

Every broker starts with a base score of 100 and we subtract points according to what criteria they match in each category.

Whilst trust score provides a good insight into the broker’s reputation, our overall rankings are based off our own thorough reviews plus the user reviews. Therefore, brokers with a high trust score aren’t always guaranteed to be ranked at the top.

XM scorecard – 99 / 100

Major sponsorships: the fastest man on the planet, usain bolt is sponsored by XM. This provides a large credibility boost for this broker as usain bolt would only be associating himself with brands that can further enhance his reputation.

Forex xm

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM group review

While XM group struggles to stack up against industry leaders, in terms of its platform offering, range of markets, and pricing, XM group provides an outstanding offering of quality educational content and market research.

Top takeaways for 2021

Here are our top findings on XM group:

- Founded in 2009, XM group is regulated in two tier-1 jurisdictions and one tier-2 jurisdiction, making it a safe broker (average-risk) for trading forex and cfds.

- XM group is a best in class metatrader broker in 2021, that offers the complete metatrader suite, along with a few notable upgrades to enhance the experience, in addition to custom indicators. Besides social copy trading, where XM group finished best in class (7th place), XM group’s research offering is rich with depth and variety, challenging industry leaders such as IG and saxo bank.

- Pricing at XM group varies by account type. Overall, the broker is not a stand out for low-cost trading when compared to pricing leaders such as CMC markets and IG.

Overall summary

| feature | XM group |

|---|---|

| overall | 4 stars |

| trust score | 84 |

| offering of investments | 4 stars |

| commissions & fees | 4 stars |

| platforms & tools | 4 stars |

| research | 4.5 stars |

| mobile trading | 4 stars |

| education | 4.5 stars |

Is XM group safe?

XM group is considered averge-risk, with an overall trust score of 80 out of 99. XM group is not publicly-traded and does not operate a bank. XM group is authorised by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and one tier-3 regulator (low trust). XM group is authorised by the following tier-1 regulators: australian securities & investment commission (ASIC) and financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | XM group |

|---|---|

| year founded | 2009 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 2 |

| tier-2 licenses | 2 |

| tier-3 licenses | 1 |

| trust score | 84 |

Offering of investments

Through its various brands, XM offers traders a total of 1,230 cfds across multiple asset classes, including forex, along with 100 exchange-traded securities (non-cfds). The following table summarizes the different investment products available to XM group clients.

| Feature | XM group |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 57 |

| cfds - total offered | 1273 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Traders who need instant execution will appreciate no requotes or rejections with XM’s zero account, compared to market execution offered by other agency-only brokers. That said, XM group still trails the best forex brokers when it comes to its pricing for budget and active traders.

Account options: the commissions and fees at XM group depend on the type of account and which global entity you choose. There are three primary accounts. While the commission-free micro and standard accounts are expensive, the commission-based XM zero account is more competitive.

Spreads and commissions: in the commission-based XM zero account, average spreads on the EUR/USD stands at 0.1 pips (according to XM group website data), making the effective spread 0.8 pips after including the $7 per round-trip commission. The standard and micro accounts have average spreads of 1.6 to 1.7 pips for the same pair and are comparably less attractive options at XM group.

Execution method: XM group acts as the sole dealer (principal market-maker) in all trades it executes. This execution method allows XM group to provide execution for up to $50 million worth of currency at a time and permits up to 200 simultaneous open positions which is reasonable compared to peers.

Shares trading: forex and cfds aside, XM group provides a shares account that requires a $10,000 deposit and is for investors who want to trade shares directly (non-CFD) with no leverage. This account is not available at all the entities of the group.

Gallery

| Feature | XM group |

|---|---|

| minimum initial deposit | $5-100 |

| average spread EUR/USD - standard | 1.6 (aug 2020) |

| all-in cost EUR/USD - active | 0.8 (aug 2020) |

| active trader or VIP discounts | no |

Platforms and tools

Offering the full metatrader suite (MT4, MT5) with additional platform add-ons is a crucial distinction among the best metatrader brokers. XM group checks these boxes, offering the full MT suite alongside multiple proprietary indicators, such as the rivers indicator developed by its in-house staff.

