Online trading for free

Ultimately, choosing the best commission-free trading platform will come down to your preferences.

Actual forex bonuses

That said, there are a few things you should look for before selecting the best platform for you. Essentially, acorns rounds up your everyday purchases to the nearest dollar. Then, they take that change and invest it when it adds up to at least $5 from your linked accounts.

Want to trade commission-free? Here are best online brokers for commission free trading in 2021

Modified date: december 28, 2020

The fact that you can now trade stocks without paying commissions removes one of the barriers to stock trading for those without a ton of money to invest.

Traditionally, you had to pay anywhere from $4.95 and up for each stock trade you make. Firms relied on these fees as a significant part of their revenue. Needless to say, I was very surprised when a few major platforms announced, all within just a few days, that they would no longer charge fees to trade stocks on their platform.

Now, you have a large number of options to trade stocks and other securities commission-free. Even so, each trading platform has different benefits and drawbacks. To help you find the best commission-free trading platform for you, I put together this list. Here’s what you need to know.

Best commission-free trading platforms overview

Robinhood

While robinhood is well known for starting the commission-free trade movement, they also want you to learn about investing, as well. Their website has an in-depth learn section to help you learn about investing basics, the markets, and trading lingo. These resources can help you figure out how to get started investing. They offer tools to help you manage your portfolio, too.

While robinhood’s main service is free, you can upgrade to robinhood gold starting at $5 per month. This gives you the ability to trade on margin, make larger instant deposits, and the ability to access professional research reports. This is more than the average investor likely needs, but it’s nice to have as an option if you’d like to take advantage of these services.

Advertiser disclosure – this advertisement contains information and materials provided by robinhood financial LLC and its affiliates (“robinhood”) and moneyunder30, a third party not affiliated with robinhood. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Securities offered through robinhood financial LLC and robinhood securities LLC, which are members of FINRA and SIPC. Moneyunder30 is not a member of FINRA or SIPC.”

Public

The idea behind the app is you can buy slices of stocks and etfs rather than having to pay the full share price. At the same time, you can connect with the investing community within the app. Public allows you to share your own insights and follow other investors that do the same. You can even start group chats.

The app also includes a feature called themes. This allows you to discover new companies that share unique themes such as female-led companies in the S&P 500. Public has built-in safeguards for risky stocks and they don’t allow day trading, margin loans or complex investment instruments. You can even earn free stock by referring your friends to public.

M1 finance

You can invest in stocks and etfs. M1 finance even allows you to purchase fractional shares which can be great if you’re just getting started and don’t have a lot of money to invest.

Your first deposit will be invested based on the portfolio percentages you set up. Future investments will be used to make purchases to bring your total balances back in line with that portfolio.

M1 finance doesn’t charge any trading commissions or management fees, but underlying investments may charge fees.

If you want access to two daily trading windows, a lower rate on the offered flexible line of credit and checking accounts that pay APY and cash back, you’ll have to pay a $125 annual fee to upgrade to M1 plus.

E*TRADE

E*TRADE focuses their business on active traders rather than passive investors that prefer index funds.

They have an easy-to-use platform and tools, a dedicated trader service team, as well as a vast database of educational resources.

Acorns

The acorns app gives you a unique way to invest that most other trading platforms don’t allow. Acorns allows you to start investing through micro-investing.

Essentially, acorns rounds up your everyday purchases to the nearest dollar. Then, they take that change and invest it when it adds up to at least $5 from your linked accounts.

Acorns does charge a monthly fee that ranges from $1 to $3 depending on the services you want access to.

TD ameritrade

TD ameritrade was founded in 1975 and was rated as the best online broker for 2018 in kiplinger’s personal finance best online brokers review. Currently, TD ameritrade has reached a definitive agreement to be acquired by charles schwab.

TD ameritrade offers commission-free trades on most US exchange-listed stocks and etfs. There is a $0.65 fee per contract for options trades.

TD ameritrade offers a robust trading platform, free research and good customer support to back up their service. I’ll be interested to see what changes after TD ameritrade gets acquired.

Vanguard

Vanguard charges for stock trades depending on the amoun of assets you hold with the company. Those with over $1,000,000 in assets do get some free trades, but those with fewer assets at vanguard get charged anywhere from $2 to $20 per trade for online trades.

Vanguard offers commission-free ETF trades for over 1,800 etfs as long as you trade online. There is a fee if you trade etfs over the phone.

Similarly, all vanguard mutual funds have no transaction fees and over 3,000 non-vanguard mutual funds can be traded for free online. Fees do apply for phone purchases and certain other transactions.

Summary of the best commission-free trading platforms

How I came up with this list

I examined the market and selected a variety of commission-free trading platforms that would appeal to different audiences.

I looked at the firm’s history, its unique features, the minimum account opening requirements, the types of investments available to account holders to invest in, as well as any other costs associated with the platforms.

What may be the best trading platform for one person may not be a good fit for someone else, so I focused on finding a variety of platform options based on differing needs.

How to choose the best commission-free trading platform for you

Ultimately, choosing the best commission-free trading platform will come down to your preferences. That said, there are a few things you should look for before selecting the best platform for you.

Figure out how much you can invest

First, figure out how much money you have available to start investing. Next, decide what you want to invest that money in.

Based on these two answers, you can start narrowing down your options. Eliminate options that don’t allow you to start investing in your chosen investment with the amount of money you have available.

