How to open forex account

During the final steps of opening your account, you will see risk disclosures.

Actual forex bonuses

Please take these seriously. Forex is a difficult business for beginners. It tends to eat them for dinner if they aren't careful. There are more losers than winners on average. The broker is required to remind you of the forex risks. The reality of trading is quite different from the sales pitches most people hear. That's because it is hard to be consistently profitable and most traders lose money in the early stages of their experience.

How to open a forex trading account

What is needed and why

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Foreign-currencies-58c5b0253df78c353c57c52f.jpg)

Artifacts images / digital vision / getty images

Forex trading sounds like an exciting financial opportunity to those who hear about it for the first time. The possibility of trading large sums of leveraged money sparks the imagination, but most who find the prospects of this market attractive will soon find they are surrounded by online hype and hyperbole.

The reality of trading is quite different from the sales pitches most people hear. That's because it is hard to be consistently profitable and most traders lose money in the early stages of their experience.

What is not hard, however, is actually opening a brokerage account. Choosing a brokerage is more meaningful if a beginner has actually tried out several different forex demo accounts.

Typical requirements to get started

The first thing you'll do is set up an account with a forex broker. You'll need to provide a good deal of personal information to get your account set up, including the following:

- Name

- Address

- Phone number

- Account currency type

- A password for your trading account

- Date of birth

- Country of citizenship

- Social security number or tax ID

- Employment status

You will also need to answer a few financial questions, such as:

Industry compliance

You might wonder why forex brokers want to know all of this information. The simple answer is to comply with the law. The environment surrounding forex trading has a comparatively low degree of regulation, but in recent years, more regulations have been put in place to provide some degree of protection or assurance to account holders. Additionally, forex brokers need to ask these questions to protect themselves from the risk of loss. They want to make sure customers who overleverage themselves will still be able to pay back any unexpected losses.

It's unlikely that you will find any broker willing to open your trading account without requiring these questions to be answered. If you do happen to find one that isn't asking many questions, you should be suspicious. If you are ever feeling wary about a particular broker, you can look them up through the national futures association to find out their status.

Forex trading and risk

During the final steps of opening your account, you will see risk disclosures. Please take these seriously. Forex is a difficult business for beginners. It tends to eat them for dinner if they aren't careful. There are more losers than winners on average. The broker is required to remind you of the forex risks.

Once you've turned in all of your information to be processed, the broker will verify it and typically ask you to send in some verification documents such as a government-issued ID, and maybe a utility statement to verify your name and address. The back and forth process can slow down the process by a day or two, but it's nothing to concern you.

Once your information is verified, you can fund your account and begin trading. One piece of advice that I like to give to all new traders is not to put any money in the account that you cannot afford to lose.

It seems like obvious advice, but some people start off feeling like they know more than they do, and take unnecessary risks. Start with a fair amount of money and trade small. Nothing can prepare you for the emotions that you feel when your money is truly at risk, so go slow in the beginning.

Forex should be boring

Forex seems very exciting, but in reality, it should be boring and cut and dried. If you feel a great deal of anxiety when making trades, be careful. It's common to either get too wound up from your winning trades or become a destructive trader from your losing trades.

Learning to make trades using research and systematic logic will serve you much more than relying on emotion to guide your trading. Forex should feel like simple, methodical decision-making with precautionary steps in case of failure. While that might sound boring to you, you will survive much longer if you approach that market that way.

Keep your cool

If you find yourself feeling like you are making common forex mistakes and just generally feeling frustrated, stop trading, and review the basics again. Forex trading is one of those industries where occasionally you have to re-evaluate your methods to make sure you are achieving your goals. Try not to get too frustrated and keep your approach scientific and unemotional.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

You will be required to select your preferred forex trading account. There are 3 major types of forex trading accounts-the mini, standard, and managed accounts. Each has its pros and cons. You will need to choose your account type depending on such factors as your tolerance risk, how much time you will have to trade daily, and your size of starting investment, etc.

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

Step-by-step guide on how to open a forex account

You can not open an account directly on the forex market. Your account must be with a forex broker who will act as an intermediary between you and the foreign exchange interbank market.

To open a forex account:

Go to the rating list for forex brokers.

Choose a broker from among the highest-ranking brokers.

Click the "open account" button on the webpage of your selected broker.

Fill in the registration form that opens up.

What is a forex account and why do you need it?

A forex trading account is a clientвђ™s personal account opened on a brokerвђ™s platform. It stores the funds of the trader (you) for all your transactions. The funds deposited in the clientвђ™s trading account are his unconditional property and they remain at his full disposal.

How a trader uses his trading account:

- В—Џ carries out online-trading;

- В—Џ conducts many financial transactions such as: make a deposit; replenish a deposit, apply to withdraw funds;

- В—Џ gets access to the trading platform;

- В—Џ connects to various services for efficient trading;

- В—Џ participates in bonus promotions and programs;

- В—Џ gets free access to training.

Before starting to trade on the forex market, a trader should choose a reliable broker to open an account with. Thereafter, the trader comes up with his main goals and chooses the appropriate type of account.

It is impossible to trade on forex without opening an account, which stores the funds of the trader so he can conduct trading activities.

We recommend opening accounts with brokers through traders union. This allows you to get additional income in the future and have greater protections.

You can choose from among the list of top-ranked brokers.