Gallery

| Feature | XM group |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | yes |

| ctrader | no |

| duplitrade | no |

| zulutrade | no |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

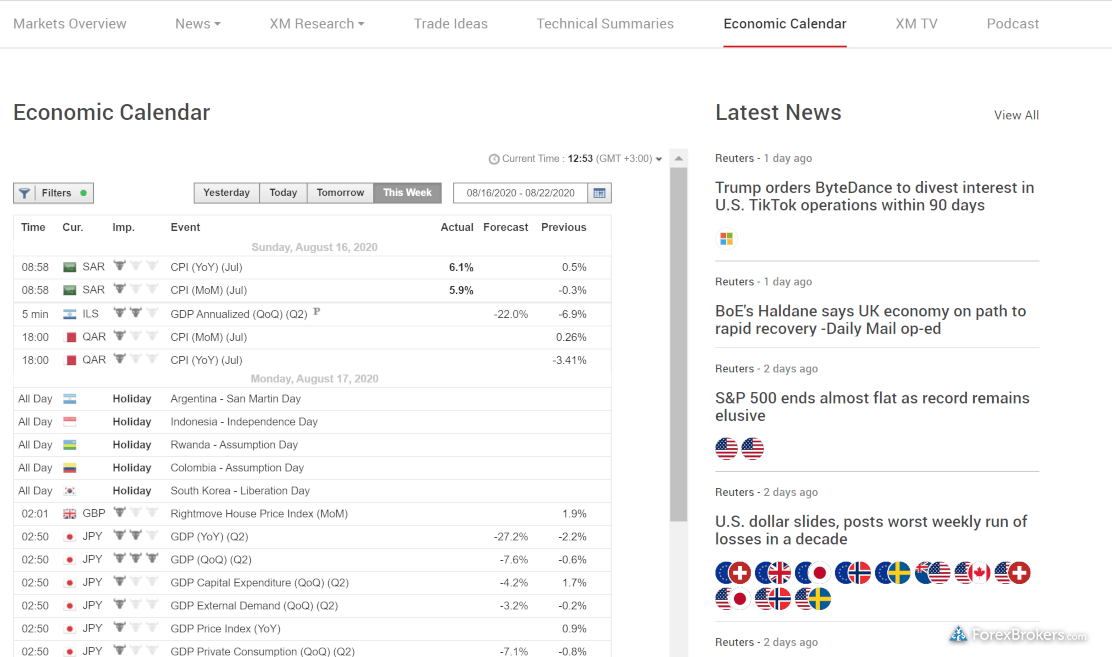

XM group’s XM TV is a winner, delivering excellent daily in-house market commentary that competes with industry leaders in video including IG, saxo bank, and CMC markets. And, while market research is found primarily outside of MT4, XM group offers a comprehensive and quality package that will satisfy most traders.

XM TV: XM group has done a great job creating daily forex news videos with market analysis explained in a TV interview-style format. The audio from these videos is also uploaded as a podcast to syndicate the content across media formats.

Articles: video aside, the news section on the XM group’s website allows filtering content by asset classes, making it easier to find articles about forex, indices, stocks, and cryptocurrencies. It is easy to appreciate the scope of research content with XM group, thanks to quality daily market recaps alongside technical and fundamental analysis articles.

Trading signals: XM group offers its trade ideas and technical summaries hub to live account holders, with signals streaming from autochartist and analyzzer. The broker also provides trading ideas (shares only) from trading central. In addition to the metatrader signals market, which allows automated trade copying, XM group supports social copy trading from compatible expert advisors developed by analyzzer.

Accessibility: given that the trading platforms are segmented away from the research, XM is at a slight disadvantage when compared to the best forex brokers for research. For comparison, saxo bank, IG, and CMC markets integrate research features into their platforms.

Gallery

| Feature | XM group |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

XM group offers a high quality, diverse selection of educational content. For example, the in-house video collection, tradepedia, is a great collection for beginners to reference. No question, XM group holds its own against education leaders such as FXCM, IG, and saxo bank.