Since some platforms have no or extremely low account opening minimums, you should be able to find an option for you.

Pick the right account type for you

Once you’ve narrowed down your options, make sure you can open the account type you want to invest in. For most people, this is an IRA, roth IRA, or traditional taxable brokerage account. These account types are fairly common at most platforms.

However, those that need specialized accounts such as SEP iras, solo 401(k)s or others may have limited options for the best platform for them.

Make sure to watch out for any other fees the platforms may charge. If they have a monthly fee or additional non-trading fees that eat away at your returns, they may not be the best fit for you for the long-term.

Once your balance has grown, you may want to consider moving to a different platform if it better meets your needs.

Should you invest with a commission-free trading platform?

The investing industry is quickly moving to a mostly commission-free trading environment. This is good for consumers because it cuts investing costs and makes investing more accessible to the general public.

Even so, trading commission-free can have some downsides. Trading commissions provided a barrier to discourage frequent trading. Without this barrier, it may be tempting to trade stocks more often.

The more you trade, the more chances you have to make mistakes. If no commissions on trades make you tempted to trade more often, it may not be a good fit for you.

Additionally, these platforms that used to make money on trade fees still have to turn a profit. While you aren’t paying fees on trades anymore, watch out for other fees or costs that could end up costing you more over the long run.

These may not appear for all types of investments, but it’s always smart to watch out for increasing costs.

If you’re a disciplined investor, commission-free trades could save you a few bucks here and there. If there are no additional costs elsewhere, you might as well take advantage of the cost savings.

Are there disadvantages to free stock trades?

While free stock trades sound great, they may cause issues for some people. In the past, the stock trade fee made many investors carefully consider their trades. With no stock trade fees, you can trade as much or as little as you’d like.

What should I look out for at commission-free brokerages?

Whenever you get something for free, you should carefully consider why you’re getting it for free. Chances are, there are fees (however small) for some things you may eventually have to do.

I’ve always heard the saying there is no such thing as a free lunch and this includes commission-free trading platforms.

Summary

Commission-free trading platforms can be a great option for active traders to save money on their trading commissions. If you’re currently paying for stock, ETF, or mutual fund trades, consider switching to one of our best commission-free trading platforms listed above.

Just remember, free trading doesn’t mean you should trade more often. While some active traders are successful, you may be better off sticking with long term index investing. Make sure to consider all of your investment options and consult an investment professional if you need help deciding what you should invest in.

Online stock trading 101: A beginner's guide

Learn the ropes if you're a newbie to online trading

:strip_icc()/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

Image by hilary allison © the balance 2020

It's important to educate yourself before you consider any type of investment or investment strategy. This beginner's guide to online stock trading will give you a starting point and walk you through the basics so you can feel confident in assessing your options, picking a brokerage, and placing a trade.

Choose an online broker

If you haven't already opened a brokerage account with a respected online stock brokerage, do it now. Take your time researching so you can feel confident you are choosing the best online stock broker for your situation. As you research, consider factors like whether there are trading commission fees (many brokerages offer free trading), how intuitive the app or website is, and any research or educational tools available for customers.

Choosing the best brokerage ultimately comes down to personal preference, and traders have a lot of options. Established giants like fidelity and charles schwab have channeled their decades of expertise into both online and app-based trading tools. There are also newcomers that specialize in perfecting the user experience of their apps, such as robinhood, webull, and sofi.

Research stocks to trade

Once you have a brokerage, you can buy stocks, but what stocks should you buy? If you're brand new to trading, the best place to start may not be with stocks, but with exchange-traded funds (etfs). Etfs allow investors to buy a bundle of stocks at once—which can help if you don't feel confident choosing one company over another. Etfs built to replicate major indices like the dow, nasdaq, and S&P 500 are good places to start to give your portfolio broad exposure to the U.S. Stock market. Many traders also diversify their holdings with assets other than stocks, such as bonds, as a way of hedging their risk during stock market downturns.

If you decide to invest in individual stocks, make sure to use some financial analysis ratios to compare a company's performance to its competitors. Successfully choosing individual stocks is difficult, but extensive comparative analysis can help ensure you're adding the best stocks to your portfolio.

Decide what kind of trade is right for you

When you want to buy (or sell) a stock, ETF, or any other traded asset, you have options for the type of trade order you want to place. The two most basic types are market orders and limit orders. Market orders execute immediately for the best price available at that moment. Limit orders won't necessarily execute right away, but they give you greater control over the price you pay (or receive, when selling). Once you own a stock, you might consider placing a trailing stop loss sell order, which allows you to continue riding positive momentum and automatically sell when the trade starts to turn on you.

No order type is necessarily better than another. They all have their place, and by learning as many of them as possible, you ensure you're using the right tool for your scenario.

Know what it'll cost you to trade stocks

One of the biggest enemies of successful stock trading is expenses. They represent money you pay just to own or trade securities. One type of expense is a commission fee, which you should consider while shopping around for brokerages.

If you're buying individual stocks through a brokerage that doesn't charge commission fees, you might not incur any expenses. However, when you start trading etfs, mutual funds, and other types of investments, then you need to understand expense ratios. These funds are managed by a person who is paid a percentage of the fund's assets every year. So, if an ETF has an expense ratio of 0.1%, that means that you will pay $0.10 per year in expenses for every $100 you invest in the ETF.

