Octafx cent account

Keep in mind that you can sign up several accounts for the contest if you want to.

Actual forex bonuses

If you make several deposits when competing for one prize drop, the total gain is calculated as a sum of separate gains for all timespans between deposits: gain sum = gain 1 (from initial deposit to deposit 2) + gain 2 (from deposit 2 to deposit 3) + gain N (after deposit N).

Octafx cent account

To win a prize you need to achieve the highest results possible across all three categories before the prize drop arrives. The traders performing best will win the main prizes. When the winners are determined, all results are reset, and all participants can start competing for the next drop.

Regardless when you enter the race, you can win.

New deposits made to your contest account do not negatively affect your current gain, can positively affect your future gain, and increase your chances in the traded volume category!

To win in the gain or profit factor categories, you need to trade well. Every profitable trade will increase your ranking. To win in the traded volume category, the amount of your balance is what mostly matters. The higher your balance, the more orders you can close and more lots you can trade.

But remember, that to win, you need to be as close to the top as possible in all three categories.

Gain = (personal funds + amount withdrawn – personal funds when deposited) / personal funds when deposited × 100%

In this equation, personal funds are the contest account’s current equity excluding bonuses, amount withdrawn is the total amount of money withdrawn from the contest account after its checking in for the prize dop or making a deposit to it, personal funds when deposited is equity of the contest account (bonus funds not included) at the moment of making a deposit to it.

If you make several deposits when competing for one prize drop, the total gain is calculated as a sum of separate gains for all timespans between deposits: gain sum = gain 1 (from initial deposit to deposit 2) + gain 2 (from deposit 2 to deposit 3) + gain N (after deposit N).

Whenever you make a new deposit to your contest account, we fix the gain that has already been made in this account before the deposit (gain 1) and then start to calculate the gain after the deposit (gain 2), until the current drop finds its winners or another deposit is made.

Example: you invested 100 USD into your contest account and claimed a 50% bonus to it (50 USD). While trading, you withdraw 50 USD to support your margin on your other account, but as you trade profitably, at the end of the day, your balance ends up to be 250 USD (including the bonus amount). In the next few weeks, you did not make any withdrawals but added 100 USD more to this account and then raised your balance to 650 USD (including the 50 USD bonus claimed to your first deposit) by the moment of summarising the results.

In this case, your gain will be calculated as a sum of four steps; bonus funds to not affect the calculations.

Step 1. You withdrew 50 USD in the course of trading, and your balance, without bonuses, is now 50 USD. Gain #1 = 0.

Step 2. You made a profit of 150 USD, you also had 50 USD of your funds + 50 USD of bonus funds on your balance. Gain #2 = 150 (profit) × 100% / 50 (your funds) = 300%.

Step 3. You added 100 USD to your balance, which became equal to 300 USD without bonuses. Gain #3 = 0%.

Step 4. You made a profit of 300 USD, you also had 300 USD of your funds on your balance. Gain #4 = 300 (profit) × 100% / 300 (your funds) = 100%.

So, your overall gain is calculated as follows: gain = 0% + 300% + 0% +100% = 400%

Profit factor = profit from trades (in USD) / loss from trades (in USD)

If you have equal results with another participant, your ranking is determined by the volume of your profitable trades—if you have greater volume, you win. If these volumes also match, you win if you obtained this profit with fewer trades.

Traded volume = total volume of all trades made during competing for one drop.

The volume of trades opened before signing up for the contest is counted in your statistics for the first prize drop you compete for.

Overall ranking = the sum of your places across all three categories in the yearly ranking - the higher the place, the smaller the number.

The winner is determined by their overall ranking being the smallest number.

If the participants have equal overall ranking, the winner is determined as follows:

1. The participant with the lowest sum of places taken in the profit factor and traded volume categories wins.

2. The participant with the highest gain wins. (if the sum of places across profit factor and traded volume matches.)

If you have spoiled your contest statistics with several unsuccessful trades, you can make a recharge and increase the odds for winning. The recharge is a reset of all previously achieved results in order to start participating in the contest anew.

In order to perform a recharge, you need to log in to your personal area, view your personal statistics, click the recharge button, and make sure the trading account’s personal funds (equity excluding bonuses) is at least 50 USD or EUR and therefore qualified for joining the contest (otherwise deposit the required amount to qualify). All previous data regarding the balance, trades, traded volume, deposits, withdrawals, losses, and profits associated with this account will stop being counted in the contest statistics after the recharge is made (this does not affect the account itself or trades being opened). The recharge does not affect your previous results, i.E. The ranking you achieved when competing for the previous drops will not reset even if a winner makes the recharge. You are entitled to use the recharge any number of times.

This will take a little time. We will contact you within seven business days after determining the winners.

Keep in mind that we run a background check on the winners, their legitimacy, information validity, and possible violations. You'll need to provide a full set of original documents (passport or other ID certifying your residence) before being able to take the prize. Your ID must be valid.

Then we will send you your prize or appoint a date and time for the prize award ceremony.

That depends on the place you take. You can win prizes from every drop, but only until you win a car and become an absolute winner. Absolute winners cannot compete for other drops.

For instance, if you are placed third when the first drop arrives, you win a macbook air and can compete for other prizes in the next three-month run, but if you win a car after that, you won’t be able to participate and fight for the third prize drop.

Create a dedicated contest account. Sign up or log in to your personal area, create a new real account, and check the box sign up this account for octafx 16 cars. Make sure your first deposit amounts at least 50 USD or EUR.

Assign your existing real account for the contest. Sign up or log in to your personal area, pick a metatrader 4 account you are willing to sign up for the contest in the my accounts list at the bottom of the page, press this account and select assign as contest account. Make sure your first deposit amounts at least 50 USD or EUR.

Keep in mind that you can sign up several accounts for the contest if you want to.

Yes, you can. You only need to register your real account once, and it will automatically participate in all subsequent runs as long as its personal funds (equity excluding bonuses) amount to 50 USD (EUR) or more. If your personal funds drop below 50 USD (EUR) when a new drop arrives, the account will not qualify for this run until you replenish the personal funds to at least 50 USD (EUR).

I registered an account for the contest, but I'm not in the rankings and I did not receive a link to the contest statistics. Why is that?

Simply registering an account for the contest is not enough to participate. Your account will be activated for the contest and its performance will be counted in the ranking only after you top up your balance by enough that its current equity excluding bonuses becomes at least 50 USD (EUR).

You don't need to register in advance. Just sign up your real account for the contest at any moment and start trading when the prizes appear on the contest page.

We’ll close registration seven days prior to the contest end date.

