Fbs broker minimum deposit

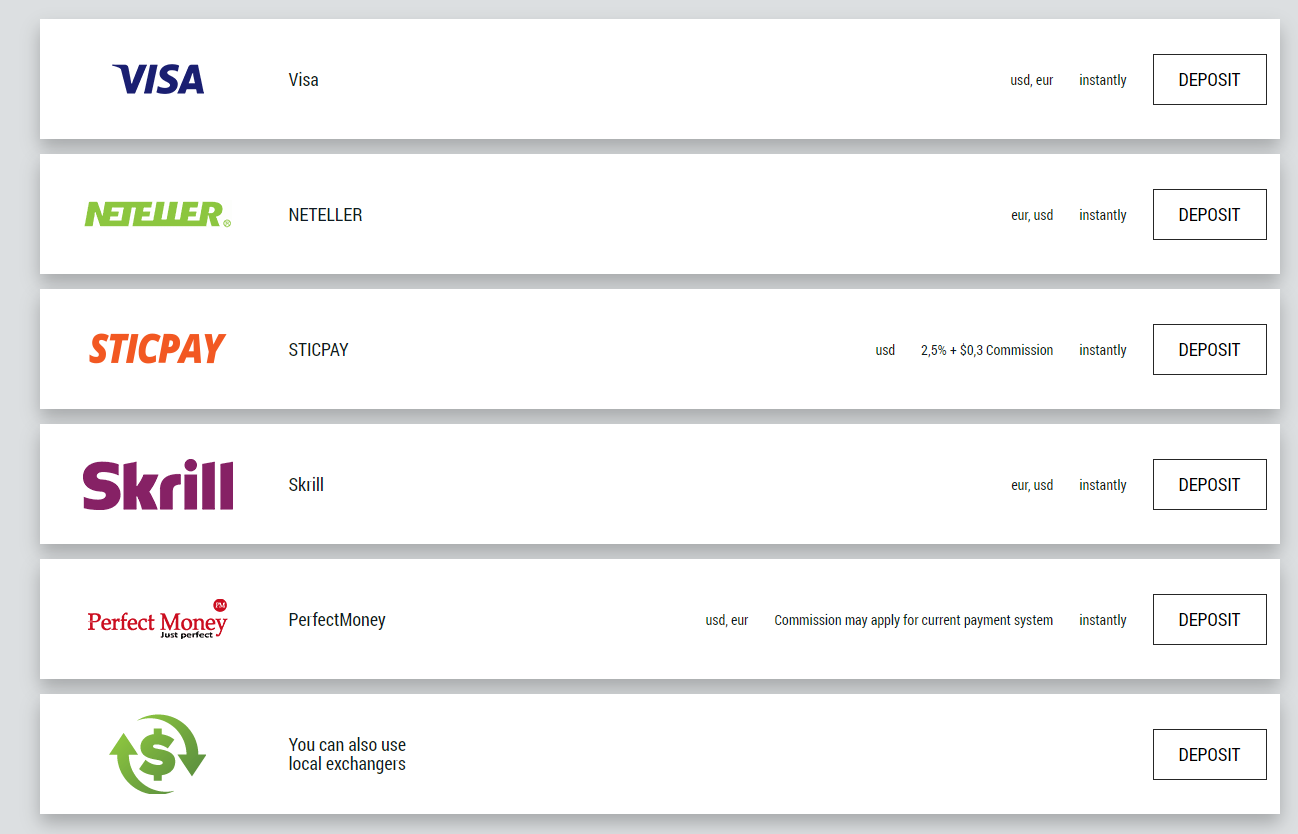

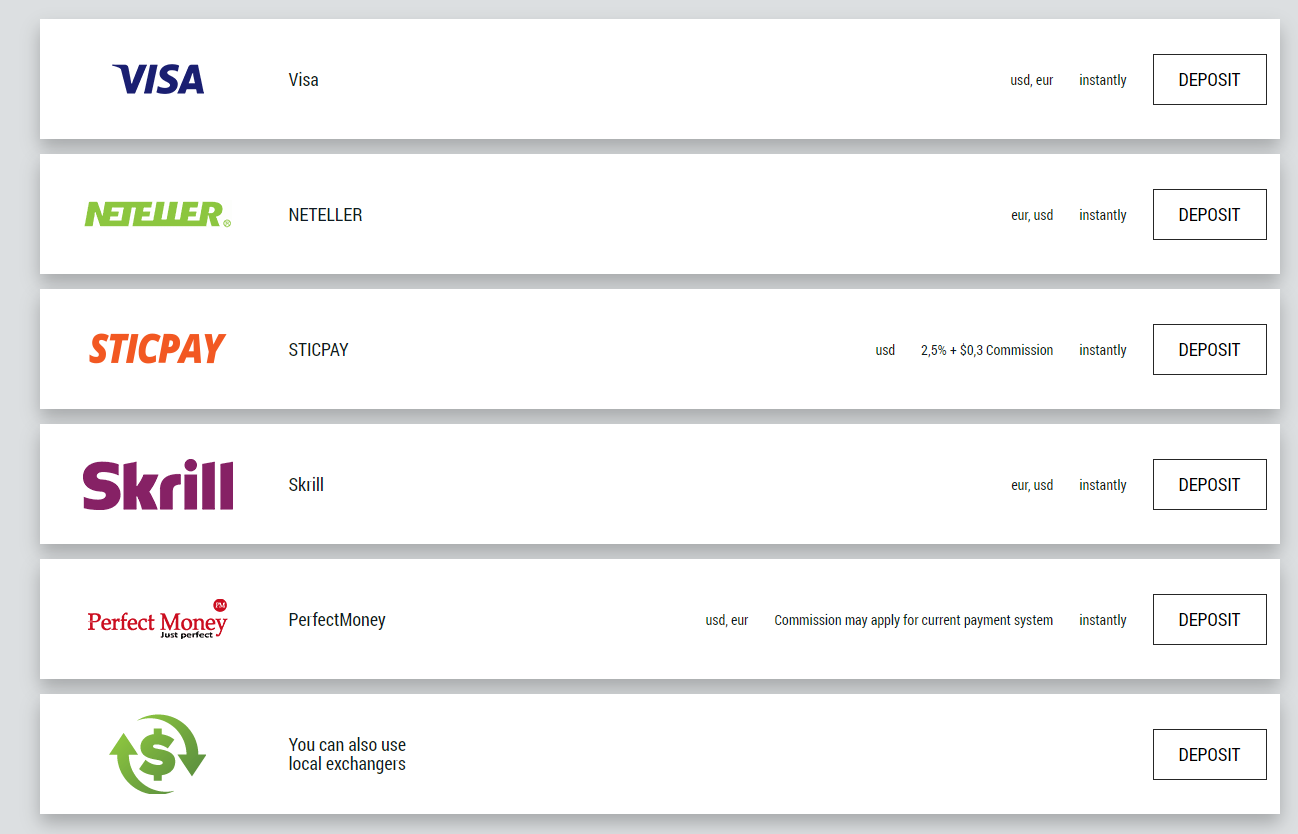

FBS offers different funding methods, including numerous electronic payment systems, credit and debit cards, bank wire transfers, and exchangers.

