Trading apps that give you money to start

Best for: crypto traders you have to trade at least $100 of cryptocurrency to get the $10 bonus.

Actual forex bonuses

After you get the bonus, you can trade it or withdraw it to your bank account or paypal.

5 trading apps with free bonuses

Who doesn’t love a great bonus? We do. We’ve complied the best trading apps with free bonuses so that you can start your trading off with a bang.

Let’s have a look at the best free bonus trading apps.

1. Moomoo

Best for: US stock traders & investors

Bonus: 3 free stocks (up to $1,250)

Moomoo offers a great free bonus offer for new registrations. You can grab 3 free stocks valued up to $1,250.

2. Currency.Com

Best for: crypto traders

Bonus: up to $100

Currency.Com is a free, regulated trading app which gives you a random bonus of up to $100 USD value when you sign up, complete verification and make a deposit.

3. Coinbase

Best for: cryptocurrency enthusiasts

Bonus: $10 free bitcoin

Free bitcoin? Why not! Coinbase offers a $10 free bitcoin bonus offer to new registrations who use an invite link to sign up. The bonus is deposited into your coinbase account.

You have to trade at least $100 of cryptocurrency to get the $10 bonus. After you get the bonus, you can trade it or withdraw it to your bank account or paypal.

4. Webull

Best for: US traders

Bonus: 2 free stocks (up to $1,400)

Webull is a popular alternative commission trading app. When you deposit any amount, you will get 2 free stocks worth up to $1,400 – cool right? The difference between this bonus is the value – it’s up to a huge $1,400. Will you be lucky? Find out by grabbing your free stocks today.

You can sell the free stocks and withdraw them directly to your bank account.

Best for: anyone

Bonus: free VPN

XM is one of the world’s leading CFD trading apps. They’re currently running a neat promotion which gives you a free trading VPN – don’t miss out on it! Sign up for a free XM account today.

Summary

There are a ton of awesome free bonuses on trading apps, it’s hard to choose the best ones, but these are our personal favourites.

There’s no limit to how many bonuses you can redeem you can get, so why not try them all?

Here’s our final roundup of the best free bonus trading apps.

- Currency.Com: best overall

- Moomoo: best for advanced traders

- Coinbase: best for cryptocurrency traders

- Webull: best for US traders

- XM: best for everyone

Have you seen any other awesome free trading bonuses? Let us know in the comments!

About us

Trading apps is your trusted guide to the world of trading on mobile applications. We test and review hundreds of trading apps to bring you the best. Learn more about us on our ‘about‘ page.

The best investing apps that let you invest for free

Updated: january 4, 2021 by robert farrington

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We're proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. Thecollegeinvestor.Com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The college investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews (or even pay for a review of their product to begin with).

For more information and a complete list of our advertising partners, please check out our full advertising disclosure. Thecollegeinvestor.Com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product's website. All products and services are presented without warranty.

Investing is risky. It comes with few guarantees. The only investing guarantee I can offer is this: everything held equal, the less you pay in fees, the better your returns. And investing apps are making it easier than ever to invest commission-free.

Fees don’t have to stop you from making wise and lucrative investments. Thankfully, we live in the 21st century, and there’s never been a better time to be a small investor.

And now, in today's mobile world, investing is becoming easier and cheaper than ever. Plus, with the investing price war that's been going on, it's cheaper than ever to invest!

Here are the best investing apps that let you invest for free (yes, free). You might also check out our list on the best brokers to invest.

Bonus offer: right now acorns is offering a $10 bonus when you open a new account. Get started at acorns here and start rounding up to invest. Open an account here >>

The best investment apps for beginners

The best investment apps for beginners offer low fees and access to the types of accounts and investment products you care about most. The app you choose should suit your investment style and offer the tools you need to achieve your financial goals.

Best overall: sofi

| editor's rating | 4.8 out of 5 |

| fees | none |

| account minimum | $0 |

| consider it if. | You want an easy-to-use platform paired with rock-bottom pricing |

Why sofi made our list:

Sofi is a top pick for beginners thanks to an easy-to-use platform paired with rock-bottom pricing. You can get started at sofi invest with just $1, and there are no commissions for trades and no recurring account fees. Even the managed portfolio product, where your investments are all picked and managed for you, is free to use.

The app includes stocks and etfs listed by category, making it easy to browse potential investment opportunities. The app doesn't have the most in-depth investment research, but there is enough to get you started and guide your research off the app. You can also access investment education articles from inside the app.

As an added bonus outside of the app, sofi offers complimentary financial planning sessions for all members, among other benefits. If you are a beginner and want help putting an investment strategy together, sofi is an ideal place to start.

Best overall runner-up: ally invest

| editor's rating | 4.7 out of 5 |

| fees | none |

| account minimum | none for DIY portfolios, $100 for robo-adviser |

| consider it if. | You want easy-to-use apps paired with excellent checking and savings accounts |

Why ally invest made our list:

Beginners often do well with simple and straightforward investment platforms. Ally invest offers just that through its mobile app. You can trade stocks and etfs with no commissions; mutual fund trades will incur a $9.95 commission fee. There are no recurring fees or minimum balance requirements to worry about.

The ally app, which is also used by ally bank, is straightforward and easy to navigate. It doesn't have as many bells and whistles as some active trading platforms, but it has everything a beginner and most passive investors might need.

Best for automated investing: acorns

| editor's rating | 4.7 out of 5 |

| fees | $1 to $5 per month |

| account minimum | $0 |

| consider it if. | You want a totally hands-off investing experience |

Why acorns made our list:

Acorns is an investment app for people who know they should be investing but don't have or want to spend the time to manage it themselves. For $1 per month, acorns will take care of everything. That includes automatically investing spare change through transaction round-ups, automated transfers, and a fully automated investment plan.

