Real money trading

Here's my two biggest problems with paper trading for beginners and I think this encompasses a lot of different things that hinder your ability to make the leap between paper trading and real money trading.

Actual forex bonuses

Here are a couple of tips I have for paper trading to do it right. If you are going to paper trade, you want to paper trade which I think is a good idea, let’s make sure that you do it right, so here are my top four tips.

Paper vs. Real money trading

With paper trading no real money is put at risk, instead “monopoly money” or “paper money” is used, hence the name. I am a firm believer that paper trading is not only beneficial, but is an absolute requirement of successful trading (and I still paper trade new ideas).That said, everyone can read about trading or take a course about trading but until you actual open up a real money account with a broker and start placing orders; you will never learn exactly how it works.As the old saying goes, “there is no substitute for seat time.” the more experience and education you have the more profitable you will be as a trader.

In today's video, I just want to talk about some of the differences that you should be aware of between paper trading and real money trading. With paper trading, no real money is put at risk, and that's why people like it.

It’s kind of this monopoly money that you can use, hence the name, the paper money that you can trade, and it gets you acclimated to the broker platform and the margin and the markets.

If you’re new to trading or even if you’ve been a trader for a long time, it’s a good way to get your feet wet without risking a lot of money. I’m a firm believer that paper trading is not only beneficial, but it's an absolute requirement of successful trading.

To be honest, I still paper trade new ideas. I do the bulk of my trading with real money, but if I have a new idea or a new way of doing things, I might paper trade that strategy for a couple of months and try to test it out a little bit before I put some real money to use.

Here's my two biggest problems with paper trading for beginners and I think this encompasses a lot of different things that hinder your ability to make the leap between paper trading and real money trading.

The first thing is that it teaches you to do things you normally wouldn’t do with real money. This is the number one thing for me because with paper money, you usually get this account that's $100,000 of paper money and it's just not realistic.

It’s paper money; you know that it's not real money, so you end up making trades that are more aggressive than you normally would, you end up getting out of trades maybe slower than you normally would.

And it doesn't teach you that much because you don’t have real money on the line, skin in the game. That's the first thing, is that it doesn’t teach you. It teaches you to do things that you normally wouldn't do with your account.

Number two is that market fills and pricing are instant when you paper trade. This is true of the thinkorswim broker platform, their paper money account.

When you enter a trade, as long as the market is open and your price is very close to where the market is trading, you’ll instantly get filled, and you’ll instantly get filled at your price because it’s just paper money, so they don't care about real fills.

But when it comes to real money trading, market pricing and fills are extremely important. In fact, we did a huge tutorial on just how much money you can lose on slippage, not trading liquid products and it's amazing.

The difference that people tell me about when they go from paper money trading to real money trading, they think that they can get in and out of all these markets quick and at great pricing and it’s just not the case.

I think that's the number two thing on my list here because that makes a huge difference in your ability to be successful, is the ability to get in and out of things quickly at great prices.

Now that said, everyone can read about trading or take a course on trading, but until you open up a real money account with a broker and start placing orders, you will never learn exactly how it works.

This is what everyone always talks about. As the old saying goes, there’s no substitute for seat time. The more experience and the education that you have, the more profitable you will become a trader.

That doesn't mean that you have just to start out investing all of your money, but putting some money at risk is a really good thing because then, it ties your emotion into the game and that's really important.

Here are a couple of tips I have for paper trading to do it right. If you are going to paper trade, you want to paper trade which I think is a good idea, let’s make sure that you do it right, so here are my top four tips.

Number one: resize your paper money account down to mirror your account. I think it's insane that when you open up a paper money account that you start trading with $100,000 or $200,000 because you can set whatever price you want.

What you ideally should do is resize that paper trading account down to what you're going to trade or even less, and then if you can make money with less money paper trading than you have in your real account, then you’re probably ready to make that jump over.

Number two: automatically reduce fill prices by $5 across the board. I would even say if you can successfully do it and reduce prices by $10 across the board, that’ll give you a little bit better idea of what will happen in the market when you go to real money trading.

Number three: you’ve got to stick with the system and treat it like real money. I know this is hard because you know it’s paper money, it’s fake money, so my tip here is making a side bet with your spouse for competition or a brother, a sister, a friend, a co-worker, it doesn't matter.

Make a side bet between you two. They don’t even have to be traders. Just say, “hey look. I’m making this bet. I’ll bet you $100 that at the end of six months I have more money in my paper trading account than I had, to begin with.”

That’s all you should be doing, is just trying to make a profit or even turn everything over and stay even in your account as you get started.

But helping to do that is by making that side bet with a spouse or somebody else, a brother, a sister, a co-worker to keep you accountable to the system.

Number four: you’ve got to put real money at risk sooner than later. While I suggest absolutely that you have to start paper trading right away if you’re a newbie or even somebody who’s been in the business a long time and starting to trade new strategies.

I think that at some point, you have to put real money to risk even if it's only $1,000. I say after you’ve paper traded for maybe two weeks of three weeks as a beginner and you have the system down and the basics down, go ahead and put some real money to work.

Open up an account with $1,000. It doesn't mean that you trade all $1,000, by no means, but maybe you can make small directional trades that are $50 or $30.

There’s very small trades that you can do where you get a little bit directional, you’ve got good risk reward, and that’s how you get started in the markets and make that leap from paper trading to real money trading.

As always, I hope you guys enjoy these videos. If you have any comments or questions, please add them in the lesson page below. Until next time, happy trading!

Real money trading in games: a cryptocurrency solution

@ lordmancerlordmancer II

Real money trading has a long history in the game industry, and has been historically banned or discouraged by most western game developers and publishers, especially in the case of mmorpgs. Coincidentally, mmorpgs are also the games in which real money trading and markets are in highest demand by users, due to the way that resource and item scarcity gate progress.

Below are a few examples of trading and market implementations in real games.

Team fortress 2 and DOTA 2

These games contain “cosmetic item markets” (steam workshop) where you can exchange or sell your goods to another player for real dollars. This is condoned and encouraged by valve, and they created a backend and framework to support this type of exchange.

Valve has disclosed that over 90% of the items in TF2 were actually created by players. Users can submit models and textures to be voted on by the community, and those with high enough ratings are sold in the TF2 store. Creators a cut of the profits.

There is no publically available data concerning turnover in the cosmetic item market in DOTA 2, but in 2015 total monthly revenue of the game exceeded $18 million USD.

Second life

Second life is an online virtual world. While not a traditional MMOG, second life fosters interaction between players and with the world by simulating as much of the real world as possible in a virtual space. Linden labs, the developer, implemented a player-centric economy in which players can make real money. The economy is build upon the linden dollars (L$), which players can earn by engaging in various activities in the game. Some activities are quite passive, such as sitting on camping chairs, while others like creating virtual content and trading virtual real estate require real skill.

