Open a trading account

You can open a trading account by simply completing an online form – meaning that you can often start trading in minutes.

Actual forex bonuses

We invented spread betting in 1974 and have led the way in our industry ever since. Today, we’re the world’s no.1 choice for spread betting and CFD trading. 1

Create a trading account

Fill in a simple form

We’ll ask about your trading knowledge to ensure you get the best experience

Get instant verification

We can usually verify your identity immediately

Fund and start trading

You can also withdraw your money easily, whenever you like

Start trading today. Call 0800 195 3100 or email newaccounts.Uk@ig.Com. We’re here 24 hours a day, from 8am monday to 6pm friday.

Contact us: 0800 195 3100

Start trading today. Call 0800 195 3100 or email newaccounts.Uk@ig.Com. We’re here 24 hours a day, from 8am monday to 6pm friday.

Contact us: 0800 195 3100

Why open a trading account with us?

Easy-to-use platforms

Seize your opportunity quickly and securely on fast, powerful platforms and apps.

The world’s no.1 1

Join over 239,000 traders worldwide who trust our FTSE 250, FCA-regulated status, and benefit from over 45 years’ market leadership and expertise.

Competitive spreads

Trade popular markets like EUR/USD from 0.6 points, FTSE 100 from 1 point and spot gold from 0.3 points.

Friendly support

We’re on hand to help you achieve your trading goals, right from the moment you join – 24hrs a day from 8am saturday to 10pm friday.

Effective risk management

Help protect your capital in-platform with our range of stop and limit orders, and keep track of your funds with an always-visible snapshot of your profit and loss.

Expert education

Develop your trading skills with our range of learning resources and practise risk-free in your demo account. Monitor your performance with the trade analytics tool once you start trading live.

What traders are saying

" IG is consistently reliable and trustworthy. You need a name you can trust when you have your money with them "

" IG are premier league compared to other trading systems. I have continuously recommended IG "

" IG is a fantastic broker. Easy deposits, great learning aids and their signals are also very good "

" IG offers by far the best trading service in the UK. Their whole team are both knowledgeable and helpful "

Who are IG?

We invented spread betting in 1974 and have led the way in our industry ever since. Today, we’re the world’s no.1 choice for spread betting and CFD trading. 1

Our business model is built around being on your side and wanting you to trade profitably. We’re a FTSE 250 company, based in london, authorised and regulated by the FCA. We keep your money secure in ring-fenced accounts at regulated banks.

Who are IG?

We invented spread betting in 1974 and have led the way in our industry ever since. Today, we’re the world’s no.1 choice for spread betting and CFD trading. 1

Our business model is built around being on your side and wanting you to trade profitably. We’re a FTSE 250 company, based in london, authorised and regulated by the FCA. We keep your money secure in ring-fenced accounts at regulated banks.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Trade on the UK's best platform 2

Create a trading account with IG and you’ll find a wealth of features to save you time and help you deal.

Fast charts

Spot your opportunity and deal direct from our fastest, most responsive HTML5 charts ever.

Trading alerts

Keep your finger on the pulse, wherever you are, with price, indicator and economic alerts.

Best execution

Your success means you’ll stay with us. So we do our utmost to act in your favour at every stage of the dealing process.

Trade wherever, whenever

Busy schedule? Take your position on the move from our award-winning apps. 2

Important information

- Applying by post

- Eligibility requirements

- Proof of identity

- Corporate account

If you'd prefer to apply by post, download and print the relevant pdf form and send it to:

New accounts

IG

cannon bridge house

25 dowgate hill

london

EC4R 2YA

Please remember to include proof of your identity when returning this form. Also make sure that you’ve read and understood our risk disclosure notice, customer agreements, order execution policy, conflicts policy and complaints information.

- You must be over 18

- You must meet our appropriateness assessment (in the application form) to see if spread betting, CFD trading or share dealing is appropriate for you – this is a regulatory requirement

- You must be resident in the UK or ireland to open a spread betting account

- Please note you must be a UK resident to open an IG stocks and shares ISA

Information checklist

We must verify your identity before opening an account for you.

We aim to finalise or respond to your application within a few business hours. Please provide a copy of the following documents:

- Passport OR driving licence

- PLUS a bank statement, credit card bill or utility bill from the last six months (we can’t accept mobile phone bills)

You can send these via any of the methods below:

1. Take a photo of the documents on your smartphone or tablet, then email them to newaccounts.Uk@ig.Com

2. Fax a copy to +44 (0) 20 7 633 5370

3. Post a photocopy to IG, cannon bridge house, 25 dowgate hill, london, EC4R 2YA.

If you’d prefer to discuss your application with a member of our account opening team, please call us on 0800 195 3100 (freephone) or +44 (0) 20 7633 5300.

