Share cfd

Another notable difference between buying shares vs CFD trading is the costs to open a position.

Actual forex bonuses

For cfds, trades are leveraged, which means you only need to deposit a percentage of the total position size to gain full exposure to the asset. When investing in shares, the full value of the position is paid upfront. When considering CFD trading vs stock or share trading, one of the key differences lies in whether the underlying asset is owned by the trader. With cfds, you do not own the underlier, whereas share trading does involve taking ownership.

CFD trading vs share trading

CFD trading or shares trading both offer excellent opportunities to profit from rising and/or falling prices in the financial markets. If you’re weighing up CFD trading vs share trading, we can help you determine the key differences to make an informed investment decision. We also run through the best brokers for trading cfds or stocks.

Before we look at the CFD trading vs share trading debate, what is CFD investing and share dealing?

What is CFD trading?

CFD (contract for difference) trading involves speculating on the price movement of a financial instrument. Traders can take a position on rising prices (going long) or falling prices (going short). As cfds are a derivative product, you do not take ownership of the underlying asset.

You can trade cfds in numerous global markets, including forex pairs, stock indices, commodities, options and shares. CFD products are also leveraged, which gives you full market exposure without needing to deposit the full value of the trade.

What is share trading?

Share trading, or investing, is a longer-term form of trading, whereby you take ownership of the stock and profit from price movements. Compared to cfds, it’s harder to go short to speculate on falling prices with share trading.

When investing in company shares or exchange traded funds (etfs), traders cannot access leverage, so the full value of the trade must be put down.

CFD trading vs share trading – differences

Ownership

When considering CFD trading vs stock or share trading, one of the key differences lies in whether the underlying asset is owned by the trader. With cfds, you do not own the underlier, whereas share trading does involve taking ownership.

Market access

When choosing between CFD trading vs share trading, you may also want to consider which markets you wish to access. Cfds allow you to trade a variety of instruments, including forex pairs, indices, commodities, options, futures and shares, whereas share trading only gives you access to shares and etfs.

Financing

Another notable difference between buying shares vs CFD trading is the costs to open a position. For cfds, trades are leveraged, which means you only need to deposit a percentage of the total position size to gain full exposure to the asset. When investing in shares, the full value of the position is paid upfront.

Trading hours

When looking at CFD trading vs share trading, cfds come with the benefit of 24-hour investing on many major assets. This is because you get access to a range of global markets, meaning it is possible to trade around the clock. With share trading, however, you can only really trade during the stock exchange’s opening hours.

Fees & charges

Whether you’re trading CFD products or stocks, your positions will be subject to fees. In most CFD markets, pricing is determined by the spread, though CFD shares are often subject to a commission. With share trading, you usually just pay a commission and any conversion fees, if applicable. Overnight funding fees will also apply to cfds but not to share trades.

UK taxes

The CFD trading vs normal shares trading argument can also be characterised by their tax implications. In the UK, cfds are exempt from stamp duty because there is no ownership involved. Note that any profits from cfds are still subject to capital gains tax. With share trading, both stamp duty and capital gains tax are payable.

Find out more about UK trading and investing taxes.

Trading platforms

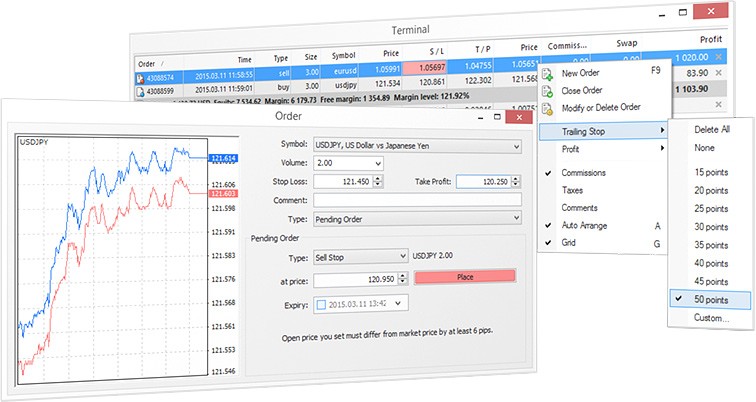

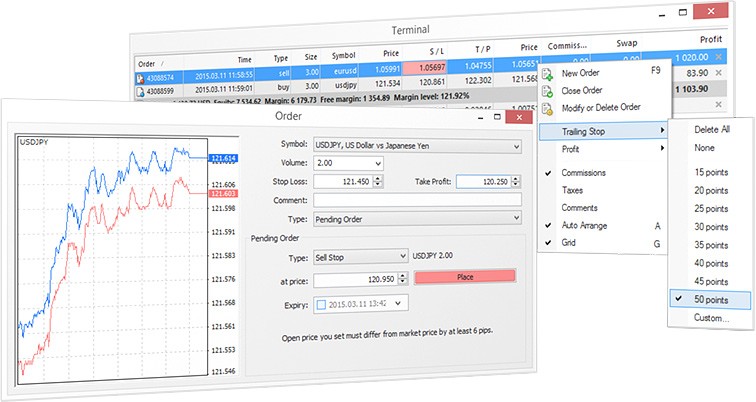

Fortunately, when considering CFD trading vs share trading, both are usually available on desktop and mobile trading applications. Most brokers offer popular platforms such as the metatrader suite, or their own proprietary software. Traders should take advantage of any demo accounts offered to test out the features.

Other considerations

Other key characteristics in the CFD trading vs share trading debate are:

- Expiries – there are generally no expiry dates when trading a CFD or share, however, assets such as CFD futures and options do have expiries. These are usually on a monthly basis, but make sure to check with your broker for details.

- Shareholder privileges – whilst no shareholder privileges are available when trading cfds, you can benefit from dividends and in some cases, voting rights, when investing in shares and etfs.

- CFD trading vs share trading strategies – the timeframe in which you wish to trade may also determine your decision with trading shares vs cfds. Cfds are usually best for short-term, intra-day and medium-term strategies, whereas share trading is ideal for long-term buy and hold investments.

Best UK brokers for CFD trading

There is a good selection of CFD brokers available in the UK, offering award-winning features such as competitive spreads or top-notch research tools. The best option for you will depend on your preferences and experience level. Etoro, for example, offers both CFD vs stock trading and is a great broker for beginners.

Best UK brokers for stock trading

If you’re stock trading, you’ll want to consider a broker that offers a wide range of shares and etfs. Traders using IG, for example, have thousands of CFD vs shares instruments to choose from, as well as other attractive features such as extended trading hours for shares.

