Tickmill withdrawal problem

Tickmill offers more than 10 different payment methods for money transactions.

Actual forex bonuses

You can use the method which you want in order to do the withdrawal or deposit. Electronic methods like neteller are very fast (in our withdrawal test only 1 day duration). Generally, tickmill confirm your payment within 1 working day. In conclusion, tickmill is a trusted forex broker who threats the funds of clients very well. As we showed in our screenshot the payments are processed within one day. There are many payment methods for everyone. And the biggest advantage is you do not pay any fees for withdrawals. All in all, we can recommend trading with tickmill. It is very easy to do the withdrawal of profits.

Tickmill withdrawal proof & tutorial

Many traders are worried about withdrawals with forex brokers because on the internet you will find a lot of claims about bad brokers. But with tickmill you will trade with a serious and trusted forex broker. How to do a withdrawal with tickmill? – on this page, we will show you an exact tutorial on how to do it and our personal withdrawal proof with tickmill. Inform you about the methods and processes.

Tickmill withdrawal proof with neteller

As you see in the picture above the withdrawal with tickmill is done in less than 3 days (1 day on our example). The following steps will show you exactly how to do a withdrawal and in the next section, we will go in detail.

How to do the withdrawal:

- Be sure your trading account is fully verified

- Select your trading account

- Select the payment method

- Choose the amount and submit the withdrawal

- You will get an email when the withdrawal is processed

There are no withdrawal fees

(note: get 5% commission rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Step 1: an verified trading account is important

Tickmill is a regulated forex broker who is acting under strict laws and rules. The company has to verify your identity and trading account in order to confirm your payments. Also, trading with real money is not possible with a non verified account under the FCA or cysec regulation. The broker will always ask you for the real documents.

The documents will be verified in a few hours. Just upload a picture or scan of the required identity check. After you did it you can use all the functions of the tickmill trading account and very fast withdrawal.

Step 2: select your tickmill trading account

To do the withdrawal you have to select your trading account. You directly see your account balance that you can withdrawal.

