Jp market account types

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools.

Actual forex bonuses

Also, you should learn how to manage your risks well. A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

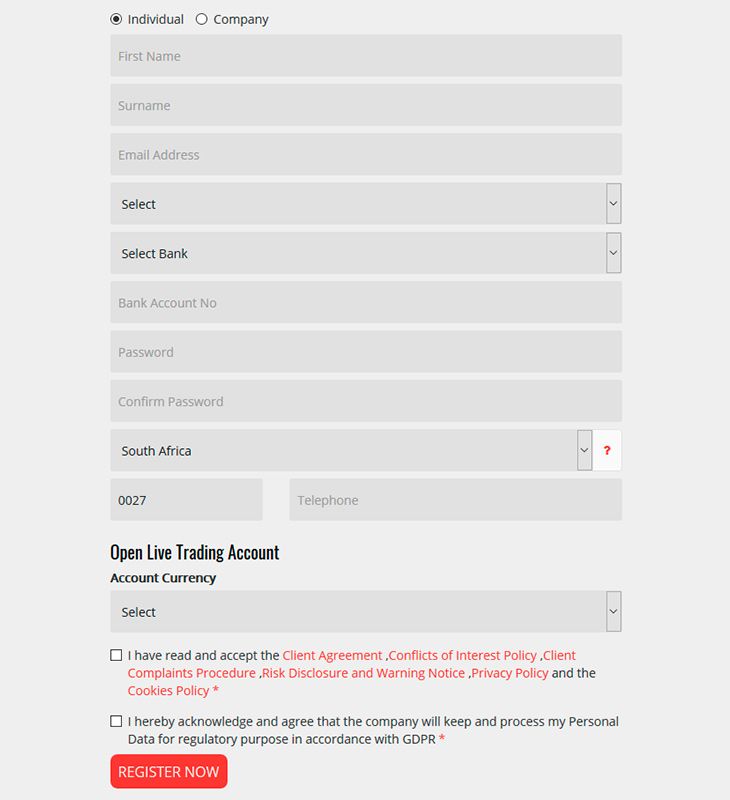

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Trading account types

XM CY trading account types

Micro account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 1,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots (MT4)

0.1 lots (MT5)

- Lot restriction per ticket

- 100 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

Standard account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

XM zero accounts

- Base currency options

- USD, EUR, JPY

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 0 pips

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 100$

The figures above should only be regarded as reference. XM is ready to create custom-tailored forex account solutions for every client. If the deposit currency is not USD, the amount indicated should be converted to the deposit currency.

You may be new to forex, so a demo account is the ideal choice to test your trading potential. It allows you to trade with virtual money, without exposing you to any risk, as your gains and losses are simulated. Once you have tested your trading strategies, learned about market moves and how to place orders, you can take the next step to open a trading account with real money.

What is a forex trading account?

A forex account at XM is a trading account that you will hold and that will work similarly to your bank account, but with the difference that it is primarily issued with the purpose of trading on currencies.

Forex accounts at XM can be opened in micro, standard or XM zero formats as shown in the table above.

Please note that forex (or currency) trading is available on all XM platforms.

In summary, your forex trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

Similarly to your bank, once you register a forex trading account with XM for the first time, you will be required to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details.

By opening a forex account, you will be automatically emailed your login details, which will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients’ members area are provided and constantly enriched with more and more functionalities and therefore giving our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your trading account login details will correspond to a login on the trading platform which matches your type of account and is ultimately where you will be performing your trades. Any deposits/withdrawals or other changes to settings you make from the XM members area will reflect on your corresponding trading platform.

What is a multi-asset trading account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices cfds, stock cfds, as well as cfds on metals and energies.

Multi-asset trading accounts at XM can be opened in micro, standard or XM zero formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM webtrader.

In summary, your multi-asset trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

- 3. Access to the XM webtrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details that will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including the depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients members area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform which matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM members area will reflect on your corresponding trading platform.

Who should choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, cfds on stock indices, as well as cfds on gold and oil, but it does not offer trading on stock cfds. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.

Access to the MT4 platform is available for micro, standard or XM zero as per the table above.

