Tickmill webtrader

Wählen sie eine zahlungsmethode aus und zahlen sie auf ihr handelskonto ein. Kunden müssen mindestens 18 jahre alt sein, um die dienstleistungen von tickmill nutzen zu können.

Actual forex bonuses

MT4 web trader

plattform

Eine denkbar einfache online-plattform, die einen schnellen und einfachen zugang zum markt ermöglicht. Keine zusätzliche software, downloads oder installationen erforderlich.

Warum sollte ich mit dem

MT4 web trader

von tickmill handeln?

Der handel mit der metatrader 4 web trader plattform ist einfacher denn je. Es ist die gleiche MT4-plattform, die sie schon kennen, mit dem unterschied, dass sie direkt von ihrem browser aus zugänglich ist.

Mit nur einem klick öffnet sich ihre metatrader 4 web trader plattform in einem neuen fenster und bietet ihnen sofortigen zugriff auf den handel - überall und jederzeit!

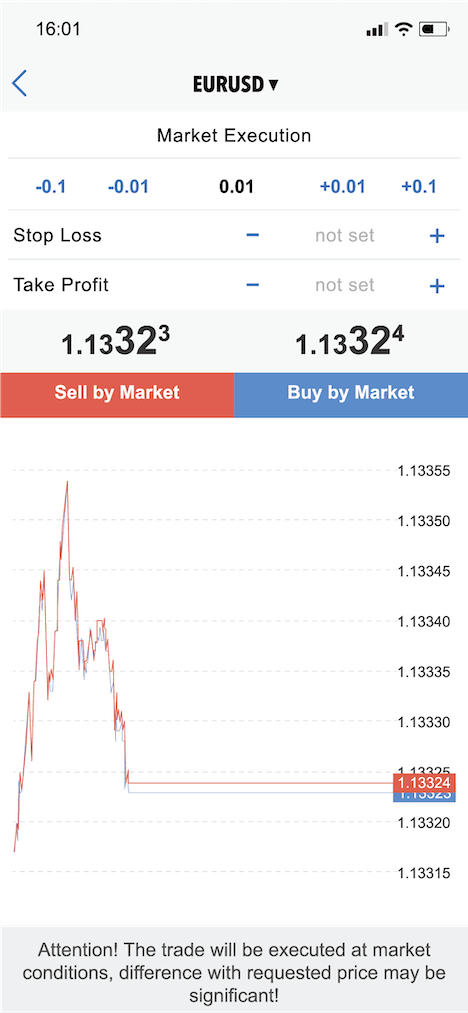

Mit der gleichen funktionalität wie die native anwendung bietet ihnen der web trader von tickmill eine zuverlässige und intuitive benutzeroberfläche, die durch die sichere verschlüsselung aller übertragenen daten erweitert wird. Unsere trader haben zugriff auf die one-click-funktionalität, um trades zu öffnen und zu schließen, ein effektives risikomanagement einzusetzen und auf außergewöhnliche charting-funktionen zuzugreifen.

In kombination mit den verbesserten handelsbedingungen von tickmill können sie eine weltweit anerkannte handelsplattform nutzen, die spreads ab 0 pips und 1,5s ausführung bietet.

Hauptmerkmale des MT4 web trader

echtzeit-kurse dank „market watch“. Anpassbare preisdiagramme. 9 verschiedene zeitrahmen. Direkter zugriff über alle modernen browser. Mehr als 30 indikatoren. Vollständige handelsgeschichte. Sichere verschlüsselte datenübertragung.

Starten sie den web- trader jetzt

Tickmill’s MT4

web trader vorteile

VOLLE MT4-FUNKTIONALITÄT

KEIN DOWNLOAD ERFORDERLICH

VERBESSERTE ZWEI-WEGE-SYNCHRONISATION

HTML-BASIERTE ANWENDUNG

SOFORTIGE SYNCHRONISATION

VOLLSTÄNDIGER ZUGRIFF AUF DIE KONTOBEWEGUNGEN

START TRADING mit MT4

webtrader-plattform

Registrieren

Schließen sie ihre registrierung ab, melden sie sich in ihrem kundenbereich an und laden sie die erforderlichen dokumente hoch.