Actual forex bonuses

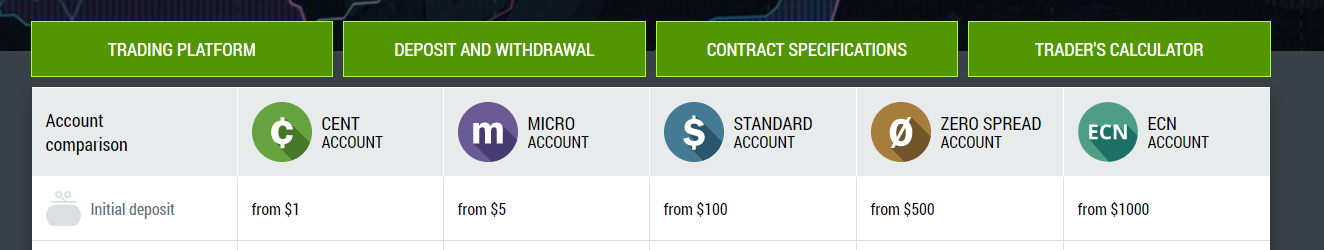

There are no deposit fees or commissions charged by FBS for any deposits into the trading accounts. FBS minimum deposit varies depending on the trading account you choose. Cent account has the smallest initial deposit from $1, while the minimum deposit required to open the ECN account is $1000.

Deposit and withdrawal

Choose the most comfortable payment method!

Frequently asked questions

Can I make a deposit in my national currency?

Yes, you can. In this case, the deposit amount will be converted into USD/EUR according to the current official exchange rate on the day of the deposit execution.

How can I deposit funds into my account?

- Open the deposit within the finances section in your personal area .

- Choose the preferred deposit method, select offline or online payment, and click the deposit button.

- Select the account you wish to deposit funds into and enter the deposit amount.

- Confirm your deposit details on the next page.

The FBS payment method is quick and simple. However, note that your payment provider may ask you for some additional steps.

What payment methods can I use to add funds to my account?

FBS offers different funding methods, including numerous electronic payment systems, credit and debit cards, bank wire transfers, and exchangers. There are no deposit fees or commissions charged by FBS for any deposits into the trading accounts.

What is the minimum deposit amount?

FBS minimum deposit varies depending on the trading account you choose. Cent account has the smallest initial deposit from $1, while the minimum deposit required to open the ECN account is $1000.

How do I deposit funds into my metatrader account?

Metatrader and FBS accounts synchronize, so you do not need any additional steps to transfer funds from FBS directly to metatrader. Just log into metatrader, following the next steps:

- Download metatrader 4 or metatrader 5.

- Enter your metatrader login and password that you have received during the registration at FBS. If you didn't save your data, get new login and password in your personal area .

- Install and open metatrader and fill in the pop-up window with login details.

- Done! You are logged into metatrader with your FBS account, and you can start trading using the funds you have deposited.

How long does it take to process a deposit/withdrawal request?

Deposits via electronic payment systems are processed instantly. Deposit requests via other payment systems are processed within 1-2 hours during FBS financial dept.

Business hours: from monday to friday. The maximum time of processing a deposit/withdrawal request via an electronic payment system is 48 hours since the moment of its creation. Bank wire transfers take up to 5-7 bank business days to process.

How can I make a deposit and withdraw funds?

You can fund your account in your personal area, via “financial operations” section, choosing any of the available payment systems. Withdrawal from a trading account can be executed in your personal area via the same payment system that was used for depositing. In case the account was funded via various methods, withdrawal is executed via the same methods in the ratio according to the deposited sums.

FBS at social media

Contact us

- Zopim

- Wechat

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

FBS minimum deposit guide (2021)

If you have read our FBS review then it is already very likely that you know a great deal about what this major forex broker has to offer.

Here though we take the opportunity to hone in on some specifics.

These specifics are the various funding methods made available at FBS and particularly the FBS minimum deposit and how this can change depending on the choices you make.

Table of contents

74-89% of retail CFD accounts lose money

FBS account base currency

The FBS base currencies are limited. If you are trading from within europe, you can only access euro as your base currency and deposit in euro only. You also cannot convert other currencies into euro through FBS.

If you are trading from another location within the international market then you will have access to two base currencies in the form of euro and USD. In this case, if you find the account with another currency, it is possible you will incur a conversion fee.

FBS funding and deposit methods

As a major forex broker, FBS makes a wide number of options available for you to choose from when funding your account. We have detailed these below and the FBS fees which are associated with each method.

Wire transfer

FBS deposit by wire transfer funding is available around the world and comes with no fees attached at all. With this said, you will want to double-check your bank’s policy of wire transfers since it is possible to incur a fee from their side, but never from the broker side in the case of FBS.

This deposit method takes 3-4 business days in order to be processed and available for trading.

Credit/debit cards

FBS credit and debit card deposits are of course also available. In this situation, visa and mastercard are both accepted although mastercard is only available within europe, while visa deposits are available around the world.

Deposits made through this method are instant and immediately available to trade within your FBS account. There are also no fees associated with this form of deposit.

Ewallets

FBS ewallet deposits are an increasingly popular way to fund your trading account. For that reason, the broker makes both neteller, and skrill available worldwide for funding.

Perfectmoney is another ewallet service which is available for FBS traders outside of europe only. Bitcoin deposits are also not permitted within the EU.

The ewallet deposits will not encounter any type of FBS fee and are also instantly available to trade with.

Deposits from indonesia

With FBS there are special exceptions made when it comes to deposits from indonesia. Indonesian traders can benefit from a fixed-rate currency exchange of 10,000 IDR for 1 USD. This means that you will not be impacted at all by currency fluctuation when making your FBS deposit.