You can also ask about opening an account on 0800 195 3100 or newaccounts.Uk@ig.Com. We're here 24hrs a day from 8am saturday to 10pm friday.

To find out more about our corporate accounts, email us on institutionalsales@ig.Com or give us a call on +44 20 7573 0219.

If you're ready to apply, please complete one of the below:

An online trading account enables you to trade on markets like forex, shares, indices and more. You may also be able to trade on both desktop and mobile, dependent on your provider.

You can open a trading account by simply completing an online form – meaning that you can often start trading in minutes.

You can typically trade across thousands of markets – such as forex, shares, indices, options and more.

Your security is ultimately in the hands of your provider. 256-bit SSL (secure sockets layer) encryption – used by IG – is the current industry standard for online financial transactions. Some providers also offer two-factor authentication for added account security.

Try these next

Which markets can I trade?

About IG

Learn to trade

Discover our range of over 17,000 markets

See how we've been changing the face of trading for more than 40 years

Explore our resources and take your skills to the next level

1 based on revenue excluding FX (published financial statements, june 2020)

2 best trading platform as awarded at the ADVFN international financial awards and professional trader awards 2019. Best trading app as awarded at the ADVFN international financial awards 2020

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Forex trading account – how to open trading account

“disclosure: some of the links in this post are “affiliate links.” this means if you click on the link and purchase the item, I will receive an affiliate commission. This does not cost you anything extra on the usual cost of the product, and may sometimes cost less as I have some affiliate discounts in place I can offer you”

One of the first steps in forex trading is opening a forex trading account. Account gives you entrance into trading world where you will be one of the traders on the biggest market.

" data-medium-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" data-large-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" loading="lazy" width="259" height="244" src="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" alt="forex trading account" />

I will show you what you need to do to open account with broker.

How to open trading account

In order to continue you need to have broker. If you do not have broker even then you can continue to inform yourself about opening an account. It is not bad to know more if you want.

To open trading account, demo or real, necessary steps are:

- Selecting trading account type

- Registration

- Activating trading account

This is global overview but I will get into more details further in this text. Be sure to open first demo account and then after demo trading, real account.

Choosing trading account type

This post is about opening real account. If you are looking how to open demo account check this:

Step by step guide: admiral markets demo account

When opening account, real account, you need to decide which type you want to open. Brokers offers a lot options for any trader and before deciding please read as much as you can so you do not get scammed.

Broker can offer you few account types:

- Business

- Personal

- Managed

- Managed

- Spot

- Futures

- Forwards

Managed account

Some brokers have account where you can deposit money and then let broker to trade for you. These kind of accounts are known as managed account. If you want to trade on forex market by yourself then do not choose this account type.

By the way they charge fees through profit they make on your account and there is minimum amount on deposit which can be different by brokers. Deposit amount is mostly several thousands dollars which can be to high for individual investor.

Be sure that you open forex spot account and not one of the other accounts like futures and forwards.

Trading account size

Between account sizes you will need to choose small or large accounts. Small account is for trader with small amount of invested money. Large account is for trader with high amount of invested money.

Small accounts with every pip move will bring you smaller profit but also small loss if market moves against you. At start it is best to have small loss if you make a bad trade. In time how your progress through forex market you can deposit more money and have large account. With large account every pip move will bring you more money on your account.

For beginners it is recommended to use small account until they master trading and afterwards they can continue on the larger accounts. This way they will protect heavily earned money from fast losing on forex market.

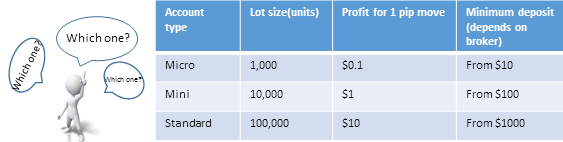

During account opening process sometimes you will encounter three types of account that broker offers you. They are:

- Mini account

- Micro account

- Standard account

There is difference between them as their name suggest it but in general there is no to much complicated differences.

What is micro account

Micro account is account mostly intended for novice traders but it is not mandatory that he is novice.

This account requires smaller amount of deposit and that is between $10 – $250. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $1,000 on the market. Every pip move gives $0.1 difference on trading account. If trade goes in your favor you will earn $0.1 and if trade goes against you then you lose $0.1.

As you can see 1 pip move does not bring a lot profit or loss. If you open a trade and wait until market moves in one direction for 100 pips then this amount will be $10. $10 can be a lot if you have invested $50 on your trading account.

If you are able to invest more money on you account it is best to do it because this way you will avoid possible margin call. With higher amount on the account you will have wide space to trade if trade becomes a bad trade.

Margin call happens when you have bad trade active and without enough money to sustain further loss. When critical level is reached broker automatically close your trade.

