Free live account in forex

Contracts for difference (cfds) are not available to US residents. For traders who are seeking ultra-tight spreads with fixed commissions.

Actual forex bonuses

Open an account

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Related faqs

How do I open a joint or corporate account?

What are the differences between a demo and live account?

How does FOREX.Com make money?

Try a demo account

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Leverage your growth

With zero commission and ultra-low spreads, the road to success has never been simpler.

Explore the worldвђ™s financial markets with competitively low spreads and no commission on six asset classes.

FX MAJORS

| AUD/USD | loading | loading | loading |

| EUR/USD | loading | loading | loading |

| GBP/USD | loading | loading | loading |

| USD/JPY | loading | loading | loading |

CRYPTOS

| BTC/USD | loading | loading | loading |

| ETH/USD | loading | loading | loading |

| LTC/USD | loading | loading | loading |

| XRP/USD | loading | loading | loading |

We empower traders by simplifying the withdrawal process. Weвђ™ve eliminated excess waiting periods and unnecessary steps, and our team processes all withdrawal requests within 24 hours.

Our aim is to help traders grow by providing all the support you need to flourish. We offer over 170 assets to trade on through the metatrader 4 platform, 24/7 support for all clients, as well as informative materials to help you get started.

Since we donвђ™t charge any commission, traders can use their full deposit to trade forex, crypto, stocks, indices and commodities. With 0% commission, we make trading fair and accessible to all.

Free demo and live MT4 accounts

Whether youвђ™re looking to practise trading risk-free, or to open a live trading account to start earning, we offer free demo and live accounts on the renowned metatrader 4 platform. You can even perfect your strategy and acquaint yourself with the platform through a demo account before depositing any funds. Both account types present identical market conditions, helping you get ready to go live!

Benefit from 0% commission, ultra-low spreads and free transactions today

Drop us a line in the form below and one of our support agents will get back to you shortly.

Thank you, we'll email you back to resolve your query shortly.

Contact us via our live chat service, weвђ™re available to answer your questions 24/7!

В© copyright 2020 all rights reserved. Cedar LLC, st. Vincent and the grenadines.

*this website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.**risk warning: trading leveraged products such as forex and cryptos may not be suitable for all investors as they carry a degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary seek independent advice. Read more here

Welcome bonus up to $500

Welcome bonus - a bonus which is equal to 100% of the first deposit, but does not exceed $500. It is credited automatically. The profit can be withdrawn without any limitations, and the bonus itself can be withdrawn after required trading turnover completed.

Welcome bonus advantages

How to get the welcome bonus

Terms and conditions

- To credit a welcome bonus, it is required to open a live account MT4.Directfx, MT4.Classic+, MT5.Directfx or MT5.Classic+. Please note, "cent" accounts are not allowed. Welcome bonus can be credited only to standard account.

- Welcome bonus can be obtained only once with the first deposit of at least $50. For this purpose, check “enroll welcome bonus” option on the replenishment form.

- Bonus amount is equal to 100% of the deposit sum, but can not exceed $500 (or equivalent in the account currency).

- The profit can be withdrawn at any time, but the welcome bonus can be withdrawn only after the required trading turnover is achieved. The required trading turnover can be calculated upon the formula: .

Example:

The trader made a deposit $200 and received welcome bonus $200. Required turnover = 200 * 50,000 = $10,000,000 (which is equivalent to 44 lots of EURUSD in metatrader)

Examples:

BUY 1 lot EURUSD (1 lot = 100,000 EUR) position opened at a price of 1.1257 and closed at 1.1283.

SELL 5 lot USDJPY (1 lot = 100,000 USD) position opened at a price of 109.806 and closed at 109.352.

BUY 3.5 lot GBPUSD (1 lot = 100,000 GBP) position opened at a price of 1.2978 and closed at 1.2985.

Example:

The trader made a deposit $500 and received welcome bonus $500. In case the equity goes down to $500 (value in the credit field), welcome bonus will be automatically cancelled, and all positions will be closed forcibly (stop out).

