Withdraw fund

When you have successfully requested a withdrawal to your nominated account you’ll receive a confirmation by email.

Actual forex bonuses

As part of our security requirements, the first time you request a withdrawal we will need to verify that your bank account belongs to you. Normally this can be done automatically in a few simple steps. You’ll then be able to make withdrawals quickly and securely.

How to withdraw your available funds

How to withdraw your available funds

Here we give a step by step guide of how to withdraw available funds from your funding circle account. If you are withdrawing for the first time, you will need to set up a nominated bank account, which is also set out below.

What are available funds?

When you have lending switched on, your funds are automatically lent out to businesses. By switching lending off, the repayments you receive each month will accrue in your account as available funds, which can be withdrawn at any time.

Important note: all lending from individual investors is currently paused, as is the option to sell loans to other investors. This means that funds will accrue in your account that can be withdrawn at any time.

How to withdraw available funds

When logged into your funding circle account click on the transfers tab

Then select transfer out:

You can withdraw some or all of your available funds, and there is no minimum withdrawal amount. Funds can take up to 3 working days to arrive in your bank account, but should arrive the following day if you make your request on a working day.

When you have successfully requested a withdrawal to your nominated account you’ll receive a confirmation by email.

Withdrawing for the first time – how to set up a nominated bank account

As part of our security requirements, the first time you request a withdrawal we will need to verify that your bank account belongs to you. Normally this can be done automatically in a few simple steps. You’ll then be able to make withdrawals quickly and securely.

To start, click ‘add bank account’:

You will then be asked to confirm your personal details, with the option to update these if the information is out of date. Please ensure the details are correct and match your bank account information to increase the chance of your bank account being verified automatically.

Once you have confirmed your details, you will be asked to enter the account number and sort code of your bank account:

If we are able to verify the bank account automatically, you will see that your account has been added successfully and you will be able to enter an amount to withdraw:

If we are unable to verify your bank account automatically, you will be required to provide further details. There are a number of reasons why the check may not pass automatically, for example if your bank account was opened a long time ago or if it is a joint account. Click continue and follow the instructions to upload a copy of your bank account details:

Once this has been verified by our team you will receive an email confirming that you are now able to log in and withdraw funds.

Withdrawing funds

Betvictor reserves the right to cancel and re-process the withdrawal of funds in order to comply with card scheme rules. Betvictor can not be held liable for any charges incurred as a consequence of abiding by these regulations. Please note that, wherever possible, all withdrawals must be sent to the original method of deposit used to credit your betvictor account. Documents may be requested at any time to ensure the security of all our customers.

Debit and credit cards

All account holders who have made a deposit by debit or credit card can have their winnings refunded to the same card, where possible. Funds should be credited back to your card within 2-5 working days of the request being made. There is no charge for this service. Some visa or mastercard issuers do not accept these transactions and alternative methods may be used.

Fastfunds withdrawals

Betvictor has introduced the fastfunds option to our withdrawal methods. It’s a fast, convenient and secure method that gets your withdrawals into your account within 30 minutes of approval. Fastfunds is available to VISA users. Your bank must offer the fastfunds feature, not all issuing banks currently have the facility. We would recommend that you check with your bank to see if this feature is available for you.

Skrill (moneybookers), paypal and neteller

Subject to individual countries’ licence restrictions, payments back to e-wallets may be an option available. Funds should be credited back to your E-wallet within 1-3 days of the request being made. There is no charge for this service. Paypal funds should be credited in 1 day.

BACS (UK only)

Payments will only be made to a bank account in the account holder's name.

Funds will be processed the same day for withdrawals made before 3pm UK time.

You will need to complete your bank details online.

There is no charge for this service.

Telegraphic transfer/ international bank transfer

Payments will only be made to a bank account in the account holder's name.

Funds should reach your account within 3-10 working days of the request being made.

You will need to complete your bank details online.

Payments are made in the currency of your account and may incur a bank charge.

Customers with a UK bank account should use the BACS withdrawal facility described above, which is free of charge.

Withdrawals

You can make a withdrawal from your PIP at any time. Here we explain your options.

Who is your PIP held with?

Halifax

Halifax PIP

Withdrawing some or all of my PIP

You can withdraw funds from your PIP by either requesting a regular payment or a one off lump sum.

If you choose to withdraw more than your 5% tax deferred allowance per year there may be tax to pay. Depending on which option you choose when making a withdrawal there can be an excessive and artificially high tax liability. So it’s important to understand your options before making a withdrawal.

We recommend that you take a few minutes to read through our PIP guide to making withdrawals, to help you better understand the key points involved.

Things to think about before making a withdrawal

The investment you made into your PIP should be viewed over the medium to long term, at least a five to ten year period, to help meet your financial objectives. Leaving your money invested over the longer term means you’re less likely to be impacted by short-term ups and downs in the stock market.

Before withdrawing funds from your PIP it’s important to consider:

- You’ll lose any future investment growth on anything you take out of your plan.

- You may have income tax to pay when making a withdrawal.

- Your plan may receive yearly management charge (YMC) reductions which could be lost if you take money from your plan – you can find more information about YMC reductions on pages 5–7 of the key features.

- You may be eligible for a loyalty bonus in the future, which could be reduced or lost if you take money out of your plan.

