How to make money on forex

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading.

Actual forex bonuses

The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions. Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

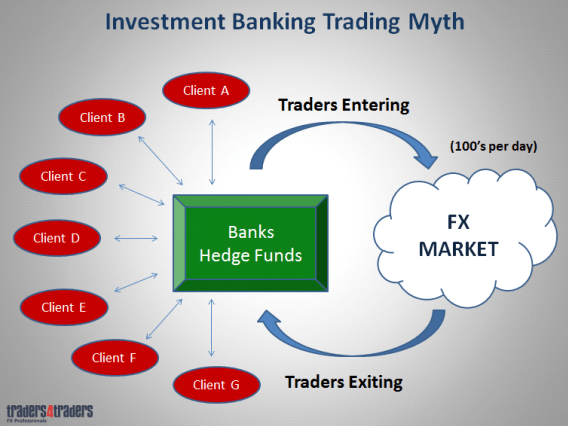

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

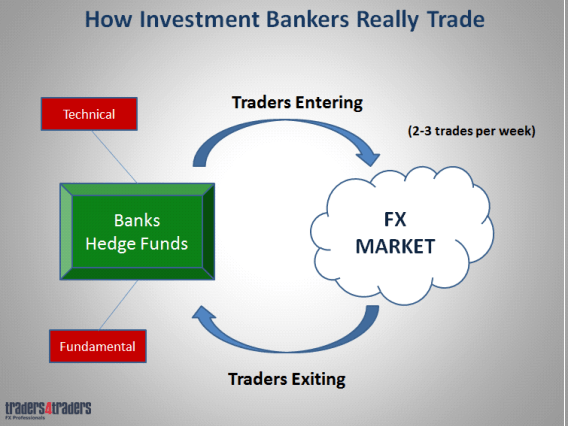

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

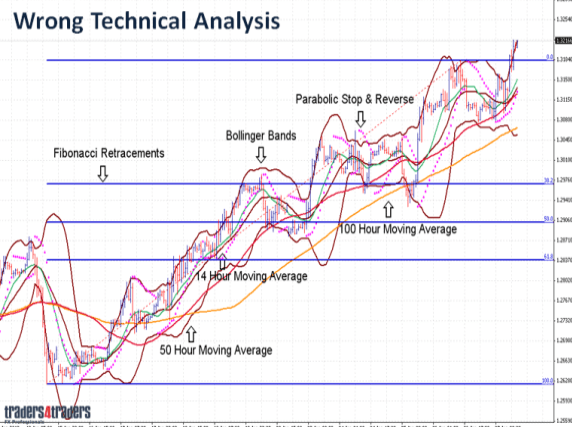

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

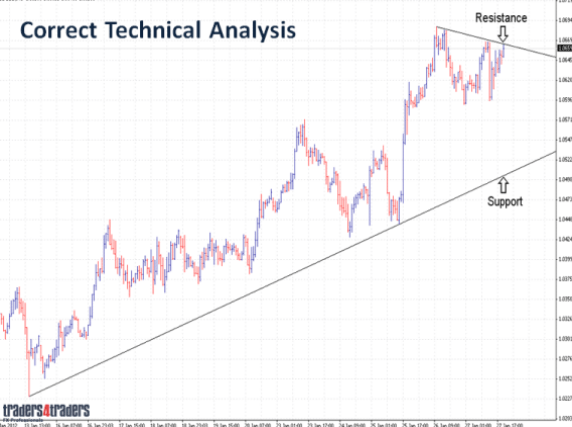

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

How to make money with forex?

When am I ready to profit with forex?

Forex market is like any other market where instead of stocks or bonds people trade currencies and make money.

Trading in forex is popular low capital trading but you have to know how to make money with forex. The truth is that you don’t need a huge capital to get started. Also, the forex market is available 24 hours during working days, but you can’t trade over weekends. Maybe the most common truth about every single person that enters the forex market is that they are excited, eager to earn a lot, and fast, but only a few of them know how to make money with forex.

How beginners in forex trading look like?