© 2014-2021, forexchief ltd

Risk warning: trading with complex financial instruments such as stocks, futures, currency pairs, contracts for difference (CFD), indexes, options, and other derivative financial instruments involves a high level of risk and is not suitable for all categories of investors. You must realize that there is a probability of partial or complete loss of your initial investments and you should not invest facilities that you can't afford to lose. Until you begin to carry out trading transactions, make sure that you fully realize the risks associated with this type of activity.

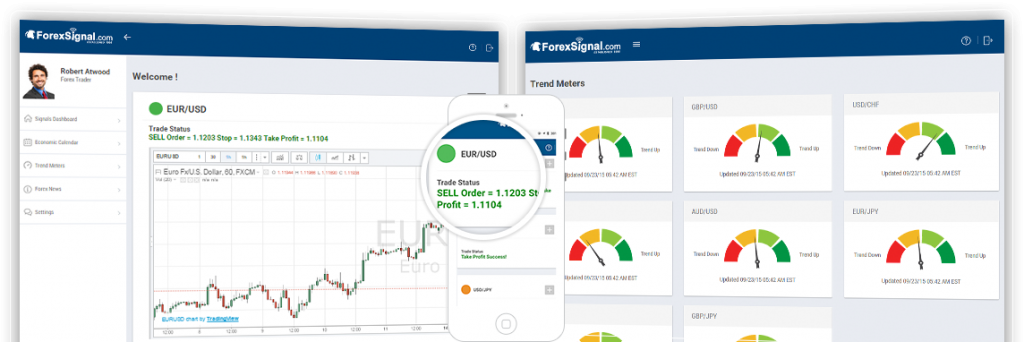

We monitor the forex (FX) market 24 hours a day and identify BUY and SELL trade opportunities.

Trading signals and market analysis performed for these currency pairs: EUR / USD USD / CHF GBP / JPY AUD / USD USD / CAD EUR / JPY GBP / USD USD / JPY

When we identify a trade opportunity, you’ll be alerted to follow our entry point, stop loss and take profit targets.

Follow us on the road, at home or wherever you are. Access our forex signal platform on your phone, tablet or computer.

Receive text alerts (SMS) when it is time to trade or necessary to make adjustments to an active trade.

Try us for a month, if you’re not satisfied you can easily cancel.

FOREX OFFER NOW AVAILABLE

FOREXSIGNAL SUBSCRIPTION

SMS +email alerts includes buy / sell entry point, stop loss and take profit.

Why trade with forexsignal.Com?

- We monitor the forex (FX) market 24 hours a day and identify BUY and SELL trade opportunities.

- Trading signals and market analysis performed for these currency pairs: EURUSD, USDCHF, GBPUSD, USDJPY, AUDUSD, USDCAD, EURJPY

- When we identify a trade opportunity, you’ll be alerted to your email and phone with a forex signal.

- All signals include entry point, stop loss and take profit targets.

- Access our forex signal platform on your phone, tablet or computer.

*disclaimer: any and all opinions, commentary, news, research, analyses, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice nor a solicitation and there are no guarantees associated with them. We are not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. We have taken reasonable measures to ensure the accuracy of the information on the website. The content on this website is subject to change at any time without notice.

Foreign exchange market (FX, forex) is very speculative in nature, involves considerable risk and is not appropriate for all investors. Therefore, before deciding to participate in off-exchange foreign exchange trading/forex, you should carefully consider your investment objectives, level of experience and risk appetite. Investors should only use risk or surplus capital when trading forex because there is always the risk of substantial loss. Most importantly, do not invest money you cannot afford to lose. Any mention of past performance is not indicative of future results. Account access, trade executions and system response may be adversely affected by market conditions, quote delays, system performance and other factors.

Commodity futures trading commission: futures, options and foreign currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the forex/futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to buy/sell forex/futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. CURRENCY TRADING INVOLVES HIGH RISK AND YOU CAN LOSE A LOT OF MONEY.

Free live account in forex

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the trading course, you are guaranteed a placement in the FTMO proprietary trading firm where you can remotely manage funded account of up to 100,000 USD. Your journey to get there might be challenging, but our educational applications, account analysis and performance psychologist are here to guide you on the endeavour to financial independence.