Some players would rather save time and spend cash for L$, and other players prefer to generate L$ with their in-game activities. The balance between these types of players supports the lindex currency exchange, and provide the liquidity necessary to allow players to purchase L$ for real currency.

Entropia universe

Entropia universe is a good example of a game that allows players to exchange hard currency into real money. Entropia uses a micropayment business model in which players may buy in-game currency (PED — project entropia dollars) with real money. Later, if the user gains more than they can use or decides to leave the game, they can redeem their remaining PED for U.S. Dollars at a fixed exchange rate of 10:1. This means that virtual items acquired within entropia universe have a real cash value, and the company generates income via transaction fees levied during the exchange process.

Like lordmancer II, entropia universe is a free game, but spending money on the in-game currency allows users to purchase items, skills, deeds/shares, and services from other players. Entropia also contains a market where expendable resources (ammunition, probes, guns, finders, extractors) can be purchased directly or other players.

Entropia universe was noted in the guinness world records book in both 2004 and 2008 for the most expensive sale of a virtual world object. In 2009, a virtual space station, a popular destination in the game, sold for $330,000 USD. This was then eclipsed in november 2010 when jon jacobs sold a club named “club neverdie” for $635,000 USD; this property was sold in pieces, the largest of which was sold for $335,000 USD.

According to the mindark’s 2015 earnings report, their 2015 profit was 4 million SEK.

World of warcraft & diablo III

Prior to diablo III, blizzard did not permit any form of real money trading in their games, and the company engaged in long-running and generally-successful campaign to stop character leveling services and gold farmers/sellers in world of warcraft. At the same time that blizzard was working on eliminating external game markets, they also began to experiment with monetization of their their games with in-app purchases like special mounts and realm transfers.

In july of 2011, blizzard announced that the diablo III auction house would include a real money aspect auction house. Only items (and eventually characters) would be available for sale, and blizzard intended for it to operate in tandem with the in-game gold auction house. Players would be able to list items on either service and blizzard charged a flat fee for each item listed (to discourage players from flooding the market with junk items). Transaction fees on successful purchases were also applied. Proceeds from sales on the real money auction house could be spent on blizzard merchandise and games, or withdrawn into actual currency for a small transaction fee paid to blizard and their financial partner.

In late 2011 and early 2012 a lengthy saga ensued as the korean games rating board repeatedly refused to certify diablo III for sale in korea due to inclusion of the real money auction house. Korea strictly regulates all online and offline forms of gambling, and the design of the real money mechanism built into diablo III’s categorizes it as a form of gambling. One quote from a september 2011 korea times article explains the potential problem:

“the issue of gambling, illegal for korean nationals, is a sensitive one, especially after a 2005–06 nationwide scandal over the sea story game machines that first passed the regulatory body inspection but were removed after the police discovered excessively speculative and addictive behavior among the players. Due to this controversy, the watchdog and approval committee was created in the game rating board.

The country’s attitude toward gaming involving cash transactions has irked blizzard’s local staff who are reluctant to deal with the controversy expected with the introduction of the auction house but are forced by headquarters to launch the feature, an industry source familiar with the matter said.”

This prediction proved correct, and when diablo III was submitted to the ratings board in early 2012, there were significant delays. Blizzard submitted a second time with the “cash out” element removed, but was still unable to receive an age rating in korea. Not until diablo III was submitted without any real money auction house at all was the game finally approved for sale, on january 13th 2012.

No blizzard games since 2012 have featured any kind of real money trading.

Cryptocurrency: a possible solution

These examples along with a numerous black markets for game items and currency demonstrate a clear interest from players in real money trading. However, projects that implement various forms of the mechanic meet several difficulties:

· it’s difficult to balance an in-game economy which is connected to an external currency, and often causes developer revenue to be volatile and unpredictable;

· in some regions the mechanics may cause the game to fall into a category of gambling games are regulated differently from other games.