The big upside of acorns is that it's so easy to use. The big downside is that there's a fee no matter what. While $1 per month doesn't sound like much, when you have a relatively low account balance, that's a big percentage. If you have a $100 balance, $1 per month is more than 10% per year. For additional accounts and features, including retirement accounts, you'll have to pay $3 or $5 per month.

Best for active trading: TD ameritrade

Why TD ameritrade made our list:

If you are new to the markets and plan to get into active trading, TD ameritrade is a good place to start. It charges no commissions for stock or ETF trades and offers multiple account platforms that align with various investment styles and goals.

When you're starting out, you'll probably feel most comfortable in the main TD ameritrade app. As your investment skills grow, you can upgrade to thinkorswim, the premier active trading platform from TD ameritrade. It has tons of useful features for active traders. Important for beginners, there's a feature to chat with an expert trader inside of thinkorswim.

Important to note: TD ameritrade has agreed to an acquisition by charles schwab. That means TD ameritrade accounts will likely turn into schwab accounts in the future. However, schwab has announced it plans to keep thinkorswim in its product lineup going forward.

Best for social investing: public

| editor's rating | 4.6 out of 5 |

| fees | none |

| account minimum | $0 |

| consider it if. | You want a social component to your investing experience |

Why public made our list:

When you're a beginner in the stock market, it can feel intimidating to research and choose stocks and other investments on your own. Public combines features from social networks like facebook and twitter with traditional brokerage features. That makes for an investment app ideal for beginners learning their way around the markets.

With fractional shares starting at $5, you can also buy into a huge number of supported companies without putting up enough cash for a full share. While it doesn't offer every popular type of investment, it covers stocks and etfs in a way that's great for newer investors or even experienced investors looking to improve their investment strategy.

Best for no commissions: robinhood

| editor's rating | 4.5 out of 5 |

| fees | none |

| account minimum | $0 for most investors, $5+ per month for premium accounts |

| consider it if. | You want to invest in a wide range of stocks and etfs |

Why robinhood made our list:

Robinhood is a pioneer in the no-commission brokerage model. It remains a solid choice for beginners, as they can invest in stocks, etfs, and options with zero commissions. Typical stock and ETF investors will be able to use robinhood with no costs at all, though premium accounts are available with more features for a monthly fee starting at $5.

Robinhood has been at the center of controversies over downtime and how some users have been able to enter extremely risky trades that they didn't understand. As with any investment app, it's important for robinhood traders to understand the risks of what they're doing so they can invest in line with their goals and avoid unexpected losses.

Best for kids: stockpile

| editor's rating | 4.5 out of 5 |

| fees | 99 cents per trade; fees for gift cards |

| account minimum | $0 |

| consider it if. | You want to invest with kids or teens |

Why stockpile made our list:

Unlike the other brokerages on this list, stockpile does not offer commission-free stock and ETF trades. But it does provide some unique features that could make its modest commission of 99 cents per trade worthwhile.

Stockpile allows fractional share investing and supports the gift of stock through gift cards, which makes it perfect for the youngest investors.

If you are a parent, grandparent, aunt, uncle, or another relative who wants to help a child in your life learn how the stock market works, stockpile is perfect for your needs. It makes it easy to gift stock and keep tabs on the account of a minor. It also makes it fun to navigate through supported stocks while educating users through "mini-lessons" that teach how to invest.

Other apps we considered

- Webull: webull is a newer commission-free investment platform. It may be a little more challenging for some newer investors to navigate but offers excellent pricing and investment tools.

- Firstrade: firstrade's web and desktop investment apps feel a little lower-tech, but its mobile app is simple and easy to navigate. It offers excellent pricing including commission-free mutual fund trades.

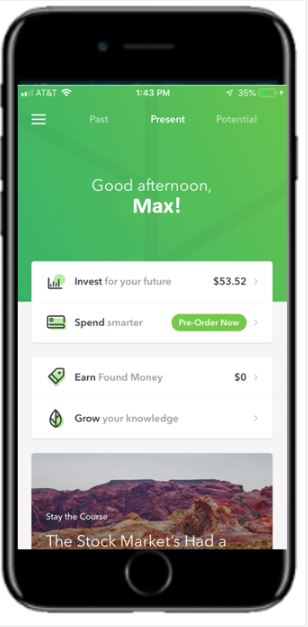

- Stash: stash is great for newer investors looking to learn how to invest and build the right mindset, but monthly $1 to $9 fees make it less appealing.

Frequently asked questions

How did we choose the best investment apps for beginners?

For beginners, it's important to choose an investment app that combines low costs with the features you care about most. Whether you're looking to build a passive portfolio of funds, an active portfolio of stocks, or any other investment strategy, there's a brokerage and investment app designed to meet your needs.

To make our selections, we focused on costs and fees, app features, types of accounts available, investment products available, and beginner-friendly features to manage your investment account on the go.

What are brokerage accounts?

Brokerage accounts are a type of account where you can store cash and investments — to use an investment app, you'll fund a brokerage account. With a brokerage, you can fund your account with cash and use that cash to buy and sell stocks, bonds, funds, and other investments supported by your brokerage.

Every brokerage has its own core features and pricing, so there is no perfect brokerage for everyone. However, anyone can find a brokerage that's a good fit for their needs.

How do brokerage accounts work?

Brokerage accounts work like checking accounts at a traditional bank in many ways. In fact, many brokerages offer checkbooks for brokerage accounts if you want one. You can add and remove funds similar to a bank, though certain types of retirement and other tax-advantaged accounts have rules around withdrawals.

Brokerages in the united states are regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA). Accounts may lose value, but assets are insured by the securities investor protection corporation (SIPC) in case your brokerage goes out of business.

Who should use a brokerage account?

Just about every single person in the US could benefit from a brokerage account. As long as you have high-interest debts paid off, putting a portion of your income into investments is a wise long-term decision.

