How to trade

Fed up with 2%-3% returns on savings being wiped out by inflation, I bought a few hundred shares at a price significantly higher than they were trading this week, though I am holding out for their long-term revival.

Actual forex bonuses

I'm clinging on to the fact that BP made £22bn last year, and that the americans still use oil like the rest of us use water: I can only see oil prices going in one direction over the next decade – up. Share deals table photograph: guardian

Share trading for beginners

Think you can spot a stock market winner? Photograph: AP

Think you can spot a stock market winner? Photograph: AP

Last modified on fri 18 jun 2010 15.35 BST

I'm a complete beginner. Where do I start?

The cheapest way is to set up an online account (see table). With your bank details and a debit card, you can start trading almost immediately with just a few hundred pounds. That said, if you set up an account with a company you've never had any dealings with before (eg, if you opt for halifax share dealing but your bank account is with lloyds), you won't be able to start dealing until you receive a password in the post. The dealer may also require a minimum deposit, often around £100.

Most of the providers offer dealing services by phone, though these may cost a little more per deal. For example, halifax charges £11.95 per trade online and from £15 per trade over the phone.

There's a full list of brokers at the association of private client investment managers and stockbrokers (APCIMS). Killik & co offers old-fashioned personal stockbroking, but with a minimum trading fee of £40.

How do I find the right account for me?

There are dozens of online stockbrokers, all charging different fees. We found the cheapest flat-fee deals at interactive investor and the motley fool at £10 for UK trades with no other charges. Hargreaves lansdown has two services at £9.95 a trade, though its active trader service carries a £12.50 quarterly admin charge too. If you prefer the comfort of a big banking name, halifax and HSBC cost £11.95 and £12.95 a trade.

If you are starting with very small sums, it's worth looking at the share centre. It charges 1% on trades, with a minimum of £7.50 for real-time trades. But that becomes pricey once you start dealing in sums much above £1,000.

Watch out for sites that charge higher fees if you trade bigger sums. Hargreaves lansdown's £9.95 deal on its share account is only on trades up to £500. That jumps to £14.95 between £500 and £2,000, and to £29.95 for more than £20,000 (the active trader service charges a flat-rate £9.95).

What do I actually have to do to trade?

Select the stock name you want and you are given an indicative price quote, normally in pence per share. Then you choose the amount you want to spend, and deal. You'll get a real-time quote and have around 15 seconds to execute the deal. The money is cleared from your online account. Obviously you can only deal with the amount of money you have deposited with the share dealer.

Do I have to pay tax?

Yes. There is a 0.5% stamp duty reserve tax on all share purchases and profits from the shares are taxable, too. This will probably all change in tuesday's emergency budget, but for now you are allowed to make profits of up to £10,100 before you are charged capital gains tax at 18%. Expect the rate to rise to 40% and the exemption limit to fall.

What's the best account for regular traders?

Many sites offer regular trading accounts for people who deal frequently, where the cost per trade can be as low as £1.50. Barclays stockbrokers charges £12.95 per trade, but this falls to £9.95 if you trade between 15 and 24 times a month, and £6.95 for 25-plus.

How easy is it to get stung?

If you are contacted out of the blue by someone inviting you to invest in shares, say no. It is almost certainly a share scam, or a boiler room scam, where high-pressure salespeople try to convince you to buy a stock which they say is about to take off. It won't. One way to build your confidence in share dealing is to join an investment club, where you can learn about the stock market and swap ideas. Proshare has lots of information on setting up a club.

Where can I find more information?

Share investment is an area with almost endless information available on the web. The BBC's market data pages are a rich source of information, as is citywire, while you can find individual data and stock quotes at reuters and yahoo. Share sites such as ADVFN, motley fool, digital look and morningstar are also worth a look.

Share deals table photograph: guardian

Taking stock: pumped up by oil prospects

After years of avoiding shares investment, I'm one of those who has bought BP stock in the belief its price has gone below its true value, writes miles brignall.

Fed up with 2%-3% returns on savings being wiped out by inflation, I bought a few hundred shares at a price significantly higher than they were trading this week, though I am holding out for their long-term revival. I'm clinging on to the fact that BP made £22bn last year, and that the americans still use oil like the rest of us use water: I can only see oil prices going in one direction over the next decade – up.

I signed up to buy the shares online with broker TD waterhouse, which took a bit of time but was relatively easy. I paid an online commission of £9.95, though you need to be aware the broker applies charges for dormant accounts.

I won't be day trading, and remain sceptical as to whether share investing is a good bet.

How to trade bitcoin

Bitcoin manages to reach new all time highs over and over again and make the headlines across the globe.

Bitcoin is no doubt innovative as a payment option, and it runs on blockchain technology. You will learn how you can trade bitcoin even if you are just a beginner. Start making money with bitcoin and other cryptocurrencies.

What is bitcoin?

Why bitcoin?

What makes cryptocurrency unique, is that there are no middlemen like banks. However bitcoin transfers are a lot faster and a lot cheaper than bank wires.

How to trade bitcoin – buying your first bitcoin

Bitcoin can be bought in a variety of ways depending on where you live on earth. Trading bitcoin has become very popular – millions of dollars are being traded every day. The following options are widely used:

- Bitcoin brokers (recommended for bitcoin traders)

you can buy/sell bitcoin and other cryptocurrencies on these cryptocurrency brokers. The big advantage of the brokers is that they are regulated in the european union and other countries. This means that your funds are safe. The support is also great and you have a variety of deposit methods. The disadvantage is that you can’t withdraw your crypto. You can trade is on the broker and withdraw fiat money (USD, EUR etc.) when you wish. - Bitcoin exchanges

bitcoin is usually bought by using an exchange. In any of the exchanges like coinbase, binance or kucoin, you need to provide your personal details to register an account and be validated. While coinbase is restricted to users from america and a few countries, you can register on poloniex and binance from other countries. - Peer-to-peer avenues

peer-to-peer avenues like localbitcoins give you an opportunity to buy bitcoin. You will need to register an account on the platform to be able to use the platform to buy bitcoin. Sellers and buyers are registered on localbitcoins to facilitate bitcoin trading. - Bitcoin ATM

bitcoin atms are increasingly becoming a glaring feature in major global cities. In america, europe, asia and south africa, there are bitcoin atms that give you a chance to buy bitcoin. You need to have your bitcoin account barcode scanned at the ATM to buy the quantity of your choice. If there is a bitcoin ATM around where you live or visit, you can locate it on google map and buy your bitcoin with ease.

- Bitcoin brokers (recommended for bitcoin traders)

Google map of bitcoin atms in new york city

- Mobile appsbuying and trading bitcoin is now easier than ever before with several apps on mobile phones now making it easier to do so. The square app can be used to buy and sell bitcoin on your mobile phone.Several other apps have a similar function, and they can be downloaded from google play and apple istore.

According to recent data, only 8,5% of the traders are female investors. Maybe the reason for this is that men are more interested in new technologies. Over the next 2 years, the percentage of female investors is expected to double.

How beginners can make money with bitcoin trading

It’s very easy to get started with bitcoin trading. You can either deposit money to an exchange and trade it there, or you can sign up with a regulated cryptocurrency broker and discover the huge variety of bitcoin trading options.

If you are only interested in trading bitcoin and other cryptocurrencies, then signing up with a broker is probably the best choice.

Here are some statistics about bitcoin:

Click here to see the infographic in full size want to add this infographic on your site?

Adoption of bitcoin

Statista.Com image -global spread of bitcoin usage

Bitcoin has come a long way since it was first introduced in 1998, and it has become a global currency without boundaries. The value of bitcoin is universal, and it is accepted as a means of payment in many countries on earth. The popularity of bitcoin has given rise to alternative coins (or altcoins) like ethereum, bitcoin cash, ripple, among others.

You can shop online and buy a range of goods and pay for services with bitcoin. Many merchants accept bitcoin as a means of exchange, and this has become easier with the issuance of bitcoin debit cards.

The bandwagon effect of bitcoin has led to a growing acceptance of the altcoins, and this can be seen in the increasing market activity. For example, ethereum price leaped to its highest peak of $1,389 on january 15, 2018 as the demand for it exploded. Bitcoin is accepted by businesses like microsoft, dell, wordpress, and paypal.

Answers to important questions – there are some important questions that newbies always ask about bitcoin. Here are the major ones you should know:

Altcoin stands for ‘alternative coin’. Bitcoin being the first crypto coin, it is not an altcoin. All other coins, but bitcoin are altcoins (ex. Monero)

How can I make money with bitcoin?

There are several ways to make money with bitcoin. A few of them are: trading or long term investing

Who created bitcoin?