Types of forex accounts

There are two types of forex trading accounts: demo and real. A demo account is a training account and works exactly like a real one, except that the money you use is virtual (i.E., not real) money.

Real trading accounts are divided into cent (micro), standard or classic, professional, crypto, ECN, and swap-free forex islamic accounts. PAMM and RAMM accounts make up a separate group of accounts that provides the trader with passive investment income.

Demo accounts on forex

A demo account is a free training account with virtual currency that is useful to novice traders. With its help, a novice trader learns to trade on forex in real market conditions and put the acquired theoretical knowledge into practice. The risk of losses is removed when using a demo account since you trade with virtual (and not real) cash.

A demo account allows you to:

- В—Џ get familiar with the trading platform and the features of the forex market;

- В—Џ work out charts, monitor the situation on the market and analyze it;

- В—Џ study and test the available financial instruments;

- В—Џ polish up your technical skills before starting real trading;

A demo account has its pros and cons like any other type of account.

Рџ‘Ќ advantages of demo accounts:

- Вђў almost every broker offers demo accounts;

- Вђў no need to deposit real money;

- Вђў allows you to polish up your trading skills in a comfortable environment and without risks;

- Вђў study the features of the forex market and its tools;

- Вђў develop and test trading strategies;

- Вђў most brokers do not limit your use of their/your demo account;

- Вђў can be opened, closed, or reopened at any time;

- Вђў virtual currency trading eliminates the problem of psychological pressure and stress.

Рџ‘Ћ disadvantages:

- Вђў long-term trading on demo accounts dulls your competitive skills and thwarts your forex learning curve toward achieving successful trades (watching boxers in the ring and being a boxer in the ring are two different experiences);

- Вђў lack of emotional stress makes the trader inattentive to his trading;

- Вђў the trader gets used to the quick and high-quality opening of positions, which is not always possible when trading from a real account.

How to open a demo account?

A demo account can be opened not only on the broker's website but on all trading terminals.

Guide on opening a demo account in metatrader4 and metatrader5 terminals:

- В—Џ register on the brokerвђ™s official website. Include your email, name, phone number, and country of residence.

- В—Џ log onto the system.

- В—Џ download and install the trading platform onto your computer, laptop, or mobile device.

- В—Џ choose the вђњopen demo-accountвђќ option. After confirmation, youвђ™ll see a window with a login and password. Enter your login and password information when requested.

Instructions for opening a demo account (the fxpro broker is used as an example):

Go to the brokerвђ™s website.

Register by providing your email, name, and phone number.

Click on the вђњopen accountвђќ button.

Select вђњdemoвђќ among the list of accounts and simultaneously mark the desired trading terminal in the drop-down list and then click the вђњconfirmвђќ button.

After that, you will be assigned an account number and type, as well as a password. Enter these data when opening the trading platform.

The procedure for opening a demo account is simple and takes no more than 10 minutes.

There is a button opposite each brokerвђ™s name in the forex brokers rating list on traders unionвђ™s website that allows you to open a demo account quickly.

Real forex accounts

A real trading account allows you to trade in the forex market using real money and receive real, not virtual, income. There are a few types of real accounts that differ in trading terms. All such accounts enable the trader to deposit funds for trading, perform trading operations, fill out applications for withdrawing profits, and also connect to various services for effective trading in forex.

Main types of real trading accounts:

- В—Џ cent (micro, mini);

- В—Џ standard, classic;

- В—Џ premium or professional (pro, VIP, gold, and premium).

Cent (micro, mini)

Рџ‘Ќ advantages:

- Вђў minimal investments;

- Вђў optimal sizes for spreads and leverages;

- Вђў training in actual trading conditions on a standard account;

- Вђў testing and evaluation of trading conditions of a particular broker, including analysis of the effectiveness of advisers and robots.

Рџ‘Ћ disadvantages:

- Вђў trading conditions limitations вђ” largely a reduction in transaction time and the assets number;

- Вђў insignificant financial losses can make a trader too relaxed, which does not allow him to fully concentrate on trading.

Standard accounts (standard, classic)

Рџ‘Ќ advantages:

- Вђў most brokers have a constant spread level on these accounts;

- Вђў it is suitable for non-aggressive medium- and long-term trading;

- Вђў allows you to conduct auto trading on a daily, weekly, etc., basis and use trend advisers.

Рџ‘Ћ disadvantages:

- Вђў delays in the execution of orders when there are significant changes in the market;

- Вђў not suitable for scalping and intraday trading.

Professional accounts

Рџ‘Ќ advantages:

- Вђў wide range of financial instruments;

- Вђў there are no limits on the duration of transactions;

- Вђў access to quotes of the best liquidity providers;

- Вђў can apply any strategies, including scalping, news trading, etc.;

- Вђў social trading is available.

Рџ‘Ћ disadvantages:

You can find a broker for any size of deposit in the traders union rating list. For example, the forex4you broker offers its customers a cent type account with a minimum deposit of just $1, while exness provides customers with standard accounts of $10 or more.

How to open an account on a trading platform?

A real account could be opened in the desktop version of the trading platform, as well as in the mobile applications metatrader 4 and metatrader 5. The account must be opened on the broker's website (instructions below) if trading is to be carried out using a web terminal.