Most brokers on this list have no recurring fees and no minimum balance. You can often get started with as little as $5 to buy your first stock or ETF.

How much should a brokerage account cost?

Brokerage accounts should be free! The best brokerages charge no recurring fees and have no minimum balance or activity requirements to avoid a monthly service fee.

In addition, most brokerages have dropped fees for stock and ETF trades, so you shouldn't pay any commissions for those types of trades.

How do I choose an online brokerage?

Your choice for online brokerage and investing apps should come down to your investment goals. If you are interested in active investing, you would want a different platform than passive investors. But in any case, it's important to review fees to make sure you're not paying for anything you plan to do regularly.

If an app supports the types of accounts you need and the types of investments you want on a platform you enjoy using, you've likely found a winner.

Eric rosenberg has over a decade of experience writing about personal finance topics, including investing. He has an undergraduate degree and MBA in finance and spent time during his MBA program managing a portion of the university of denver endowment fund. He is an expert in investments, banking, payments, credit cards, insurance, and business finance.

Can you really make money with trading apps? Your complete guide to trading apps

Online trading on mobile devices is one of the latest and biggest hypes in the financial sector right now, and the interest is increasing by the day. Still, many traders seem to be confused about mobile trading, and we hear a lot of people wondering if you can make money with trading apps.

Now, while the trading apps themselves aren’t going to make you any money, they can be used as a tool to make money with the right strategy and some basic knowledge.

So in an attempt to clear things up, we’ll walk you through what’s needed to use mobile trading apps to make money.

Please note that the most important factor when it comes to being successful is developing a great strategy, something that might have been hard to do 10 years ago. However, today you will be able to find an abundance of great trading resources and investment guides

Step one: find a trading app

Naturally, the first step of the process is to find a trading app that you will use as your trading platform. Depending on which instruments you want to trade, the apps look different, so before you pick an app, you need to decide what you want to trade.

Most of the leading trading apps today are forex trading apps which is why we suggest you pick forex trading.

Every regulated and safe forex broker in the industry offers mobile versions of their platforms so as long as you stick to the top brokers, you’ll get access to a great trading app.

Step two: learn how to trade

Making money as a trader, regardless of the market you’re focusing on requires a great understanding of the instruments as well as tried and tested trading skills.

There are several very good trading courses you can partake in, and most brokers offer different types of educational material ranging from videos and webinars to guides and ebooks. Moreover, there is a huge selection of trading books available on the market that you can learn a lot of useful skills from.

However, in our opinion, the best way to learn how to trade on a mobile app is to combine a trading course with a demo account.

A demo account is a free and risk-free version of a brokers platform, and they are often available on the trading apps as well. The purpose of a demo account is to allow you to trade under real market conditions but without the risk of losing money. It’s a great way to gain an advantage of the market and a shortcut that wasn’t available only a few years ago.

Step 3: develop a strategy and start trading

With access to a good trading app as well as basic trading skills, it’s time for you to start implementing a trading strategy. There is a range of different strategies that one can pick from depending on the instrument you’re trading, the number of funds you have available as well as the timeframe in which you want to earn money.

Also for the best possible results you should really try and develop a strategy based on your own needs and preferences.

You won’t become a rich trader overnight, but by combining the three factors we’ve mentioned above and putting in the time and dedication needed, you will be able to start making money from a trading app eventually.

Of course, all of this is technically speaking since trading is associated with high risk. In fact, as many as 80% of recreational traders lose money in the long-term so be careful.

Best forex trading apps 2021

"> updated: december 8, 2020

Forex traders need to have constant access to trading accounts and market news to take advantage of unexpected opportunities. Mobile apps are the best way to keep trading when on the move, but mobile trading also has its downsides.

To make this list of the best forex trading apps, we have included the apps that best capture the desktop trading experience. This includes advanced charts, news feeds and live market data.

- Avatrade - best forex trading app

- FXTM - best app for automated trading

- XM - fastest execution speed

- Hotforex - best app for forex analysis

- Etoro - best app for social traders

- Marketsx - most instruments to trade

- Plus500 - best for non-forex cfds

- XTB - best regulated forex broker

Best forex trading apps 2021

Last updated on 8 dec 2020

Updated 8 dec 2020

All brokers regulated

All brokers regulated

With over 200,000 active traders around the globe on the MT4, MT5, and avago platforms, and the award for best trade execution 2016 by the african finance expo, avatrade is a good partner for all types of trader. Avatrade has built its reputation on being a client-focused, dependable broker, and continues to add to that reputation with the recent addition of avaprotect to its product lineup.

With great trading conditions across forex, commodities, cryptocurrencies, etfs, bonds, and equities and boasting FSCA and ASIC regulation, avatrade is competitive with some of the best brokers in the world.

FXTM is regulated by the FCA, cysec and the FSCA in south africa and the educational material offered is first-class. By keeping the focus on beginners looking for reasonable trading conditions, the FXTM team of educators and analysts have succeeded in creating a welcoming environment for new traders. Additionally, FXTM are one of the few brokers with 24/7 support, allowing new traders to get set up on weekends or holidays.

For the absolute beginner, FXTM has a great deal of training material to help new traders get started. Materials include articles, videos, webinars and a searchable glossary of new vocabulary. This is an excellent resource and many hours can be spent covering the basics of forex trading. There is an additional set of videos that cover analysis topics, and more detail on chart reading techniques.

FXTM has an open вђњdaily market analysisвђќ section on their website where research analysts post bulletins that connect daily news items with analysis and actionable trading ideas. This can be combined with other sources to achieve a more comprehensive view of global events and the trading opportunities they represent.

The standard account has a minimum deposit of 100 USD and spreads start at 1.3 pips. FXTM also offers a cent account where the minimum deposit if only 10 USD but the spreads will be wider. If you can afford it, I would recommend starting with the standard account.