Select your tickmill trading account for the withdrawal

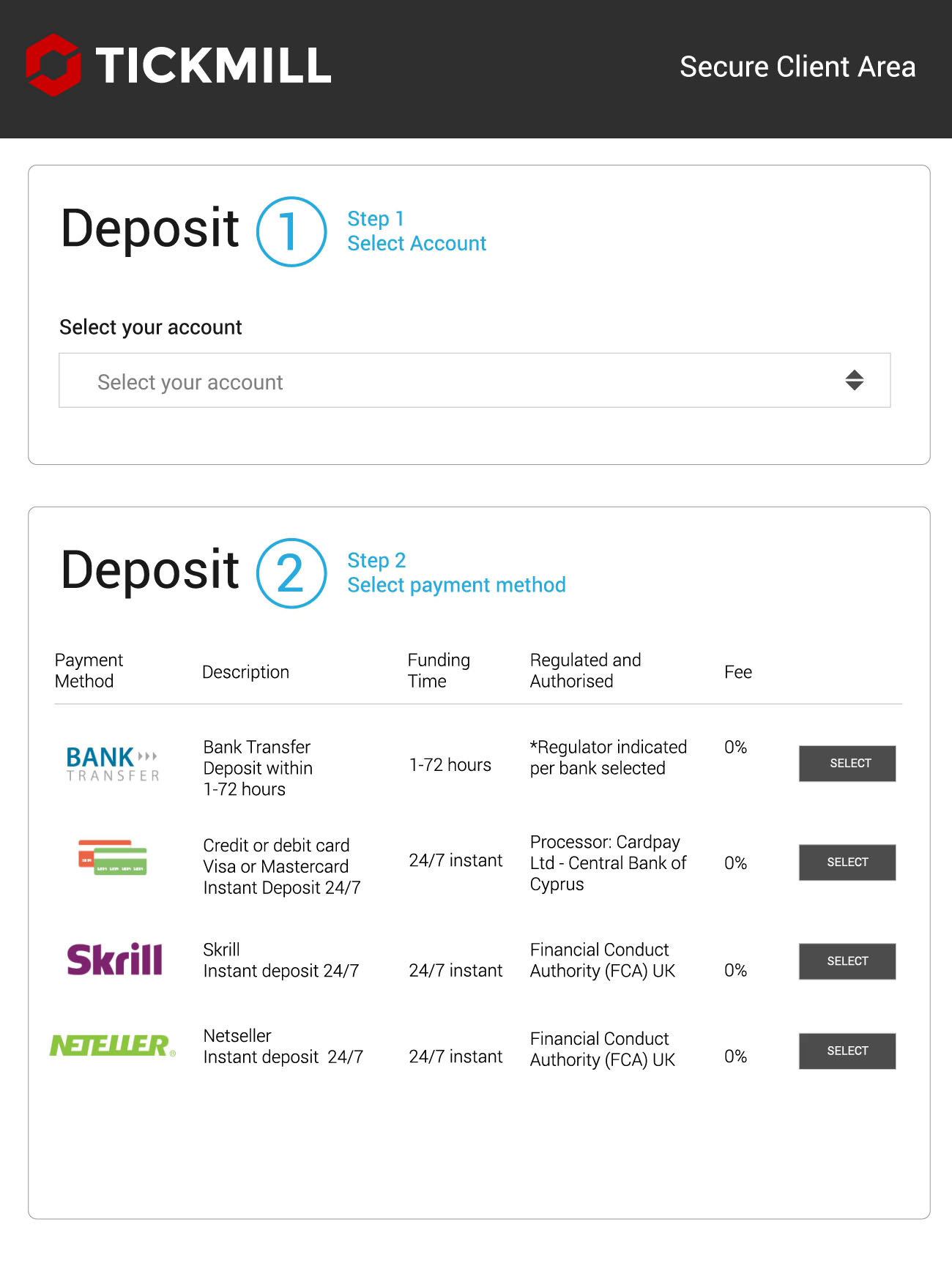

Step 3: select the payment method

Tickmill offers more than 10 different payment methods for money transactions. You can use the method which you want in order to do the withdrawal or deposit. Electronic methods like neteller are very fast (in our withdrawal test only 1 day duration). Generally, tickmill confirm your payment within 1 working day.

The payment methods are depending on your country of residence and the regulation.

Select your payment method

Payment methods:

- Bank transfer

- Credit cards

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Nganluong.Vn

- Qiwi

- Webmoney

Step 4: choose the withdrawal amount

Now you have to insert your payment details (see the picture below) and the withdrawal amount. Then you can submit the payment. Make sure that the data is correct. If the data is not correct the broker will inform you.

Insert your tickmill withdrawal methods

Step 5: wait till the withdrawal is processed

As mentioned before tickmill will inform you with an email when the withdrawal is processed. The normal withdrawal duration is 1 working day. The support team is working monday till friday. On the weekends the withdrawals are not processed.

Problems with the withdrawal

Sometimes there can be a problem with your withdrawal. That is why we repeat it: you should verify your account correctly in order to trade real money and do correct withdrawals. In addition, tickmill can require additional documents from you. It is very important to follow the advice.

Moreover, the withdrawal details should match exactly your personal data. You can not a withdrawal to a foreign bank account or credit card. Tickmill only processes withdrawals to payment accounts which are belonging to your identity. This is a very important safety feature. Even hackers can not steal your money.

To do a successfull withdrawal you should:

- Verify your account

- Insert the right personal data and payment details

- Follow the brokers instructions

Conclusion: tickmill withdrawals are working without a problem

In conclusion, tickmill is a trusted forex broker who threats the funds of clients very well. As we showed in our screenshot the payments are processed within one day. There are many payment methods for everyone. And the biggest advantage is you do not pay any fees for withdrawals. All in all, we can recommend trading with tickmill. It is very easy to do the withdrawal of profits.

The advantages:

- More than 10 different payment methods

- Payments are processed within one working day

- No fees for your payments.

- Minimum withdrawal amount only $10

As we showed on this website the withdrawals with tickmill are working very fast and without any fees. (5 / 5)

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Honest tickmill forex broker review – scam or not?

| Review: | regulation: | min. Deposit: | forex pairs: | spreads: |

|---|---|---|---|---|

| (5 / 5) | FCA (UK), cysec (EU), FSA (SE) | 100$ | 50+ | 0.0 pips + 1$ commission per 1 lot |

Are you looking for real experiences and a critical test to the tickmill broker? – then you are exactly right on this page. As traders with more than 7 years of experience in the financial markets, we have tested the provider in detail for you with real money. Learn more about the conditions and seriousness of the broker. Is it really worth it to invest in forex broker tickmill money or not? – inform yourself in detail now.

Official website of tickmill

What is tickmill? – the company presented

Tickmill is an international broker for trading derivatives financial forex and cfds. The main headquarters are located in london: 1 fore street, london EC2Y 9DT, united kingdom. For many years, the company has proven itself to offer traders professional trading on the best terms. Also, there are branches in cyprus and seychelles.

According to the website, tickmill should provide an excellent trading experience with the cheapest spreads and commissions, which we will take a closer look at in the following test. Furthermore, the broker shines with many different awards in the industry and allows his traders to pursue any trading strategies.

Facts about tickmill:

- Forex broker from great britain (london)

- Made by traders for traders

- Specialized in forex trading with special conditions and lowest spreads

- Worldwide branches in different countries

- 114 billion average trading volume per month

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Is tickmill a regulated forex broker?

Regulations and licenses are important for traders and brokers so that a trusting relationship can be created. When a broker applies for a license, certain criteria and requirements must be met. A violation of the policy means in most cases a direct loss of the license.