Evaluation process

FTMO challenge

Verification

FTMO trader

Know your trading objectives

Before we allow you to trade for our proprietary trading firm, we need to be sure that you can manage risk. For this reason, we developed trading objectives. By meeting the trading objectives, you prove that you are a disciplined and experienced trader. Your trading style is entirely up to you; we don’t set any limits on instruments or position size you trade.

| Step 1 FTMO challenge | step 2 verification | step 3 FTMO trader | |

|---|---|---|---|

| trading period | 30 days | 60 days | indefinite |

| the FTMO challenge duration is 30 calendar days; the verification duration is 60 calendar days. |

If you manage to pass the trading objectives sooner, you do not need to wait for the remaining duration days.

A trading day is defined as a day when at least one trade is executed.

If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

Current daily loss = results of closed positions of this day + result of open positions.

For example, in a case of the FTMO challenge with the initial account balance of €40000, the max daily loss limit is €2000. If you happen to lose €1000 in your closed trades, your account must not decline more than €1000 this day. It must also not go -€1000 in your open floating losses. The limit is inclusive of commissions and swaps.

Vice versa, if you profit €2000 in one day, then you can afford to lose €4000, but not more than that. Once again, be reminded that your maximum daily loss counts your open trades as well. For example, if in one day, you have closed trades with a loss of €1000 and then you open a new trade that goes into a floating loss of some -€1200 but ends up positive in the end, unfortunately, it is already too late. In one moment, your daily loss was -€2200 on the equity, which is more than the permitted loss of €2000.

Be careful as the maximum daily loss resets at midnight CE(S)T! Let’s say that one day you had a profit of €600. On the same day, you have an open position with a currently floating loss of €2500. On this day, the maximum daily loss is not violated. The current daily loss is €1900. ( €600 closed profit – €2500 open position). However, if you hold this position with the open loss of €2500 after midnight, the daily loss limit will be violated. This is because your previous day profit doesn’t count to a new day and the open loss of €2500 exceeds the max daily permitted loss of €2000.

The size of the maximum daily loss gives trader enough space for trading and it guarantees a clearly defined daily risk to the investor. Both the trader and investor benefit from this rule as the account value will not drop below the limit. That’s also why maximum daily loss limit includes your possible floating losses.

You can get more insight into why this rule is in place in this article.

10% of the initial account balance gives trader enough space to prove that his/her account is suitable for the investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% (80% in case of aggressive version) of its value under any circumstance.

For example: if you trade challenge with $100,000 account balance, your profit target is $10,000 in the FTMO challenge and then $5,000 in the verification.

Note that we will provide you with a new free challenge every time you meet all the trading objectives (regardless of whether that is challenge or verification) except for the profit target. To receive the new FTMO challenge for free, your account profit must be positive at the end of the duration with all positions being closed.

Fxpro demo trading account

To access the fxpro demo accounts, you need to complete the registration form and provide us with some information, however, you do not need to upload verification document(s) or fund until you are ready to trade live.

A real account will be automatically created upon completion but to activate it, we will need to verify your identity and may need to confirm some additional details with you. In the meantime however, you can immediately open a demo from the ‘accounts’ page in fxpro direct, allowing you to utilise risk-free trading and bringing you one step closer to the start of your trading journey.

- Real-time pricing

- Up to 100k in virtual funds

- Available for all platforms

- 8 base currencies

- Top up via fxpro direct

- 180-day life span

Open a demo account

Opening a demo account through our fxpro mobile app is the perfect option, as after completing the registration, you can immediately start using the demo account, within the very same app!

Alternatively, you can open a demo account from your fxpro direct portal, for any of our platforms and account types. Please click here for a full comparison.

Compliment your demo account trading with our exclusive content & trader tools including:

- Educational material

- Fxpro.News

- Calculators

- Economic calendar

What is demo trading?

A trading demo or simulation essentially allows you to experience the market and platform features, using virtual funds and therefore without risk.

Why open a demo with fxpro?

New to trading? Our free demo forex accounts will allow you to practise and hone in your trading skills risk-free until you feel confident enough to trade live.

You can also make use of it as an experienced trader if you want to test different trading strategies.

Demo faqs

Although demo accounts present real market conditions and prices, please keep in mind that they are simulations and cannot always reasonably reflect all of the market conditions as during highly volatile or illiquid periods (e.G. Market openings, news announcements) they may not behave in the same manner as live accounts.