To open an account in the MT4 and MT5 terminals:

- В—Џ register on the broker's official website if you have not done so already. Include your name, email, phone number, and country of residence;

- В—Џ install the metatrader 4 and/or metatrader 5 desktop version onto your computer or laptop; or a mobile device application to use on your smartphone and tablet;

- В—Џ select "open accountвђќ in the terminal. After confirming the operation, a window with a login and password will appear in your personal account to authorize you to enter the terminal. A unique identification number is assigned to the userвђ™s trading account and it must be inserted when replenishing your deposit.

How to open an account on a forex brokerвђ™s website?

To open an account on the brokerвђ™s website:

- В—Џ register on the broker's official website by filling out a standard form with personal data: name, email, phone number;

- В—Џ log in to your personal account by inserting your login and password;

- В—Џ select the type of real account from the list and click "open account". After that, the account number will appear in your account, as well as the login and password for MT4 and MT5. Brokers recommend changing your password after the first login to the trading terminal.

Replenish your real account after opening in the currency specified in the corresponding window. When replenishing (in the payment purpose), you need to specify the number of the trading account.

Now you are ready to start trading on forex. Congratulations.

Pрђрњрњ account for investments on forex

PAMM accounts are a type of trust management account that allows an investor to earn passive income. Even novice traders without any experience of independent trading can invest using the PAMM system.

The key point of the PAMM program is that one or more investors entrust their assets to a professional trader-manager. He carries out transactions from his account while using both his own funds and his investorвђ™s funds. All investors share profits and losses in proportion to the amount invested. The manager gets a commission for successful transactions, the amount of which shall be agreed in advance and specified in the cooperation agreement.

How to choose a pрђрњрњ account

The key to success is to choose the right manager and PAMM broker. These are important criteria to evaluate brokers and their PAMM accounts:

How long in operation.

Choose pamms that have been opened for more than six months because accounts with a shorter operating period will not allow you to readily assess the profitability margins because their PAMM system has not yet obtained sufficient information and market statistics.

Profit margins.

A PAMM accountвђ™s stability over the entire operation period matters more than its high indicators. An income of 100-400% indicates that the manager uses highly risky strategies leading to a quick deposit outflow;

Average drawdown.

There are no managers trading without losses. You should choose accounts whose drawdown levels do not exceed 40%;

Amount of the managerвђ™s equity capital.

A trader who has invested big money will trade reasonably and as smoothly as possible.

Take the choice of a PAMM account seriously because the probability of achieving profits depends on it

How to invest in PAMM

Simply deposit money into a PAMM account and start receiving passive income. To do that:

- В—Џ choose a reliable broker from the PAMM brokers rating list and register on its website;

- В—Џ open a real-money trading account;

- В—Џ deposit an amount of money that you can afford AND that you can afford to lose;

- В—Џ study the ratings of managers on the broker's website to choose a professional trader with profitable transactions;

- В—Џ click the вђњinvestвђќ button and indicate the amount of investment after choosing a manager in the rating.

The investor (you) can withdraw funds from the PAMM account at any time. Therefore submit the appropriate application, indicating the amount required. In this case, it is up to the investor (you): to withdraw all the money, part of it or only the profit. When the money hits the brokerвђ™s account, the broker can invest them in other PAMM accounts or withdraw it in a conveniently accessible way.

Comparison of training (demo) and real accounts

A demo or so-called training account is the best option to start on forex. Novice traders can test advisers, indicators, and their own trading strategies on a demo account.

| Account type | the need to invest real money | ability to make trading transactions | real trading income | payments from traders union (rebate) |

|---|---|---|---|---|

| demo | no | yes | no | no |

| real | yes | yes | yes | yes |

Demo accounts have a lot of advantages but they all have one significant disadvantage. You are trading with virtual (imaginary) currency so it does not allow you to earn real money. That is why you should not use it for a long time.

Is it better to start with a demo or real account?

You must open a trading account if you decide to start trading in the forex market. However, before opening it, you must choose a reliable broker and determine your key goals as a trader, as well as define your financial capabilities.

Novice traders should start with a demo account. With the demo version, you will learn the key principles of forex trading without risking your own funds and become familiar with the interface of your chosen broker.

Start with a cent (micro or mini) account if you have a tight budget. Later you can increase investments step by step. This will protect you from serious financial losses.

We recommend investing in PAMM accounts or copying transactions of successful traders if you prefer to get a passive income rather than conducting your own trading.

Focus on trading conditions вђ” the size of the minimum deposit, leverage, and the spread level вђ” when choosing an account.

The author of this article on opening a forex account

- Mr. John mayer graduated with a masterвђ™s degree in data analytics from one of the top business schools in the UK. For the last ten years, he has worked as an analyst in the foreign exchange market.

- His years of experience in the forex market gives him this opportunity to share what he has learned as a foreign exchange market analyst.

Faqs regarding opening an account on forex

I am a novice on forex. What type of account should I choose?

Choose a reliable broker among the traders union ratings, and then open a demo account with digital funds.

What types of accounts are there on forex?

There are demo and real accounts and cent, standard, and premium real money accounts. Their respective trading conditions differ.

I plan to engage in passive investing. What type of account should I open?

Open a PAMM account with a trusted and reliable broker to get passive income.

How long does it take to open a trading account with a broker?

The whole procedure takes less than 10 minutes. You need to register on the broker's official website and install a trading terminal or open a web platform.

Risk disclosure:

Information on the tradersunion.Com website is for informational purposes only and does not constitute any motive or suggestion to visitors to invest money. Moreover, we hereby warn you that trading on the forex and CFD markets is always a high risk. According to the statistics, 75-89% of customers lose the funds invested and only 11-25% of traders earn a profit.