Tickmill is even regulated several times. The broker has licenses from the FCA (UK), cysec (cyprus) and FSA (seychelles). It gives us a positive direct impression. European traders have to trade with the english license (FCA) or cysec license, which brings further benefits. On the other side, international traders have to choose the FSA license.

The safety of customer funds

The security of client funds should be given to a trusted broker. In online investments, trust in a broker is very important. Many smaller brokers with no license and experience sometimes handle money incorrectly. In order to avoid such a fraud, one should pay attention to certain criteria in broker selection.

Tickmill insures client funds separately from corporate funds to manage. For this purpose, the barclays bank is used, which operates internationally and is always liquid. In addition, client funds will be protected in the unlikely event of a bankruptcy or financial dilemma of tickmill with the financial services compensation scheme (FSCS) of up to £ 75,000. This is a very high value compared to other brokers, which usually have no deposit guarantee or a smaller one.

Regulation and safety:

- Regulated by FCA, cysec, and FSA

- Customer funds are managed by barclays bank

- High deposit guarantee of 75,000 GBP (FCA license)

- Safe website communication

Review of the tickmill conditions for traders

Tickmill is a true NDD broker (non-dealing desk) with well-known liquidity providers. It is traded herewith excluded conflict of interest between broker and customer. This is a big advantage as it is not a market maker.

There are more than 84 instruments available on the market. The broker is constantly trying to expand its offer and, for example, integrate new assets such as bitcoin. The offer is quite manageable and the tickmill tries to specialize with its offer on currencies (forex). Cfds (contracts for difference) are also available for commodities, government bonds or stock indices. Individual shares cannot be traded on this broker, so here’s a small smear in the rating that must be made.

Tickmill is characterized by its extremely tight spreads and low commission. We have compared many providers in recent years and tickmill is and remains the cheapest. The typical spread in the EUR/USD is only 0.00 – 0.01 pips small and the commission is a maximum of $ 2 per traded $ 100,000 (1 lot) in the pro account. Traders with higher deposits can even benefit from even smaller commissions ($ 1).

In addition, there are no requotes, as it is a true forex broker. This means you will always be able to open and close a position for the next best price in the market. The liquidity is always given by the various liquidity providers and the slippage is also very low on business news.

The best conditions:

- Very low spreads starting at 0.0 pips

- The extreme low commission in pro and VIP account is a huge advantage

- Pay only 2$ (pro) or 1$ (VIP) commission per 1 lot traded

- Fast execution and high liquidity

- More than 50 forex pairs

- Max. Leverage of 1:500

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Tickmill trading platform test

As a trading platform, the metatrader 4 is offered to you. This is a proven and worldwide trading platform for private and professional traders. The platform is available for the browser (web), desktop (download), android (app) and ios (app). With the metatrader, you can easily and flexibly access the markets of tickmill from anywhere in the world.

The metatrader is perfect for any trader who wants to earn sustainable money in the markets. Even with small capital can be traded, because there are micro lots available. In addition, there is always a guaranteed execution at tickmill and no partial execution.

Professional charting and analysis

A trading platform should be user-friendly and flexible. This can offer the metatrader. Several chart settings for the technical analysis are adjustable. Use the well-known candlesticks for an even better analysis of the markets. Tickmill also provides educational tutorials for beginners.

In addition, use free indicators, which are adjustable for your personal strategy. The metatrader comes with a lot of tools after installation. If you do not have enough, you can add additional tools to metatrader 4. Use self-programmed indicators for every chart.

Facts about the platform:

- Flexible and user-friendly trading platform

- Available for every device

- Free indicators

- Very many different analysis tools

- Automated trading possible

Available for any device

In addition, tickmill offers education material and webinars for its clients.

Trading tutorial: how do forex and CFD trading work?

Forex is the largest market worldwide. Daily several trillions of dollars are being transacted in this market. That is why it is also highly liquid and interesting for beginners and experienced traders. Tickmill offers over 60 different currency pairs. Including many currencies from emerging markets. This is a huge advantage for those who are looking for an exotic currency pair for trading. For currencies, you can bet on falling or rising prices. Buy one currency and sell the other currency from the currency pair. The difference in the price is well written as profit.

Cfds are also offered. They are leveraged derivatives that can be traded on a variety of values. For the opening of a CFD trade, you do not buy directly the underlying asset, but only the contract to that value. This has several advantages because you can act with a high level of leverage and very easily place short trades. The broker rounds off the offering with cfds on stock indices, commodities, precious metals, and bonds.

Invest in falling or rising prices and secure the position with a stop loss and take profit. These are limits that automatically close your position. Since the calculation is sometimes confusing, tickmill offers a forex calculator. With this calculator, you can determine your risk and the position size in just a few seconds.

Tickmill offers fast order execution and high liquidity

Tickmill has several data and data centers around the world. In metatrader 4 you can choose the best access (server) for you. The broker is also characterized by its low latency. With the connection to the live server in london I have a latency of under 30 ms. If that is still too slow, you can rent a VPS server.

