Deposit trading forex

While there is no deposit fee at forex.Com, the available deposit methods are also important for you.Actual forex bonuses

See how forex.Com deposit methods compare with similar online brokers: the average transfer times for the different methods are:

Forex.Com minimum deposit

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

Forex.Com minimum deposit amount

The minimum deposit at forex.Com is $100.

Check the following comparison table to see how forex.Com stacks up against similar brokers when it comes to minimum deposits:

| forex.Com | oanda | IG | |

|---|---|---|---|

| minimum deposit | $100 | $0 | $0 |

They expect to deposit 100 of your account currency but they advise to have at least 1000 units of your account currency

The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at forex.Com. Here are the main pros and cons when it comes to depositing at forex.Com:

| Pros | cons |

|---|---|

| • credit/debit card deposit | none |

| • no deposit fee | |

| • several account base currencies |

Visit broker

79% of retail CFD accounts lose money

Why does forex.Com require a minimum deposit?

Online brokers sometimes require a minimum deposit in order to cover their initial costs associated with creating a new account and to ensure their profitability. The higher the amount you deposited, the higher the chance for you to trade more and generate bigger profits for the broker.

In some cases, the very high minimum deposit (like the £1 million amount at the VIP account of saxo bank) is there to differentiate the level of services they offer you.

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Forex.Com minimum deposit

forex.Com deposit fees and deposit methods

Forex.Com does not charge a deposit fee. This is great because the broker won't deduct anything from your deposits and you only have to calculate with the costs charged by the bank / third-party you send the money with. If you want to know more about forex.Com fees, check out the fee chapter of our forex.Com review.

While there is no deposit fee at forex.Com, the available deposit methods are also important for you. See how forex.Com deposit methods compare with similar online brokers:

| forex.Com | oanda | IG | |

|---|---|---|---|

| bank transfer | yes | yes | yes |

| credit/debit card | yes | yes | yes |

| electronic wallets | yes | yes | yes |

The average transfer times for the different methods are:

- Wire transfer: 2-3 days

- Credit / debit card and online wallets: instant or a few hours

A minor issue with depositing money to forex.Com is that based on our experience it's not user-friendly compared to similar brokers. This means either that the interface is not user-friendly or that figuring out where and how you have to make the transfer is a bit complicated.

Find out more about depositing to forex.Com on their official website:

Visit broker

79% of retail CFD accounts lose money

Forex.Com minimum deposit

deposit currencies

Each trading account has a base currency, which means that the broker will hold your deposited money in that currency. At some brokers, you can also have more trading accounts with different base currencies. For example, at IG, it is possible to have both EUR and USD-based accounts.

Why does this matter? A currency conversion fee will be charged if you deposit in a different currency than the base currency of the target trading account. It's likely not a big deal but something you should be aware of.

Some online brokers offer trading accounts only in the major currencies (i.E. USD, GBP, EUR and sometimes JPY) and some support a lot more than that.

| forex.Com | oanda | IG | |

|---|---|---|---|

| number of base currencies | 6 | 9 | 6 |

Forex.Com supports the major currencies like USD, GBP and EUR, but does not support minor currencies. If you would deposit in a major currency anyway, then the online broker won't have to convert it. However, if you use a minor currency that is not supported, forex.Com will convert your deposits and you will be charged a currency conversion fee.

A convenient way to save on the currency conversion fee if you wish to fund your brokerage account from a less common currency (or just a currency different from your existing bank account) can be to open a multi-currency digital bank account. At revolut or transferwise the account opening only takes a few minutes after which you can upload your existing currency into your new account, exchange it in-app at great rates, then deposit it into your brokerage account for free or cheap.

Want to stay in the loop?

Sign up to get notifications about new brokerchooser articles right into your mailbox.

Forex.Com minimum deposit

steps of sending the minimum deposit

The specific process of sending your minimum deposit to forex.Com might vary slightly from the following, but generally the process involves the following steps:

Step 1: open your broker account

At most brokers, you can open your trading account online. To open an account, you have to provide your personal details, like your date of birth or employment status, and there is also usually a test about your financial knowledge. The last step of the account opening is the verification of your identity and residency. For this verification you usually have to upload a copy of your ID card and a document that validates your proof of residence, for example, a bank statement.