Satoshi did not create bitcoin alone, as he worked with other developers on the project. As a result of this approach, bitcoin operates as an open source and decentralized platform.

While many people have wondered whether satoshi was a pseudonym or a true identity; the answer remains unknown.

Other collaborators on the bitcoin project are gavin andresen, jeff garzik, mike hearn, among others.

Bitcoin is definitely the outcome of a painstaking work that includes the footprints of several people.

Bitcoin is created when a computational difficulty is solved on the bitcoin blockchain, and this is rewarded through block rewards. Block rewards are given to miners who successfully completed the recognized process that gives rise to a bitcoin.

Block rewards are not arbitrary as they are subject to a verification process built-in as a part of the bitcoin algorithm.

What drives the price of bitcoin?

Bitcoin derives its price from the interplay of the forces of demand and supply. As people increasingly acquire it, the price soars and the inverse leads to a price drop as demand reduces. Bitcoin can then be seen in the likeness of gold or diamond that is scarce in supply.

Bitcoin is limited in supply to the tune of only 21,000,000, and about 17,000,000 of these are in supply at present. It is not known if any change can be made successfully to the underlying framework of bitcoin; otherwise, it has a fixed supply.

Is bitcoin & bitcoin trading legal?

In china, bitcoin is illegal, and south korea has also imposed a couple of restrictions on it. A few other countries have come up with laws to restrict its use. However, an overwhelming number of countries are open to bitcoin.

Are bitcoin transactions free?

One important aspect of bitcoin transactions is the fact that it also attracts transaction fees. While the fees charged might vary according to the processor, transacting in bitcoin is not free. When you buy bitcoin, you have to pay trading fees, and if you exchange it for fiat money, you will incur charges.

What is a bitcoin account like?

Bitcoin is stored in an account that you can liken to a bank account. The difference is that unlike a bank account, your bitcoin account is a virtual bitcoin wallet. There is a unique address for each bitcoin wallet that is created, and you can use it globally.

On a trading exchange, when you create your account, your bitcoin wallet address is automatically created. You can choose to leave your bitcoin on the exchange for trading or withdraw it to a private bitcoin wallet. There are hardware, online, mobile, paper, web, brain, multi-sig, desktop wallets for bitcoin.

There are different kinds of non-exchange wallets that you can use to store your bitcoin for security purposes. Every wallet has a public wallet address and a private key used for accessing it. Your private key is like your password for emails.

Can I lose my bitcoin?

Bitcoin is safe if you have it stored in your private wallet. There is a difference between storing your bitcoin in your trading exchange wallet and a private wallet. Your trading exchange wallet is considered to be risky to store your bitcoin.

When hackers attack exchanges or there is a system breakdown, you can lose access to your bitcoin. To prevent this, it is advisable to use a hardware wallet for storage. Trezor and ledgerwallet are two of the best known hardware bitcoin wallets.

You can also lose your bitcoin if you send it to a wrong address. It is important that you use ‘CTRL C’ on your keyboard when copying a recipient’s address. If you send bitcoin to an unknown address, there is no way to claim it back at present.

How does bitcoin mining work?

While the profitability of the mining exercise also depends on the market price of bitcoin, the electricity implications have to be evaluated. As bitcoin surges in market price, mining becomes more lucrative, and a crash in market price also means that you could incur losses.

You can also decide to use your PC for bitcoin mining, and this will require that you download a bitcoin mining extension by using your browser. Using a browser extension for bitcoin mining is a rather passive means to earn an income. You will be credited a share of the bitcoin mined with your browser by the service provider.

What is A blockchain?

An understanding of the blockchain is equally important for anyone who is keen to follow-up on its underlying basics. Blockchain is best described as a distributed ledger that operates within a decentralized network of linked computers, nodes and devices.

There is no central control over the blockchain, and it can be accessed anywhere around the globe.

The use of blockchain extends across several spheres of human endeavor from medicine to shipping, payment systems to database validation, etc.

Payroll processing, invoice management, and insurance are some of the other facets of life that are revolutionized by the blockchain. Bitcoin value in itself can be traced to the transparency, traceability, and auditable nature of the blockchain.

The outlook for bitcoin looks bright with many countries opting for regulation instead of a ban. This perception is a green light for many people as they look out for ways to share in the bitcoin boom. Evidently, bitcoin will wax stronger in the days ahead.

How to trade stocks

Your guide to placing your first stock order

Make sure you understand some key ideas before placing your first trade.

Intro to asset allocation

What are the biggest myths about investing?

What is a dividend?

Doing your research can help you identify investments that are right for you and fit your goals. Luckily, E*TRADE has a rich collection of tools and information to help you analyze potential opportunities and find investing ideas.

Start with what you know

A good way to start thinking about potential stocks is to consider the companies and brands you use every day. There are a number of resources and tools available at E*TRADE that may help guide your decisions about investing in companies that you are interested in.

- Market news. Events reported in the news about a company may offer signals about how its stock will perform. The launch of a new product might be a sign that a stock's price will rise, for example. Bad news, on the other hand, might mean that the price will drop.

- Sector information. How does the price of a particular company's stock compare to the stock of other companies in the same type of business, or sector (e.G., technology or energy)? If the price of your first stock is overvalued or outside your target range, there may be other opportunities to invest in similar companies that have more attractive evaluations.

- Watch lists. Following the price and performance of a stock over time may help you form an opinion about buying the stock and what price you think it's worth. Watch lists make it easy, and you can set them up with just a few clicks.

Before you enter your stock order, decide whether you want to trade on on your computer or via our mobile app.

When you're ready to buy (or sell) a stock, it's time to fill out the trade ticket. It's good to have a clear idea about price types and other order details. (help icons at each step provide explanations.)

E*TRADE has more choices for you when placing a trade than just the below options. Here we show you some of the more common selections.

Select a price type:

- Market : choose this type to buy or sell a security such as a stock that will be executed immediately at the best price currently available on the market. Market on close is another option, but is less common

- Limit : A limit order buys a stock at (or below) a specific price you target, or sells a stock at (or above) a price you target--and it only executes if you get your price or better.

- Stop: В you can sell a security such as a stock if its price falls past a specified point, used to limit (i.E. Вђњstopвђќ) losses or lock in profits. (buy stop orders also exist but are less common.)

Choose a duration:

- Good for day : specifies an order that will remain in effect for one day, or until it is fully executed or cancelled.

- All-or-none : select this to enter an order that must buy or sell the full quantity of shares that you specified in a single transaction, or it won't execute at all.

More resources to help you get started

24/7 support

Need a little help? Get support from our team of experienced financial professionals.

Learn more arrow_forward

Trade on the go

Stay connected to the markets, make trades, and manage your positions anytime, anywhere with the E*TRADE and power E*TRADE apps.

Start the year with a cash bonus, plus commission-free trades.

Got $5,000? Get $50 or add even more and get up to $2,500 when you open and fund a new account.

ETRADE footer

About us

Service

Quick links

Connect with us

Check the background of E*TRADE securities LLC onв FINRA's brokercheckв andв see

E*TRADE securities LLC and E*TRADE capital management, LLCВ relationship summary.

PLEASE READ THE IMPORTANT DISCLOSURES BELOW.

E*TRADE credits and offers may be subject to U.S. Withholding taxes and reporting at retail value. Taxes related to these credits and offers are the customer's responsibility.В

Offer validВ for new E*TRADE securities customers opening one new eligible retirement or brokerage account by 1/31/2021 and funded within 60 days of account opening with $5,000 or more. Promo code 'WINTER21'.

New customer opening one account:В these rules strictly apply to clients who are opening one new E*TRADE account, do not have an existing E*TRADE account and do not open any other new E*TRADE account for 60 days after enrollment in this offer. For other circumstances, please refer to the вђњexisting clients or new clients opening more than one accountвђќ disclosures below. Cash credits will be granted based on deposits of new funds or securities from external accounts made within 60 days of account opening, as follows:$5,000-$9,999 will receive $50; $10,000-$19,999 will receive $100; $20,000-$24,999 will receive $150; $25,000-$99,999 will receive $200; $100,000-$249,999 will receive $300; $250,000-$499,999 will receive $600; $500,000-$999,999 will receive $1,200; $1,000,000 or more will receive $2,500. Reward tiers under $100,000 ($5,000-$9,999; $10,000-$19,999; $20,000-$24,999; $25,000-$99,999) will be paid following the expiration of the 60 day period. However, if you deposit $100,000-$249,999, you will receive a cash credit within seven business days. If you have deposited at least $100,000 in the new account, and you make subsequent deposits in that account to reach a higher tier, you will receive a second cash credit following the close of the 60 day window. For example, if you deposit $150,000, you will receive a cash credit of $300 within seven business days, then if you deposit an additional $100,000 into your new account, you will receive an additional cash credit of $300 at the end of the 60 day window for a total reward of $600. If you deposit between $250,000 and $999,999 in your new account, you will receive a cash credit in two transactions at the end of the 60 day windowвђ”depending on your initial funding amount. If you deposit $1,000,000 in your new account, you will receive two cash credits that will total $2,500 within seven business days.