Aside from expenses, you also need to consider your risk tolerance. A common risk assessment method involves considering a hypothetical scenario in which your investments suddenly lose 50% of their value. Would you buy more after the crash, do nothing, or sell? If you would buy more, you have an aggressive risk tolerance, and you can afford to take more risks. If you would sell, you have a conservative risk tolerance, and you should seek out relatively safe investments.

Understanding how you would emotionally react to losses is one thing, and understanding how much you can lose without sacrificing financial stability is another. You may have an aggressive risk tolerance, but if you don't have an emergency fund to fall back on in case of sudden job loss, then you shouldn't use your limited funds to invest in risky stocks.

Understand how trading stocks affects your tax bill

Along with expenses, it's important to understand the tax rules for each of your positions, especially if you're going to actively trade stocks. The taxes you pay on stock profits are known as capital gains taxes. In general, you pay more capital gains taxes when you hold a stock for less than a year, and you pay less when you hold a stock for more than a year. This tax structure is designed to encourage long-term investing.

While selling stocks for a profit will increase your tax bill, selling stocks for a loss will decrease your tax bill. To prevent people from taking advantage of these tax benefits, there's something known as the "wash sale rule." essentially, this rule delays the tax implications of any profits or losses if you re-enter the same position within 30 days. in other words, if you sell a stock for a loss, and then buy the same stock a week later, your loss will no longer give you tax benefits—it's carried over into your new position. The loss will be accounted for once you sell the stock again.

If minimizing your tax bill is a primary concern, consider investing in a retirement account like a roth IRA or 401(k) plan instead of using a standard brokerage account.

Online trading courses

Develop the skills of trading – from first steps to advanced strategies – with our interactive courses. Learn at your own pace, checking your understanding with practical exercises and quizzes.

Introducing the financial markets

Take a tour of the financial markets. Discover how they operate, what drives them and how you can capitalise on their movements.

How does trading work?

Find out about the people and organisations who make the trading world tick, and discover the mechanisms behind market prices.

Orders, execution and leverage

Get an understanding of the steps involved in placing a trade, including how to protect yourself against risk and use leverage wisely.

Planning and risk management

Learn how to create a plan that will help you achieve your trading goals, and discover tools you can use to manage risk.

The basics of technical analysis

Discover how to find potential trading opportunities by analysing market patterns or trends using technical indicators.

Trading psychology

Prepare yourself to handle the emotions you’ll experience while trading. Learn to keep a cool head and avoid common mistakes.

Fundamental analysis

Learn how to identify stocks with potential by analysing economic factors and scrutinising company details.

Understanding risk and reward

Discover five simple rules to help you manage risk and maximise the long-term profitability of your trading.

Prefer to learn at a live session?

Join one of our free webinars or in-person seminars to get personal guidance from our experts and classroom-style trading education on a wide range of topics.

The risks of loss from investing in cfds can be substantial and the value of your investments may fluctuate. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

CFD accounts provided by IG international limited. IG international limited is licenced to conduct investment business and digital asset business by the bermuda monetary authority and is registered in bermuda under no. 54814.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG international limited is part of the IG group and its ultimate parent company is IG group holdings plc. IG international limited receives services from other members of the IG group including IG markets limited.

Free stock trading courses online

Learn stock trading with the free stock trading tutorials and online courses.

Subjects

Certification

Level

Ratings

Duration

Stock trading: intelligent investing in stocks on the stock market

Start making money by investing in the stock market! Learn the intelligent ways of investing in stock trading with this online course. Get started today!

Strongest reversal candlestick patterns - forex trading / stock trading

This is a mastery course for both the beginner and advanced - FOREX and stock market traders, who wants to increase their potentiality by analyzing the reversal candlestick patterns in price action chart to earn consistent profit from their trades.

Stock trading with candlestick patterns | technical analysis

Learn how to use over 20+ candlestick patterns to perform technical analysis, and to predict the future price movement of stocks.

Stock trading & investing | beginners masterclass

This is your guide to the world of technical stock trading, as you learn how to strategically trade stocks (and other assets) using technical analysis & candlestick charts!

Investment and technical analysis methods on stock markets

In this online course, you will learn to become a better investor, stock picker, portfolio manager, analyst and many more. Enroll now to learn method on stock market

Stock trading strategies : technical analysis masterclass 2

31 analysed stock trading strategies for day / swing trading options trading & forex by technical analysis + ASSIGNMENTS

Trading in a futures market - revised

This course covers futures trading. This course explains in simple terms trading concepts such as contango, backwardation and how to analyse future curves.

Stocks and short selling revised course - an introduction

Learn more about how stocks and shares are valued and how to borrow stocks that you do not own and buy it back at a later time, ideally at a lower price.

Learn how to do online trading: online trading for beginners

Wish to know how to do online trading? Follow this online trading for beginners course to learn online trading concepts & how to do online trading.

Free financial trading tutorial - introduzione al trading online

Le basi dell'analisi tecnica nel trading online - free course

Details about free stock trading certification and courses

Want to learn stock trading ? This is the list of free stock trading courses available online. From this list, you can take any of the stock trading course to learn stock trading in details and become master of stock trading.

Learn stock trading from the free stock trading courses and free stock trading certifications online. Select free courses for stock trading based on your skill level either beginner or expert. These are the free stock trading certification and courses to learn stock trading step by step.