Tradepedia: XM group offers tradepedia, an in-house video course that provides educational forex and CFD content. I found the series useful with 39 videos across seven chapters with good quality coverage for beginner and advanced video content.

For example, the course instructor demonstrates how to use some of the firm’s proprietary indicators, such as the avramis river indicator. The video had multiple examples to help users interpret this particular study in different market conditions.

Webinars: with 49 webinar instructors covering 19 languages throughout the week, XM group has extensive coverage of time-zones and a detailed schedule organized by experience level for traders to subscribe.

Articles: there are a series of 53 written articles that are organized in a progressive format across six chapters covering 13 lessons regarding forex, starting with basics, and ending with advanced subjects. Pros aside, XM group should consider adding CFD education for other asset classes to further enhance its educational coverage.

Gallery

| Feature | XM group |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | yes |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Mobile trading

Since XM group is a metatrader-only broker, the ios and android versions of the MT4 and MT5 mobile apps come standard and are both available for download from the apple itunes store and android play store, respectively. With no proprietary mobile app available, XM group trails the industry leaders in this category, such as IG, and saxo bank.

Gallery

| Feature | XM group |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | yes |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

As a vanilla metatrader broker, XM group offers over 1300 instruments, including 57 currency pairs, yet trails behind the best forex brokers who offer many thousands of tradeable symbols. Meanwhile, while XM group’s pricing on commission-based accounts is close to the industry average, its standard account spreads are expensive.

Drawbacks aside, XM group provides traders excellent research and education, making it a strong choice for beginners and traders who appreciate quality market research.

About XM group

XM group consists of multiple entities that use the XM brand and hold regulatory status in various jurisdictions. The group’s first entity was founded in 2009 in cyprus and is regulated by cysec (license 120/10) under the name trading point of financial instruments ltd.

In 2015, the group established an entity in sydney, australia, regulated by ASIC (license number 443670). In the united kingdom (UK), XM holds regulatory status in london through its FCA-regulated entity (license number 705428), under trading point of financial instruments UK ltd. Finally, in 2017 XM global limited obtained regulatory status in belize, where it is regulated by the IFSC (license number IFSC/60/354/TS/19).

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

XM review

XM review 2021

Latest detailed information about XM broker

XM group is a group of regulated online brokers. Trading point of financial instruments ltd was established in 2009 and it is regulated by the cyprus securities and exchange commission (cysec 120/10), trading point of financial instruments pty ltd was established in 2015 and it is regulated by the australian securities and investments commission (ASIC 443670) and XM global limited was established in 2017 with headquarters in belize and it is regulated by international financial services commission (IFSC/60/354/TS/19).

USA traders: not accepted

Regulation: the XM group is licensed by ASIC in australia (trading point of financial instruments pty limited) and by cysec in cyprus (trading point of financial instruments ltd), adhering to enhanced regulatory standards.

Note: previously known as tradingpoint and megatraderfx

Latest awards: best FX service provider for 2020 awarded by city of wealth management awards 2020, best FX service provider

Awarded by city of london wealth management awards 2019

Trade over 1000 instruments - forex, cfds on stock indices, commodities, stocks, metals and energies.

Get more than a forex and CFD trading account at XM

- Personal account managers

- Unlimited access to video tutorials

- Free daily technical analysis

- Free access to forex market research

- Daily access to forex trading signals

- Daily forex market outloo

- Free access to daily forex webinars

- 16 platforms to choose from. Any device, anywhere

- 24/5 hour live help

XM review: account types and trading conditions

Trading platforms: metatrader 4, metatrader 5, XM webtrader

Cryptocurrency trading: not available

Variable spread start from 0.1 pips plus $3.5 commission per standard lot traded (XM zero account)

Islamic swap free accounts: available upon request

Special features: ultrafast execution 99.35% of all trades executed in less than 1 second

XM group offers its clients 4 types of account: MICRO, STANDARD, ZERO and ULTRA LOW with low spreads. The MICRO account allows you to operate with micro lots, lower level of risk and it has minimum initial deposit of $5. The STANDARD account allows you to operate with standard lots and it has minimum initial deposit of $5. The XM ZERO account allows you to operate with standard lots, lower spreads starting at 0 pips and it has minimum initial deposit of $100. XM ZERO account has a $3.5 commission per $100,000 traded. Finally, the XM ULTRA LOW account allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50. *XM ultra low account is not applicable to all entities of the group.