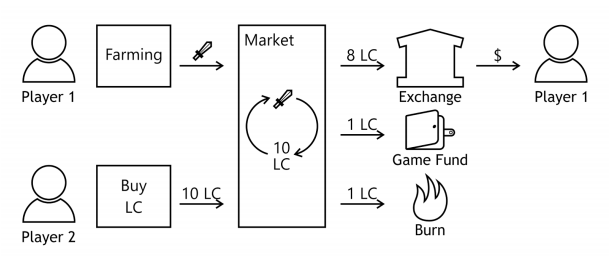

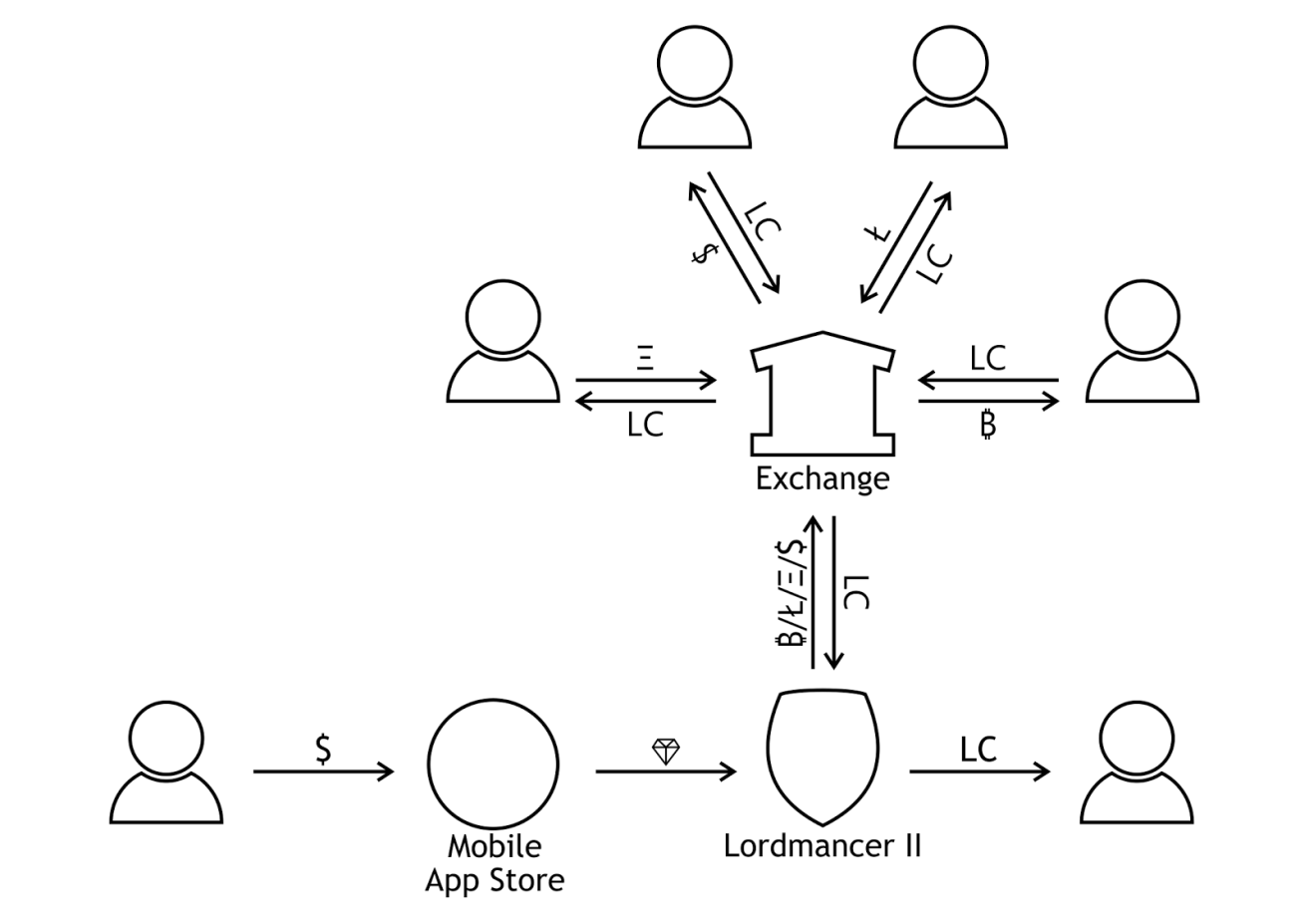

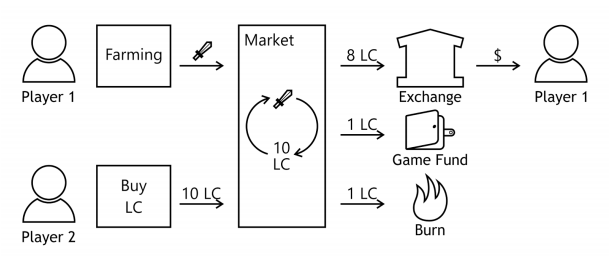

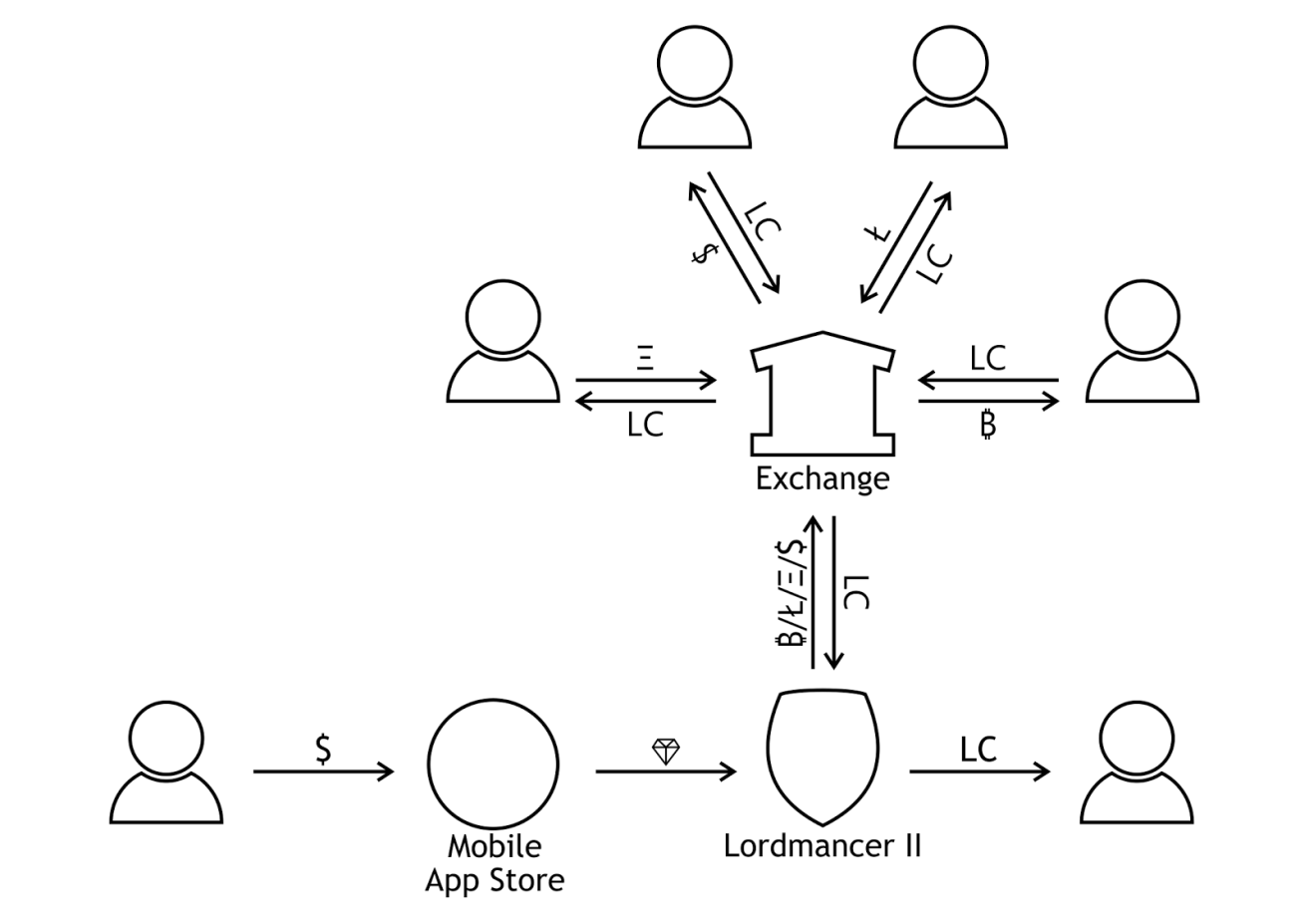

An MMO RPG called lordmancer II claims to be “the first open-world MMORPG on mobile where players can mine cryptocurrency”. Its creator, a russian game studio active games, introduced an ethereum-based cryptocurrency token as the game’s second hard currency. According to active games, this approach solves both problems:

· the game economy is based on a turnover of lord coin, and is regulated through token burn and developer fees levied on each transaction;

· lordmancer II only allows users to withdraw crypto tokens, so officially the game can not be treated as gambling.

A player can purchase lordcoins in one of three possible ways.

On a crypto exchange

After the game’s ICO is finished this october and the game is released, its lordcoin tokens will be available on crypto exchanges. Any player will be able to purchase tokens and move them to their game account.