Existing clients or new clients opening more than one accountв are subject to different offer terms. Please click here to view offer terms.

Offer rules for all participantsВ new funds or securities must be deposited or transferred within 60 days of enrollment in offer, be from accounts outside of E*TRADE, and remain in the account (minus any trading losses) for a minimum of twelve months or the cash credit(s) may be surrendered. For purposes of the value of a deposit, any securities transferred will be valued the first business day following completion of the deposit. Removing any deposit or cash during the promotion period (60 days) may result in lower reward amount or loss of reward. E*TRADE securities reserves the right to terminate this offer at any time. If you are attempting to enroll in this offer with a joint account, the primary account holder may have to fulfill at the tiers noted before the secondary account holder can enroll in this offer. If you experience any issues when attempting to enroll with a joint account, please contact us 800-387-2331 (800-ETRADE-1) and we will be able to assist you with your enrollment.

Offer limitations:В this offer is not valid for any business (incorporated or unincorporated) accounts, E*TRADE futures, E*TRADE capital management, E*TRADE bank, E*TRADE savings bank accounts, or select retirement accounts including SEP IRA, SIMPLE IRA, retirement accounts for minors, profit sharing plans, money purchase pension plans, investment only noncustodial retirement plans and some business accounts. Excludes current E*TRADE and morgan stanley employees, including any subsidiaries thereof, non-U.S. Residents, and any jurisdiction where this offer is not valid. You must be the original recipient of this offer to enroll. Customers may only be enrolled in one offer at a time. One offer per customer at a time. Cannot be combined with any other offers.

Securities products and services offered by E*TRADE securities LLC. Member FINRA/SIPC. Investment advisory services offered by E*TRADE capital management, LLC, a registered investment adviser. Commodity futures and options on futures products and services offered by E*TRADE futures LLC, member NFA. Bank products and services offered by E*TRADE bank and E*TRADE savings bank, both federal savings banks and members FDIC. Stock plan administration solutions and services offered by E*TRADE financial corporate services, inc. All separate but affiliated subsidiaries of E*TRADE financial holdings, LLC.

Securities, investment advisory, commodity futures, options on futures and other non-deposit investment products and services are not insured by the FDIC, are not deposits or obligations of, or guaranteed by, E*TRADE bank or E*TRADE savings bank, and are subject to investment risk, including possible loss of the principal amount invested.

System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors.

В© currentyear E*TRADE financial holdings, LLC, a business of morgan stanley. All rights reserved.В E*TRADE copyright policy

How to start trading stocks

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/finding-digital-solutions-517179196-b867c8bf46bc4a0695f1ab079aba7e06.jpg)

Whether you want to start trading stocks actively or just want to invest for the long-term, there are things you need to know before starting. Knowing what to expect and what tools you need improves your chances of success. Here's how to start trading stocks.

Get to know the stock market

Before you get started trading stocks, it's important to know how the market works. Here are key terms to know.

- Stocks: these are small pieces of a company.

- Shares: these are units of stock.

- Stock price: the price reflects the value of a company and its outlook, as determined by those trading the stock (traders and investors). Stocks don't have a set price. They continually fluctuate as they're bought and sold.

- Exchange: stocks trade on an exchange, which has set hours. Most buying and selling of stocks takes place during these hours, although some trading does occur outside these hours. Trading outside of hours is called pre-market and after-hours trading.

- NYSE: the new york stock exchange is the largest stock exchange in the world. Seventy of the biggest corporations in the world are traded on the NYSE along with thousands of other stocks. its hours are 9:30 a.M. To 4:00 p.M. Eastern time.

- Nasdaq: the nasdaq is another stock exchange. All its trades are done electronically and its hours are also 9:30 a.M. To 4:00 p.M. Eastern time.

- Ticker symbol: these are a one- to five-letter code used to trade a stock. For example, the ticker symbol for amazon is AMZN.

- Bid-ask spread: the price to buy a security is the ask price. The price to sell a security is the bid price. The difference between these two is the bid-ask spread. It's a measure of supply and demand for a given stock as well as a measure of liquidity. A tight bid-ask spread indicates that a stock has good liquidity.

- Market liquidity: liquidity means that the stock can be bought or sold quickly at a stable price.

- Short selling: while many investors buy a stock and sell it later for a profit, it's also possible to sell first, then buy the stock at a lower price. That's called short selling. Investors can sell first by borrowing the stock.

Decide what kind of trader you are

As you consider how to get started in the stock market, you also need to decide what kind of trader you are. Do you see yourself trading every day? Do you want to trade a couple of times per week? Or do you want to buy stocks and hold them for the long-term?

While there's no right or wrong way to trade, there are risks and rewards to different approaches. Common approaches include:

- Day trading: day traders buy and sell stocks throughout the day. The securities and exchange commission (SEC) defines pattern day traders as those who execute four or more day trades within five business days. Day traders often use borrowed money, which can lead to debt if the day trading isn't profitable. It has the potential for quick returns.

- Swing trading: this is a longer-term approach than day trading. Swing traders take trades that last from a day to several weeks. It offers relatively quick rewards and less potential for loss than day trading, but it's still a labor-intensive approach.

- Investing: this is when you buy and hold stocks for the long term, which could be months or even years.

Day trading is a stressful, risky approach to stock trading.

Consider your finances

If you want to day trade stocks in the U.S., you need to maintain a balance of at least $25,000 in your account. if that's not possible, it rules out day trading.

Swing trading doesn't have a minimum capital requirement, but to be able to trade stocks of varying prices as opportunities become available, you may want at least $10,000 committed to the endeavor. This helps keep your account balance from being whittled away by broker commissions and fees, which are what a broker charges for trading.

Investing requires less capital. Since trades are held for a long period of time, commissions aren't as much of a factor. You can buy stocks as soon as you can afford 100 shares (stocks typically trade in blocks of 100) of the stock you're interested in. Some brokers also allow you to buy fractional shares, so you could get started with even less.

Save money on commissions by making one trade instead of multiple trades. For example, instead of buying 100 shares every week, save the money for a month and make one large purchase.

Find a broker and trading platform

A broker facilitates trading between market participants, allowing you to buy stocks from sellers and sell stock to buyers (there is a buyer and seller for every transaction). As a trader you want a broker that is:

- Low cost: low commissions and fees

- Reliable: can trade when you want with minimal system outages

- Honest: won't steal your money or engage in risky behaviors with it

- Gives you tools for research: least important, since there are many free tools available online

If you want to day trade, you may want a few more things in a broker.

- The broker should execute orders instantly with no intervention on their part. Even a one-second delay is too much.

- "trade from chart" capabilities, and/or the ability to rapidly place, adjust, and cancel orders.

There are many brokers, some of which are better for investors and some which are better for day traders or swing traders. Spend time researching the above factors before choosing a broker.

Each broker offers a trading platform. This is the technology that allows you to view stock quotes, see charts, do research, and, most importantly, place orders. Test out various platforms by opening demo accounts with various brokers.

Practice before you start trading

One way to test-drive potential brokers and practice your trading skills is to use a demo or virtual trading account. A virtual trading account simulates trading, but you're not actually spending any money. TD ameritrade and tradestation both offer virtual trading accounts.

While making a profit on a virtual platform doesn't necessarily mean real money profits will come just as easily, it's a valuable tool for learning how trading works and what style fits you the best.

The bottom line

Trading stocks is exciting because it involves risk and reward. Starting to trade is the easy part, though. Be prepared for losses, and don't trade more than you can afford to lose. Over time, you'll learn what works for you, your goals, and your financial situation.

SELL MY PHONE

Your search results for "<>"

HOW TRADE-IN WORKS

We’ll send you a free trade-in pack

Send us your device and receive payment

GET AN EXTRA £100 FOR YOUR TRADE-INwhen you buy a samsung S20 family device or Z-flip

GET AN EXTRA £100 FOR YOUR TRADE-IN when you buy a samsung S20 family device or Z-flip

POPULAR TRADE INS

Samsung galaxy S10

64GB

Samsung galaxy S10 plus

64GB

Samsung galaxy S9

Galaxy S8

64GB

Apple iphone XS max

64GB

Apple iphone 8

64GB

A brand you can trust

As long as we receive your device in the condition you described, we'll pay you the price we quoted.

Speedy payment

We'll send the agreed amount of cash straight to your bank account via BACS within 3-5 working days of receiving your device.