That is why you should only invest money that you are prepared вђ” or can afford вђ” to lose at such high risks. Tradersunion.Com does not provide any financial services, including investment or financial advisory services. Also, the traders union is not a broker and does not get money for trading in the forex or CFD markets. Our website only provides information on brokers and the markets and helps its users to select the best brokerage company based on detailed information and objective analysis of brokers.

Disclaimer:

Tradersunion.Com assumes no responsibility for the consequences of the clientвђ™s trade decisions or for the possible loss of his capital caused by the use of this site or the information on it. The forex trading, as well as CFD or cryptocurrencies trading, are not for everyone and forex trading is a very risky business. Before investing, please assess your competence to trade in the forex markets and make sure you understand and appreciate all the risks, particularly in terms of leveraged trading. The information on this site is not intended for distribution, dissemination, or use by any person in any country or jurisdiction where such distribution, dissemination, or use would violate domestic legislation or regulation.

Any payments made by tradersunion.Com to the users of our website are only as a bonus for activity on the website, in the form of advertising income deduction; and such payment cannot:

В· be subject to any claim by our users or third parties;

В· obligate tradersunion.Com to act or refrain from any act;

В· expose or subject tradersunion.Com to any legal or other dispute; or

В· be considered as part of the services provided by the brokers.

Disclosure of advertisers and revenues:

How to open A forex account? [fastest and simplest way]

It’s easy to open a forex account and trading. Almost everyone in the world today has access to internet connection. If you are reading this article, you are already online. And if you have visited this blog, you are interested in forex trading. Well, how to open a forex account?

Before you open a forex account, you should find the right broker for you. What kind of trading strategy do you follow? Is long-term trading, short-term trading or scalping? Which pairs do you trade in most, EURUSD, gold, oil, BTC? What is your risk preference? Do you want high leverage or low leverage? The answer to all these questions determines the account type and broker you choose.

For example; if you have not decided on a trading strategy yet and do not want to take risks, you can use a nano account. So you can try yourself with an amount like $ 5. Then, you can look at the percentage of profit you have achieved and measure your success. Also investors who want to try forex robot usually use nano account.

If you want to trade on standard conditions, you can choose the standart account type. However, if you are going to fund higher amounts, you may prefer the ECN account, which offers more advantageous conditions. So you can reduce the spread cost or get market analysis support.

Besides these, there may be muslim investors who do not want to earn or pay interest. These investors also prefer the swap free account option. Many brokers also offer swap free account options.

Each brokers has some advantages and disadvantages. ECN account conditions are very advantageous in a broker while standard account features may be advantageous in another broker. You can read my forex broker reviews to find out which account types and trading instruments are more advantageous for which firm. I tried to write it as simple as possible by making comparisons among brokers. After reviewing these, you can decide which broker you are going to open an account with.

You have done your research and decided which forex broker you are going to open an account with. How to open a forex account? Let’s open an account together.

I will use the XM forex broker for account opening. Because XM forex broker is the most preferred among the visitors of my blog. You can choose another broker. I’m just doing this for the example. Account opening processes will be similar to each other.

If you click on the above account open button, you will be taken to the account opening page. There are two parts here, personal details and account details. Fill in the details section of the personal details such as name, email, phone etc. Then select the platform type and the account type from the account details. If you want to trade cryptcureencies, you need to select MT5. Then click on the “proceed to step 2” button.

Fill in your birth date and address information. The next sections are important. In the account details section, select your account’s base currency, leverage, and bonus preferences.

The next part is to measure your trading knowledge and experience. The answers here may affect the limitations of your account’s leverage. Try to give the right answers as possible. This part is often found in forex brokers regulated by the FCA. If you are residing outside the UK or europe, you may not encounter this section.

After you have filled in these sections, enter your account’s password in next section. Then check the following confirmation boxes and click the “open A real account” button.

Then you will receive a mail as you see above. You need to confirm your account within 24 hours. Click on the red button you see and your account will be confirmed. Then you will get an login page as follows. You can log in by entering your account number and your password.

If you encounter a problem in this process, you can ask me in the comment below. Or you can contact the customer support of your broker.

How to open a forex trading account

The forex market is as old as the advent of currencies and has grown to become the largest financial market in the world. But, surprisingly, trading in the currency market hasn’t been very accessible to the general public for most of its history.

However, this has changed ever since the arrival of the internet and retail forex brokerages have popped up to facilitate trading. Nowadays, opening a forex trading account is no more different than opening a bank account. However, before one starts trading, it is important to be aware of some information that can ensure that your trading experience remains secure and successful.

Find the right broker

Finding the right broker in the market is perhaps the all-important first step that you are going to take. Since currency trading is decentralized and not-so-well regulated, it is highly recommended that traders research the broker’s reputation thoroughly before taking the plunge.

This can easily be done by verifying a broker’s history with the national regulatory agencies. Furthermore, it is also advisable to know about the services that a broker offers. Some may provide basic brokerages while others may provide sophisticated trading platforms and resources for analysis that assist in well-informed trading decisions.

You should also look to compare any fees or commissions that brokers may be charging for their services. When ascertaining the profitability of trading, these extra costs can become quite important for the trader.

Information required for account creation

Once you have decided upon a broker, you will be required to provide a variety of personal information to set up your trading account.