- If you don’t need all the money in your PIP now, you could take a one-off withdrawal of the amount you need and leave the rest invested, or you could set up regular withdrawals from your plan.

- If you hold money in a savings account, that might be a more appropriate source of funds than cashing in some or all of your PIP.

Regular withdrawals

You can take a regular withdrawal of either a specified amount or a percentage of your investment. This will be paid directly into your bank account.

- You can make regular withdrawals on a monthly, half-yearly or yearly basis (there’s a £50 monthly, £250 half yearly and £500 yearly minimum).

- You’ll need to leave at least £100 in your plan (£1,000 for plans invested in the managed income fund) – otherwise we’ll close it, cash in the remaining units and pay you the proceeds.

Lump sum withdrawals

You can withdraw money by requesting a one-off lump sum.

- You have to take out £100 or more.

- You’ll need to leave at least £100 in your plan (£1,000 for plans invested in the managed income fund) – otherwise we’ll close it, cash in the remaining units and pay you the proceeds.

How do I make a withdrawal from my plan?

Your PIP is made up of 100 separate parts, or segments. Withdrawals can be taken by cashing in these segments in different ways – we’ve listed your options below.

Depending on the option you choose to make a withdrawal there can be an excessive and artificially high tax liability. So it’s important to understand your options before making a withdrawal.

There are five ways to make a withdrawal from your PIP:

- Option 1 – withdraw a specific amount of money using a combination of options 2 & 3

- Option 2 – take a lump sum or regular withdrawals by partly cashing in an equal amount from across all segments

- Option 3 – cash in whole segments

- Option 4 – cash in a specific number of whole segments and then partly cash in an equal amount from across all the remaining segments

- Option 5 – withdraw all of your investment and close your plan

Before making any decisions, please refer to our PIP guide to making withdrawals which provides information on each of these options, along with some worked examples.

To make a withdrawal please call us.

Alternatively please download a withdrawal form and return it to us at:

Scottish widows limited

PO box 24175

69 morrison street

EDINBURGH

EH3 1HR

Once we have all the information needed, your request will be processed within five working days. Payments are made through BACS (banks automated clearing system) and usually take 3-4 working days to be credited to your account.

What about tax?

When you make a withdrawal from your PIP a chargeable event gain can occur. Chargeable event gains normally occur when you make a profit on your investment; for example if you invest £10,000 and this grows to £15,000 then you’ve made a gain of £5,000. Chargeable event gains are taxable under income tax rules, so you might have tax to pay when you make a withdrawal.

Key points to consider

Scottish widows pay tax on the growth of underlying investments, which means that there is no personal liability to income tax at the UK basic rate, or to capital gains tax.

However, you may have income tax to pay if:

- You normally pay tax above the UK basic rate when the gain arises.

- The chargeable event gain results in you becoming a higher rate or additional rate tax payer.

- If you're unsure about the tax implications of making a withdrawal from your PIP we suggest that you speak to a financial adviser.

For more information please refer to the key features and guide to making withdrawals

Have you used your tax-deferred allowance?

You have a 5% tax deferred withdrawal allowance. This 5% withdrawal allowance is cumulative and any unused allowance can be carried forward to future years - subject to the total cumulative 5% allowance amount not exceeding 100% of the amount you have paid into your PIP. For example, with an initial investment of £30,000 you could withdraw £1,500 each plan year over 20 years.

Large withdrawals from your PIP can result in an excessive and artificially high tax liability, so we recommend that you speak to your financial adviser or tax office before taking any withdrawals in excess of the 5% allowable allowance.

The value of any tax benefits of your plan depend on your personal circumstances. Your circumstances and tax rules may change in the future.

How to get in touch

Contact us by phone or in writing

To find out the value of your plan, top up your investments, move funds, or make a withdrawal, call us.

You can also contact us in writing at:

Scottish widows limited

PO box 24175

69 morrison street

EDINBURGH

EH3 1HR

To allow us to help you quickly, please include:

- Your account, plan or policy number

- Your full name

- Your address

- How you would like us to reply and your contact details (e.G. Telephone number or email address)

- Your signature is your consent to follow your instruction.

Once we have received your letter, we aim to respond to your request within five working days. We may need to get in touch with you for additional information before completing your request. To avoid any delays, please include a daytime contact number or email address.

Scottish widows

Scottish widows PIP

Withdrawing some or all of my PIP

You can withdraw funds from your PIP by either requesting a regular payment or a one off lump sum.

If you choose to withdraw more than your 5% tax deferred allowance per year there may be tax to pay, depending on which option you choose when making a withdrawal there could be an excessive and artificially high tax liability. So it’s important to understand your options before making a withdrawal.

We recommend that you take a few minutes to read through our PIP guide to making withdrawals, to help you better understand the key points involved.

Things to think about

The investment you made into your PIP should be viewed over the medium to long term, at least a five to ten year period, to help meet your financial objectives. Leaving your money invested over the longer term means you’re less likely to be impacted by short-term ups and downs in the stock market.

Before withdrawing funds from your PIP it’s important to consider:

- You’ll lose any future investment growth on anything you take out of your plan.

- You may have income tax to pay when making a withdrawal.

- Your plan may receive yearly management charge (YMC) reductions which could be lost if you take money from your plan – you can find more information about YMC reductions on pages 4–5 of the key features.