CFD trading vs share trading – which one is right for me?

When it comes to CFD trading vs share trading, it’s important the weigh up the various benefits and risks and how they apply to you. Cfds give you access to a wider range of markets than share trading. But whilst leveraged cfds can be profitable, they can also lead to substantial losses. As a result, less experienced traders may want to consider trading shares to start with, as they don’t involve as much leverage risk and are less complicated. In any case, make sure to test out the broker’s platforms and practice your strategies in a demo account first.

What is the difference between CFD trading vs real stock trading?

Cfds involve speculating on price movements either way and are derivative products, meaning you do not own the underlying asset. Cfds are also leveraged, which means you can gain exposure to the market by putting down just a fraction of the full trade. Stock trading on the other hand, allows you to take ownership of the asset, whereby you profit from upward price movements. Stock trading is not leveraged, so you must put down the whole trade value.

Buying cfds vs buying stocks: what are the differences with fees?

Generally, cfds and share trades are subject to spreads and commissions, respectively. If you take CFD shares vs actual shares, however, both are usually subject to commissions. There are also overnight financing fees on cfds and conversion fees on shares, if applicable.

How do I open A CFD or investing account?

To open an account, you will need to complete the online application process at your chosen broker. You may be asked to verify your identity before setting up your account login credentials. When looking at a CFD vs investing account, its worth comparing the broker’s fees and funding methods to see which best suit your requirements.

Should I trade cfds or shares?

The decision to either trade cfds or stocks will depend on your risk appetite and other trading requirements. Cfds can be great for more seasoned traders who understand, and have experience with, leveraged trading. Share trading is less risky and works well for beginners, though you won’t get access to a wide range of markets.

Are CFD and share trading safe?

Both forms of trading are generally safe, but traders should consider a regulated broker who will provide a good level of fund safety and security. New traders should also carry out their own research into the risks of leveraged trading.

An introduction to contract for differences (cfds)

A contract for difference (CFD) is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the current value of an asset and its value at contract time. Cfds allow traders and investors an opportunity to profit from price movement without owning the underlying assets. The value of a CFD contract does not consider the asset's underlying value: only the price change between the trade entry and exit.

This is accomplished through a contract between client and broker and does not utilize any stock, forex, commodity, or futures exchange. Trading cfds offers several major advantages that have increased the instruments' enormous popularity in the past decade.

Key takeaways

- A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes.

- A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset.

- Some advantages of cfds include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short.

- A disadvantage of cfds is the immediate decrease of the investor's initial position, which is reduced by the size of the spread upon entering the CFD.

- Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin.

Contract for differences (CFD)

How cfds work

A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities or derivatives) between the time the contract opens and closes.

It is an advanced trading strategy that is utilized by experienced traders only. There is no delivery of physical goods or securities with cfds. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down.

Essentially, investors can use cfds to make bets about whether or not the price of the underlying asset or security will rise or fall. Traders can bet on either upward or downward movement. If the trader that has purchased a CFD sees the asset's price increase, they will offer their holding for sale. The net difference between the purchase price and the sale price are netted together. The net difference representing the gain from the trades is settled through the investor's brokerage account.

On the other hand, if the trader believes that the asset's value will decline, an opening sell position can be placed. In order to close the position, the trader must purchase an offsetting trade. Then, the net difference of the loss is cash-settled through their account.

Countries where you can trade cfds

CFD contracts are not allowed in the U.S. They are allowed in listed, over-the-counter (OTC) markets in many major trading countries, including the united kingdom, germany, switzerland, singapore, spain, france, south africa, canada, new zealand, hong kong, sweden, norway, italy, thailand, belgium, denmark, and the netherlands.

As for australia, where CFD contracts are currently allowed, the australian securities and investment commission (ASIC) has announced some changes in the issue and distribution of cfds to retail clients. ASIC’s goal is to strengthen consumer protections by reducing CFD leverage available to retail clients and by targeting CFD product features and sales practices that amplify retail clients’ CFD losses. ASIC’s product intervention order will be effective on march 29, 2021.

The U.S. Securities and exchange commission (SEC) has restricted the trading of cfds in the U.S., but non-residents can trade using them.

Fast fact

CFD trading is surging in 2020; the increase in popularity may be because of covid-19-induced volatility in the markets. A key feature of cfds is that they allow you to trade on markets that are heading downwards, in addition to those that are heading up—allowing them to deliver profit even when the market is in turmoil.

The costs of cfds

The costs of trading cfds include a commission (in some cases), a financing cost (in certain situations), and the spread—the difference between the bid price (purchase price) and the offer price at the time you trade.

There is usually no commission for trading forex pairs and commodities. However, brokers typically charge a commission for stocks. For example, the broker CMC markets, a U.K.-based financial services company, charges commissions that start from 10%, or $0.02 cents per share for U.S. And canadian-listed shares. The opening and closing trades constitute two separate trades, and therefore you are charged a commission for each trade.

A financing charge may apply if you take a long position; this is because overnight positions for a product are considered an investment (and the provider has lent the trader money to buy the asset). Traders are usually charged an interest charge on each of the days they hold the position.

For example, suppose that a trader wants to buy cfds for the share price of glaxosmithkline. The trader places a £10,000 trade. The current price of glaxosmithkline is £23.50. The trader expects that the share price will increase to £24.80 per share. The bid-offer spread is 23.48-23.50.

The trader will pay a 0.1% commission on opening the position and another 0.1% when the position is closed. For a long position, the trader will be charged a financing charge overnight (normally the LIBOR interest rate plus 2.5%).

The trader buys 426 contracts at £23.48 per share, so their trading position is £10,002.48. Suppose that the share price of glaxosmithkline increases to £24.80 in 16 days. The initial value of the trade is £10,002.48 but the final value is £10,564.80.

The trader's profit (before charges and commission) is: £10,564.80 – £10,002.48 = £562.32.

Since the commission is 0.1%, upon opening the position the trader pays £10. Suppose that interest charges are 7.5%, which must be paid on each of the 16 days that the trader holds the position. (426 x £23.48 x 0.075/365 = £2.06. Since the position is open for 16 days, the total charge is 16 x £2.06 = £32.89.)

When the position is closed, the trader must pay another 0.01% commission fee of £10.

The trader's net profit is equal to profits minus charges: 526.32 (profit) – 10 (commission) – 32.89 (interest) – 10 (commission)= £473.43 (net profit).