We accept all kinds of devices

We're happy to take most types of mobile phones. We even take damaged and non-working devices.

It’s good for the environment

We pride ourselves on being environmentally friendly; our new trade-in postage packs are 100% recyclable!

FIND A STORE TO TRADE-IN

You can trade-in your device at one of our stores.

We’ll trade in both working and faulty phones, but they must meet some simple criteria to be accepted:

Working phones must:

- • power ON/OFF

- • have no missing pixels, damage, burnt LCD's

- • include battery and charges up

- • have NO cracks or chips on screen

- • working home button

- • have no damage or faults to camera

- • have sound & vibrates

- • have no liquid damage

- • not be bent, miss shaped and have all parts

Non-working phones must:

However, we will accept handsets that are water damaged, won't power up/work properly or have a chipped or cracked screen, case or buttons and includes battery.

We can trade in a huge range of handsets, including smartphones from major brands like:

- Apple (including iphone models such as the iphone 7, iphone 8, iphone X and much more)

- Samsung (including galaxy models such as the S7, S8, S9 and much more)

- HTC

- Sony

- Nokia

- LG

- Blackberry

Postage-paid packages can take up to two working days to arrive. If you still haven’t received it after this time, give us a call us on 0870 087 0168 and we’ll send you another one.

Once you’ve traded in your device, we pass it on to a third party so it can be re-used. Handsets are checked, all the data is wiped and most are then sent to developing markets where mobiles phone use is growing rapidly.

Once your device has been successfully traded in, we’ll pay you the value of your device by direct bank transfer. This means the money will reach your account within three working days of us receiving your item. If you’d prefer a cheque, just let us know.

There are two easy ways you can trade in your device with carphone warehouse:

Online. Just enter your device’s details (brand, model or IMEI/serial number) and we’ll tell you what it’s worth. We’ll send you a pre-paid package so you can post your handset to us. Then, as soon as we receive your item, we’ll directly transfer the money into your account within three working days.

In store. You can bring your phone into any carphone warehouse store and we’ll tell you how much it’s worth. We’ll pay you by direct bank transfer, so you can take the amount off any replacement device you buy in store.

Unlike many of the other phone recycling outfits we guarantee to pay the agreed quote (assuming the phone is in the stated condition of course!). If for any reason we believe the phone is in a different condition to specified we can return the phone to you free of charge.

Once you have requested a phone pre-paid mailing package we will mail it to the delivery address you specify, and you simply put the phone into the post and once we receive your phone and ensure it is in the stated condition we will process payment to you on the same day.

As soon as we receive your phone and ensure it is in the stated condition we will process payment to you on the same day. If you have chosen to be paid by bank transfer you will receive this within 3-5 working days.

We can pay you via bank transfer directly into your bank which you will receive in 3-5 working days, or we can send you a cheque if you prefer.

Your existing phones trade-in value could help you buy out your current contract early, letting you upgrade your phone early without any penalties.

As well as working phones we also pay cash for all types of broken phones, including phones that don’t turn on or have moderate damage such as a broken screen or damaged casing. We can recycle for free any phones which have been extensively damaged, such as where the casing is smashed, or the internals are exposed.

We buy all phones and tablets whether or not they were bought from carphone warehouse.

We buy phones from all networks whether or not you bought the phone from carphone warehouse.

We recommend you do a factory reset on the phone before you send it in, and we also back that up by wiping the phone as part of our recycling process.

1. You confirm that you consent to the carphone warehouse limited(CPW) using your information (including name, address, telephone number, email address, device make/model/IMEI/network) to allow us to process your trade in and contact you and the network in relation to the trade in and unlocking of the device only.

2. You will be deemed to have accepted these terms and conditions ("conditions") when you provide us with the device you wish to trade in (the "device") by either handing us the device if you trade in in-store, or sending the device to us if you trade in online or over the telephone. Before providing us with the device, if you have any questions relating to these conditions please contact us via our website at www.Carphonewarehouse.Com or by calling us on 0370 111 6565.

3. You confirm that you are either the owner of the device or you have obtained express permission from the rightful owner to trade in the device.

4. The device must not be stolen or listed with us or a third party as stolen. We will check the device with checkmend, from the suppliers of IMMOBILISE as used by UK police forces to trace stolen and missing property. If the device fails any due diligence check we may notify the relevant police authority and we may pass the device and your details to them and the quoted value will not be paid to you.

5. The device must not have been purchased from CPW within the 30 days prior to trade in.

6. The quoted device trade in value ('quoted value') will be determined by us or a third party on our behalf based on the make and model of the device.

7. If the device contains a SIM card, you must remove this along with any accessories prior to trade in. We will not be liable for any consequences of you not removing the SIM card or accessories, including any payments associated with the device or the SIM card.

8. Data stored on the device that you wish to retain must be saved elsewhere and you must remove any memory card and/ or all data that has been put onto the device prior to trade in. We will not be liable for any damage, loss or erasure of any such data or for any consequences of you not removing your data or memory card, including use or disclosure of such data.

9. We may deem the device to be a working device or a non-working device, where a:

'working device' means all features of the device are in good working order and condition, there is no physical damage (e.G. Not bent, mis-shaped and has all parts, no missing pixels, burnt lcds, screen has no cracks or chips and device home button works) or evidence of liquid damage. Its battery is included and can charge and power up, camera has no damage or faults, has sound and vibrates, not be subject to any previously agreed trade in arrangement and in the case of apple products, any icloud accounts must be deleted from the device prior to trade in; and

'non-working device' means a device that is not fully functional (e.G. Does not power up, has a damaged screen, case or buttons, or has water damage) but includes a battery, has all its parts, is not crushed or bent, has no missing components and is not subject to any previously agreed trade-in arrangement, and for either the working device or non-working device:

1. For trade ins in-store only:

2. We will pay the quoted value onto your debit card where available within 3 working days; or

3. The value can be used to create a trade-in credit note against any purchase you make in store; or

4. The value can be used as part or full payment for other products. When the trade-in value exceeds the cost of the purchased product(s), any remaining value can be refunded onto a debit card or used to create a trade-in credit note.

5. Once you have traded in the device, it will not be returned to you under any circumstances.

6. For trade ins online and by telephone only,

7. Following you accepting to trade in, we will send you a pre-paid addressed padded envelope (the "envelope") within 3 working days. We will only accept the device if it is returned to us in this envelope. We will not be liable for loss of your device before we receive it;

8. In order to honour the quoted value we must receive the device within 14 calendar days of you accepting to trade in; and

9. Provided the device received is as advised by you and has been received within the 14 calendar days in the envelope, we will send you a cheque within 7 working days or make a transfer via BACS for the quoted value within 3 working days of receipt of the device.

10. If the device received does not completely match the description and detail as advised by you or we have not received it within the 14 calendar days, we will contact you to give you the option either to have the device returned to you at our cost, in which case no value will be paid to you, or proceed with the trade in at a new value advised to you. If you do not respond to this contact as advised therein within 7 working days, we will assume that you have accepted our revised offer and proceed with payment accordingly. Should you wish to make a complaint about the trade-in service, you may do so in the following way:

11. By calling 0370 111 6565

12. In writing addressed to the carphone warehouse, PO box 373, southampton, SO30 2PP

13. Both parties aggregate liability in relation to these conditions (whether in contract or for negligence or breach of statutory duty or otherwise howsoever and whether to any entrant or otherwise) for any loss or damage shall be limited to and in no circumstances shall exceed £250 for any one incident or series of related incidents.

14. CPW reserves the right to withdraw or to change the terms of this offer at any time. Changes will be published on our website atwww.Carphonewarehouse.Com/help.

15. Nothing in these terms and conditions shall affect your statutory rights.

16. These conditions are governed by english law and the courts of england shall have exclusive jurisdiction to settle any dispute or claim arising out of or in connection with these conditions.

17. Each clause of these conditions shall be construed separately and independently of each other and the invalidity of any one part shall not affect the validity of any other part.

18. Calls to our telephone numbers should be charged at local rates but may vary from some providers and mobile phones. Calls may be monitored and/ or recorded.

19. 'CPW' means the carphone warehouse limited (registered no. 2142673), 1 portal way, london W3 6RS VAT number 927 2265 40

20. 'we/ us/ our' means the carphone warehouse limited.

Qualifying terms:

sales within retail - buy the promotional product on a consumer pay monthly connection (new or upgrade) and we will give you the promotional amount advertised at point of sale when you trade-in a relevant phone. Trade-in and connection must take place in the same transaction to qualify. Traded-in phone must be a mobile phone used on the UK network within the last 10 years.

Smartphone is defined as a phone with an operating system running ios, android, blackberry OS or windows.