Collection of free stock trading courses

These free stock trading courses are collected from moocs and online education providers such as udemy, coursera, edx, skillshare, udacity, bitdegree, eduonix, quickstart, youtube and more. Find the free stock trading tutorials courses and get free training and practical knowledge of stock trading.

Get started with stock trading for free and learn fast from the scratch as a beginner. Find free stock trading certifications for beginners that may include projects, practice exercises, quizzes and tests, video lectures, examples, certificate and advanced your stock trading level. Some courses provide free certificate on course completion.

Stock trading courses are categorized in the free, discount offers, free trials based on their availability on their original platforms like udemy, coursera, edx, udacity, skillshare, eduonix, quickstart, youtube and others moocs providers. The stock trading courses list are updated at regular interval to maintain latest status.

After collecting courses and certification from different moocs and education providers, we filter them based on its pricing, subject type, certification and categorize them in the relevant subject or programming language or framework so you do not have to waste time in finding the right course and start learning instead.

Suggest more stock trading courses or certifications ?

Do you think any stock trading certification or stock trading course need to include on this list? Please submit new stock trading certification and share your stock trading course with other community members now.

Online trading

Buy and sell securities using a wealth of research and advanced tools on our intuitive trading website.

Why trade online with fidelity

- Competitive online commission rates

- Free, independent research from 20+ providers

- Margin, short selling, and options trading tools

Features & benefits

Advanced tools and services

Accounts with online trading

Features & benefits

Pay $0 commission for online U.S. Stock, ETF and options trades, plus $0.65 per contract for option trades.

Get an overview of what’s happening right now in specific markets and sectors, and read news and analysis to help you understand the short- and long-term impact.

Dig into the details with research reports on 4,500+ stocks from more than 20 independent, third-party research firms.

Evaluate your investing ideas using the accuracy-weighted equity summary score provided by starmine.

Take advantage of stock screen strategies from independent third-party experts to research stocks, etfs, and options, or create your own screens using over 140 custom filters.

Create real-time watch lists to track stocks that interest you.

Set alerts to receive balance updates, trade notifications, market news, or stock research messages via email and our mobile apps.

Track real-time profit and loss information on every trade.

Advanced tools and services

Set trailing stops and conditional orders ahead of time to help manage risk and maximize profits.

Monitor, trade, and manage up to 50 stocks as a single entity using basket trading.

Explore advanced account features including margin, short selling, and options trading.

Qualified customers can take advantage of our active trading software to get streaming quotes, directed trading, and more.

Invest in multiple bonds with staggered maturities to help provide a consistent income stream and hedge against interest rate risk.

Compare bonds by coupon rates, yields, call dates, and ratings.

Using up to 10 years of daily historical data, test strategies before you invest. Save strategies and manage trade alerts.

Accounts with online trading

Explore the details of this full-featured brokerage account, consistently rated among the best in the industry.

Pay no taxes on your gains within an IRA until you take withdrawals.

View all of your brokerage account choices including trusts, the fidelity account for businesses, custodial accounts, and more.

Next step

Questions?

Get our free mobile app

Keep up with the changing markets, research, trade, & more, wherever you are.

Research investments

$0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions ® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The equity summary score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. The equity summary score is provided by starmine from refinitiv, an independent company not affiliated with fidelity investments. For more information and details, go to fidelity.Com.

Barron's, february 21, 2020 online broker survey. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Fidelity tied interactive brokers for #1 overall.

Investor's business daily ® , january 2020: best online brokers special report. Fidelity was named best overall online broker, and also first in equity trading tools, research tools, low-cost/ETF trading, investment research, mobile trading platforms/apps, and portfolio analysis & reports. Results based on having the highest customer experience index within the categories composing the survey, as scored by 4,199 respondents. The survey was conducted by investor's business daily's polling partner, technometrica market intelligence. © investor's business daily, inc. All rights reserved.

System availability and response times may be subject to market conditions.

The 5 best free online trading courses

Posted by: wesley nolan on august 14, 2018 under: millionaire stock traders |

5 FREE online trading courses! You don’t have to spend money learning to trade stocks – here are the best free online stock trading courses that you can start today. Hopefully these trading course reviews will help you learn more about stock trading.

I became a professional stock trader after completing #1 in the list below!

Disclaimer: there are affiliate links on this page. This means that if you click through and purchase anything, I could possibly make a commission without adding any extra cost to you.

If you’re curious (or in a hurry):

Get this online streaming trading DVD worth $1000 for FREE! Click here to get instant access!

This article will give you an overview of the free trading courses, webinars and other resources that can help you learn a new trading strategy.

I am a huge advocate of learning from mentors and people who have already achieved what you want to achieve. I have learned many new stock trading strategies from these free online trading courses and I am SURE that you will too.

Want the best penny stock alerts service?

The best penny stock alerts service that I am a member of is called FAST5 ALERTS!

You can also check out this FREE WEBINAR that explains why fast5 is the best penny stocks alerts service that you can join – and the lowest cost!

Disclosure: please note that some of the links on this page are affiliate links. This means that we may earn a commission, at no cost to you, if you decide to make a purchase after clicking through the link. Please understand that we have experience with these companies, and we recommend them because they are helpful and useful, not because of the small commissions that we may receive if you decide to buy something through our links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Free stock market courses for beginners and experts!