XM review: platform, social trading and spreads

Trading platforms: MT4, MT5, XM webtrader

Built-in technical indicators: yes

Extensive back-testing options: yes

Advanced charting tools: yes

Account types: micro, standard, zero

Virtual private server VPS hosting: free for deposits of minimum $5,000

Maximum leverage is up to 1:888

Average spread starts from 1.7 pips

XM review: payment methods for funding and withdrawals

Minimum deposit requirement: $5

Payment methods: credit cards, wire transfer, skrill, neteller, webmoney, paysafe, ideal, sofort, qiwi, cashu, giropay, przelewy24, western union

ZERO FEES ON DEPOSITS & WITHDRAWALS

- All e-wallets 100% covered

- All major credit cards 100% covered

- Wire transfers above 200 USD covered

- Instant account funding

- No hidden fees or commissions

Learning material and latest promotions

Bonus and promotions

100% bonus UP TO $5,000 or currency equivalent

- Bonus is instant and automatic

- Trade to maximize your bonus amount

- Limited time offer

- Executive level entry to the XM loyalty program

XM LOYALTY PROGRAM

With so many rewards and incentives already, you might think that XM could not be any more generous, but you would be wrong. In addition to all other bonuses and rewards, a few times a year XM will offer special seasonal bonuses marking certain calendar events and occasions that will be available for very limited periods of time. In addition to this we will also offer highly exclusive bonuses that will be made available on an invitation only basis.

FREE VPS SERVICES make the most of your trades

- Eliminate downtime

- Ideal for eas

- Increase the speed of your trades

- Accessible from anywhere

- Online 24/7

Educational materials: seminars, webinars, unlimited access to video tutorials, market reviews, trading signals, daily technical analysis

Customer support: email, phone, online chat, personal account manager

Questions answers about XM

How long does it take to open a trading account with XM?

In case you fill out all details correctly, it takes less than 5 minutes.

What trading account types does XM have?

We offer the following trading account types:

MICRO: 1 micro lot is 1,000 units of the base currency

STANDARD: 1 standard lot is 100,000 units of the base currency

ZERO: 1 standard lot is 100,000 units of the base currency

What is the minimum deposit/withdrawal for a trading account?

It is $5 for MICRO and STANDARD accounts, while for ZERO accounts it is $100.

How long can I use a demo account?

At XM demo accounts do not have an expiry date, and so you can use them as long as you want. Demo accounts that have been inactive for longer than 90 days from the last login will be closed. However, you can open a new demo account at any time. Please note that maximum 5 active demo accounts are allowed.

What spreads does XM offer?

We offer variable spreads that can be as low as 0 pip. We have no re-quoting: our clients are given directly the market price that our system receives.

What leverage does XM have?

XM provides leverages between 1:1 – 888:1. This leverage applies to clients registered under XM global ltd. Leverage depends on the financial instrument traded.

Does XM allow hedging?

Yes, XM broker allows hedging. You are free to hedge your positions on your trading account. Hedging takes place when you open a LONG and a SHORT position on the same instrument simultaneously.

In which currencies can I deposit money into my trading account?

You can deposit money in any currency and it will be automatically converted into the base currency of your account, by XM prevailing inter-bank price.

What is the minimum and maximum amount that I can deposit/withdraw?

The minimum deposit/withdrawal amount is 5 USD (or equivalent denomination) for multiple payment methods supported in all countries. However, the amount varies according to the payment method you choose and your trading account validation status. You can read more details about the deposit and withdrawal process in the members area.

Is there an official european/international regulatory agency where XM company is listed?

Licensed and regulated by cysec (cyprus securities and exchange commission) under license number 120/10;

- Governed by mifid (markets in financial instruments directive);

- Operation according to the cypriot investment services and activities and regulated markets law of 2007 (law 144(I)/2007);

- Regulated by the australian securities and investments commission (ASIC 443670) and the international financial services commission (IFSC/60/354/TS/19)

Which are the supported features of XM?