You just need to create a metatrader 4 (micro) account and check this account as a contest account, or assign your existing metatrader 4 (micro)account, and make sure that your account’s personal funds (equity excluding bonuses) are 50 USD (or its equivalent in EUR) or above.

To register, press join contest on the contest page or go to your personal area, pick a metatrader 4 account you are willing to sign up for the contest in the my accounts list at the bottom of the page, press this account and select assign as contest account.

Octafx review

Octafx

Leverage: 1:30 | 1:500

Regulation: cysec

Min. Deposit: 100 EUR

HQ: SVG, cyprus

Platforms: MT5, ctrader

Found in: 2011

Octafx licenses

- Octa markets cyprus ltd - authorized by cysec (cyprus) registration no. 372/18

- Octa markets incorporated - authorized by the FSA (SVG)

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

- What is octafx?

- Awards

- Safe or a scam?

- Leverage

- Accounts

- Market instruments

- Fees

- Deposits and withdrawals

- Trading platforms

- Customer support

- Education

- Conclusion

What is octafx?

Octafx is a technology based brokerage company that operates since 2011 and offers industry leading platforms such as metatrader5 and ctrader with numerous investment opportunities and great capabilities.

At the beginning of its establishment octafx walked a path from an offshore brand located in SVG and further on operated in the UK, however since 2017 closed its entity and moved to cyprus.

So, together with the european cysec license broker operates also a global offering from its entity, therefore check on carefully under which regulation you will fall as it may propose different trading conditions.

| Pros | cons |

|---|---|

| forex and cfds offered | phone support not available 24/7 |

| great trading tools | no forex education |

| MT5 and ctrader platforms offered | |

| fast account opening and free demo account | |

| no commission deposits and withdrawal options |

What type of broker is octafx?

Octafx is an STP forex broker also with high standards of secure trading environment, as of the regulation it imposes. The offering to the clients is wide and even comprehensive since proposes the same if not more investment opportunities to the world trading community.

10 points summary

| �� headquarters | broker located in SVG and cyprus |

| ��️ regulation | cysec, FSA SVG |

| �� platforms | MT5, ctrader |

| �� instruments | cfds on commodities, forex, metals, indices and energies |

| �� demo account | available |

| �� minimum deposit | 100$ |

| �� EUR/USD spread | 0.5 pips |

| �� base currencies | USD, EUR |

| �� education | available only through international entity |

| ☎ customer support | 24/5 |

Awards

Octafx already quite known and operates for a while despite a fact that received its european license just recently. So for the years it operates, octafx participates to various exhibitions and received numerous international awards along with the huge number of active traders registered at the company. That all in all confirm its status and reputable position in the industry, which we will also be able to see in detail further in our octafx review.

Is octafx safe or a scam?

The main issue and topic of our octafx review among others if its safe trading environment, which is checked as first due to its regulatory obligation and license under which the broker operated. Octafx launched since 2011 walked a path with various operation licenses including SVG registration, operating the UK branch, yet suspended this entity back in 2017 and target cyprus as its next destination of operation.

| Pros | cons |

|---|---|

| cysec regulated international broker | previously operated only offshore entity |

| global coverage and years of operation | |

| negative balance protection applied |

Is octafx legit?

So, the main gap for these years of operation was the fact that octafx was a brand of the octa markets incorporated company that is registered, regulated and governed by the law of saint-vincent and the grenadines. Which is offshore heaven for its tax-management as well as relative ease to establish a company. Now, since octafx established its legal entity in cyprus and respectively got a license from the local cysec, which also impose regulation according to european ESMA standards.

Therefore, now we can state that octafx and its octa markets cyprus ltd entity shows us a clear state of the compliance to the necessary operation standards.

Since the regulation demands strict follow of forex business operations management, it is considered safe to open an account either with cyprus or international octafx entity.

How are you protected?

The set of regulatory requirements enables protection to the clients and including – funds segregation, application of negative balance protection while the broker is constantly overseen by the authority in terms of its safety compliance. In addition, there is a security of the traders’ accounts applied by the investor protection and compensation schemes in case the broker goes bankrupt.

Leverage

As for the leverage as a known instrument that increases the initial capital you trading with and can be a very useful tool to magnify potential gains is offered by the octafx broker as well. However, along with its great capabilities, leverage increases risks together with its benefits, so you should always learn how to use tools smartly.

Risk level

The risk level is defined also by the leverage level you use since higher leverage dramatically increases your high risk to lose money as well.

For this reason, world authorities and regulators restrict leverage to use to specify, safer levels for retail traders. Therefore, octafx cyprus entity together with its operations established under ESMA rules offers lower leverage levels as defined by the regulator. This means that european traders or those clients that are registered with octafx european entity will fall under ESMA regulation that recently limited leverage.

Yet, if you still prefer to use high leverage international entity of octafx still allows so.

- European traders leverage is maximum 1:30 for major currency pairs, 1:10 for commodities

- International traders can still use leverage until 1:500

Accounts

Another important note within octafx review is a range of account types through which you will access trading. Eventually, the broker offers two account types that also define trading conditions and the platform that is used for trading itself.

| Pros | cons |

|---|---|

| fast digital account opening | none |

| single account for metatrader5 or ctrader platforms | |

| demo account offered | |

| option between trading fee models |

Types of accounts

As the broker defines by itself the MT5 account offered for a conservative trader as it is suitable for the majority of investors also supporting all trading styles and social trading as well. While ctrader will be more suitable for progressive traders or professionals as offers comprehensive trading conditions with commission based fee structure.

Besides, there is an option to submit for a demo practice account and use its unlimited sources to polish strategy or get to know platforms and octafx conditions better.

Yet, the international proposal includes also ECN and PRO account based on the platforms, besides micro account on metatrader4 platform is offered too. It is recommended for novice traders and allows micro lot trading with floating spreads starting at 0.4 pips or fixed spread at 2 pips.

Trading instruments

So what you can trade with octafx? The market range offers you the most demanded instrument while base on the CFD trading model and offering you an opportunity to speculate on the price movement on forex currency pairs, metals, energies and indices.

Another good point at octafx is its pricing strategy or a fee which you will need to pay for the usage of the octafx trading service. There are two options according to the account type you choose and the platform you use, offered by the octa markets.

While an international brand may offer slightly different conditions, which you may check from the site better.

| Pros | cons |

|---|---|

| low forex fees | inactivity fee |

| options between spread only or commission fee basis | |

| 0$ withdrawal fee | |

| micro lot trading available |

Our find on CFD fees

So fee strategy is different according to the platforms while MT5 offers you spread only basis with a minimum spread of EUR USD 0.2 pips, which is a very good offering compared to industry standards.