These may include the following:

- Name

- Country of citizenship

- Date of birth

- Address

- Phone number

- Currency type for account

- Tax ID or social security number

- Employment status

Along with these, you may also be required to answer a few financial questions.

- Trading experience

- Annual income

- Trading objectives

- Net worth

Choose the account type

When you’re all set to open an account, you will have to decide exactly which trading account type you want. You can choose either a personal account or a corporate (or business) account. One had to choose amongst ‘standard,’ ‘mini,’ and ‘micro’ accounts in the past.

But, since traders allow one to trade custom lots, this isn’t a problem anymore and is great news for those beginners who have only a small capital amount. It also keeps things flexible for traders as they won’t be necessitated to trade any more than they are comfortable with. Plus, you must always remember to read the fine print of your agreement.

Many application forms will have the option of a ‘managed account,’ which is good if you want the broker to trade for you. But, if you’re not looking to give the reins to someone else, you should be wary of this. Besides, a managed account demands big capital, somewhere north of $25,000. On top of that, the managing person may also take a cut out of your profits.

Industry compliance

One might be driven to wonder why brokers require so much information to open a trading account. The reason is that they have to abide by the law and be industry compliant. Ever since forex went retail, it has some regulations, which have been put in place to keep traders from harm and offer some protection.

As such, you won’t find many brokers ready to open an account without warranting all this information. If, however, you come across a broker that doesn’t require such information, be wary of them.

Registration

There might be some paperwork that you are required to submit to successfully open your account and the forms that you provided will vary depending on your broker. Soft copies of the same will be provided to you, which you can view and print at your pleasure.

Furthermore, be aware of the affiliated costs that you might have to pay, such as charges for bank transfer applied by your bank. Some banks actually may cost a lot, which might take a big bite out of your trading capital and may surprise you later.

Activate the account

As soon as the broker receives all the required paperwork, you should be greeted with an email providing the necessary instructions for activating your account. Once you have gone through the steps, a final email will be sent to you providing everything from username and password to detailed instructions that will assist you in funding your account.

Now, you can log in and begin trading. However, if you are just starting out, you would be better off trying your hand on demos. This will help you get the hang of the trading strategies and get familiar with simulated market conditions before you risk your account capital on live trading.

Summary

The procedure of opening and setting up a forex trading account isn’t too dissimilar from opening any other type of financial account. You will be required to do your research beforehand to ensure that your broker is reputable, provide the relevant information necessary for the process, choose an account type depending on your goals, register, and finally activate your trading account.

Once you have begun, you should be able to trade round the clock at your pleasure. It is highly advised that you read all the conditions in the documents provided by your broker carefully and are aware of any terms and conditions that might be associated with your trading account activity.

Though trading on a live account shouldn’t be your first experience with trading, as long as you approach trading with a scientific and stoical mindset. Use proper risk management, remain vigilant, and you should be well on your way to a successful forex trading career.

How to open a metatrader 5 account

Interested in learning how to set up a metatrader 5 account? This article will explain in detail everything you need to know about how to get started. Moreover, this article will also discuss how to create a demo account for metatrader 5 (MT5) and other useful tips to help you get started, such as adding and withdrawing funds.

Trading with metatrader 5

To answer the question of how to open a trading account on metatrader 5, we need to look at six steps that are part of involved in the process.

- Choose a metatrader 5 broker

- Download the trading platform

- Creating a trading account

- Log in to metatrader 5

- Installing metatrader 5 supreme edition.

- Adding funds to your live account

Let's look at these six stages individually, to provide us with a more detailed understanding of how to open a trading account on metatrader 5.

1) choose a metatrader 5 broker

The first step in opening a metatrader 5 trading account, is to choose a forex broker which offers the metatrader 5 trading platform. Choosing a good broker can be a daunting task due to the amount of choice there is out there. Be sure to do your research carefully and, if in doubt, read our guide on ' how to find the best CFD & forex brokers ' which will help guide you through this process.

At admiral markets, we offer the ability to trade using both the metatrader 4 and 5 trading platforms.

2) download the trading platform

Whether you are considering opening a live account for metatrader 5, or a demo trading account, you will need to download the software.

If you are using windows, head over to the metatrader 5 download page , fill in your details and begin your download! For mac users, read our article ' how to install metatrader 5 for mac ' in order to learn how to proceed. The specific steps , which will depend on which mac OS you have installed.

Once you have downloaded the installation file, open it to begin the installation process. To log in, you will need to have either a live or demo trading account, both of which we will explain how to open later on.

3) create your metatrader 5 account

Once you have the metatrader platform on your device, you will need to open an account with your chosen metatrader 5 broker.

For new traders, we it is recommend youed to practice on a demo account before making the transition to a live metatrader 5 account. The process for opening a demo trading account does not differ greatly from that of opening a live account with admiral markets, however, below we will walk you through both processes.

Opening a demo account

A forex demo account enables you to trade forex in metatrader 5 with virtual funds, allowing you to practice different trading strategies without risking your own capital. You can practice trading on a wide range of products, all with real market prices.

To create a new demo account for metatrader 5, simply visit the demo account page on our website and complete the form. Once you have done this, you will receive an email with your trading account details, which you can then use to log in to MT5.