They are excited by the possibility of quick money earning and becoming rich. Beginners will easily sign up on some platforms without doing the necessary research. They are entering a position like gambling putting money somewhere and somehow, random, without a strategy. Even more, they don’t know how to place a trade, when to enter the position, where to set stop-loss orders or limits, or take profit. Actually they know nothing. And what happens? After several days when everything invested is lost, they will conclude the forex is fraud and it is impossible to make money there. For them it is completely the truth. With this approach, they will never earn because they don’t know how to make money with forex.

The other side of the forex rainbow

Beginners could see successful forex traders. But they are using tested and well-checked strategies. The strategies that they have developed or discovered thanks to a lot of trials and errors made for a long time. Yes, that’s the way! You’ll have to make many trials and mistakes to understand forex trading and understand how to make money with forex.

Forex traders have a unique trading style, a unique system, and their own strategy. But they came up to them after deep research, hundreds of attempts, losing a lot of money before they found a profitable strategy that works for them and became successful traders. Well, we are sure that the most successful traders will never talk about their failures but now and then you can find someone ready to share that unpleasant experience. On the other hand, you’ll find a lot of them sharing their great stories about winning trades. Learn from them. Only the knowledge will allow you to make the proper strategy, consistent profits on it every single day. That is possible, of course. But you have to learn how to make money with forex. And here are some hints.

How to make money with forex?

If you are a complete beginner without knowledge but willing to start forex trading and make money from it, the first thing you have to do is to read reputable books. Sorry folks, but knowledge is MUST. The point with reading books is that you’ll obtain theoretical knowledge. It is extremely important to understand the financial markets, otherwise, you’re not able to trade them especially if you want to stay there for the long run.

Good places for sharing knowledge are social networks. Join as many groups as you can and start the conversation. Don’t be shy to ask whatever you need to get better knowledge. Professional traders are also members of such groups and often, they’ll be glad to answer you. Also, interact with other rookies and share your knowledge but dilemmas also. Ask elite traders about the effects of leverage. That could be a very interesting conversation where you could find that trading with excessive leverage could be dangerous. You don’t believe it? Well, using leverage is good but if you use excessive leverage in your trading strategy that can end up as a failure. Using excessive leverage might mean that you are not realistic in expected returns on your investments.

What is leverage in forex trading, in the first place?

In general, leverage enables you to increase the result of your trading efforts but without developing your resources. Leverage in forex will simply boost your account while you actually don’t have that money. You are borrowing it to trade with even 1.000 times greater amount than your capital is. That is giving you access to the larger volumes than it is possible with your initial capital.

We are sure that you noticed banners on the trading websites that offer trading with 500:1 leverage. Well, it’s time to explain this in more detail. As we said, leverage is a kind of loan that a broker gives you. You use leverage in margin trading. And here we come to an important point. But leverage isn’t quite a loan even if it is one of the highest that traders can take.

This thing goes right this way

When you enter the forex market, the first thing you have to do is to open a margin account with your broker. Depending on the broker, the amount of leverage can be 20:1, 50:1, 200:1, 500:1 even more. Also, the amount of leverage will depend on your position size. For example, a 100:1 leverage ratio indicates that you have to deposit on your margin account, let’s say, $1.000 to be able to trade $100.000 of currency. These 100:1 leverage or 50:1 are for the standard lot size . If your position is at $50,000 or less the leverage would usually be 200:1.

But compare these leverages with, for example, the 15:1 leverage in the futures market. Well, you might think this forex leverage is too risky. Keep in mind that currency values normally switch by less than 1% within one-day trading. So, this huge leverage is possible because of small changes in the prices of currencies. If currencies are changing more in price, the broker would never give you that much leverage.

More math on how does forex leverage work

Assume you have a small account with $1.000. A standard lot is 100.000 currency units. If you want to trade mini or micro-lots, this deposit size would allow you to open micro-lots. That is 0.01 of a single lot or 1.000 currency units with no leverage set in place. Nevertheless, you’re looking for a 2% return per trade, which is $20.

So, you decide to employ financial leverage to trade big. Your broker is giving you a leverage 200:1. This means you can open a position as large as 2 lots. To make the long story shorter, let’s do some math .

$1.000 x 200 leverage = $200.000

This equitation shows that you actually have a maximum size position of $200.000. That is 200 times the size of your deposit. So, instead of earning $1, you’ll earn $200. Also, you can lose even faster.