And ctrader brings you access to raw spread from 0 pip for EUR USD pair plus the commission charge of 3$ pet lot.

Also, see below the comparison table with a typical octafx spread and compare brokers to other CFD brokers with CFD fees, commission or inactivity fee if applicable.

Trading fees of octafx vs similar brokers

| asset/ pair | octafx fees | avatrade fees | etoro fees |

|---|---|---|---|

| EUR USD | 0.5 pips | 1.3 pips | 3 pips |

| crude oil WTI | 2 pips | 3 pips | 5 pips |

| gold | 20 | 40 | 45 |

| inactivity fee | yes | yes | yes |

| fee ranking | low | average | high |

Here is a snapshot of octafx fees

Overnight fee

Also, always consider overnight charge or swap in case you’re holding the position longer than a day. It is always defined by the instrument you trade and may be visible either through a website or platform while trading. See the example on the snap above.

Deposits and withdrawals

Being able to access your funds at any time with ease and convenience is another point with a regulated broker and our octafx review. So together with its strict money management rules, you may fund your account by deposit through a bank account with no complication.

| Pros | cons |

|---|---|

| no deposit fees | limited deposit and withdrawal option for european clients |

| withdrawals free of charge | no credit card supported for cyprus entity |

| wide range of payment methods supported by an international entity |

Deposit fees and options

As a licensed broker that obliges to safety measures, octafx cyprus offers only bank wire transfer for its european clients. While international entity includes also credit cards, e-wallets and other methods which you may check with customer service before any transfer is done.

- Bank wire transfer

What is also great, there is no charges for deposits so you won’t pay any commission, however always define it with your payment provider or bank itself as an international rule vary from jurisdiction to another.

Minimum deposit requirement

By the octafx policy, the minimum deposit set to a EUR100 allowing you to open any account type from the two offered by the broker.

Money withdrawal

Money withdrawal is the same smooth process, while octafx also covers fees so you may access your moany at any time and receive it relatively quickly. Usually, octafx confirms withdrawals within 1-2 business days, but allow extra days for you bank to process the transaction.

Here are the steps to withdraw money from octafx

By a simple follow of instructions, you may access your account and submit a withdrawal. And of course, you may always count on a great help center which is remaining at your assistance.

How do you withdraw money from account?

1. Login to your account. Select on withdraw funds’ at the menu tab

2. Fill in the form and enter the desired withdraw amount

3. Choose the withdrawal method

4. Complete the necessary form requirements

5. Confirm withdrawal details and submit

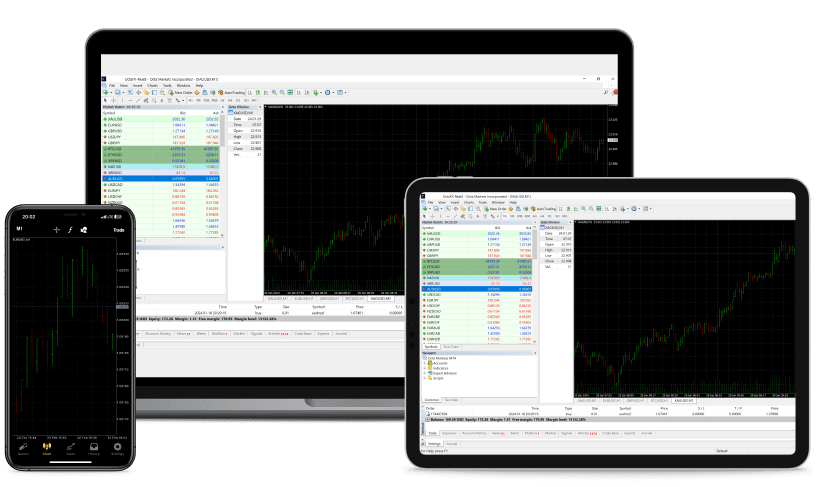

Trading platforms

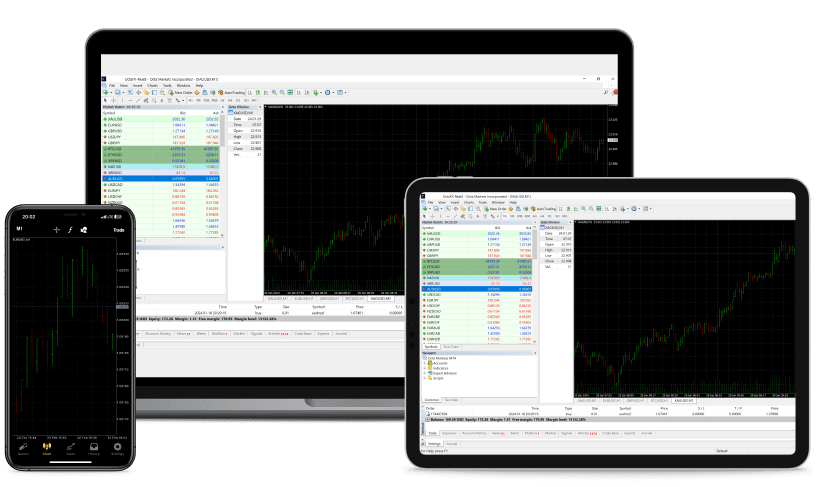

Lastly and what we like the most is the octafx platform offering, while you may select either industry leading software also its newer version metatrader5 with all benefits included and not restricted, also with copy trading option. Or to use advanced and very powerful capabilities of ctrader platform.

The choice between the platform is always your and they are indeed very different, also bringing different price model and more suitable trading strategy. Metatrader5 is good for everyone and more trader friendly software, also copy trading available through it.

While ctrader platform is more sophisticated technology also the one that offering ECN direct market access which might be a better option for professionals. Besides, if you open an account with the international brand of octafx there is an option to use metatrader4 and operate through an account with micro lot trading option.

Scores & availability of different platforms

| pros | cons |

|---|---|

| option between metatrader5 and ctrader | no education or video support for european entity, but available through international site |

| user friendly design | |

| price alerts and push notifications | |

| fee report | |

| supporting various languages | |

| web, mobile and desktop versions | |

| MT4 offered only by international entity |

Web trading platform

Both platforms supporting various versions that you may access either just by the load through your browser without any installation which is very useful. Metatrader will bring you all the benefits and powerful capabilities it offers, while ctrader webtrader is also featuring great design and look.

Desktop platform

However, advanced traders would prefer the desktop version as it feature much more customization capabilities and tools to use. So here both platforms also available for download and suitable for any operating system either ios or windows.

Look and feel

Both platforms are with clear look and feel, indeed ctrader is more complex to understand as it is packed with advanced tools yet the design is easy to navigate and customize.