Ein konto erstellen

Sobald ihre dokumente genehmigt sind, können sie ein live trading-konto erstellen.

Eine einzahlung tätigen

Wählen sie eine zahlungsmethode aus und zahlen sie auf ihr handelskonto ein.

HANDELN

Öffnen sie den MT4 webtrader über ihren browser, melden sie sich an und starten sie den handel!

Handelsinstrumente

Handelsbedingungen

Handelskonten

Plattformen

Weiterbildung

Werkzeuge

Partnerschaften

Über uns

Kundendienst

Tickmill ist der handelsname der tickmill group of companies.

Tickmill.Com gehört und wird innerhalb der tickmill-unternehmensgruppe betrieben. Die tickmill group besteht aus tickmill UK ltd, reguliert von der britischen financial conduct authority (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, reguliert von den cyprus securities and exchange commission (eingetragener sitz: kedron 9, mesa geitonia, 4004 limassol, zypern), tickmill südafrika (PTY) ltd, FSP 49464, reguliert von der financial sector conduct authority (FSCA) (eingetragener sitz: the colosseum, 1. Stock, century way, office 10, century city, 7441 kapstadt), tickmill ltd, reguliert von der financial services authority der seychellen und seiner 100% igen tochtergesellschaft procard global ltd, britische registrierungsnummer 09369927 (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - reguliert von der financial services authority of labuan malaysia (lizenznummer: MB/18/0028 und eingetragener sitz: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T., labuan, malaysia).

Kunden müssen mindestens 18 jahre alt sein, um die dienstleistungen von tickmill nutzen zu können.

Hochrisikohinweis: der handel mit contracts for difference (cfds) auf marge birgt ein hohes risiko und ist möglicherweise nicht für alle anleger geeignet. Bevor sie sich für den handel mit contracts for difference (cfds) entscheiden, sollten sie ihre handelsziele, den erfahrungsstand und die risikobereitschaft sorgfältig prüfen. Sie riskieren ihr investiertes kapital zu verlieren. Daher sollten sie kein geld einzahlen, das sie sich nicht leisten können, zu verlieren. Vergewissern sie sich, dass sie die risiken vollständig verstanden haben, und sorgen sie bei der verwaltung ihres risikos für angemessene vorsicht.

Die website enthält links zu websites, die von dritten kontrolliert oder angeboten werden. Tickmill hat keine überprüfung vorgenommen und lehnt hiermit jegliche haftung für informationen oder materialien ab, die auf einer der mit dieser website verlinkten seiten veröffentlicht wurden. Durch die einrichtung eines links zu einer drittanbieter-website unterstützt oder empfiehlt tickmill keine produkte oder dienstleistungen, die auf dieser website angeboten werden. Die informationen auf dieser website dienen nur zu informationszwecken. Es sollte daher nicht als angebot oder aufforderung an eine person in einer rechtsordnung, in der ein solches angebot oder eine aufforderung nicht zulässig ist, oder an eine person, der ein solches angebot oder eine solche aufforderung unzulässig wäre, oder als empfehlung angesehen werden einen bestimmten währungs- oder edelmetallhandel zu kaufen, zu verkaufen oder anderweitig damit zu handeln. Wenn sie sich nicht sicher sind, ob sie in ihrer lokalen währung handeln und handelsregeln für metalle beachten, sollten sie diese seite sofort verlassen.

Es wird dringend empfohlen, eine unabhängige finanz-, rechts- und steuerberatung einzuholen, bevor sie mit einem devisen- oder spothandel mit metallen beginnen. Nichts auf dieser website sollte als hinweis von tickmill oder einem seiner verbundenen unternehmen, direktoren, leitenden angestellten oder mitarbeitern gelesen oder ausgelegt werden.