Let’s follow our example, and assume you opened an order with a 1.00 lot. What will happen if the market goes against you? You will have minus 100 pips and lose $1000. Your order will be automatically closed. So, you will lose only your total deposit but you’ll not have money to continue. That’s why it is better to trade a smaller position to reduce the risks.

Use a stop-loss order to reduce risk

This one is probably most important. You can find hundreds of forex courses on the internet that promise you a strategy that will show you how to make money with forex every day. A lot of them are scammers, trust us. They just want your money for the low-quality courses. The better way is to start with some simple and easy strategy . It’s not hard to build a suitable strategy.

For example, you notice that the EUR/USD currency pair will rebound from a current support or resistance level. Your first strategy should be to take the benefit of this trend. Later, you can adjust this first strategy by adding some details that will improve efficiency. For example, set a stop-loss when the price goes down to a particular percentage or number of pips to exit the position.

Here is what you have to look out when creating a forex trading strategy.

Firstly, choose the currency pair. Pick it from the market you know, for instance, avoid currencies from exotic countries if you don’t know them well. If you trade only one currency pair you’ll have better chances to recognize trading signals . Also, your position size will determine the risk you are willing to take in every single position.

Further, find when to set your entry, will you go short or long. Never forget to set the exit level. You must know when to exit the position to maximize your profit and minimize potential losses.

Find when and how to buy or sell your currency pair.

Can you become rich with forex trading?

Some will tell you that it is impossible. And they would be right. The others will tell of course, and they would be right, also. The truth is that the forex market may give you a chance to earn a lot. This market is much bigger than the stock market, for example. Also, it offers the highest leverage possible in any market. Also, you can trade every day. In essence, the forex market is a place where small investors with small capital have a real chance to make fortune.

Trading forex is easy, but trading it with constant profit is difficult.

Opposite to what you’ve heard or read forex trading will not turn your $1.000 account into $1 million. The amount you can earn is determined by how much risk you want to take. If you want to know how to make money with forex, start with education. Sorry guys, it is necessary. When you learn the basics you can develop your skills further and you’ll start to make money for living by trading forex.

There are traders that are targeting even 100% profit per month. Yes, but the risk they are taking on is almost the same as the profit they are aiming for. In short, if you want to make a 100% profit per year, it’s possible to have a loss of 100% per year. Even if you are trading with an edge your profits will be small without leverage. On the other hand, with leverage, you can profit a lot, but you can produce extreme losses. The main point in forex trading is to buy a currency pair at a lower price and sell it at a higher price. The difference between is your profit.

For example, you have $1000 on your trading account and want to trade the EUR/USD pair with the exchange rate at 1.25. That means that for 1 euro you’ll take $1.25. Keep in mind that the prices are changing every day, from minute to minute. But you believe that EUR will increase versus the dollar.

Let’s assume, you buy 800 euros for your $1000. And the exchange rate changed from 1.25 to 1.35. That’s good for you, and you close the trade at this level and you can exchange your 800 EUR back to $1.080, and your profit is $80. But, if you used the leverage of 1:3000 you would get $24.000 in one single trade. So, you invest $1000 and trade $3.000 000! Pretty good!

Always keep in mind, if you want the higher profits you’ll have to take the higher risks.

Bottom line

One thing is completely true. If you never try you’ll never know how to make money with forex. With an account with just $1.000 and leverage of 1:100, it is possible to make a lot of money in a single trade. All you have to do is to have at least 1% of the trade on your margin account to use this leverage which is one of the most profitable. That is how to make money with forex.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

How to make money in forex fast? (simple winning strategy)

Now total disclaimer I am not suggesting in that profits are guaranteed in anyway so please visit our trading disclaimers page. So you are getting into forex and want to make money fast. That is great but make sure you get your basics down first understanding specifically about risk management you should never over leverage your account as you will likely blow it over time.

So how can you make money fast in the forex market? Use a minimal stop loss with a precision entry. It sounds simple and it can be but you need to demo before going straight to live and that goes with any strategy. Your stop loss if your profit regulators. So if you have 2% risk into a 10 pip stop loss you will make 2% every 10 pips. Same risk but using a 50 pip stop loss you will make 2% every 50 pips. That is 1/5 of what would have made with a precision entry. Just do the math.