Trading on FOREX, PRECIOUS METALS (including GOLD, SILVER), ENERGIES (including CRUDE OIL), and EQUITY INDICES is provided

- With a MINIMUM DEPOSIT as low as USD 5

- With the option to OPEN MORE THAN 1 ACCOUNT

- With NEGATIVE BALANCE protection

- NO RE-QUOTES, NO REJECTION OF ORDERS

- TIGHT SPREADS as low as 0 PIP

- FRACTIONAL PIP PRICING

- MULTIPLE TRADING PLATFORMS accessible from 1 account for speedy trading mobility

- REAL-TIME MARKET EXECUTION: 99.35 of orders executed in less than 1 sec.

- ACCOUNT FUNDING 100% automatic and instantly processed 24/7

- FAST WITHDRAWALS with NO EXTRA FEES

- ALL TRANSFER FEES COVERED BY XM

- FREE, UNLIMITED DEMO ACCOUNTS with USD 100,000 virtual funds and full access to MULTIPLE TRADING PLATFORMS

- Professional TRADING SIGNALS twice a day

How was the rating of XM performed compared to other brokers?

This 2021 forex broker review has been conducted though thorough research and assessment of rating and ranking among almost 300 international forex brokers. The final grade is given based on XM FX broker performance and features.

Overall our online XM review was conducted with the details obtained from the demo trading and the forex brokers website. If you would like to add details to this online XM or you find inaccurate details XM broker review please get in touch with us and the changes will be applied.

XM vs hotforex

Overview

If you want to be successful at forex trading, you need to choose a reliable broker. The trading industry is made up of lots of forex brokers who offer great services. You need to check reviews of different forex brokers before you plan to trade with any of them. Our comparative review of hotforex and XM will help you choose the forex broker best suited to you.

XM

Features

- XM group is owned by trading point of financial instruments – XM cyprus.

- The XM website operates in more than 190 countries, and is regulated by top-tier regulatory authorities, which include ASIC, cysec, and IFSC. More than 99.35% of the trades are executed within a second where you can confidently trade with XM.

- XM is one of the leading brokers offering an excellent platform to trade investment products ranging from forex, stocks, cfds and precious metals. Like other brokers. XM offers a demo account with the same trading conditions as a real trading platform so that users can familiarise themselves with the platform and practice trading.

- XM group is headquartered in cyprus, and since 2009, this broker has provided investment services in forex, commodities, indices, equity trading services. This broker is regulated by the financial conduct authority (FCA) in the UK, the cyprus securities and exchange commission (cysec), the australian securities and investment commission (ASIC), and the markets in financial instruments directive (mifid).

- The company is covered with an investor compensation fund of upto 20000 euros, that gives additional security to the clients funds.

- XM broker guarantees a deposit bonus of 50% for any deposit below $1,000.

- 75.55% of retail investor accounts lose money when trading cfds with XM. You should consider whether you can afford to take the high risk of losing your money.

XM group awards

- Best customer service experience – global – awarded by global business awards 2020

- Best FX service provider for 2020 – awarded by city of wealth management awards 2020

- Best customer service global 2019 – awarded by capital finance international magazine (CFI.Co)

- Best market research and education global 2019 – awarded by capital finance international magazine (CFI.Co)

- Best FX service provider – awarded by city of london wealth management awards 2019

- Best market research & education – awarded by capital finance international magazine (CFI.Co)

Hotforex

Features

- Hotforex is one of the leading forex and commodity brokers that has been providing trading services since 2010. It offers several services to its traders, like expert advisors, demo accounts, great customer service, etc.

- Hotforex offers security and guarantee by segregating the clients funds by offering negative balance protection and insurance through investor compensation funds.

- The hotforex website operates in different countries, and it is regulated by top-tier regulatory authorities like the cyprus securities and exchange commission(cysec), the markets in financials instruments directive (mifid) and the financial conduct authority(FCA).

- Hotforex offers a wide range of trading instruments which includes spot metals, forex currency pairs (EUR, USD)forex, cfds on commodities, penny stocks, indices, and some of the most popular shares like apple, facebook, and google on its website.