Additional methods of deposit which are available to indonesian traders include local bank deposits from BCA, BNI, BRI, and more local banks in the country. This should make it very easy and fast to deposit.

Every deposit method offered in this case is fee-free with the exception of stic pay which charges a minimal commission. Both fasapay and perfectmoney are available without any fees.

The only point to note is that bank deposits will also still incur a commission based on your bank and their policy. All the methods noted, allow for an instant deposit to your account. The exception again here is banks which can take up to 24-hours.

Other methods

There are other FBS deposit methods available aside from what we have mentioned. This is particularly the case outside of the EU in areas such as the middle east and asia. Bitwallet is one such method available only in japan.

When it comes to other methods, the minimum deposit for FBS may vary along with some fees.

74-89% of retail CFD accounts lose money

FBS minimum deposits

Having looked at the various funding methods available, let’s look closer at the FBS account types, of which there are many, and the minimum deposit FBS applies in each case.

Cent account

The FBS cent account is one that offers great value particularly to new traders, trading in cents.

This account type is available worldwide and has a very reasonable minimum deposit of 10 EUR within the EU or just $1 USD when trading outside of europe. This account has been also featured in our forex brokers with low minimum deposit guide.

FBS islamic accounts are also available.

Standard account

The FBS standard account is again one that the broker makes available to traders around the world.

Islamic accounts are always available should you require one, and the minimum deposit here stands at 100 EUR within the EU or $100 if you are trading under international regulation.

Micro account

The FBS micro account is only available to those trading from outside europe and it trades with micro lots. The account type offers excellent value again with a minimum deposit of just $5 to trade, and FBS islamic accounts available on request.

Zero account

Another account that is available only outside europe is the FBS zero account. This account makes zero spread trading available although there are commissions in place.

The FBS minimum deposit on these accounts will set you back $500 with the option of an islamic account again available if needed.

ECN account

Continuing the trend of only being available outside europe, the FBS ECN account provides for fast, effective ECN execution of your trades at the best prices and with the lowest spreads. Commissions are charged though, and only forex trading is available.

The ECN account features a minimum deposit of $1,000.

Copytrading account

The final FBS account type to take a look at is the copytrading account. This is again only available to those trading from outside europe and you can choose to be a signal provider or an investor.

If you choose to be a signal provider, you should be aware that you will only be allowed to open standard or micro account types and so you will be subject to those conditions and minimum deposits associated with those accounts.

As an investor, also known as a copytrader, you can open any account type and start to copy trade once your account is verified and you have a balance of more than $100. So, in the end, the FBS copy trade minimum deposit is 100$.

Related guides:

74-89% of retail CFD accounts lose money

FBS deposit bonus

Lastly, after all the FBS broker minimum deposit variables, we will take a look at the FBS bonus conditions and criteria. This will help ensure that you do not miss out on an FBS bonus if one is available to you.

No deposit bonus

An FBS no deposit bonus of $100 is available to you as a trader under certain conditions. Among these conditions are that you cannot withdraw the money immediately. So, as such, you cannot withdraw this base FBS bonus. What you can do though is withdraw the profits you make on the bonus in the event that you successfully trade at least 5 lots within a 30-day timeframe.

$123 no deposit bonus

The FBS 123 bonus is one that used to be available. It is no longer available however and has since been replaced with the no deposit bonus which we mentioned above. This still represents a positive FBS bonus deal for the majority of traders.

100% deposit

An FBS deposit bonus is also available on request and under certain conditions. This means that you can effectively double your FBS deposit depending on the circumstances up to a limit.

FBS pro challenge

The final FBS bonus we will take a look at is the FBS pro challenge. In fact, this is not a direct type of deposit bonus, but it is a special type of contest event which is periodically opened to FBS traders to participate in.

With this type of challenge, you typically get to trade with a $10,000 FBS demo account on 100:1 leverage. If you are successful in making the most profit among your fellow competitors on this demo account over a 2-week period, then you will receive an FBS bonus amount of $450.

74-89% of retail CFD accounts lose money

FBS broker minimum deposit tutorial and payment methods

FBS is an international forex and CFD broker that serves clients from over 190 countries. Since 2009, it has proven and demonstrated excellence as evidenced in its numerous prestigious awards and the number of partnerships and endorsements the broker has been able to bag. It has its main headquarters in belize and other headquarters in cyprus as well as in the marshall islands.

This means that it is a european broker. Being a european derivatives broker subjects a broker to thorough regulation and supervision by designated authorities. In just a short time of operations, FBS has been able to bag numerous awards – over 40 to be precise. Particularly, it has been awarded for transparency and great customer service. It has also been noted to be one of the most beloved brands in the forex brokerage space.

In this article, we want to discuss the minimum deposit when opening an account with FBS. We will show you all the details and payment methods.

FBS broker deposit methods

Facts about the FBS minimum deposit:

- The minimum deposit is at least $ 1

- The minimum deposit is depending on the account type

- Multiple payment methods are available

- Instant deposits

- No fees for deposits

(risk warning: your capital can be at risk)

Payment methods for the minimum deposit

To deposit funds into a live trading account, FBS offers a range of the most convenient payment options, featuring over 100 payment systems. The payment systems are depending on your country of residence. For example, people in europe can not use unionpay but chinese people can do it. They are neatly grouped into:

- Wire transfer

- E-wallets such as skrill and neteller.

- Bank cards such as mastercard and visa.

However, this might be applicable for FBS international only, since the EU regulator puts in place a strict money transfer policy.

The most popular deposit methods with FBS:

- Credit cards

- Neteller

- Sticpay

- Skrill

- Perfect money

- Bank transfer

Are there fees for minimum deposits?

FBS does not charge any fees when you are depositing money. Most payment methods are for free. From our research, sticpay is the only method where fees of 2,5% + $0.3 commission apply.

What is the FBS minimum deposit?

FBS offers multiple account types. For the live account, we have the cent account and the standard account. Each has its own features and perks. As for the minimum deposit amount, FBS allows trading through cent account only with 10$ at the start, which is a fantastic option for beginner traders. Standard account, on the other hand, requires a deposit of 100$ initial deposit.

- Cent account – $ 1 minimum deposit – best for beginners with small amounts of money

- Micro account – $ 5 minimum deposit – best for beginners

- Standard account – $ 100 minimum deposit – average trading account

- Zero spread account – $ 500 minimum deposit – best for news trading

- ECN account – $ 1000 – best trading account overall

On our page FBS account types, we compared the trading accounts in detail. You should visit it before signing up.