What is mini account

Similar to micro account mini account is for traders who wants to invest money in range from $100 – $500. It is a little bit higher then micro account but it gives you possibility to earn $1 with every pip move.

Every trade/contract that you open you control $10,000. Every pip move gives $1 difference on trading account.

It is 10 times more than micro account and for new traders this is more then enough. Same as for micro account here is better to have larger amount of money on account.

What is standard account

Standard account is account mostly intended for experienced traders but it is not mandatory. Novice traders sometimes use standard account for trading.

This account requires larger amount of deposit and that is from $1000 and above. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $100,000. Every pip move gives $10 difference on trading account.

Which account to open

Micro, mini or standard account depends on you and your preferences. Do you want to earn more money with 1 pip move or less money with 1 pip move.

Forex account – micro, mini and standard

Those who have more money and know how to trade they will go for standard account. For novice it is the best to go with mini account. With every pip move novice will earn $1 which is a good profit.

Advantage that you can have with mini account over standard account is when you have high amount invested on trading account you can open several trades. If you have 10 orders on mini account it is same as you have 1 order open on standard account.

On mini account each trade gives you $1 for pip move. If something goes wrong and your margin starts to become red you can close one of orders and rest of them leave open. This way your margin will not be overloaded and you will stay in the game with other orders. If market moves in your direction open orders will bring you profit.

As a conclusion mini account gives you more flexibility in trading over standard account but enough profit for 1 pip move. Choose wisely which account is best for you and your trading preferences.

Leverage

Another thing to watch out when choosing account is leverage on that account. Leverage is ability to control large sum of money using small amount of your invested money.

You can choose different leverage like from 1:50 up to 1:500. This is different from broker to broker. 1:50 means that with one 1$ you can control $50 on the market. Broker lends you rest of the money so you can trade on the market and make more money. But also lose more money if market goes against you.

After you have decided which account you want to have, personal/business or small/large you need to decide to open

- Live or

- Demo account

As said earlier, for beginners it is best to open demo to test and later on to open live account. On demo account you should at least learn how to open and close a trade.

From my experience I can tell you that I have started immediately with live account because demo account could not give me what I wanted and that is – live experience.

Registration

When registering real/live account you will need to do some paper work in order to open it. Those papers could be

- Your ID number

- Utility bill not older than 3 months with your personal address on it, so they can verify that it is really you and data you have provided are accurate

They need this information to comply with the law. Regulatory agencies wants to protect you so they have set requirements for broker to open an account for you. If you are not required to give them these information’s you should be suspicious because that is minimum what they should ask you to provide.

During registration broker could ask you several information about your trading experience, your trading intentions or how much you will invest. They like to get know you(KYC – know your customer) and your trading intentions.

Please read all what is written in their documents so you are familiar with all costs that can arise, if there is any. Also, pay attention when depositing money over wire transfer how much does bank charge for their services.

Trading account activation

When registration of your live account is done you will receive confirmation mail with account details. Information that trader receives in e-mail can be different because not all forex broker sends same e-mail.

- Account number

- Password for trading platform

- Server on which to connect

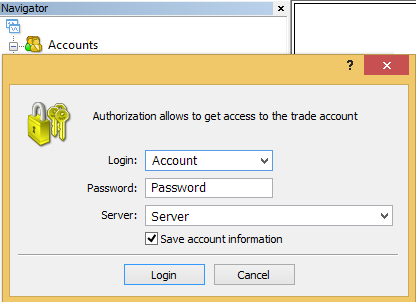

In order to activate trading account open your trading platform and follow further steps.

In the MT4 platform right click on the “accounts” menu which is located under “navigator” menu. After right click you will select “login to trade account“.

Use those information’s and enter them into new window that appears, like the picture below this text.

If everything is fine with data entered your trading platform will start to show you real information about trading pair price. If not, you will hear sound that indicates you have entered incorrect data.

Possible cause you did not connect to trading platform with information from broker is:

- Wrong login data – check information from broker

- Wrong trading platform – use platform from your broker

- No internet access – check can you open some other website in your browser in order to verify is internet connection ok

If you have entered all data as shown above and you have tested possible source of the problem and even then you are not connected then please call broker support.

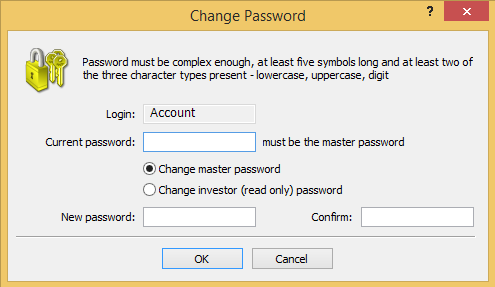

Password change

Password is possible to change immediately after you login into trading account. You are not obligated to leave same password you have received from your broker. You can change it to your desired password where you need to fulfill certain requirements.