If you don't know which broker is suitable for you, use our broker selector tool.

Step 2: make the deposit

First you have to sign in to your already opened trading account and find the depositing interface. After this, you select one of the deposit methods the broker supports, enter the deposit amount and make the deposit.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you'll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it's required to use a card that's in your name. In some cases, like with IC markets, you'll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.

- Online wallets like paypal, skrill, neteller, etc.: it works just like any other online purchase. The interface of the wallet will pop up where you'll have to enter your credentials (username and password) and carry out your transaction.

Step 3: review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

Visit broker

79% of retail CFD accounts lose money

Fxdailyinfo - forex no deposit bonus, forex deposit bonus

Glossary of concepts: if you want to walk the walk, you first need to talk the talk. Learn the language of traders, in this detailed glossary of terms.

Which one the best forex bonus countenance? Fxdailyinfo presented reviews for offers on best trading bonus. In forex marker many fraud brokers tries to bait your trading capital by offering fascinating forex bonus promotion. Forex bonuses help you to pick forex deposit bonus and no deposit forex bonus.

2019 grand forex bonus offer : to get best trading bonus program 2019- check fxdailyinfo.Com forex bonus list. For bonus offer description click read more. You can visit no deposit bonus pages to trade without deposit. Which offer is new to know you can check what`s new this week program. Fxdailyinfo help you to pick best forex deposit bonus, no deposit bonus and all forex related news.

Different type of trading bonus : present day broker houses announced different type of bonus. Deposit bonus, welcome bonus and no deposit bonus are very attractive for client all of these have different type of benefits. For trader bonus offer is very attractive for trader but bonus deals are knotted by term and condition for that some trader are loser and cannot fill the term and condition. Without any knowledge and experience of forex traders surprised of offer and some time they lose and some time gain.

“at a glance” forex bonus : bonus by deposit on forex traders live account. Percentage of deposit amount credited account by bonus. Broker houses offer withdrawal and tradable bonus

No deposit forex bonus : without any deposit and risk free bonus credited on client account for trade. With this bonus trader can earn. Some broker offer to trader bonus and profit withdrawal.

Bonus for trade : with tradable bonus you can gain or lost the bonus and it is part of trading system. Some experienced trader trade and make profit. Broker offer many type of bonus.

Contest of demo : by trade on demo account trader can win tradable cash amount. After winning the contest trader can withdrawal balance some time they win another prize.

Contest on live account : trader trade on live account by deposit amount. Trader can win huge cash amount and prize. Broker houses offer lucrative prize and gift for winner who participated.

Friend referring : after refer your friend on your broker. Your friend open account and make deposit you will get special bonus and commission. Referring friend is profitable for client.

Rebate : forex cashback is a payment rebated to traders for each trade executed. Cashback providers refer traders to brokers and share the rebates they earn from each trade made by the client with that client. The model is becoming standard for most brokers in the industry. It’s also attractive a standard tool for traders to reduce costs.

Forex gift : come check out our giant selection of T-shirts, mugs, tote bags, stickers and more. Cafepress brings your passions to life with the perfect item for every occasion. Free returns 100% pleasure guarantee fast shipping.

Draw bonus: A forex draw bonus is of course a type of a bonus, and just like the other bonuses it is a particularly tailored gift provided by the broker to the client.

Seminars : live in person forex seminar . We can make live presentations to groups of forex traders from 50 to 150 people. In the past, these presentations all have been 4-8 hour long seminars and include complete training on our trading system, and lunch or catering in a classroom environment with WIFI internet.

Webinars: A webinar is an educational, informative or instructional presentation that is made available online, usually as either video or audio with slides.

Tradable bonus: tradable bonus is your support in the time of draw-down. Tradable bonus supports on open position as extra margin for trading and save for getting early margin call. It can be traded like own money. It boosts account's money and added to equity. In addition rescue bonus or tradable bonus provide extra safety in the time of draw-down.

Volume bonus : most common type of deposit bonus, it allows you to enlarge your trading volume. Often the bonus can be cashed on trading lot condition.

Freebies : freebies. If you wish to open a live account with a specific broker then remember always to ask for any free tools they can supply you. They can offer you free eas, free trading analysis, free signals and more.

