Tick mill

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade.

Actual forex bonuses

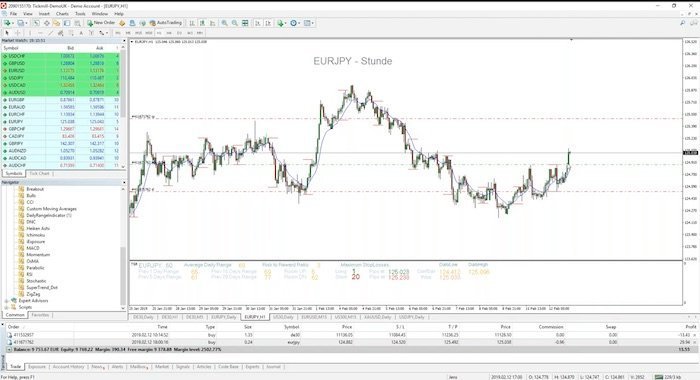

Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees. MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Contact us

Got any questions? Let us know how we can help.

Get in touch

Sales line:

Client support:

Office:

Client support hours:

Mon-fri 7:00 - 16:00 GMT during daylight saving time

Registered address:

3, F28-F29 eden plaza, eden island, mahe, seychelles

Regulation:

Financial services authority (FSA seychelles) | licence no. SD 008

Registration number:

Company registration no. 8414279-1

Email:

[email protected] - get a response within 24 hours on business days

Client support:

Client support hours:

Registered address:

Office no. 5, unit 25,1st floor paragon labuan, jalan tun mustapha, 87007 labuan F.T., malaysia

Regulation:

Financial services authority of labuan malaysia | licence no. MB/18/0028

Registration number:

Company registration no. LL14858

Email:

[email protected] - get a response within 24 hours on business days

Still have questions? Find most of the answers in our FAQ section

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill reviews

286 • great

Write a review

Write a review

Reviews 286

Great with lowest spread compared to…

Great with lowest spread compared to other's brokers.

Tickmill is the best forex broker I've…

Tickmill is the best forex broker I've ever known. I really believe!

Best. We want traders to succeed

Changing my leverage from 500:1 to…bad history and will not recommend to any other traders

Changing my leverage from 500:1 to 100:1 during my period of trading is not acceptable .Refusing to transfer my money to my visa and bank account even after return the original amount to the initial deposit method which was skrill is not professional way to deal with trader .Nothing in the terms and conditions tell this at all in the web site. I draw all my money and working with other broker who respect and full fill my trading needs

I am not satisfied with WTI changes of…

I am not satisfied with WTI changes of contract. Almost all other brokers I collaborate with, the price for WTI is 40-42 . Your price is 16. You closed possibilities to buy or sell it. You have really large swap for long positions. All these facts are disappointing me. I am still working with you, but if I will get few more negative situations which depends on you, than I will stop collaboration probably with you same like investors which gave me accounts for managing.

This is the most professional

This is the most professional, most user friendly, most supportive brokers I've ever invested in.

Great broker

Great broker

fast funding & withdrawal

Reliable and fast broker

Reliable and fast broker. I've been trading with tickmill for more than 3 years with 100% satisfaction.

Best broker for me

Best broker for me. Very fast and no requotes. Reliable and proven.

Faced no problem so far trading with…

Faced no problem so far trading with them since more than 6 months. The only bad thing for me was that their withdrawal is not automatic, other than that, it's perfect.

Decent broker to trade with

Decent broker to trade with, lots of instruments to trade and multiple deposit options.

I sent my ID and my proof of residence

I sent my ID and my proof of residence. The ID was approved but not the proof of residence. Why? All you want is the address to match the ID, it's my bank statement, do you want to see my personal business too?

As a regulator broker, tickmill follows strict procedures with our KYC documents.

If you need any clarifications or further assistance, do not hesitate to contact our support team.

One of broker that I prefer to use

Strong points : strong regulation / tight spread / trust brand

feedback for improve - more instrument to trade, and cent accounts for grid's strategy

I have been using tickmill since 2017.

I have been using tickmill since 2017.. Their execution speed never dissapoint me. All my withdrawal requests were done, not fast but still processed under 24 hours. I hope they can make it faster in the future.