Automated trading

Octafx automated trading capabilities are also useful for either beginning or professional trading through the use of popular eas. You may either create your own once or follow a specified strategy available through the community or in the market place.

Mobile trading platform

The mobile app is also offered for both platforms, while apps are simple to use and offer a wide range of tools at the same time. MT5 mobile offers various charting capabilities also customization which is fantastic for mobile trading along with full management of your account.

Customer service

Also, octafx customer support provides its clients with 24-hour live support available through live chat, email and phone support in various languages. Eventually, avatrade offers some of the greatest quality support with fast and reliable answers and a huge range of free of charge lines all around the world.

Education

Unfortunately, there is no education center or any learning materials about the trading process offered by cyprus entity, either octafx does not provide webinars or analytical research which is not so good for complete beginners.

However, octafx provides education and analysis through its international brand along with unlimited demo platforms allowing to practice strategies and test the offered systems. So if you’re beginning trader maybe you can see competition or participate to the course using other sources.

Yet, we can forgive this missing point to octafx as there are truly many benefits on the trading conditions they provide.

| Pros | cons |

|---|---|

| free unlimited demo account available | no education videos, webinars or learning materials provided by the cyprus entity. All education and analysis tools included in the international offering |

| wide range of trading tools | |

| trading ideas and social trading options | |

| economic indicators and news feed |

Research

In addition to its some of the good quality trading offerings among industry, all clients can enjoy absolutely stunning research tools and trading tools that are accessible directly through the platforms. Along with other user-friendly tools including calculator, fantastic and clear charting with built-in news feed and other essential trading data for your better trading.

Conclusion

Overall, octafx review shows us a broker with a quality trading strategy which offers also flexibility in terms of conditions, platforms and instruments it proposes.

While before we had some concerns due to its operation only through offshore entity now the trust is on a certain good level as octafx is regulated by the european cysec aligned with mifid directive. Therefore means its operation aligned to the necessary protection level through its either entity.

Read more about octafx license through our news by the link.

What we also admit is high-tech access to a range of the instrument and multiple platforms either for manual, algorithmic or social trading. It is definitely a great advantage that octafx offers both industry popular metatrader platform and powerful ctrader which is highly regarded by the professional traders.

Nevertheless, make sure to check the proposal of the particular octafx entity as an international brand and a cyprus one offers slightly different conditions. While obviously, octafx international proposal features more comprehensive tools and conditions along with education and research materials also MT4 availability.

Yet, it is always great to hear your personal opinion about octafx. So you may share your experience or thoughts or discuss them below or ask us for additional information.

Forex brokers with micro and cent accounts 2021

Forex brokers with micro and cent accounts allow their clients trade for real but without putting significant funds at risk. Advantages of companies allowing trading on cent and micro accounts are evident for the forex newcomers who have just began their trading career. Such clients need access to the minimal transaction volume, which makes them have the real feeling of the market, as distinct from trading on a demo account. Brokers and dealing desks offering cent and micro accounts make their clients feel more confident when opening real deals as thus they do not put their funds at risk. Forex brokers featuring cent and micro accounts are no longer rare on the currency market; however, not too many companies are ready to set the minimum deposit size at $1. Our list will help you choose a forex broker to start trading with at an easy rate.

Read our extended forex guide to find out how to choose the best forex broker 2021.

Start forex trading now! Open forex account with the best forex brokers 2021.

Convert popular currencies

Forex forecasts

Cryptocurrencies trading forecasts

The cryptocurrency market experienced an increased wave of selling pressure and within the last hour bitcoin (BTC) price dropped below the $30,000.

Bitcoin (BTC) slid under $33,000 for the first time in over a week on jan. 21 as selling pressure gathered to drive price action lower. Data from cointelegraph.

The price of bitcoin (BTC) dropped sharply from $37,800 to $35,000 overnight, liquidating $572 million worth of cryptocurrency futures positions. There are three.

For over 20 years, FIBO group has been creating better working conditions for traders. These include 260 trading instruments, spreads starting at 0 pips, high execution speeds of 0.03 seconds or better, trading accounts in USD, EUR, RUB, CHF, GBP, BTC, ETH, gold, and cent accounts. Depositing and withdrawing your funds is fast and convenient. Experienced consultants are here to answer all of your questions. We have long-term statistics for testing any trading strategies. We provide all versions of the MT4 and MT5 trading platforms for the web, android, and ios.

The price of ether (ETH), the native cryptocurrency of the ethereum blockchain network, has been soaring since the beginning.

Bitcoin's price seems to have settled down somewhat following its major rally, and subsequent fall and correction. This has seen the coin now sitting.

Over the past two months the open interest on bitcoin options has held reasonably steady even as the figure increased by 118% to reach $8.4 billion.

Automated trading systems are an opportunity to create passive earnings in the financial markets for all users. Successful and proven strategies are integrated into the algorithm of advisers, which will make it possible to earn on the pricing of assets without delving into the subtleties of technical analysis. We present the top 10 forex advisors including equilibrium, excalibur, night owl.

Top 10 forex advisors 2021

A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. What should be this vital decision based on? To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets.

Top 5 best forex cent accounts for 2021

Top rated:

There are often many types of accounts available to try within the fx broker that you choose to deal with. Among these is the cent account.

Particularly if you are a forex trader trying to balance risk management with getting involved in forex trading, this may be the ideal solution for you.

With that in mind, we have collected more information and a selection of what we consider to be the best forex cent account options in the industry for you.

What is a cent account?

As you may be able to guess from the name, cent accounts facilitate trading in the smallest denomination of currency through micro lot trading. These trades can typically be opened with as little as 0.1 nano lots. One of the other keys to the cent account is the fact that your account balance shows as cents, for example, a $10 deposit would appear as 1000 US cents in your trading account.

This low volume trading availability makes cent accounts some of the cheapest and lowest-risk account options for those traders who may be new to the industry. They are also highly accessible due to the low or no minimum deposits that are often involved.

If you are searching beyond cent accounts and wish to open a standard account type with a very low minimum deposit, you should also make sure to check out our listing of the best brokers with nano lot size.

Top 5 cent accounts

Here we have compiled a listing of the best cent account forex broker options for you to choose from. These 5 are the top cent account forex brokers in the industry and a great starting point if you are opening a forex cent account.

1. FBS

The first forex broker featured is FBS. With this brokers cent account, trading can be started with a micro lot of 1,000 currency units and you can then trade with as little as 0.1 nano lots which is 10 currency units. The FBS minimum deposit is also great value at just $10 for europeans and $1 for non-europeans.

In the majority of cases, no FBS fee is attached to your deposit and the broker also makes a fully operational demo account available for a 90-day period to test the service. This period can be further extended through contact with the FBS support team.