I am going to state this again just do the math when it comes to forex. You aren’t going to make 10 million overnight and forex should never be looked at as a get rich quick scheme as you can lose hard earned money quickly.

That is why it all comes down to risk percentage and how big your stop loss is. Then of course you add in win percentage and amount of pips that is how quickly the compounding can add up.

5 pips a day can make you a millionaire in 2 years with a $5k trading account by just doing the math. Don’t believe me? That’s okay just go to any compounding calculator and put 1% daily, 20 days a month, starting with 5k for 2 years and there is the evidence.

If it is this simple why isn’t every doing it?

That is because of the penny doubled everyday mentality doesn’t exist. As I am writing this article for example there is hardly anybody that is going to see this article for months maybe even a year. But I am investing my time to be rewarded later. That is all it takes to succeed in life, but it is tough we are brought up to succeed in this way.

We are brought up to work and get our paycheck. When it comes to getting into shape everybody wants overnight results however it takes time and consistency to get the results you are looking for. That is no different with forex.

So why not in every aspect of your life apply the compound affect? (read or listen to the book by darren hardy)

This is just a way of life it is hard not to take the reward as quick as possible it took me many years to get any kind of handle on this mentality. I still struggle with it everyday. It is something that you have to just say I am going to do it and then work on the mindset as you move forward.

Make money fast in forex?

Okay back to the original question. Using a tighter stop loss yields bigger rewards without over-leveraging your account. So how do I get the precise entries? You need to focus on trading in the new paradigm. This includes using harmonics, trend lines, pithforks and the almighty fibonacci. Build energy points which is where you are stacking these confirmations together to create a tight price reversal zone (PRZ).

Here is example of a 190 pip drop caught with a 10 pip stop loss. Does this happen all the time? Of course not but you only need one of these a month and then take your 10-20 pip trades along the way.

It does take a lots of practice (volume of trades) to get these trades down. What happens though is that your losses instead of being -10 pips become -3 to -5 pips which means you are going to risk 2% for ever 10 pips but if you get out at -5 pips you are really only risking 1%.

This probably doesn’t make sense but just remember at the end of the day your job as forex trader is to protect your capital. Trading in the new paradigm is the best the way to that as well.

Related questions

(from our free facebook group)

Can you get rich by trading forex?

You absolutely can get rich by trading forex, but you can also lose all your money as well. Trade smart if you risk 3% of your account it will take you losing over 33 straight trades to actually lose your account. If you are winning 7-8 out of 10 trades and not over-leveraging this will never happen. Getting rich quick doesn’t exist for most people you need to put in the work and be patient. The penny doubled a day mindset does work so stick to it for the long run taking one step at a time.

Is forex A good way to make money?

It can be if you learn to win more trades then you lose and use proper risk management. Don’t let the get rich mindset blow your account. If you learn to build slowly you will never lose your money quickly. If you make your money quickly that usually means can lose your money quickly. The shortcuts can be the longest ways in reality. Forx is a great way to make money as you can do it from anywhere in the world all you need is laptop and internet connection.

How to make money trading forex with no previous experience?

You need to start with the groundwork. Learn how to open a demo account which we teach you live for free with our membership. Start with the basics then work up to an easy strategy. Demo the heck out of it until you do something along the lines of doubling your account or maybe getting to winning 8 out of 10 trades which should be 80 out of 100. There are no gimmicks with forex you either win or you lose. Different then gambling is that you control what you risk on any given trade with your stop loss but you can ride a trade as long as you want. Just move your stop profit up and ride the trend.

Hello I am tab winner welcome to my forex blog. I have been trading forex and cryptos for over 5 years now. Been a stay at home dad for about the same amount of time.

Saving your charts is a great way to never lose your work or markups. The other upside is you can access it from anywhere you have an internet connection that includes even tradingviews mobile.

It happens you get going want to share with world your idea on trading then bam you make a mistake hit publish now you want to go back and fix. Publishing an idea on tradingview does need some fixes.

About me

Hello I am tab winner welcome to my forex blog.

My site is called stayathometrader.Com for 2 main reasons:

1. I am a stay at home father have been for over 5 years now. This blog will be documenting my journey and daily struggles of raising a daughter (4 years old now) and intraday trading forex and crypto.