- Hotforex provides a wide choice of customizable solutions on its trading platforms for new, intermediate, and experienced traders. It also offers low spreads combined with scalping and hedging.

- The minimum amount to be deposited to start trading with hf markets is $5; a reasonable amount.

- 71.37% of retail investor accounts lose money when trading cfds with hotforex. You should consider whether you can afford to take the high risk of losing your money.

Awards

- Decade of excellence forex brokerage asia 2020 – awarded by global banking & finance review

- Most transparent broker – awarded by the european – global banking & finance review awards

- Best client services – global 2020 – awarded by capital finance international magazine (cfi. Co)

- Best partners program global 2020 – awarded by international investor awards 2020

- Excellence in customer service global 2020 – awarded by international investor awards 2020

- Most trusted forex broker – global – awarded by global forex awards

XM vs hotforex – pros and cons

| XM | hotforex | |

| pros | ||

| the account opening process is easy and fast | the minimum amount needed is $5 | |

| this broker charges low withdrawal and CFD fees | regulated by top-tier authorities | |

| it offers great educational and trading tools | customer service is great | |

| cons | ||

| it charges inactivity fees | this broker does not allow scalping | |

| for european clients, only forex and cfds are available | hotforex does not offer expert advisors | |

| forex fees are a bit high | ||

XM vs hotforex – features

| features | XM group | hotforex |

| about | established in 2009 | established in 2008 |

| headquartered in | cyprus | UK |

| regulated by | cyprus securities and exchange commission (cysec), the international financial services commission (IFSC), australian securities and investments commission (ASIC) | the financial conduct authority (FCA), mifid, and cysec |

| safety | provides negative balance protection, segregated client funds in major banks | provides negative balance protection, segregated client funds in major banks |

| copy-trading | N | Y |

| social trading | Y | Y |

| ECN broker | N | Y |

| STP broker | N | Y |

| one click trading | Y | N |

| expert advisors | Y | N |

| minimum deposit | $5 | $5 |

| maximum leverage | 1:500 | 1:100 |

| deposit and withdrawal fees | N | N |

| minimum lot size | 0.01 | 0.01 |

| platforms | ||

| metatrader 4 desktop | Y | Y |

| metatrader 5 desktop | Y | Y |

| MT4 web | Y | Y |

| MT5 web | Y | Y |

| mac platform | Y | N |

| mobile trading | ||

| ios | Y | Y |

| android | Y | Y |

| windows | Y | N |

| CFD | Y | Y |

| forex | Y | Y |

| alerts | Y | Y |

| charting and trading tools | Y | Y |

| account types | ||

| VIP account | N | N |

| standard account | Y | Y |

| zero spread account | Y | N |

| micro account | Y | N |

| demo account | Y | Y |

| islamic account | Y | Y |

| customer support | ||

| live chat | Y | Y |

| email support | Y | Y |

| phone support | Y | Y |

XM vs hotforex – leverage

- XM provides flexible leverage from 1:1 to 1:500.

- Hotforex maximum leverage is 1:1000. Some jurisdiction’s cap leverage ratios are lower, like in the USA, it is 1:50, and in poland, it is 1:100.

Risk warning – cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

XM vs hotforex – deposit and withdrawal methods

- XM group accepts payment options such as credit card and debit cards, skrill, neteller, bank wire transfer, etc. This broker covers deposit and withdrawal transfer fees that are used for payments made through moneybookers, neteller, and major credit cards. All withdrawals and deposits that are more than 200 USD are processed by a wire transfer.

- Hotforex has a wide choice of payment methods including credit cards, debit cards, american express, bank wire transfer, and e-wallet payment systems like neteller, skrill, webmoney, trustpay etc.

XM vs hotforex – trading platforms

XM trading platforms

- XM offers both metatrader 4 and metatrader 5. The metatrader 4 trading platform can be accessed from desktop, mobile, and web. It provides free virtual private server (VPS) hosting to existing and new customers with a minimum deposit of $5,000 and trading a minimum of 5 lots a month. Virtual private server hosting permits the traders to execute their trade orders 24hours and 5 days a week.