On the game’s website

Alternatively, a player will be able to purchase lordcoins on the game’s website. This would be convenient to those players not familiar with cryptocurrency world. In this case, the game itself would purchase lordcoins on a crypto exchange and move it to the player’s account. The price will be twice as high, due to additional conversion costs.

In the game

There is another hard currency in lordmancer II. It’s called crystals and it can be purchased for fiat money using standard in-app purchase mechanisms provided by appstores.

A player will be able to exchange crystals for lordcoins, but at a rate four times higher than on a crypto exchange. This is due to even higher costs: only some 30% of a player’s payment will reach active games, of which 25% will be spent on purchasing tokens.

Players are winners

Using this approach, active games studio aims to make its lordmancer II an attractive ecosystem for players wishing to earn fiat money by farming in-game items and by cultivating game characters for sale. Of course, the game itself needs to be good enough to become popular. Will the studio succeed? Only time will tell.

At this time, lordmancer II is in beta-testing in russia, it is available in russian google play.

The studio sold out pre ICO in august and raised 340 ETH. The main ICO round starts on october 23.

Real money trading

Real money helps you become a smarter investor by giving you practical ideas and market analysis from jim cramer and more than 30 pros, money managers and financial analysts.

Real money has resources to help you become a better investor

Cramerвђ™s commentary

Jim cramer provides a daily analysis of whatвђ™s happening in the market. Jim posts three times daily: an early morning scene-setter, a midday bulletin, and an afternoon wrap-up.

Real money best ideas

See the dayвђ™s stock picks from our wall street experts and what returns they are driving. Cramer and more than 30 investing pros share technical analysis and money-making ideas.

Stock of the day

The real money experts share their perspectives on what the latest news developments mean for a particular company and how investors should play the stock.

Meet your coaches

Cramer founded thestreet in 1996 and writes daily market commentary for real money. In addition to hosting mad money with jim cramer on CNBC, he manages action alerts PLUS, an investing club that follows positions and trades of his charitable portfolio. Cramer graduated magna cum laude from harvard, and after several years as a newspaper reporter, he returned to earn a law degree. Instead of practicing law, cramer joined goldamn sachs and went on to manage his own hedge fund. He retired from active money management in 2000 to embrace media full time and has authored seven books on investing.

James "rev shark" deporre

Deporre is the founder and CEO of shark asset management and the author of invest like a shark: how a deaf guy with no job and limited capital made a fortune investing in the stock market. He also operates sharkinvesting.Com, an interactive online community for active investors.

Kamich is thestreet's in-house technical analyst with 40 years experience working with a number of bulge bracket firms, accumulating knowledge on commodities, interest rates, equities and etfs along the way.

Kamich was one of the earliest chartered market technicians (CMT). He is author of chart patterns and how technical analysis works and is a two-time past president of the market technicians association, the professional organization for chartists worldwide.

Boroden is a commodity trading advisor and technical analyst who has been involved in the trading industry for over 25 years. Her background includes working on the major trading floors including the chicago mercantile exchange, the CBOT, NYFE and COMEX, where she eventually shifted over to focusing on technical analysis of the markets.

Garner is an experienced futures and options broker with decarley trading, a division of zaner group, in las vegas, nevada. She is also the author of higher probability commodity trading; A trader's first book on commodities; currency trading in the forex and futures markets; and commodity options: trading and hedging volatility in the world's most lucrative market.

Her e-newsletters, the decarley perspective and the financial futures report have garnered a loyal following; she is also proactive in providing free trading education at decarleytrading.Com.

Guilfoyle earned his nickname serving as a sergeant in reserve components of the U.S. Marine corps and U.S. Army while simultaneously working on wall street.

Guilfoyle is the founder and president of sarge986 LLC, a family-run trading operation. An NYSE floor trader for over 30 years, guilfoyle has served as the chief market economist for stuart frankel & co., the U.S. Economist for meridian equity partners and as a vice president in block trading and investment banking with credit suisse.

Frequently asked questions

What is your cancellation policy?

You can cancel your subscription by calling our customer service department at 1-866-321-8726 monday through friday (excluding federal reserve holidays) between the hours of 7:00 a.M. And 6:00 p.M. EST. You may not cancel a subscription by any other means (such as by sending a request via email, postal mail or by calling any other phone number). If you are entitled to a refund we will seek to credit your account within 7-14 business days following your call.

What is your renewal policy?

For uninterrupted service, we will renew your subscription automatically at the term stated and charge your card the then-current list price [or such discounted price as thestreet may elect to apply], until you cancel. For subscriptions longer than 6 months in length we will notify you of your renewal rate 30 days prior to the expiration of your current subscription. You may cancel by calling 1-866-321-8726.

How many times does jim cramer post per day?

Jim posts three times each trading day: an early morning scene-setter, a midday bulletin, and a late afternoon wrap-up with conclusions about the next day's possibilities.

Who writes for real money?

Real money has more than 30 investing pros, money managers, financial analysts, and news breakers, who provide investing ideas every trading day.

Is technical analysis included?

Yes. Our writers examine supply and demand in the market to predict future performance of top stocks. Real moneyвђ™s in-house technical analyst bruce kamich was one of the earliest chartered market technicians (CMT) and has a 40-year career analyzing commodities, interest rates, equities and etfs.

What does “real-money trading” of virtual items mean? [social games]

Apart from gacha (and complete gacha in particular), real-money trading is another area for which japan’s social gaming industry has been under fire in recent months.

What is real-money trading?

Real-money trading (RMT) describes a phenomenon under which virtual items are being sold for real money, usually off-platform. Most of the transactions are known to take place on yahoo japan auctions, the country’s biggest auction platform: the possessor of a certain rare item lists it on the site and sells it off to the highest bidder, just like in any other auction.

After the payment is done, the two parties exchange their GREE or mobage handles, meet in-game, and exchange items (usually the buyer gives away a worthless item and gets back the item they paid for in return to close the deal). It’s very easy.

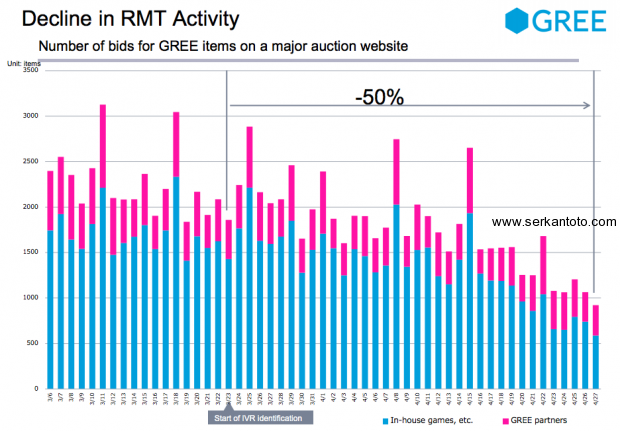

How big of a phenomenon is real-money trading?