These 5 legitimate companies will give you free stocks

We’re all about freebies around here. Free gift cards? Heck yeah! Free money? Sign us up! Free stocks? Even better — they could increase in value over time!

And before you ask: yes, there is a such thing as free stocks. We know, we know. It sounds too good to be true, but you just have to know where to look — and that’s where we can help you.

Collect free stocks from these companies

We researched the best, most legitimate investment companies, apps and trading platforms that offer something for free.

Without further delay, here are our favorite companies giving away free stocks:

1. Robinhood: up to $200

Free stock value: $2.50 to $200

An investing app called robinhood will give you up to $200 worth of free stock in companies like visa, microsoft and GE, just for downloading its app and opening a free account.

Robinhood is free and easy to navigate, which is why more than 10 million people use it — including both news junkies looking to outsmart the market and people who want to carefully put a few bucks away in a long-term investment.

Plus — it’s free to buy and trade stocks, options, exchange-traded funds (etfs) and cryptocurrencies. There are no account minimums and no maintenance fees.

How to claim your free stock: sign up using this unique referral link. Once you create your account, robinhood will give you a free share of stock. The share is chosen randomly (hence why it could be worth anywhere from $2.50 to $200) and can fluctuate with the stock market.

Available via desktop, apple ios and google android.

2. Stash: $5

Free stock value: $5

Take a look at the forbes richest people list, and you’ll notice almost all the billionaires have one thing in common — they own another company.

But if you work for a living and don’t happen to have millions of dollars lying around, that can sound totally out of reach.

That’s why a lot of people use the app stash. It lets you be a part of something that’s normally exclusive to the richest of the rich — buying pieces of other companies for as little as $1.*

How to claim your free stock: when you sign up for stash through the penny hoarder, you’ll get a $5 bonus.

Available via apple ios and google android.

3. Acorns: $5

Free stock value: $5

If you’re just entering the world of stock trading, we get it: it can be quite intimidating. Start out slow(er) by investing in etfs, which are basically fractions of stock.

With the acorns micro-investing app, for example, you can connect your debit or credit card and choose to round-up your transactions to the nearest dollar. Then, acorns automatically takes your digital spare change and funnels it into etfs.

No, you probably won’t get rich investing in etfs, but it’s a great place to start. Note that acorns charges a $1 monthly fee for balances under $1 million. However, there are no minimums and no free trades.

How to claim your free stock: when you sign up for acorns through the penny hoarder, you’ll get a $5 bonus. Use that $5 to begin dabbling in etfs.

Available via apple ios and google android.

4. Stockpile: $5

Free stock value: $5

Stockpile lets you buy fractional shares of stock and etfs. It stands out from the other options on this list because you can also gift stocks to family and friends (the perfect graduation present).

Start with a $5 investment. Once you’re in, there are no monthly fees and no account minimums. However, you’ll be charged 99 cents per trade.

How to claim your free stock: sign up for a stockpile account with this referral link, and buy your first stock or e-gift of at least $10 in stock.

Available via desktop, apple ios and google android.

5. M1 finance

Free stock value: $10

Do you know what the “1” in M1 stands for? One account. The goal of M1 is to simplify your finances, so you can invest, borrow and spend money all from one spot.

Now, let’s focus on the investing part. M1 allows you to build a custom portfolio of stocks and funds. Or, if you’re not feeling as adventurous, you can opt for a pre-built expert portfolio. It also lets you invest in fractional shares of companies (if you don’t want to fork over nearly $2,000 for amazon stock) and will let you opt into automated investing, which lets M1 take over with free stock trading.

Basically, M1 gives you a ton of options, and they’re all free. You’ll need to deposit at least $100 to get started.

How to claim your free stock: to get this free $10 to put toward stock, you’ll need a friend. Once you’ve funded your account, click “refer and earn” to find a unique referral link to send to your friends. Once they’ve funded their accounts, you’ll get $10.

Available via desktop, apple ios and google android.

Carson kohler ([email protected]) is a personal finance writer at the penny hoarder. She casually dabbles in etfs.

Best stock trading apps

The best stock trading apps combine low costs and useful features

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/beststocktradingapps-767c084f5ccb44f7a974ff04d9f5264b.jpg)

Some investors are happy putting their money into a boring fund and letting it simmer for the long term. Others are more interested in taking a hands-on approach to managing their money with active stock trading. Whether you buy and sell once in a while or want to enter a trade or more every day, there’s definitely a stock trading app for you.

The best stock app for your unique needs depends on your experience and trading goals. After reviewing fees, tradable assets, and more across several brokerages, we rounded up the best stock trading apps for both beginner and advanced investors to consider.

Best stock trading apps of 2021

| stock trading app | why we picked it | |

|---|---|---|

| TD ameritrade | best overall | open account |

| fidelity | best for beginners | open account |

| webull | best free app | open account |

| sofi | best for learning about trading | open account |

| tastyworks | best for options trading | open account |

| ally | best with banking products | open account |

TD ameritrade mobile: best overall

TD ameritrade gets the top spot because it offers something for everyone and excellent pricing. The basic TD ameritrade mobile app is great for beginners and casual stock traders who want to manage their investments on the go. Advanced and expert traders can use the upgraded thinkorswim mobile app for a professional-style experience.

You get access to both apps with a TD ameritrade brokerage account, which has no minimum balance requirements and no fees to trade stocks and etfs. The fully-featured apps combine important account management features and trading features regardless of which one you choose. Thinkorswim also includes a live CNBC feed inside the app.

In november 2019, charles schwab announced that it is acquiring TD ameritrade. The acquisition is expected to close by the end of 2020. Once closed, it’s likely that TD ameritrade trading platforms and charles schwab trading platforms will be combined into one.