Die dienstleistungen von tickmill und die informationen auf dieser website richten sich nicht an bürger / einwohner der vereinigten staaten von amerika und sind nicht zur verteilung an oder nutzung durch eine person in einem land oder einer rechtsordnung bestimmt, in der eine solche verteilung oder verwendung entgegenstehen würde nach lokalen gesetzen oder vorschriften.

MT4 web trader

platform

An online platform that gives quick and easy access to the market. No need for additional software, downloads or installations.

Why trade with tickmill’s

MT4 web trader?

Trading is more accessible than ever with our metatrader 4 web trader platform. It’s the same MT4 platform that you’re used to, but is now available directly in your browser.

In just one click, your metatrader 4 web trader platform will open up in a new window giving you instant access to trading – anywhere, anytime!

With all of the same functionality as the native application, tickmill’s web trader gives you a reliable and intuitive interface, enhanced by securely encrypting any transmitted data. Our traders have access to one-click functionality to open & close trades, employ effective risk management and access exceptional charting capabilities.

In combination with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform directly in your browser, accompanied by spreads from 0 pips and 1.5s execution.

Key features of MT4 webtrader

real-time quotes in the market watch. Customizable price charts. 9 different time frames. Direct access through all modern browser. 30+ indicators. Complete trading history. Securely encrypted data transmission.

Launch web trader now

Tickmill’s MT4

web trader benefits

FULL MT4 FUNCTIONALITY

NO DOWNLOAD NECESSARY

ENHANCED TWO-WAY SYNCHRONISATION

HTML-BASED APPLICATION

INSTANTANEOUS SYNCHRONISATION

FULL ACCOUNT HISTORY ACCESS

START TRADING with MT4

webtrader platform

Register

Complete your registration, login to your client area and upload the required documents.

Create an account

Once your documents are approved, create a live trading account.

Make a deposit

Select a payment method and fund your trading account.

TRADE

Open the MT4 webtrader through your browser, login and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill webtrader

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Platform

metatrader 4 (MT4)

Platform MT4 tickmill sepenuhnya dapat disesuaikan dan dirancang untuk memberikan keunggulan dalam trading anda.

Mengapa trading dengan tickmill

metatrader 4?

Dirancang khusus untuk para trader, platform metatrader 4 kami menyediakan antarmuka yang ramah pengguna dan sangat dapat disesuaikan, disertai dengan alat manajemen order yang canggih membantu anda mengontrol posisi anda dengan cepat dan efisien.

MT4 secara luas diakui sebagai platform trading forex favorit di dunia. Ini menawarkan antarmuka pengguna yang mudah digunakan, fungsi chart yang disempurnakan, indikator dan mendukung bahasa MQL. Jadi, anda dapat dengan mudah memprogram indikator dan expert advisors (EA) untuk memperdagangkan pasar forex 24/5 tanpa intervensi dari pihak anda.

Dikombinasikan dengan kondisi trading tickmill yang ditingkatkan, anda dapat menggunakan platform trading yang diakui secara global disertai dengan spread dari 0 pips dan eksekusi 0,20 detik.

Fitur utama dari MT4

CFD pada forex, indeks saham, komoditas dan obligasi. Eksekusi order anda tanpa pemenuhan order secara parsial, sebagai hasil dari kedalaman likuiditas kami yang sangat besar. Fasilitas trading EA dengan menggunakan layanan VPS kami. Analisis teknikal canggih, 50+ indikator dan chart yang dapat disesuaikan. Dalam 39 bahasa. Signal trading dengan sistem notifikasi canggih.

Panduan pengguna

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

TRADING

Jalankan platform, masukkan nama server tickmill untuk login dan mulai trading!

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, teregulasi oleh financial services authority of seychelles dan anak perusahaannya yang 100% dimiliki procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lantai 3, 27-32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

Tickmill webtrader

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Trader of the month

Longjun showed excellent account and risk management skills in september 2020 and got a $1,000 prize!