Who should choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices cfds, gold and oil cfds, as well as stock cfds.

Your login details to the MT5 will also give you access to the XM webtrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for micro, standard or XM zero as shown in the table above.

What is the main difference between MT4 trading accounts and MT5 trading accounts?

The main difference is that MT4 does not offer trading on stock cfds.

Can I hold multiple trading accounts?

Yes, you can. Any XM client can hold up to 8 trading accounts of their choice.

How to manage your trading accounts?

Deposits, withdrawals or any other functions related to any of your trading accounts can be handled in the XM members area.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Jp market account types

J.P. Morgan asset management manages separately managed accounts, including equity and fixed income separately managed accounts offered through various sponsor platforms. A separately managed account provides direct ownership of securities and is tailored to the specific needs of the client.

Important disclosure documents

Professional expertise

Smas are professionally managed, giving clients access to the expertise of skilled portfolio managers—and a level of service typically enjoyed by large institutional clients alone.

Tax-efficient investing

Because clients own the individual securities in their SMA and may fund the account with securities in kind, they can work with their tax and financial advisors to implement tax-efficient strategies.

Portfolio customization

Smas can be tailored to clients’ specific investment strategy and goals. Clients may choose to exclude certain securities or sectors based on their social, political or environmental convictions.

Explore our managed accounts strategies

Discretionary fixed income (DFI) strategies

Equity income strategy

Focused equity income strategy

Focused european multinationals strategy

Growth advantage strategy

High yield strategies

Intermediate municipal strategy

International ADR strategy

Intrepid value strategy

Large cap growth strategy

Mid cap growth strategy

Mid cap value strategy

Municipal ladder strategies

- Fact sheet: municipal ladder 1 – 5 year strategy

- Fact sheet: municipal ladder 1 – 10 year strategy

- Fact sheet: municipal ladder 1 – 17 year strategy

- Fact sheet: municipal ladder yield curve enhanced strategy

- Monthly holdings: municipal ladder 1-5 year strategy

- Monthly holdings: municipal ladder 1-10 year strategy

- Monthly holdings: municipal ladder 1-17 year strategy

- Monthly holdings: municipal ladder yield curve enhanced strategy

- Commentary: municipal ladder yield curve enhanced strategy

- Commentary: municipal ladder 1-5 year strategy

- Commentary: municipal ladder 1-10 year strategy

- Commentary: municipal ladder 1-17 year strategy

Tax aware managed reserves strategy

U.S. Large cap equity strategy

U.S. Technology leaders strategy

Value advantage strategy

IMPORTANT INFORMATION: separately managed accounts (smas) are not mutual funds. Smas are discretionary accounts managed by J.P. Morgan investment management inc. (JPMIM), a federally registered investment adviser.

Professional money management may not be suitable for all investors. It should not be assumed that investments made in the future will be profitable.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan asset management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

INFORMATION REGARDING MUTUAL FUNDS/ETF:

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for mutual funds: contact jpmorgan distribution services, inc. At 1-800-480-4111 or download it from this site. Exchange traded funds: call 1-844-4JPM-ETF or download it from this site.

J.P. Morgan funds and J.P. Morgan etfs are distributed by jpmorgan distribution services, inc., which is an affiliate of jpmorgan chase & co. Affiliates of jpmorgan chase & co. Receive fees for providing various services to the funds. Jpmorgan distribution services, inc. Is a member of FINRA FINRA's brokercheck

INFORMATION REGARDING COMMINGLED FUNDS:

For additional information regarding the commingled pension trust funds of jpmorgan chase bank, N.A., please contact your J.P. Morgan asset management representative.

The commingled pension trust funds of jpmorgan chase bank N.A. Are collective trust funds established and maintained by jpmorgan chase bank, N.A. Under a declaration of trust. The funds are not required to file a prospectus or registration statement with the SEC, and accordingly, neither is available. The funds are available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the funds are not bank deposits and are not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the fund before investing.

INFORMATION FOR ALL SITE USERS:

J.P. Morgan asset management is the brand name for the asset management business of jpmorgan chase & co. And its affiliates worldwide.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan asset management in accordance with our privacy policies at https://www.Jpmorgan.Com/privacy.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright © 2021 jpmorgan chase & co., all rights reserved

Compare accounts

Find the one that's right for you

The right account for you will depend on your goals. Whether you're building a pension pot or just saving for the future, we can help you find the one which suits you best.