Margin and leverage settings may vary between your demo and live account and you should not expect any success with the demo account to be replicated in your live trading.

For this reason, it is strongly recommended that demo accounts are viewed solely as a learning tool for inexperienced traders or a place for testing new trading strategies.

Счета для мусульман

IC markets предоставляет исламские счета, на которых исключены свопы** (доступно для счетов raw spread и "стандарт" на платформах MT4, MT5 и ctrader).

Мы стремимся предоставить нашим клиентам лучшие торговые условия. Исламские счета характеризуются хорошей скоростью исполнения и инфраструктурой, что дает трейдеру дополнительные преимущества.

Ежесуточная оплата

На счетах без свопа не начисляются и не взимаются проценты, однако взимается небольшая фиксированная суточная плата за перенос сделки. Суточная плата может варьироваться в зависимости от рыночных условий. Комиссии и спред счета raw spread и стандартного счета также присутствуют и на исламских счетах.

Нажмите сюда для ознакомления с условиями пользования исламским счетом на IC markets.

* В ночь с пятницы на субботу своп взимается в тройном размере.

** IC markets оставляет за собой право запрашивать дополнительные документы, требуемые для открытия счета без свопа.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

Fxdailyreport.Com

The forex market is becoming increasingly popular every day. With over 3.5 trillion dollars traded on a daily basis, the market can be both risky and lucrative. There are many types of live forex trading accounts available in the market. Each of these various accounts come with their own rewards and downsides. Knowing the right trading account is the key to the successful trading experience.

As a beginner, you need to open up an account will a reliable forex trading company. But, how will you know the right account to meet your level of expertise? What is the best trading account suiting your needs? Below is a detailed guide on the different forex trading accounts.

1. Demo account

This is the entry point for all forex traders. This type of trading account is offered nearly by all forex brokers. It gives a trader a virtually equal experience to trade with fewer risks of losing funds. As a trader, you are allowed to test your trading strategy for viability, draw-downs and other performance procedures.

In addition, the demo account allows for an appraisal of the broker company providing the account without the requirement of real funds. A good number of forex trading companies will allow a trader to create a demo account without much commitment. The broker will only require a few personal details to complete the registration process.

- This account enables you to trade with liberty. The absence of actual funds implies you trade without any form of suppression.

- A second chance. In case you lose your trading account, there is a good chance to fix the problem and start trading. The capital risks are simulated and have no actual effect on your income.

- Limits. A demo trading account offers limited funds. In addition, there is a limit on the time you are allowed to trade over the platform. Once it expires, you will have to open up a new one.

- Easy to trade the wrong way. Since it’s a demo account, it’s very easy to mismanage it. Where there is freedom to trade the way you want, chances are you will overdo it.

- Profitable spreads: occasionally this trading account gives impractical spreads that are misleading.

2. Micro forex trading accounts

This type of accounts allows a trader to invest a small amount of capital. You can invest as low as $1-$10 to open up the account.

- Low risks-since you invest low amounts of capital, it becomes easier to control risk factors.

- Minimal profits-with a low investment, you get no benefits from the forex brokers.

3. Mini forex trading accounts

Just like its name suggests, the account is ideal for new traders who want to invest small amounts of money. You can trade with a personal investment ranging as low as$100. A large number of forex brokers provides a 400:1 leverage on this type of trading account. This means you can transact as more as $10000 with fewer risks on personal funds. As a result, a trader is likely to reap big more than their investments. The opposite is also true. You can lose a lot of money more than your personal investments. A trader s also allowed to use leverage with mini trading accounts. With higher leverages, you can easily access a substantial trade size equivalent to the actual funds.

- Fewer funds at risk. Accessibility is the major benefits of using this account. It’s affordable to many traders and allows for leverage meaning you can make good money even on a small investment.

- Low risk. Once you are done with a demo account, the mini trading account is an excellent option to jump into. It comes with low risks as compared to other live accounts.

• limited proceeds: despite its low risks in forex marketing, the gains are relatively low for an ambitious trader.