Opening a live account

If you are ready to trade on the live markets, you can open a live metatrader 5 account with admiral markets. To do this, you must firstly log in to the trader's room with your registered email address and password (if you have a demo account, this is the same email you used in that sign up process). If you do not already have a trader's room account, you will need to create one .

Once logged in to your trader's room, just follow these steps:

- Click the 'open live account' button.

- Add and verify your phone number.

- Add your details over the following pages. These details will include contact information, tax identification details and your passport number.

- Read and accept the confirmation notice.

- Verify your identity by uploading the requested documents.

From here, admiral markets will review your application, after which we will contact you by email with the results of your application. If your application is successful you will receive your account details by email, these will include:

- An account ID

- A main password

- An investor password

- Account server

- Account type

- Account balance

- Leverage available

You can see the full process for opening a live account in the video below.

4) log in to metatrader 5

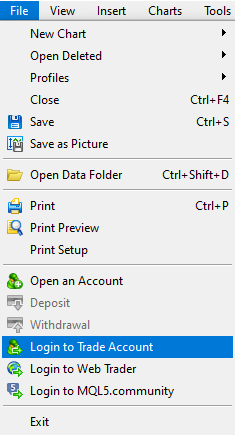

Once you have your trading account set up, open metatrader 5. Once opened, click 'file' at the top of the screen and select 'login to trade account', as shown in the image below.

Source: admiral markets metatrader 5 - file - login to trade account

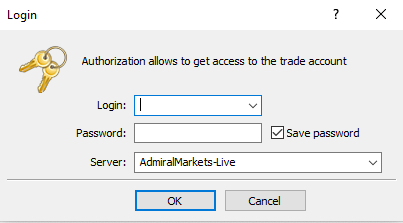

A dialogue box will then appear on your screen prompting you to login. You need to ensure that the 'server' field matches the server details provided by your metatrader 5 broker. You can overtype in this field if needs be. Enter your account ID in the 'login' field and complete the 'password' field with your main password.

Source: admiral markets metatrader 5 - login

5) metatrader 5 supreme edition plugin

Once you have opened your account, you will have access to a core bundle of indicators. If you would like to expand that selection, there are a vast number of custom indicators that you can purchase from the MT5 marketplace .

Alternatively, you can add a number of cutting-edge indicators and other trading tools free of charge, by downloading the admiral markets metatrader supreme edition plugin (MTSE). MTSE is a custom plugin developed by market professionals that expands the choice of indicators and expert advisors (eas) available on the MT5 platform.

6) add funds to your account

To add funds to a live metatrader 5 account, you will need to log in to the trader's room dashboard using the same email address and password you used to sign up for your trading account. Once you've logged in, follow these steps:

- Scroll down to the account where you would like to deposit funds, and click 'deposit'.

- Choose your preferred payment method and follow the prompts to deposit funds.

Depending on your payment method, funds may take up to three business days to clear. Once they have cleared, your account balance will appear in your trader's room dashboard next to your live account details.

Note that you can also withdraw funds from the trader's room. Both the deposits and withdrawals processes are outlined in the video below.

Final thoughts

We hope you have found this article on how to create a new account in metatrader useful. Of course, opening an account for metatrader 5 really is just the first step on your journey as a successful trader. If you would like to learn more about the technical tools you'll find in the trading platform itself, you might want to read our list of the ' most important forex indicators '.

Trade on metatrader 5 with admiral markets

Admiral markets offers the ability to trade with metatrader 5 in your browser, or to download the entire platform for FREE! Gain access to real-time market data, technical analysis, insight from professional trading experts, and thousands of trading instruments to trade and invest with. Start your trading journey the right way, click the banner below to get started!

About admiral markets

Admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today !

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks .

TOP ARTICLES

Metatrader 4

Forex & CFD trading platform

Iphone app

Metatrader 4 for your iphone

Metatrader 5

The next-gen. Trading platform

MT4 for OS X

Metatrader 4 for your mac

Android app

MT4 for your android device

MT webtrader

About us

Start trading

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

Products

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

Platforms

Analytics

Education

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Partnership

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Please enable cookies in your browser

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our privacy policy.

Top 10 unlimited forex demo account for 2021

Top rated:

When you decide to begin in the world of forex, demo trading accounts are an important first step that you may decide to take when trying to choose from some of the best forex brokers around.

Starting out with a demo trading account is not just for beginners though, this is something you can use as an experienced trader to get to know more about almost any broker, how they operate, and the trading platforms that they offer.

Throughout this article, we will explain what are the forex brokers where you can get the best demo account with NO time limitation and how you can get the most out of your demo trading account with all of the top forex trading brokers in the industry.

Table of contents

What’s a demo account?

If you are not already aware, demo trading accounts are offered by almost all of the top forex brokers. This is a risk free way in which you can learn more about every broker as a forex trader or if you are involved in CFD trading.

These accounts are offered on a trial basis typically with an amount of virtual money that you can risk. This prevents you from possibly losing your own money while you get to know the trading platform of each broker in more detail. These demo trading account trial periods may be limited in terms of the duration you can use them, or they may also be unlimited. This decision is up to the particular forex broker.

As well as risk free trading in which you cannot lose your money, it is also a chance to find out more about the regulation of online trading under each authority and within the cfd trading or forex broker. This can be helpful in knowing what kind of leverage is available as well as other things such as how account types and funding methods work.

Within this top 10 demo trading account piece, we have collected a range of top brokers who offer demo trading accounts which do not expire, and who also provide access to a large selection of account types for you to choose from as well as trading platforms like the well-known MT4.