- You may be eligible for a loyalty bonus in the future, which could be reduced or lost if you take money out of your plan. If you don’t need all the money in your PIP now, you could take a one-off withdrawal of the amount you need and leave the rest invested, or you could set up regular withdrawals from your plan.

- If you hold money in a savings account, that might be a more appropriate source of funds than cashing in some or all of your PIP.

To help you better understand the key points involved, we recommend that you take a few minutes to read through our PIP guide to making withdrawals.

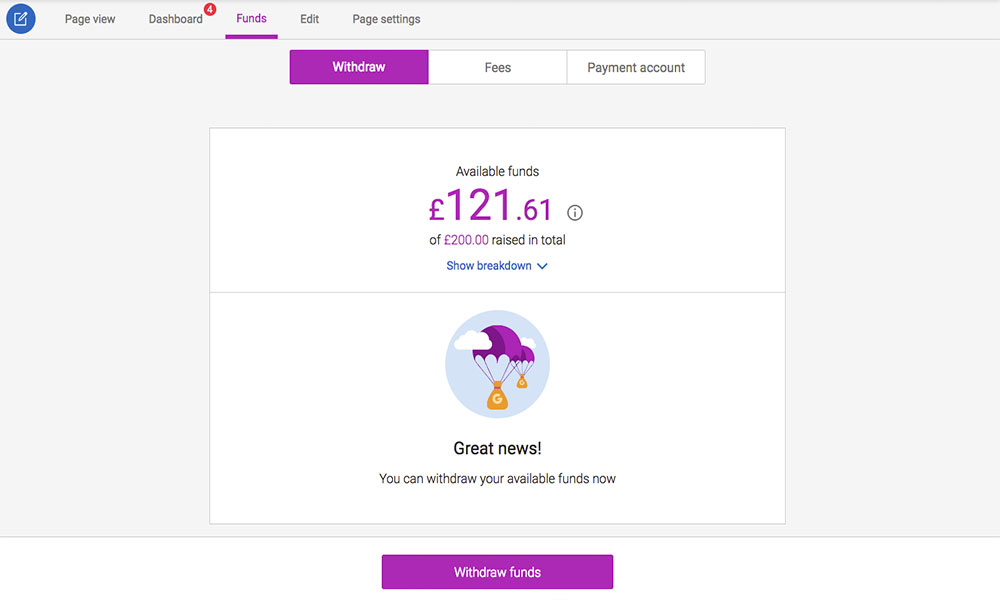

Withdrawing donations from your crowdfunding page

Have your funds at your fingertips and learn how easy it is to withdraw what you've raised.

Everything you need to know:

- Funds are available to withdraw 14 days after launching your page.

To withdraw what you've raised so far, all you need to do is head to the 'funds' tab on your page.

Available funds: here is the amount ready for you to withdraw. Not all donations made to your page will be shown here as it takes up to 3 days for the money from each donation to reach us. But don’t worry, you’ll be able to withdraw all your funds once we have processed them successfully.

Eg: you have £100 on your page, (10 supporters, donating £10 each). 8 of these donations have been processed, so your available balance will be shown as £80 (minus our small card processing costs).

Raised since last withdrawal: this amount reflects the donations made to your page since your last withdrawal.

Total raised: this amount relates to the overall total raised on your page from launch date to now.