You can check the different features of our award-winning investment and savings accounts in the table below, or tell us your goals to narrow the field.

GOLD STANDARD FOR RETIREMENT 2017

gold standard awards

BEST INVESTMENT PLATFORM 2017

investors chronicle

I'm investing or saving.

I've used up my full ISA allowance for the current tax year (£20,000)

Investments can go down as well as up in value, so you could get back less than you put in. The information on this page isn't personal advice – please ask us for advice if you’re not sure which investments are right for you. Tax rules can change and their benefits depend on your circumstances. Once in a pension your money isn't usually accessible until 55 (57 from 2028).

Overview

Tax benefits

Minimum to open

Maximum contributions

Eligibility

Stocks and shares ISA

A simple way to invest up to £20,000 free from UK tax.

Tax benefits

Minimum to open

£100

lump sum

£25

per month

Maximum contributions

£20,000

per year

Eligibility

Fund and share account

A low-cost, flexible dealing account that makes anytime trading quick and easy.

Tax benefits

- Make use of your tax-free dividend allowance, capital gains tax allowance and personal savings allowance

Minimum to open

£25

per month

Maximum contributions

Eligibility

- UK and EEA residents

- Individuals, companies, investment clubs, trusts and charities

Self-invested personal pension

A flexible pension that gives you the control to choose your own investments.

Tax benefits

- Up to 45% tax relief on contributions if under age 75 (up to 46% for scottish tax payers)

- Tax-free growth

- No UK tax on investment income (i.E. Dividends and interest payments)

- Up to 25% can usually be withdrawn tax free, the rest is taxed as income

Minimum to open

£100

lump sum

£25

per month

Maximum contributions

As much as you earn, usually up to £40,000 per year (see rules)

Eligibility

Lifetime ISA

Save and invest for your first home or later life, with up to £1,000 per year in extra help from the government.

Tax benefits

- 25% government bonus on any contributions

- Tax-free growth

- No UK tax on income

- Tax-free withdrawals when buying a first home or at age 60

Minimum to open

£100

lump sum

£25

per month

Maximum contributions

£4,000 per year until age 50 (contributions also count towards your £20,000 ISA allowance)

Eligibility

Active savings

Pick and mix easy access and fixed term savings from a range of banks and building societies, all through the convenience of one online account.

Tax benefits

Taxed as savings interest

- Up to £1,000 tax free under personal savings allowance

Minimum to open

Maximum contributions

Unlimited

although savings products will have individual limits

Eligibility

Junior SIPP

A self-invested personal pension you can start on behalf of a child to help them invest for later life.

Tax benefits

- 20% boost from the government

- Tax-free growth

- No UK tax on investment income (i.E. Dividends and interest payments)

- Up to 25% can usually be withdrawn tax free, the rest is taxed as income

Minimum to open

£100

lump sum

£25

per month

Maximum contributions

£3,600

per year (including £720 tax relief)

Eligibility

- Parents or guardians can open a junior SIPP for their child, if the child is a UK resident

Junior investment account

Hold funds and shares for a child until they are ready to trade themselves.

Tax benefits

Minimum to open

£25

per month

Maximum contributions

Eligibility

- Anyone can open a junior investment account on behalf of a child

- The person giving the money, the person running the account and the child all need to be UK or EEA resident

Junior stocks and shares ISA

Why wait to start investing in their future? A junior ISA is a tax-efficient investment account for children under 18, and anyone can add money to it.

Tax benefits

Minimum to open

£100

lump sum

£25

per month

Maximum contributions

£9,000 (in the 2020/2021 tax year)

Money market account

What is a money market account?

A money market account is an interest-bearing account at a bank or credit union—not to be confused with a money market mutual fund. Sometimes referred to as money market deposit accounts (MMDA), money market accounts (MMA) have some features not found in other types of accounts. Most money market accounts pay a higher interest rate than regular passbook savings accounts and often include checkwriting and debit card privileges. They also come with restrictions that make them less flexible than a regular checking account. They are important for calculating tangible net worth.