4. Standard forex trading accounts

This is the most typical type of forex trading account. Its name is attributed to the fact it allows traders to perform standard kind of transactions usually ranging within $10000. With this amount, you dot necessarily have to invest the whole amount. Instead, this forex trading account has a leverage of 100:1. As a trader, you can start with a capital of $1000. Depending on the brokerage firm, there are different requirements to create this type of account.

- Possible for realistic gain. Since you are required to invest big, there is a potential for a genuine gain.

- Extra services from the forex provider. Standard trading accounts generate good amounts of commissions. As a result, the brokerage firm offers more services as a way of maintaining their clients. For instance, a trader is allowed to access expert FX services, free deposit, bonuses among others.

- Possibility of a huge loss. The same way it’s easy to make huge proceeds, you can also incur huge losses. It’s a two-way traffic kind of trading. The combination of huge capital and leverage makes it ideal for expert traders only. It takes time before you know how to trade well.

- Larger capital investment: the minimal amount of capital required to invest in this type of account ranges from $1000. Only wealthy traders can afford a standard trading account.

5. Managed forex trading accounts

This is an automated type of trading account where a forex broker executes trades on behalf of the account holder. The role of the trader is limited to providing capital requirements only. The trader will contribute all the capital required but the management of the account lies with an expert forex company. Your work is to lay down the goals of trading while the account manager tries to achieve the goals. There are various ways of trading with managed trading accounts starting with social platforms all the way to in-house trader services.

- Potential for success- this account is ideal for both experts and beginners. Even with little knowledge in forex trading, having somebody trade on behalf means the good possibility to make money.

- Freedom: forex trading is complex and time-consuming. Having an expert trade for you means you can focus on other things far from the screen.

- The cost of liberty- you must pay a certain fee for somebody else to manage your trading account.

- Possible to lose. You are trading on someone else’s trust. This means you can incur losses out of a robot or human error.

6. VIP trading accounts

Also known as the premium, this type of trading account is ideal for the high rollers. Only traders who can raise a minimum of $10000 can open a VIP account.

- Lots of bonuses- traders enjoy up to 100% bonus on their deposits

- Additional services- VIP traders get access to other services such as travel benefits, debit cards, technical analyses among other benefits.

- Only loaded traders can afford to open this type of forex trading account.

- Potential for the big losses-the same way you can make big proceeds, you are also likely to lose.

Fxdailyreport.Com

The forex market is becoming increasingly popular every day. With over 3.5 trillion dollars traded on a daily basis, the market can be both risky and lucrative. There are many types of live forex trading accounts available in the market. Each of these various accounts come with their own rewards and downsides. Knowing the right trading account is the key to the successful trading experience.

As a beginner, you need to open up an account will a reliable forex trading company. But, how will you know the right account to meet your level of expertise? What is the best trading account suiting your needs? Below is a detailed guide on the different forex trading accounts.

1. Demo account

This is the entry point for all forex traders. This type of trading account is offered nearly by all forex brokers. It gives a trader a virtually equal experience to trade with fewer risks of losing funds. As a trader, you are allowed to test your trading strategy for viability, draw-downs and other performance procedures.

In addition, the demo account allows for an appraisal of the broker company providing the account without the requirement of real funds. A good number of forex trading companies will allow a trader to create a demo account without much commitment. The broker will only require a few personal details to complete the registration process.

- This account enables you to trade with liberty. The absence of actual funds implies you trade without any form of suppression.

- A second chance. In case you lose your trading account, there is a good chance to fix the problem and start trading. The capital risks are simulated and have no actual effect on your income.

- Limits. A demo trading account offers limited funds. In addition, there is a limit on the time you are allowed to trade over the platform. Once it expires, you will have to open up a new one.

- Easy to trade the wrong way. Since it’s a demo account, it’s very easy to mismanage it. Where there is freedom to trade the way you want, chances are you will overdo it.

- Profitable spreads: occasionally this trading account gives impractical spreads that are misleading.

2. Micro forex trading accounts

This type of accounts allows a trader to invest a small amount of capital. You can invest as low as $1-$10 to open up the account.

- Low risks-since you invest low amounts of capital, it becomes easier to control risk factors.

- Minimal profits-with a low investment, you get no benefits from the forex brokers.