Binary options : just like traditional options, binary options have a premium, a hit price, and an ending. The dissimilarity is that, with binary options, the “premium” amount for the option is chosen by the trader (usually determined by the market with traditional options) and the expiration timeframes are much shorter.

Forum posting: get a small trading bonus for each of your post in forms.

IB: introducing brokers and forex. An introducing broker (IB) is essentially an agent which introduces new customers to a forex brokerage. In return for sending custom to a brokerage, the introducing broker receives a fee, when it comes to forex this is normally a certain share of the spread or commission charged by the brokerage.

Forex affiliates : choosing the program that is best for you plays a crucial role in profiting from such a partnership in the forex industry. We give details to you the differences between an introducing broker and a forex affiliate. Introducing broker an IB finds most clients through a network that he or she has developed through personal or business relationships.

Free signal : most of broker offer free signal for trade. Free signal is helpful for client to know current condition of forex market. By following forex free signal forex trader start trading

Free VPS server : broker houses offer free virtual private server to maintain the certain amount of trader balance. Some trader can use virtual private server for their trading balance.

What is a pip? Currency prices naturally move in such tiny increments that they are quoted in pips or percentage in point. In most cases, a pip refers to the fourth decimal point of a price that is equal to 1/100th of 1%.

Expos events: it's a unique chance to meet with forex brokers, investors like yourself, attend unique workshops and more. A forex expo can provide you with great opportunities to learn about new trading strategies, network with other forex traders and become familiar with the latest developments from within the industry.

Almost every household has an unsolved rubiks cube but you can esily solve it learning a few algorithms.

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

Fxdailyreport.Com

Benefits of trading with small amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce commissions

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better management of risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of forex brokers with a low minimum deposits 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial brokerage services (FBS)

Choose a forex trading account to open

Forex trading account is a half of your success on forex. Read all the conditions for each account we offer and choose the most suitable for you and own trading style. We offer trading conditions for every forex account that will satisfy both beginners and professionals in the forex market. Your success is important to us and we offer you no minimum forex deposit to start trading with us and enjoy all the services from freshforex. Thus, you are free to fund trading account with any sum of money.

Types of fresh forex accounts

An excellent option

to start your real trading

Classic

More than 130 tools

leverage up to 1:2000

0.01 of lot – minimum order

This type of account suits active

traders and scalpers perfectly

Market PRO

Precise quoting: 5/3 digits

spread from 0.9

execution from 0.1 sec.

Professional trading

on the advanced level

Trading inside spread

high liquidity

prompt switch to interbank

- Available on classic, market pro and ECN accounts

- Fixed commission from $5 per lot

- Suited for muslim traders

Learn our trading conditions and choose the type of forex account which suits you best. You can open a forex trading account free just to learn trading or to practice your trading skills. When you are ready to trade on a real account, choose classic account with a high leverage or market pro with floating low spread. If you are already confident in your skills, choose a professional ECN account which does not require any minimum forex deposit. We offer you several options for your trading and it is only up to you to choose what is the most comfortable, suitable and profitable for you.

Windows, iphone/MAC, android, linux

Windows, iphone/MAC, android

1. According to the "regulations for trading operations" each friday 5 hours before market closing (7:00pm EET trading server time) and before the holidays, margin requirements for all instruments on ECN accounts with the balance less than 500 USD/450 EUR/0.05 BTC are settled based on the highest leverage 1:100 (for CFD it is pro rata lower according to the specifications published on the company’s website).

2. If the price of a financial instrument rapidly changes (before and after releases of fundamental data, speeches of economic decision-makers, market interventions, etc.), minimum levels for setting orders can be increased, but not more than by 10 times as compared to the levels listed in contract specifications (order levels on market pro and ECN accounts will be increased according to the levels set for classic accounts taking into account the number ofdecimal places in prices).

3. On the first day of the month on ECN accounts accrued swaps and trading commissions are converted to the account balance to settle with the company contractors.

4. Trading cfds on cryptocurrencies is available daily from mon to sun from 00:05 to 24:00 EET (eastern european time : UTC+2 in winter, UTC+3 in summer).

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period of XM bank wire transfer withdrawal was 5 days in my last 8 years.