Advantages of cfds

Higher leverage

Cfds provide higher leverage than traditional trading. standard leverage in the CFD market is subject to regulation. It once was as low as a 2% maintenance margin (50:1 leverage), but is now limited in a range of 3% (30:1 leverage) and could go up to 50% (2:1 leverage). Lower margin requirements mean less capital outlay for the trader and greater potential returns. However, increased leverage can also magnify a trader's losses.

Global market access from one platform

Many CFD brokers offer products in all the world's major markets, allowing around-the-clock access. Investors can trade cfds on a wide range of worldwide markets.

No shorting rules or borrowing stock

Certain markets have rules that prohibit shorting, require the trader to borrow the instrument before selling short, or have different margin requirements for short and long positions. CFD instruments can be shorted at any time without borrowing costs because the trader doesn't own the underlying asset.

Professional execution with no fees

CFD brokers offer many of the same order types as traditional brokers including stops, limits, and contingent orders, such as "one cancels the other" and "if done." some brokers offering guaranteed stops will charge a fee for the service or recoup costs in another way.

Brokers make money when the trader pays the spread. Occasionally, they charge commissions or fees. To buy, a trader must pay the ask price, and to sell/short, the trader must pay the bid price. This spread may be small or large depending on the volatility of the underlying asset; fixed spreads are often available.

No day trading requirements

Certain markets require minimum amounts of capital to day trade or place limits on the number of day trades that can be made within certain accounts. The CFD market is not bound by these restrictions, and all account holders can day trade if they wish. Accounts can often be opened for as little as $1,000, although $2,000 and $5,000 are common minimum deposit requirements.

Variety of trading opportunities

Brokers currently offer stock, index, treasury, currency, sector, and commodity cfds. This enables speculators interested in diverse financial vehicles to trade cfds as an alternative to exchanges.

Disadvantages of cfds

Traders pay the spread

While cfds offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. The spread also decreases winning trades by a small amount compared to the underlying security and will increase losses by a small amount. So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, cfds trim traders' profits through spread costs.

Weak industry regulation

The CFD industry is not highly regulated. A CFD broker's credibility is based on reputation, longevity, and financial position rather than government standing or liquidity. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account.

Risks

CFD trading is fast-moving and requires close monitoring. As a result, traders should be aware of the significant risks when trading cfds. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset.

Leverage risks expose you to greater potential profits but also greater potential losses. While stop-loss limits are available from many CFD providers, they can't guarantee you won't suffer losses, especially if there's a market closure or a sharp price movement. Execution risks also may occur due to lags in trades.

Because the industry is not regulated and there are significant risks involved, cfds are banned in the U.S. By the securities and exchange commission (SEC).

Example of a CFD trade

Suppose that a stock has an ask price of $25.26 and the trader buys 100 shares. The cost of the transaction is $2,526 (plus any commission and fees). This trade requires at least $1,263 in free cash at a traditional broker in a 50% margin account, while a CFD broker requires just a 5% margin, or $126.30.

A CFD trade will show a loss equal to the size of the spread at the time of the transaction. If the spread is $0.05 cents, the stock needs to gain $0.05 cents for the position to hit the break-even price. While you'll see a $0.05 gain if you owned the stock outright, you would have also paid a commission and incurred a larger capital outlay.

If the stock rallies to a bid price of $25.76 in a traditional broker account, it can be sold for a $50 gain or $50 / $1,263 = 3.95% profit. However, when the national exchange reaches this price, the CFD bid price may only be $25.74. The CFD profit will be lower because the trader must exit at the bid price and the spread is larger than on the regular market.

In this example, the CFD trader earns an estimated $48 or $48 / $126.30 = 38% return on investment. The CFD broker may also require the trader to buy at a higher initial price, $25.28 for example. Even so, the $46 to $48 earned on the CFD trade denotes a net profit, while the $50 profit from owning the stock outright doesn't include commissions or other fees. Thus, the CFD trader ends up with more money in their pocket.

Cfds faqs

What are cfds?

Contracts for differences (cfds) are contracts between investors and financial institutions in which investors take a position on the future value of an asset. The difference between the open and closing trade prices are cash-settled. There is no physical delivery of goods or securities; a client and the broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed.

How do cfds work?

A contract for difference (CFD) allows traders to speculate on the future market movements of an underlying asset, without actually owning or taking physical delivery of the underlying asset. Cfds are available for a range of underlying assets, such as shares, commodities, and foreign exchange. A CFD involves two trades. The first trade creates the open position, which is later closed out through a reverse trade with the CFD provider at a different price.

If the first trade is a buy or long position, the second trade (which closes the open position) is a sell. If the opening trade was a sell or short position, the closing trade is a buy.

The net profit of the trader is the price difference between the opening trade and the closing-out trade (less any commission or interest).

Why are cfds illegal in the U.S.?

Part of the reason that cfds are illegal in the U.S. Is that they are an over-the-counter (OTC) product, which means that they don't pass through regulated exchanges. Using leverage also allows for the possibility of larger losses and is a concern for regulators.

The commodity futures trading commission (CFTC) and the securities and exchange commission (SEC) prohibit residents and citizens of the U.S. From opening CFD accounts on domestic or foreign platforms.

Is trading cfds safe?

Trading cfds can be risky, and the potential advantages of them can sometimes overshadow the associated counterparty risk, market risk, client money risk, and liquidity risk. CFD trading can also be considered risky as a result of other factors, including poor industry regulation, potential lack of liquidity, and the need to maintain an adequate margin due to leveraged losses.

Can you make money with cfds?

Yes, of course, it is possible to make money trading cfds. However, trading cfds is a risky strategy relative to other forms of trading. Most successful CFD traders are veteran traders with a wealth of experience and tactical acumen.

The bottom line

Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees. However, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. Indeed, the european securities and markets authority (ESMA) has placed restrictions on cfds to protect retail investors.

Share CFD trading

Zero markets offer a wide range of share cfds on our MT4 & MT5 platforms. Trade up to 54 international shares across your favourite companies like apple, google, amazon and netflix across 4 international exchanges.

What are the advantages of trading share cfds with ZERO markets?

4 international exchanges

MT4 & MT5 platforms on desktop and mobile

Trade 24 hours a day, 5 days a week

Is share trading different to share CFD trading?

What is share CFD trading?

Do you know the difference between trading shares and trading share cfds? The key difference is ownership. When trading share cfds you are speculating on a price without actually owning the asset. Shares, on the other hand, require you to purchase the stock and take ownership of the asset.