Personally, we had no problems with the order execution. The website also emphasizes that there are no requotes. Even with large position sizes 30 lot + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill is a non-dealing desk broker, which has a similarity to an ECN broker. The difference between NDD and ECN is that the broker still sits between the market and clients. An obligation to pay additional funds can be excluded.

Use a VPS-server for the best connection

The provider allows any strategies and automatic programs. Expert advisors (eas) can run 24 hours a day automatically through a VPS server at tickmill. The latency is very low and the price from $ 22 a month too.

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

Tickmill automated trading is possible

Tickmill allows every strategy and also automated programs. As mentioned above you can rent a VPS server very cheap. In connection with the metatrader 4 it works without problems and the setup is very simple. Program automatic programs for your trading or use provided trading systems. Today, more than 50% of the order executions are made automatically in the forex market.

Here you can see again that tickmill is a serious NDD broker. Dubious brokers forbid strategies or automatic programs. In addition, tickmill has no limit for stop-loss and take-profit brands. So it can be traded very small movements. Due to the low fees, it is worthwhile to scalping and day trading.

VPS-server allows you trading 24/7 on tickmill.

How to open your free tickmill account:

Another plus point for tickmill is the simple depot opening. According to the website, you need a maximum of 3 minutes for this and we can confirm this personally. Fill in the form with your personal data. Then you get direct access to the customer portal of tickmill. In addition, your email must be confirmed.

After that, the account has to be verified. Thanks to the strong regulations, brokers are not allowed to pay out to unverified customers. Even after the first deposit, the account must be verified urgently. Since our account is a bit older, we can not tell you whether a deposit without verification is possible.

For verification, it is sufficient to upload your ID and proof of address. The broker confirms the documents within 24 hours (weekdays). For even faster verification, contact support and say that your documents have been uploaded. Then you have access to the full functions of the trading account.

Unlimited demo account for beginners at tickmill

The free demo account of tickmill is perfect for beginners or experienced traders. It is unlimited and without expiration time. Traders can trade the markets with virtual assets and simulate real trading. Experienced traders learn new strategies or test new markets. For the demo account, no deposit or verification is necessary.

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

3 different account types – which one you should choose?

Tickmill offers 3 types of accounts for traders. Interesting for us is only the pro and VIP account. From our experience, it is not worth the classic account to open, because the fees are accordingly higher than in the pro account. In the following text, we will inform you about the terms of each account.

As described above, the fees are sensationally low. Read the table below for more details. The pro accounts commission is only $2. So you pay only a fee of $4 per completed trade. When you open a VIP account, you save another 50%, because you only pay $2 for each completed trade. Even with our code (under the registration button) can save another 5%.

Tickmill gives you the exact interbank spreads from 0.0 pips. Trading is smooth and fast processing is provided by european servers. Upon request, an islamic account without swaps (interest) can be created.

| Classic | pro | VIP | |

|---|---|---|---|

| min. Deposit: | 100$ | 100$ | 50.000$ |

| spreads: | 1.6 pips | 0.0 pips | 0.0 pips |

| leverage: | max. 1:500 | max. 1:500 | max. 1:500 |

| commission: | 0$ | 2$ per 1 lot traded | 1$ per 1 lot traded |

Info: tickmill also offers its european customers to sign up as a professional trader and keep the high leverage of 1: 500.

The VIP account is the best choice for high volume forex traders

High-volume traders or companies can open a VIP account. From a deposit of 50,000$, you have even cheaper fees. You then only pay $ 1 per traded lot. This makes $ 2 per completed trader. These low costs can generate an increased profit. In addition, stop orders and limit orders are allowed close to market prices. This is a very good offer in comparison.

In summary, tickmill account types offer a great opportunity for every trader. The terms are very good and much better than other forex brokers. No matter if you want to trade the markets with small or big capital, tickmill is the right decision for beginners or advanced traders.

Compare the terms between tickmill and other brokers yourself. Tickmill is always the cheapest and has, therefore, made the first place in my forex broker comparison. With no other broker, you get so cheap trading fees without conflict of interest.

Review of the deposit and withdrawal of tickmill

At tickmill you can deposit and withdraw using the same methods. Bank transfer, credit card, skrill and neteller are available. On the payment and deposit, there are no fees.

My tests and experiences have shown that the payouts are very fast and the money is sent on the journey within 24 hours. You will receive a confirmation email after payment when the payout has been made.

How high is the minimum deposit? – trading with a small amount of money

The minimum deposit is regularly 100$/€. You can trade in the trading platform as low as 0.01 lot. This is a very small position size and the risk is in most cases only a few cents high. The provider is thus broadly positioned because even larger investors can trade without problems at this broker.

Tickmill deposit and withdrawal methods

Questions and tips for your transactions:

- Open your free account at tickmill. Complete your data and verify the account. After verification, all functions of the broker are available to you.

