Tickmill no deposit

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Actual forex bonuses

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Welcome account

Experience one of the best trading environments in the industry risk-free with our $30 welcome account.

A special welcome to the world of trading

and our superior services

Jump-start an exciting trading journey with tickmill and explore our world-class services with the $30 welcome account.

New clients have the opportunity to trade with free trading funds, without having to make a deposit. The welcome account is very easy to open and the profit earned is yours to keep.

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Your perfect start

with tickmill

NO RISK

PROFITABLE

- The “welcome account” campaign is held by tickmill ltd (FSA SC regulated).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill ltd (FSA SC regulated).

- The welcome account is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- European union citizens cannot apply for a welcome account.

- Expert advisors (eas) are not allowed on welcome accounts.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 14 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved. Login details will be sent automatically to the email address provided in the registration form. Please note that these credentials may only be used to create a welcome account, not to access the client area.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- New live MT4 trading account should not be connected to any other promotions (e.G. Rebate campaign).

- After a deposit is made to a live MT4 account, the client should send an email to funding@tickmill.Com and request a transfer of profit from the welcome account to the live MT4 account. Transfer of profits should be requested to the same trading account where an initial deposit was made.

- If initial deposit was made to rebate promotion trading account, transfer of profit should be requested to another live account which is not designated for the rebate promotion.

- It is not allowed to make third party deposits and tickmill reserves the right to cancel bonus at any time upon detecting third party payment.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 tickmill ltd account holder (FSA SC regulated) has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

$30 no deposit forex bonus by tickmill

Who grants it? Actively present in asia, the middle east and africa, tickmill is a no-dealing-desk forex and CFD broker that holds a license with UK’s financial conduct authority. It also operates a unit registered in the seychelles.

End date : 31 december 2017

Who can get it? All new clients of tickmill, who open a special welcome account (existing clients cannot apply for a such an account). It has identical trading conditions to the live ECN pro account type and is available for trading for 90 days from the day of opening. Once 90 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 30 days to claim the earned profit.

Keep in mind that a client may open only one welcome account and this offer is not available in USA, north korea, iran, indonesia, nigeria, lesotho, pakistan, bangladesh, ghana and kenya. Besides, no deposits can be made to the welcome account.

What’s the catch ? The bonus amount cannot be withdrawn or transferred from the welcome account. What is more, the maximum profit is $100 and in order to use it for trading purposes, one has to deposit at least $100.

A minimum of $30 and a maximum of $100 of the profit earned can be transferred from the welcome account to a live MT4 trading account (classic, ECN pro or VIP account type with minimum deposit of $100).

Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

Additional information on trading conditions : tickmill offers trading on the popular metatrader 4 platform. Trading conditions on the welcome account are identical to the ones on ECN pro account: leverage up to 1:500, tight variable spreads averaged 0.2 pips and a commission of $4 / lot (round trip).

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | PLN , USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | via alternative methods |

| currencies | EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | EUR , PLN , GBP , USD |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | during 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