Key features

- App names: TD ameritrade mobile and thinkorswim

- Account minimum: no minimum deposit required

- Fees: $0 commission for online stock, ETF, and options trades, but there is a 65 cent flat fee per options contract; $25 for broker-assisted trades; $49.99 for no-load mutual funds; additional fees may apply

- Tradable assets: wide range, including stocks, options, etfs, mutual funds, bonds, and more

- Account types: supports standard, retirement, education, and other types of accounts

Beginner and advanced mobile apps

Support for a wide range of assets and account types

Extensive research resources

Uncertainty of future after schwab acquisition

Top 10 money earning apps – best of 2020

Best apps to make money fast

I never thought twice about earning money from my phone. Fast-forward to the age of smartphones, and it started to make sense. Today, it’s amazing how easy it is to earn some side cash from the palm of my hand!

If you’re looking for new ways to make extra money, you’ll want to check out the top 10 money earning apps.

There are more than 10 apps that can earn you money but I wanted to point out the best apps to make money fast.

You can also check out the highest paying apps to make sure you’re making the most money for your time.

This list includes money making apps for android phones and IOS.

I personally earn money from the top 5 apps in this list and will also share with you 5 other legitimate money-earning apps through people I’ve interviewed and testimonials.

Out of all the online earning apps I have used and researched, these are the winners.

If you’re looking for more ways to make money, definitely check out our most popular article 30 legitimate ways to make money from home from people who are doing it today.

If you want to stay updated on ways to make money from home be sure to subscribe to our mailing list as I often get companies reaching out to me about available remote positions and I only share these with my subscribers. Click here to subscribe.

This post contains affiliate links, which means I may receive a small commission at no cost to you, if you make a purchase through a link.

The top 10 money earning apps that make you the most money

Download each of one these legit apps to make money from your phone! I truly believe that these are the best apps to make money fast, even as a busy mom.

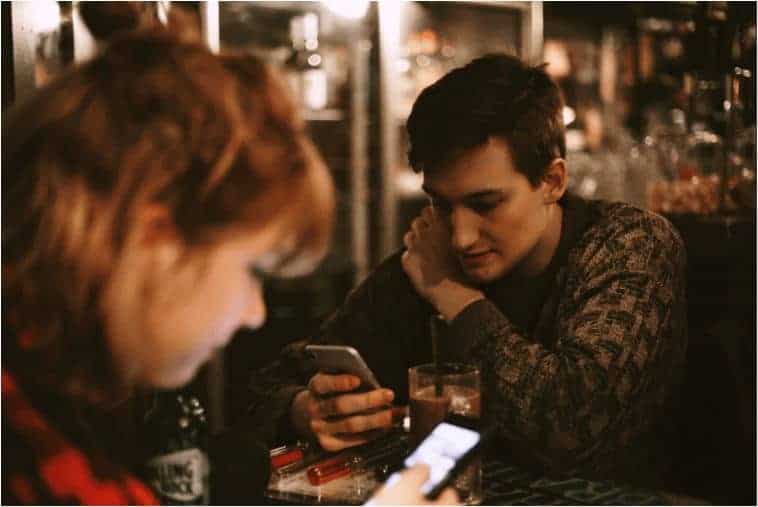

1. Ebates

Ebates is one of my favorite online best earning apps because you get cash back for things you’re going to buy anyway, as long as you do it through their app. How? Stores pay ebates a commission for sending customers to their store. Ebates splits that commission with you, so you both win.

I’ve made over $500 from shopping online through ebates and referring friends.

When I know I want to purchase something and I don’t need it right away, I buy it online (if shipping is free) to take advantage of my ebates perks.

I have a nice check of $265 on the way! This is the best android app for earning money, and it’s now available on IOS!

If you use my link to sign up with ebates, you get $10 when you spend at least $25 online.

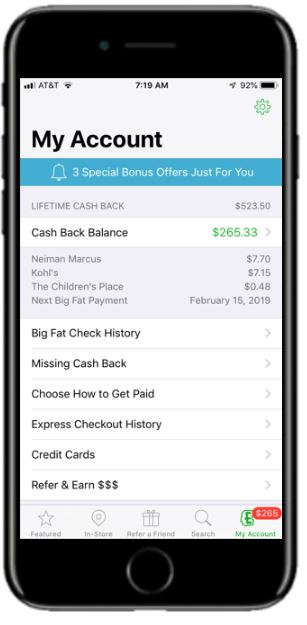

2. Dosh

Dosh is a must-have cash back app, I absolutely LOVE it. It’s all passive income since all you need to do is link your credit/debit card and it will automatically give you cash back when you shop, eat, travel, and more at participating local and national merchants.

I forgot I had this app, and I was out to dinner with my husband for our anniversary and received this email after we paid:

And this keeps happening when I use my credit card at participating merchants!

I’ve made $75 with this app from using my card at participating stores and referring friends.

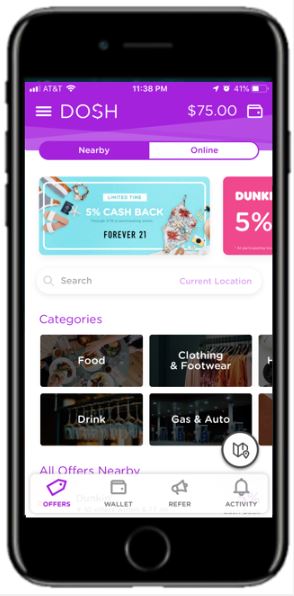

3. Ibotta

Ibotta is another app that allows you to get cashback for items you buy anyway. I LOVE this app.

- Download the ibotta app and before you shop, add offers on products you normally purchase anyway.

- Buy the products you selected at any participating store. Don’t forget your receipt!

- Redeem your offers by taking a photo of your receipt. Ibotta will match the items you bought to the offers you selected and give you the cash!

Your cashback will be deposited into your ibotta account within 48 hours.

I’ve made $105.53 so far from a combination of shopping and referring friends. If you tell your friends to sign up they get $10 and you get $5!