Read longjun's interview and see his account statement – to make your own success story

How long have you been trading?

I have been trading more than 30 years.

How did you get involved in forex trading?

I started trading as part of my job which involved currencies.

What is your trading style?

Try to analyze the market situation with calm attitude. But when there is potential investment choice, it is necessry to be radical to get into the trade.

Do you practice risk management?

Yes, risk management is really important. Trader should refrain from opening new positions if the loss is more than planned.

What are some good habits smart traders develop?

Try to keep calm in market fluctuations and analyze the situation logically.

Describe your best/most memorable trade (how much did you profit? What was the strategy? What pair?

The trade involved the GBP/USD pair. One should not be hurry to take the profit when the market trend is really strong. Trader may wait when the trend changes a bit and then close the position. Although it does not get the price at peak point, but then total profit can be maximized.

What advice would you give to new traders?

It is necessary for new trader to have a good understanding of the basic and simple trading logics, so they can analyze the market situation more easily and logically.

Considering the current state of the market, what do you think are the news/events traders should keep an eye on?

Traders should pay attention on every detail, and try to avoid opening big positions.

What are the most important things you look for in a forex broker?

I like tickmill because it has a safe payment environment.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

Our tickmill review found this forex broker has a choice of 2 accounts and 1 forex trading platform with metatrader 4. While they have over 60 currency pairs, the range of markets is limited with 2 metals, 4 bonds, 14 indices but no crypto or shares

| ��️ regulation | UK, europe, south africa, malaysia |

| �� trading fees | low spreads |

| �� trading platforms | MT4 |

| �� minimum deposit | $100 |

| �� deposit/withdrawal fee | $0 |

| ��️ instruments offered | forex, cfds, bonds |

| �� credit card deposit | yes |

Tickmill account types

Tickmill offers you the choice of three account types for trading forex and cfds using a no dealing desk model with ECN style pricing. These include the pro account, the classic account, and the VIP account. Each of these account types will suit a different level of trading experience.

- When trading with tickmill, all accounts include the following features:

- Minimum lot size of 0.01 (micro-lots)

- Available base currencies: USD, EUR, GBP

- Hedging, scalping, arbitrage, expert advisors permitted

- Swap-free islamic account options

Pro account

You can get started with a pro account with a minimum deposit of $100. The pro account offers low spreads from 0.0 pips EURUSD and charges commission fees of $2.00 per side ($4 round-turn) per lot. This account offers the best pricing for retail traders, as it has ECN pricing.

This account is the most popular among traders because of the low commission rate and tight spreads.

Classic account

The classic account is the same as the standard account that many brokers offer. This means you will not pay commission fees. To open a classic account, you will require a minimum deposit of $100. Spreads start from 1.6 pips. The classic account is more suitable for beginner traders with little experience.

VIP account

There is no minimum deposit required for the VIP account, however, you will require a minimum account balance of $50,000 to trade. This makes this trading account more suitable for experienced traders. Spreads start from 0.0 pips, and the commission fees are only $1.00 per side.

Islamic account

Tickmill also offers islamic accounts for traders of the muslim faith. You can select from a pro account, classic account, or VIP account and convert it to an islamic account. Trading conditions remain the same as with the other trading accounts, along with compliance with the sharia law.

Our rating

The overall rating is based on review by our experts

Spreads

Tickmill offers competitive spreads across a range of 62 currency pairs, stock indices, oil, metals, and bonds. The classic account offers slightly higher average spreads on the range of currency pairs. Typical spread data from the pro account and VIP account shows an offering of 0.10 pips on the EUR/USD pair.

Commission spreads

The following table compares the average spreads across a range of commission-based account types, including the pro account and VIP account from tickmill.

Data taken from broker website. Accurate as at 05/01/2021

Non-commission spreads

The following table displays average spreads from non-commission accounts with the classic account from tickmill and others.