The advantage of trading cfds is it allows you to leverage the product because you only need to purchase a fraction of the full trade, commonly known as ‘the margin’. The upside of this is it could potentially increase your profits while the downside it could on also amplify your losses.

How does share trading work?

Shares at ZERO markets are offered as cfds. These are an over-the-counter (OTC) derivative transaction that gains profits from price changes without actually owning the shares. You choose a share and make a decision on its price based on whether you think the price will rise or fall. It is a contract for difference (CFD) to potentially gain profits using the price changes of basic assets.

Leverage is available while trading stocks and you can freely make short or long buying contracts. We offer 54 share cfds through our MT4 platform, accessible via desktop and mobile devices.

Metatrader 4 (MT4) & metatrader 5 (MT5)

What are the most recommended platforms for share trading?

MT4 & MT5 are the platforms offered for our share CFD traders. Zero markets’ MT4 & MT5 are packed with extras to ensure you’re equipped with all the tools you need to make better informed trading decisions. Tight raw pricing, fast execution and superior charts are the building blocks for our MT4 & MT5 solutions.

Start trading with ZERO on spreads from 0.0 pips

Share trading example

The gross profit on your trade is calculated as follows:

Closing price at $250 × 1 contract = $250 gross profit on trade $250 – $200 = $50

Closing price at $150 × 1 contract = $150 gross loss on trade $150 – $200 = -$50

Opening the position

The price of apple share is $200 and you decide to buy 1 contract. The total value was 200 USD.

Closing the position

Two weeks later, if the price of apple share is $250 and you decide to take your profit by selling 1 contract apple share, the total value is $250 and the gross profit is $50; if the price of apple share has fallen to $150 and the total value is $150 the trade loses $50.

Available share cfds on MT4

| seccode | exchange | description | mgn% | short |

| SHELL | london | SHELL | 5% | YES |

| BP | london | BP | 5% | YES |

| GSK | london | GSK | 5% | YES |

| HSBC | london | HSBC | 5% | YES |

| RIO | london | RIO | 5% | YES |

| STDCHART | london | STDCHART | 5% | YES |

| RBS | london | RBS | 5% | YES |

| LLOYDS | london | LLOYDS | 5% | YES |

| VODAPHONE | london | VODAPHONE | 5% | YES |

| NVIDIA | NASDAQ GS | NVIDIA | 10% | YES |

| PEPSI | NASDAQ GS | PEPSI | 10% | YES |

| CISCO | NASDAQ GS | CISCO | 5% | YES |

| STARBUCKS | NASDAQ GS | STARBUCKS | 5% | YES |

| INTEL | NASDAQ GS | INTEL | 5% | YES |

| APPLE | NASDAQ GS | APPLE | 5% | YES |

| MICROSOFT | NASDAQ GS | MICROSOFT | 5% | YES |

| COMCAST | NASDAQ GS | COMCAST | 5% | YES |

| ADOBE | NASDAQ GS | ADOBE | 5% | YES |

| NETFLIX | NASDAQ GS | NETFLIX | 10% | YES |

| NASDAQ GS | 10% | YES | ||

| NASDAQ GS | 5% | YES | ||

| AMAZON | NASDAQ GS | AMAZON | 5% | YES |

| EXXON | new york | EXXON | 5% | YES |

| CHEVRON | new york | CHEVRON | 5% | YES |

| VISA | new york | VISA | 10% | YES |

| MCDONALDS | new york | MCDONALDS | 5% | YES |

| BOA | new york | BOA | 5% | YES |

| NIKE | new york | NIKE | 10% | YES |

| HOMEDEPOT | new york | HOMEDEPOT | 5% | YES |

| WALMART | new york | WALMART | 5% | YES |

| COCACOLA | new york | COCACOLA | 5% | YES |

| AMEX | new york | AMEX | 5% | YES |

| JPMORGAN | new york | JPMORGAN | 5% | YES |

| AT&T | new york | AT&T | 10% | YES |

| VERIZON | new york | VERIZON | 5% | YES |

| MASTERCARD | new york | MASTERCARD | 10% | YES |

| ORACLE | new york | ORACLE | 10% | YES |

| CATERPILLAR | new york | CATERPILLAR | 5% | YES |

| WELLSFARGO | new york | WELLSFARGO | 10% | YES |

| IBM | new york | IBM | 5% | YES |

| BOEING | new york | BOEING | 5% | YES |

| PFIZER | new york | PFIZER | 10% | YES |

| SAP | new york | SAP | 10% | YES |

| GOLDMAN | new york | GOLDMAN | 10% | YES |

| DISNEY | new york | DISNEY | 10% | YES |

| DAIMLER | xetra | DAIMLER | 10% | YES |

| BAYER | xetra | BAYER | 10% | YES |

| BASF | xetra | BASF | 10% | YES |

| ALLIANZ | xetra | ALLIANZ | 10% | YES |

| VOLKSWAGON | xetra | VOLKSWAGON | 10% | YES |

| BMW | xetra | BMW | 10% | YES |

| ADIDAS | xetra | ADIDAS | 10% | YES |

| DBANK | xetra | DBANK | 10% | YES |

| SIEMENS | xetra | SIEMENS | 10% | YES |

Start trading forex today

Open & fund your account instantly

Technical analysis tools

Same day account opening

24/5 customer

support

Any

questions?

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions. Help centre

Follow us for

market analysis

Trade responsibly: this website may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Zero markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations.

Quick links

* fee free funding for MT4/MT5 only. Terms & conditions apply.

** data from zero markets server shows our EURUSD spread to be 0.0 pips on average 36.88% of the live ticks from 1st october 2020 – 31st october 2020, which is available for our super zero trading accounts with RAW spread only).

Features of our products including fees and charges are outlined in the relevant legal documents available on our websites. The legal documents should be considered before entering into transactions with us. Zero markets is a group of companies which include zero financial pty ltd and zero markets LLC. Clients receiving services in australia are provided by zero financial pty ltd (ZERO markets, ABN 72 623 051 641), which is an authorised representative (no. 001273819) of first prudential markets pty ltd (ABN 16 112 600 281, AFSL 286354). First prudential markets pty ltd is the issuer of the products and provider of the platform described on the site www.Zeromarkets.Com.Au, and its PDS are located here. Clients receiving services in saint vincent and the grenadines are provided by zero markets LLC, which is a registered company of st. Vincent and the grenadines, limited liability number 503 LLC 2020. Please refer to the legal documents on this website or download our SVG privacy policy.