(risk warning: your capital can be at risk)

FBS regulation and safety of customer funds

As mentioned, being a european broker subject a trader to some thorough regulation that they have to adhere to. As such, FBS is a heavily licensed and regulated broker – and it is registered under numerous jurisdictions. It is licensed by the cyprus securities and exchange commission (cysec), one of the most prominent and trusted regulators of derivatives brokers which has been known to be thorough in its supervisory activities with forex, cfds, and binary options brokers.

It is as well registered under the international financial service commission, which is the financial regulatory authority of belize. By far, the most important point in this is the fact that by being a european broker, FBS is subjected to the markets in financial instruments directive (mifid). The mifid is the european union (EU) regulation that oversees and supervises the work of financial brokers. Mifid puts brokers under heavy regulation to comply with strict guidelines and rules.

For one, under no circumstance can the broker breach any terms of agreement against the trader. If they do so and the broker makes that known to the authorities, not only will the broker be fined, but it also has to compensate the trader. Such compensation can be very heavy at times. Furthermore, one of the regulations is that the broker must keep the funds deposited by traders separate from its own internal running funds. In fact, authorities expect that brokers keep such funds with third parties. Hence, if there is an issue with the broker, especially as regards insolvency or bankruptcy, the traders will not be affected. Nothing will happen to the traders’ funds. In fact, mostly they will have their funds given back to them.

If these do not convince anyone, one fact that proves the credibility of FBS is the partnerships that it has developed. FBS is the official trading partner of the barcelona football club. Popularly referred to as FC barca, barcelona FC is one of the biggest football clubs not only in spain and europe but in the entire globe. Both on the pitch and away from the pitch, barcelona FC is huge. It features some of the world’s very best players. It is also one of the richest clubs. All these confirm the authenticity of FBS as a broker.

FBS is FC barcelona sponsor

However, some facts are notable. One of the downsides to trading with FBS is that it operates in the form of a double entity. This means that it somewhat offers different services to different people. The services that FBS offers to traders in the EU area are also somewhat different from the ones that it offers to traders in other parts of the world. As such, it appears we have FBS europe and FBS international. However, this is not due to any faults of the broker. Signing up to be an EU-registered broker makes them liable to a lot of regulations. They have a lot of restrictions as to which type of services they can offer to traders. Many of such offers, however, cannot offer to traders from other parts of the world.

What you get when you trade with FBS

FBS offers traders a lot of premium services that you may not find with other brokers. They include:

- Better and much bigger leverage

Leverage is one of the most wonderful concepts in forex trading. In forex trading, it means borrowing to add to your trading account so that you can take more risks and take more trading positions. Normally, entering positions and trading in the financial markets is quite expensive. It is not for the average individual trader. For instance, investing in a stock like amazon might require a trader putting up at least $2,400 per share.

To trade gold (XAU/USD), you need to put up a similar amount. This is just for one single unit. Most traders cannot put up with this amount to trade. The concept of leverage however comes to their rescue. In essence, their broker assists them by helping them increase the power of their trading capital via leverage. FBS provides its traders in the EU with leverage as high as 1:30 for trading major currencies. Although this is small, it is entirely due to caps placed by EU regulators.

However, the case is entirely different for international traders. FBS offers leverage as high as 1:1000 and even 1:3000 in some cases. This gives traders all the space in the world to carry out trades and take up risks which can lead to more bountiful profits. However, as high leverage can benefit a trader, it can also hurt a trader’s account substantially.

- Social trading

Social trading involves copying the trades of other experienced and veteran traders directly. Social trading was one of FBS’s creations to help traders start earning from the day they start trading by copying others. It saves them a lot of stress and time that would have been spent learning.

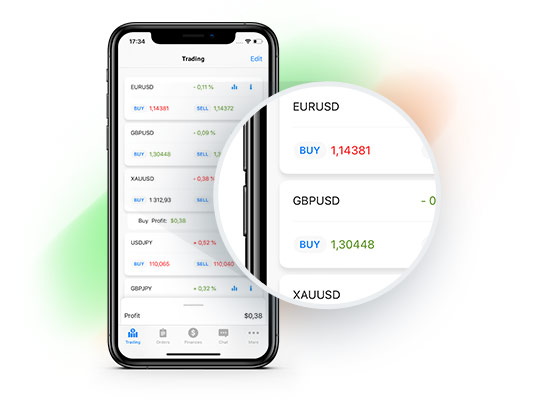

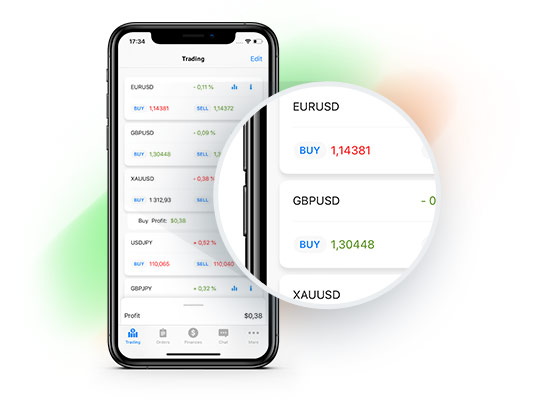

Trading platforms

FBS provides traders access to trading via multiple channels. They include the popular metatrader4 and its more advanced version, the metatrader5. However, traders can also choose to go for the proprietary trading software known as the FBS trader.

All the above platforms are accessible via web trading and mobile apps on the google play and apple app stores.

FBS online trading platform

Web trading

Web trading is very comfortable since you don’t need to download or install any software. You simply login online through a browser and you start to trade instantly. You can access both the MT4/MT5 and the FBS trader via web trading.

MT4/MT5

MT4 delivers a wealth of features, advanced charting, and customization along with auto-trading capabilities while being available for PC/ mac, android, and ios devices. In addition to the stellar features and functions of the MT4, you can enjoy daily technical and fundamental analysis data that is made available in the news section. Other features include over 50 technical indicators, one-click trading, the possibility to create and use eas with no limitations, and even trade with VPS service support.

Moreover, in case you will be trading with FBS international, you will be offered access to the upgraded version, the metatrader5. This comes with more capabilities, features, and opportunities.

FBS trader

FBS trader functions as a copytrade app for social trading platform. It allows the following trading professionals or strategies, which is a great option for beginner traders to learn and earn.