Very honest broker

My friend say me try this broker for low spreads and I expected I must big deposit to have low spread but they say me I can start with small deposit. I tryed tickmill and thought they have low spread but hi commission, old broker trick..Hahah. But I saw they ggive me low spread, low commission and even no swap charge. It was very big surprise and I said to all my friends. I give 5 stars because honest broker and they give what they promise. And their manager omar always helping my account so I have answers for my questins very fast.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Tick mill

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill group licenses

& regulation

Group licenses

Cyprus securities and exchange commission (cysec)

Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission as a CIF limited company.

Cysec is the financial regulator of the republic of cyprus, established according to section 5 of the securities and exchange commission (establishment and responsibilities) law of 2001. The purpose of cysec is to safeguard investor protection and facilitate the sound development of the securities market through the exercise of efficient supervision.

Seychelles financial services authority (FSA)

Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority.

FSA is established under the financial services authority act 2013. The regulator’s key responsibilities include the licensing, supervision and development of non-bank financial services in seychelles through a solid regulatory regime.

Financial conduct authority (FCA)

Tickmill UK ltd is authorised and regulated by the financial conduct authority.

FCA register number: 717270

The FCA is an independent public body given statutory powers by the financial services and markets act 2000, regulating the conduct of both retail and wholesale financial services firms in the UK. The regulator’s mission is to make financial markets work well with the aim to protect consumers, enhance market integrity and promote competition.

Labuan financial services authority (labuan FSA)

Tickmill asia ltd is authorised and regulated by the labuan financial services authority.

Labuan FSA acts as the central regulatory, supervisory and enforcement authority of the international business and financial services industry in labuan. The authority plays a vital role in ensuring all entities operating under labuan IBFC abide by the highest financial standards.

Financial sector conduct authority (FSCA)

Tickmill south africa (pty) ltd is authorised and regulated by the financial sector conduct authority (FSCA).

Licence number: FSP 49464

The financial sector conduct authority (FSCA) serves as the dedicated market authority in south africa with a mission to enhance the efficiency and integrity of financial markets, promote fair customer treatment by financial institutions and assist in maintaining financial stability.

Registrations

Financial conduct authority

Federal financial supervisory authority

Commissione nazionale per le società e la borsa

Autorité de contrôle prudential

Comisión nacional del mercado de valores

Directives and memberships

Mifid II

The european union’s markets in financial instruments (mifid II) directive 2014/65/EU provides a harmonised regulatory regime for the provision of investment services within the european economic area. The key objectives of the directive are to maximise efficiency, increase financial transparency, encourage competition and offer greater consumer protection. Mifid II allows investment firms to provide investment and ancillary services within the territory of another member state and/or a third country, provided that such services are covered by the investment firm’s authorisation.

Financial services compensation scheme (FSCS)

Tickmill UK ltd is a member of the financial services compensation scheme (FSCS). The FSCS is an independent compensation fund of last resort for customers of authorised UK financial services firms, set up under the financial services and markets act 2000. The FSCS’s objective is to pay compensation up to the value of £85,000 per client if a firm is unable or likely to be unable to pay claims against it in the event the firm has stopped trading or has declared to be in default.

Investor compensation fund (ICF)

Tickmill europe ltd is a member of the investor compensation fund (ICF). The ICF has been set up according to article 59(1) and (2) of law 144(Ι)/2007 as an investor compensation fund for CIF clients and its functions are regulated by the directive DI87-07 of cysec. The fund’s objective is to secure the claims of covered clients against the ICF members through the payment of compensation for any claims arising from the failure of a member of the fund to meet its obligations.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

ABOUT US

SUPPORT

Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission – cysec (CIF licence number 278/15) and is a member of the investor compensation fund (ICF).

Tickmill europe ltd is registered with the UK financial conduct authority – FCA (registration number: 733772), the german federal financial supervisory authority – bafin (registration number: 146511), the french autorité de contrôle prudentiel et de résolution – ACPR (registration number 75473), the italian commissione nazionale per le società e la borsa – CONSOB (registration number 4310), the spanish comisión nacional de mercado de valores – CNVM (registration number: 4082).