In their recent financial report, GREE said they were able to reduce the number of items traded off-platform for real money by 50% in recent weeks (click to enlarge):

But the problem still exists. For example, just a few minutes ago (may 14, 930pm JST) this auction on yahoo japan for a card in a mobage game closed. In the end, 10 bids came in, and the auction ended with a price of 19,500 yen (US$243) – for a single card:

I have seen auctions of this kind finishing with ten times this amount. There are still dozens and dozens of these auctions live, despite the efforts of the platform providers to get the problem under control. Some people auction off their entire collection of cards when they are fed up playing a certain card battle game, for example.

What is the industry doing to prevent RMT?

Dena has restricted the trading function in their games by introducing trading partners to each other randomly and making it impossible for users to exchange some selected,”super-rare” items.

The company is also a member of the six-party council of social gaming companies that has been set up to make it “safer” for users to play these games, i.E. By combatting RMT.

GREE introduced a number of initiatives, i.E.

- Setting up an internal “task force” to deal with this problem

- Trying to appeal to external sites (yahoo auctions japan in particular) to remove problematic auctions

- Changing its TOS

- And cooperating with 3rd-party developers.

Just a few hours ago, GREE made it impossible to trade items between two different games, according to a report.

What is problematic about RMT?

RMT has existed for a long time but became a bigger problem in recent months.

The “trigger” was a technical glitch in GREE’s super-popular card battle game doliland that made it possible for users to copy rare cards and sell multiple copies online. This happened in february this year and made the general public aware of RMT for the first time.

As I mentioned a few days ago, removing the “complete gacha” mechanic was just a first answer to one of the two big areas why some people in japan are calling for governmental regulation: quite a few people in japan are likening RMT to gambling, as players can monetize their items – including those acquired through gacha.

Personally, I am doubting that the government will be satisfied with removing “kompu gacha” and that more will come, possibly with regards to RMT.

As mentioned above, dena already restricted in-game exchanging of items to a certain extent, but removing the function entirely would be difficult. The problem here is that exchanging or gifting items, for example to help other players, constitutes a strong social element: if the government stepped in and restricted this function in social games, this would obviously push down the social aspect in a number of titles on GREE and mobage.

Real money trading in games: a cryptocurrency solution

@ lordmancerlordmancer II

Real money trading has a long history in the game industry, and has been historically banned or discouraged by most western game developers and publishers, especially in the case of mmorpgs. Coincidentally, mmorpgs are also the games in which real money trading and markets are in highest demand by users, due to the way that resource and item scarcity gate progress.

Below are a few examples of trading and market implementations in real games.

Team fortress 2 and DOTA 2

These games contain “cosmetic item markets” (steam workshop) where you can exchange or sell your goods to another player for real dollars. This is condoned and encouraged by valve, and they created a backend and framework to support this type of exchange.

Valve has disclosed that over 90% of the items in TF2 were actually created by players. Users can submit models and textures to be voted on by the community, and those with high enough ratings are sold in the TF2 store. Creators a cut of the profits.

There is no publically available data concerning turnover in the cosmetic item market in DOTA 2, but in 2015 total monthly revenue of the game exceeded $18 million USD.

Second life

Second life is an online virtual world. While not a traditional MMOG, second life fosters interaction between players and with the world by simulating as much of the real world as possible in a virtual space. Linden labs, the developer, implemented a player-centric economy in which players can make real money. The economy is build upon the linden dollars (L$), which players can earn by engaging in various activities in the game. Some activities are quite passive, such as sitting on camping chairs, while others like creating virtual content and trading virtual real estate require real skill.

Some players would rather save time and spend cash for L$, and other players prefer to generate L$ with their in-game activities. The balance between these types of players supports the lindex currency exchange, and provide the liquidity necessary to allow players to purchase L$ for real currency.

Entropia universe

Entropia universe is a good example of a game that allows players to exchange hard currency into real money. Entropia uses a micropayment business model in which players may buy in-game currency (PED — project entropia dollars) with real money. Later, if the user gains more than they can use or decides to leave the game, they can redeem their remaining PED for U.S. Dollars at a fixed exchange rate of 10:1. This means that virtual items acquired within entropia universe have a real cash value, and the company generates income via transaction fees levied during the exchange process.

Like lordmancer II, entropia universe is a free game, but spending money on the in-game currency allows users to purchase items, skills, deeds/shares, and services from other players. Entropia also contains a market where expendable resources (ammunition, probes, guns, finders, extractors) can be purchased directly or other players.

Entropia universe was noted in the guinness world records book in both 2004 and 2008 for the most expensive sale of a virtual world object. In 2009, a virtual space station, a popular destination in the game, sold for $330,000 USD. This was then eclipsed in november 2010 when jon jacobs sold a club named “club neverdie” for $635,000 USD; this property was sold in pieces, the largest of which was sold for $335,000 USD.

According to the mindark’s 2015 earnings report, their 2015 profit was 4 million SEK.

World of warcraft & diablo III

Prior to diablo III, blizzard did not permit any form of real money trading in their games, and the company engaged in long-running and generally-successful campaign to stop character leveling services and gold farmers/sellers in world of warcraft. At the same time that blizzard was working on eliminating external game markets, they also began to experiment with monetization of their their games with in-app purchases like special mounts and realm transfers.

In july of 2011, blizzard announced that the diablo III auction house would include a real money aspect auction house. Only items (and eventually characters) would be available for sale, and blizzard intended for it to operate in tandem with the in-game gold auction house. Players would be able to list items on either service and blizzard charged a flat fee for each item listed (to discourage players from flooding the market with junk items). Transaction fees on successful purchases were also applied. Proceeds from sales on the real money auction house could be spent on blizzard merchandise and games, or withdrawn into actual currency for a small transaction fee paid to blizard and their financial partner.

In late 2011 and early 2012 a lengthy saga ensued as the korean games rating board repeatedly refused to certify diablo III for sale in korea due to inclusion of the real money auction house. Korea strictly regulates all online and offline forms of gambling, and the design of the real money mechanism built into diablo III’s categorizes it as a form of gambling. One quote from a september 2011 korea times article explains the potential problem:

“the issue of gambling, illegal for korean nationals, is a sensitive one, especially after a 2005–06 nationwide scandal over the sea story game machines that first passed the regulatory body inspection but were removed after the police discovered excessively speculative and addictive behavior among the players. Due to this controversy, the watchdog and approval committee was created in the game rating board.

The country’s attitude toward gaming involving cash transactions has irked blizzard’s local staff who are reluctant to deal with the controversy expected with the introduction of the auction house but are forced by headquarters to launch the feature, an industry source familiar with the matter said.”

This prediction proved correct, and when diablo III was submitted to the ratings board in early 2012, there were significant delays. Blizzard submitted a second time with the “cash out” element removed, but was still unable to receive an age rating in korea. Not until diablo III was submitted without any real money auction house at all was the game finally approved for sale, on january 13th 2012.