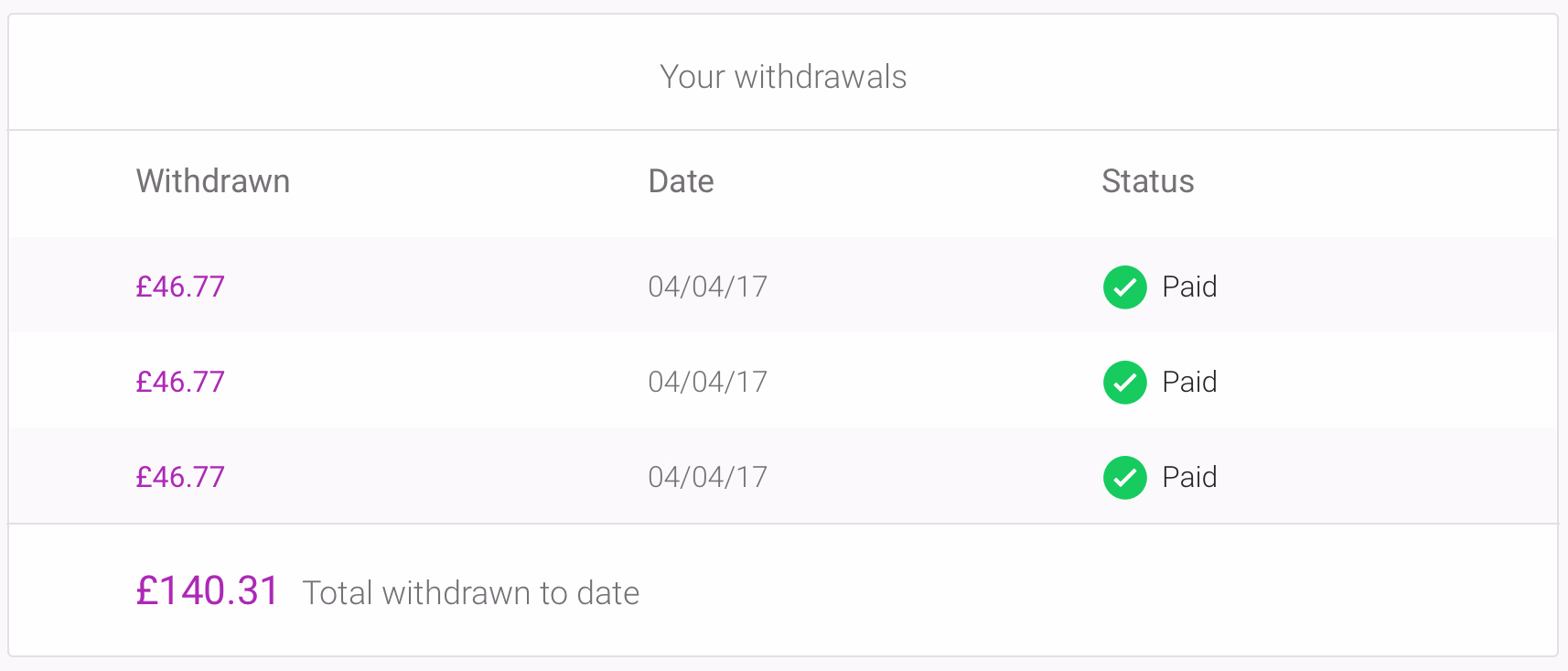

Your withdrawals

When funds have been paid to you, the status of your payment will change to 'paid'. We make payments via bacs transfer, so they can take 2-3 working days to reach you once paid.

Payment timeframe

The timeframe below details when you should expect to receive the funds you've withdrawn, depending on which payment method you've chosen:

UK bank account:

4 - 7 working days

Page receiving in USD($):

up to 30 working days

Justgiving has a 0% platform fee on donations made through the site, donors have the option to add a voluntary contribution on top of their donation instead. This voluntary contribution is reinvested in to ensuring our users have a seamless and enjoyable experience using our platform.

Donations made in GBP via debit or credit card are charged at 2.9%.

Donations made via paypal are charged at 1.45%.

Donations made in USD using a debit or credit card are charged at 2.90%.

"will the total on my page drop when I make a withdrawal?"

No, your page will always reflect the total amount you've raised.

"I don't need all the money. Can I withdraw some of the funds / not all of it?"

At the moment, you can only withdraw everything you've raised so far.

"can I withdraw new donations, whilst an existing withdrawal is processing?"

You'll need to wait until the current withdrawal is paid before you can request another.

How to withdraw your pension

Written by dom james, financial content writer

Here is how to find out what age you can withdraw from each type of pension and what you need to do to claim them.

Pensions are long term investments. You may get back less than you originally paid in because your capital is not guaranteed and charges may apply.

When can you withdraw from your pension?

Here is how old you need to be to start withdrawing from your pension:

| type of pension | age you can withdraw |

|---|---|

| defined contribution (DC) pension | 55 |

| defined benefit (DB) pension* | 65 |

| self invested personal pension (SIPP) | 55 |

| state pension | varies |

* some let you withdraw from age 55, but this could reduce your retirement income.

On 1 february, 2021 the FCA will be placing new rules for those who have defined contribution pensions. These rules apply to those who’ve already decided to take a retirement income through drawdown but don't take professional advice.

The new rules will require pension providers to offer their customers investment pathways that will be designed to apply to four specific scenarios. It would then be up to then individual to chose which pathway is right for them.

I have no plans to touch my money in the next five years.

I plan to use my money to set up a guaranteed income (annuity) within the next five years.

I plan to start taking my money as a long-term income within the next five years.

I plan to take out all my money within the next five years.

DC and DB pension withdrawals

If you have a DC pension, you can withdraw up to 25% of your pension, tax free , when you retire. You will have income tax deducted on any amount you withdraw over this. For example:

Your pension is worth £200,000 and you withdraw 40% (£80,000)

You pay no tax on £50,000 (25% of your pension)

You pay income tax on £30,000 (remaining 15% of total withdrawal)

If you have a DB pensions, withdrawals are calculated differently and each scheme has their own formula for making deductions.

You should contact your pension company to ask for more details if you want to withdraw a lump sum from your total DB pension fund.

How to claim

You will receive paperwork in the post up to six months before you can start drawing an income from your pension. This will:

Explain when you will start getting your monthly pension

Ask if you want to withdraw a lump sum payment worth 25% of your total pension pot

Making additional withdrawals

For DC pensions, the first 25% of any money you withdraw will be tax free, but the remaining 75% is taxed at your income tax rate .

This type of withdrawal is called an uncrystallised funds pension lump sum (UFPLS).

For example, a withdrawal of £1,000 will give you £250 (25%) tax free, but the remaining £750 (75%) will be taxed at your rate of income tax.

Some companies could offer to give you access to your pension fund before you reach your retirement age.

This is usually illegal and can end up costing you up to 55% in tax and charges.

If you have not reached your retirement age yet and need access to your pension, contact an independent financial adviser to discuss your options.

SIPP withdrawals

A self invested personal pension is a type of defined contribution pension.

This means your pension is only worth as much as you have paid in, plus growth from any funds your pension has been invested in.

How to claim

You can claim on your SIPP in the same way you would if you had saved in a defined contribution pension with an employer.