2. I trade from home. I do two things for work SEO and trading forex. Both I think of in terms of compounding for myself and families future. I will be trying to post at least 1-2 times a week as I work on my education and daily trades during the week.

Some other quick things about me:

– I live in the middle of nowhere and own a small old

family farm

– we also have horses, dogs and a cat

– I do not consider myself a professional trader even

though I do make a living from it I am continually

learning and building on my methodology.

– I am a big believer in mindset. Once you get your

mind right you can do anything you want to in life.

Legal information

Stay at home trader is owned and operated by tab winner. Stay at home trader is a participant in the amazon services LLC associates program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.Com. Stay at home trader also participates in affiliate programs with siteground, clickbank, CJ, shareasale, and other sites. Stay at home trader is compensated for referring traffic and business to these companies.

This message is only visible to admins:

unable to display facebook posts

How to make money trading forex - A beginner’s guide

To put it simply, the basis of making money trading forex sounds relatively easy: when the price is low, buy; when the price is high, sell.

However, supposedly up to 96% of traders lose money and end up quitting altogether. Conversely, other sources have suggested that actually, traders win more trades than they lose, but often their losses are larger than their gains .

So, making money trading forex can be… let’s say… complicated.

It really requires a mixture of the following:

- Patience . You need to be patient to learn and patient to earn.

- Understand forex . You need to know the ins and outs of the forex market.

- Understand risk management . You won’t make money if you’re part of that 96%!

- The ability to strategise . You need a plan if you want to be profitable.

If you don’t have any of those and do not have the time to invest in them, trading forex might not be for you.

The best way to learn all of the above is with a forex trading course. Trading education is currently offering a free forex trading education for beginners. Click here to find out more.

The basics

If you’re an absolute newbie, then it is highly likely that you don’t know what forex even is.

In that case, we should start from the very beginning.

The forex market shifts $5 trillion a day between traders, buying and selling currency pairs and is the largest market in the world.

A currency pair is the rate of exchange between two countries' currencies.

For example, at the time of writing this article, the exchange between the EUR (euro) and USD (united states dollar), which would be displayed as EUR/USD, was 1.1252.

That means that for one euro, you could buy 1.1252 of USD.

These rates are constantly changing , in most cases the last two digits, up and down. We call this fluctuation in price liquidity.

Traders are looking for opportunities to buy one currency at a low rate and then sell it for a higher rate.

That is basically how you trade forex.

How much money do I need?

Forex trading is a good choice for many traders because it requires less capital than other forms of trading/investing, such as stocks.

This is because of the way currencies are broken down. Most, with the exception of USD/JPY (united states dollar/japanese yen), are broken down to the fourth decimal, which is called a pip .

Most financial instruments cannot be broken down to such small figures.

Even if you’d actually prefer to trade stocks or another instrument, forex is a good place to start and help you understand the fundamentals of trading and potentially gain some capital.

Technically, you’ll need enough money to open a trading account, which can vary quite significantly depending on different brokers. Some brokers don’t require a minimum deposit, while others may require as much as £500 or more.

With the money you have used to open your account, it is best that you only risk about 1% on any trade . That money can go very, very quickly.

Remember, at the very beginning, it is more important to learn how to trade than to make a profit . If you lost money, investigate how it happened and make sure you don’t make the same mistake twice.

If you found this article by googling ‘ how to make money with forex ’ or anything like that, you are 100% not ready to start using leverage. Leverage is something you should leave until much later .

Likewise, you should keep in mind that big profits often require big investments .

You also need to think about fees as well. Unfortunately, that nice little profit you make when you trade might not be the entire sum of money you’ll actually make.

Though most forex brokers will not charge a commission on your trades, some might. There are also specific fees to bear in mind as well, such as swap fees , which are what brokers charge you for holding a position overnight.

Luckily, if you’re from the UK, you won’t have to pay tax on your earnings from forex trading. However, if you’re based in another country, you should check what the tax laws are on income gained from forex trading.

How much time do I need?

Before we talk about how long it will take for you to be ready to start trading and making money, we need to talk about having the right mindset .

Look at trading as a ‘business’ not a quick way to make money . No business is immediately profitable, especially if they are still learning when they start operating.