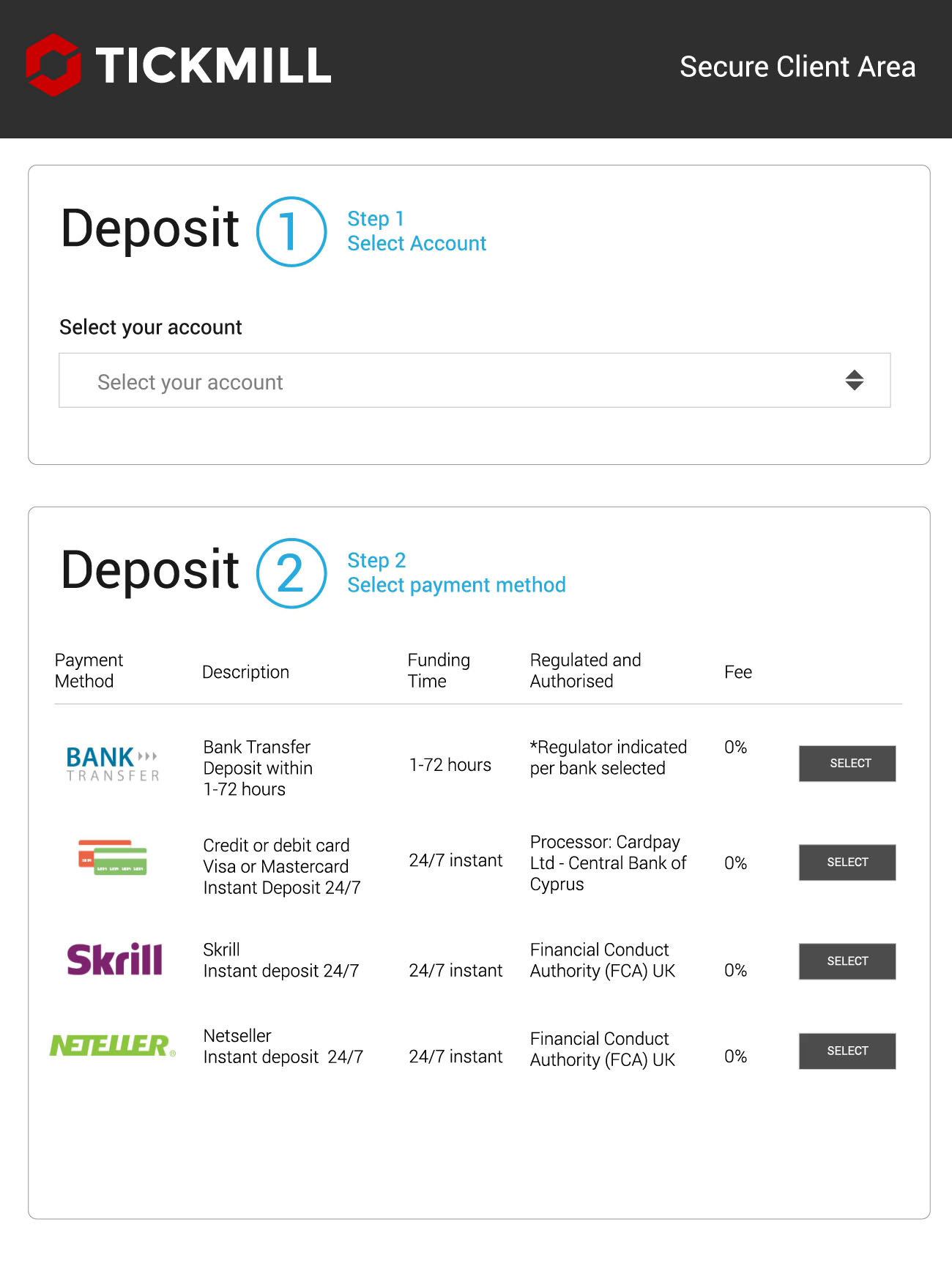

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to [email protected] .

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

Forex & cfds

Futures

TRADING CONDITIONS

Forex & cfds

Futures

TRADING ACCOUNTS

Forex & cfds

Futures

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

ABOUT US

SUPPORT

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ. Authorised and regulated by the financial conduct authority. FCA register number: 717270.

Clients must be at least 18 years old to use the services of tickmill UK ltd.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading cfds or our other products and seek advice from an independent adviser if you have any doubts. Past performance is not indicative of future results. Please refer to the summary risk disclosure.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill.Com review – claim your $30 tickmill no deposit bonus

As you know, we like to spread our capital to several brokers. At the moment, we have a maximum of $5000 deposit with any one broker at any time. It’s not a lot that we deposit per account but we rather spread our eggs all over the place. Maybe one day we will increase our deposits per broker but for now it’s $5000 limit per broker. Recently we came across a broker that has received good reviews all over the internet and we decided to check it out. So we opened our brand new live forex account with tickmill.Com. And after trading for several weeks with tickmill, we figure it’s time to write a tickmill.Com review and share with you our experience with tickmill.

Tickmill.Com review – fast execution and tight spreads. Impressive so far!

Who is tickmill.Com?

Firstly, tickmill.Com was founded in 2007 and it offers wide range of trading vehicles from forex pairs to precious metals to stocks and even bonds. At first glance, tickmill.Com does not give us too much confidence because of it’s registered address. It’s address is…

Trop-X securities exchange building

3 F28-F29 eden plaza

eden island, mahe, republic of seychelles

…YIKES! Was our reaction when we first saw this corporate address. However, we have dealt with supposedly reputable brokers with 1st world country address that sucks so we decided to investigate a little more into tickmill.Com

Tickmill.Com review – why did we decide to open a live trading account with tickmill.Com?