Tickmill europe ltd is licenced to provide the investment services of reception and transmission of orders, execution of orders on behalf of clients, dealing on own account and portfolio management in relation to transferable securities, options, futures, SWAPS, forward rate agreements, financial contracts for difference (cfds) and other derivatives.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading cfds with tickmill europe ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

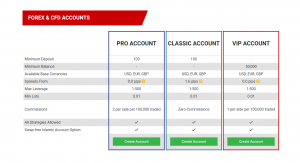

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

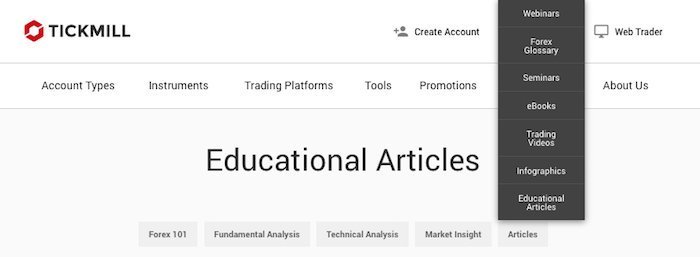

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

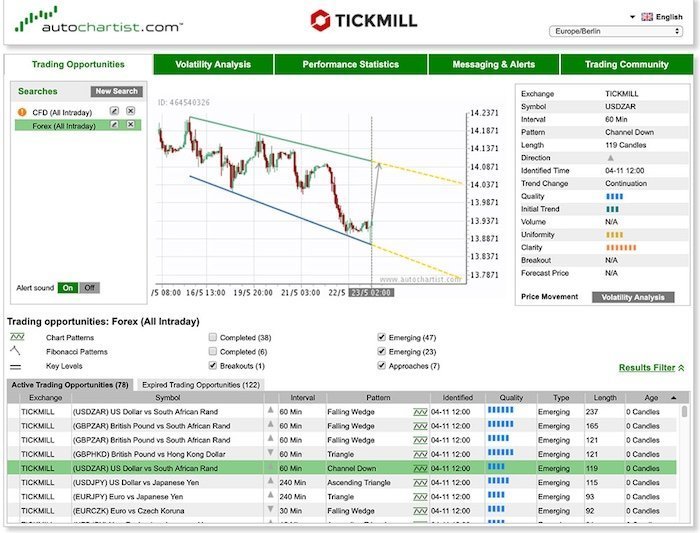

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

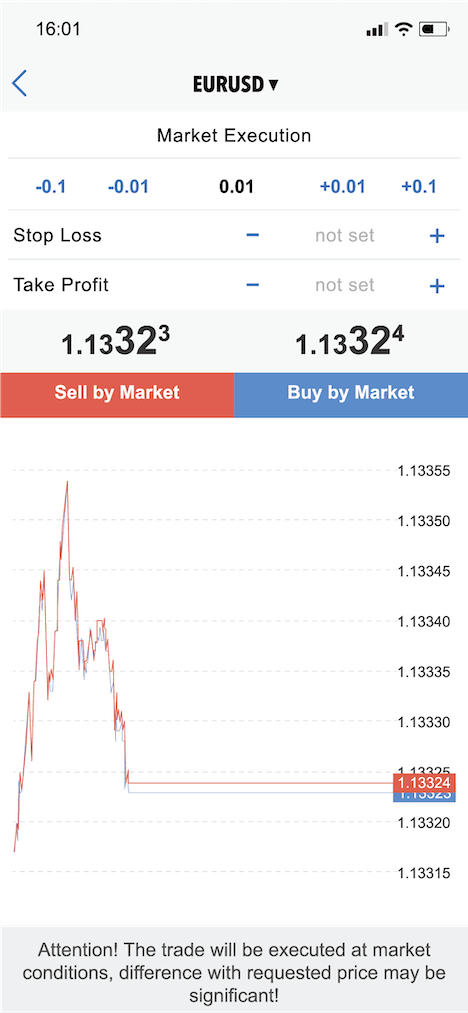

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Roboforex vs tickmill

If you're choosing between roboforex and tickmill, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, avatrade, as another alternative to consider.

What would you like to compare?

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

Roboforex is regulated by cysec. Roboforex have provided forex trading services since 2009.

Tickmill is regulated by FSA SD008. Tickmill have provided forex trading services since 2014.

Avatrade is regulated by the central bank of ireland, ASIC (australia), FSA (japan), FSB (south africa) and BVI. Avatrade have provided forex trading services since 2006.

TRADING SERVICES OFFERED

Losses can exceed deposits

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

English, chinese simplified, chinese traditional, indonesian, malaysian, portuguese, spanish, italian, polish, arabic, thai, russian, and ukrainian

English, spanish, russian, chinese, indonesian, and vietnamese

English, italian, german, french, greek, hebrew, spanish, arabic, malay, russian, chinese, portuguese and dutch

Losses can exceed deposits

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by roboforex and tickmill

Losses can exceed deposits

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

FUNDING METHODS

Losses can exceed deposits

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

Losses can exceed deposits

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

Losses can exceed deposits

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

All information collected from http://www.Roboforex.Com/. Last updated on 01/01/2021.