© 2020 ZERO markets. All right reserved. Privacy policy | terms & conditions

Cfds vs share trading

Cfds vs share trading

Trading cfds has a number of benefits over traditional share dealing

Cfds (contracts for difference) can help you make gains similar to those you can achieve through share ownership – but they’re not same as owning shares.

Here are the key similarities and differences between trading cfds and owning shares.

| Key differences | cfds | share dealing |

|---|---|---|

| ownership | you don’t own the shares | you do own the shares |

| dividends and voting | you get dividends but don’t have any voting rights | you get dividends and may have voting rights |

| cost | your initial outlay is only a proportion of the position value (which could be as low as 0.5%) to place a CFD trade | you need to pay up the full value of the shares |

| market risk | you can go ‘long’ or ‘short’, so you can gain if the market rises or falls | you’ll only make a gain if the share price rises |

| how to buy | online, using spread co’s trading platforms | through a broker |

| commission | none, all costs are included in the spread | may be broker commission to pay |

| stamp duty | no 1 | yes 1 |

| overnight financing | LIBOR +2% only when you go long, none when you go short | no |

A CFD trade vs a share trade in practice

Here’s an example of a share trade and a CFD trade on the same asset.

Opening trade

| Share trade | CFD trade | |

|---|---|---|

| share price | 100p | 100p |

| size of trade/stake | 10,000 shares | 10,000 cfds |

| value of trade/stake | £10,000 | £10,000 |

| stamp duty 1 | £50 | £0 |

| cost/margin | £10,050 | £2,000 |

This is just an example. If the share price fell by a similar amount the loss on the CFD trade would be magnified in the same way that the profit has been in this example.

CFD trading vs share trading

CFD trading or shares trading both offer excellent opportunities to profit from rising and/or falling prices in the financial markets. If you’re weighing up CFD trading vs share trading, we can help you determine the key differences to make an informed investment decision. We also run through the best brokers for trading cfds or stocks.

Before we look at the CFD trading vs share trading debate, what is CFD investing and share dealing?

What is CFD trading?

CFD (contract for difference) trading involves speculating on the price movement of a financial instrument. Traders can take a position on rising prices (going long) or falling prices (going short). As cfds are a derivative product, you do not take ownership of the underlying asset.

You can trade cfds in numerous global markets, including forex pairs, stock indices, commodities, options and shares. CFD products are also leveraged, which gives you full market exposure without needing to deposit the full value of the trade.

What is share trading?

Share trading, or investing, is a longer-term form of trading, whereby you take ownership of the stock and profit from price movements. Compared to cfds, it’s harder to go short to speculate on falling prices with share trading.

When investing in company shares or exchange traded funds (etfs), traders cannot access leverage, so the full value of the trade must be put down.

CFD trading vs share trading – differences

Ownership

When considering CFD trading vs stock or share trading, one of the key differences lies in whether the underlying asset is owned by the trader. With cfds, you do not own the underlier, whereas share trading does involve taking ownership.

Market access

When choosing between CFD trading vs share trading, you may also want to consider which markets you wish to access. Cfds allow you to trade a variety of instruments, including forex pairs, indices, commodities, options, futures and shares, whereas share trading only gives you access to shares and etfs.

Financing

Another notable difference between buying shares vs CFD trading is the costs to open a position. For cfds, trades are leveraged, which means you only need to deposit a percentage of the total position size to gain full exposure to the asset. When investing in shares, the full value of the position is paid upfront.

Trading hours

When looking at CFD trading vs share trading, cfds come with the benefit of 24-hour investing on many major assets. This is because you get access to a range of global markets, meaning it is possible to trade around the clock. With share trading, however, you can only really trade during the stock exchange’s opening hours.

Fees & charges

Whether you’re trading CFD products or stocks, your positions will be subject to fees. In most CFD markets, pricing is determined by the spread, though CFD shares are often subject to a commission. With share trading, you usually just pay a commission and any conversion fees, if applicable. Overnight funding fees will also apply to cfds but not to share trades.

UK taxes

The CFD trading vs normal shares trading argument can also be characterised by their tax implications. In the UK, cfds are exempt from stamp duty because there is no ownership involved. Note that any profits from cfds are still subject to capital gains tax. With share trading, both stamp duty and capital gains tax are payable.

Find out more about UK trading and investing taxes.

Trading platforms

Fortunately, when considering CFD trading vs share trading, both are usually available on desktop and mobile trading applications. Most brokers offer popular platforms such as the metatrader suite, or their own proprietary software. Traders should take advantage of any demo accounts offered to test out the features.

Other considerations

Other key characteristics in the CFD trading vs share trading debate are:

- Expiries – there are generally no expiry dates when trading a CFD or share, however, assets such as CFD futures and options do have expiries. These are usually on a monthly basis, but make sure to check with your broker for details.

- Shareholder privileges – whilst no shareholder privileges are available when trading cfds, you can benefit from dividends and in some cases, voting rights, when investing in shares and etfs.

- CFD trading vs share trading strategies – the timeframe in which you wish to trade may also determine your decision with trading shares vs cfds. Cfds are usually best for short-term, intra-day and medium-term strategies, whereas share trading is ideal for long-term buy and hold investments.

Best UK brokers for CFD trading

There is a good selection of CFD brokers available in the UK, offering award-winning features such as competitive spreads or top-notch research tools. The best option for you will depend on your preferences and experience level. Etoro, for example, offers both CFD vs stock trading and is a great broker for beginners.

Best UK brokers for stock trading

If you’re stock trading, you’ll want to consider a broker that offers a wide range of shares and etfs. Traders using IG, for example, have thousands of CFD vs shares instruments to choose from, as well as other attractive features such as extended trading hours for shares.

CFD trading vs share trading – which one is right for me?

When it comes to CFD trading vs share trading, it’s important the weigh up the various benefits and risks and how they apply to you. Cfds give you access to a wider range of markets than share trading. But whilst leveraged cfds can be profitable, they can also lead to substantial losses. As a result, less experienced traders may want to consider trading shares to start with, as they don’t involve as much leverage risk and are less complicated. In any case, make sure to test out the broker’s platforms and practice your strategies in a demo account first.

What is the difference between CFD trading vs real stock trading?

Cfds involve speculating on price movements either way and are derivative products, meaning you do not own the underlying asset. Cfds are also leveraged, which means you can gain exposure to the market by putting down just a fraction of the full trade. Stock trading on the other hand, allows you to take ownership of the asset, whereby you profit from upward price movements. Stock trading is not leveraged, so you must put down the whole trade value.

Buying cfds vs buying stocks: what are the differences with fees?