Available markets

FBS gives you access to many markets to trade cfds. However, the range of instruments is still rather limited as there are around 40 currency pairs including exotic ones that are offered and 6 indices based on CFD trading, along with metals and energies. If you prefer trading stocks, futures, or many other instruments, FBS does not provide those.

FBS customer support

We have to note that FBS provides top-notch customer support services. Highlights of their customer support services include 24/7 accessibility via any of live chat, international phone lines, email, or even social media. FBS customer support gives relevant and quick answers to questions and concerns and they are definitely client-oriented.

Conclusion on the FBS minimum deposit

FBS is undoubtedly one of the best online brokers out there and one that you would really want to do business with. We have to note that its minimum required deposit, especially for the cent account, is a very trader-friendly one, when you consider the services offered. It is one of the lowest you find amongst quality forex brokers.

(risk warning: your capital can be at risk)

FBS forex broker review

It is never easy to find a decent broker without risking lots of money for making accounts in different websites to test and check. But when you read our reviews, you will be directed to the trading platforms that, indeed, deserve your attention and that might change your overall strategy. Today, we represent you a completely new broker to consider. Read our FBS reviews and see if this trading platform corresponds to your interests and preferences in forex world.

The basics as to FBS company and establishment

FBS is not a common broker that is based and operates in a particular area. It is actually a typical international trading platform that has many offices alongside the entire world. The headquarters and the basic administrative centers of FBS are located in the asian countries indonesia, malaysia and china. The company behind FBS broker was established back in 2009 year and only few months after its formation, the platform received an official license to operate on the forex market and the financial services industry. Due to the fact the broker does not belong to a particular nationality or country, it has an independent regulation program. FBS has chosen the self-regulating model and it has hired the non-government controlling agency “centre for regulation in OTC financial instruments and technologies” (CRFIN). CRFIN, although not a common state and national regulation body, succeeds to manage the security feature in a superb way, so the customer`s personal data, as well as his or her money is at safe place.

FBS customer support services

The customer support services at FBS are available 24/5 and as you can guess by the international nature of FBS platform, they are also provided at multiple languages – english, korean, arabic, thai, russian, lithuanian, vietnamese, spanish, portuguese, malay, indonesian and chinese. You can reach the FBS customer support representatives via phone call or through an email.

FBS forex broker common features and options

FBS forex broker has lots of cool extras, trading instruments and options to offer to its audience. The leverage here is 1000:1, the spreads are floating and the least is 1 pips. They distinguish due to the different account types you can open in this website. Choose between cent (the common mini account) with a minimum deposit of $1, micro account with minimum deposit of $5, the unlimited account that covers the most basic ECN forex broker features (FBS is in general market maker type of a trading platform) and minimum deposit of $500. The deposit and withdrawals payment methods are credit or debit card, webmoney, skrill moneybookers, perfect money, neteller, OK pay, dixipay, egopay and ordinary bank wire transfer. The currency types for opening an account at FBS are only the two common USD and EUR.

What is the bonus system in FBS broker?

Besides its cool facilities, FBS broker can also brag about its great and attractive bonus system. Find out what the current bonuses are at the FBS website:

– demo account

as a type of a bonus, the demo account does not charge you for making a quick and fixed as time test of FBS platform. You will be offered with the chance to make trades without investing your own money to see if this is your type of a broker.

– no deposit bonus

it is available for cent (mini) account only and you will be awarded with $5 before even making your initial deposit, but right after completion of your FBS registration

– self rebate bonus

win up to $15 for each next transaction you make. The bonus refers to both – deposits and withdrawals.

– 100% deposit bonus

Any time you make a deposit, you will receive 100% of your invested money sum. Double your investment and have bigger profit!

More about the trading platform in FBS

Since FBS broker uses the two types of trading platforms, it becomes a bit difficult to estimate which to choose and whether both are safe and reliable enough. See the software types that generate the FBS website and ensure that both of them are trustworthy enough:

– metatrader 4 – it is popular enough among the trading community, so every trader knows that this is the best option to make quick and faultless trades.

– FBS trader 4 is a web-based and FBS broker owned software that does not require installation or downloading.

Fxdailyreport.Com

Benefits of trading with small amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce commissions

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better management of risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of forex brokers with a low minimum deposits 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial brokerage services (FBS)

Trade forex, cfds, stocks and metals with honest broker

For newbies, risks are 100 times lower

Highest honest leverage on market

Wide payment systems geography

Feel free to choose any account type you like!

For experienced market players making their way to forex heights

Perfectly suits those who are just starting on their way to success on forex

Ideal for those who want to calculate their profit precisely

Designed for those who prefer trading at the fastest speed

For those who want to feel the full power of trading with ECN technologies

To grow your confidence, train your trading skills on a demo account.

Deposit with your local payment systems

Be armed with the latest news

Amazing updates in our FBS copytrade app: scan your card for easier transactions!

FBS new year promo results

FBS runs a christmas charity event in brazil

AUD/JPY: risk off remains and gains momentum

Oil dropped on weak demand

USD strength on risk off mood

USD strengthened as optimism waned

Lots and lots of pmis on friday

FBS at social media

Contact us

- Zopim

- Wechat

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

FBS broker minimum deposit tutorial and payment methods

FBS is an international forex and CFD broker that serves clients from over 190 countries. Since 2009, it has proven and demonstrated excellence as evidenced in its numerous prestigious awards and the number of partnerships and endorsements the broker has been able to bag. It has its main headquarters in belize and other headquarters in cyprus as well as in the marshall islands.

This means that it is a european broker. Being a european derivatives broker subjects a broker to thorough regulation and supervision by designated authorities. In just a short time of operations, FBS has been able to bag numerous awards – over 40 to be precise. Particularly, it has been awarded for transparency and great customer service. It has also been noted to be one of the most beloved brands in the forex brokerage space.

In this article, we want to discuss the minimum deposit when opening an account with FBS. We will show you all the details and payment methods.

FBS broker deposit methods

Facts about the FBS minimum deposit:

- The minimum deposit is at least $ 1

- The minimum deposit is depending on the account type

- Multiple payment methods are available

- Instant deposits

- No fees for deposits

(risk warning: your capital can be at risk)

Payment methods for the minimum deposit

To deposit funds into a live trading account, FBS offers a range of the most convenient payment options, featuring over 100 payment systems. The payment systems are depending on your country of residence. For example, people in europe can not use unionpay but chinese people can do it. They are neatly grouped into:

- Wire transfer

- E-wallets such as skrill and neteller.

- Bank cards such as mastercard and visa.