Leverage

What is leverage?

Price movements in the forex market can be small. Leverage is a tool that allows you to access borrowed equity to trade with higher without investing an exorbitant amount of using your own funds. For example, trading with 1:100 leverage will allow you to trade up to $100,000 with only $1,000 in your account. Remember that this invokes a high risk as price movements can turn unfavourably in certain trading environments.

What determines leverage?

The maximum leverage that a CFD broker can offer depends on what the regulator of the country you are trading from will permit. Tickmill uses the following regulators: FCA, cysec for clients in the UK and europe, FSCA for clients in south africa, LFSA for malaysia clients and FSA for clients in other regions.

Retail investor accounts (for clients in the UK and europe):

- Up to 1:30 on forex in the UK and europe

- Up to 1:20 on stocks indices and oil

- Up to 1:20 on metals

- Up to 1:5 on bonds

FCA and cysec regulations are tighter than most regulators in other countries require. However, if you are in the UK or europe, you may be eligible for a professional account which will allow you to access leverage in line with tickmill clients in other regions.

Professional investor accounts (UK and europe clients) and retail investors accounts (outside the UK and europe):

- Up to 1:500 on forex

- Up to 1:100 on stocks indices and oil

- Up to 1:500 on metals

- Up to 1:100 on bonds

Trading platforms

Tickmill only allows you to trade using the most popular trading platform: metatrader 4. Despite the minimal selection of trading platforms, metatrader 4 is the most commonly used system and provides a range of features to help you trade the financial markets.

Metatrader 4

Metatrader 4 is the first and most popular trading platform developed by metaquotes software. Metatrader 4 is user-friendly, customisable, and designed to let you trade with ease on desktop or mobile trading (including ios and android). This platform is the favourite among many forex traders around the world because of its sophisticated level of trading analysis tools, customisable interface, charting functionality, and access to expert advisors through the accompanied metatrader marketplace.

Along with the advanced trading conditions from tickmill, you can enjoy many features from using the metatrader 4 trading platform:

- Fast order execution on a range of cfds including forex, stock indices, commodities, and bonds

- Expert advisor trading facilities and advanced trading signals (run on tickmill VPS) suitable for scalping

- Provision of fundamental and technical analysis tools including over 50 indicators and customisable charting

Metatrader 4 webtrader

The metatrader 4 webtrader platform allows you to access the markets online directly through your web browser. The webtrader trading platform through tickmill makes trading more accessible as the metatrader system is available directly in your browser. Equipped with all the same functions as the original, the webtrader version has enhanced security with data encryption. However, the trade execution time is a little more lagged.

The metatrader 4 webtrader trading platform offers:

- Access to one-click trading through all modern browsers

- Real-time quotes on customisable price charts

- Over 30 indicators to use across 9 different time frames

- Trading history and encrypted data transmission

Other platform

Myfxbook copy trading

If you prefer to copy the trades of other successful traders, then myfxbook is available within your metatrader 4 trading account.

Myfxbook works by providing you with tools to find and follow other traders in their social network. You can then use filters which will allow you to replicate their trades within the conditions you set. Social trading is popular for those that don’t have the experience or time to invest in trading themselves, instead, you can leave the work to other traders.

Third-party tools

Tickmill clients can access third-party technical analysis tool autochartist. This is one of the most comprehensive forex trading tools that can add some value to your trading. Authochartist uses advanced technology to analyze past market trends and identify real-time trading opportunities across a wide selection of CFD instruments.

Some of the best tools included in the autochartist market analysis pack include:

- Automated trade alerts

- Volatility analysis for SL and TP optimization

- Fibonacci patterns

- Market reports delivered 3 times per day

- Historical performance statistics

- The key support and resistance levels

- Customizable searches to only get the data you need

Autochartist is offered free of charge to all tickmill live account holders. This tool is offered as an MT4 plugin as well as a standalone web application.

Financial products

A range of trading instruments including forex, stocks indices and oil, precious metals, and bonds are available.