Generally, cfds and share trades are subject to spreads and commissions, respectively. If you take CFD shares vs actual shares, however, both are usually subject to commissions. There are also overnight financing fees on cfds and conversion fees on shares, if applicable.

How do I open A CFD or investing account?

To open an account, you will need to complete the online application process at your chosen broker. You may be asked to verify your identity before setting up your account login credentials. When looking at a CFD vs investing account, its worth comparing the broker’s fees and funding methods to see which best suit your requirements.

Should I trade cfds or shares?

The decision to either trade cfds or stocks will depend on your risk appetite and other trading requirements. Cfds can be great for more seasoned traders who understand, and have experience with, leveraged trading. Share trading is less risky and works well for beginners, though you won’t get access to a wide range of markets.

Are CFD and share trading safe?

Both forms of trading are generally safe, but traders should consider a regulated broker who will provide a good level of fund safety and security. New traders should also carry out their own research into the risks of leveraged trading.

CFD trading on shares

Join city index and go long or short on company shares like barclays, amazon and apple.

Trade cfds with tight spreads and low commission on thousands of major global shares.

- Commission from 0.08% on UK shares

- Trade cfds on 4500+ global shares

- Margins from just 20%

| markets | spread | commission per trade | margin from * |

|---|---|---|---|

| FTSE 100 shares | market | 0.08% (£10 minimum) | 20% |

| other UK shares | market | 0.08% (£10 minimum) | 20% |

| european shares | market | 0.08% (€10 minimum) | 20% |

| US shares | market | 1.8CPS ($10 minimum) | 20% |

For full market details please consult market information sheet in platform.

Cfds: shares options

We offer a large range of share options over the phone. Please call our options desk on 0845 355 0801 (local rate) for pricing.

Why trade shares cfds?

CFD trading is a popular way to trade shares. City index offers a choice of 4500+ global shares from companies listed in US, UK, europe, australia, singapore and hong kong stock exchanges.

Cash cfds

Shares cash cfds

Spreads

market spread only

Commission

from £10 or 0.08% commission or per trade

Rollover

positions roll over automatically to next trading day

Financing charge

incurs a finance charge for positions held overnight

Dividend adjustments

A dividend adjustment may be applicable to shares

Profit and loss

P&L crystallised only when positions are closed or partially closed

Trade wherever you are, on our fast, reliable platforms

Customisable charts

Award-winning platform

Actionable trade ideas

Trade anytime, anywhere

Why city index?

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

* spread betting and CFD trading are exempt from UK stamp duty. Spread betting is also exempt from UK capital gains tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

† 1 point spreads available on the UK 100, germany 30, france 40 and australia 200 during market hours on daily funded trades and cfds (excluding futures).

‡ voted “best trading platform”, “best mobile application” and “best spread betting provider” at the OPWA awards 2019. Voted “best professional trading platform” and “best spread betting provider” at the 2019 shares awards. Voted “best CFD provider” at the ADVFN international financial awards 2020.

City index is a trading name of GAIN capital UK limited. Head and registered office: devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is a company registered in england and wales, number: 1761813. Authorised and regulated by the financial conduct authority. FCA register number: 113942. VAT number: GB 887 937 443. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

City index and city trading are trademarks of GAIN capital UK ltd.

The information on this website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

A guide to trading stock cfds

Trading stock cfds is, in some ways, very similar to trading shares on the equities market. However, there are some key differences.

One such difference, and probably the most obvious to those familiar with financial derivative products, is that when trading with contracts for difference (cfds), the trader never actually owns the underlying asset, in this case a company's shares. There are other differences between the two and, in this article, we will examine some of these.

Cfds explained

For those of you who are unsure what CFD trading is and how it works, here we will briefly explain the concept. When trading with cfds, a trader enters into a contract between themselves and the CFD provider whereby an agreement is made to exchange the difference in the value of an asset between the time the contract is opened and closed.

This method of trading brings advantages, disadvantages and differences from traditional investment, which we will explore in the following sections.

Leverage

Before we analyse all the differences between the two methods of trading, the concept of leverage deserves its own section, as this really is a key selling point of trading cfds.

Cfds are leveraged products, whereby traders are able to trade on margin and, therefore, are not required to tie up the full value of a transaction. This allows traders to open larger positions than they would otherwise be able to. In order to open a leveraged position, the trader needs to deposit a percentage value of the position, this value is known as the margin.

Of course, it must be noted that leveraged share trading is also available for investors. However, typically speaking, the leverage offered is usually significantly lower. It is also not as commonplace for online brokers to offer retail traders access to leveraged share trading, when compared with cfds.

Leverage can be a very useful tool for a trader. By accessing larger positions, traders can expect larger returns when the market moves in their favour. However, it is very important to bear in mind that as well as having the potential to magnify profits, leverage will also magnify losses if the market moves against you. Therefore, taking this into account, it is imperative that leverage is always used with the utmost respect.

An example of leverage

With a trade.MT5 account from admiral markets, retail traders can enjoy leverage of 1:5 on stock cfds. Let's say then, for example, that you wanted to buy 100 shares of apple, which were priced at $130 per share.

This would result in a total position size of $13,000. However, with leverage of 1:5, the required margin would be 20% (or 1/5th) of this figure, meaning that you would actually only need an outlay of $2,600. Thus, you are left with more capital to utilise on other trades, should you wish to do so.

Stock cfds: the key differences

Apart from what we have already described above, there are more key differences between buying shares and trading stock cfds, in this section we will examine the advantages and disadvantages of trading stock cfds.

Advantages

Cfds can be traded both long and short, moreover, you are not required to deliver the underlying asset in the event of a short sale. This feature of cfds allows traders to speculate on both rising and falling markets which, again, is a big selling point for cfds.

For example, if a piece of news is released which you think will negatively affect the share price of company A, you can open a short position using cfds. If you are correct and company A's share price falls, you will profit from this downward price movement.

Furthermore, in the UK, cfds are exempt from stamp duty, however, all profits are subject to capital gains tax.

Disadvantages

Trading cfds using leverage can be a useful tool, as discussed above. However, because when trading on leverage, the broker is effectively lending you the capital to open a larger position, a leveraged CFD trade incurs an interest charge if left open overnight.

This fee is known as the "swap" fee. It is normally based on the full market value of the open position and the rate will be set by your broker. The swap fees charged by admiral markets can be viewed in the contract specification section of our website.

Naturally, if you were to buy shares using your own capital, you would not be exposed to this charge. This means that if you are looking to buy shares in order to hold onto them for a longer period of time, doing so via cfds will end up incurring a lot of fees.