You will be contacted by your pension supplier up to six months before you are eligible to claim on your workplace pension and given the option to withdraw up to 25% of your pension pot.

State pension withdrawals

You have to wait until you reach your state pension age before you can receive anything from your state pension.

You cannot withdraw a lump sum from your state pension, but do get a monthly payment that is based on how long you contributed national insurance throughout your life.

How to claim

There are three ways you can claim your state pension:

Phone the pension service, telephone details are on the GOV.UK website

Alternatively, if you live abroad there are two ways you can claim your state pension:

By completing the international state pension claim form and sending it to the address found on the form

Can you withdraw your pension early?

This depends on the type of pension, so make sure you contact your pension supplier to find out when you can withdraw to find out if there are any charges.

If you need your pension money early to pay off debt, then speak to an independent financial adviser first who may be able to discuss an alternative solution.

What to do with your pension when you retire

Your pension supplier will usually offer you an annuity rate on your pension pot. This is how much they will pay you each year in return for keeping your pension money invested.

You do not need to accept what you are offered and can shop around to find a better rate with another company. Find out more about annuities here .

What is income drawdown?

This lets you reinvest your pension into a new investment that gives you an income based on the annual amount you want to draw from it.

For example, if your pension pot was worth £250,000, you could choose an annual income of £7,000 which will be deducted from your pot each year.

There are two types of income drawdown:

Flexi access drawdown: this option has been available since april 2015, and lets you take as much money as you like as an income.

Capped drawdown: this let you choose up to a set amount to withdraw each year, but this option was withdrawn from 6th april 2015.

Make sure you speak to an independent financial adviser before choosing an income drawdown product, as the amount you choose to withdraw each year could limit how long your income will last.

FCA introduces 'investment pathways' for retire

You can help ensure you have the retirement you want by finding the best personal pension plan to make your money work as hard as it can.

How to withdraw money from mutual fund?

Nitin agrawal

All you need to know about mutual fund withdrawal

A mutual fund is considered one of the best wealth creation and investment vehicle that can be adopted by the predominantly middle-class indians. It not only provides a way in for us to get involved in stock trading but also alleviates the risk associated with share markets. When we have a dedicated mutual fund manager to identify the best stock to pick based on our respective wealth building objectives, things get a lot simpler.

One of the biggest advantages of a mutual fund is its liquidity. Unlike other forms of investments, mutual funds come in handy in case of urgent emergencies. However, we need to time the mutual fund withdrawal well, so that we are able to extract maximum performance from our investments.

The basics of mutual fund withdrawal

The securities and exchange board of india (SEBI) regulate mutual funds. Because of this, there are well-established norms about the withdrawal of mutual funds. At a very high level, an investor needs to apply to withdraw certain units from the existing fund (or withdraw the entire amount). In the application, the investor will need to specify a bank account to which it needs to be deposited. Once the processing for redemption is finished, the withdrawal amount specified will be transferred to the investor’s bank account in three working days.

Ways to withdraw mutual funds

A. Offline mode

1 – fill in important details like folio number, scheme name, number of units to redeem, and the unit holder’s name in the redemption request form.

2 – submit the form to the AMC (direct)

3 – you can also submit the redemption request at the offices of a registrar like CAMS or karvy that handles several mutual fund schemes and its paperwork

B. Online mode

1 – log in to the AMC website using your sign-in credentials like folio number and PAN number

2 – select the scheme, number of units or the amount to be redeemed

3 – confirm to begin the online redemption process

4 – you can even visit the websites of registrars like CAMS (if they service your AMC) to carry out the redemption process.

Points to note before mutual fund withdrawal

1. The current NAV

It is important to note that the NAV (net asset value) determines the fund value applicable. This is declared every working day once the trading session is over for that day. Therefore, you need to time your redemption request submission so that you can utilize the current day’s NAV (usually up to 3 pm on a trading day) before your mutual fund withdrawal.

2. Processing time taken

After the request for mutual fund withdrawal is submitted, the AMC needs time to verify and process the request. This typically takes around 3 working days. The amount will be credited to the unitholder’s bank account in this duration.

3. Examine the lock-in period

Lock-in period determines the time bracket after which you can withdraw money from your mutual fund investment. It is important to check the type of scheme you have taken up. Here are details about the lock-in period for major types of mutual funds

1 – open-ended schemes – these do not come with a lock-in period

2 – close-ended schemes – these carry a lock-in period of 3 to 5 years. This means that you cannot withdraw money from such schemes before this duration

4. Exit loads and applicable taxes

Your mutual fund withdrawal will have implications in the form of taxes and exit loads. You would need to check on these before you raise the redemption request.

Tax implications on mutual fund withdrawal

The tax impact for withdrawals will depend on two factors –

1 – the type of mutual fund (i.E. Long-term/equity funds and short-term/debt funds)

2 – the duration of the investment

Let’s look at individual situations for the right assessment of tax impact

1 – equity funds

The rationale behind opting for equity mutual funds is that you would not need the amount 8-10 years from the start date. There are two scenarios here

A. Withdrawal before 1 year is complete – 15% short-term capital gains tax is applicable on such withdrawals.

B. Withdrawal after 1 year – 10% (if the capital gain in the year is above rs. 1 lakh)

2 – debt funds

The typical investment horizon is 1-4 years for such funds.