This, along with dealing in a range of assets and CFD trading in the likes of cryptocurrency and even copy trading demo accounts, can really help you to better understand the industry as a forex trader and the direction you would like to take.

Top10 unlimited forex demo accounts

The following are 10 of the best brokers offering exceptional unlimited demo trading accounts that we have reviewed and feel would be the best choice in your search for a well authorized and regulated broker.

1. XTB

Looking at XTB, the broker offers both standard and pro accounts for you to choose from as a trader. Both of these account types do come with a demo trading account also available. This demo trading account unlike some others, does not expire. With that said, it may be closed if you have not trading in a 30 day period.

Often, you go to as a trader is currency trading and the ability to trade in one top currency pair or another. In this respect, the XTB broker offers a choice of more than 45 forex pairs across both of these XTB account types.

The XTB spreads are also highly competitive starting from just 0.1pips on some major pairs. If you are more into CFD trading, then you can also sample this within the XTB demo trading account at no risk to your real money whatsoever.

There are more than 100 cfds to choose from in various categories such as indices, commodities, futures, etfs, and a selection of 25 cryptocurrencies to choose from. An XTB broker review will show that they apply a 0.08% fixed commission to every trade and then a possible $3.50 per lot traded commission which depends on the account type you select.

When it comes to trading platforms you can try out and that are available as part of your demo trading account, XTB offers MT4 and xstation. Finally, in terms of fees, the broker does offer some rollover-free accounts although not in every country so you should check with their support team particularly if you are a islamic forex trader.

With XTB you also have the chance to further your development by taking advantage of a strong educational infrastructure through videos, tutorials, webinars, and more to help you grow as a top forex trader.

Steps to open an offshore forex account

Massive growth in the global foreign currency exchange (forex) markets has attracted the interest of traders and investors alike. With a plethora of currencies available and trade volumes running into the trillions of dollars, forex markets provide a convenient way to take advantage of inherent leverage and volatility and to make handsome returns. Many traders have started opening offshore forex accounts in foreign jurisdictions because of favorable tax treatments in these locations and to overcome overly restrictive regulations in their own country (like the foreign account tax compliance act or FATCA in the united states).

Let us look at how a US-based investor can open an offshore forex account:

Key takeaways

- U.S. Citizens seeking to trade forex markets often open brokerage accounts overseas due to more favorable tax treatment and more generous leverage and access to more products.

- While this is legal, traders that choose this option must make sure they disclose their activity to the IRS and are in compliance with U.S. Regulations such as FACTA.

- You will likely need to provide information and documents to the new broker to prove your identity.

- As with any new broker account, do your research to make sure your brokerage is regulated, trustworthy, and low-cost.

Steps to open an offshore forex account

Pick a forex broker

The first step towards opening an offshore forex account is selecting a broker. There are numerous sites which rate the best international forex brokers such as forex brokers review. Some things to keep in mind while selecting a broker include fees and commissions, the minimum balance required to operate and fund the account, capabilities of customer service staff, etc. It is important to ensure that the broker meets all requirements and standards set by commodity futures trading commission (CFTC) and national futures association (NFA) and complies with the local offshore laws. This will help avoid running into regulatory issues later on.

Opening and operating the forex account

The documentation involved in opening an offshore forex account is relatively straightforward these days, with minor variations per the regulations of the offshore country. Most brokerages will make their first-time customers fill out a terms and conditions agreement and a customer trading form.

A notarized passport copy and other forms of identification (e.G. Bank statements, credit card statements, utility bills, etc.) confirming the address of the applicant are generally required. Some brokers provide the flexibility of operating the forex account with a minimum amount of as little as $100.

Alternatives for forex investing

For investors with a sizeable amount to invest ($100,000), opening an offshore international business corporation (IBC) or an offshore trust might be a more profitable option. An IBC is one of the most flexible and safe methods for offshore forex investing. Establishing an IBC is a little costly upfront (

$1,500), but it frees the investor from onerous reporting requirements and the costs can be recouped early through tax savings. It also allows an investor to trade forex any way he or she wishes.

Disclosures and legal compliance

It is of utmost importance to check whether the selected broker and the types of forex trades the investor intends to carry out in the chosen jurisdiction are all in compliance with the legal and regulatory bodies of the home country. For US investors, the treasury’s foreign account tax compliance act (FATCA) governs investing and banking overseas. According to FATCA, foreign financial institutions (ffis) are required to provide information about US citizens invested in offshore accounts outside the US to the internal revenue service (IRS). FATCA-compliant ffis can be viewed here: FATCA ffis.

The bottom line

With the ongoing integration of the global financial markets, opening an offshore forex account is not a daunting task anymore. Retail investors should keep in mind their relative information disadvantage and the inherent volatility in the forex market which may lead to huge losses. If opting for an offshore account, investors should aim to thoroughly understand the legal, tax, and regulatory implications both in their home country and in the offshore location.

Question: how to open a forex account with deriv?

How to open deriv’s FX trading account?

Deriv - what's now?

Note that the website hercules.Finance does not promote or introduce the service of binary options.

Deriv does not provide the service to residents in USA, canada, and hong kong, or to persons below 18.

How to open a forex account of deriv MT5?

To open a FX account of deriv MT5, follow the simple steps below.