The best businesses need to have a business plan and that plan can take time to develop.

Persistence is key. Some traders only really start to make money after three to five years.

The real question is: how much time do you have? If you have a full-time job and other commitments, these, of course, will come first. You need to be honest with yourself about the amount of time you can devote to learning.

After learning to trade, finally, you can start practising.

Be mindful that not only might you sometimes lose money, you sometimes might not be able to find an appropriate opportunity to trade at all.

How much money can I make?

Look, you’re not going to become a millionaire overnight. Unfortunately, that’s something all forex traders need to accept.

As you would with a salary, you need to look at your profits over a long period of time , such as a month or a year.

As we said earlier, when you start trading, you should ideally be risking only 1% of your account per trade.

You need to think about how many pips you’ll gain on each trade.

To be honest, this is something you will need to figure out for yourself. Though most beginners will look to gain around 10 to 15 pips per trade as practice.

However, as you acquire more experience, such gains will not be worth your time. In fact, it is highly advised that you don’t waste your time agonising over such gains and instead look for larger, less time-consuming, profits.

For many traders, making between 50% and 55% is considered successful and profitable . Over time that small percentage builds up.

Win more than you lose. But don’t chase those losses !

Where can I make money trading forex?

Retail forex traders make trades via a broker in the form of a CFD (contract for difference).

Now, your mental image of a broker shouldn’t be of a guy in a suit, sitting at a desk and waiting for you to call him. We live in the 21st century after all.

Practically all brokers operate online . They utilise high-powered data connections to push through your order to an exchange where it will be fulfilled.

You place these buy and sell orders through a platform which can either be web-based, which is very popular these days, an application on your desktop or smartphone, such as MT4, MT5, ctrader, and some brokers can even enable you to make trades via a smartwatch.

There are numerous exchanges covering different time zones around the world. These exchanges allow us to trade forex, 24 hours a day, from sunday 6 pm till friday 5 pm, EST (united states eastern standard time).

Not all brokers are the same. In fact, they can operate in very different ways.

There are two primary types of brokers: dealing desk , which is often referred to as a market maker and non-dealing desk , which can be either STP (straight through processing) or ECN (electronic communication network), and there are also DMA (direct market access) brokers.

In most cases though, brokers will offer a mixture of the above, in the form of different account types.

While it may sound appealing to use a broker with more direct access to the forex market, choosing a broker should really be down to your preferences .

Strategy, strategy, strategy

Strategies are how you make your money.

Without a strategy, you can’t really say you are even trading. You may as well be gambling at a roulette table .

You can’t rely on just one strategy . In fact, many of them can only be used in certain circumstances, depending on the direction the market is heading. For example, trending upwards, trending downwards, or simply ranging .

You need to assess the market before setting up a strategy. Then, when you are able to confirm a change has emerged in the market, you need to put your strategy into action.

Strategies are also much more effective at making big gains . Without a strategy, you cannot expect to make large gains at all.

Popular trading strategies seek to make a profit from the changes and abnormalities of the market.

Another important part of strategising is that they can also be used to mitigate risks, which brings us to the next section.

Let’s talk about risk

This should always be at the front of your mind. It’s very natural to think about the rewards of successful trading, but we also need to plan for our losses as well.

We need to think about what we might lose should our plans fall short or even fail completely.

In forex trading, you can’t afford to not be prepared . Nothing should catch you by surprise.

To understand it, we need to understand our risk-reward ratio . In other words, how much are you willing to risk in order to get a reward?

Ideally, your risk should be low and your reward should be large , or at least larger than your risk. The further apart the two numbers are the better.

It really is possible to lose everything trading forex if you don’t understand the risks involved.

One of the best ways to prevent big losses is by using stop-losses and take-profit orders. These are orders you place on your trading platform that automatically exit a position when the price reaches a certain point.

Think of such orders as an insurance policy.

Key points

If you remember anything from this article, make sure it’s these key points:

- You can make a profit if your wins are higher than your losses . 50-55% is successful and sustainable for most traders.

- Strategising is how you make your money trading forex . Don’t start trading without a plan and an idea of how to make money in different scenarios.

- Risk management can stop you from losing everything . With every trade, you should know how much you are willing to lose.