Tickmill.Com review – good reviews prompted us to open an ECN pro account with tickmill.Com

Like most traders, we have been burnt before by scam brokers. And we learned our lesson well. One way we combat this is by limiting our account to $5000 max per broker. Another way is we look at reviews from different sources to make sure that the broker is good. And once we have decided that the broker is good through reviews, we will start with a small account and slowly increase our deposit gradually on a weekly basis as we trade. If we continue to make a profit and we are happy with the spread, we continue adding (like a weekly savings plan) until we have a $5000 deposit before we look for a new broker to trade with.

The main thing that gave us confidence with tickmill.Com is the general good reviews from various review sites.

“to be honest as a newbie , trading with ECN broker like tickmill is a new experience for me. Because i am usually trade with fixed spreads broker that provide cent lot trading. I heard rumors if in ECN brokers -spreads will be widening like crazy when financial event /news announced, and ECN broker spreads will be bigger than any fixed spreads broker.

But i did not experience that with tickmill, in fact, i only had around 2.6 spreads widening with tickmill ecn when NFP . And to compare with my old broker, i can say they have great server with fast executions.

Never encountered any delay . Trade with them with $75 deposit, and already withdrew total $100 .

And i do not feel their server and executions become slower, like my old broker.”Bakti adhikara, indonesia

source: forexpeacearmy.Com

Yep. Spreads are important to us as traders and wide spread is a no no. This one review and many others began to change our mind. We continue our research and became more convinced with with tickmill.Com.

“I have traded for a few months with armada (now tickmill). Never had a single issue with trading, depositing and withdrawing. Yesterday I was able to greatly profit of the huge CHF volatility. I did not get a single re-quote or nullification of my orders. I could withdraw my gains without any problem, which were transferred on my bank account a few hours after. The day after tickmill even sent an email to their customers to reassure them that all trades would be honored. A solid company and a professional behavior that other brokers should learn from!”

Giorgio biaisol, italy

source: forexpeacearmy.Com

tickmill.Com review

And we also want to see plenty of reviews on fund withdrawal. And so far, all seem fine with withdrawals from tickmill.Com.

“the money that I invested two years ago rapidly increased. Tickmill is my 3rd broker and I also have different accounts on different brokers. I have a total of 1500USD deposits and I happy to say that I never saw any suspicious trading activities since I opened an account with them.”

Gard reyna

source: ratingfx.Com

tickmill.Com review“my trading style is to put all of my balance in one trading. That is why I only deposit as low as possible and take profit as much as possible. And market only need move 50.0-100.0 pips against my open trade before i got stop out other broker ban my trading style. I do not know why. And some of other let me do my style and delete my profit after that. Which is unfair. In my tickmill classic account, i can trading using my style without any problem. They accept my style.And have no problem withdrawing my profit.”

Riza kharista ramdhani

source: dailyfx.Com

tickmill.Com review

So after reading numerous good reviews, we decided to open an ECN pro live account with tickmill.Com! And we were given a surprise no deposit bonus from tickmill.Com. We usually don’t bother with all these bonuses as it’s usually only a small amount and in this case, it’s $30 but since we got a nice welcome bonus from tickmill.Com, we immediately put the deposit to work.

Tickmill.Com review conclusion

Don’t pay too much attention to the no deposit bonus as there are more important matters to consider when it comes to choosing your forex broker. Matters like tight spreads, execution, withdrawals and customer support (live chat) must all be above par before you consider the broker.

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Question: what's the withdrawal conditions of tickmill $30 no deposit bonus?

Withdrawal conditions of tickmill $30 no deposit bonus

You cannot withdraw the bonus amount 30 USD, but you can withdraw profits made in the bonus account.

After 90 days from the first day of account opening, the bonus account will be suspended for trading.

The bonus account will have then another 30 days to withdraw the profit.

Here are the requirements to withdraw profits from the bonus account.

- The profit amount you can withdraw is from 30 USD to 100 USD.

- Profit withdrawal can be made only once.

- You must have completed account verification.

- Open a live MT4 account (besides the bonus account) and deposit $100.

Once you made a withdrawal from your bonus account, the bonus account will be disabled and no further trading will be possible.

You can find the full terms and conditions of the promotion in the page here.

Tickmill

Post tags

FSA regulated forex broker with superior trading conditions.

Related

Related faqs

Features

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

Deriv MT5 - how to subscribe/copy signals on the platform?

Liteforex MT4 and MT5 now available for macos

Superforex's millisecond execution for scalping trade

Deriv trading guide - deposit and withdrawal methods and conditions

MT5 update - deriv's new trading servers with lower spreads

Vantagefx largely reduces crypto CFD spreads (BTC, BCH, ETH, LTC)

All forex brokers

All crypto-currency exchanges

Latest article

MTN money payment is available for rwanda

Deposit your superforex account with MTN money.