However, this might be applicable for FBS international only, since the EU regulator puts in place a strict money transfer policy.

The most popular deposit methods with FBS:

- Credit cards

- Neteller

- Sticpay

- Skrill

- Perfect money

- Bank transfer

Are there fees for minimum deposits?

FBS does not charge any fees when you are depositing money. Most payment methods are for free. From our research, sticpay is the only method where fees of 2,5% + $0.3 commission apply.

What is the FBS minimum deposit?

FBS offers multiple account types. For the live account, we have the cent account and the standard account. Each has its own features and perks. As for the minimum deposit amount, FBS allows trading through cent account only with 10$ at the start, which is a fantastic option for beginner traders. Standard account, on the other hand, requires a deposit of 100$ initial deposit.

- Cent account – $ 1 minimum deposit – best for beginners with small amounts of money

- Micro account – $ 5 minimum deposit – best for beginners

- Standard account – $ 100 minimum deposit – average trading account

- Zero spread account – $ 500 minimum deposit – best for news trading

- ECN account – $ 1000 – best trading account overall

On our page FBS account types, we compared the trading accounts in detail. You should visit it before signing up.

(risk warning: your capital can be at risk)

FBS regulation and safety of customer funds

As mentioned, being a european broker subject a trader to some thorough regulation that they have to adhere to. As such, FBS is a heavily licensed and regulated broker – and it is registered under numerous jurisdictions. It is licensed by the cyprus securities and exchange commission (cysec), one of the most prominent and trusted regulators of derivatives brokers which has been known to be thorough in its supervisory activities with forex, cfds, and binary options brokers.

It is as well registered under the international financial service commission, which is the financial regulatory authority of belize. By far, the most important point in this is the fact that by being a european broker, FBS is subjected to the markets in financial instruments directive (mifid). The mifid is the european union (EU) regulation that oversees and supervises the work of financial brokers. Mifid puts brokers under heavy regulation to comply with strict guidelines and rules.

For one, under no circumstance can the broker breach any terms of agreement against the trader. If they do so and the broker makes that known to the authorities, not only will the broker be fined, but it also has to compensate the trader. Such compensation can be very heavy at times. Furthermore, one of the regulations is that the broker must keep the funds deposited by traders separate from its own internal running funds. In fact, authorities expect that brokers keep such funds with third parties. Hence, if there is an issue with the broker, especially as regards insolvency or bankruptcy, the traders will not be affected. Nothing will happen to the traders’ funds. In fact, mostly they will have their funds given back to them.

If these do not convince anyone, one fact that proves the credibility of FBS is the partnerships that it has developed. FBS is the official trading partner of the barcelona football club. Popularly referred to as FC barca, barcelona FC is one of the biggest football clubs not only in spain and europe but in the entire globe. Both on the pitch and away from the pitch, barcelona FC is huge. It features some of the world’s very best players. It is also one of the richest clubs. All these confirm the authenticity of FBS as a broker.

FBS is FC barcelona sponsor

However, some facts are notable. One of the downsides to trading with FBS is that it operates in the form of a double entity. This means that it somewhat offers different services to different people. The services that FBS offers to traders in the EU area are also somewhat different from the ones that it offers to traders in other parts of the world. As such, it appears we have FBS europe and FBS international. However, this is not due to any faults of the broker. Signing up to be an EU-registered broker makes them liable to a lot of regulations. They have a lot of restrictions as to which type of services they can offer to traders. Many of such offers, however, cannot offer to traders from other parts of the world.

What you get when you trade with FBS

FBS offers traders a lot of premium services that you may not find with other brokers. They include:

- Better and much bigger leverage

Leverage is one of the most wonderful concepts in forex trading. In forex trading, it means borrowing to add to your trading account so that you can take more risks and take more trading positions. Normally, entering positions and trading in the financial markets is quite expensive. It is not for the average individual trader. For instance, investing in a stock like amazon might require a trader putting up at least $2,400 per share.

To trade gold (XAU/USD), you need to put up a similar amount. This is just for one single unit. Most traders cannot put up with this amount to trade. The concept of leverage however comes to their rescue. In essence, their broker assists them by helping them increase the power of their trading capital via leverage. FBS provides its traders in the EU with leverage as high as 1:30 for trading major currencies. Although this is small, it is entirely due to caps placed by EU regulators.

However, the case is entirely different for international traders. FBS offers leverage as high as 1:1000 and even 1:3000 in some cases. This gives traders all the space in the world to carry out trades and take up risks which can lead to more bountiful profits. However, as high leverage can benefit a trader, it can also hurt a trader’s account substantially.

- Social trading

Social trading involves copying the trades of other experienced and veteran traders directly. Social trading was one of FBS’s creations to help traders start earning from the day they start trading by copying others. It saves them a lot of stress and time that would have been spent learning.

Trading platforms

FBS provides traders access to trading via multiple channels. They include the popular metatrader4 and its more advanced version, the metatrader5. However, traders can also choose to go for the proprietary trading software known as the FBS trader.

All the above platforms are accessible via web trading and mobile apps on the google play and apple app stores.

FBS online trading platform

Web trading

Web trading is very comfortable since you don’t need to download or install any software. You simply login online through a browser and you start to trade instantly. You can access both the MT4/MT5 and the FBS trader via web trading.

MT4/MT5

MT4 delivers a wealth of features, advanced charting, and customization along with auto-trading capabilities while being available for PC/ mac, android, and ios devices. In addition to the stellar features and functions of the MT4, you can enjoy daily technical and fundamental analysis data that is made available in the news section. Other features include over 50 technical indicators, one-click trading, the possibility to create and use eas with no limitations, and even trade with VPS service support.

Moreover, in case you will be trading with FBS international, you will be offered access to the upgraded version, the metatrader5. This comes with more capabilities, features, and opportunities.

FBS trader

FBS trader functions as a copytrade app for social trading platform. It allows the following trading professionals or strategies, which is a great option for beginner traders to learn and earn.

Available markets

FBS gives you access to many markets to trade cfds. However, the range of instruments is still rather limited as there are around 40 currency pairs including exotic ones that are offered and 6 indices based on CFD trading, along with metals and energies. If you prefer trading stocks, futures, or many other instruments, FBS does not provide those.

FBS customer support

We have to note that FBS provides top-notch customer support services. Highlights of their customer support services include 24/7 accessibility via any of live chat, international phone lines, email, or even social media. FBS customer support gives relevant and quick answers to questions and concerns and they are definitely client-oriented.