Online and direct channels - if you have bought a promotional product on a consumer pay monthly connection (new or upgrade) you will need to go to www.Carphonewarehouse.Com/tradeinpromo to enter your new handset IMEI once it has been delivered. We will pay you the promotional amount advertised at point of sale for your trade-in value once we have received and evaluated your phone.

Exclusions - customers who have taken a cashback, web-exclusive or pre-order incentive are excluded from this offer. Promotion cannot be used in conjunction with any other offer. Business connections are excluded from this promotion. Excludes SIM-free handsets, PAYG, business and any 'gift-with-purchase' offers

Other terms:

we reserve the right to withdraw this promotion or change these terms and conditions at any time

maximum of 1 trade-in per connected promotional product.

Trade-in value will be calculated at the time of the trade-in.

Promotional value will be automatically calculated.

For online transactions, the handset must arrive within 14 days after the end of the offer to be eligible for this offer.

As per standard trade-ins terms and conditions

traded-in phone must be a mobile phone used on the UK network within the last 10 years

trade-in call centre opening hours are 9am-7pm monday-friday, 10-6pm saturday and 10-5pm on sunday. Calls to this number cost a maximum of 24p/min with a 15p call set up fee when made from a BT landline. Prices of calls from other providers may vary and from mobiles may cost significantly more. Calls may be recorded and/ or monitored.

You will receive an additional £50 trade-in value when trading in any apple iphone to purchase a new apple iphone 12 mini or iphone 12 .

£400 trade-in value is the promotional price based on trade-in of an unlocked iphone XS max 64GB in working condition.

| Model | working promotional price | non-working promotional price |

| iphone XS max 64GB | £320 | £145 |

| iphone XS max 256GB | £390 | £155 |

| iphone XS max 512GB | £410 | £160 |

| iphone XS 64GB | £350 | £135 |

| iphone XS 256GB | £380 | £145 |

| iphone XR 64GB | £310 | £110 |

| iphone XR 128GB | £325 | £110 |

| iphone XR 256GB | £340 | £120 |

| iphone 8 64GB | £165 | £85 |

| iphone 8 256GB | £215 | £90 |

| iphone 8 plus 64GB | £230 | £95 |

| iphone 8 plus 256GB | £235 | £100 |

Step 1:order your new apple iphone 12 mini or iphone 12.

Step 3: receive a return postage page envelope in the post and return your old device within 7 days of receiving your new device.

Step 4: funds transferred to your account within 72 hours of receiving your device. Please note: both the trade in and purchase must be done together either online or in store. You can’t purchase your new phone online and trade in in store. The additional £50 won’t be visible online when trading in but will be applied once the device is received and checked at our warehouse. Any additional trade-in value will be given via bank transfer. Full trade in offer available with selected working and non-working handsets. Trade in price is determined by whether the phone is working or non-working. To qualify for a working price the phone needs to power ON/OFF, have no missing pixels, damage, burnt LCD's, include battery and charges up, have no cracks or chips on screen, all working buttons, have no damage or faults to camera, have sound & vibrates, have no liquid damage, not be bent, miss shaped and have all parts. Any handsets that fail these conditions will be deemed non-working and pricing will be reflected. We will accept handsets that are water damaged, won't power up/work properly or have a chipped or cracked screen, case or missing buttons and includes battery and will be given a non-working value. We do not accept crushed handsets.

Receive an additional £100 when you trade in any samsung smartphone when you purchase a samsung galaxy S21 5G, S21 plus 5G or S21 ultra 5G.

Step 1: order your new samsung galaxy S21 5G, S21 plus 5G or S21 ultra 5G.

Step 2: complete your trade-in online https://www.Carphonewarehouse.Com/mobiles/trade-in.Html

Step 3: receive a return postage page envelope in the post and return your old device within 7 days of receiving your new device.

Step 4: funds transferred to your account within 72 hours of receiving your device. Please note: both the trade in and purchase must be done together either online or in store. You can’t purchase your new phone online and trade in in store. The additional £100 won’t be visible online when trading in but will be applied once the device is received and checked at our warehouse. Any additional trade-in value will be given via bank transfer. Full trade in offer available with selected working and non-working handsets. Trade in price is determined by whether the phone is working or non-working. To qualify for a working price the phone needs to power ON/OFF, have no missing pixels, damage, burnt LCD's, include battery and charges up, have no cracks or chips on screen, all working buttons, have no damage or faults to camera, have sound & vibrates, have no liquid damage, not be bent, miss shaped and have all parts. Any handsets that fail these conditions will be deemed non-working and pricing will be reflected. We will accept handsets that are water damaged, won't power up/work properly or have a chipped or cracked screen, case or missing buttons and includes battery and will be given a non-working value. We do not accept crushed handsets.

Receive an additional £100 when you trade in any samsung smartphone when you purchase a samsung galaxy note 20 , Z fold2 or the samsung galaxy Z flip.

Step 1: order your new samsung galaxy note 20, Z fold2 or the samsung galaxy Z flip.

Step 2: complete your trade-in online https://www.Carphonewarehouse.Com/mobiles/trade-in.Html

Step 3: receive a return postage page envelope in the post and return your old device within 7 days of receiving your new device.

Step 4: funds transferred to your account within 72 hours of receiving your device. Please note: both the trade in and purchase must be done together either online or in store. You can’t purchase your new phone online and trade in in store. The additional £100 won’t be visible online when trading in but will be applied once the device is received and checked at our warehouse. Any additional trade-in value will be given via bank transfer. Full trade in offer available with selected working and non-working handsets. Trade in price is determined by whether the phone is working or non-working. To qualify for a working price the phone needs to power ON/OFF, have no missing pixels, damage, burnt LCD's, include battery and charges up, have no cracks or chips on screen, all working buttons, have no damage or faults to camera, have sound & vibrates, have no liquid damage, not be bent, miss shaped and have all parts. Any handsets that fail these conditions will be deemed non-working and pricing will be reflected. We will accept handsets that are water damaged, won't power up/work properly or have a chipped or cracked screen, case or missing buttons and includes battery and will be given a non-working value. We do not accept crushed handsets.

1. The trade-in promise is only valid for comparisons on the cash price offered for the same device, in the same condition.

2. The promise is only available against EE, O2, sky mobile, tesco mobile, three, virgin mobile, vodafone and mazuma mobile on their direct trading sites only – i.E. Not affiliates or comparison sites.

3. Trade-in value will be calculated at the time of the trade-in and you must provide proof of comparison which means official written proof of the higher price; e.G. A printed advertisement or published online deal.

4. To claim a price promise you must email tradeuphelp@cpwplc.Com with proof of the competitors deal such as a screenshot within 7 days.

5. Payment for successful claims will be made directly into your bank account within 3-5 working days.

6. The trade-in promise specifically excludes prices offered by EE, O2, sky mobile, tesco mobile, three, virgin mobile, vodafone and mazuma mobile which are contingent upon certain conditions, such as spending a certain amount on other goods, or any other promotional offers.

7. We reserve the right to withdraw this trade-in promise or change these terms and conditions at any time.

8. The carphone warehouse limited takes your privacy and security of your personal information very seriously. Our privacy policy explains how we collect and use personal information in accordance with data protection laws. Our privacy policy can be found at www.Carphonewarehouse.Com/terms-and-conditions/privacy-policy

9. English law applies to these terms and conditions.

The carphone warehouse limited (registered in england no. 2142673), 1 portal way, london W3 6RS.

How to start trading crypto – a beginner’s guide

Putting on a cryptocurrency trade is very easy. The process of registering with an online broker, depositing funds and clicking on ‘buy’ is very similar to other online shopping experiences. There are some pitfalls to avoid, and no-one can guarantee the price is going to go in a particular direction. Knowledge of the subject is all-important, so this cryptocurrency trading guide will help by outlining how to start trading in cryptocurrencies.

Getting the basics right

The pathway to trading cryptocurrencies starts by addressing where to trade them. That involves applying a little bit of common sense and making sure you use only regulated brokers. Some crypto brokers offer markets in more types of digital coins than others, but they all support trading in the most well-known cryptocurrency, bitcoin. Below are two examples of well-regulated brokers and the kind of company profile that comes with being a highly regarded broker.

Practice, practice, practice

Competition between online brokers is intense, which means there are lots of neat perks for those looking to start trading cryptocurrencies. Brokers typically offer a free ‘demo’ account where you can register using little more than an email address and then use virtual funds to buy virtual cryptocurrencies.

Even though they are free to use, demo accounts are packed with all the functionality and features of a live account. They also use the same price feeds so you can get a life-like feeling for what it is like to be trading in cryptocurrencies.