We hope that you will benefit from these free stock market courses for beginners and free online day trading courses. Many of the online trading courses discussed in this article are made by expert stock traders that offer additional paid alerts services.

However, you are under no obligation to pay for any of the premium services if you participate in the free online trading courses that they offer.

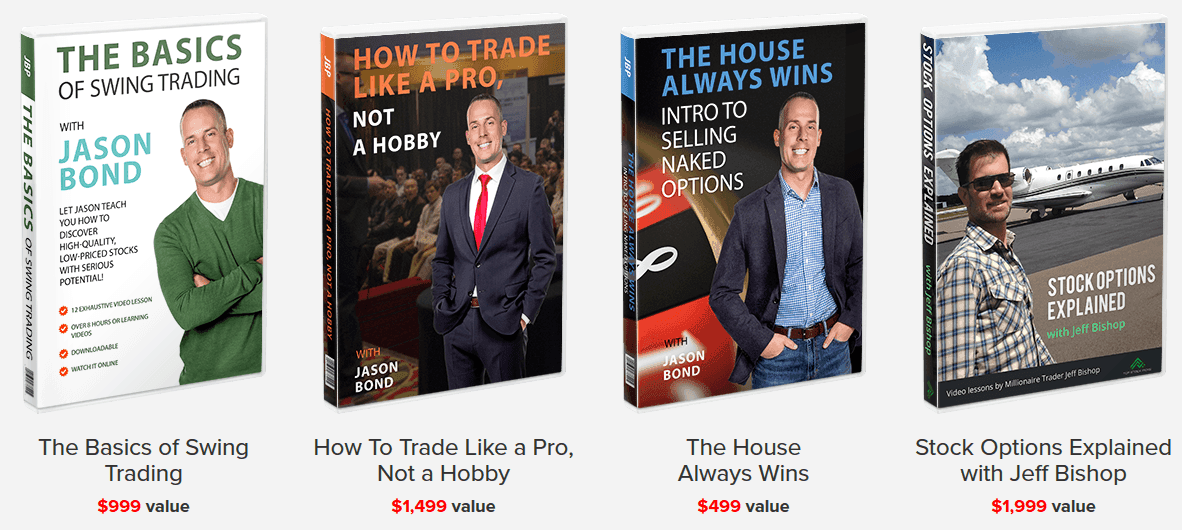

#1 the basics of swing trading by jason bond

Here is free access to this webinar and the free online swing trading course.

This is one of the best online stock trading courses in my opinion. All you have to do is put in your email and start learning from jason bond. Jason is a multi-millionaire stock trader and he is also a great teacher.

Jason teaches his three simple swing trading patterns that he uses to make 10% – 20% profits in just 1-4 days per trade. I learned his swing trading strategy and his trades consistently help me to make money trading.

This is probably the best value free stock trading training that you will ever find! Jason includes access to his entire video suite of stock trading courses – this is worth $5,000! The value here is just incredible – you will not find a better collection of free stock market courses for beginners or any level of trader!

Jason does offer a truly amazing premium swing trading alerts service which helped me a lot to learn how trade the stock patterns that he explains in the free courses. If you would like to learn more about that – be sure to check out my jason bond picks review .

How to trade like a pro, not a hobby

Jason goes through the lessons that he has learned in his journey from -$250k in debt to multi-millionaire stock trader. He focuses on the importance of patience and discipline in swing trading.

The house always wins

This is an excellent introduction to selling naked options. If naked options is your thing then this is worth watching.

Stock options explained with jeff bishop

Jeff bishop is one of the worlds best options traders so this training is worth its weight in gold. Jeff regularly makes 100% wins with his options trade and he shows you how he does it in this free training. We have written quite a bit about jeff as he seems to have a very compelling options trading strategy.

#2 kyle dennis biotech trading webinar + free video lessons

Kyle dennis turned $15,000 into $3M as a trading student in jason bonds millionaire roadmap program.

Now he teaches his own stock trading strategy to show people that it is possible to make money trading high risk/high reward biotech stocks.

Kyle is another trader that has helped me make a ton of money trading stocks so of course I highly recommend checking out his FREE biotech trading webinar.

Kyle dennis is an expert at finding biotech stocks that have a catalyst event coming up and trading them for massive profits!

I learned from his FDA insider alerts program and his sniper report longer term stock picks are still making me money. Kyle’s course is another one of the best online stock trading courses that you can get for free and then upgrade to his alerts service later.

#3 investors underground 100% free online day trading courses

Free online day trading courses are not so easy to find. If you want to try some good free online day trading courses, we highly recommend that you try the free day trading course that is offered by investors underground. You can sign-up for it here .

This excellent day trading video series starts by going over the basics of how to day trade for beginners. They cover different more advanced trading strategies for day traders that have a bit more experience.

I think there is something in these free online day trading courses that will help improve your day trading regardless of what your experience level is.

Investors underground has some of the best free online day trading courses to learn to day trade.

#4 free online day trading course by bullishbears.Com

The founders of bullishbears.Com (tim davis, daniel adams, and lucien bechard) offer some great free stock market courses for beginners. They have a lot of free stuff on the site including free trading courses for beginners.

They claim to have $3000+ worth of free trading courses for beginners and experienced traders so it is worth checking out. If you want to read a complete B ullishbears.Com review, check out this one.