At FBS, cent accounts are supported by the availability of both MT4 and MT5 trading platforms and a wide range of assets are available. This includes 28 currency pairs and 10 cfds for trading if you are in europe, and 35 currency pairs and 30 cfds if you are outside europe. The FBS floating spread starts from 1 pip.

Why should you choose FBS?

They have developed a global reputation as one of the most trusted forex brokers in the world.

There is a wide and diverse range of assets to choose for cent accounts, particularly outside europe.

Metatrader 4 free trading software

Download metatrader 4 for all device versions

Download metatrader 4 on your phone

Metatrader 4 web-platform

MT4 web platform allows you to trade from any browser on any operating system with a well-known interface of a desktop platform. All major tools are available including one click trading and chart trading.

Metatrader 4 desktop

Metatrader 4 is highly customisable. It includes charting tools, market indicators, scripts and eas, advanced risk management, real time market execution and more.

Metatrader 4 android

Enjoy a complete set of trade orders, trading history, interactive charts and the widest variety of supported devices - all that is metatrader 4 for android. Wherever you are and whatever you do, forex will always be with you!

Metatrader 4 ios

Widespread trading software is now available for your iphone/ipad. Login to your account and have the opportunity to trade on metatrader 4 from anywhere in the world via your ios device.

THE MOST POPULAR FOREX TRADING PLATFORM

Metatrader 4 (MT4) provides robust technology and high security to enable traders to choose forex or CFD positions without worrying about the stability of the platform. It offers instruments to follow price fluctuations, identify trend patterns through charts and graphs, and also deploy automated trading techniques to manage trades.

Why choose metatrader 4?

This electronic trading platform is used by new and experienced traders alike. It’s trusted by individual traders as well as large introducing brokers and trading companies. It offers excellent trading and analytical tools, and is flexible enough to implement simple as well as highly complex trading strategies. The platform supports trading in forex, cfds and cryptocurrencies.

At octafx, we provide our clients with the MT4 platform to enable them to carry out their trading activities efficiently and with complete peace of mind. We also offer educational material, as well as MT4 demo accounts, so they can practice risk-free trading.

Easier trading with metatrader 4

- Flexibility: there are several choices of currency pairs to trade in, as well as cryptocurrencies and cfds.

- User-friendly: MT4 has a user-friendly interface that is suitable for traders of all levels.

- Customisation: develop your own expert advisors (eas) and technical indicators on metatrader 4, to match your trading needs and practices. Windows and charts can be arranged for each profile according to your preferences.

- Efficiency: MT4 doesn’t slow down the performance of your PC or mobile, keeping disruption to a minimum.

- Charting tools: advanced charting tools help analyze the technical aspects of the market.

- Expert advisors: trading robots enable the automation of trades and access to the platform’s algorithmic trading benefits.

- Language: the platform is available in multiple languages.

Learn how to start forex trading in 4 easy steps

learn how to start trading on MT4

Metatrader 4 offers enhanced security

The MT4 platform offers the highest security standards to protect traders’ funds. The client terminal and platform servers exchange data through encrypted servers, and the platform uses RSA digital signatures. Your IP address also remains protected.

Moreover, alongside metatrader 4 security, octafx provides it’s own measures taking fund security to the next level:

- Segregated accounts: as per international regulatory standards, octafx keeps customers' funds separate from the company's balance sheets.

- SSL-protected personal area: customers’ personal data and financial transactions are protected with 128-bit encryption, making browsing safe and client data inaccessible to any third party.

- Account verification: octafx encourages customers to verify their account by submitting a personal ID scan and proof of address to ensure transactions are authorised and secured.

- Secure withdrawal rules: withdrawals require email confirmation and customers are encouraged to use the same payment details for both deposits and withdrawals.

- 3D secure visa authorisation: 3D secure technology is used for processing credit and debit cards.

- Advanced protection: octafx ensures the technical environment is monitored 24/7 by a dedicated team of security engineers and technical specialists.

Metatrader 4: OS and device compatibility

Metatrader 4 is available as a web platform that’s compatible with windows, linux and mac OS. MT4 can also be accessed from a smartphone or tablet, whether it has an ios or android operating system. Trade anytime and anywhere, and have access to trading information 24 hours a day, even while you’re traveling or on vacation. It is super-easy to download and install the terminal on any compatible device.

Metatrader 4: trade execution modes

An order is an instruction to perform a trade. There are three trade execution modes on the MT4 platform:

- Execution by market: your order opens a position at the latest price, even if there’s a deviation from what is visible on the platform. This results in much faster execution of orders, as it doesn’t involve requotes. *

* supported by octafx - Instant execution: the system tries to execute your order using the current price on the platform. If the exchange rate changes while the order is being processed, a requote option becomes available, which the trader can accept or reject.

- Execution on request: prices are requested before the order is placed. Once the exchange rates come in, order execution can be confirmed or rejected.

Metatrader 4: сharting tools for technical analysis

Metatrader 4 offers advanced charting capabilities to determine entry and exit points with technical analysis, which uses historical price and volume data to help make predictions. It’s also possible to send trading orders straight from the chart.

By default, MT4 opens with four charts, each representing a unique currency pair. On the left of the charts is the market watch window, with two tabs. The symbols tab shows a list of currency pairs with their bid and ask prices, while the tick charts tab shows the real-time price activity of chosen currency pairs. Below this is the navigator window, where traders can view their account(s), indicators and expert advisors.

The appearance of the charts can be customised. Each currency pair on the chart can be seen in nine different timeframes (including one minute, five minutes, one hour, daily, weekly, monthly). Graphical objects can be included in the charts, such as shapes (rectangle, triangle, ellipse), arrows and text.

Forex brokers with cent accounts

There was a time, when, in order to open an account and start trading in the market, one should have had $500. Therefore, many of those who wanted to try their hand in the financial markets, just could not afford it.

The bigger competition has radically changed the situation. In addition to the recognized market leaders there emerge new brokerage companies, yet unknown but willing to develop, which offer account opening with much lesser sums. The sums have been decreasing, and there appeared forex brokers with cent accounts.

What is a cent account?

The main difference of such an account in the terminal would be that all the values are multiplied by one hundred. If you open a cent account and deposit $10 to it, when entering the terminal you will see the value of 1,000 cents. Now a trading lot is worth 100,000 cents, and not $100,000.

Different dealing centers may have different minimum trading lots. 0.1 is 10,000 cents, and each point of EUR/USD is worth one cent. In one 0.01 lot each cent is equal to the EUR/USD passage rate of 10 points.