- Go to deriv official website

- Click on “signup” or “create free demo account” button

- Enter your email address and “submit”

- Check “inbox” of your email and click on the registration link

- Complete the online registration with deriv

- Receive account information and login credentials

- Login to deriv official website

The account opening is free and may only take a few minutes to complete.

Go to deriv official website and start your online registration today.

Invest in spot forex and cfds on deriv MT5

On deriv MT5, you can invest in forex currency pairs, cryptocurrency, stock indices, commodities (precious metals and oils) and synthetic indices.

There are over 100 financial markets that you can invest in with deriv.

Deriv MT5 adopts “market execution” with STP (straight through processing) model.

With the STP execution, deriv MT5 provides you fair and fast trading environment, where there is no conflict of interest between deriv and its investors.

For more information about deriv MT5’s trading conditions, visit deriv official website.

Deriv

Post tags

Deriv is an online forex and CFD broker with 1:1000 leverage on MT5 platforms. Deriv has been in the financial industry since 1999.

Deriv does not provide the service to residents in USA, canada, and hong kong, or to persons below 18.

Related

Related faqs

Features

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

Deriv MT5 - how to subscribe/copy signals on the platform?

Liteforex MT4 and MT5 now available for macos

Superforex's millisecond execution for scalping trade

Deriv trading guide - deposit and withdrawal methods and conditions

MT5 update - deriv's new trading servers with lower spreads

Vantagefx largely reduces crypto CFD spreads (BTC, BCH, ETH, LTC)

All forex brokers

All crypto-currency exchanges

Latest article

MTN money payment is available for rwanda

Deposit your superforex account with MTN money.

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Traders trust now offers HKD, SGD, CZK, ZAR, RUB, NOK, and PLN currency pairs.

Interviewing the top forex trader who won the hotforex contest

What strategy has this FX trader chosen to win the contest?

What's the most profitable forex currency pairs?

The most profitable currency and metal trades of 2020.

Make a deposit to yadix MT4 with perfect money

Transfer fund from perfect money to yadix MT4, get an extra 5% equity bonus with the coupon code.

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

Direct online bank transfer deposit is available for traders of south africa.

Deriv MT5 - how to subscribe/copy signals on the platform?

Here is a manual of deriv MT5 signals for both subscribers and providers.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

FOREX.Com demo account

Your form is being processed.

The power to conquer the markets

/media/forex/images/global/icons/icon-performance.Svg" alt="trade with precision" />

Trade with precision

/media/forex/images/global/icons/icon-candlesticks.Svg" alt="indicators icon" />

Professional charting

/media/forex/images/global/icons/icon-bulb-actionable-trade-ideas.Svg" alt="integrated news and analysis" />

Actionable insights

/media/forex/images/global/icons/icon-mobile.Svg" alt="mobile solutions" />

Trade on the go

Metatrader 4

- Integrated reuters news and FOREX.Com global market research

- Free EA hosting capabilities

- Web and mobile trading support

*based on active metatrader servers per broker, jan 2018.

The markets are moving. Stop missing out.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

So, let's see, what we have: looking to open a forex trading account? Find out how to do it and get information on the requirements you need to get started. At how to open forex account

Contents of the article

- Actual forex bonuses

- How to open a forex trading account

- What is needed and why

- Typical requirements to get started

- Industry compliance

- Forex trading and risk

- Forex should be boring

- Keep your cool

- Fxdailyreport.Com

- Step-by-step guide on how to open a forex account

- What is a forex account and why do you need it?

- Types of forex accounts

- Demo accounts on forex

- How to open a demo account?

- Real forex accounts

- How to open an account on a trading platform?

- How to open an account on a forex brokerвђ™s...

- Pрђрњрњ account for investments on forex

- Comparison of training (demo) and real accounts

- Is it better to start with a demo or real account?

- The author of this article on opening a forex...

- Faqs regarding opening an account on forex

- I am a novice on forex. What type of account...

- What types of accounts are there on forex?

- I plan to engage in passive investing. What type...

- How long does it take to open a trading account...

- How to open A forex account? [fastest and...

- How to open a forex trading account

- Find the right broker

- Information required for account creation

- Choose the account type

- Industry compliance

- Registration

- Activate the account

- Summary

- How to open a metatrader 5 account

- Trading with metatrader 5

- 1) choose a metatrader 5 broker

- 2) download the trading platform

- 3) create your metatrader 5 account

- 4) log in to metatrader 5

- 5) metatrader 5 supreme edition plugin

- 6) add funds to your account

- Final thoughts

- TOP ARTICLES

- Metatrader 4

- Iphone app

- Metatrader 5

- MT4 for OS X

- Android app

- MT webtrader

- About us

- Start trading

- Products

- Platforms

- Analytics

- Education

- Partnership

- Please enable cookies in your browser

- Top 10 unlimited forex demo account for 2021

- What’s a demo account?

- Top10 unlimited forex demo accounts

- Steps to open an offshore forex account

- Pick a forex broker

- Opening and operating the forex account

- Alternatives for forex investing

- Disclosures and legal compliance

- The bottom line

- Question: how to open a forex account with deriv?

- How to open a forex account of deriv MT5?

- Invest in spot forex and cfds on deriv MT5

- Deriv

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- FOREX.Com demo account

- The power to conquer the markets

- Metatrader 4

- The markets are moving. Stop missing out.

- Try a demo account

- Try a demo account

No comments:

Post a Comment