I could only find that one bullishbears.Com review, but given that they offer so much free stuff you probably don’t need to read a full bullishbears review unless you are purchasing a service from them.

A good starting point is their introductory free online day trading course that you can check out here . This free day trading course covers all the basics and some nice strategies that you can implement for yourself.

#5 free stock watch lists from expert traders

This final free bonus is not really a day trading course or free stock market course. It is something that you can add to your new-found knowledge that will help you find some great stocks to trade.

Basically, you can just sign-up for the traders at ragingbull to send you a weekly free email watch list that details some of the stocks that they are trading or watching.

The stocks on this watch list are generally swing trades which means you can usually buy them and hold them for a few days. I prefer this style of trading and I have made quite a bit of money from following these free stock picks every few weeks.

Conclusions – the best free online trading courses

Free stock market courses for beginners and advanced traders are available if you know where to find them. If you are looking at signing up for a free stock trading course – don’t hesitate, what do you have to lose? Hopefully you can take advantage of the free online day trading courses and make some money trading stocks!

Best online stock trading platforms

Sarah horvath

Contributor, benzinga

Trading stocks means you can end up with a mixed bag of emotions. You might be excited at the prospect of watching your money grow, overwhelmed at the number of stock options available to you or even frustrated if you’re having trouble making your 1st buy.

You don’t want to pile on the feeling of being overcharged by your online trading platform. Commissions, account maintenance charges and other hidden fees can quickly add up and eat into your profits. As a new trader, you may already feel especially hesitant to start investing. You might not be sure which broker to trust and which is worth the price.

Luckily, most brokerages have recognized this fear and created free options to help new traders save more money when getting started. Take a look at our top picks to compare services and find your match today.

Best online trading platforms:

- Best overall online trading platform: tradestation

- Best mobile brokerage: webull

- Best for advanced traders: moomoo

- Best advanced platform: TD ameritrade

- Best for professional traders: interactive brokers

- Best for beginners: robinhood

- Best for advanced traders: schwab

- Best for saving on taxes: vanguard

Compare online brokers

Take a look at our top picks for online stock brokers. Compare what each offers to find the right service for you.

Best for

Overall rating

Best for

1 minute review

Webull, founded in 2017, is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit.

Webull is widely considered one of the best robinhood alternatives.

Best for

- Commission-free trading in over 5,000 different stocks and etfs

- No account maintenance fees or software platform fees

- No charges to open and maintain an account

- Leverage of 4:1 on margin trades made the same day and leverage of 2:1 on trades held overnight

- Intuitive trading platform with technical and fundamental analysis tools

Best for

Overall rating

Best for

1 minute review

Tradestation is for advanced traders who need a comprehensive platform. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Tradestation’s app is also equally effective, offering full platform capabilities.

Best for

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

- Confusing pricing structure to leave new traders with a weak understanding of what they pay

- Cluttered layout to make navigating tradestation’s platform more difficult than it should be

Best for

Overall rating

Best for

1 minute review

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Best for

- World-class trading platforms

- Detailed research reports and education center

- Assets ranging from stocks and etfs to derivatives like futures and options

- Thinkorswim can be overwhelming to inexperienced traders

- Derivatives trading more costly than some competitors

- Expensive margin rates

Best for

Overall rating

Best for

1 minute review

Moomoo is a commission-free mobile trading app available on apple, google and windows devices. A subsidiary of futu holdings ltd., it’s backed by venture capital affiliates of matrix, sequoia, and tencent (NASDAQ: FUTU). Securities offered by futu inc., regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Moomoo is another great alternative for robinhood. This is an outstanding trading platform if you want to dive deep into smart trading. It offers impressive trading tools and opportunities for both new and advanced traders, including advanced charting, pre and post-market trading, international trading, research and analysis tools, and most popular of all, free level 2 quotes.

Get started right away by downloading moomoo to your phone, tablet or another mobile device.

Best for

- Free level 2 market data for all users who open an account

- Commission-free trading in over 5,000 different stocks and etfs

- Over 8,000 different stocks that can be sold short

- $0 contract fee for trading options, no commission either

- Strong market data and analysis tools with over 50 technical indicators

- Access trading and quotes in pre-market (4 a.M. To 9:30 a.M. ET) and post-market hours (4 p.M. To 8 p.M. ET)

- No minimum deposit to open an account.

- Active trading community with more than 100,000 app users

Characteristics of a successful online stock trader

Though each trader has his own individual set of financial and personal goals, the most successful stock traders enter the market with the following 3 characteristics:

Commitment to education. The most successful traders never buy stocks based on a “gut feeling.” they do their research, look at the history of the company and its leadership and make selections based on hard data and perspectives of industry experts.

They also stay up to date on political happenings both at home and abroad and they factor in how new laws and regulations affect the market. Looking to increase your knowledge of the stock market? Check out our list of the best low-cost day trading courses you can sign up for right now.

Things to look for in an online trading platform

Though most stock trading platforms charge account maintenance fees and commissions, you’ll find a number of brokers that will allow you to trade for free. Some characteristics that all reliable free trading platforms share include:

- An intuitive trading site. A brokerage firm isn’t very useful if you can’t understand how to get started. Watch a few youtube tutorials or website overviews to get a feel for the platform before you commit desktop space and time to the broker. If the platform isn’t intuitive, check the brokerage’s customer service options. A responsive team of customer service professionals may be able to help you understand how to operate a more complicated platform.