Go into MT4 menu “tools” and select “options” with which you will open new window.

“tools” menu for trading account password change

In “options” window under tab “server” you will see option to change password. All other parameters you can leave as they are.

Change trading password under tab “server”

Select “change” and window “change password” will appear where you need to enter new password details. Enter your current password you have received from broker and enter new password. There is 2 places where you need to enter password, “new password” and “confirm“.

Trading account password change

Please pay attention to fulfill all necessary conditions for new password.

- At least five symbols

- At least two of the three character lowercase, uppercase and digit

After all above is done you will have account on MT4 platform ready for trading. If you are using real account then you will need to fund it with real money.

Transfer of real money on the trader account is done in trader room. I cannot show you steps because trader room is different on each broker. But mostly they have instructions how to transfer money from your credit card or bank account or any other possible channel.

FREE 5 day email course

Email course is for beginners who do not know to much about forex trading but wants to know

- What is forex

- What is trading and where to start

- What is metatrader 4

- How to setup charts on metatrader 4

- How to open and close order in metatrader 4

After you are done you will know how to use FREE trading platform to activate order by selecting currency pair on the forex market and make money.

- Trading platform?

- Activate order?

- Select currency pair?

- Make money?

To much strange words? Get them clear and start trading!

Frano grgić

A forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the first choice for traders and beginners. Market analysis is featured by forex factory next to large publications like dailyfx, bloomberg. Getknowtrading is becoming recognized among traders as a website with simple and effective market analysis.

BETA TESTERS WANTED

This is opportunity to be one of the first people to:

On online course about how to start trading

Join if you want to be part of and learn while testing

Categories

Forex signals

FREE PDF's

What is leverage?

How to calculate pip value?

What is margin?

What is lot?

How long demo trade?

0 comments

Disclaimer: any advice or information on this website is general advice only – it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by get know trading, it’s employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, CFD’s, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

How to open a share-dealing account

How to choose the best trading account for share dealing, and start investing in UK and international markets.

Updated jun 30, 2020 . What changed?

How we chose our best trading apps

What's in this guide?

Invest in shares with 0% commission on etoro

Other fees may apply. Your capital is at risk.

- Unlimited trades, with no dealing charges or management fees

- If your trades get copied you can earn extra money

- Create an account today in a few minutes

All investing should be regarded as longer term. The value of your investments can go up and down, and you may get back less than you invest. Past performance is no guarantee of future results. If you’re not sure which investments are right for you, please seek out a financial adviser. Capital at risk.

Online share dealing allows you to buy and sell shares in publicly listed companies from your phone, laptop or tablet. Where previously you needed a broker in order to access markets, these days investors trade directly by opening a share-dealing account with an online share-trading platform.

This guide allows you to easily compare online share-trading accounts, and takes you through the steps involved when choosing a platform.

Compare the UK’s leading trading platforms

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

All investing should be regarded as longer term. The value of your investments can go up and down, and you may get back less than you invest. Past performance is no guarantee of future results. If you’re not sure which investments are right for you, please seek out a financial adviser. Capital at risk.

Or use a stocks and shares ISA

A stocks and shares ISA can be another good option for investors. Legal & general’s award-winning stocks and shares ISA let’s you choose from three investment options. You can let them do it for you, use index-tracking funds to build your own portfolio, or pick your own funds.

Why trade shares online?

Trading shares online offers a secure and easy way to manage your investments. You can place trades at a time and place convenient to you, with the obvious benefits of dividend payments and investing for the future.

There are of course risks attached to trading shares, including the possibility of losing money you invest. It’s important to make sure you’re aware of those risks before you start trading.

Thank you for subscribing!

How do I choose an online share-dealing platform?

You’ll need to carefully consider what you need before deciding on the right online trading platform. Some of the issues to consider include:

- Your trading knowledge and experience. Some online trading platforms are designed to suit casual investors. Other trading platforms have features geared towards experienced traders, such as advanced charting tools, speedy execution of trades and live market data. These features may come at a cost,

however, and may not add much value if you are a less experienced trader. - The markets you can access. Some share-dealing platforms only provide access to companies listed on the london stock exchange, while others will also allow you to place trades on international markets. Some trading platforms will also provide access to other trading instruments, for example forex and contracts for difference (cfds).

- The fees involved. There are two main costs you need to consider when choosing a share trading platform: the brokerage fee and the ongoing fee. The brokerage fee applies each time you place a trade and is usually around £10-£25, but could be higher based on the size of the transaction. Ongoing subscription fees are charged monthly and vary depending on the provider and the account features you select. Before choosing a platform, make sure you understand the fees you’re likely to pay. As boring money CEO holly mackay told finder, “t ransparency has improved a lot and some platforms are actually now quite good at being very clear on what investors will pay.”