Forex brokers with cent accounts: what’s the benefit and advantage for a trader?

Why not make all the accounts cent accounts? The fact is that many traders work with brokers, because their standard account funds are in any case to be withdrawn somewhere; as for the cent accounts, a dealing center may confirm it actually is the counterparty of the deals. Just think, if we’re considering the one-dollar deposit with a 0.0001 lot, what interchange and withdrawal can we speak of at all?

Cent accounts are especially beneficial for novice traders; their rapid emergence has caused the increase of registrations of those who are willing to master trading. Everybody knows that before you start full-scale trading on the currency market it is necessary to open a demo account to start with, for training and gaining experience. However, switching from a demo account to a real money account is quite stressful psychologically, what prevents many novices from successful trading when they start. Training without any risk is one thing, but substantial financial losses possible on a real money account are definitely something else.

The advantage of a cent account is that is lets you trade ‘for real’, thus getting used to actual trading and at that not risking to lose a large sum of money. It can be used not only by traders; if you decide to test trading conditions offered by a certain broker or a new strategy and don’t want to put your money at risk, forex cent accounts should be your choice.

Brokers are different, some of them let you start trading with a few dollars only, other do not want to mess with a trader for penny profits. When choosing a broker take a notice of a forex rating, and consider advice of the professional traders. Choose a company that allows the client to decide which sum to deposit and does not limit the deposit size. A good broker should provide an opportunity of trading to clients with any size of funds. If you wish to check the quality of brokerage services and try your hand in forex, read forex reviews, check the ratings and choose a company that is interested in every client, even the smallest one.

Are you an ambitious, venture trader with a strong interest in foreign exchange trading? Read this article to get a better understanding of strong and weak currency.

Forex is a unique financial platform. It gives traders an opportunity for both incredible profit and equally incredible loss. Thousands of people every day decide.

Amazon is unarguably one of the world's most successful companies. Amazon is a marketplace for vendors and buyers of different products from across the globe.

We bet you've heard many times that a great journey starts with a small step. What if we say that success is just a journey, not a final destination. But where you have to.

Trading risk management is vital to becoming a successful trader and making money online. Learn the risks of poor risk management and discover how you could.

Foreign exchange, or more colloquially known as forex or FX, is the buying and selling of currencies to make profits based on the changed currencies' values.

Currency exchange rates have always been a considerable factor used to determine a country's economic health and stability. This is typically defined as the rate at which one.

People who are engaged in trading in the financial market grapple with such terms as leverage. However, for many reasons, not all investors fully understand what.

As margin is a widely used tool in trading, we need to understand margin definition, buying stock on margin, and how it applies in practice. This article is going to answer.

Octafx UK review - is octafx.Co.Uk scam or good forex broker?

RECOMMENDED FOREX BROKERS

Octafx UK withdrew their UK license due to brexit and switched focus to cysec licence, which covers most of europe. The UK subsidiary is no longer operational but you still can open a account with octafx EU.

Trading accounts

| Account type | minimum deposit | minimum trade size | maximum leverage | average spreads |

| micro | $5 | 0.01 | 1:500 | 0.6 pips |

| ECN | $50 | 0.1 | 1:500 | 0.6 pips |

Octa FX UK offers its clients a choice 2 basic account types on the most popular forex trading platform MT4. Both account types offer fast market execution leverage up to 1:500, and floating spreads. Micro tradeable lots are available solely on micro accounts, while ECN ones offer more instruments to trade in.

Swap-free (islamic) accounts are also provided by this broker.

The company. Security of funds

| Company | country | regulation |

| octafx UK limited | UK | no longer authorized by FCA |

Octa FX UK is the UK unit of offshore brokerage octa FX. It is an award-winning forex broker that offers trading in 28 currency pairs and precious metals under attractive trading conditions on the popular MT4. Until recently, it was authorised to provide financial services by the UK's financial conduct authority (FCA), one of the most reliable regulators worldwide.

Apart from the numerous strict requirements to licensed entities, the financial regulation in the UK also involves a compensation scheme. All FCA-licensed companies are under the umbrella of the financial services compensation scheme (FSCS) and in the event of insolvency, there is a maximum compensation cover of £50,000 per person.

However, octa FX UK withdrew its FCA authorization in 2017 due to brexit.

Trading conditions

Minimum initial deposit

The minimum initial deposit for octa FX UK clients is just $5, a symbolically low amount.

Average spreads & commissions

This broker provides commission-free trading and tight variable spreads. Octa FX UK cites as typical a spread of 0.6 pips for the EUR/USD pair, which is a really good offer while most brokers offer spreads within the range of 1.0 - 1.5 pips.

For further information and comparison, you may look up real-time spreads of 15 leading brokers here.

The maximum leverage level provided by this broker is high, reaching 1:500. In fact, many forex brokers offer leverage 1:500 and even higher, however that is probably about to change in UK, as FCA has proposed leverage to be capped to 1:50 (like it is in the US).

Regulators impose restrictions on leverage in order to protect traders from the risks associated with trading on margin, which may lead to losses exceeding initial investments.

Trading platforms

Unlike its sister company octa FX, which offers metatrader 4 (MT4), metatrader 5 (MT5) and ctrader, its UK unit supports solely the MT4, available as PC version and mobile apps.

Metatrader 4 continues to be the preferred choice of most traders and brokers, despite the fact that its developer metaquotes threatened to stop issuing updates to it. The platform is equipped with a number of technical analysis indicators, advanced charting package, expert advisors (EA) and extensive back-testing environment. Here is a list of more forex brokers offering MT4 platform. It comes in desktop and mobile versions.

Currently octa FX forex offers up to 50% bonus on each deposit.

Methods of payment

Clients of octa FX UK may choose from a wide range of payment methods: bank wire transfer, credit card, skrill, and netteller.

Conclusion

Octa FX UK is the UK branch of octafx group, which, however, is no longer licensed by FCA. The broker offers trade in currency pairs and spot metals on the industry’s standard MT4 under competitive trading conditions. To sum up the above, here are the advantages and drawbacks in relation to this broker:

| Pros | cons |

| tight spreads | no longer authorised by FCA |

| fast execution speedion | no choice of trading platforms |

| STP/ECN execut |

Latest news about octafx UK

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

FBS is a broker with cool marketing and promotions. It runs an loyalty program, offers a $100 no-deposit bonus for all new clients outside EU willing to try out its services, and an FBS mastercard is also available for faster deposits and withdrawals.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

What is a cent account in forex brokers?

When it comes to forex trading, the strategy is one of the essential parts to be successful. Even if you just started trading, you can gain profit with a good strategy in hand, which can be obtained either by experience or improving your analytical skills. To be able to do that, you need room for practice and expand your knowledge.