All information collected from http://www.Tickmill.Com/. Last updated on 01/01/2021.

All information collected from http://www.Avatrade.Com/. Last updated on 01/01/2021.

Roboforex is an online forex and binary options trading service provider who are regulated by cysec, ICF. To open an account with roboforex, minimum deposits start from $1.

With roboforex you can trade forex, metals, and CFD. If you like to trade on the go, roboforex have iphone, ipad and android apps so you can trade from anywhere on your phone.

Roboforex offer metatrader4, metatrader5, ctrader, webtrader, iphonetrader, android trader, ctrader web, currenex viking trader platforms to make your trades and support 14 different languages.

The spreads offered by roboforex for the most popular instruments are:

2 EUR/USD, 30 FTSE 100, 100 GOLD,

3 GBP/USD, 40 DOW/JONES, 14 crude oil,

see all the spreads here.

For more information about trading with roboforex, we have put together an indepth roboforex review with all the pros and cons about this broker.

Tickmill is an online forex trading service provider who are regulated by the financial services authority. To open an account with tickmill, minimum deposits start from $25 or equivalent.

With tickmill you can trade forex, stocks, indices, commodities, cfds and metals. If you like to trade on the go, tickmill have iphone, ipad and android apps so you can trade from anywhere on your phone.

Tickmill offer metatrader 4, metatrader 4 for PC & MAC, metatrader 4 for android & ios, virtual private server (VPS) platforms to make your trades and support 6 different languages.

The spreads offered by tickmill for the most popular instruments are:

1 EUR/USD, 3 FTSE 100, 13 GOLD,

1.5 GBP/USD, 4 DOW/JONES, 4 crude oil,

see all the spreads here.

For more information about trading with tickmill, we have put together an indepth tickmill review with all the pros and cons about this broker.

Since 2006, avatrade have attracted over 20,000 traders to their platform. While their spreads are not the most competitive, they do offer traders a range of great features, such as guaranteed stop losses, the ability to hedge / scalp, and low margins.

For more information about trading with avatrade, we have put together an indepth avatrade review with the pros and cons about this broker.

Popular comparisons feat. Roboforex

Popular comparisons feat. Tickmill

Popular comparisons feat. Avatrade

so, let's see, what we have: download metatrader 4 for PC, mac, android and IOS and trade with an award winning trading platform. Open your MT4 demo account today with tickmill at tick mill

Contents of the article

- Actual forex bonuses

- Metatrader 4 (MT4) platform

- Why trade with tickmill’s ...

- Key features of MT4

- User manuals

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Contact us

- Get in touch

- Sales line:

- Client support:

- Office:

- Client support hours:

- Registered address:

- Regulation:

- Registration number:

- Email:

- Client support:

- Client support hours:

- Registered address:

- Regulation:

- Registration number:

- Email:

- Still have questions? Find most of the answers in...

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill reviews

- 286 • great

- Write a review

- Write a review

- Reviews 286

- Great with lowest spread compared to…

- Tickmill is the best forex broker I've…

- Changing my leverage from 500:1 to…bad history...

- I am not satisfied with WTI changes of…

- This is the most professional

- Great broker

- Reliable and fast broker

- Best broker for me

- Faced no problem so far trading with…

- Decent broker to trade with

- I sent my ID and my proof of residence

- One of broker that I prefer to use

- I have been using tickmill since 2017.

- Very honest broker

- A comprehensive tickmill review – is this broker...

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Tick mill

- Tickmill group licenses& regulation

- Group licenses

- Cyprus securities and exchange commission (cysec)

- Seychelles financial services authority (FSA)

- Financial conduct authority (FCA)

- Labuan financial services authority (labuan FSA)

- Financial sector conduct authority (FSCA)

- Registrations

- Financial conduct authority

- Federal financial supervisory authority

- Commissione nazionale per le società e la borsa

- Autorité de contrôle prudential

- Comisión nacional del mercado de valores

- Directives and memberships

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

- A comprehensive tickmill review – is this broker...

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Roboforex vs tickmill

- What would you like to compare?

- TRADING SERVICES OFFERED

- PLATFORM & FEATURES

- ACCOUNT INFORMATION

- TRADING CONDITIONS

- RISK MANAGEMENT

- FUNDING METHODS

- DETAILED INFO

No comments:

Post a Comment