- Trading resources. From educational tutorials to research and investment advice, check what tools a platform offers to help you make informed trading decisions.

- Customer service. If you ever have a problem or need help with a trade, check to make sure you will be able to access prompt and helpful customer support.

How to open a share-trading account

The exact process for opening a share trading account varies depending on the trading platform you select. However, you’ll generally need to complete the following steps when signing up:

- Choose your broker.Research a range of options to find the online stockbroking provider that offers all the features you want at an affordable price. Some providers also offer a choice of share trading platforms, for example a free web-based platform for casual investors and a more complicated software package with a monthly subscription fee for experienced traders.

- Choose your membership level. Some providers offer a choice of membership tiers, each with a different level of features and a different ongoing fee. For example, you may need to choose between a bronze, silver or gold trading account.

- Provide your details. You’ll need to provide your full name and a valid form of photo ID, as well as your email address, phone number.

- Link your bank account. You’ll need to supply details of the bank account which will be used to finance your trades and you may be required to deposit a minimum amount. Some share dealing platforms will also require you to open a cash management account with a specific financial institution before you can start trading.

- Submit your application. Your application to open a share trading account will usually be processed within 1-2 business days.

- Start trading. Once your application has been approved you can login to your account and start trading.

Tips for new investors

Hargreaves lansdown’s sophie lund-yates shares her advice for new investors looking to join the stock market.

FOREX trading accounts

Choose an account type that best suits your trading style.

FOREX.Com account

- Advanced trading platforms with customizable interfaces

- Trade forex, equities and more, all on one account

- Fast, reliable trade executions

Metatrader account

- Dedicated FX trading platform

- Exclusive in-platform market news and analysis

- Trades execute at the best available price

DMA account

- Trade on prices as low as 0.1 on all major FX pairs

- Get commission discounts as low as $20/m traded

- Split the spread and place orders within the top of book spreads

What information do I need when opening an account?

We will need you to provide us with your name and address to establish your identity. Typically, we can verify your identity instantly. For more information, see our account document faqs.

What markets does FOREX.Com offer?

You can trade over 80 currency pairs at FOREX.Com. View our full range of markets.

When is forex market open for trading?

You can trade forex at FOREX.Com 24 hours a day, five days a week. For details, read our forex trading times article.

Is there a charge for central clearing?

We provide central counterparty clearing through an omnibus segregated clearing account (OSCA) free of charge as standard to all clients. If you wish to open an individual segregated clearing account (ISCA), fees apply:

- For an individual these charges are: £13,000 account opening fee, plus account maintenance and transaction charges

- For a corporate entity these charges are: £200,000 account opening fee, plus account maintenance and transaction charges

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Реальный торговый счет

Global markets at your fingertips

Unfortunately, IC markets do not accept traders from the united states unless they are “eligible contract participants” (“ecps”), as defined in section 1a(18) of the commodity exchange act. If you qualify as an ECP, you may continue to register as a client of IC markets provided you upload the ECP eligibility declaration form duly completed and signed on secure client area upon registration.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

IC markets (EU) ltd does not offer its services to residents of belgium. For further information, please contact our support at support@icmarkets.Com.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

IC markets (EU) ltd does not offer its services to residents of latvia . For further information, please contact our support at support@icmarkets.Com.

IC markets (EU) ltd is regulated by the cyprus securities and exchange commission (cysec) under the CIF licence no 362/18.

Residents of europe that wish to open an account under cysec license, please proceed to www.Icmarkets.Eu

You are now being redirected to internation capital markets pty ltd, a company regulated by the australian regulator ASIC.

Please confirm that you want to be redirected by clicking accept.

You are now being redirected to raw trading ltd, a company regulated by the seychelles regulator FSA.

Please confirm that you want to be redirected by clicking accept.

You are now being redirected to IC markets (BS) ltd, a company regulated by the bahamas regulator SCB.

Please confirm that you want to be redirected by clicking accept.

We are very sorry, our ASIC licensed entity can accept residents of australia only. We're redirecting you to our SC licensed entity where you can choose to continue your application.

The website you are visiting now is operated by IC markets global, an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Based on your country selection you might want to visit instead www.Icmarkets.Eu

If you want to proceed with onboarding with IC markets global please confirm that, this decision was made independently at your own exclusive initiative and that no solicitation or recommendation ha been made by IC markets or any other entity within the group.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

How to open a trading account?

India has been moving towards a cashless economy. The government is actively pushing digital forms of transactions in the country. Digital modes of transactions are faster, secure and more cost-efficient. If one traces the origin of the digital revolution in the financial sector of the country, the search may end at the capital markets. The stock markets had migrated from physical to electronic mode of trading in 1996. The introduction of the depositories act 1996, led to the dematerialisation of shares.