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Traders trust now offers HKD, SGD, CZK, ZAR, RUB, NOK, and PLN currency pairs.

Interviewing the top forex trader who won the hotforex contest

What strategy has this FX trader chosen to win the contest?

What's the most profitable forex currency pairs?

The most profitable currency and metal trades of 2020.

Make a deposit to yadix MT4 with perfect money

Transfer fund from perfect money to yadix MT4, get an extra 5% equity bonus with the coupon code.

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

Direct online bank transfer deposit is available for traders of south africa.

Deriv MT5 - how to subscribe/copy signals on the platform?

Here is a manual of deriv MT5 signals for both subscribers and providers.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Tickmill $30 no deposit bonus

Free $30 to start trading cryptocurrency pairs now!

Promotions

Popular pages

Main conditions of tickmill $30 no deposit bonus

Here is a brief summary of the welcome bonus promotion.

| Bonus amount | 50 USD for free |

|---|---|

| bonus requirements | account opening & verification |

| promotion period | 90 days from the account opening |

| leverage | 1:3 (1:500 for forex) |

| withdrawal | profit is available for withdrawal* |

The promotion is available everyday for the new traders!

Tickmill gives away $30 to all new traders for free!

Get yourself the free bonus and start investing in cryptocurrency pairs.

How to get the $30?

- Open an account with tickmill

- Go to the ‘$30 no deposit bonus’ promotion page and fill in the form

- Receive the login credentials

- Start trading now

- The $30 is already in your account!

The bonus account is provided with leverage up to 1:5 (1:500 for forex), and spread from 0.0 pip.*

Withdrawal conditions

You cannot withdraw the bonus amount itself , but you can withdraw the profit made in the account.

To withdraw the profit, you must complete the following 3 tasks:

- Register for a client area from tickmill’s official website

- Verify your account by submitting documents (ID and POA ‘proof of address’)

- Open a MT4 account and deposit at least $100

Once you complete the tasks above, send an email to tickmill’s support team to request fro the profit withdrawal.

You can withdraw a minimum of 30 USD and a maximum of 100 USD of profit.

Terms and conditions

Here are the important conditions of the promotion. For the full conditions, please refer to tickmill’s official website.

- The bonus is available for all new traders of tickmill ltd (FSA SC regulated).

- The bonus is not available for residents in north korea, iran, USA, indonesia, nigeria, lesotho, pakistan, bangladesh, ghana, egypt, kenya or european union citizens.

- The bonus is available only one time per trader.

- Any existing traders cannot receive the bonus.

- The bonus account has the same trading conditions as ‘pro account’ type.

- Once 90 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 30 days to claim the earned profit.

- The base currency of the bonus account is USD.

Posted by maria sanchez

For more information, please inquire to tickmill official website official website directly. In order to participate to the promotion, you must have a tickmill account. If you haven't opened an account yet, please open one from here for free.

Tickmill official website is here.

Please click "introduction of tickmill", if you want to know the details and the company information of tickmill.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill minimum deposit

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

Tickmill minimum deposit amount

The minimum deposit at tickmill is $100.

Check the following comparison table to see how tickmill stacks up against similar brokers when it comes to minimum deposits:

| tickmill | axi | FXCM | |

|---|---|---|---|

| minimum deposit | $100 | $0 | $300 |

The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at tickmill. Here are the main pros and cons when it comes to depositing at tickmill:

| Pros | cons |

|---|---|

| • credit/debit card deposit | none |

| • no deposit fee | |

| • depositing is user-friendly |

Visit broker

73% of retail CFD accounts lose money

Why does tickmill require a minimum deposit?

Online brokers sometimes require a minimum deposit in order to cover their initial costs associated with creating a new account and to ensure their profitability. The higher the amount you deposited, the higher the chance for you to trade more and generate bigger profits for the broker.

In some cases, the very high minimum deposit (like the £1 million amount at the VIP account of saxo bank) is there to differentiate the level of services they offer you.

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill minimum deposit

tickmill deposit fees and deposit methods

Tickmill does not charge a deposit fee. This is great because the broker won't deduct anything from your deposits and you only have to calculate with the costs charged by the bank / third-party you send the money with. If you want to know more about tickmill fees, check out the fee chapter of our tickmill review.