Tickmill does lack some diversity in the cfds on offer. For example, you cannot trade popular cfds such as cryptocurrencies, stocks, etfs or soft commodities (such as crops and livestock) through tickmill. This can limit your ability to spread your risk through investment diversity.

Forex

The forex market is the most popular financial market because of its volatile price movements and 24/5 availability for trading. When trading forex, you are simultaneously buying and selling currencies for profit. Tickmill offers you access to over 60 currency pairs, allowing you to trade popular currencies such as USD, EUR, and GBP. Spreads start from 0.0 pips, and the average trade execution speed is 0.20 seconds.

At tickmill, trading minor and exotic forex pairs is also available with no requotes and ultra-fast execution speed of 20ms.

Stock indices and oil

Stock indices allow you to track a group of stocks to buy and sell them as an aggregate, rather than picking single stocks. Where stocks show the performance of a company, stock indices are useful to determine the economic health of sectors, industries, or countries. Tickmill offers 14 stock indices with no commission fees.

Trading WTI oil serves a similar purpose. Variations of oil are available to trade as an amassed average across sectors. Speculating on the price of oil enables you to trade on highs or lows, as you would any other asset.

Trading oil serves a similar purpose. Variations of oil are available to trade as an amassed average across sectors. Speculating on the price of oil enables you to trade on highs or lows, as you would any other asset.

Precious metals

Gold and silver metal commodities against the USD are available through tickmill. These trading instruments are relatively uniform across the world and are typically safer assets during periods of market uncertainty. With the metatrader 4 trading platform, you can trade gold and silver from 0.0 pips spreads, no commissions, and an average trade execution speed of 0.20 seconds. Much like the forex market, you can trade precious metals 24/5.

The tickmill range of precious metals is small. Other popular metals such as copper, palladium, platinum are not available.

Bonds

Tickmill offers 4 types of government bonds (also known as treasury cfds) which are agreements between borrowers and lenders that you can trade over the counter. These bonds are futures (cash) contracts. Tickmill provides access to german bonds from 0.0 pips spread and no commissions.

Customer service

Hours of support

Tickmill provides extensive trading services and customer support with the head office in london, united kingdom. You can contact the CFD broker through the client support number or office number during 7:00 to 16:00 GMT monday to friday. Tickmill also provides a support email with a response time within 24 hours on business days. A livechat is also available through their website tickmill.Com, one can choose from 14 different languages.

Education and research

Tickmill provides a range of educational resources to help you improve your trading experience with tickmill. Some of these tools are available for download and some require registration. These tools can help you improve your trading strategies.

- Ebooks – topics include introduction to fibonacci analysis, know your trading costs, risk management, trading forex

- Videos – forex trading, market analysis, trading psychology, trading strategies, social trading, stocks, MT4

- Webinars – hosted by forex experts, these webinars are in a range of languages including english, german, polish, portuguese, turkish

- Seminars – these seem to have stopped at least for 2020 but are allow you to hear from forex experts online

- Infographics – these are visual graphics that visualise data, charts and statistics on trading topics

Minimum deposit – funding

Tickmill has a zero fees policy for deposits and withdrawals. This means there are no costs from the brokers’ end for using when transferring funds. If your wire transfer and your deposit are greater than $5000, tickmill will refund any fees up to $100 with if you can provide a bank statement.

To open an account with tickmill, you will require a minimum deposit of $100. To access a VIP account, your balance will need to be $50,000 to open your position. Tickmill accepts 4 different deposit currencies EUR, GBP, USD and PLN. Deposits made in unsupported currencies will be converted incurring a conversion fee to the previously mentioned currencies.

Tickmill offers a range of deposit and withdrawal methods, and there is a minimum withdrawal requirement of $25. Fund transfer will be instant or up to 1 working day:

- Bank transfer

- Visa and mastercard

- Skrill

- Neteller

- Dotpay

- Paysafecard

- Sofort

- Rapid transfer

- Paypal

- Unionpay

- Fasapay

- Qiwi

Tickmill doesn’t have any official inactivity fees however tickmill may apply charges if they believe you are not actively using your account.