No blizzard games since 2012 have featured any kind of real money trading.

Cryptocurrency: a possible solution

These examples along with a numerous black markets for game items and currency demonstrate a clear interest from players in real money trading. However, projects that implement various forms of the mechanic meet several difficulties:

· it’s difficult to balance an in-game economy which is connected to an external currency, and often causes developer revenue to be volatile and unpredictable;

· in some regions the mechanics may cause the game to fall into a category of gambling games are regulated differently from other games.

An MMO RPG called lordmancer II claims to be “the first open-world MMORPG on mobile where players can mine cryptocurrency”. Its creator, a russian game studio active games, introduced an ethereum-based cryptocurrency token as the game’s second hard currency. According to active games, this approach solves both problems:

· the game economy is based on a turnover of lord coin, and is regulated through token burn and developer fees levied on each transaction;

· lordmancer II only allows users to withdraw crypto tokens, so officially the game can not be treated as gambling.

A player can purchase lordcoins in one of three possible ways.

On a crypto exchange

After the game’s ICO is finished this october and the game is released, its lordcoin tokens will be available on crypto exchanges. Any player will be able to purchase tokens and move them to their game account.

On the game’s website

Alternatively, a player will be able to purchase lordcoins on the game’s website. This would be convenient to those players not familiar with cryptocurrency world. In this case, the game itself would purchase lordcoins on a crypto exchange and move it to the player’s account. The price will be twice as high, due to additional conversion costs.

In the game

There is another hard currency in lordmancer II. It’s called crystals and it can be purchased for fiat money using standard in-app purchase mechanisms provided by appstores.

A player will be able to exchange crystals for lordcoins, but at a rate four times higher than on a crypto exchange. This is due to even higher costs: only some 30% of a player’s payment will reach active games, of which 25% will be spent on purchasing tokens.

Players are winners

Using this approach, active games studio aims to make its lordmancer II an attractive ecosystem for players wishing to earn fiat money by farming in-game items and by cultivating game characters for sale. Of course, the game itself needs to be good enough to become popular. Will the studio succeed? Only time will tell.

At this time, lordmancer II is in beta-testing in russia, it is available in russian google play.

The studio sold out pre ICO in august and raised 340 ETH. The main ICO round starts on october 23.

Using paper trading to practice day trading

Day trading has become incredibly competitive with the surge of high-speed trading and algorithmic trading taking place in the markets. The good news is that many online brokers have enabled paper trading accounts to help traders hone their skills before committing any real capital.

Key takeaways

- If you're thinking about becoming a day trader, it makes sense to get some realistic practice in first to test the waters.

- Paper trading is a way to simulate trading strategies and see how they would have paid off, or not, in reality.

- Online brokerage platforms increasingly allow sophisticated paper trading abilities through demo accounts or as a feature for its existing customers.

What is paper trading?

Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money. While it’s possible to backtest trading strategies, traders may be tempted to use past information to make current trades—known as the look-ahead bias—while the wrong backtesting dataset could involve a survivorship bias. Survivorship bias is the tendency to view the performance of existing funds in the market as a representative sample.

Investors may be able to simulate trading with a simple spreadsheet or even pen-and-paper, but day traders would have quite a difficult time recording hundreds or thousands of transactions per day by hand and calculating their gains and losses. Fortunately, many online brokers and some financial publications offer paper trading accounts for individuals to practice with before committing real capital to the market. This allows them to test out strategies and practice using the software itself.

Setting up a day trading account

Day traders should ideally paper trade with the same day trading broker they plan to use for their live account since it will be as close to reality as possible.

As you look for the best place where to practice your trades, consider paper trading platforms that offer live market feeds before you start with real capital. This is important because you'll want to be able to trade without delayed feeds or processing orders.

Among the most popular brokers are interactive brokers and tradestation, which both have fully-featured simulators that even work using their automated trading rules. Day traders using these platforms will need to open an account to use the simulator, which may mean depositing the minimum funding requirements. The good news is that traders can use the simulator before making live trades with their capital.

Online brokers such as fidelity and TD ameritrade also offer clients paper trade accounts. Investopedia provides a free stock simulator that can be used for paper trading and for those looking to get started with a day trading account, investopedia compiled a list of the best stock brokers for day trading to make the process easier.

It’s important to keep in mind there are still some differences between simulated and live trading. On a technical level, simulators may not account for slippage, spreads or commissions which can have a significant impact on day trading returns. On a psychological level, traders may have an easier time adhering to trading system rules without real money on the line—particularly when the trading system isn’t performing well.

Paper trading tips

Day trading practice depends largely on the strategy that’s being used to trade. For example, some day traders are focused on "feel" and must rely on paper trading accounts alone, while others use automated trading systems and may backtest hundreds of systems before paper trading only the most promising ones. Traders should choose the best broker platform for their needs based on their trading preferences and paper trade on those accounts.

When paper trading, it’s important to keep an accurate record of trading performance and track the strategy over a long enough time horizon. Some strategies may only work in bull markets, which means traders can be caught off-guard when a bear market comes along. It’s important to test enough securities in a variety of market conditions in order to ensure their strategies hold up successfully and generate the highest risk-adjusted returns.

Finally, paper trading isn’t a one-time-only endeavor. Day traders should regularly use paper trading features on their brokerage accounts to test new and experimental strategies to try their hand in trading markets. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day. This makes paper trading an integral part of long-term success.

Pros of paper trading

Starting out with a paper trading account can help shorten your learning curve. But there are other benefits beyond just educating yourself. First, you have no risk. Because you're not using real money, you don't lose anything. You can analyze what mistakes you've made and help create a winning strategy. This also helps you build your confidence, allows you to practice techniques and strategies needed to be a successful day trader including profit or loss taking and pre-market preparation. Finally, it takes the stress out of trading. You can concentrate on your strategies in a relaxed environment and take the emotion out of trading.

Cons of paper trading

While paper trading will help give you the practice you need, there are a few downfalls. Because it doesn't use real money, you don't get an idea of how fees and commissions factor into your trades. These simulators also don't accurately reflect the reality of the markets, with the lows and highs and the emotion that goes along with trading. Thus, it's important to remember that this is a simulated environment as you get your trading skills in check.

Practice, practice, practice

If you're a first-time investor, take as much time as you can paper trading before you jump ship and begin live trading. Be sure to explore different strategies and new ideas so you can get comfortable. The idea behind using simulators is for you to get comfortable and cut down on your learning curve.

Once you feel as though you've mastered all that you can be using a simulator, try trading with a stock that has had a predictable run—with a lower price and a consistent response to market conditions. If you start trading with a highly volatile stock, it may be a challenge. But if you choose something safer, you can practice what you've learned without taking on too much risk.