Some useful background information is that crypto trading evolved out of a very tech-orientated environment. It operates using the principles of blockchain, which is an interesting topic. An analogy of blockchain is a group of people playing cards with their cards face-up on the table. All present can see how many cards of what value each person is holding. While it might not make for an entertaining game, there is 100% transparency.

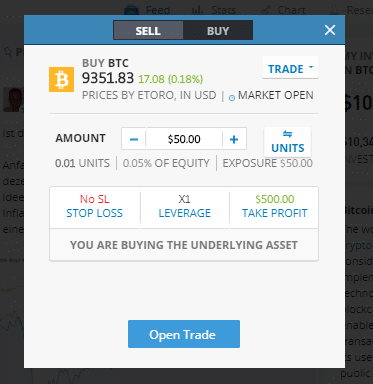

With cryptocurrencies, the information of what everyone holds is held online rather than on a tabletop. Possibly more importantly for the general public, the mechanics of the system have been simplified to make crypto trading easy to do and available to a much wider audience. When bitcoin was first traded, some degree of tech knowledge was required, but those days are long gone. If you want to know how to start trading cryptocurrencies, then the example buy trade of $50 of bitcoin at etoro is an excellent place to start. It is as easy as putting those details into the trading monitor, as per below and clicking ‘open trade’.

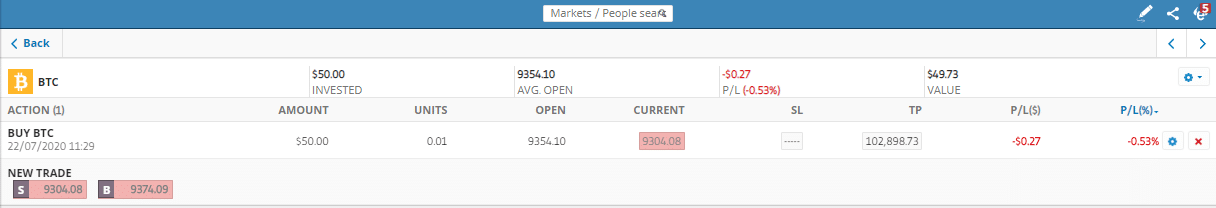

Once booked, that trade will sit in your portfolio and the value of your holding will fluctuate according to the price of bitcoin in the global market. Moments after opening your position, in this example, a 27 cent loss is showing on the position. This would mostly be made up of the difference between the bid and offer spreads that brokers offer.

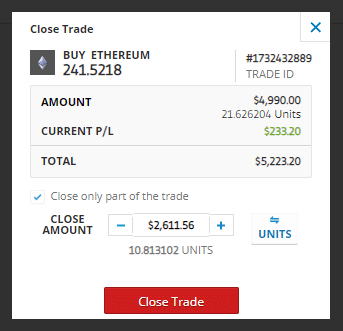

When it comes to the question of how to sell bitcoin, we simply click on our position, go through to the ‘close trade’ monitor, and at the touch of a button, sell out of the position. That crystalizes the profit or loss on the position and the funds used to make the trade are returned to our cash balance.

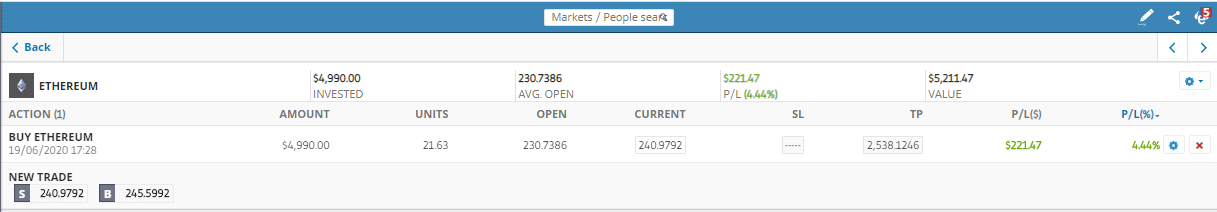

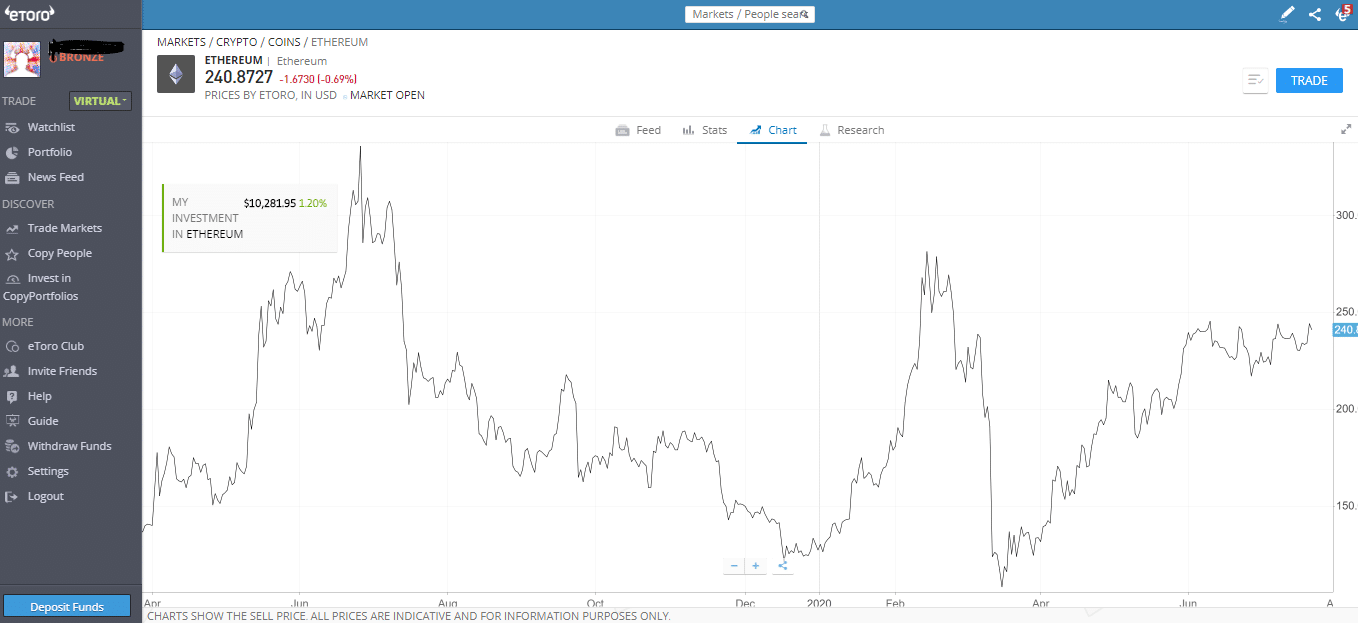

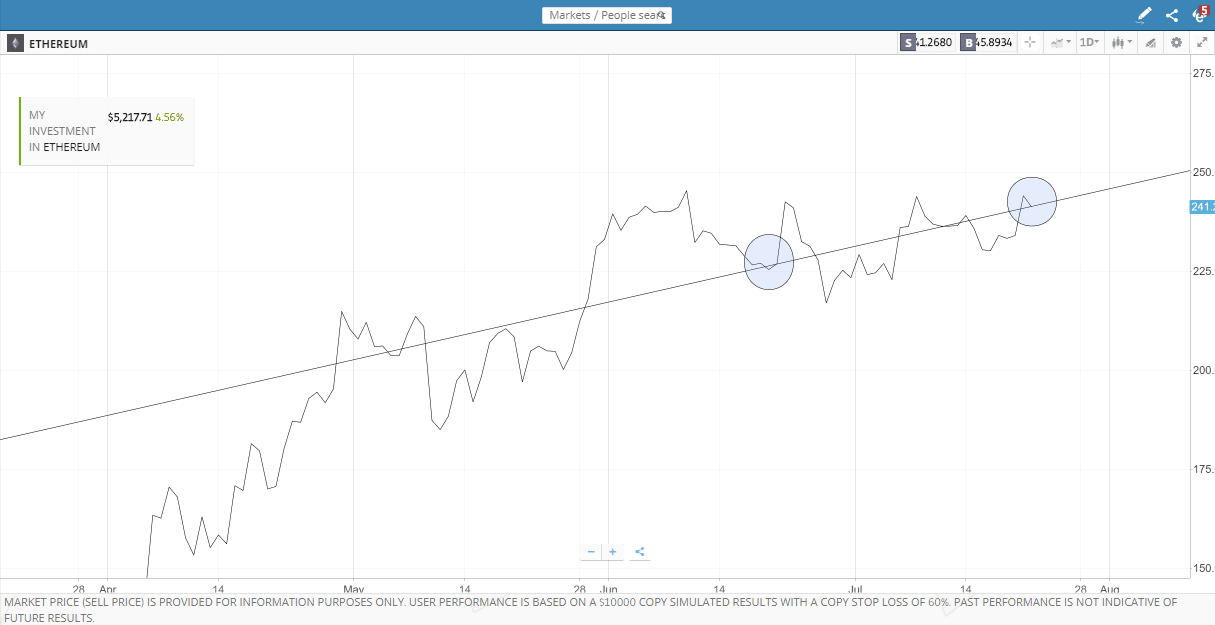

Other cryptocurrencies are also available to trade. The virtual account at etoro has been running a new strategy in the crypto, ethereum. In little more than one month, here, the price has moved in your favour, and the position bought for $5,000 is now worth an additional $211.47.