XM fund safety

To keep their clients’ funds, the forex traders safe, XM takes all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use to trade, become familiar with the features, and test strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

Latest forex no deposit bonus list 2021

The no deposit bonus is a free tradable bonus gifted broker for new clients. You can take the bonus without any deposit.

The free bonus is not allowed in the EU and US residents but it’s very popular in some countries.

Newbie traders like to grab the free bonus because it is one of the free powerful leverage for them.

Hey! Want to start forex trading? You can fire right now with the forex no deposit bonus.

The ultimate guide about the no deposit bonus

Not all brokers but most of them offer the free bonus. It is a welcome bonus. Upon joining with a broker, the broker provides a free bonus.

While you think to consider for a no deposit bonus, don’t miss to check our best broker no deposit bonus!

No deposit bonus without verification

While you will register to create an account, you have to give you full name, email, phone number (often), the birth of date, country, and other some filed if need.

Usually, most of the forex brokers ask to verify your identity, at least phone number, or email based on their requirements.

But, sometimes a few brokers offer to start trading without verification of any information.

Why a no deposit bonus?

A freeway! Who doesn’t love to take free money? Actually, the forex broker offers a free bonus to learn forex trading, without any risk. After gaining some profit you will get big confidence to invest in it and make some bigger.

What about your profits?

The bonuses are good to make your profit, depends on you! Most of the bonuses offered to withdraw the gain profit and also you should continue to live trading with the profit.

Here is a big list of bonuses, we collect for you, and you can choose and fire now.

Best no deposit bonus forex brokers 2021

The brokers below represent the best no deposit bonus forex brokers.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Cysec, FCA, FSA(SC), FSCA, labuan-fsa

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Your capital is at risk

Ctrader, MT4, MT5, proprietary

Dealing desk, ECN, market maker, no dealing desk, STP

Your capital is at risk

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Note: not all forex brokers accept US clients. For your convenience we specified those that accept US forex traders as clients.

Tickmill

Regulated by: cysec, FCA, FSA(SC), FSCA, labuan-fsa

Headquarters : 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill was founded in 2014 and is regulated by the UK financial conduct authority (FCA), the cyprus securities and exchange commission (cysec) and the seychelles financial services authority (FSA).

The broker provides more than 80+ CFD instruments to trade on covering forex, indices, commodities and bonds through three core trading accounts called the pro account, classic account and VIP account. They also offer a demo trading account and islamic swap-free account.

GO markets

Regulated by: ASIC, cysec

Headquarters : level 22, 600 bourke street, melbourne, VIC 3000, australia

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Australian brokers are definitely making a name for themselves in the trading arena as some of the most reliable, intuitive and forward thinking firms around. This broker is no different with a wide variety of tools, assets and reasonable trading conditions.

GO markets pty ltd an ASIC regulated broker has been in operation since 2006. The head office is located in melbourne, australia. With over a decade of experience, GO markets has grown to become a leading broker with a huge client base from over 150 countries. GO markets offers forex, share cfds, indices, metals and commodities for trading on the MT4 and MT5 trading platforms.

Roboforex

Headquarters : 2118 guava street, belama phase 1, belize city, belize

Your capital is at risk

The roboforex brand is operated by the roboforex group, and is located in belize. Roboforex began operations in 2009 and has grown in size and capacity. The brand offers over multiple trading instruments which include forex, stocks, indices, etfs, commodities, energies, metals and cryptocurrencies.

They also offer cutting edge platforms. Roboforex boasts of over 800,000 clients from 169 countries. They are both a dealing desk and non dealing desk broker offering ECN and STP trading accounts through their platforms. This means a different payment model to you the trader eg. Lower spreads for ECN accounts with some commissions to pay.

*leverage depends on the financial instrument traded and on the client’s country of residence.

Axiory

Headquarters : no.1 corner of hutson street and marine parade belize city, belize

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Axiory was founded in 2012 and is a trading name of axiory global ltd which is authorised and regulated by the international financial services commission (IFSC) of belize. The broker segregates client funds from their own and offers negative balance protection. The company is also audited by pricewaterhousecoopers and is a member of the financial commission.

Users can choose from three types of trading accounts called nano, standard and max to trade on 80 different markets covering forex and cfds on indices, energies, stocks and metals. Axiory offers maximum leverage of up to 1:500 and also provides access to islamic swap-free accounts and a demo trading account. Users can also access data regarding execution times and slippage distribution for even more transparency.