The lines between high-yield savings accounts and money market accounts are increasingly blurred, and you may want to compare both money market accounts and savings account rates to ensure you're picking the best product for you.

Money market accounts vs. Savings accounts

How money market accounts work

Money market accounts are offered at traditional and online banks and at credit unions. They have both advantages and disadvantages compared with other types of accounts. Their advantages include higher interest rates, insurance protection, and checkwriting and debit card privileges. Banks and credit unions generally require customers to deposit a certain amount of money to open an account and to keep their account balance above a certain level. Many will impose monthly fees if the balance falls below the minimum.

Money market deposit accounts also provide federal insurance protection. Money market mutual funds generally do not. Money market accounts at a bank are insured by the federal deposit insurance corporation (FDIC), an independent agency of the federal government. The FDIC covers certain types of accounts, including mmas, up to $250,000 per depositor per bank. If the depositor has other insurable accounts at the same bank (checking, savings, certificate of deposit), they all count toward the $250,000 insurance limit.

Joint accounts are insured for $500,000. for credit union accounts, the national credit union administration (NCUA) provides similar insurance coverage ($250,000 per member per credit union, and $500,000 for joint accounts). for depositors who want to insure more than $250,000, the easiest way to accomplish that is to open accounts at more than one bank or credit union.

Potential disadvantages include limited transactions, fees, and minimum balance requirements. Here is an overview:

Types of bank accounts

:max_bytes(150000):strip_icc()/Logo_300x150-efac110d800741a6a7cf480294457064.png)

Different types of bank accounts serve different needs. It’s wise to put money into the best account type for your financial goals so you get access to the right tools for spending and saving. Doing so allows you to maximize the return from your bank, minimize fees, and manage your money conveniently.

Most banks and credit unions offer the following account types:

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of deposit (cds)

- Retirement accounts

Savings accounts

Consumers use this type of bank account to set aside money for future use. Since your deposits collect interest, your money grows over time.

Savings accounts are typically the first official bank account anyone opens. Children may open an account with a parent to establish a pattern of saving. Teenagers can also open accounts to stash cash earned from a first job or household chores and manage money while in college.

Opening a savings account also marks the beginning of your relationship with a financial institution. For example, when joining a credit union, your “share” or savings account establishes your membership.

A savings account is an excellent place to park cash for financial goals or emergencies safely and separately from the money you use for ongoing expenses.

- Good for: A first bank account for kids or teens or an account for adults looking for a place to earn interest on savings or park cash they would otherwise be tempted to spend

- Drawbacks: savings accounts often yield a lower interest rate than money market accounts and cds. they don't come with a debit card for purchases (however, if your savings account is at the same financial institution as your checking account, you could use your debit card for ATM withdrawals from your savings account if your bank permits it). Moreover, banks have traditionally limited consumers to no more than six withdrawals per month from these accounts.

Although the withdrawal restriction was lifted in april 2020, it's still in effect at some banks, so check with your bank for the latest rules.

Savings account tips

- If local banks or credit unions are too expensive, look at online-only options. Online savings accounts often pay the most interest and charge the lowest fees.

- To build up your savings account, drop a lump sum of cash into an account to start with or set up automatic monthly deposits into savings.

Checking accounts

Checking accounts are used for everyday spending. The key features of this type of bank account are a linked debit card you can use for purchases or ATM withdrawals, as well as check-writing abilities. The account type also allows you to deposit cash or checks and pay bills. Most banks now offer online bill-pay services through checking accounts, streamlining payments.

While traditional checking accounts don't earn interest, interest-bearing checking accounts provide an opportunity to get extra interest on top of what you get from a savings account.

This basic type of bank account is the best place to keep cash for short-term use and is essential to managing your monthly cash flow.

- Good for: anyone who needs a place to deposit a paycheck or cash or make payments, those who keep a relatively small balance, and people who enjoy the convenience of a debit card.

- Drawbacks: traditional checking accounts don't offer interest and are subject to a variety of fees and restrictions, including monthly maintenance fees and minimum balance requirements, which can become expensive and cumbersome quickly. But there are checking accounts with waivable monthly fees, along with free checking accounts without maintenance fees.