- How much money should you deposit? – this is entirely up to the goals and ideals of the trader. Some trading strategies, for example, are not feasible with a small sum of € 100. Be sure to test the demo account before making your first deposit.

- Are my transactions with tickmill safe? – yes, tickmill works only with the best banks and verified payment providers. You can check all transactions in the customer portal.

- Also, open several trading accounts in the customer portal. Thus it is possible to use different accounts for different strategies. An internal transfer takes only a few minutes.

New: now use sofortüberweisung (klarna) or paysafecard to capitalize your account even faster.

Is there negative balance protection?

The negative balance of an account is very feared by many traders. And this is also very justified. For some brokers, traders in the past have been able to build up debt or negative balance through extreme market conditions, which had to be balanced.

At tickmill there is no additional funding and you are thus protected against a negative balance.

With tickmill you cannot lose more money than your deposit.

Tickmill service and support for traders

One of the last important points in this review is trader support and service. Tickmill offers support in more than 10 different languages (also africa, asia, india, thai clients). From our experience, the broker employs international employees who exclusively look after every customer.

Support is available to customers 24 hours a week, 7 days a week. The support is provided by chat, phone or email. A trader should not lack anything here. My tests showed that the support is always fast and reliable!

Tickmill presented itself in different countries, for example at the world of trading in frankfurt. The broker had his own stand there and sought direct contact with his clients. Service is one of the most important things for traders and tickmill shows confidence and seriousness.

To further improve its service, well-known and professional traders are invited to hold webinars or other information sessions. Well-known names are giovanni cicivelli or mike seidel. The saying “by traders for traders” also applies here. Tickmill tries to give its customers the best performance combined with good service.

In summary, the support from tickmill is very good and professional. Our personal concerns were always resolved very quickly and we can make a clear recommendation here. Overall, the overall package is rounded off with a great service.

| Support: | available: | phone number: | special: |

|---|---|---|---|

| phone, chat, email | 24/5 | +44 (0)20 3608 6100 | webinars, 1 to 1 support, events |

Conclusion of my review: tickmill is one of the best forex brokers

My experience and tests show on this page that tickmill is a very good broker. He gets from us a 5-star rating. We recommend this forex broker with a clear conscience. Tickmill offers an offer for every type of trading.

With the world’s cheapest fees, the broker is currently topping any competitor. The trading experience is unique with this broker and you save a lot of money on the order execution. For every trader who trades forex, this is the right provider.

If you have further questions, contact support by phone or chat. International employees are ready to help you.

Advantages:

- UK regulation and high customer safety

- The cheapest forex broker of the world

- No requotes and high liquidity

- The best execution

- Good service and support

- The best conditions for forex traders

- Very low trading fees

Disadvantages:

- No stocks for trading

Tickmill is the best forex broker in the world because of the cheap trading fees and good execution. (5 / 5)

Read our other articles about tickmill:

Question: what's the withdrawal conditions of tickmill $30 no deposit bonus?

Withdrawal conditions of tickmill $30 no deposit bonus

You cannot withdraw the bonus amount 30 USD, but you can withdraw profits made in the bonus account.

After 90 days from the first day of account opening, the bonus account will be suspended for trading.

The bonus account will have then another 30 days to withdraw the profit.

Here are the requirements to withdraw profits from the bonus account.

- The profit amount you can withdraw is from 30 USD to 100 USD.

- Profit withdrawal can be made only once.

- You must have completed account verification.

- Open a live MT4 account (besides the bonus account) and deposit $100.

Once you made a withdrawal from your bonus account, the bonus account will be disabled and no further trading will be possible.

You can find the full terms and conditions of the promotion in the page here.

Tickmill

Post tags

FSA regulated forex broker with superior trading conditions.

Related

Related faqs

Features

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

Deriv MT5 - how to subscribe/copy signals on the platform?

Liteforex MT4 and MT5 now available for macos

Superforex's millisecond execution for scalping trade

Deriv trading guide - deposit and withdrawal methods and conditions

MT5 update - deriv's new trading servers with lower spreads

Vantagefx largely reduces crypto CFD spreads (BTC, BCH, ETH, LTC)

All forex brokers

All crypto-currency exchanges

Latest article

MTN money payment is available for rwanda

Deposit your superforex account with MTN money.

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Traders trust now offers HKD, SGD, CZK, ZAR, RUB, NOK, and PLN currency pairs.

Interviewing the top forex trader who won the hotforex contest

What strategy has this FX trader chosen to win the contest?

What's the most profitable forex currency pairs?

The most profitable currency and metal trades of 2020.

Make a deposit to yadix MT4 with perfect money

Transfer fund from perfect money to yadix MT4, get an extra 5% equity bonus with the coupon code.

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

Direct online bank transfer deposit is available for traders of south africa.

Deriv MT5 - how to subscribe/copy signals on the platform?