The other main disadvantage of trading stock cfds comes as a result of not actually owning the underlying company shares. Company shareholders usually enjoy additional rights, such as voting rights when the company is making key decisions. Trading stock cfds means that a trader will not benefit from this right as they are not a shareholder.

Final thoughts

Hopefully, after reading this article, you should have a better idea as to the key differences of trading stock cfds and its advantages and disadvantages when compared with buying shares.

There is no definitive answer as to which of these financial instruments is better, as it depends on each trader’s individual profile and purpose as to which instrument will be better suited to them.

Trade stock cfds with admiral markets

If you are feeling inspired to start trading, you might be interested to know that with a trade.MT5 account from admiral markets, you can trade cfds on over 3,300 shares and over 300 exchange-traded funds (etfs), all from the world's largest stock exchanges! Other benefits include access to leverage and free use of the world's number one multi-asset trading platform, metatrader 5 ! Click the banner below to open an account today:

Please note : tax treatment depends on your individual circumstances. Tax law can change or may differ in a jurisdiction other than the UK.

About admiral markets

Admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today !

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks .

Commissions

Tiered

Transparent volume-tiered pricing

- Our low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees.

- In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you. 1

Fixed

Fixed rate pricing

- Charges a fixed rate low commission per share or a set percent of trade value.

- Includes all exchange and regulatory fees.

- For US stocks, etfs and warrants, the transaction fees are passed through on all stock sales.

2020 awards

#1 - best online broker - 5 out of 5 stars

#1 for active traders

#1 for international traders

#1 for retirement investors

Disclosures

- IBKR's tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Costs passed on to clients in IBKR’s tiered commission schedule may be greater than the costs paid by IBKR to the relevant exchange, regulator, clearinghouse or third party. For example, IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients.

Commissions

Stocks, etfs (etps) and warrants - overview

Interactive brokers ®, IB SM , interactivebrokers.Com ®, interactive analytics ®, IB options analytics SM , IB smartrouting SM , portfolioanalyst ®, IB trader workstation SM and one world, one account SM are service marks and/or trademarks of interactive brokers LLC. Supporting documentation for any claims and statistical information will be provided upon request. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Options involve risk and are not suitable for all investors. For more information read the characteristics and risks of standardized options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 312-542-6901 or click here. Before trading, clients must read the relevant risk disclosure statements on our warnings and disclosures page. Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, click here. Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, read the security futures risk disclosure statement. For a copy click here. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Before trading, please read the risk warning and disclosure statement.

Follow us on social media

- Youtube

Why trade cfds instead of stocks?

Q: what is the difference between buying a share through a traditional broker versus trading it via a contract for difference?

The key difference between trading a CFD long and buying a security is due to the leverage that is employed. Contracts for difference are traded on margin which means that there is no need to tie up the full market value of purchasing the equivalent stock position. This also allows traders to open larger positions than their capital would otherwise allow.

There are a number of key differences between trading an underlying asset and a CFD -:

- As opposed to holding the underlying asset, a CFD is traded on margin which means that an initial deposit is lodged with the CFD broker which allows the investor to buy or sell a number of cfds according to margin computations which allow extra leverage over the stock purchase itself.

- The investor doesn’t down own the underlying asset over which the CFD is based but enters a contractual agreement with the CFD broker to exchange the cash difference in price between the opening and closing prices of the contract.

- Cfds can be traded short or long and you are not required to deliver the underlying asset in the event of a short sale.

- Presently, cfds are exempt from UK stamp duty of 0.5% although profits are subject to capital gains tax.

One CFD will usually be equivalent to one share, except that with a contracts for difference position your provider will usually only require you to put down 5% to 20% of the actual contract value in order to trade. On a share CFD with a 5% margin, you can gain exposure up to twenty times as many shares for the same capital outlay compared to an investor in physical shares. For instance, suppose you buy 5 shares of google at $400, you would have to pay $2000 ($400 x 5). But if you bought 5 google cfds at $400, and the margin requirement was 10%, you would only be required to fork out $200 leaving you money to use on more trades. The net effect is a return (or loss) of 10+ times the amount using cfds over shares due to the leverage that is employed. The fact that cfds are traded on margin (which means that your broker is effectively lending you money) implies that a contracts for difference trade attracts finance charges while a position is held, while this does not apply to the share trade. The interest is charged on the full market value of the CFD position and the rate is set by your CFD provider, and again usually set with a spread around the base rate of the country within which the stocks are traded. So for shares traded on the london stock exchange, this would be LIBOR while for USA shares this would be the fed rate..Etc.

The downside is that geared trading opens you up to the risk of losing more than your initial outlay – there is a risk that you would wipe out your account and end up owing more funds to your CFD provider. This cannot happen if you buy the physical shares. This could happen, for instance if you were to short shares and the market moved sharply against you. Of course, it is very difficult for retail investors to short shares in the physical market. It is also important to note that while the value of the CFD is derived from the value of the underlying asset, it may not mirror it exactly.

Lastly, and this is an important difference with cfds you do you have the right to acquire the referenced shares, or benefit from any ownership rights, such as voting rights, in the underlying shares and therefore only have an economic interest in the share. So for instance if you trade a CFD on apple or BP, you are in effect trading the price difference between your entry point and your exit point. You do not own the apple or BP shares, you are only speculating on their price going up or down. Cfds are concerned ONLY with movements in price – nothing else. The contract is between you and your broker.

Cfds provide all the benefits of share trading combined with the added advantage of being able to utilise your unrealised profit, and only outlay part of the full notional value of your position.

Q: do I get a share certificate when I trade a share CFD?

Q: do cfds have the 3 days settlement period like real shares?

Q: why trade cfds instead of stocks?

- Gearing i.E. The ability to leverage your capital. You are only required to provide only initial collateral at between 5 to 10% of the nominal value of the underlying share when the contract is opened. This allows you to trade up to 20 times (sometimes even more!) the value of your cash outlay – potentially benefiting from stock price movements without having to purchase that share outright. If you have $20,000 in a shares dealing account, then you would be able to buy shares for a total market value of $20,000. Once all your capital is ‘invested’ in positions you wouldn’t be able to take advantage of other trading opportunities unless you sold a portion of your stock portfolo. This is not so with a CFD brokerage account where if you put $20,000 in it – not only would you still be able to trade up to $20,000 but more importantly you will also be able to open extra positions should you notice other trading opportunities (without having to sell any of your existing holdings). This is leverage and is the greatest advantage of cfds compared to traditional shares dealing.