Checking tips

- Balance your checking account every month. This process of evaluating cash inflows and outflows from the account helps you manage your money, avoid fees, and spot fraud or errors before they cause major problems.

- Set up direct deposit of your wages into your checking account. If your employer doesn't offer direct deposit, use mobile deposit if your bank offers it so that you don't have to visit a bank branch or ATM to deposit a check.

- For day-to-day spending, it may be safer to use a credit card instead of a debit card because money is physically taken out of your checking account with a debit card purchase but not a credit card charge. And if your credit card gets hit with a fraudulent charge, your maximum liability for those charges is less than it is for unauthorized debit card charges.

Act quickly if you observe a fraudulent debit card charge. If you report debit card fraud to your bank within two days from when you notice it, your liability for the charges tops out at $50. After 60 days, your maximum loss is the full amount that was taken from your account.

Money market accounts

A money market account combines features of both savings and checking accounts. They offer limited check-writing privileges and collect interest at higher rates than savings or checking accounts, making them useful for short- or long-term needs.

If you tend to carry higher balances in checking accounts and want the ability to earn more interest and write checks, these bank accounts can be a great option to park cash.

- Good for: people who hold high balances in their account and want to earn higher interest rates.

- Drawbacks: money market accounts have higher minimum balance requirements than other types of bank accounts. interest rates are sometimes low, and you need to watch for fees. The number of withdrawals permitted monthly has traditionally been capped at six as with savings accounts.

Money market account tips

- Use money market accounts as emergency funds or a place to park money for larger financial goals (a down payment on a home, for example). Don’t access the money for other purposes to ensure that it’s there when you need it.

- If you can’t find an affordable money market account, look at online-only banks and cash management accounts, which are typically low-cost options.

Certificates of deposit (cds)

A CD is like a savings account that holds your money for a fixed term—three months or five years, for example. It usually allows you to earn more than any of the accounts listed above, but you'll have to commit to keeping your money in the CD for the full term (ending on the "maturity date") to avoid an early withdrawal penalty.

This type of bank account is best for saving for financial goals with a planned end date. For example, if you know you're going to take a trip abroad within six months, a CD would be a good place to keep (and grow) your money until you need it.

- Good for: money that you don't need to spend right away. You'll earn more by locking it up for a while, but both short- and long-term cds are available.

- Drawbacks: if you decide to pull your funds out early, you'll have to pay a penalty. That penalty might wipe out everything you earned, and even eat away at your initial deposit.

CD tips

- If you’re concerned about locking up all of your money, set up a CD ladder (multiple cds with staggered maturity dates) to make a portion of your savings available periodically.

- To avoid penalties altogether, look for banks that offer flexible cds that give you the option to withdraw money early—without a penalty.

Your deposits in all of the above accounts are federally insured for up to $250,000 per bank, per depositor, either through federal deposit insurance corporation (FDIC) insurance for banks or national credit union share insurance fund (NCUSIF) insurance for credit unions.

Retirement accounts

As the name suggests, these are accounts you use to set aside money for spending in retirement. Most banks offer individual retirement arrangements (iras), but some also provide 401(k) accounts and other retirement accounts for small businesses.

Most types of retirement accounts offer tax advantages. Both iras and 401(k) plans let you avoid paying income tax on the growth of your contributions each year, but you'll have to pay taxes at different points depending on the account type. Traditional IRA and 401(k) contributions reduce your taxes now, but you'll have to pay taxes on withdrawals later. Contributions to a roth IRA don't reduce your taxes now, but the upside is that you won't pay taxes on withdrawals later.

These are the best types of bank accounts for saving for retirement because they allow you to invest your money in the stock market, which creates the potential for greater returns than you could get on deposits in other types of bank accounts.

Jpmorgan emerging markets class B - accumulation (GBP)

Income and accumulation units

With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Generally accumulation units offer a slightly more efficient way to reinvest income, although many investors will choose to hold income units and reinvest the income to buy extra units.