A. Withdrawal before 3 years are complete – profit on the withdrawn amount will be added to your taxable income as per applicable slabs.

B. Withdrawal after 3 years – tax at 20% of the amount withdrawn after factoring in the indexation

When NOT to withdraw mutual fund?

In case the market is fluctuating wildly then it is a common tendency to get out and sell the mutual funds. However, experts recommend that this is not the best course of action. A mutual fund helps you purchase more units when the market is in a downturn. Even the risk is minimized as market corrections would definitely happen in quick time and reverse the downward trend. In addition, there may be temporary factors like upcoming elections that might affect the movement of mutual fund NAV. However, these are not permanent and hence should not be a reason why you exit a mutual fund.

Nitin agrawal

Nitin is the co-founder and CEO at orowealth and has worked at deutsche bank for 6 years in equity structuring across their london and singapore offices. He is a MBA from IIM bangalore and has a degree in electrical engineering from IIT bombay.

2 comments

Pratik shah

This is pratik shah here, wanted a clarification on LTCG on mutual funds. As mentioned by you there will be no tax on the investments withdraw post 1 year of investment in mutual funds. But according to the recent modifications in the LTCG tax structure all investments in the equity are taxable at a rate of 10% (till 1 lakh it is exempt). I might be understanding it wrong. Can you clarify on this

Abhinay

Hi, you are right in the observation. It was a mistake on our end. We have updated the article. Thank you so much for your vigilance! Please keep visiting us and interacting with us!

Withdrawing funds

Betvictor reserves the right to cancel and re-process the withdrawal of funds in order to comply with card scheme rules. Betvictor can not be held liable for any charges incurred as a consequence of abiding by these regulations. Please note that, wherever possible, all withdrawals must be sent to the original method of deposit used to credit your betvictor account. Documents may be requested at any time to ensure the security of all our customers.

Debit and credit cards

All account holders who have made a deposit by debit or credit card can have their winnings refunded to the same card, where possible. Funds should be credited back to your card within 2-5 working days of the request being made. There is no charge for this service. Some visa or mastercard issuers do not accept these transactions and alternative methods may be used.

Fastfunds withdrawals

Betvictor has introduced the fastfunds option to our withdrawal methods. It’s a fast, convenient and secure method that gets your withdrawals into your account within 30 minutes of approval. Fastfunds is available to VISA users. Your bank must offer the fastfunds feature, not all issuing banks currently have the facility. We would recommend that you check with your bank to see if this feature is available for you.

Skrill (moneybookers), paypal and neteller

Subject to individual countries’ licence restrictions, payments back to e-wallets may be an option available. Funds should be credited back to your E-wallet within 1-3 days of the request being made. There is no charge for this service. Paypal funds should be credited in 1 day.

BACS (UK only)

Payments will only be made to a bank account in the account holder's name.

Funds will be processed the same day for withdrawals made before 3pm UK time.

You will need to complete your bank details online.

There is no charge for this service.

Telegraphic transfer/ international bank transfer

Payments will only be made to a bank account in the account holder's name.

Funds should reach your account within 3-10 working days of the request being made.

You will need to complete your bank details online.

Payments are made in the currency of your account and may incur a bank charge.

Customers with a UK bank account should use the BACS withdrawal facility described above, which is free of charge.

Withdrawals

You can make a withdrawal from your PIP at any time. Here we explain your options.

Who is your PIP held with?

Halifax

Halifax PIP

Withdrawing some or all of my PIP

You can withdraw funds from your PIP by either requesting a regular payment or a one off lump sum.

If you choose to withdraw more than your 5% tax deferred allowance per year there may be tax to pay. Depending on which option you choose when making a withdrawal there can be an excessive and artificially high tax liability. So it’s important to understand your options before making a withdrawal.

We recommend that you take a few minutes to read through our PIP guide to making withdrawals, to help you better understand the key points involved.

Things to think about before making a withdrawal

The investment you made into your PIP should be viewed over the medium to long term, at least a five to ten year period, to help meet your financial objectives. Leaving your money invested over the longer term means you’re less likely to be impacted by short-term ups and downs in the stock market.

Before withdrawing funds from your PIP it’s important to consider:

- You’ll lose any future investment growth on anything you take out of your plan.

- You may have income tax to pay when making a withdrawal.

- Your plan may receive yearly management charge (YMC) reductions which could be lost if you take money from your plan – you can find more information about YMC reductions on pages 5–7 of the key features.

- You may be eligible for a loyalty bonus in the future, which could be reduced or lost if you take money out of your plan.

- If you don’t need all the money in your PIP now, you could take a one-off withdrawal of the amount you need and leave the rest invested, or you could set up regular withdrawals from your plan.

- If you hold money in a savings account, that might be a more appropriate source of funds than cashing in some or all of your PIP.

Regular withdrawals

You can take a regular withdrawal of either a specified amount or a percentage of your investment. This will be paid directly into your bank account.

- You can make regular withdrawals on a monthly, half-yearly or yearly basis (there’s a £50 monthly, £250 half yearly and £500 yearly minimum).

- You’ll need to leave at least £100 in your plan (£1,000 for plans invested in the managed income fund) – otherwise we’ll close it, cash in the remaining units and pay you the proceeds.

Lump sum withdrawals

You can withdraw money by requesting a one-off lump sum.