4. Acorns

Acorns is a neat money earning app to get you to start micro-investing. It rounds up your purchases to the nearest dollar and invests the difference on your behalf.

For example, if you buy a coffee for $1.75, acorns will round it up to $2.00 and automatically invest $.25 in “smart portfolios”.

You can link as many credit or debit cards as you like and put your “change” to work for you in a low-cost ETF.

I recently downloaded this app and made over $50 without even noticing. There are no fees associated with withdrawing, just keep in mind that it may be more of a tax implication for the following year.

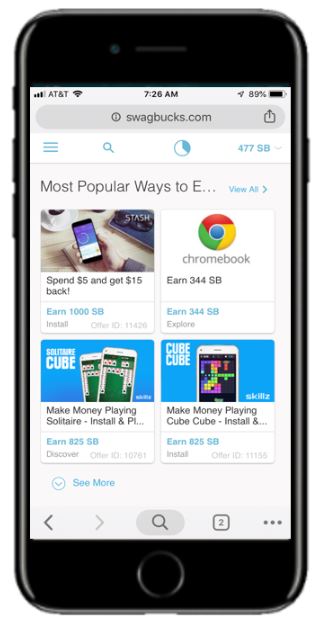

5. Swagbucks

Swagbucks is another app for earning money that will pay you to take surveys, watch videos, search the web, refer friends and test products. This app won’t make you rich but it’s an easy way to make some extra money.

I’ve recently downloaded this app and I’m at 477 SB (swagbucks). If you sign up with my referral link you’ll already beat me with the $5 sign-up bonus. I could get a $5 amazon gift card (1 SB = 1 cent) with this amount but I plan on doing the things mentioned above which will help me earn $50-$100 a month.

If you want to make more money with surveys check out survey junkie and prizerebel, these are the only survey sites I recommend.

6. Healthywage

Healthywage is a money earning app supported by the government to incentivize people to lose weight by putting their own money at risk with the potential to earn up to $10,000!

- Start with the healthywage prize calculator. Enter how much weight you want to lose, how long you’ll take to lose it, and how much you want to bet a month for that period of time.

- The calculator determines your prize amount, up to $10,000. You can play around with the calculator until you get your desired prize amount.

- Sign up and agree to pay the monthly amount for the duration of the challenge.

- Achieve your weight-loss goal, and win your prize!

If you don’t hit your goal, your money goes to support healthywage, including prizes for others who achieve their goals.

7. Instacart

Do you need to make money fast? Consider instacart and get paid for doing something you do almost every week, grocery shopping.

People pay for convenience every day, and that does not exclude the daunting task of grocery shopping.

Instacart has capitalized on this need for those who want to leave the shopping to someone else, it opens a door for you to fulfill the orders, make the delivery, and get PAID.

You can easily make $100 or more per day in just 3 hours. This is one of the best apps to make money fast.

I did a full review of instacart and you can check it out to learn more, or you can just apply to become a shopper here.

If you like instacart, you’ll definitely love shipt. It’s pretty much the same thing with an average pay of $22 per hour. Click here to apply to become a driver!

8. Seated

So, here’s the thing, when I became a stay-at-home mom we’ve had to cut costs on going out to eat. I need every incentive to go out to eat and thanks to seated, I get paid when I eat out, if I make a reservation through their app.

The payment is in gift cards and you can typically make $10 to $50 each time you book a reservation. I know someone who eats out a lot and made $200 in one month using this online earning app.

- Book an available reservation on the app and choose your preferred reward (lyft, amazon, or starbucks gift card).

- Dine out and upload a photo of your receipt to verify what you’ve spent.

- Your selected reward code will be delivered digitally in the app within 24 hours of each successful reservation.

Restaurants are always looking for ways to get new loyal customers, that’s why they are willing to give $10-$50 in hopes they become a loyal customer. The seated app is such a great idea.

9. Foap

Foap is a money earning app that photographers can use to make money from their phone.

You do not have to be a professional photographer, but it would be good to learn how to take quality photos from your smartphone.

The foap app has something called missions where companies will tell you what kind of photo or video they are looking for and if you decide to take on that “mission” and your photo/video is selected, you could win hundreds of dollars!

Simply follow the mission brief and upload one or multiple videos or pictures that reflect what kind of imagery the company is after.

10. Trim

Want to negotiate your comcast bill for a lower price, lower your car insurance, and find additional ways to save money? Let the trim app do it for you! Trim acts as your personal financial assistant.

Link your bank to the trim app and they will analyze your spending and work to save you money in every area.

Money saved is money earned.

Trim makes money by taking 25% of the money they save you, so you know they are working extra hard to save you money.

More things to do online (beyond installing a money earning app)

Don’t stop with just installing the best apps to make money fast–take these steps to maximize your earnings!

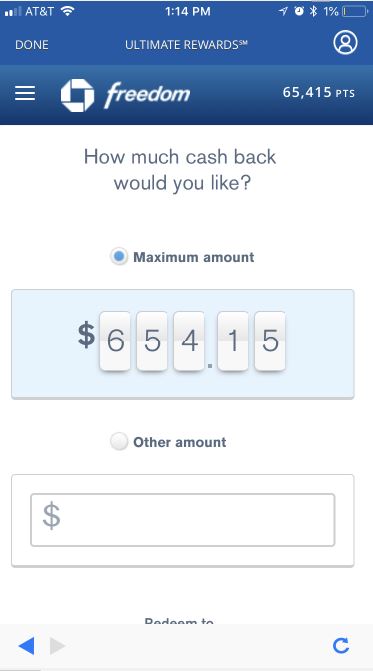

Make money by spending it using a credit card

Do you spend money on groceries, bills, clothes, gas, and entertainment? Of course you do, so why not get a percentage of that money back?

My husband and I use one credit card on everything because the more you spend the more points you accumulate. We use the chase freedom credit card and had over $500 last year that we used on christmas (cash and gift cards) and we’re back up to $654.15.