The bottom line

Day traders face intense competition when it comes to successfully identifying and executing trade opportunities. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term risk-adjusted returns and performance.

Thestreet's best newsletters and subscriptions

for stock traders and investors

Which of our top stock trading subscriptions or investment newsletters is right for you?

Thestreet offers a variety of top wealth-building investment and stock trading subscriptions and newsletters for investors of all levels and styles. Whether you are looking for the best daily market commentary newsletters with professional insight or actionable stock trading ideas, thestreet has what you need. Compare all of our top subscription options below and find the service that is best for you.

| Category | model portfolio | trade alerts | market commentary | buy/sell ideas | 30-day guarantee | ||

| action alerts PLUS | mid to large-cap stocks |  |  |  |  |  |  |

| trifecta stocks | small to large-cap stocks |  |  |  |  |  |  |

| stocks under $10 | low priced stocks |  |  |  |  |  |  |

| thestreet quant ratings | quantitative stock idea tool |  |  |  |  | ||

| real money | market/equity analysis - 30+ pros |  |  |  | |||

| real money pro | full-spectrum analysis - 50+ pros |  |  |  |  | ||

| top stocks | technical analysis |  |  |  |  |  |

You're protected 100% with our satisfaction guarantee.

If you're not completely satisfied with your subscription, we are happy to help you with no questions asked. For an annual subscription, simply call to cancel within the first 30 days of your initial subscription term and receive a refund for the remaining months of your annual subscription. All the free gifts and alerts are yours to keep.

Risk: low to mid

Stock investing on a 6 to 12 month horizon

Jim cramer and his research team actively manage a charitable trust portfolio and reveal all their money management tactics while giving advance notice before every trade. Learn more

- $2.5 million+ charitable trust portfolio

- Large-cap and dividend focus

- Intraday trade alerts from jim cramer

- Weekly roundups

$6/week for an annual subscription*

Risk: low to mid

The ultimate portfolio and stock idea tool

Thestreet quant ratings is thestreet's proprietary quantitative and algorithmic stock rating service and it will put your portfolio through the kind of tough scrutiny it must pass to succeed. Learn more

- Buy, hold, or sell recommendations for over 4,300 stocks

- Unlimited research reports on your favorite stocks

- A custom stock screener

$1/week for an annual subscription*

Risk: mid to high

Market commentary and analysis

Jim cramer and 30+ wall street professionals write daily, with actionable advice ranging from technical analysis to momentum market trading to reliable, fundamental stock picking. Real money offers a wealth of advice and analysis for all styles of investing. Learn more

- Access to jim cramer's daily blog

- Intraday commentary and news

- Real-time trading forums

$3/week for an annual subscription*

Risk: mid

Technical analysis newsletter

With top stocks, helene meisler uses short and long-term indicators to pinpoint imminent breakouts in stocks. Learn more

- Daily trading ideas and technical analysis

- Daily market commentary and analysis

$10/week for an annual subscription*

Risk: low to mid

Triple-filtered stock picks for maximum profit potential

Every trifecta stocks recommendation goes through THREE layers of intense scrutiny—quantitative, fundamental and technical analysis—to maximize profit potential and minimize risk of loss. Learn more

- Model portfolio

- Intra day trade alerts

- Access to thestreet quant ratings

$6/week for an annual subscription*

Risk: mid to high

High-quality, low-priced stocks

SU10 team uncovers high-quality, low dollar stocks with serious upside potential that are flying under wall street's radar. Learn more

- Model portfolio

- Stocks trading below $10

- Intraday trade alerts

- Weekly roundups

$4/week for an annual subscription*

Risk: mid to high

Investing across the stock spectrum

For the advanced trader, our all-star line-up of wall street professionals including legendary hedge fund manager doug kass, deliver actionable trade ideas, a comprehensive look at the market and solid trade ideas every day. Learn more

- Includes real money

- Kass, cramer and 15 other wall street pros

- Intraday commentary and news

- Actionable investing ideas, including options trading

$16/week for an annual subscription*

Special subscription bundles

Want more than one service? Sign up to one of our packaged services and take advantage of amazing savings!

| Action alerts PLUS |  |  |

| stocks under $10 |  |  |

| thestreet quant ratings |  |  |

| real money |  |  |

| real money pro |  |  |

| trifecta stocks |  | |

| top stocks |  | |

|  |

*pricing applicable to new subscriptions and is subject to change at any time.

MMORPG to make real money

Even though many people are neglecting videogames, many mmorpgs provide an opportunity to earn real money for in-game activities. Usually, these games offer the chance to do business in trades with other players, or by levelling your characters to the top and selling them. Some games have official ways to cash out, some have an unofficial market, but all MMORPG to make real money provide an opportunity to receive the valuable reward for your efforts.

Recommended games

An isometric sandbox MMORPG with extensive world-building

Entropia universe is a MMORPG in sci-fi setting, featuring the outstanding economic system .

Second life is an online virtual world that provides unique roleplaying opportunities.

EVE online is a social space-based sci-fi MMORPG in the genre of spaceship simulator.

A multiplayer RPG from grinding gear games. The ideological successor of the diablo series.

One of the most famous and popular mmorpgs with an interesting plot and incredible world.

More about MMORPG to make real money

Almost every popular MMORPG have a black market where players can buy in-game items, resources, values and even accounts. However, it's not a proper way of enrichment, and many projects ban those players who obtain something by workarounds. Still, the different services are entirely legal at various MMORPG to make real money, so there is an opportunity to earn money levelling up the character of other player or creating the most balanced skill builds.

Other MMORPG to make money provide an official opportunity to trade for real money, withdraw the currency from the game and exchange it for different currencies. There are many people who famous even outside of the game world because they earned millions of dollars on in-game deals, such as real estate trading, production of valuable resources and resale of various items. Usually, the rarest and useful things can cost up to several thousands of dollars. For example, games like EVE online has a colossal player-driven market, where you can buy probably anything, from most common resources to spaceships which costs incredible amounts of money.

However, all of these games require you to have a talent for trading, or great luck to loot a rare item from a mob. If you don't have any of it, you will have to spend much more time and efforts than on the usual work. MMORPG to make real money rarely can change the full-time job, but videogames still can be an entertaining and profitable hobby.

Best MMORPG to make real money

- Second life has fantastic player-driven economics, and the most profitable activity in this videogame is real estate trading. The first virtual millionaire has appeared in this project, and it was a talented businesswoman who made many successful deals.

- EVE online is a sci-fi MMORPG with healthy player-driven economics and market, where you can sell probably whatever you want — from resources to services.

- Entropia universe is an MMORPG, which provides the most sophisticated economic mechanics and trading-based core mechanics.