- Clear and easy-to-understand free trading. Though some platforms will allow you to trade for free indefinitely, some may only allow commission-free trades within a limited window after opening an account. When you sign up for an account on a free trading platform, make sure you read the terms of service to understand how many free trades you are entitled to with your account. Brokerages that try to hide this information may make their money “tricking” users into thinking that trades are free indefinitely, only to stick them with high fees later on by hiding a clause in the fine print.

- Realistic claims. Trading platforms that make unrealistic claims (like promising a dollar amount of returns or claiming that they have “secrets” that other brokers hide) are more than likely just trying to take your money with a hidden fee or commission. Remember, if it sounds too good to be true, it probably is.

The best online trading platforms

Based on the criteria above, we’ve compiled a list of the best online trading platforms to get started trading stocks for free.

DAY TRADING COURSES

Free day trading courses for beginners gives you in depth online training and education on momentum trading, best day trading indicators, and learn how to day trade stocks using the most popular momentum strategies. Our online classes are educational, easy to learn, and give you advanced knowledge on how to become a successful day trader.

Register for free below to gain access.

GET ACCESS TO YOUR

FREE TRADING COURSES TODAY!

Free day trading course

If you’ve been searching for free day trading courses for beginners then you’ve come to the right place. In our videos, you’re going to learn how to day trade stocks, proper risk management strategies, preparing in the pre-market, scanning for low and high float stocks, trading red to green moves, gap & go’s, dip buying and so much more…

We recommend taking this course if you are new and before you enter our day trade room. We teach the important nuts and bolts that you’ll need to become a successful day trader and make the process as simple as possible. Make sure to take what you learn in our course and practice it live each day in our day trade room. Register for your free membership below to gain access to our free day trading course as well as the rest of our course catalog.

GET ACCESS TO YOUR

FREE TRADING COURSES TODAY!

Strategy

Day trading strategies: what you’ll learn in our day trading course

Advanced

Basic & advanced training in our day trading courses

Trade live

How to day trade live: after our day trading course

Day trading strategies: what you’ll learn in our day trading course

- What you will learn

- Momentum trading for beginners

- Pre-market routine

- Float price

- Gap & go strategy

- How to short stocks

- How to chart breakout stocks

- The best day trading indicators

- Low float vs high float stocks

- Order execution

- Risk management

Our momentum trading lessons are among our most popular, mainly because momentum trading is one of the biggest attractions in the market. What we mean by that is EVERYONE gets excited when a stock is hot, and going up day after day or week after week.

Because this style of trading is so critical to learn for day traders, we get right down to the nuts and bolts of how to day trade momentum stocks. You’ll learn some of the best strategies that work when a stock breaks out, pulls back to support, and what to do when momentum begins to vanish, and how to recognize these events as they happen.

Our students learn when to buy, when to sell, and when to sit on your hands. This is so important due to the fact that momentum stocks are volatile in both directions. If you can’t keep your focus on the trade at hand, momentum trading is not for you. You need to be someone who is comfortable scalping stocks for short periods of time. We’ll teach you how to become a master of buy and sell signals in a momentum environment. Believe it or not, momentum trading is easy, its the discipline you must have to stick to the trading plan that is the most difficult factor.

When it comes to day trading, preparation is one of the keys to success. If you’re looking around for a place to learn day trading then you’ll find a lot of companies (and gurus) are pitching their online day trading classes. For hundreds or thousands of dollars. Our free day trading course for beginners is worth every penny that they charge, but its free? Why? Because we are here to give you a foundation in day trading that doesn’t cause a dent in your wallet.

We will help you get started as a momentum trader without all of the flashy hype that you see all over the internet. If you want to look at pictures of lambo’s and pools, this isn’t the place for that. If you want a trading education… then lets do the work!

That work starts with preparation, and we are going to teach you how to prepare for a trade.

We recommend taking what you learn in our course and practicing for several months in a paper trading account first before trading live. Our courses are also best paired with access to our trade room so you can learn from our team in real time. In our trade room you’ll learn our pre-market morning routine. You’ll see how we chart the morning gap & go’s, share our custom scanners, and teach you how to day and swing trade every day.

Day trading aka intraday trading is a very popular way to make money in the market, and you’re going to learn the best practices on how to effectively day trade.

Traders use their brokerage accounts as leverage to buy anywhere from 1,000 shares to 10,000+ to scalp trades within seconds to minutes. If you want to learn trading then you’ll need to be quick and able to handle the emotional trading situations that come with becoming a day trader.

The best day trading courses in the world won’t prepare you for the real world experience of trading penny stocks, large caps, options or futures.

Small cap stocks are extremely volatile due to the nature of their low float. Low floaters is a term that determines the amount of shares of a stock that are available to trade.

The lower the shares the higher the volatility, hence the term pump and dump. Low floaters tend to pump and dump a lot. They are high reward but also high risk. These are the stocks that the TOP trading guru’s you will find online are always talking about or trading? Why? Because they are incredibly easy to buy and then get your followers to buy! CRAZY! That’s why having proper risk management is key when trading small cap stocks. What’s risk management? Don’t worry we’ll teach you best practices for this too.

Low floaters are typically stocks under 20 million float. Really low floaters are stocks that are under 10 million float. Medium float stocks are typically stocks between 50 million to 100 million. Higher float stocks are over 100 million. The higher the float the slower the breakout and breakdown, generally speaking. Keep in mind that even large cap stocks can be volatile under the right conditions.