Before the conversion of physical certificates into an electronic form, the stock markets operated on an open outcry system. Traders communicated verbally and through gestures to buy and sell shares. With the advent of electronic trading, investors do not have to be present at the stock exchanges and a simple online command is enough to execute a trade. However, certain tools are a prerequisite for electronic trading. You need to have a demat account, trading account and bank account to access the capital markets.

What is a trading account?

All the three accounts are linked and work in tandem with each other. The bank account is used to store cash which is used to trade in securities. The demat account is hosted by depositories and is used to store the different kinds of securities bought by the investor. But when you have to sell your holdings or buy new securities, you will have to use a trading account. The trading account is essentially an interface between the demat account and the investor. It is not possible to buy or sell a unit of security without a trading account. The trading account has replaced the open outcry system prevalent in earlier times. Now, you just have to place the order through the trading account and the request is forwarded to the stock exchanges. Upon the completion of the transaction, the securities are deposited in the demat account and the required amount is deducted from the bank account.

Uses of trading account

A trading account is not limited to stocks. There are trading accounts for currencies, commodities, bonds, gold and exchange-traded funds. There are several benefits of an online trading account. The biggest benefit is that you can open trading accounts online and do not need to visit a bank or the office of the broker. Trading accounts provide one-point access unlike physical trading.

Through a single trading account, you can access stock exchanges like BSE and the national stock exchange and commodity exchanges like multi-commodity exchange and national commodity and derivatives exchange. Open trading accounts online to get the flexibility to trade through multiple mediums. With a trading account you can trade through mobile, desktop or through a call.

Step by step guide on how to open a trading account

Opening a trading account online opens up a host of investing possibilities. You must be wondering how to open a trading account. You can open a trading account in a few simple steps.

- In the first step, choose a brokerage firm to open a trading account. Conduct thorough research and opt for a credible brokerage firm. Take the various charges levied by brokerages, the interface of the trading platform and the value-added services into account before finalising a brokerage.

- After zeroing in on the broker, get in touch with and enquire about the trading account opening procedure. The brokerage will require you to fill up an account opening form and a know your customer form. A representative from the brokerage firm will assist you with the process. Most brokerages offer a demat-cum-trading account as a demat account is mandatory to store the securities.

- Along with the forms, you will have to submit identity proof, residence proof and in some cases proof of income. A photocopy of the aadhar card or passport, besides several other documents can be used as proof of residence. Similarly, a copy of an aadhar card or PAN card can be used as identity proof. The PAN card is compulsory to open a trading account.

- Post submission of the documents, the brokerage will conduct a manual know your customer verification. A representative may visit your house to verify the documents or you may be asked to verify the documents over the phone.

- If you do not want to manually verify the documents, you can opt for the e-KYC process. For the e-KYC process, you will have to ensure that your PAN card is linked to the aadhar card and your bank account. The mobile number submitted in the account opening form should be the same as the aadhar card for the e-KYC process.

- It generally takes 3-4 days to activate the trading account after the completion of the verification process.

Benefits of india infoline trading account

IIFL securities is one of the oldest and the most credible names in the market. Opening a trading account with IIFL securities can provide you a host of benefits.

- The company offers paperless account opening option improving customer convenience.

- Successful investing is a result of informed decisions based on reliable information. Along with the facility to buy and sell securities, you also get access to reliable financial data and research reports with the IIFL demat and trading account.

- The requirement for different categories of investors varies. A day trader may need low brokerage rates, but a long-term investor may not be concerned with brokerage fees. IIFL securities provides an option of three brokerage plans to choose from.

- The company has an extensive network of over 4000 branches across india.

- It also gives the investors an edge with its five next-generation trading platforms. With IIFL securities, you do not have to worry about asset classes as it facilitates trading in all segments such as equity, derivatives, commodity, currency and mutual funds.

IIFL trading platforms & technologies

IIFL has developed various trading platforms to suit the needs of different types of investors. Some investors need different types of charts and financial data, while some investors need just research reports. Depending on the level of investor’s sophistication, IIFL offers five different next generation platforms.

IIFL markets:

TT iris:

IIFL MF app:

Along with the IIFL markets, IIFL MF and TT iris, IIFL has also developed the TT web and the ttexe platforms.

Trading account charges (refer to the fees page for details)

IIFL securities has three equity brokerage plans catering to different types of investors.

Variable brokerage plan:

Flat brokerage charge:

Value-added subscription plan:

Faqs on trading account

Does IIFL provide online commodities and currency trading accounts?

With a trading account from IIFL securities, you can invest in the commodities and currency markets

Can I trade in the derivatives market with an IIFL trading account?

Yes, you can trade in the derivatives market with an IIFL trading account.

Is IIFL a full-service broker or a discount broker?