Best MMORPG to make real money with crafting

The best MMORPG to make real money with crafting are the ones that feature only legit and official ways to earn real money. All of these projects provide an opportunity to create items and trade or exchange them for receiving some kind value: it can be in-game currency or real money.

- Entropia universe is an MMORPG featuring massive micropayment business model. The players can obtain in-game items for the real-world currency, which means that every object in the game has its cost. It’s possible to receive money for crafted items, buildings, and other objects that can be sold.

- World of warcraft features an opportunity to earn money for farming gold, helping other players to develop their characters, selling accounts and in-game items. Be careful to explore the game rules before you start working on this game, because some forms of earnings may be considered as illegal.

- EVE online is a cosmic simulator featuring the most sophisticated system of trading, craft, and character development. This game has one of the most extensive player-driven economics and the most expensive items.

Best MMORPG to make real money in 2017

There are only several games that provide an official opportunity to earn real money while playing. All other kinds of earnings may be considered as illegal by developers and unsustainable by other players. It means that you will be banned for your actions and even hated by the community of the game. Be careful while learning the strategies of earnings and avoid illegal ways to earn.

- Fortnite is a free-to-play game, but it features an opportunity to sell accounts, skins and unique items bought for in-game currency and earned during the specific events. Some rare items can cost a tremendous amount of money, but it takes considerable efforts to obtain them.

- Destiny 2 is a popular MMOFPS with RPG elements where you can earn money for selling in-game items on auction or helping other players to develop their characters.

- MU legend is a korean MMORPG featuring numerous rare in-game items which can be sold on auctions and exchanged for real money.

Best MMORPG to make real money in 2018

Most of the video games released in 2018 don’t feature an opportunity to earn money; however, the best MMORPG to make real money in 2018 provides an opportunity to obtain some cash. You can also try to help other players for money, which is often legit in video games.

- Raid shadow legends if a cross-platform MMORPG where you can help other players to develop their accounts and characters for real money.

- Shroud of the avatar is an MMORPG where you can earn money on the player marketplace and exchange items with other players.

Best MMORPG to make real money in 2019

The best MMORPG to make real money in 2019 is featuring an opportunity to exchange crafted items and rare objects for real money. However, you will have to use unofficial sites or programs, and you have no guarantees to receive real income.

- Lost ark is an MMORPG where you can sell gold and items for real money on auctions. Beware that most of your actions may be considered as illegal.

- Lineage 2 essence is an MMORPG which provides an opportunity to sell rare items for real money and exchange with other players.

Best MMORPG to make real money in 2020

Even though there aren’t much video games that feature an opportunity to earn real money, there are several impressive projects that allow to legally exchange and sell resources on auctions, or even create your game servers and monetize them. Still, you have to explore all features when you choose the best MMORPG to make real money in 2020.

- Path of exile 2 is an MMORPG with hardcore grind and numerous amount of items, crafts, and other options that can be sold for players for real money.

- Reworld MMO is a project that provides an opportunity to create your own game and monetize it.

- Crimson desert is an upcoming MMORPG where you can sell items for real money.

Escape from tarkov has banned 10k cheaters, and real-money traders are next

Since escape from tarkov’s latest major patch, battlestate games has been pursuing cheaters with renewed aggression. The day after the wipe, the company banned some 3,000 players, and that number has now climbed to almost 10,000. Battlestate chief operations officer nikita buyanov says the studio has plans to address real-money trading and high pings as well.

Taking to the tarkov subreddit, buyanov provided players with an update on battlestate’s plan for addressing cheating in the game. Battleye, the anti-cheat solution tarkov uses, has been responsible for nearly 10,000 bans, and buyanov says battlestate is working with battleye to refine that system to make bans process as quickly as possible.

The studio also plans on adding an in-game player report system – although buyanov writes that reports will be used alongside battleye data to make a determination on whether a ban is appropriate. Another tool in development is SMS-based two-factor authentication, although buyanov admits that cheaters willing to pay $200 for a cheat are likely willing to buy a new SIM card as well.

“this will just make their life a little harder, but it’s a good thing,” buyanov says.

Buyanov went on to say that battlestate is banning anyone caught trading with real money in the tarkov flea market – and that policy covers buyers and sellers both. “planning a lot of things against them which I can’t disclose,” buyanov wrote.

The studio is also considering disallowing players from connecting to tarkov from behind vpns, as these can result in bad ping rates that reduce the quality of matches for everyone involved.

“unfortunately, some of [the] past and upcoming measures can influence … the fair players, restrict[ing] them somehow,” buyanov said. “that’s why it’s not an easy and quick bunch of measures – it must be done properly.”

Finding your way around tarkov for the first time? Check out our guide to tarkov’s interchange map, which will show you – most importantly – where the exits are.

Get involved in the conversation by heading over to our facebook and instagram pages. To stay up to date with the latest PC gaming guides, news, and reviews, follow pcgamesn on twitter and steam news hub.

We sometimes include relevant affiliate links in articles from which we earn a small commission. For more information, click here.

Senior news writer, and former military public affairs specialist. Writes about wargames, strategy, and how games and the military interact.

So, let's see, what we have: paper vs. Real money trading with paper trading no real money is put at risk, instead “monopoly money” or “paper money” is used, hence the name. I am a firm believer that paper trading is not at real money trading

Contents of the article

- Actual forex bonuses

- Paper vs. Real money trading

- Real money trading in games: a cryptocurrency...

- Real money trading

- Real money has resources to help you become a...

- Meet your coaches

- Frequently asked questions

- What is your cancellation policy?

- What is your renewal policy?

- How many times does jim cramer post per day?

- Who writes for real money?

- Is technical analysis included?

- Real money has resources to help you become a...

- What does “real-money trading” of virtual items...

- What is real-money trading?

- How big of a phenomenon is real-money...

- What is the industry doing to prevent...

- What is problematic about RMT?

- Real money trading in games: a cryptocurrency...

- Using paper trading to practice day trading

- What is paper trading?

- Setting up a day trading account

- Paper trading tips

- Pros of paper trading

- Cons of paper trading

- Practice, practice, practice

- The bottom line

- Thestreet's best newsletters and subscriptions...

- You're protected 100% with our satisfaction...

- $6/week for an annual subscription*

- $1/week for an annual subscription*

- $3/week for an annual subscription*

- $10/week for an annual subscription*

- $6/week for an annual subscription*

- $4/week for an annual subscription*

- $16/week for an annual subscription*

- You're protected 100% with our satisfaction...

- Special subscription bundles

- MMORPG to make real money

- More about MMORPG to make real money

- Best MMORPG to make real money

- Best MMORPG to make real money with crafting

- Best MMORPG to make real money in 2017

- Best MMORPG to make real money in 2018

- Best MMORPG to make real money in 2019

- Best MMORPG to make real money in 2020

- Escape from tarkov has banned 10k cheaters, and...

No comments:

Post a Comment