That profit of $211.47 equates to a gain of 4.44% on our trade – the price chart on the etoro site shows the course of price movements since april 2019.

In the case of the ethereum position, the strategy we are testing is relatively active. Spotting that the long-term price pattern was rising, we bought a dip, rode out the price falling away some more, but now that it has recovered, we are in profit.

One of the many cryptocurrency trading tips is that it’s never a bad idea to take a profit. As a result, we sell half of our position, crystalize that gain and leave the other half live, hoping for more price gains.

This type of trading strategy isn’t the only way to make money trading cryptocurrency. Some will trade more frequently using strategies based on ‘scalping’. This involves taking a lot of small profits on positions held for a short period.

Another strategy, possibly tailored towards cryptocurrency trading for beginners, is more ‘buy and hold’ in nature. This involves buying crypto and waiting until the price moves in your favour. If it moves against you and you start making a loss on the position, that will not be crystalized if you don’t sell out. Being patient, disciplined and sticking with your strategy would, in an ideal scenario, see the price rally and trade above your trade entry point. Such a price move provides a textbook example of how to make money by trading cryptocurrency.

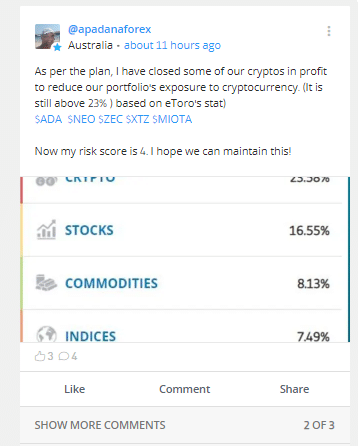

If you’re looking for other cryptocurrency trading tips, then it’s a case of sifting through the abundance of available information rather than struggling to find any. That raises the question of how to grade the quality of the advice on how to trade in cryptocurrency. One starting point might be the social trading function of the etoro site. In this area, traders share their thoughts and tips on crypto trading. A lot are actively trading in the market and are more than happy to share their views on how to make money trading cryptocurrency.

Capturing the imagination

Other cryptocurrency markets are available. At etoro there is a total of 16. Each has different ‘characteristics’. For example, some are associated with more volatile price moves. All follow the same principle that they are bought or sold using ‘traditional’ cash. When the position is closed ,the difference between the entry and exit price level determines the profit/loss on the trade.

Bitcoin is a popular first market for those wondering how to start trading cryptocurrency. Its popularity means that it might even come up in general conversation. Most people may know someone, or of someone who claims to have ‘made a fortune’ trading bitcoin. Such claims are best treated with care. Excessive returns are associated with extreme risk/return profiles. Bitcoin’s role in everyday conversation means you might hear others sharing thoughts, or indeed remarking that the price has shot up. All information has a value, so trading a market that a lot of others are also trading could be a good starting place for beginners.

The most straightforward approach to learning how to start trading crypto comes down to answering a few questions. Which of the regulated brokers to use? How long to practice trading on a demo account? Which particular crypto and crypto trading strategy best suits your approach?

Some like to mull over the options, others jump in, use a reputable and regulated broker and buy a little bit of bitcoin then let the position ride.

Finding out crypto trading tips is a continuous process. Using an unregulated broker is the biggest no-no of all.

Then there is the question of why cryptocurrencies have caught the public imagination to such an extent. Answering this point counts as trading analysis. The allure of bitcoin and other cryptos comes back to the blockchain aspect of their DNA. Some retailers already accept cryptocurrencies as payment on goods and services. If, and it’s a big ‘IF’ cryptocurrencies become widely accepted as legal tender, then the price will rise dramatically. The argument goes that if bitcoin will in the future be needed to buy things, then people will trade out of their dollars, pounds, euro and yen to buy the currency of the future. The result is that this extra demand will drive prices sky-high.

If that doesn’t happen, then they will become virtually worthless – just lines of computer code stored online.

The extreme difference between the two outcomes means that prices swing around dramatically. A report that ethereum (ETH) may become more widely accepted and take a step towards the ultimate target of being a bona fide global currency would have eye-watering effects on the price of ETH. If this move is in your favour, then that’s great news, but it can go the other way. No-one knows the direction, but historical price activity states the fact that the markets are incredibly volatile.

Blockchain is a very transparent accounting system and a societal shift to accept it is what those going long are hoping for. If that doesn’t happen then the players at the crypto card table will be showing each other their cards, but each hand will be as good as worthless.

For more insight, explore our range of our beginner’s guides that detail how to trade bitcoin, how to invest bitcoin long-term, and what to consider before investing in cryptocurrencies, amongst a wealth of resources.

PEOPLE WHO READ THIS ALSO VIEWED:

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

How to trade dax 30: trading strategies and tips

Dax trading: the basics

- Dax 30 is one of the world’s most widely followed and traded index es.

- Dax news and analysis can inform DAX trading strategy, and using common technical patterns .

- When trading dax traders should use a stop loss and little to no leverage.

Why trade the dax 30?

The dax 30 is one of the world’s most actively traded indices and provides traders with a high degree of liquidity, tight trading spreads and long trading hours. The FSE trading hours for the DAX are 09:00 GMT to 17:45 GMT and most providers will also give pre and post-market indications. This is to help traders gauge where markets are expected to open and where they are quoted after the official market has closed.

Dax trends can be easy to spot making it a favourite market to trade. Additionally, dax traders find the technical patterns to be clean on a multitude of time frames. Due to these factors, traders from around the world follow the dax and use it to gain exposure or hedge their exposure to equities.

Traders should look to trade dax 30 when the market is at its most liquid. Trading in low-liquidity conditions leaves traders at risk of low-volume ‘spikes’ or ‘blips’ that can break outside of normal trading patterns.

For example, the chart below shows how the intraday dax volumes increase near the open and the close of the cash market. This indicates when the liquidity is generally higher for trading dax 30.

Data source: bloomberg from august 13-18, 2018 , DAX futures

What moves the dax 30?

When trading the dax, a number of variables come into play and traders must be aware of their potential impact and the effect they will have on the value of the index. These variables include top-level macro themes, global fundamentals and markets and micro-themes including company and industry moves and valuations.

- Global and regional trade wars bring into question what effect will tariffs have on various companies and sectors in the dax?

- Currency wars will impact the bottom line of exporters, weighing on their share price and market valuation.

- A weak/strong euro exchange rate will impact exporters and importers differently.

- Brexit, whether a ‘soft’ or ‘hard’ brexit will impact companies listed in the dax in different ways.

- Knock-on effects – global markets are intertwined and the ripple effect of a sector crisis in one country will impact sentiment on the same industry in different countries around the globe.

- Company weightings in the index – a 5% price movement in one company within the dax can have a completely different impact on the index than a 5% move from another company with a different index weighting.

How to trade dax 30 using technical analysis

The dax 30 has been traded for over 30 years giving technical analysts a comprehensive set of historical trading data and resources to build graphs and technical set-ups. Technical analysis helps visualise patterns, trends and price points in a constantly moving environment.

Monthly dax 30 price chart with a selection of technical indicators

In the graph above we have used a selection of technical indicators to help us define trends, highlight shifting sentiment, identify significant highs and lows and potential retracement patterns. Technical analysis helps traders make more informed decisions by identifying potential trade set-ups and exits.

There are a variety of different technical indicators available and traders should decide which ones that they want to use and why. The best way to decide which indicators to use is by rigorously testing various scenarios and indicators and finding out which ones you are comfortable and confident using.

We have a wide range of technical resources and analytical guides for traders of all levels and run free trading webinars covering all aspects of the financial markets - including technical trading, fundamental market analysis and sentiment.

Dax trading strategy: top tips

Tradin g the D ax 30 is very similar to buying and selling a wide range of financial assets and the reasons for entering and exiting a trade, discipline and psychology remain constant and key.

A trader should make sure that they fully understand the product and what trading medium they want to use; for example, futures or spread trades. A trader must know his/her reason for entering the trade and must not be swayed by market ‘noise’ or recommendations and be disciplined enough not to let the market lead him/her into a trade.