Hotforex trading platforms

- Hotforex provides a copy trading and social trading service known as hfcopy, which helps the traders to follow other traders and copy their trades. Free VPS hosting can be used by both existing and new customers with a deposit amount of $5,000; given that they maintain the same amount for the forthcoming months.

Comparison of fees

Both brokers don’t charge deposit or withdrawal fees. XM group does not charge commissions for ultra-low and standard account types, but the commission is charged for the shares account type. The traders will be charged based on lot size, and it also charges inactivity fees from the traders.

Hf markets do not charge a commission for accounts like hfcopy, pamm, micro, auto, and premium accounts. Zero spread accounts are charged commissions. For one lot size orders on USD currencies, it charges $3 as commission.

Comparison of education and research

- XM provides research tools like news, XM research, market overview, technical summaries, trade ideas, XM TV, economic calendar, podcast education, XM live, live education, forex webinars, platform tutorials, educational videos, and forex seminars.

Hotforex education

- Hf markets offer market analysis, market outlook, market news, economic calendar, live webinars, videos training courses and E-courses.

Comparison of risk management tools

XM risk management

| Features | XM | hotforex |

| stop losses | Y | Y |

| trailing stops | Y | Y |

| limit orders | Y | Y |

| one click trading | Y | Y |

| price alerts | Y | Y |

| signal trading | Y | Y |

Hotforex risk management

Comparison of spreads

| spreads | XM | hotforex |

| forex pairs | starts from 0 pip, depends upon the account type | starts from 0 pip |

| commodities | starts from 0 1 pips | starts from 4.31 pips |

| indices | starts from 0.6 pips | starts from 0.23 pip |

| precious metals (gold & silver) | starts from 0.3 pip | starts from 0.6 pips |

| energy | starts from 0.1pip | starts from 0.6 pip |

| bonds | not applicable | starts from 0.05 pip |

| cryptocurrency | not applicable | starts from 0 1 pips |

Comparison of assets

| assets offered | XM | hotforex |

| forex | Y | Y |

| commodities | Y | Y |

| stock cfds | Y | N |

| precious metals | Y | Y |

| equity indices | Y | Y |

| shares | Y | Y |

| energies | Y | Y |

| penny stocks | N | Y |

| cryptocurrencies | N | Y |

| bonds | N | Y |

XM vs hotforex – accounts

- XM provides three types of accounts to choose from; standard account, zero spread account and micro account. Commission-free trading and tighter spreads are offered on the micro account and standard account. Zero spread account provides tighter spreads that involve commissions and initial deposits. XM provides floating spreads and high leverage levels. Beginners can make use of a micro account with a minimum deposit of $5, and micro-lots can be used to trade on all accounts. It also provides a free islamic account that can be used by traders who are not interested in earning interest.

- Hotforex offers its clients several account types and currency pairs like EUR, USD to select from. The trader can select from floating and fixed spreads, commission-free trading in premium, micro, and fixed accounts, or they can choose tighter spreads that involve commission fees. New traders can sign up with a minimum amount of $5 with micro accounts, and micro-lots are available for trading on all accounts. Hotforex zero spread account is a low-cost trading solution that is suitable for all types of traders. Also, swap-free islamic accounts are available to certain traders with a minimum amount of $150; this can be used by clients who would not like to earn interest because of religious reasons.

XM vs hotforex – promotions and bonus

XM

- 15% – welcome bonus up to $500

- XM loyalty program

- Refer a friend

- Free VPS services

Hotforex

- You can earn daily cash rebates of USD 2 per lot directly to your trading account

- Applies to every deposit of USD 250 or more

- Leverage of underlying account prevails

- Maximum cumulative rebates of USD 8,000

- Automatically triggered and calculated

- Cash available for trading or withdrawal

Wrap up

XM is an award-winning broker that offers a wide choice of account types, trading products, and great trading platforms. On the other hand, hotforex is the more reliable broker that offers a great range of services to its traders. XM group provides the lowest price on more popular forex instruments like EUR USD.

FAQ’s

1) what is the minimum deposit for XM group?