If a stock has a low float, and a news catalyst, then often there will be a lot more volatility. (fast movements up and down) we’ll teach you how you need to approach these stocks ( love them and leave them) you’ll learn to take your profits and how to not get greedy. Traders who have taken our low float course content understand the risks and the proper ways to play these stocks. Are you ready to learn what the pros do when a low float stock is running?

Do you want to learn the how to trade the most popular day trading strategies? These are the top day trading strategies such as the gap & go, red to green moves, and dip buying stocks. In this course you’re going to learn them all and have the right foundation to become a day trader.

We’ll teach you how to recognize gap up stocks that are prime for a continuation, when to jump in and when to jump out. You won’t need someone to tell you when to trade! How cool is that?

You’re also going to learn about terms such as pink sheets, OTC (over the counter), market capitalization, shares outstanding, short float, trading halts, parabolic movers, surging volume, relative volume, average daily volume, moving average crossovers, gappers (gap up & gap down), earnings dates, stock news, and so much more in our course.

Online trading for free

See what the media has to say about etoroвђ™s trading and investing platform

Those with less expertise might like to try a platform called etoro, which allows customers to copy вђњstar tradersвђќ directly, and can make traders of even the least informed of punters.

The best returns occur when investors are plugged into diverse social groups that enable them to collide with information from multiple networks. In the social media world, as in real life, it pays to hover on the edge of cliques вђ“ but not get slavishly sucked into just one.

Internet social networks that let users follow investments the way they track status updates on facebook are attracting record interest, turning top performers into market stars for individual investors.

A recent research we carried out with the massachusetts institute of technology has shown that copy trading, where traders watch the trading activity of other people and make their decisions accordingly, performs significantly better than manual trading.

Etoro is the worldвђ™s leading social trading platform, which offers both investing in stocks and cryptocurrencies, as well as trading CFD with different underlying assets.

Top instruments

Support

Learn more

Find us on

About us

Privacy and regulation

Partners and promotions

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services licensce 491139

Past performance is not an indication of future results

general risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever. Cryptocurrencies markets are unregulated services which are not governed by any specific european regulatory framework (including mifid). Therefore when using our cryptocurrencies trading service you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution. Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro - your social investment network.

Copyright В© 2006-2021 etoro - your social investment network, all rights reserved.

So, let's see, what we have: if you want to trade stocks without paying commissions, check out my list of the best commission-free trading platforms of 2021. At online trading for free

Contents of the article

- Actual forex bonuses

- Want to trade commission-free? Here are best...

- Best commission-free trading platforms...

- Robinhood

- Public

- M1 finance

- E*TRADE

- Acorns

- TD ameritrade

- Vanguard

- Summary of the best commission-free trading...

- How I came up with this list

- How to choose the best commission-free trading...

- Should you invest with a commission-free...

- Are there disadvantages to free stock trades?

- What should I look out for at commission-free...

- Summary

- Online stock trading 101: A beginner's guide

- Learn the ropes if you're a newbie to online...

- Choose an online broker

- Research stocks to trade

- Decide what kind of trade is right for you

- Know what it'll cost you to trade stocks

- Understand how trading stocks affects your tax...

- Online trading courses

- Introducing the financial markets

- How does trading work?

- Orders, execution and leverage

- Planning and risk management

- The basics of technical analysis

- Trading psychology

- Fundamental analysis

- Understanding risk and reward

- Prefer to learn at a live session?

- Free stock trading courses online

- Stock trading: intelligent investing in stocks on...

- Strongest reversal candlestick patterns - forex...

- Stock trading with candlestick patterns |...

- Stock trading & investing | beginners masterclass

- Investment and technical analysis methods on...

- Stock trading strategies : technical analysis...

- Trading in a futures market - revised

- Stocks and short selling revised course - an...

- Learn how to do online trading: online trading...

- Free financial trading tutorial - introduzione al...

- Details about free stock trading certification...

- Collection of free stock trading courses

- Suggest more stock trading courses or...

- Online trading

- Why trade online with fidelity

- Features & benefits

- Advanced tools and services

- Accounts with online trading

- Features & benefits

- Advanced tools and services

- Accounts with online trading

- Next step

- Questions?

- The 5 best free online trading courses

- 5 FREE online trading courses! You don’t...

- I became a professional stock trader...

- Disclaimer: there are affiliate links on this...

- If you’re curious (or in a...

- Want the best penny stock alerts...

- Free stock market courses for beginners...

- #1 the basics of swing trading by jason...

- #2 kyle dennis biotech trading webinar +...

- #3 investors underground 100%...

- #4 free online day trading course by...

- #5 free stock watch lists from expert traders

- Conclusions – the best free online...

- Best online stock trading platforms

- Best online trading platforms:

- Compare online brokers

- Characteristics of a successful online stock...

- Things to look for in an online trading platform

- The best online trading platforms

- DAY TRADING COURSES

- GET ACCESS TO YOUR FREE TRADING...

- Free day trading course

- GET ACCESS TO YOUR FREE TRADING...

- Day trading strategies: what you’ll learn in our...

- Online trading for free

- Top instruments

- Support

- Learn more

- Find us on

- About us

- Privacy and regulation

- Partners and promotions

No comments:

Post a Comment