Here’s our top dax trading strategies and tips:

- Decide your entry level, exit point and stop loss. If you are using technical analysis to decide levels to trade dax 30, make sure you have rigorously tested your analysis before trading and that you are comfortable entering the position.

- Entering trades before major data releases is risky and should be avoided. It is better to let the ‘dust settle’ after a release and miss a small part of the move than to gamble that the data release will be good or bad for the market.

- Do not place a trade - either a long or a short - without placing a firm stop loss.

- Before entering a trade, decide your risk-reward; for example, risk one unit to make three units. See our t raits of s uccessful traders research for more detail as to why.

- Do not place a large percentage of your capital on any one trade, however strongly you feel about it. At dailyfx we suggest limiting your exposure to less than 5% risk on all open trades.

- Select your timeframe for the trade , such as one hour, one day, one week or several weeks.

- Make sure that you are in a ‘good place’ before trading the dax 30. Do not trade when you are tired, distracted, emotional or bored.

- Don’t be greedy when trading . Experienced traders will tell you that buying at the bottom of the market and selling at the top is nigh on impossible and increases risk.

- Record all your trades comprehensively, making sure that you note why you entered the trade, how you felt, how the trade played out and the final result. The more you record your trades and their outcomes, the better prepared you will be for your next trade.

- Trading is like a full-time job and should be treated like one. Constantly study and update your trading technique.

- There are a variety of financial products available to trade. Traders should use a practice account test run various products to find where their strengths and weaknesses lie.

- And remember to enjoy it !

RESOURCES TO HELP YOU TRADE THE MARKETS

Whether you are a new or an experienced trader, at dailyfx we have many resources to help you: analytical and educational webinars hosted several times per day as well as trading guides to help you improve your trading performance.

Dailyfx provides forex news and technical analysis on the trends that influence the global currency markets.

Cryptocurrency day trading – winning strategies and tips

Cryptocurrency trading is a very lucrative business and a perfect alternative to the holding mentality that continues to cripple the cryptocurrency community. Given the high volatility nature of the cryptocurrency market, it’s extremely easy to make a living trading cryptocurrency. Currently, there are several types of trading, but day trading remains the most popular. Properly conducted, day trading is hugely profitable. It takes a lot of discipline and experience to master. Even professional financial advisors and managers tend to shy from it. However, with a well-planned strategy, even a novice can make it a lucrative career.

What is day trading?

Day trading is a kind of trading that involves the practice of purchasing and selling security within a single trading day. It’s a short-term strategy that traders utilize to earn small profits from minute, intraday fluctuations in prices of securities or digital currencies. It occurs in any market place but is most common in the stock, forex, and cryptocurrency markets. Day traders never hold any positions overnight; they enter and exit trading positions within the same day. Instead, they buy digital assets and hold them for a short period, anywhere between a few minutes to a few hours, before they sell them off.

Types of traders

Traders can be classified into two broad categories. Speculators and technical analysts. The speculators keep a watchful eye over the cryptocurrency market for news and activities that may indicate that particular crypto will lose or gain value. Their main concern is outside market influences such as coin hacks, developments, and significant partnerships, among others. Analysts, on the other hand, are concerned about the internal workings of the cryptocurrency market and tend to rely on financial patterns and charts for their insight. However, as a day trader, it’s vital that you do not confine yourself into any of these two broad categories. You may find that being unique and true to yourself extremely beneficial.

Other types of traders include:

- Scalpers

- Noise traders

- Swing traders

- Position traders

- Fundamental traders

How to day trade cryptocurrency

Choose your marketplace

The first step towards your day trading journey is to pick a marketplace. Different marketplaces offer different fee structures, coin pairings, trade amounts, etc. This is extremely important because little profits on large trade volumes can quickly disappear into fees. Therefore, it’s imperative that you pay attention to fee structures. Once you find a viable marketplace, go ahead and find two to three other marketplaces and register accounts on each. Doing so gives you flexibility in terms of cryptocurrency fees, liquidity, and availability.

Develop a strategy

Next, you need to develop a solid trading strategy. This step involves a lot of research and self-discipline. For starters, you need to ensure that you do not risk more than you are willing to lose. This can be a tough act to practice, but having a conservative strategy ensures that you don’t lose your entire cash on risky bets. Day trading is a numbers game, and you are bound to make some losses here and there. Therefore, it’s way better to collect small gains and remain safe rather than to risk big to score big.

Stop loss limits

Another vital factor in cryptocurrency trading is the stop-loss limit or as commonly known, your exit strategy. Most exchanges allow traders to set a stop loss that automatically exits a trade at a certain price level. For instance, if you purchase a particular cryptocurrency at $200, you may set a stop loss at $180 to ensure that you at least preserve a large chunk of that investment in case prices take a nose-dive.

Limit sell orders

Limit sell order is another important concept in cryptocurrency trading. Unlike the stop-loss order, the limit sell order automatically closes a trade one once your digital asset hits a specific high price. For instance, if the said digital asset is on an upward trend, and you perceive the top market price to be $300, you can set a limit sell order of that amount. Once the asset hits that price point, the limit sell order will automatically sell your asset.

Crypto trading bot

The cryptocurrency trading market is currently filled with a large number of trading bots and trading algorithms. Some are freely available on open-source platforms while others are given at a fee. As tempting as it is to utilize the services of these trading bots, extreme caution is recommended. Crypto trading bots are only as good as their programming. Therefore, any corruption in their code, and you can expect them to make mistakes. However, we recommend using the 3commas crypto trading bot as it’s easy to set up and performs reliably compared to most of its competitors. Features such as bot performance analytics, social trading, portfolio creation and tracking make it a robust option for any trader interested in automated cryptocurrency day trading.

Best crypto day trading strategies

Scalping

Scalping is a standout strategy in day trading that’s well-recognized in the forex market but also commonly used in the cryptocurrency trading market. It’s conducted by executing hundreds of trades per day in an attempt to make a small profit from each trade. The trader undertaking scalping hopes to profit by exploiting the bid-ask spread. Scalping is a quick, paced strategy that tends to be dangerous at times. Therefore, you need to be hot on timing and vigilant for unpredictable assets.

Force

This is a popular strategy that depends on following up on news sources and recognizing price moves. The values of digital assets are guaranteed to move around every day; therefore, there’s always a chance to take advantage of this strategy. You need to make sure that you remain mindful of up and coming news and declarations since you’ll have moments before they affect the values of the digital assets.

Inversion

Inversion is a commonly discussed strategy utilized all over the world. It’s fondly referred to as pattern trading, switch trading, or pull back inclining. This strategy follows a fundamental rationale as it fixates on buying and moving day by day low and high pull-backs. Therefore, it requires the capacity to anticipating pull-backs quality and precisely distinguishing them.

How to day trade bitcoin

Bitcoin is more volatile than any other type of asset in the cryptocurrency market. Therefore, day trading bitcoin comes with a considerable amount of risk. Bitcoin prices are highly sensitive to public sentiments and regulatory changes. They fluctuate quickly depending on the types of news circulating in the industry, whether positive or negative. Therefore, before trading bitcoin, you want to wait until there is a high reading of volatility to make correct entries. It’s also essential to check how liquid the crypto is by verifying the 24-hour volume of the crypto trade.

Not having enough liquidity could trigger a substantial slippage that could lead to even more significant losses. Bitcoin is a safe commitment for a new trader as it can be used as a long-term store of value. It also comes with relatively fewer risks compared to altcoins. Furthermore, trading bitcoin doesn’t need to occur every single day. You only need to day trade bitcoin when all conditions align in your favor. Therefore, avoid trading on weekends and limit trading only to days with the highest volume.

Day trading ethereum and altcoins

The safest altcoins to trade are those that are the top by market cap. These are the ones that are less volatile and are most likely to serve as long-term stores of value. A great example is ethereum, ripple, bitcoin cash, among others. These coins are less apt to disappear. Smaller altcoins are profitable in the short-term, but the risks associated with them are much higher. Their prices can be artificially boosted through pump and dump. Therefore, the risk of your funds going up in smoke is much higher compared to bitcoin. A little dash of due diligence is needed in determining which altcoins to day trade.

How to make money trading cryptocurrency

Day trading taxes

Different countries hold different tax views concerning cryptocurrencies. Therefore, it’s crucial to conduct due diligence as to what tax laws govern your state. Alternatively, you may want to utilize the services of an accountant to make your work easier. The following tax overview is U.S.-centric and does not apply to non-U.S. Citizens. It’s divided into two; crypto held for less than a year and crypto held for more than a year. How much tax you pay is conditional to how long you have owned your digital assets.