Unfortunately, to fully enter the financial market, traders are required to have a sufficient amount of capital which realistically, not everyone can afford it. Many of those who wanted to get their hands to trade couldn't afford it and ended up choosing something else to invest their money in. Market leaders and brokers then noticed this problem and came up with a solution called the cent account.

Contents

What is a cent account?

To put it simply, a cent account allows you to trade with a much lesser transaction size than any other regular accounts. The main feature is on the base currency. Instead of your usual dollar, cent account uses cent dollar. So if you open a cent account and deposit a dollar, it will be accounted for 100 cent dollars.

Bear in mind that cent accounts are most commonly used for USD and other major currencies like the euro and pound. Since its first release, cent accounts have been discussed a lot among new traders and gained popularity, prompting many brokers to offer cent accounts in their services. This article will talk about the benefits of a cent account and the list of top brokers offering it.

What can you get in a cent account?

The main benefit of a cent account is the opportunity to learn trading "for real" without risking a large sum of money. This type of account is a good choice for you to get used to trading and try different strategies. While using a cent account, you can search for a strategy that works for you while at the same time exploring new chances and probabilities in the market.

If you're looking for high profits, then the cent account is probably not the best answer because it offers a low-risk environment. The account will help you sharpen your trading skills before you open a regular account and invest in bigger amounts. Not only that, a cent account can also be used to check the service quality of a broker and see if it suits your needs.

One can argue that before you start trading for real on the currency market, it is necessary to open and try out a demo account to train and gain more experience. However, in reality, it is hard to switch from a demo account to a standard regular account. Psychologically, it is quite stressful to just switch like that because usually traders would think that the demo account is only for practice and not real. When they switch to a regular account, they could get anxious by thinking that "this is the real deal that involves my money", which then could lead them to unsuccessful trades.

In contrast, by using a cent account, traders get to experience real trade from the very beginning. Thus you’ll be getting used to trading without having to risk a considerable amount of money. The key to using a cent account is to manage it as if it's a regular account. With its smaller size, cent account can help you make more precise lot calculations.

Even if it's not much, profit is still profit, and you can implement the strategy that works in the cent account once you enter a regular account with more significant sums of money. The point is, cent account is useful if you want to trade for skills instead of money. That is why it is most beneficial for novice traders who want to master trading by experience.

Top brokers offering cent accounts

Not all brokers offer a cent account in their services. Nearly all brokers that offer the account use metatrader 4 or metatrader 5 as their trading platforms. These brokers generally allow the cent account in USD or EUR cents to avoid limiting the volume of orders on the metatrader platforms, which do not allow trade sizes less than 0.01 standard lot.

Changing the account currency from standard USD or EUR to the cent types can also let the broker effectively reduce the minimum volume from 100 to 10 units. In other words, cent accounts offer the opportunity to trade with nano lots and smaller position sizes via the metatrader software.

You can check some of the best brokers with cent accounts below:

1. Exness

Key features extensive review

Islamic accounts available

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads. For example, the spread for mini and classic accounts is only 0.1 pip. This is very suitable for traders who use scalping strategies (scalper). Spreads on major pairs for ECN account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as an automatic fund withdrawal system. If a trader withdraws funds through the e-payment facility provided by exness, the processing time is instant and goes straight into the account. This means that when traders make a withdrawal, everything happens automatically without human intervention.

The safety of traders' funds is also guaranteed as exness is one of the european-based STP/ECN brokers. Exness's ability to become an official partner of the real madrid soccer team for 3 years, starting july 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable for delays in processing deposits and withdrawals if such delays are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. When trading on exness, transaction fees are not charged to traders. A variety of payment methods are provided for traders, including wire transfer, bank card, neteller, skrill, and many others.

All information displayed on the exness website is tested and proven. Their business is audited quarterly by deloitte, which is an audit company for financial services.

Moreover, exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by exness vary in metatrader 4, metatrader 5, web, and mobile platforms. This makes it easy for traders when trading on exness, as they can also access exness platforms anywhere and anytime.

Over the years, exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and cysec.

One measure of client confidence can be put on the trading volume. By december 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by exness, traders also have the opportunity to earn extra income by becoming their partners. From the introducing broker (IB) program, partners can earn up to 33% spread commission from every new client that registers through them.

Additional income can also be obtained from exness partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading on exness, profit opportunities generated by traders also increase with VPS hosting services. This feature helps to maintain trading activities to progress smoothly and without interruption in the event of unexpected troubles such as lost internet connection or electricity problems that shut down traders' pcs unanticipatedly.

From the review above, it can be concluded that exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

Exness offers trading via metatrader 4 and 5 and allows you to trade across devices. The cent account in this broker starts with a minimum deposit as low as $1. One of the main reasons for the popularity of this broker is instant payment. It does not take more than a minute to withdraw funds from the trading account.

Moreover, exness gives no additional charges or commission fees in their cent account. However, you can be charged spread in the same amount as the other trading account types. The leverage in their cent account is also the same compared to the other accounts. It can be concluded that the main difference between their cent account and other account is only that the profit and loss will be directly calculated in cents instead of dollars.

2. AGEA

Key features extensive review

Islamic accounts available

There is no more reason for traders to consider deposit conditions as an obstacle when opening a trading account, at least in AGEA. This broker provides no deposit program for new traders, so they no longer need to prepare any money as a deposit. The number of free fund amounts to $5 and is specifically given to streamster clients. Besides, the AGEA broker also provides virtual money worth $10,000. The purpose of these funds is to practice trading.

Another advantage traders can receive from AGEA is low spreads. The lower the spreads set by the broker, the higher the chance for traders to earn more profits. AGEA also provides a trading facility in the form of swap-free. All trading accounts registered with AGEA can trade without being burdened by swap fees. This facility is certainly very suitable for beginners and professional traders.

Facilities offered by AGEA to help clients make the company as one of the most trusted brokers among traders from all over the world. This broker is registered with the company name of AGEA international AD. Since founded in 2005, AGEA has its headquarters in montenegro, southeast europe.

The head office's position in montenegro helps AGEA to be regulated by the market in financial instruments directive (mifid). To ensure its service quality, AGEA is working continuously with legal and compliance experts so that they are fully compliant with relevant local and international laws and regulations.

Traders' convenience also increases with the security of funds trading services at AGEA. Client funds held by AGEA are maintained in separate bank accounts at local and international banks, in line with relevant laws and regulations.

AGEA provides its services through several trading platforms. One example is AGEA's proprietary platform, streamster. In this platform, traders will get a comfortable and simple trading experience. Streamster is also a powerful platform that has its API for algorithmic trading. The interface of streamster is considered as user-friendly and easy to use. On a streamster account, traders can trade with a leverage of 1:100.