Getting an education

Wow, there cowboy! Were you just thinking of jumping right into forex trading after reading one little article? While we are flattered that we managed to convince you to get into forex trading, one article is not enough to start!

You need to educate yourself.

Before anything in this article is of any use to you, you need to know the basics.

Trading education is offering a free forex trading course, the ultimate guide to forex trading , and it is the best guide for beginners to make money trading forex , as well as professionals.

With our course you will learn the following:

- Foundation in forex trading

- Mechanics of forex trading

- Advanced analysis in forex

- Popular trading strategies in forex

Only when you understand the above will you really be able to make money trading forex.

Our forex trading education would normally cost you £2,500, but luckily for you, our partners are paying for it instead.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Can forex trading make you rich?

Can forex trading make you rich? Although our instinctive reaction to that question would be an unequivocal "no,” we should qualify that response. Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

But first, the stats. A bloomberg article in nov. 2014 noted that based on reports to their clients by two of the biggest forex companies at the time—gain capital holdings inc. (GCAP) and FXCM inc.—68% of investors had net losses from trading currencies in the prior year. While this could be interpreted to mean that about one in three traders does not lose money trading currencies, that's not the same as getting rich trading forex.

Key takeaways

- Many retail traders turn to the forex market in search of fast profits.

- Statistics show that most aspiring forex traders fail, and some even lose large amounts of money.

- Leverage is a double-edged sword, as it can lead to outsized profits but also substantial losses.

- Counterparty risks, platform malfunctions, and sudden bursts of volatility also pose challenges to would-be forex traders.

- Unlike stocks and futures that trade on exchanges, forex pairs trade in the over-the-counter market with no central clearing firm.

Note that the bloomberg numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading. On jan. 15, 2015, the swiss national bank abandoned the swiss franc's cap of 1.20 against the euro that it had in place for three years. as a result, the swiss franc soared as much as 41% against the euro on that day.

The surprise move from switzerland's central bank inflicted losses running into the hundreds of millions of dollars on innumerable participants in forex trading, from small retail investors to large banks. Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolvent, and took FXCM, then the largest retail forex brokerage in the united states, to the verge of bankruptcy.

Unexpected one time events are not the only risk facing forex traders. Here are seven other reasons why the odds are stacked against the retail trader who wants to get rich trading the forex market.

Excessive leverage

Although currencies can be volatile, violent gyrations like that of the aforementioned swiss franc are not that common. For example, a substantial move that takes the euro from 1.20 to 1.10 versus the U.S. Dollar over a week is still a change of less than 10%. Stocks, on the other hand, can easily trade up or down 20% or more in a single day. But the allure of forex trading lies in the huge leverage provided by forex brokerages, which can magnify gains (and losses).

A trader who shorts $5,000 worth of euros against the U.S. Dollar at 1.20 and then covers the short position at 1.10 would make a tidy profit of $500 or 8.33%. If the trader used the maximum leverage of 50:1 permitted in the U.S. (ignoring trading costs and commissions) the profit is $25,000, or 416.67%.

Of course, had the trader been long euro at 1.20, used 50:1 leverage, and exited the trade at 1.10, the potential loss would have been $25,000. In some overseas jurisdictions, leverage can be as much as 200:1 or even higher. Because excessive leverage is the single biggest risk factor in retail forex trading, regulators in a number of nations are clamping down on it.

Asymmetric risk to reward

Seasoned forex traders keep their losses small and offset these with sizable gains when their currency call proves to be correct. Most retail traders, however, do it the other way around, making small profits on a number of positions but then holding on to a losing trade for too long and incurring a substantial loss. This can also result in losing more than your initial investment.

Platform or system malfunction

Imagine your plight if you have a large position and are unable to close a trade because of a platform malfunction or system failure, which could be anything from a power outage to an internet overload or computer crash. This category would also include exceptionally volatile times when orders such as stop-losses do not work. For instance, many traders had tight stop-losses in place on their short swiss franc positions before the currency surged on jan. 15, 2015. However, these proved ineffective because liquidity dried up even as everyone stampeded to close their short franc positions.

5 effective ways to earn more money in the forex market

Earning money in the forex market is quite easier than many might think. Here are simple and effective ways you can grow your forex investment.