This is FREE money. What’s the catch? Pay your bills on time. That’s the only way this works. As long as you don’t spend what you can’t afford, you win. This is a great form of passive income.

If you sign up for the chase freedom credit card as we did you get a $150 bonus if you spend $500 within the first 3 months. That should be easy to do if you use it on everything like us.

Sign up for research studies – up to $400 per study

You can make quick easy money by participating in research studies. Below are the best-paid companies to sign up for

Make money with your amazon alexa and/or google home

What do you think about the top 10 money earning apps?

Do you use any of these top 10 money earning apps? If so, how have they worked for you? I hope you enjoyed this list and found that these really are some of the best earning apps for android in 2020.

I’m always looking for ways to make money and save, so if you want to stay in the know make sure you subscribe to our mailing list. If you’re looking for more ways to make money DEFINITELY check out our ultimate list of 30 ways to make money from home.

The best investment apps for beginners

The best investment apps for beginners offer low fees and access to the types of accounts and investment products you care about most. The app you choose should suit your investment style and offer the tools you need to achieve your financial goals.

Best overall: sofi

| editor's rating | 4.8 out of 5 |

| fees | none |

| account minimum | $0 |

| consider it if. | You want an easy-to-use platform paired with rock-bottom pricing |

Why sofi made our list:

Sofi is a top pick for beginners thanks to an easy-to-use platform paired with rock-bottom pricing. You can get started at sofi invest with just $1, and there are no commissions for trades and no recurring account fees. Even the managed portfolio product, where your investments are all picked and managed for you, is free to use.

The app includes stocks and etfs listed by category, making it easy to browse potential investment opportunities. The app doesn't have the most in-depth investment research, but there is enough to get you started and guide your research off the app. You can also access investment education articles from inside the app.

As an added bonus outside of the app, sofi offers complimentary financial planning sessions for all members, among other benefits. If you are a beginner and want help putting an investment strategy together, sofi is an ideal place to start.

Best overall runner-up: ally invest

| editor's rating | 4.7 out of 5 |

| fees | none |

| account minimum | none for DIY portfolios, $100 for robo-adviser |

| consider it if. | You want easy-to-use apps paired with excellent checking and savings accounts |

Why ally invest made our list:

Beginners often do well with simple and straightforward investment platforms. Ally invest offers just that through its mobile app. You can trade stocks and etfs with no commissions; mutual fund trades will incur a $9.95 commission fee. There are no recurring fees or minimum balance requirements to worry about.

The ally app, which is also used by ally bank, is straightforward and easy to navigate. It doesn't have as many bells and whistles as some active trading platforms, but it has everything a beginner and most passive investors might need.

Best for automated investing: acorns

| editor's rating | 4.7 out of 5 |

| fees | $1 to $5 per month |

| account minimum | $0 |

| consider it if. | You want a totally hands-off investing experience |

Why acorns made our list:

Acorns is an investment app for people who know they should be investing but don't have or want to spend the time to manage it themselves. For $1 per month, acorns will take care of everything. That includes automatically investing spare change through transaction round-ups, automated transfers, and a fully automated investment plan.

The big upside of acorns is that it's so easy to use. The big downside is that there's a fee no matter what. While $1 per month doesn't sound like much, when you have a relatively low account balance, that's a big percentage. If you have a $100 balance, $1 per month is more than 10% per year. For additional accounts and features, including retirement accounts, you'll have to pay $3 or $5 per month.

Best for active trading: TD ameritrade

Why TD ameritrade made our list:

If you are new to the markets and plan to get into active trading, TD ameritrade is a good place to start. It charges no commissions for stock or ETF trades and offers multiple account platforms that align with various investment styles and goals.

When you're starting out, you'll probably feel most comfortable in the main TD ameritrade app. As your investment skills grow, you can upgrade to thinkorswim, the premier active trading platform from TD ameritrade. It has tons of useful features for active traders. Important for beginners, there's a feature to chat with an expert trader inside of thinkorswim.

Important to note: TD ameritrade has agreed to an acquisition by charles schwab. That means TD ameritrade accounts will likely turn into schwab accounts in the future. However, schwab has announced it plans to keep thinkorswim in its product lineup going forward.

Best for social investing: public

| editor's rating | 4.6 out of 5 |

| fees | none |

| account minimum | $0 |

| consider it if. | You want a social component to your investing experience |

Why public made our list:

When you're a beginner in the stock market, it can feel intimidating to research and choose stocks and other investments on your own. Public combines features from social networks like facebook and twitter with traditional brokerage features. That makes for an investment app ideal for beginners learning their way around the markets.

With fractional shares starting at $5, you can also buy into a huge number of supported companies without putting up enough cash for a full share. While it doesn't offer every popular type of investment, it covers stocks and etfs in a way that's great for newer investors or even experienced investors looking to improve their investment strategy.

Best for no commissions: robinhood

| editor's rating | 4.5 out of 5 |

| fees | none |

| account minimum | $0 for most investors, $5+ per month for premium accounts |

| consider it if. | You want to invest in a wide range of stocks and etfs |

Why robinhood made our list:

Robinhood is a pioneer in the no-commission brokerage model. It remains a solid choice for beginners, as they can invest in stocks, etfs, and options with zero commissions. Typical stock and ETF investors will be able to use robinhood with no costs at all, though premium accounts are available with more features for a monthly fee starting at $5.

Robinhood has been at the center of controversies over downtime and how some users have been able to enter extremely risky trades that they didn't understand. As with any investment app, it's important for robinhood traders to understand the risks of what they're doing so they can invest in line with their goals and avoid unexpected losses.