Here is a manual of deriv MT5 signals for both subscribers and providers.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Tickmill reviews

286 • great

Write a review

Write a review

Reviews 286

Strugglling trader to find a reliable broker, just go for tickmill

In my case, this broker is best in terms of reliability, exacution speed, zero spread option account, prizes, withdrawals and deposits. It is just instance. From turkey, you might not find better broker among large companies as this. I highly recommend tickmill syc for especially traders from turkey who struggles to find reliable broker. By the way, I witdrawed my money using bank wire (direct bank transfer), it was in my bank account in one day. Thank you tickmill.

Easily claim for refund with mr joe…

Easily claim for refund with mr joe msgs on tele gram joeboss1limited reliable person

Please introduce MT5

I have been trade on tickmill flatform

I have been trade on tickmill flatform, its good, fast excution and low spread

All sense awesome :)

Very good.

Great I love it and I want it better…beutifull

Great I love it and I want it better than all the other one that I have experience

They clearly indicate that they have…

They clearly indicate that they have 0.1 pip spread for forex trading. They are lying. Spread are so wide that it’s impossible for those scalper and day trader and maybe swing trader as well to earn more despite all of your time and efforts and strategies and plans you’ve made. It seems that taking our money is their initial motive. Switch to other broker. This is useless.

All great so far

All great so far. Deposits cleared same day, customer support is excellent and fast while the most important trading experience is supreme as spreads are low and liquidity high even in some exotic pairs

Credit where credit's due.

5 months and.

No problem with deposit, withdraw or transfer between accounts.

No extraordinary spreads or mismatching price/movemens etc.

Great client support, fast feed backs for any kind of questions.

Looks like my last station for now..

Wonderfull broker

Wonderfull broker. Recomended 100%. After working 2 years with them. Couldnt find one issue with there systems attention or connection.

Well done.

Note: only need to add more bank account so they can support more banks arround the world

Tickmill review

Tickmill

Leverage: 1:30

Regulation: FCA, FSA, cysec

Min. Deposit: 100 US$

Platforms: MT4, webtrader

Found in: 2014

Tickmill licenses

- Tickmill UK ltd - authorized by FCA (UK) registration no. 717270

- Tickmill ltd seychelles - authorized by FSA (seychelles) registration no. SD008

- Tickmill europe ltd (ex vipro markets ltd) - authorized by cysec (cyprus) registration no. 278/15

- Tickmill asia ltd - authorized by labuan FSA registration no. MB/18/0028

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

- What is tickmill?

- Awards

- Is tickmill safe or a scam?

- Leverage

- Accounts

- Fees

- Market instruments

- Deposits and withdrawals

- Trading platform

- Customer support

- Education

- Conclusion

What is tickmill?

Tickmill is a new player among the brokers and online trading world since the company established in 2014 with its headquarter in london, UK as well as offices in seychelles. Tickmill strives to innovate a unique trading experience to its clients while understanding traders’ rights as the major part of the trade, for this purpose company, continuously facilitates trading conditions.

Indeed, the broker develops rapidly and their yearly achievements are quite impressive. Recently tickmill management responsibilities expanded, since additional part to “tickmill family” been added in the name of a tickmill europe ltd (ex vipro markets ltd).

| Pros | cons |

|---|---|

| fully regulated broker | conditions vary according to regulation and entity |

| globally recognized and multiple awarded broker | no 24/7 support |

| standard and pro trading conditions | |

| good costs and commissions | |

| excellent support, learning and research tools |

10 points summary

| �� headquarters | UK |

| ��️ regulation | FCA, FSA, cysec |

| �� instruments | 62 currency pairs, cryptocurrencies, bonds, cfds and precious metals, stock indices |

| �� platforms | mt4, webtrader |

| �� EUR/USD spread | 0.3 pips |

| �� demo account | available |

| �� base currencies | USD, GBP, EUR |

| �� minimum deposit | 100 USD |

| �� education | professional education center with trading blog |

| ☎ customer support | 24/5 |

Awards

Tickmill as a new company has grown rapidly throughout only a few years so that the broker has been recognized by industry publications already, which is definitely great for the building of a successful portfolio.

Along with that tickmill constantly runs a range of fascinating promotions, which helps to boost trading and enhancing even beginning traders’ possibilities.

Is tickmill safe or a scam?

When it comes to defining whether tickmill or any other broker is a legit and safe broker, we definitely check on the registration where the broker operates and applicable regulatory obligations that oversee the forex trading industry.

| Pros | cons |

|---|---|

| regulated broker with good record | additional offshore entity |

| FCA license and overseeing | |

| negative balance protection | |

| global expand and cysec license with european cross border authorization |

Is tickmill legit?

Tickmill is a multiply regulated broker is various jurisdictions, thus considered a safe broker to trade with. Tickmill trading name of a tickmill UK ltd and tickmill ltd seychelles regulated as a securities dealer.