Ans: when you register on XM, the minimum amount required is $5 for standard and micro-accounts, while $100 is the minimum amount for zero accounts. Deposits can be made through major credit card and debit cards, wire transfers, electronic payment methods, bank transfers, and several more.

2) how are hotforex and XM regulated?

Ans: the XM group is regulated by cysec, IFSC, and ASIC, and hotforex is regulated by FCA, mifid, and cysec.

3) what are the instruments offered by XM and hotforex?

Ans: both XM group and hotforex have popular forex currency pairs like the EUR USD for trade. XM group offers 55 currency pairs. If you want to trade cryptocurrencies, hotforex has several cryptocurrency cfds, which include bitcoin, ripple, and ethereum. If you want to trade commodities such as silver, gold, or oil, XM group is the way to go. Hotforex does not offer commodity trading.

4) do XM and hotforex offer metatrader and copy trading?

Ans: both brokers offer copy trading as well as the metatrader platform to their traders.

Investment advice

Take your time when looking for a forex broker because a bad decision can be costly. 9 out of 10 retail investor accounts lose money within the first two years because they lack structure. Good forex brokers help their clients create a trading plan that can provide that structure. Top brokers will offer robust resources, low trading costs, and access to the worldwide interbank system. They’ll also handle your money with care, even if you open a small account in the hopes of turning it into a small fortune through your trading skills.

Risk warning

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

So, let's see, what we have: members area access use your MT4/MT5 real account number and password to log in to the members area. New to XM? © 2021 XM is a trading name of trading point holdings ltd. All rights at forex xm

Contents of the article

- Actual forex bonuses

- Members area access

- New to XM?

- XM review and tutorial 2021

- Company details

- XM trading platform

- Assets / markets

- Spreads & commission

- Leverage

- XM mobile apps

- Payment methods

- Demo account

- Bonus deals and promotions

- Regulation and licensing

- Additional features

- XM account types

- Benefits

- Drawbacks

- Trading hours

- Contact details / customer support

- Safety and security

- Overall verdict

- Accepted countries

- XM broker review

- Regulation

- Feedback

- Advantages and disadvantages

- Forex xm

- Sleek, modern appeal for the “new age”...

- Opening my account

- The million dollar competition

- Newbie friendly

- Key benefits of trading with XM

- $30* no deposit bonus

- Up to $5,000* in deposit bonuses

- Loyalty reward points

- XM regulation & licenses

- Where is XM regulated?

- Minimum & maximum deposits / withdrawals

- XM deposits summary table

- XM minimum deposit

- XM maximum deposit

- XM withdrawals summary table

- XM withdrawals

- XM bad reviews

- Is XM a scam?

- What is trust score?

- XM scorecard – 99 / 100

- Forex xm

- XM group review

- Top takeaways for 2021

- Overall summary

- Is XM group safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About XM group

- 2021 review methodology

- Forex risk disclaimer

- XM review

- XM review 2021

- Latest detailed information about XM broker

- Get more than a forex and CFD trading account at...

- XM review: account types and trading conditions

- XM review: platform, social trading and spreads

- XM review: payment methods for funding and...

- Learning material and latest promotions

- Questions answers about XM

- How long does it take to open a trading account...

- What trading account types does XM have?

- What is the minimum deposit/withdrawal for a...

- How long can I use a demo account?

- What spreads does XM offer?

- What leverage does XM have?

- Does XM allow hedging?

- In which currencies can I deposit money into my...

- What is the minimum and maximum amount that I can...

- Is there an official european/international...

- Which are the supported features of XM?

- How was the rating of XM performed compared to...

- XM vs hotforex

- Overview

- XM vs hotforex – pros and cons

- XM vs hotforex – features

- XM vs hotforex – leverage

- XM vs hotforex – deposit and withdrawal...

- XM vs hotforex – trading...

- Comparison of fees

- Comparison of education and research

- Comparison of risk management tools

- Comparison of spreads

- Comparison of assets

- XM vs hotforex – accounts

- XM vs hotforex – promotions and...

- Wrap up

- FAQ’s

- Investment advice

- Risk warning

No comments:

Post a Comment