3. Mini forex trading accounts

Just like its name suggests, the account is ideal for new traders who want to invest small amounts of money. You can trade with a personal investment ranging as low as$100. A large number of forex brokers provides a 400:1 leverage on this type of trading account. This means you can transact as more as $10000 with fewer risks on personal funds. As a result, a trader is likely to reap big more than their investments. The opposite is also true. You can lose a lot of money more than your personal investments. A trader s also allowed to use leverage with mini trading accounts. With higher leverages, you can easily access a substantial trade size equivalent to the actual funds.

- Fewer funds at risk. Accessibility is the major benefits of using this account. It’s affordable to many traders and allows for leverage meaning you can make good money even on a small investment.

- Low risk. Once you are done with a demo account, the mini trading account is an excellent option to jump into. It comes with low risks as compared to other live accounts.

• limited proceeds: despite its low risks in forex marketing, the gains are relatively low for an ambitious trader.

4. Standard forex trading accounts

This is the most typical type of forex trading account. Its name is attributed to the fact it allows traders to perform standard kind of transactions usually ranging within $10000. With this amount, you dot necessarily have to invest the whole amount. Instead, this forex trading account has a leverage of 100:1. As a trader, you can start with a capital of $1000. Depending on the brokerage firm, there are different requirements to create this type of account.

- Possible for realistic gain. Since you are required to invest big, there is a potential for a genuine gain.

- Extra services from the forex provider. Standard trading accounts generate good amounts of commissions. As a result, the brokerage firm offers more services as a way of maintaining their clients. For instance, a trader is allowed to access expert FX services, free deposit, bonuses among others.

- Possibility of a huge loss. The same way it’s easy to make huge proceeds, you can also incur huge losses. It’s a two-way traffic kind of trading. The combination of huge capital and leverage makes it ideal for expert traders only. It takes time before you know how to trade well.

- Larger capital investment: the minimal amount of capital required to invest in this type of account ranges from $1000. Only wealthy traders can afford a standard trading account.

5. Managed forex trading accounts

This is an automated type of trading account where a forex broker executes trades on behalf of the account holder. The role of the trader is limited to providing capital requirements only. The trader will contribute all the capital required but the management of the account lies with an expert forex company. Your work is to lay down the goals of trading while the account manager tries to achieve the goals. There are various ways of trading with managed trading accounts starting with social platforms all the way to in-house trader services.

- Potential for success- this account is ideal for both experts and beginners. Even with little knowledge in forex trading, having somebody trade on behalf means the good possibility to make money.

- Freedom: forex trading is complex and time-consuming. Having an expert trade for you means you can focus on other things far from the screen.

- The cost of liberty- you must pay a certain fee for somebody else to manage your trading account.

- Possible to lose. You are trading on someone else’s trust. This means you can incur losses out of a robot or human error.

6. VIP trading accounts

Also known as the premium, this type of trading account is ideal for the high rollers. Only traders who can raise a minimum of $10000 can open a VIP account.

- Lots of bonuses- traders enjoy up to 100% bonus on their deposits

- Additional services- VIP traders get access to other services such as travel benefits, debit cards, technical analyses among other benefits.

- Only loaded traders can afford to open this type of forex trading account.

- Potential for the big losses-the same way you can make big proceeds, you are also likely to lose.

So, let's see, what we have: open a forex trading account with FOREX.Com. At free live account in forex

Contents of the article

- Actual forex bonuses

- Open an account

- Active trader program

- Related faqs

- How do I open a joint or corporate account?

- What are the differences between a demo and live...

- How does FOREX.Com make money?

- Try a demo account

- Try a demo account

- Leverage your growth

- With zero commission and ultra-low...

- Welcome bonus up to $500

- Welcome bonus advantages

- How to get the welcome bonus

- Terms and conditions

- We monitor the forex (FX) market 24 hours...

- When we identify a trade opportunity, you’ll be...

- Receive text alerts (SMS) when it is time...

- FOREX OFFER NOW AVAILABLE

- FOREXSIGNAL SUBSCRIPTION

- SMS +email alerts includes buy / sell entry...

- Why trade with forexsignal.Com?

- Free live account in forex

- Fxpro demo trading account

- Open a demo account

- Счета для мусульман

- Ежесуточная оплата

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- Fxdailyreport.Com

- Fxdailyreport.Com

No comments:

Post a Comment