The broker authorized and regulated by two major UK financial conduct authority and by the financial services authority of seychelles, hence either entity includes strict regulations. Besides, tickmill now grows to asia region as well and establishes its entity to cover the proposal.

In addition, newly added to the company line tickmill europe ltd (ex vipro markets ltd) is authorized and regulated by the cyprus securities and exchange commission (cysec) and is a member of the investor compensation fund (ICF).

Customer protection

To ensure security and transparency of transactions tickmill keeps clients’ funds in segregated accounts with trusted financial institutions, as per FCA regulations. In addition, clients are covered by the FSCS with investments up to £50,000.

Leverage

Being a UK and european based regulated broker tickmill follows strict guidelines set by the european authority ESMA. A recent update from the european regulator set a limitation towards maximum offered leverage levels, as ESMA recognized a potential risk in case very high leverage is used.

- Clients of tickmill europe may use leverage up to 1:30 for forex products, 1:5 for cfds and 1:10 for commodities.

- International traders since tickmill serves entity through seychelles and other entity as well, so the clients with the opened account under this jurisdiction may enjoy high level of leverage.

Accounts

Tickmill clients can benefit from the various types of accounts with quite competitive trading conditions. Tickmill contends attractive packages and a new way of trading with low market spreads, no requotes, transparency and innovative trading technology. There are 3 main account types in tickmill’s proposal.

| Pros | cons |

|---|---|

| fast account opening | none |

| standard account | |

| commission based pro account | |

| islamic account | |

| account base currencies USD, GBP, EUR |

Account types

There are 3 main account types in tickmill’s proposal, where you can choose either account based on spread only classic account or with commission per trade pro account. The third account is designed for high-volume traders and is named VIP account where conditions are tailored and defined as per agreement.

Additionally, islamic or swap-free account, been added to the broker features recently too. These accounts comply with the sharia law, which has exactly the same trading conditions and terms, but there is no swap or rollover interest on overnight positions, that is against the faith.

How to open account at tickmill

As we already see by the account offering, there are different price modes according to the account type you choose. Besides, fee conditions always vary according to the regulatory rules authority impose and broker obliges to. So be sure to verify specific conditions as well. Here we will check a brief of spreads and commission charges that are defined by the account type.

| Pros | cons |

|---|---|

| options between spread account or commission account via pro account | none |

| low CFD fees and stock fees | |

| good standard account spreads | |

| no hidden costs |

Our find on trading fees

For a better understanding of the tickmill pricing model and spread see the table below, yet as mentioned before according to the type of account trader will enjoy lower costs along with some commission per trade. In the tale we compare standard spread conditions, while pro accounts are based on the commission of 2 per side and interbank spreads from 0 pips.

The overnight fee should be considered as a cost as well, e.G. EURUSD swap for long position is -11.742 while for short is 6.693 US$.

You can also compare tickmill trading fees to another popular broker forex CT.

Comparison between tickmill fees and similar brokers

| asset/ pair | tickmill fees | GO markets fees | XM fees |

|---|---|---|---|

| EUR USD | 0.3 pips | 1.2 pips | 1.6 pips |

| crude oil WTI | 4 | 1.9 | 5 |

| gold | 20 | 1.4 pip | 35 |

| inactivity fee | yes | yes | yes |

| deposit fee | no | no | no |

Trading instruments

Tickmill europe ltd is fully licensed to provide the investment services of agency only execution which deliver high-grade trading instruments 62 currency pairs, cryptocurrencies (opportunity to trade CFD on bitcoin, with margin 20% and 0 commission per side, per 1 CFD).

Stock indices, bonds, cfds and precious metals, with a minimum deposit requirement of only 25$, fluctuating spreads from 0.0 pips, some of the lowest commissions in the industry and no requotes, delays or interventions policy.

Deposits and withdrawals

For the deposit or withdrawal options broker using convenient methods with perform payments with ease and diverse.

Deposit options

Payment options including popular bank transfers, credit/ debit cards, E-wallets neteller, fasapay, unionpay, dotpay, nganluong. Vn (only for clients of the tickmill ltd seychelles) with available currencies USD, EUR, GBP, PLN.

| Pros | cons |

|---|---|

| fast digital deposits | conditions may vary according to entity rules |

| no internal deposit fees or withdrawal fees | |

| multiple account base currencies EUR, USD, GBP |

What is the tickmill minimum deposit?

The minimum allowed deposit is 100$, which is a fantastic opportunity for the trader of even very small size, in reverse 10$ is set for withdrawals which is good as we see in our tickmill review.

Withdrawals

All money manipulation withdrawals, deposits or requests are submitted via your online account area. While tickmill process withdrawals within 1-2 business days as per regulatory obligations.

Moreover, at tickmill a zero fee policy is employed, where no charges or fees applicable to monetary transactions. All deposits from 5,000$ also including zero fee policy and all fees up to 100$ will be covered.