Regulation and risk management

Global regulation

Tickmill has regulation in several countries including:

- Tickmill UK ltd: financial conduct authority (FCA) for the UK (register number 717270)

- Tickmill ltd: seychelles financial services authority (FSA) for seychelles (licence number SD008)

- Tickmill europe ltd: cyprus securities and exchange commission (cysec) for cyprus (licence number 278/15)

- Tickmill asia ltd: labuan financial services authority (LFSA) for labuan (licence number MB/18/0028)

- Tickmill south africa (pty) ltd: financial sector conduct authority (FSCA) for south africa (licence number FSP 49464)

Tickmill asia applies for clients in malaysia, all clients outside tickmill subsidiaries that have FCA, cysec, LFSA and FSCA regulation will have FSA regulation. While tickmill policies for FSA will be in line with other regulators, you need to remember that FSA is an offshore regulator. So if you have any complaints, you may not have the protection you need to settle disputes in case of scams.

If you are australian or from dubai, then you may note that tickmill does not have ASIC or DFSA regulation. We don’t advise using regulators outside your country. So tickmill may not be a suitable broker for your situation.

Risk management features

If an account falls below a zero balance, tickmill will cover the debt by providing negative balance protection. This means that tickmill will cover any losses below a zero balance on your account in the event of trading losses or excessive slippage. The forex broker also uses a risk department to monitor traders’ risk appetite and may notify the client of excessive risk-taking or even reduce the leverage.

Tickmill provides a degree of risk management to improving trading conditions. The range of educational resources and research-based features helps you to improve your trading ability on a demo account before testing your skills with a live account. These tools are a form of risk management as they ensure you understand the nature of trading before getting started.

Furthermore, tickmill allows the maximum leverage depending on the relevant regulatory entity. For retail clients trading forex, leverage is capped at 1:30 whereas professional clients can access leverage up to 1:500. Tickmill also provides a simple and transparent calculation of the required margin for clients to visualize the risk of trades.

Tickmill FAQ

Is tickmill an ECN broker or market marker

Tickmill is an ECN pricing. Tickmill doesn’t advertise themselves as an ECN broker or STP broker but they offer ECN pricing because they connect you with forex liquidity providers without a dealing desk. This is why spreads are low. As there is no dealing desk, tickmill is not a market maker.

If you are looking for other forex brokers with ECN pricing then see our best ECN brokers. All these brokers offer ECN trading execution using the MT4 trading platform.

What trading platforms does tickmill offer?

Tickmill only offers one trading platform. This is metatrader 4 (MT4). Metatrader 4 is the world most popular platform with brokers and traders so is a solid choice for a trading platform.

Some traders may wish to consider metatrader 5 over metatrader 4 as metatrader 5 allows you to deal with exchange-traded cfds and has superior trading features and speed.

Is tickmill good for beginners?

Tickmill can be a good option for beginners as they have a commission-free account (called the classic account), negative balance protection ensures you account balance never goes below zero, metatrader 4 trading platform and a demo account.

If you are looking for other suitable trading platforms for beginners, see out best trading platforms for beginners.

Is tickmill a good choice for australian traders?

You can certainly use tickmill if you are in australia, however, you will be using seychelles financial services authority (FSA) as your regulator. Compareforexbrokers never recommend using an offshore regulator. If you are trading in australia then we suggest our best brokers australia who all have regulation with the australia securities investments commissions (ASIC).