Best for kids: stockpile

| editor's rating | 4.5 out of 5 |

| fees | 99 cents per trade; fees for gift cards |

| account minimum | $0 |

| consider it if. | You want to invest with kids or teens |

Why stockpile made our list:

Unlike the other brokerages on this list, stockpile does not offer commission-free stock and ETF trades. But it does provide some unique features that could make its modest commission of 99 cents per trade worthwhile.

Stockpile allows fractional share investing and supports the gift of stock through gift cards, which makes it perfect for the youngest investors.

If you are a parent, grandparent, aunt, uncle, or another relative who wants to help a child in your life learn how the stock market works, stockpile is perfect for your needs. It makes it easy to gift stock and keep tabs on the account of a minor. It also makes it fun to navigate through supported stocks while educating users through "mini-lessons" that teach how to invest.

Other apps we considered

- Webull: webull is a newer commission-free investment platform. It may be a little more challenging for some newer investors to navigate but offers excellent pricing and investment tools.

- Firstrade: firstrade's web and desktop investment apps feel a little lower-tech, but its mobile app is simple and easy to navigate. It offers excellent pricing including commission-free mutual fund trades.

- Stash: stash is great for newer investors looking to learn how to invest and build the right mindset, but monthly $1 to $9 fees make it less appealing.

Frequently asked questions

How did we choose the best investment apps for beginners?

For beginners, it's important to choose an investment app that combines low costs with the features you care about most. Whether you're looking to build a passive portfolio of funds, an active portfolio of stocks, or any other investment strategy, there's a brokerage and investment app designed to meet your needs.

To make our selections, we focused on costs and fees, app features, types of accounts available, investment products available, and beginner-friendly features to manage your investment account on the go.

What are brokerage accounts?

Brokerage accounts are a type of account where you can store cash and investments — to use an investment app, you'll fund a brokerage account. With a brokerage, you can fund your account with cash and use that cash to buy and sell stocks, bonds, funds, and other investments supported by your brokerage.

Every brokerage has its own core features and pricing, so there is no perfect brokerage for everyone. However, anyone can find a brokerage that's a good fit for their needs.

How do brokerage accounts work?

Brokerage accounts work like checking accounts at a traditional bank in many ways. In fact, many brokerages offer checkbooks for brokerage accounts if you want one. You can add and remove funds similar to a bank, though certain types of retirement and other tax-advantaged accounts have rules around withdrawals.

Brokerages in the united states are regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA). Accounts may lose value, but assets are insured by the securities investor protection corporation (SIPC) in case your brokerage goes out of business.

Who should use a brokerage account?

Just about every single person in the US could benefit from a brokerage account. As long as you have high-interest debts paid off, putting a portion of your income into investments is a wise long-term decision.

Most brokers on this list have no recurring fees and no minimum balance. You can often get started with as little as $5 to buy your first stock or ETF.

How much should a brokerage account cost?

Brokerage accounts should be free! The best brokerages charge no recurring fees and have no minimum balance or activity requirements to avoid a monthly service fee.

In addition, most brokerages have dropped fees for stock and ETF trades, so you shouldn't pay any commissions for those types of trades.

How do I choose an online brokerage?

Your choice for online brokerage and investing apps should come down to your investment goals. If you are interested in active investing, you would want a different platform than passive investors. But in any case, it's important to review fees to make sure you're not paying for anything you plan to do regularly.

If an app supports the types of accounts you need and the types of investments you want on a platform you enjoy using, you've likely found a winner.

Eric rosenberg has over a decade of experience writing about personal finance topics, including investing. He has an undergraduate degree and MBA in finance and spent time during his MBA program managing a portion of the university of denver endowment fund. He is an expert in investments, banking, payments, credit cards, insurance, and business finance.

So, let's see, what we have: who doesn't love a great bonus? We do. We've complied the best trading apps with free bonuses so that you can start your trading off with a bang. At trading apps that give you money to start

Contents of the article

- Actual forex bonuses

- 5 trading apps with free bonuses

- 1. Moomoo

- 2. Currency.Com

- 3. Coinbase

- 4. Webull

- Summary

- About us

- The best investing apps that let you invest for...

- The best investment apps for beginners

- Best overall: sofi

- Best overall runner-up: ally invest

- Best for automated investing: acorns

- Best for active trading: TD ameritrade

- Best for social investing: public

- Best for no commissions: robinhood

- Best for kids: stockpile

- Other apps we considered

- Frequently asked questions

- How did we choose the best investment apps for...

- What are brokerage accounts?

- How do brokerage accounts work?

- Who should use a brokerage account?

- How much should a brokerage account cost?

- How do I choose an online brokerage?

- Can you really make money with trading apps? Your...

- Best forex trading apps 2021

- These 5 legitimate companies will give you free...

- Collect free stocks from these companies

- Best stock trading apps

- The best stock trading apps combine low costs and...

- Best stock trading apps of 2021

- TD ameritrade mobile: best overall

- Top 10 money earning apps – best of 2020

- Best apps to make money fast

- The top 10 money earning apps that make you the...

- 1. Ebates

- 2. Dosh

- 3. Ibotta

- 4. Acorns

- 5. Swagbucks

- 6. Healthywage

- 7. Instacart

- 8. Seated

- 9. Foap

- 10. Trim

- More things to do online (beyond installing a...

- Make money by spending it using a credit card

- Sign up for research studies – up to $400 per...

- Make money with your amazon alexa and/or google...

- What do you think about the top 10 money earning...

- The best investment apps for beginners

- Best overall: sofi

- Best overall runner-up: ally invest

- Best for automated investing: acorns

- Best for active trading: TD ameritrade

- Best for social investing: public

- Best for no commissions: robinhood

- Best for kids: stockpile

- Other apps we considered

- Frequently asked questions

- How did we choose the best investment apps for...

- What are brokerage accounts?

- How do brokerage accounts work?

- Who should use a brokerage account?

- How much should a brokerage account cost?

- How do I choose an online brokerage?

No comments:

Post a Comment