IIFL is a full-service broker and provides high-quality research and other financial data to investors. Discount brokers just provide buying and selling services.

Can I invest in mutual funds with an IIFL account?

With an IIFL demat and trading account, you can invest in mutual funds along with stocks, currencies and commodities. IIFL has developed a dedicated platform IIFL MF app for mutual fund investments.

Does IIFL charge a minimum brokerage for trading?

If you are trading in the cash delivery system, you will be charged a minimum of rs 25 per scrip under the variable brokerage and flat brokerage plans.

Will I get a demat account with an IIFL trading account?

With IIFL, you do not have to worry about opening a separate demat account. IIFL offers demat-cum-trading account which eliminates the need to search for a demat account provider.

Can I invest in ipos through an IIFL trading account?

Yes, you can invest in ipos and fpos through an IIFL demat-cum-trading account.

Does IIFL provide research reports and stock recommendations?

With IIFL, you can rest assured of getting access to high-quality research reports. A team of professional analysts prepares the reports which lead to rewarding stock recommendations.

Table of content

How to open a trading account?

Learn about demat & trading account

Demat account:

Trading account:

Open free demat account at IIFL & get the best trading experiences!

Our representative will contact you shortly!

Free bloomberg ebook

Getting technical: a guide to trend trading

Discover the different technical tools you can use to elevate your trades with our free ebook, written in partnership with bloomberg.

- Debunking the myths of technical analysis

- The different trend trading strategies, and variety of technical indicators

- How to build strategies for short-term and long-term trading

Trade with the world’s no.1 CFD provider 1

Get an easy-to-use platform, expert trade ideas and friendly support as standard.

You can contact us on +61 3 9860 1799 or helpdesk.En@ig.Com about opening an account. We're here 24hrs a day from 8am saturday to 10pm friday (UK time).

You can contact us on +61 3 9860 1799 or helpdesk.En@ig.Com about opening an account. We're here 24hrs a day from 8am saturday to 10pm friday (UK time).

Experienced trader?

Tight spreads, fast execution and a team of experts on call around the clock.

New to trading?

Comprehensive education, round-the-clock support and a free demo account.

What our clients think

17,000+ markets. Countless opportunities.

Trade cfds with us to take advantage of both rising and falling prices.

Platform by traders, for traders

Seize your opportunity, with technology built designed to ensure that your deal goes through .

- Fast, easy-to-use web platform

- Award-winning apps optimised for all devices 2

- Specialist platforms and charting – L2 dealer, prorealtime and MT4

- Full suite of alerts and risk management tools

Support when you need it

Round-the-clock support

24 hours a day, from 8am saturday to 10pm friday (UK time).

Interactive education

Free trading courses and webinars on IG academy

Speak to other traders

Online peer and staff support in IG community

Up-to-the-minute analysis

Inform your decisions with timely dispatches from our large team of global analysts. Stay updated while trading, with in-platform reuters and twitter feeds.

Latest news and analysis

EUR/USD and USD/JPY reach resistance, while GBP/USD trends upward

The outlook for EUR/USD is unclear, data suggest

EUR/USD, GBP/USD, and AUD/USD start to roll over from resistance

Live prices on popular markets

Live prices on popular markets

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

IG international is a member of IG group which has over 45 years of experience offering a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

IG international is a member of IG group which has over 45 years of experience offering a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

1 based on revenue excluding FX (published half yearly financial statements, june 2020).

2 awarded ‘best trading app’ at the investors chronicle and financial times investment and wealth management awards 2018, and at the professional trader awards 2019.

Markets

Trading platforms

Learn to trade

About

Contact us

The risks of loss from investing in cfds can be substantial and the value of your investments may fluctuate. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

CFD accounts provided by IG international limited. IG international limited is licensed to conduct investment business and digital asset business by the bermuda monetary authority and is registered in bermuda under no. 54814.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG international limited is part of the IG group and its ultimate parent company is IG group holdings plc. IG international limited receives services from other members of the IG group including IG markets limited.

Open your trading account today

Kane pepi

Share trading account

75% of retail investor accounts lose money when trading cfds with this provider.

Buy over 800 global shares with zero commission trade share cfds with tight spreads copy top share traders with the copytrader tool excellent share trading app for ios and android simply user-friendly trading platform

Forex trading account

72.6% of retail investor accounts lose money when trading cfds with this provider.

Huge range of over 140 forex pairs 0% commission forex trading and tight spreads AI-powered trading platform trading app and stand alone educational app news and analysis via capital.Com TV

Share CFD account

80.5% of retail investor accounts lose money when trading cfds with this provider.

Some of the lowest spreads on the market cfds for over 1,800 global shares low overnight interest rates high-quality charting with 107 built-in indicators unlimited share trading demo account

Social trading account

75% of retail investor accounts lose money when trading cfds with this provider.