Trading platforms

Like most brokers the broker using as mainstay trusted and well-tried MT4. Trading platform available on desktop or tablet, in web or on the go with a smartphone. As well, though many among the brokers do not allow stop and limit orders placing close to market prices, tickmill allows so, so it is another good point in tickmill’s proposal.

| Pros | cons |

|---|---|

| MT4 and webtrader | no alternative platform or proprietary software |

| copy trade, social trading and technical indicators | |

| no restrictions on strategies | |

| fast execution | |

| available in various languages |

Web platform

Web platform is very useful to any size of the trade since does not require any installations, but is reachable right from your browser. Yet, this platform is rather limited with tools and drawing instruments so for comprehensive analysis you would definitely need a desktop version.

Desktop platform

It is fact that every platform is different even you trade metatrader4, as it is a broker decision what to include and propose in its software. Good news that tickmill platforms have been enhanced with the span of useful tools including:

- Autochartist – powerful technical analysis tool with automatic recognition feature

- Myfxbook autotrade – allows following of the strategies developed by the successful trader

- One click trading – trading through eas (by the company statistics about 63% of the executes are placed by algorithms and eas)

- Tickmill VPS – keeps eas and signals active even while the trader is offline

- Forex calendar – plugging market insights and news

- Forex calculators – displays currency converter, margin calculators, etc.

Tickmill striving to reach success trading among their client, hence they do not impose restrictions on profitability and allows all trading strategies including hedging, scalping and arbitrage. Nevertheless, be sure to verify conditions with particular entity regulatory restrictions as those may apply.

Mobile platform

Customer support

Also good to consider customer support, where tickmill shows a professional team available around the clock and supporting international languages accessible via live chat, email, and phone lines in various regions including the UK and international as well.

Yet, customer service isn’t available during the weekends, so you can leave your request via the contact form to be advised.

| Pros | cons |

|---|---|

| 24/5 support | no 24/7 client support |

| relevant answers | |

| live chat, international phone lines and email |

Education

Another good point to note in tickmill proposal and offering is established learning center along with professional trading blog where traders can find recent updates, various educational materials and educational programs designed to develop skills and knowledge.

Online webinars, live market analysis, technical analysis, regularly held seminars and traders community of minded traders all is a very good level and available for all.

| Pros | cons |

|---|---|

| education programs free trading signals and research tools | none |

| seminars, webinars and video lessons | |

| market outlook and research | |

| trading blog |

Conclusion

Overall, tickmill inviting clients with their attractive features such as a low minimum deposit (only 25$), technical solutions, a great range of instruments and interesting promotional campaigns. Moreover, the company’s strive to achieve targets quickly and effectively while posing tickmill as a high-tech and trustable forex broker, either to start or to gain new apex with.

The fact that the company been established only in 2014 and until now became one of the industry progress which stand in the leaders’ row, definitely means a lot. Also considering the fact, that company recently grow by establishing a branch of tickmill europe ltd, which been done by the purchase of vipro markets ltd.

Thus, tickmill should be strongly considered while choosing the broker with whom a trader or investor will start his journey to the financial markets.

Nevertheless, it is always good to know your opinion about tickmill which you may share in the comment area below.

Global provider of FX and CFD brokerage services tickmill has announced that it has sponsored the kyrenia triathlon team at the IRONMAN austria, one of the most exciting races in the world. Known to be one of the greatest challenges of endurance that triathlon has to offer, IRONMAN austria took place on 7th july 2019.

Tickmill as a relatively new player among the brokers that offers its services 2014 but already showed its significant impact on the trading industry by the number of clients and gains they report. The rapid development of tickmills’ trading environment recently brings the fantastic achievement of a record increase in net profits consolidated for 3.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

So, let's see, what we have: how to do a withdrawal on tickmill and how long does it take? ✔ methods and tutorial for traders in 2021 ➜ read more about it at tickmill withdrawal problem

Contents of the article

- Actual forex bonuses

- Tickmill withdrawal proof & tutorial

- How to do the withdrawal:

- Step 1: an verified trading account is important

- Step 2: select your tickmill trading account

- Step 3: select the payment method

- Step 4: choose the withdrawal amount

- Step 5: wait till the withdrawal is processed

- Problems with the withdrawal

- Conclusion: tickmill withdrawals are working...

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Honest tickmill forex broker review – scam or not?

- What is tickmill? – the company presented

- Is tickmill a regulated forex broker?

- The safety of customer funds

- Review of the tickmill conditions for traders

- Tickmill trading platform test

- Professional charting and analysis

- Trading tutorial: how do forex and CFD trading...

- Tickmill offers fast order execution and high...

- Use a VPS-server for the best connection

- Tickmill automated trading is possible

- How to open your free tickmill account:

- Unlimited demo account for beginners at tickmill

- 3 different account types – which one you should...

- The VIP account is the best choice for high...

- Review of the deposit and withdrawal of tickmill