Conclusion on the FBS minimum deposit

FBS is undoubtedly one of the best online brokers out there and one that you would really want to do business with. We have to note that its minimum required deposit, especially for the cent account, is a very trader-friendly one, when you consider the services offered. It is one of the lowest you find amongst quality forex brokers.

(risk warning: your capital can be at risk)

Review

Introduction

FBS is an international online trading brokerage that was launched out of belize back in 2009. Since their establishment, FBS have expanded their trading services to over 190 countries around the world and now service 8,000,000 traders and 315,000 partners across the globe and supports 17 different languages. The brokerage provides a simple and easy trading experience with a selection of trading platforms and wide array of tradeable instruments.

FBS is obviously a successful online trading brokerage and have won countless awards since their establishment in 2009. Some of their most notable awards include; best FX IB program, best FX broker indonesia, best forex broker southeast asia, best forex broker thailand, and best international forex broker. As well, FBS has won many other awards for various reasons.

Not only has the FBS brokerage seen great success, but they also provide safe and reliable online trading services to their clients. FBS is licensed and regulated by the international financial services commission (IFSC) of belize with license number IFSC/60/230/TS/18.

Trading conditions

The FBS online trading brokerage is very accepting and supportive of nearly every type of trader. FBS offers their clients the choice between 6 different trading accounts, each with slight differences to better suit their needs. Overall, the trading conditions outlined in these accounts vary but are very favourable. See the trading accounts and their trading conditions overviewed below.

- Deposit from $1.00

- Floating spreads

- Zero commission trading

- Up to 1:1000 leverage

- Market execution

- Deposit from $5.00

- Fixed spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $100

- Floating spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $500

- Fixed spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $500

- Floating spreads

- Zero commission trading

- Up to 1:500 leverage

- Market execution

- Deposit from $1000

- Floating spreads

- Zero commission trading

- Up to 1:500 leverage

- ECN execution

Products

The FBS trading brokerage features a wide array of tradeable instruments across the global markets for their clients to trade. For instance, traders can participate in the trading of over 35 forex currency pairs, 4 precious metals, 3 cfds, and 4 cryptocurrency cfds. While the extent of tradeable assets offered is rather small compared to some brokers, the range of markets available to trade in are wide.

Regulation

FBS is not widely regulated even though they are an international online trading brokerage. The only regulatory authority governing the FBS trading brokerage is the international financial services commission (IFSC) with license number IFSC/60/230/TS/18. FBS is an offshore trading brokerage and therefore is not as reliable as some brokers. FBS’s headquarters are located at no.1 orchid garden street, belmopan, belize, C.A.

Platforms

The FBS online trading brokerage provides their clients with the choice between two of the most highly sought-after trading platforms, the metatrader 4 (MT4) and the metatrader 5 (MT5) trading platforms. Both these platforms are highly advanced and sophisticated while at the same time very user-friendly and easy to use.

The metatrader platforms offered by FBS consist of both the webtrader platforms and the downloadable platforms. All platforms are fully compatible with windows, mac, and linux operating systems as well as multiple web browsers for the web-based versions.

All in all, both the MT4 and MT5 trading platforms offered are relatively the same. The main difference between the two is that the MT5 trading platform has an upgraded trading interface, a few additional features, and is more suitable for the trading of all financial assets other than forex. Therefore, traders looking to participate solely in the forex markets will choose the MT4 platform and traders more focused on a wider variety of markets will choose the MT5 platform.

Both platforms feature auto trading functionality with expert advisors (eas) as well as a sophisticated charting package with three chart types, over 50 technical indicators, and a variety of drawing and analysis tools.

Mobile trading

Both the MT4 and MT5 trading platforms offered by FBS feature downloadable mobile trading applications for both ios and android mobile devices. The mobile trading app can be downloaded from the apple app store and the google play store for free. The trading apps are fully optimized for the mobile screen and feature all the same functionality as the desktop platforms. As well, traders wanting to use the FBS website on a mobile device can, as it has been optimized to work on mobile devices too.

Pricing

The FBS trading brokerage is accepting of all experience levels of traders and therefore provides trading accounts with minimum deposits from as low as $1.00 and professional ECN trading accounts with minimum deposits from $1,000. As for the available spreads, FBS provides floating spreads as low as 0.2 pips, fixed spreads as low as 3 pips, and trading without spread, but with a commission starting from $20. All in all, the spreads and commissions offered by FBS are quite favourable and competitive with the industry standards.

Deposits & withdrawals

FBS provides their traders with an extensive array of deposit and withdrawal options with a total of 72. All methods of deposit are free of charge and withdrawals have varying commissions depending on the method used.

Deposits via the most popular e-wallets and credit cards are instant, and all other methods take between 15 – 20 minutes or a maximum of 48 hours to complete. Withdrawals generally take between 15 – 20 minutes or a maximum of 48 hours to complete and come with a small commission for most methods.

See below, a list of the most popular deposit and withdrawal methods.

- Visa/mastercard

- Neteller

- Skrill

- Bitcoin by skrill

- Perfectmoney

- Mybitwallet

- OKPAY

- Astropay

Customer support

The level of customer care and support provided by FBS is truly phenomenal. Traders can reach support representatives 24 hours a day, 7 days a week via email, live chat, telegram, wechat, and telephone with multiple international numbers. Also, clients can schedule a call back if they prefer not to wait. However, support representatives are generally quick to respond and friendly with their responses. Additional methods of support include an extensive FAQ page and interaction via various social media channels.

Research & education

FBS provides their traders with a comprehensive education and research centre that’s packed with educational resources and content. For instance, traders have access to market analytics such as forex news, daily market analysis, and forex tv. They also have access to trader tools including an economic calendar, central bank rates, and forex calculators. As for educational material, traders are provided with a forex guidebook, tips for traders, webinars, video lessons, seminars, and a glossary. All in all, we were very impressed with the extent of educational content and market research resources.

Noteworthy points

The FBS trading brokerage is highly successful and has an excellent reputation in the online trading industry. Therefore, the brokerage has various noteworthy points worth mentioning. For instance, FBS stands above the rest of online trading brokerages in the following areas.

- Extent of deposit and withdrawal options.

- Variety of educational content and resources.

- Exceptional selection of trading platforms.