- Ability to go short which allows you to take advantage of an overvalued stock – if you consider a share overvalued, you can short the stock using a CFD to benefit from a fall in its share price (with no extra costs).

- Avoidance of stamp duty in the UK and ireland. In quite a few cases the half-percent saving from the stamp duty exemption will actually exceed the round trip commission costs for opening and closing the trade.

- Direct trading on live tradable prices – cfds mirror the price of the underlying instrument and there’s no waiting for the execution of orders. Using DMA cfds, every trade has a corresponding trade in the real market, so you are able to take part in the opening and closing price auctions.

- Cfds allow you to make use of more advanced strategies and tactics such as hedging your existing share portfolio.

- Dividends – when holding a long CFD position over the ex-dividend date, you will receive the dividend into your trading account immediately (usually on that same day).

- Minimum amount to start trading cfds is usually $5,000 or less.

- Many international markets accessible from one CFD account – be it shares, forex pairs, indices, commodities, sectors..Etc. This is another big advantage of utilising cfds versus a traditional stock broker.

However, it is well worth noting -:

- Cfds are not standardised and every CFD provider has their own terms and conditions.

- Leverage means small market movements can have a big impact on the success of your trades..

- With cfds the issue of counterparty risk crops up. Incidentally, since all you own is a contract with the CFD provider, you are also relying that the CFD provider is in a sound financial position and will be able to meet their obligations to you so it is wise to find a well-capitalised regulated provider.

In addition the evolution of the internet and electronic trading platforms has reduced transaction costs involved in undertaking CFD transactions.

Most CFD traders want good leverage – paying small margins for potentially big pay outs. However it is important to have realistic margins. Too high and it’s not worth it, but too low and you just have too much rope to hang yourself by…

Q: if the CFD price moves like the stock price, why would you trade a CFD on IBM instead of just trading the IBM stock itself?

To see the effect of gearing, here is an example of a CFD trade compared to a traditional equity trade, where the investor uses the same amount required for a CFD deposit to buy ordinary shares instead.

| Opening the position | ||||

| CFD deal | equity deal | |||

| price of company Z | 112p | 112p | ||

| number of shares | 20,000 | 2,000 | ||

| value of shares | £22,400 | £2,240 | ||

| commission | £33.60 | £17.50 | ||

| stamp duty | £0 | £11.20 | ||

| total value of transaction | £22,433.60 | £2,268.70 | ||

| deposit required | £2,240 | £0 | ||

| initial cost | £2,273.60 | £2,268.70 | ||

| closing the position | ||||

| CFD deal | equity deal | |||

| price of company Z | 115p | 115p | ||

| number of shares | 20,000 | 2,000 | ||

| value of shares | £23,000 | £2,300 | ||

| commission | £34.50 | £17.50 | ||

| difference in share value | £600 | £60 | ||

| financing (3 days) | £9.67 | £0 | ||

| profit (difference – commission charges) | £522.23 | £13.80 | ||

| percentage ROI | 23.32% | 0.61% | ||

As you can see for the same initial outlay you can control a much larger position with a contract for difference as the contract is traded on margin. This means that you can substantially increase the return on your investment – but you should note that any losses would be equally multiplied.

The main challenge is still in educating people about cfds versus physical trading and spreadbetting and how to use leverage in a profitable way. I firmly believe that serious traders should use cfds in terms of cost, execution and versatility. There is no stamp duty, no extra spread (so costs are transparent), no expiry period and you can go long or short and gain leverage easily. The challenge is to use these products correctly; limiting your downside, positioning yourself sensibly in the market and avoiding taking profits too early.

So, let's see, what we have: the CFD trading vs share trading debate is interesting. Investing in cfds or stocks each has its merits. Find out which could best meet your trading needs. At share cfd

Contents of the article

- Actual forex bonuses

- CFD trading vs share trading

- What is CFD trading?

- What is share trading?

- CFD trading vs share trading – differences

- Ownership

- Market access

- Financing

- Trading hours

- Fees & charges

- UK taxes

- Trading platforms

- Other considerations

- Best UK brokers for CFD trading

- Best UK brokers for stock trading

- CFD trading vs share trading – which one is right...

- What is the difference between CFD trading vs...

- Buying cfds vs buying stocks: what are the...

- How do I open A CFD or investing account?

- Should I trade cfds or shares?

- Are CFD and share trading safe?

- An introduction to contract for differences (cfds)

- How cfds work

- The costs of cfds

- Advantages of cfds

- Higher leverage

- Global market access from one platform

- No shorting rules or borrowing stock

- Professional execution with no fees

- No day trading requirements

- Variety of trading opportunities

- Disadvantages of cfds

- Example of a CFD trade

- Cfds faqs

- What are cfds?

- How do cfds work?

- Why are cfds illegal in the U.S.?

- Is trading cfds safe?

- Can you make money with cfds?

- The bottom line

- Share CFD trading

- What are the advantages of trading share...

- What is share CFD trading?

- How does share trading...

- What are the most recommended...

- Start trading with ZERO on spreads from...

- Share trading example

- The gross profit on your trade...

- Opening the position

- Closing the position

- Available share cfds on MT4

- Open & fund your account...

- 24/5 customer support

- Any questions?

- Follow us for market...

- Cfds vs share trading

- CFD trading vs share trading

- What is CFD trading?

- What is share trading?

- CFD trading vs share trading – differences

- Ownership

- Market access

- Financing

- Trading hours

- Fees & charges

- UK taxes

- Trading platforms

- Other considerations

- Best UK brokers for CFD trading

- Best UK brokers for stock trading

- CFD trading vs share trading – which one is right...

- What is the difference between CFD trading vs...

- Buying cfds vs buying stocks: what are the...

- How do I open A CFD or investing account?

- Should I trade cfds or shares?

- Are CFD and share trading safe?

- CFD trading on shares

- Cfds: shares options

- Why trade shares cfds?

- Cash cfds

- Trade wherever you are, on our fast, reliable...

- Why city index?

- A guide to trading stock cfds

- Cfds explained

- Leverage

- Stock cfds: the key differences

- Final thoughts

- Commissions

- Tiered

- Fixed

- Commissions

- Why trade cfds instead of stocks?

- Q: what is the difference between buying a share...

- Q: do I get a share certificate when I trade a...

- Q: do cfds have the 3 days settlement period like...

- Q: why trade cfds instead of stocks?

- Q: if the CFD price moves like the stock price,...

No comments:

Post a Comment