Charges and savings

| initial charges | |

|---|---|

| initial charge : | 0.00% |

| initial saving from HL : | 0.00% |

| HL dealing charge : | free |

| net initial charge : | 0.00% |

The initial saving applied to a fund depends on how it is priced. Dual priced funds have two different prices (a sell price and a buy price); single priced funds have a single price (at which the fund can be bought and sold).

For dual priced funds the difference between the buy and sell price is made up of the initial charge and other costs e.G. The fund manager's dealing costs. The 'initial saving from HL' will reduce the buying price, but even with a full discount the buying price may still be higher than the selling price.

For single priced funds the price quoted does not include the 'initial charge'. Any 'initial charge' after deduction of the 'initial saving from HL' will be added to the price quoted.

Please note that even where a full saving is offered a dilution levy could be applied on the way in or out of the fund.

HMRC believes that from april 2013 rebates of annual charges (such as loyalty bonuses) paid on funds held in nominee accounts, such as our fund & share account, should be subject to income tax. Loyalty bonuses paid on funds in isas and sipps are unaffected, and they remain tax-free.

We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. However, while we make this challenge we are paying loyalty bonuses within the vantage fund & share account net of an amount equivalent to the basic rate tax. If we are successful in our challenge we will return this money to clients. If we are unsuccessful we will use the money to pay over any amounts due to HMRC.

If loyalty bonuses are taxable then the value of our ongoing saving to you could be reduced, depending on the rate of tax you pay. The below table gives an indication of how this may affect you.

In this case, the ongoing saving is 0.50%, of which 0.50% is paid by loyalty bonus. The tax that could be payable on this loyalty bonus, and therefore the value of this saving to you, is shown below.

| Non-taxpayer | basic rate taxpayer | higher rate taxpayer | additional rate taxpayer | |

|---|---|---|---|---|

| ongoing saving from HL: | 0.50% | 0.50% | 0.50% | 0.50% |

| loyalty bonus: | 0.50% | 0.50% | 0.50% | 0.50% |

| tax on loyalty bonus: | 0.00% | 0.10% | 0.2% | 0.225% |

| value of ongoing saving to you: | 0.5% | 0.4% | 0.3% | 0.275% |

Tax rules can change and benefits depend on individual circumstances. Please remember loyalty bonuses received on funds held in the vantage ISA or vantage SIPP are exempt from tax.

Also, loyalty bonuses received by overseas investors, companies and charities are not required to be paid with the deduction of tax. Therefore, if you are an overseas investor, or you represent a company or charity please let us know if you would like your loyalty bonuses paid without the deduction of an amount equivalent to the basic rate tax.

In some cases the ongoing savings are provided by our loyalty bonus. Loyalty bonuses are tax-free in an ISA or SIPP. However, they may be subject to tax in a fund & share account which would, in effect, reduce their value and increase the net ongoing charge.

Types of bank accounts

When you go to a bank to open a new account, you will have a variety of account types and features to choose from. Should you choose the basic checking option or an account that earns interest? Do you want the convenience of a bundled checking and savings account or the higher returns of a money market account?

- Checking account: A checking account offers easy access to your money for your daily transactional needs and helps keep your cash secure. Customers can typically use a debit card or checks to make purchases or pay bills. Accounts may have different options to help avoid the monthly service fee. To determine the most economical choice, compare the benefits of different checking accounts with the services you actually need.

- Savings account: A savings account allows you to accumulate interest on funds you’ve saved for future needs. Interest rates can be compounded on a daily, weekly, monthly, or annual basis. Savings accounts vary by monthly service fees, interest rates, method used to calculate interest, and minimum opening deposit. Understanding the account’s terms and benefits will allow for a more informed decision on the account best suited for your needs.

- Certificate of deposit (CD): certificates of deposit, or cds, allow you to invest your money at a set interest rate for a pre-set period of time. Cds often have higher interest rates than traditional savings accounts because the money you deposit is tied up for the life of the certificate – which can range from a few months to several years. Be sure you do not need to draw on those funds before you open a CD, as early withdrawals may have financial penalties.

- Money market account: money market accounts are similar to savings accounts, but they require you to maintain a higher balance to avoid a monthly service fee. Where savings accounts usually have a fixed interest rate, these accounts have rates that vary regularly based on money markets. Money market accounts can have tiered interest rates, providing more favorable rates based on higher balances. Some money market accounts also allow you to write checks against your funds, but on a more limited basis.