While there is no deposit fee at tickmill, the available deposit methods are also important for you. See how tickmill deposit methods compare with similar online brokers:

| tickmill | axi | FXCM | |

|---|---|---|---|

| bank transfer | yes | yes | yes |

| credit/debit card | yes | yes | yes |

| electronic wallets | yes | yes | yes |

The average transfer times for the different methods are:

- Wire transfer: 2-3 days

- Credit / debit card and online wallets: instant or a few hours

A minor issue with depositing money to tickmill is that based on our experience it's not user-friendly compared to similar brokers. This means either that the interface is not user-friendly or that figuring out where and how you have to make the transfer is a bit complicated.

Find out more about depositing to tickmill on their official website:

Visit broker

73% of retail CFD accounts lose money

Tickmill minimum deposit

deposit currencies

Each trading account has a base currency, which means that the broker will hold your deposited money in that currency. At some brokers, you can also have more trading accounts with different base currencies. For example, at IG, it is possible to have both EUR and USD-based accounts.

Why does this matter? A currency conversion fee will be charged if you deposit in a different currency than the base currency of the target trading account. It's likely not a big deal but something you should be aware of.

Some online brokers offer trading accounts only in the major currencies (i.E. USD, GBP, EUR and sometimes JPY) and some support a lot more than that.

| tickmill | axi | FXCM | |

|---|---|---|---|

| number of base currencies | 4 | 11 | 4 |

Tickmill supports the major currencies like USD, GBP and EUR, but does not support minor currencies. If you would deposit in a major currency anyway, then the online broker won't have to convert it. However, if you use a minor currency that is not supported, tickmill will convert your deposits and you will be charged a currency conversion fee.

A convenient way to save on the currency conversion fee if you wish to fund your brokerage account from a less common currency (or just a currency different from your existing bank account) can be to open a multi-currency digital bank account. At revolut or transferwise the account opening only takes a few minutes after which you can upload your existing currency into your new account, exchange it in-app at great rates, then deposit it into your brokerage account for free or cheap.

Want to stay in the loop?

Sign up to get notifications about new brokerchooser articles right into your mailbox.

Tickmill minimum deposit

steps of sending the minimum deposit

The specific process of sending your minimum deposit to tickmill might vary slightly from the following, but generally the process involves the following steps:

Step 1: open your broker account

At most brokers, you can open your trading account online. To open an account, you have to provide your personal details, like your date of birth or employment status, and there is also usually a test about your financial knowledge. The last step of the account opening is the verification of your identity and residency. For this verification you usually have to upload a copy of your ID card and a document that validates your proof of residence, for example, a bank statement.

If you don't know which broker is suitable for you, use our broker selector tool.

Step 2: make the deposit

First you have to sign in to your already opened trading account and find the depositing interface. After this, you select one of the deposit methods the broker supports, enter the deposit amount and make the deposit.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you'll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it's required to use a card that's in your name. In some cases, like with IC markets, you'll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.

- Online wallets like paypal, skrill, neteller, etc.: it works just like any other online purchase. The interface of the wallet will pop up where you'll have to enter your credentials (username and password) and carry out your transaction.

Step 3: review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

Visit broker

73% of retail CFD accounts lose money

so, let's see, what we have: experience forex trading risk-free with tickmill's $30 welcome account. It’s simple, fast and rewarding! Register now! T&cs apply. At tickmill no deposit

Contents of the article

- Actual forex bonuses

- Welcome account

- A special welcome to the world of...

- Your perfect start with...

- NO RISK

- PROFITABLE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- $30 no deposit forex bonus by tickmill

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- Forex & cfds

- Futures

- TRADING CONDITIONS

- Forex & cfds

- Futures

- TRADING ACCOUNTS

- Forex & cfds

- Futures

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill.Com review – claim your $30 tickmill no...

- Who is tickmill.Com?

- Tickmill.Com review – why did we decide to open a...

- Tickmill.Com review conclusion

- Tickmill 30$ welcome bonus (no deposit required)

- Question: what's the withdrawal conditions of...

- Withdrawal conditions of tickmill $30 no deposit...

- Tickmill

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Tickmill $30 no deposit bonus

- Main conditions of tickmill $30 no deposit bonus

- Posted by maria sanchez

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill minimum deposit

- Tickmill minimum deposit amount

- Tickmill minimum deposit tickmill deposit...

- Tickmill minimum deposit deposit currencies

- Tickmill minimum deposit steps of sending...

No comments:

Post a Comment