- You have to take out £100 or more.

- You’ll need to leave at least £100 in your plan (£1,000 for plans invested in the managed income fund) – otherwise we’ll close it, cash in the remaining units and pay you the proceeds.

How do I make a withdrawal from my plan?

Your PIP is made up of 100 separate parts, or segments. Withdrawals can be taken by cashing in these segments in different ways – we’ve listed your options below.

Depending on the option you choose to make a withdrawal there can be an excessive and artificially high tax liability. So it’s important to understand your options before making a withdrawal.

There are five ways to make a withdrawal from your PIP:

- Option 1 – withdraw a specific amount of money using a combination of options 2 & 3

- Option 2 – take a lump sum or regular withdrawals by partly cashing in an equal amount from across all segments

- Option 3 – cash in whole segments

- Option 4 – cash in a specific number of whole segments and then partly cash in an equal amount from across all the remaining segments

- Option 5 – withdraw all of your investment and close your plan

Before making any decisions, please refer to our PIP guide to making withdrawals which provides information on each of these options, along with some worked examples.

To make a withdrawal please call us.

Alternatively please download a withdrawal form and return it to us at:

Scottish widows limited

PO box 24175

69 morrison street

EDINBURGH

EH3 1HR

Once we have all the information needed, your request will be processed within five working days. Payments are made through BACS (banks automated clearing system) and usually take 3-4 working days to be credited to your account.

What about tax?

When you make a withdrawal from your PIP a chargeable event gain can occur. Chargeable event gains normally occur when you make a profit on your investment; for example if you invest £10,000 and this grows to £15,000 then you’ve made a gain of £5,000. Chargeable event gains are taxable under income tax rules, so you might have tax to pay when you make a withdrawal.

Key points to consider

Scottish widows pay tax on the growth of underlying investments, which means that there is no personal liability to income tax at the UK basic rate, or to capital gains tax.

However, you may have income tax to pay if:

- You normally pay tax above the UK basic rate when the gain arises.

- The chargeable event gain results in you becoming a higher rate or additional rate tax payer.

- If you're unsure about the tax implications of making a withdrawal from your PIP we suggest that you speak to a financial adviser.

For more information please refer to the key features and guide to making withdrawals

Have you used your tax-deferred allowance?

You have a 5% tax deferred withdrawal allowance. This 5% withdrawal allowance is cumulative and any unused allowance can be carried forward to future years - subject to the total cumulative 5% allowance amount not exceeding 100% of the amount you have paid into your PIP. For example, with an initial investment of £30,000 you could withdraw £1,500 each plan year over 20 years.

Large withdrawals from your PIP can result in an excessive and artificially high tax liability, so we recommend that you speak to your financial adviser or tax office before taking any withdrawals in excess of the 5% allowable allowance.

The value of any tax benefits of your plan depend on your personal circumstances. Your circumstances and tax rules may change in the future.

How to get in touch

Contact us by phone or in writing

To find out the value of your plan, top up your investments, move funds, or make a withdrawal, call us.

You can also contact us in writing at:

Scottish widows limited

PO box 24175

69 morrison street

EDINBURGH

EH3 1HR

To allow us to help you quickly, please include:

- Your account, plan or policy number

- Your full name

- Your address

- How you would like us to reply and your contact details (e.G. Telephone number or email address)

- Your signature is your consent to follow your instruction.

Once we have received your letter, we aim to respond to your request within five working days. We may need to get in touch with you for additional information before completing your request. To avoid any delays, please include a daytime contact number or email address.

Scottish widows

Scottish widows PIP

Withdrawing some or all of my PIP

You can withdraw funds from your PIP by either requesting a regular payment or a one off lump sum.

If you choose to withdraw more than your 5% tax deferred allowance per year there may be tax to pay, depending on which option you choose when making a withdrawal there could be an excessive and artificially high tax liability. So it’s important to understand your options before making a withdrawal.

We recommend that you take a few minutes to read through our PIP guide to making withdrawals, to help you better understand the key points involved.

Things to think about

The investment you made into your PIP should be viewed over the medium to long term, at least a five to ten year period, to help meet your financial objectives. Leaving your money invested over the longer term means you’re less likely to be impacted by short-term ups and downs in the stock market.

Before withdrawing funds from your PIP it’s important to consider:

- You’ll lose any future investment growth on anything you take out of your plan.

- You may have income tax to pay when making a withdrawal.

- Your plan may receive yearly management charge (YMC) reductions which could be lost if you take money from your plan – you can find more information about YMC reductions on pages 4–5 of the key features.

- You may be eligible for a loyalty bonus in the future, which could be reduced or lost if you take money out of your plan. If you don’t need all the money in your PIP now, you could take a one-off withdrawal of the amount you need and leave the rest invested, or you could set up regular withdrawals from your plan.

- If you hold money in a savings account, that might be a more appropriate source of funds than cashing in some or all of your PIP.

To help you better understand the key points involved, we recommend that you take a few minutes to read through our PIP guide to making withdrawals.