- Individual retirement accounts (iras): iras, or individual retirement accounts, allow you to save independently for your retirement. These plans are useful if your employer doesn’t offer retirement benefits or you want to save more than your employer-sponsored plan allows. These accounts come in two types: the traditional IRA and roth IRA. The roth IRA is popular because the funds can be withdrawn tax-free in many situations. Others prefer traditional iras because these contributions may be tax-deductible. Both accounts have contribution limits and other requirements you may need to discuss with your tax advisor before choosing your account.*

Once you understand the types of accounts most banks offer, you can begin to determine which option might be right for you.

JP markets - south africa's and africa's biggest forex broker

JP markets is a global forex powerhouse. We set high standards for our services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. We continue to grow everyday thanks to the confidence our clients have in us. We are licensed and regulated by the financial services board, south africa, FSP 46855.

Negative

balance protection

Through the use of an automated transaction monitoring and risk management system, a client’s account will never be allowed to reach negative balance.

Zero fee because

we want you to prosper

We do not charge you any fees for bank deposits or withdrawals made through our payment gateways. We are africa’s best, most reliable & trusted broker.

Quick & sufficient trading platforms

With high performing and innovative technology, our platforms are fast and sufficient for your trading. We do not lag and do not re-quote on orders. What you want you get.

Fast, reliable

deposits & withdrawals

With our almost instant deposit and almost instant funds withdrawal technology. You can enjoy your success almost instantly. No long waiting periods.

State of the art security

for your money

Safety is our top priority. Your monies is always safe with us and are kept in a separate banking account as requested by our regulator. Your money is safe and secure.

Friendly

customer support

Customer support, one of our most prized position – to what makes us different. Call, email or chat with us today. Our consultants are happy to help you with any request.

So, let's see, what we have: is JP markets reliable forex broker? Is JP regulated in south africa and other african countries? Complete guide & review with screenshots, videos & testimonials. Updated. At jp market account types

Contents of the article

- Actual forex bonuses

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- Trading account types

- XM CY trading account types

- Micro account

- Standard account

- XM zero accounts

- What is a forex trading account?

- What is a multi-asset trading account?

- Who should choose MT4?

- Who should choose MT5?

- What is the main difference between MT4 trading...

- Can I hold multiple trading accounts?

- How to manage your trading accounts?

- This website uses cookies

- This website uses cookies

- Your cookie settings

- Jp market account types

- Important disclosure documents

- Professional expertise

- Tax-efficient investing

- Portfolio customization

- Explore our managed accounts strategies

- Discretionary fixed income (DFI) strategies

- Equity income strategy

- Focused equity income strategy

- Focused european multinationals strategy

- Growth advantage strategy

- High yield strategies

- Intermediate municipal strategy

- International ADR strategy

- Intrepid value strategy

- Large cap growth strategy

- Mid cap growth strategy

- Mid cap value strategy

- Municipal ladder strategies

- Tax aware managed reserves strategy

- U.S. Large cap equity strategy

- U.S. Technology leaders strategy

- Value advantage strategy

- Compare accounts

- Find the one that's right for you

- I'm investing or saving.

- I've used up my full ISA allowance for the...

- Overview

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Stocks and shares ISA

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Fund and share account

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Self-invested personal pension

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Lifetime ISA

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Active savings

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Junior SIPP

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Junior investment account

- Tax benefits

- Minimum to open

- Maximum contributions

- Eligibility

- Junior stocks and shares ISA

- Tax benefits

- Minimum to open

- Maximum contributions

- Money market account

- What is a money market account?

- How money market accounts work

- Types of bank accounts

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of deposit (cds)

- Retirement accounts

- Jpmorgan emerging markets class B - accumulation...

- Income and accumulation units

- Charges and savings

- Types of bank accounts

- JP markets - south africa's and africa's biggest...

- Negative balance protection

- Zero fee because we want you to prosper

- Quick & sufficient trading platforms

- Fast, reliable deposits & withdrawals

- State of the art security for your money

- Friendly customer support

No comments:

Post a Comment