Besides the streamster platform, AGEA also provides metatrader 4. It is a programmable trading platform intended for use by traders who understands how to code. It provides the necessary tools and resources to analyze price dynamics of financial instruments and is integrated into expert advisors. Besides currency pairs, traders can trade with other instruments, such as cfds, gold, and silver.

The process of opening an account at AGEA is easy and fast. Traders only need to fill out a registration form online. It takes 5 minutes to fill out the form, then provides due diligence documents before trading.

Processing speed can be found when depositing and withdrawing. AGEA is known as the broker that has the most smooth system in the payment process. They provide various methods of deposit and withdrawal, including credit cards, skrill, neteller, fasapay, webmoney, wire transfers, and many more.

When joining AGEA, traders can also find unique partnership programs while receiving additional benefits. The program is called the affiliate program. AGEA's partners can refer clients to AGEA via the website or by sending them coupons in an e-mail. For each live position client closes on the streamster trading platform, partners will receive a commission in value of 15 points.

For instance, if partners have clients who sometimes close about 15-20 positions per day, they can earn hundreds or even thousands for each month by simply referring clients to AGEA. Besides, there is no charge for participation in the program.

There is also the assistant program. It provides an opportunity for current members of their affiliate program to work more closely with AGEA. To apply for the AGEA assistant program, partners need to have a regular client account. If traders still feel confused, traders can contact AGEA team support by e-mail and live chat.

Based on the review above, it can be concluded that AGEA provides so many special programs for their clients. Both beginners and professional traders have a big chance to optimize their earnings. For novice traders, they can benefit immensely from AGEA's no deposit bonus.

Previously named marketiva, AGEA provides a cent account with a minimum deposit of $6 and a %5,000 maximum balance; very suitable for beginners who wish to experience real trading with very low risk. In contrast, the standard account in this broker has a $100 minimum deposit with no upper balance limit. Both accounts come with leverage up to 1:100 and a minimum lot size of 0.01. The main advantage of using this broker is its variety of trading platforms that include streamster and metatrader 4. No additional commissions charged.

Octafx deposit bonus review

Bonus size

Eligibility

Expires

Max. Bonus

Octafx is a broker that allows customers to trade in 28 currency pairs, 10 indices, select cryptocurrencies, commodities such as gold and brent crude oil and more. The company has gathered over a million user accounts and has executed more than 250 million trades. Octafx operates multinational and currently, reaches customers in 100 countries. Interestingly, the company provides on its website a number depicting the total amount of money paid out as bonuses that are updated live. At the moment of writing, the number stands at $2,436,492. This was achieved through an octafx bonus scheme that allows customers to receive up to 50% for free on each deposit. Below we provide the octafx bonus review as well as the details on how to obtain it.

How to claim the bonus?

Octafx 50% bonus can be obtained by the users of all three platforms: MT4, MT5 and ctrader. The first step to getting the octafx deposit bonus is opening an account and making a deposit of over $50. Then, the user has a choice to receive up to 50% as a bonus in order to increase the potential profits of his/her trading operations. There are minor differences in terms of how the bonuses work for the MT4 and MT5 platforms and how they work for the users of the ctrader.

For MT4 and MT5 platforms, the verified user can claim 10%, 30% or 50% on each deposit. The bonus is credited to the user’s account and remains locked until the specified volume requirements are met. After the customer meets those requirements the bonus is deducted from MT4/MT5 credit and is deposited in the balance. The volume requirement is simple, the customer simply has to trade the standard lots equalling the bonus amount divided by two in order to be able to withdraw the bonus. “volume calculation starts from the first bonus and continues consecutively. This means that you can’t withdraw later bonuses before you trade the required volume for the first bonus, and so on. The volume calculation starts from the moment the bonus is requested. The volume of each deposit is calculated separately,” – states the company. There are other details about bonuses that should be considered as well. For example, the bonuses can be cancelled by the client at any time and the withdrawal of client’s own funds after claiming the bonus will also lead to a cancellation of the bonus. These and other details are listed on the company’s website for the user’s convenience.

Octafx bonus on deposit is also available for the ctrader accounts. In this case, the size of the bonus, as well as the volume requirements, is similar. There is also a distinction between an “active bonus” and a “total bonus”. “active bonus” is the amount of bonus the customer can use to open positions. This number can’t be more than the account’s unrealized profit & loss + balance. On the other hand, ‘”total bonus” denotes the total amount of bonus in a client’s account. Total bonus comprises all the bonuses claimed by the client for the trading account,” – clarifies the website.

So, let's see, what we have: octafx cent account to win a prize you need to achieve the highest results possible across all three categories before the prize drop arrives. The traders performing best will win the main at octafx cent account

Contents of the article

- Actual forex bonuses

- Octafx cent account

- Octafx review

- Top 3 forex brokers

- What is octafx?

- Awards

- Is octafx safe or a scam?

- Leverage

- Accounts

- Trading instruments

- Deposits and withdrawals

- Deposit fees and options

- Minimum deposit requirement

- Money withdrawal

- Here are the steps to withdraw money from octafx

- How do you withdraw money from account?

- Trading platforms

- Scores & availability of different platforms

- Web trading platform

- Desktop platform

- Look and feel

- Automated trading

- Mobile trading platform

- Customer service

- Education

- Research

- Conclusion

- Forex brokers with micro and cent accounts 2021

- Convert popular currencies

- Forex forecasts

- Cryptocurrencies trading forecasts

- Top 10 forex advisors 2021

- Top 5 best forex cent accounts for 2021

- What is a cent account?

- Top 5 cent accounts

- Metatrader 4 free trading software

- Download metatrader 4 for all device versions

- Download metatrader 4 on your phone

- THE MOST POPULAR FOREX TRADING PLATFORM

- Why choose metatrader 4?

- Easier trading with metatrader 4

- Metatrader 4 offers enhanced security

- Metatrader 4: OS and device compatibility

- Metatrader 4: trade execution modes

- Metatrader 4: сharting tools for technical...

- Forex brokers with cent accounts

- Octafx UK review - is octafx.Co.Uk scam or good...

- RECOMMENDED FOREX BROKERS

- Trading accounts

- The company. Security of funds

- Trading conditions

- Trading platforms

- Methods of payment

- Conclusion

- Latest news about octafx UK

- What is a cent account in forex brokers?

- Contents

- What is a cent account?

- What can you get in a cent account?

- Top brokers offering cent accounts

- Octafx deposit bonus review

- How to claim the bonus?

No comments:

Post a Comment