What is a no deposit forex bonus?

A no deposit forex bonus is a cash award that is deposited by the broker into the forex trader’s account, without requiring an initial deposit into the trading account by the trader.

Just like the deposit bonuses in forex (which require you to deposit first), the no-deposit bonus is used strictly for trading purposes and can only be withdrawn from the account on fulfillment of the broker’s trade volume requirements.

Typically, the no-deposit forex bonuses are not as large as the deposit bonuses. They range from between $10 and $200, depending on the broker. They are actually meant to introduce new traders into the world of real money trading and are not meant to be used for profit-oriented trading. Think of it as a form of live, real money practice account where you keep all the gains. If you lose money, you have lost nothing.

What should I do to get my bonus?

Most of the no-deposit forex bonuses in the market can be obtained as exclusive offers through affiliate partners of the forex brokers that offer them. The forex brokers who award the no-deposit forex bonuses directly are typically in the minority.

What is the difference between no deposit bonuses and deposit bonuses?

No-deposit forex bonuses do not require an initial deposit into the trading account before they are awarded. This factor distinguishes the no-deposit forex bonus from deposit bonus, which like the name implies, requires a deposit from the trader before it is awarded.

No-deposit forex bonuses are smaller in size as they mostly serve for live account practice.

What other bonus and promotion types do brokers offer?

Other bonuses and promotions may be given out by brokers occasionally.

- The cashback is the commonest bonus which a trader can get. Although this requires that some previous deposit would have been made by the trader, cashbacks are a good way to earn back any money that has been lost in previous trades. These are provided by brokers automatically without requiring further deposits.

- Trade contest awards do not require a previous deposit. You can participate in various trade contests on broker platforms for a share of the prizes. Cash prizes are usually awarded to traders as a no-deposit bonus. All you need is to ensure your account KYC documents are in place and you can claim your award if you win.

- Some brokers provide traders with tools they need to trade with on fulfillment of certain conditions such as attaining certain trade volumes within a specified time frame.

Conclusion

Are you looking for the best no deposit bonus forex brokers for 2017? Here we show a list of these brokers which we have compiled after careful evaluation of various candidates. Ensure you use the no-deposit forex bonus wisely and use it to enhance your live account trading experience.

Deposit trading forex

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

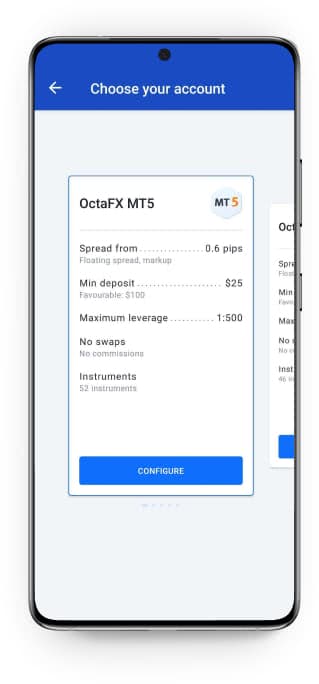

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

so, let's see, what we have: find out if forex.Com has a minimum deposit. Learn more about the deposit methods of forex.Com and its account opening process. At deposit trading forex

Contents of the article

- Actual forex bonuses

- Forex.Com minimum deposit

- Forex.Com minimum deposit amount

- Forex.Com minimum deposit forex.Com deposit...

- Forex.Com minimum deposit deposit currencies

- Forex.Com minimum deposit steps of sending...

- Fxdailyinfo - forex no deposit bonus, forex...

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

- Choose a forex trading account to open

- Types of fresh forex accounts

- XM deposit and withdrawal methods in 2021

- Latest forex no deposit bonus list 2021

- The ultimate guide about the no deposit bonus

- No deposit bonus without verification

- Why a no deposit bonus?

- Best no deposit bonus forex brokers 2021

- Tickmill

- GO markets

- Roboforex

- Axiory

- What is a no deposit forex bonus?

- What should I do to get my bonus?

- What is the difference between no deposit bonuses...

- What other bonus and promotion types do brokers...

- Conclusion

- Deposit trading forex

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

No comments:

Post a Comment