Conclusion

The FBS online trading brokerage is a widely used international forex and cfds trading brokerage that features an array of tradeable assets across the global markets. FBS is an offshore trading brokerage which raises some concerns, however, they have an excellent reputation and are licensed and regulated by the IFSC. FBS is supporting of all types and experience levels of traders and offers them favourable trading conditions and low commissions and fees. Traders at FBS have an excellent selection of trading platforms to choose from and can trade a variety of financial assets with all the tools and features necessary to succeed. All in all, FBS is a solid online trading brokerage and could be the right broker for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : IFSC, cysec

Cryptocurrencies: YES

Minimum deposit: $1

Maximum leverage: 1:3000

Spreads: low

My score: 7.0

FBS is a broker that attracts many investors who have started forex trading. Because it offers extraordinarily competitive trading conditions. There are types of accounts that can be suitable for almost every investor type. Whether you are a long-term investor or a scalper, it does not matter.

FBS is a broker founded in 2009. Actually, I can say it’s pretty oldin forex world. However, in recent years it has become a very popular forex broker. FBS has strengthened its position especially in asian countries. The official website has about 2 million visitors per month. In addition, they also open a website in a country that has a special domain in the countries where they operate. For example: , they use the vnfbs domain for vietnam while using the fbsmy domain for malaysia. They also use the esfbs domain for spanish-speaking south american countries. In this way, there are 19 different websites. So if we count the number of visitors, there are about 5 million visitors per month. It’s a pretty high number. In the following image you can see local web sites for 19 different countries.

FBS regulation and licences

FBS forex broker is regulated by two watchdogs: IFSC in belize and cysec in cyprus. Why is FBS not licensed by FCA? They generally answer this question: the FCA license has a strict policy. When offering forex trading to many countries, it is more convenient to use more flexible licenses. The IFSC has a fairly liberal control over brokers. However, the cysec license also has strict requirements similar to FCA and ASIC. So I can say the cysec license is reliable and reputable.

Client funds of brokers under the cysec regulation are guaranteed by the investor compensation fund in the case of insolvency of the broker.

Account types and spreads in FBS

FBS is very competitive in terms of account types. FBS has investors from many countries. There are 19 more local websites. You can find a wide variety of account types in FBS. You can see these account types in the following table.

| Methods | processing times (deposit) | currencies |

|---|---|---|

| instant | USD, EUR |

| 5-7 days | USD, EUR |

| instant | USD, EUR |

| instant | USD, EUR |

| instant | USD, EUR |

| instant | USD, EUR |

| instant | BTC |

| instant | JPY |

| 1-3 days | USD, EUR |

| 72 hours | USD |

Cent account is very convenient and advantageous for novice investors. So you can earn real forex trading experience without any risk. Also investors who want to try out a robot or a new trading strategy may prefer this type of account. The minimum deposit for this account type is only $ 1. The maximum leverage is 1: 1000. It is an account type similar to nano accounts in XM and FXTM.

For micro account type, the maximum leverage is 1: 3000. The property of this account is fixed spread. Standard account is similar to standard account in other brokers. Avreage spreads are 0.9 pips on EURUSD. If you do not want a floating spread, you can choose zero account. There is 0 pip spread in this account type, but $ 20 commission is charged per lot as round turn.

In ECN and unlimited account types the maximum leverage is 1: 500 but spreads are more competitive.

Deposit and withdrawal methods in FBS

Deposit and withdrawal methods are sufficient. You can deposit or withdraw funds using the methods you can see in the table below.

| Account type | minimum deposit | minimum trade size | maximum leverage | average spreads (& commission) |

|---|---|---|---|---|

| cent | $1 | 0.01 lot | 1:1000 | 2 pips |

| micro | $5 | 0.01 lot | 1:3000 | 3 pips, fixed |

| standard | $100 | 0.01 lot | 1:3000 | 0.9 pips |

| zero spread | $500 | 0.01 lot | 1:3000 | 0 pips, fixed + $20/lot |

| unlimited | $500 | 0.1 lot | 1:500 | 1.1 pips |

| ECN | $1000 | 0.1 lot | 1:500 | from -1 pip + $6/lot |

FBS bonus and promotions

- $50 no deposit bonus

- $123 welcome bonus

- %100 bonus for deposit

- Iphone X promotion

- Cashback campaign for traders

If you want to use FBS no deposit bonus as $50, you should open a forex account and verify this account via personal informations. And then you trade with leverage as 1:500. This bonus is not withdrawable but profit from this bonus account is withdrawable after you traded 2 lots and reached $25 profit. Maximum profit is $500 that you can withdraw.

So, let's see, what we have: FBS has a wide range of payment systems and instant deposits and withdrawals without commission. In addition, it is possible to transfer funds between your accounts using internal transfers. At fbs broker minimum deposit

Contents of the article

- Actual forex bonuses

- Deposit and withdrawal

- Frequently asked questions

- Can I make a deposit in my national currency?

- How can I deposit funds into my account?

- What payment methods can I use to add funds to my...

- What is the minimum deposit amount?

- How do I deposit funds into my metatrader account?

- How long does it take to process a...

- How can I make a deposit and withdraw funds?

- FBS at social media

- Contact us

- Data collection notice

- FBS minimum deposit guide (2021)

- FBS account base currency

- FBS funding and deposit methods

- FBS minimum deposits

- FBS deposit bonus

- FBS broker minimum deposit tutorial and payment...

- Payment methods for the minimum deposit

- Are there fees for minimum deposits?

- What is the FBS minimum deposit?

- FBS regulation and safety of customer funds

- What you get when you trade with FBS

- Trading platforms

- Web trading

- MT4/MT5

- FBS trader

- Available markets

- FBS customer support

- Conclusion on the FBS minimum deposit

- FBS forex broker review

- The basics as to FBS company and establishment

- FBS customer support services

- FBS forex broker common features and options

- What is the bonus system in FBS broker?

- More about the trading platform in FBS

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

- Trade forex, cfds, stocks and metals with honest...

- Feel free to choose any account type you like!

- Deposit with your local payment systems

- Be armed with the latest news

- Data collection notice

- FBS broker minimum deposit tutorial and payment...

- Payment methods for the minimum deposit

- Are there fees for minimum deposits?

- What is the FBS minimum deposit?

- FBS regulation and safety of customer funds

- What you get when you trade with FBS

- Trading platforms

- Web trading

- MT4/MT5

- FBS trader

- Available markets

- FBS customer support

- Conclusion on the FBS minimum deposit

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Forex brokers lab

- FBS regulation and licences

- Account types and spreads in FBS

- Deposit and withdrawal methods in FBS

- FBS bonus and promotions

No comments:

Post a Comment