World’s leading social and copy trading platform copy over 12 million traders and investors invest as little as $200 in copy trades professionally managed copyportfolios discuss strategies and tips with other traders

About kane pepi

Kane pepi is a british researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in malta, kane writes for a number of platforms in the online domain. In particular, kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, kane holds a bachelor’s degree in finance, a master’s degree in financial crime, and he is currently engaged in a doctorate degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find kane’s material at websites such as moneycheck, the motley fool, insidebitcoins, blockonomi, learnbonds, and the malta association of compliance officers.

Open and test drive our demo trading account

By opening this demo account you confirm your acceptance of our demo account terms and conditions and privacy policy.

Learn to trade with a demo account

Trading with city index

Technical analysis

Fundamental analysis

Financial markets

Demo trading support service

We provide detailed information about every aspect of our service with ongoing account support for every client.

Platform walkthroughs

Ongoing support

Live account upgrade

A demo account cannot always reasonably reflect all of the market conditions that may affect pricing, execution and margin requirements in a live trading environment. Margin and leverage settings may vary from time to time between your demo account and a live account due to live account setting changes imposed as a result of elevated market volatility or other factors.

Demo accounts are intended to enable you to familiarise yourself with the tools and features of our trading platforms. Success or failure in simulated trading bears no relation to probable future results with any live trading that you may choose to engage in, and you should not expect any success with the demo account to be replicated in actual live trading.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

* spread betting and CFD trading are exempt from UK stamp duty. Spread betting is also exempt from UK capital gains tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

† 1 point spreads available on the UK 100, germany 30, france 40 and australia 200 during market hours on daily funded trades and cfds (excluding futures).

‡ voted “best trading platform”, “best mobile application” and “best spread betting provider” at the OPWA awards 2019. Voted “best professional trading platform” and “best spread betting provider” at the 2019 shares awards. Voted “best CFD provider” at the ADVFN international financial awards 2020.

City index is a trading name of GAIN capital UK limited. Head and registered office: devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is a company registered in england and wales, number: 1761813. Authorised and regulated by the financial conduct authority. FCA register number: 113942. VAT number: GB 887 937 443. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

City index and city trading are trademarks of GAIN capital UK ltd.

The information on this website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

So, let's see, what we have: find out how to create a trading account online, and learn how to trade with IG - the UK's best trading platform. At open a trading account

Contents of the article

- Actual forex bonuses

- Create a trading account

- Why open a trading account with us?

- Easy-to-use platforms

- The world’s no.1 1

- Competitive spreads

- Friendly support

- Effective risk management

- Expert education

- What traders are saying

- Who are IG?

- Who are IG?

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Start trading now

- Start trading now

- Trade on the UK's best platform 2

- Important information

- Try these next

- Which markets can I trade?

- About IG

- Learn to trade

- Markets

- IG services

- Trading platforms

- Learn to trade

- Contact us

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

- How to open a share-dealing account

- How to choose the best trading account for share...

- How we chose our best trading apps

- What's in this guide?

- Invest in shares with 0% commission on etoro

- Compare the UK’s leading trading platforms

- Or use a stocks and shares ISA

- Why trade shares online?

- How do I choose an online share-dealing platform?

- Tips for new investors

- FOREX trading accounts

- Try a demo account

- Try a demo account

- Реальный торговый счет

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- How to open a trading account?

- What is a trading account?

- Uses of trading account

- Step by step guide on how to open a trading...

- Benefits of india infoline trading account

- IIFL trading platforms & technologies

- Trading account charges (refer to the fees page...

- Faqs on trading account

- Does IIFL provide online commodities and currency...

- Can I trade in the derivatives market with an...

- Is IIFL a full-service broker or a discount...

- Can I invest in mutual funds with an IIFL account?

- Does IIFL charge a minimum brokerage for trading?

- Will I get a demat account with an IIFL trading...

- Can I invest in ipos through an IIFL trading...

- Does IIFL provide research reports and stock...

- Table of content

- Learn about demat & trading account

- Free bloomberg ebook

- Getting technical: a guide to trend trading

- Trade with the world’s no.1 CFD provider 1

- Experienced trader?

- New to trading?

- 17,000+ markets. Countless opportunities.

- Platform by traders, for traders

- Support when you need it

- Up-to-the-minute analysis

- Latest news and analysis

- EUR/USD and USD/JPY reach resistance, while...

- The outlook for EUR/USD is unclear, data suggest

- EUR/USD, GBP/USD, and AUD/USD start to roll over...

- Live prices on popular markets

- Live prices on popular markets

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Start trading now

- Start trading now

- Open your trading account today

- About kane pepi

- Open and test drive our demo trading account

- Learn to trade with a demo account

- Demo trading support service

No comments:

Post a Comment