Withdraw funds

It is quick and easy to withdraw funds from your FP markets trading account via our secure client portal. Funds can be withdrawn using a wide range of funding methods including credit card, debit card, payment wallets including neteller and skrill, online banking and bank wire transfer:

(AUD, CAD, CHF, EUR, GBP, JPY, PLN,SGD, USD)

Paytrust88 (local bank transfer)

(AUD, CAD, EUR, GBP, HKD, JPY, SGD, USD)

South american payment method (directa24)

Withdraw funds from your account

Withdraw funds

from your account

Simply log into the secure client portal here

Simply log into

the secure client portal

Please note, the withdrawal amount will need to be the same amount as your deposit and via the same withdrawal method. Once deposits have been withdrawn, you can use an alternative method to withdraw profits.

E.G. 1 if your initial deposit is X and was made by card deposit. The card withdrawal must be made to the same credit/debit card.

E.G. 2 if your initial deposit was made via bank wire, it would need to be returned to the same bank account and so on.

If you have used several deposit methods, you will need to withdraw the same amount you deposited back to each one, starting with any card deposits. Once card deposits have been withdrawn back to the same credit/debit card, you will make the remaining withdrawals in the order that the initial deposits were made. You can then choose any of the previously used funding methods to withdraw profits, subject to the approval of the accounts team.

FP markets does not any additional internal fees for deposits or withdrawals. However, please note payments to and from overseas banking institutions may attract intermediary transfer fees from either party which are independent of FP markets. FP markets accepts no responsibility for any bank fee and any such fees will be the responsibility of the client. Please refer to the table above for more information on our withdrawal methods.

Assistance with withdrawals

Funding issues may arise due to bank or country restrictions and clients should contact us if they experience any funding difficulties. Please contact us via live chat or email.

For more information on withdrawals and any further general advice, please visit our faqs section here.

How do I withdraw money to my bank account?

How do I withdraw money to my bank account?

By supplying your email you agree to FP markets privacy policy and receive future marketing materials from FP markets. You can unsubscribe at any time.

Quick start & resources

Markets

Tools & platforms

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

Trading info

- Iress account types

- MT4/5 account types

- Pro account

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

About us

Regulation & licence

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

- Iress account types

- MT4/5 account types

- FP markets pro account

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

* the average order execution time between the trade being received, processed and confirmed as executed by us is 38 milliseconds. As observed from our bridge provider between 01-12-2020 to 31-12-2020. FP markets was rated by investment trends as the best for quality of trade execution 2019

** terms and conditions apply.

DISCLAIMER: this material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for difference (cfds) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading cfds you do not own or have any rights to the cfds underlying assets.

FP markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A product disclosure statement for each of the financial products available from FP markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First prudential markets pty ltd (ABN 16 112 600 281, AFS licence no. 286354). FP markets is a group of companies which include, first prudential markets ltd (registration number HE 372179), a company authorised and regulated by the cyprus securities and exchange commission (cysec license number 371/18, registered address: griva digeni, 109, aigeo court, 2nd floor, 3101, limassol, cyprus. FP markets does not accept applications from U.S, japan or new zealand residents or residents from any other country or jurisdiction where such distribution or use would be contrary to those local laws or regulations.

Thank you for visiting FP markets

The website www.Fpmarkets.Com is operated by first prudential markets PTY ltd an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Read T & cs

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by FP markets or any other entity within the group.

So, let's see, what we have: how to withdraw your available funds how to withdraw your available funds here we give a step by step guide of how to withdraw available funds from your funding circle account. If you are at withdraw fund

Contents of the article

- Actual forex bonuses

- How to withdraw your available funds

- How to withdraw your available funds

- What are available funds?

- How to withdraw available funds

- Withdrawing for the first time – how to set up a...

- Withdrawing funds

- Withdrawals

- Who is your PIP held with?

- Halifax

- Withdrawing some or all of my PIP

- Things to think about before making a withdrawal

- Regular withdrawals

- Lump sum withdrawals

- How do I make a withdrawal from my plan?

- What about tax?

- Key points to consider

- Have you used your tax-deferred allowance?

- How to get in touch

- Contact us by phone or in writing

- Scottish widows

- Withdrawing some or all of my PIP

- Things to think about

- Halifax

- Everything you need to know:

- Your withdrawals

- Payment timeframe

- How to withdraw your pension

- When can you withdraw from your pension?

- DC and DB pension withdrawals

- SIPP withdrawals

- State pension withdrawals

- Can you withdraw your pension early?

- What to do with your pension when you retire

- How to withdraw money from mutual fund?

- All you need to know about mutual fund...

- The basics of mutual fund withdrawal

- Ways to withdraw mutual funds

- Points to note before mutual fund withdrawal

- 1. The current NAV

- 2. Processing time taken

- 3. Examine the lock-in period

- 4. Exit loads and applicable taxes

- Tax implications on mutual fund withdrawal

- When NOT to withdraw mutual fund?

- Withdrawing funds

- Withdrawals

- Who is your PIP held with?

- Halifax

- Withdrawing some or all of my PIP

- Things to think about before making a withdrawal

- Regular withdrawals

- Lump sum withdrawals

- How do I make a withdrawal from my plan?

- What about tax?

- Key points to consider

- Have you used your tax-deferred allowance?

- How to get in touch

- Contact us by phone or in writing

- Scottish widows

- Withdrawing some or all of my PIP

- Things to think about

- Halifax

- Withdraw funds

- Quick start & resources

- Markets

- Tools & platforms

- Trading info

- About us

- Regulation & licence

- Thank you for visiting FP markets

No comments:

Post a Comment