Overall

With a choice of a classic account which is commission-free and ECN pricing accounts all which allow hedging, scalping and eas, tickmill is a suitable forex broker for traders of all levels of experience. The $2 commission per lot to open your position is some of the best in the market. However, tickmill has a few weaknesses. The broker only offers the metatrader 4 trading platform, which many consider the gold standard for trading platforms however it would be nice to have another trading platform to choose from. Tickmill also limits the range of cfds you can choose from. Overall, tickmill is one of the better brokers, but pepperstone exceeds the broker in most areas.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

5 key facts about tickmill

- Minimum deposit

- $100 - Forex platforms

- metatrader 4 - Trading fees

- low commissions - Regulated by

- cysec

- FCA

- FSCA

- LFSA - Trading account

- classic

- pro - Tradable instruments

- forex

- cfds

- bond CFD

visit tickmill >>

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

Tickmill webtrader

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

So, let's see, what we have: optimieren sie ihren handel mit dem MT4 web trader von tickmill, spreads ab 0,0 bis 1,5s ausführung | erweiterterte funktion für techn. Analyse- und charting. At tickmill webtrader

Contents of the article

- Actual forex bonuses

- MT4 web trader plattform

- Warum sollte ich mit dem MT4 web...

- Hauptmerkmale des MT4 web trader

- Tickmill’s MT4 web trader...

- VOLLE MT4-FUNKTIONALITÄT

- KEIN DOWNLOAD ERFORDERLICH

- VERBESSERTE ZWEI-WEGE-SYNCHRONISATION

- HTML-BASIERTE ANWENDUNG

- SOFORTIGE SYNCHRONISATION

- VOLLSTÄNDIGER ZUGRIFF AUF DIE KONTOBEWEGUNGEN

- START TRADING mit MT4

- Registrieren

- Ein konto erstellen

- Eine einzahlung tätigen

- HANDELN

- Handelsinstrumente

- Handelsbedingungen

- Handelskonten

- Plattformen

- Weiterbildung

- Werkzeuge

- Partnerschaften

- Über uns

- Kundendienst

- MT4 web trader platform

- Why trade with tickmill’s MT4 web...

- Key features of MT4 webtrader

- Tickmill’s MT4 web trader...

- FULL MT4 FUNCTIONALITY

- NO DOWNLOAD NECESSARY

- ENHANCED TWO-WAY SYNCHRONISATION

- HTML-BASED APPLICATION

- INSTANTANEOUS SYNCHRONISATION

- FULL ACCOUNT HISTORY ACCESS

- START TRADING with MT4

- Register

- Create an account

- Make a deposit

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill webtrader

- Platform metatrader 4 (MT4)

- Mengapa trading dengan tickmill ...

- Fitur utama dari MT4

- Panduan pengguna

- MULAI TRADING dengan tickmill

- Mudah dan cepat untuk bergabung!

- REGISTER

- BUAT AKUN

- BUAT DEPOSIT

- TRADING

- INSTRUMEN TRADING

- KONDISI TRADING

- AKUN TRADING

- PLATFORM

- EDUKASI

- KEMITRAAN

- PROMO

- TENTANG KAMI

- SUPPORT

- Mudah dan cepat untuk bergabung!

- Tickmill webtrader

- Trader of the month

- Longjun showed excellent account and risk...

- Read longjun's interview and see his account...

- How long have you been trading?

- How did you get involved in forex trading?

- What is your trading style?

- Do you practice risk management?

- What are some good habits smart traders develop?

- Describe your best/most memorable trade (how much...

- What advice would you give to new traders?

- Considering the current state of the market, what...

- What are the most important things you look for...

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Read longjun's interview and see his account...

- Tickmill review

- Tickmill account types

- Pro account

- Classic account

- VIP account

- Islamic account

- Spreads

- Leverage

- Trading platforms

- Financial products

- Forex

- Customer service

- Minimum deposit – funding

- Regulation and risk management

- Global regulation

- Risk management features

- Tickmill FAQ

- Is tickmill an ECN broker or market marker

- What trading platforms does tickmill offer?

- Is tickmill good for beginners?

- Is tickmill a good choice for australian traders?

- Overall

- Tickmill webtrader

- A comprehensive tickmill review – is this broker...

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

No comments:

Post a Comment