Making money through the forex market may be easier than you think. It does not require any particular skills nor you need to be an expert to understand the market dynamics. All you have to do is to follow certain techniques and develop a disciplined strategy when investing in forex.

Here are five simple yet effective ways to earn more in the forex market:

Define your trading style

It is important that you keep in mind your endgoal before you start trading in the forex market. Where do you want to be at the end of your trading journey? Having clear goals in mind is critical because your trading style is defined by these.

If you want to be an overnight millionaire, you may be required to invest more and take riskier bets. If you’re patient and can wait for the returns to accumulate, you can adopt a different style.

The first and most important principle, therefore, is to make sure you know where you want to ultimately go. Determine how much you want to earn from your forex market investments and then decide what investing style suits your goals.

Perform a trend analysis

Perhaps the best and simplest way to earn from the forex market is learning how to spot the trends in the market. Understanding the highs and lows of the bull or bear market is crucial to succeeding; take note of the trends and make a move at the right time.

However, spotting the trends in the market can be tricky. You will need to rank the highs and lows of the market, and then find the sweet spot where you feel comfortable to make your move. It is quite common for investors to take a risk at the wrong turn of the trends and find themselves stuck in unprofitable investments.

What’s the key to making a right move? Consistently follow a trend and have an intuitive feeling on where and when it will move in your favor.

Use practice accounts and start small

Start with a practice account and work your way towards live accounts. Most trading platforms will allow you to have a practice account, which can help build your confidence as an investor.

Oftentimes, new investors do not understand the technology or make errors while taking their positions when they go live. Practice accounts provide the necessary training to understand how the market works and what needs to be done without any risks.

It is also crucial that you start small when you decide to go live. Similar to a practice account, small and gradual investments can solidify your confidence to trade in the market while still making money.

Trade with price

Many investors tend to invest on the basis of fundamentals but this can go wrong. Most of the time, it is better to rely on how the market is reacting to the news instead of applying your own insight on news that you’re receiving.

It is always better to trust the market mechanism — its timing and direction — and follow the price.

Providing leads to brokers is another source of side income in the forex market. (source)

Provide leads to the brokers

If you want to earn side income while being an active investor in the forex market, you can do so through providing leads to the forex brokers.

There are two ways you can do this; one is through forex affiliate cpa and the other is through revenue sharing.

To get such types of income, however, you need to have a blog or website where you can generate the leads you’ll provide to the brokers. CPA offers get you a one-time fee whereas revenue share is as straightforward as it sounds — sharing part of the revenue earned by the broker from the leads you provided.

Making money from the forex market can be done. To do so with ease, disciplined practice and a cool head will be what you need to start earning through forex. Follow these five strategies and you may soon be on your way to make money in the forex market.

DISCLAIMER: this article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

So, let's see, what we have: discover how to make money in forex is easy if you know how the bankers trade! At how to make money on forex

Contents of the article

- Actual forex bonuses

- Making money in forex is easy if you know how the...

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- How to make money with forex?

- When am I ready to profit with forex?

- How beginners in forex trading look like?

- How to make money with forex?

- What is leverage in forex trading, in the...

- Use a stop-loss order to reduce risk

- Can you become rich with forex trading?

- How to make money in forex trading: A complete...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- How to make money in forex fast? (simple winning...

- If it is this simple why isn’t every doing it?

- So why not in every aspect of your life apply the...

- Make money fast in forex?

- Related questions

- (from our free facebook group)

- Can you get rich by trading forex?

- Is forex A good way to make money?

- How to make money trading forex with no previous...

- About me

- Legal information

- How to make money trading forex - A beginner’s...

- The basics

- How much money do I need?

- How much time do I need?

- How much money can I make?

- Where can I make money trading...

- Strategy, strategy, strategy

- Let’s talk about risk

- Key points

- Getting an education

- How to make money in forex trading: A complete...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Can forex trading make you rich?

- Excessive leverage

- Asymmetric risk to reward

- Platform or system malfunction

- 5 effective ways to earn more money in the forex...

- Define your trading style

- Perform a trend analysis

- Use practice accounts and start...

- Trade with price

- Provide leads to the brokers

No comments:

Post a Comment