Forex investment companies

As a user or an investor you need to click on sign up button. By filling up the registration form or sign up form you will get login credentials after the verification process us.

Actual forex bonuses

Earn more profit by investing with us and participating in our referral program to get benefits from generating references. As an investor you can withdraw your earnings whenever you want

We are crypto forex investment LTD

Crypto forex investment is an innovative binary options and forex trading platform provider owned and operated by B.O. Tradefinancials ltd.

How we work

We are happy to welcome all cryptocurrency fans and those who are new to the world of digital currencies on our website! Our company is involved in financial activities related to bitcoin trading and mining. This is now a very lucrative business as cryptocurrencies are rapidly gaining popularity.

Create account

As a user or an investor you need to click on sign up button. By filling up the registration form or sign up form you will get login credentials after the verification process us.

Invest with us

Crypto forex investment offers various investment plans for all interested investors around the world. Eagle invest ensures the steady daily interest on a long run on your investments by our unique strategies of our experts.

Get profit

Earn more profit by investing with us and participating in our referral program to get benefits from generating references. As an investor you can withdraw your earnings whenever you want

About us

Cryptocurrency has literally taken the world by storm. But what is a cryptocurrency? Cryptocurrency, as the name suggests, is a form of digital money designed to be secure and anonymous in most cases. It uses a technique called cryptography a process used to convert legible information into an almost uncrackable code, to help track purchases and transfers. Cryptocurrencies allow users to make secure payments, without having to go through banks. There are many other advantages of this currency. We believe cryptocurrencies are going to be the future!

This investment platform is the result of our intensive and fruitful work for the past few months, it is ready to offer secure asset management service on the basis of cutting-edge business, associated with bitcoin mining as well as highly profitable trade on cryptocurrency markets. Starting today, we urge to join us all those who are interested in news from the world of cryptocurrency mining and trading as well as believe in the globalization of digital money. We are ready to cooperate with online investors from all over the world in this promising and beneficial field.

Forex investment companies

Homepage » forex investment companies

The 95% of amateur traders don’t get consistent profits. Do you want to be one of the other 5% profitable investors? Forex investment companies are what you are looking for!

What is a forex investment company?

A forex investment company is a financial business which provides trading services in your broker’s accounts.

Your account will be operated by a professional group of asset managers paying an agreed monthly fee. That fee will be automatically deducted of your broker’s account if the account gets profits.

Let us manage your account and get profits at last in your forex investments.

Feel the peace of mind that gives having a managed account by a forex investment company. We’ll be getting profits for you meanwhile you are walking or sleeping.

Who needs an online forex investment company?

If you don’t have time to trade your funds or you think that you don’t have enough knowledge and experience, then it’s recommended that you get your funds managed by a forex investment company.

You can be an individual investor or a hedge fund company looking to diversify its savings in the forex market without having to be involved in direct managing of your funds.

Why you should look for a forex trading investment company

The main reason to hire a forex trading investment company is to have safe and long term steady profitable performance.

Forex market is a 24/5 open market

Forex market has high liquidity

Leverage can be used in forex market

The potential profits should be weighted about the risk you assume to achieve them.

- 24/5 open market can also mean that a movement against your profits could happen while you are not watching the screen.

- In most markets great liquidity could be available when you don’t need it and limited when you require it.

- Leverage gives you a good feeling when a trade is working in your favor, but it usually makes things worse if you don’t have a professional plan to get out of a losing position.

As you can see the advantages of investing in forex can turn against you easily if you are not a professional trader.

That’s why is very important to avoid risking your funds trying to control such a complex market and better choose a professional forex investment company in order to control, manage and make your funds grow.

Keep your funds safe from the beginning and let the professional asset managers do what they know and love to do. Ensure annual steady good forex profits every year, while you enjoy your life doing your regular work, being with friends, traveling, etc.

Hire fxmac team and have the complete peace of mind that means working with a professional online forex investment company.

Your turn to make a move

Start making money with fxmac

Discover our programs

152-160 city rd

london EC1V 2NX

united kingdom

Fxmac

Forex market

Trading forex carries a high level of risks, and couldn't be suitable for all kind of investors. A high degree of big leverage can work against anyone, also for you. Before taking any decision to invest in forex services you should consider your knowledge about forex, investment objectives, asking to professionals if need it, and your risk appetite. There is a possibility that you may have a loss of part or all of your initial investment and so you shouldn't invest money that you can't afford to lose. Be aware of all the risks associated with forex and look for the reviews needed to be sure. Of your possibilities of investment. Seek advice from an independent financial advisor if you think you need it. Fxmac is a trademark of the company the best secure trading consulting, corp. Registered by FSA with number 20558IBC2012, in accordance with the international business companies (amendment and consolidation) act. The objects of the best secure trading consulting, corp. Are to provide top forex managed services and reliable best managed account services in currencies, and leverage financial instruments. Fxmac offer forex services in USA, australia, UK, europe, switzerland. Singapore, south africa, all over the world. The financial services authority (FSA) of SVG certifies that the best secure trading consulting, corp is in compliance with all the requirements of the international business companies (amendment and consolidation) act and in good standing with this authority. This information here exposed doesn't constitute, may not be used for the purpose of, an offer or as a solicitation to anyone in any of a jurisdiction which such an offer or such solicitation isn't authorized or to any persons to whom it is unlawful making such offer or such solicitation. Prospective investors shouldn't construe the contents of this information here exposed as a legal, tax or any financial advice. Fxmac doesn't provide services for residents in jurisdictions in which such service delivery is not authorized. Fxmac is not authorised or registered in UK by the prudential regulation authority (PRA) and/or the FCA, or is neither exempt. Our commercial office in UK is applicable only for non- UK residents meeting the criteria for becoming eligible clients.

© 2021 fxmac forex managed account. All rights reserved

- Fxmac

- About us

- Brokers with whom we work

- Become an institutional partner

- Become our money manager

- Referral program for investors

- Forex market

- Forex news

- Top forex managed accounts

- Forex account management agreement

- Forex investment companies

- Our services

- Our programs

- Invest now

Forex investment program 2 is a steady intraday strategy based upon a complex neural network model that allows it to adapt to changes in the market.

This worthwhile investment program keeps safe risk ratios, and continually profit and grow.

It’s built upon a complex neural network model that allows it to adapt to changes in the market.

All the orders have a stop loss and a take profit placed.

The reason it’s been able to thrive unlike other trading systems is because it does avoid actively trade against trends and it impulses waves that trade into the trend direction, giving a much higher probability of success.

This great investment program has around a 78% of winner trades.

- Maximum potential DD: allowed 35%

- Broker: managed in the australian regulated brokers fusion markets and IC markets.

- Performance fee commission: 35%. This forex trading program could have a decrease of PF for investments from 25k onward.

- USA citizens allowed: for investm91ents from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=1131

Minimum investment (version x1): $5,000

Investment program 3 is a profitable steady trending follower (mostly intraday) that closes most trades within a few hours. All positions have fixed SL and TP

The annual profit goal is 120% for the ‘x2 version’.

Due the SL and TP set in all the positions; it is impossible to maintain a long drawdown period.

It has more than 80% positive trades, which makes it a very stable and profitable strategy.

It diversifies into 6 different major currency pairs.

This strategy is designed for investors looking for a calmed and very conservative trading style.

- Maximum potential DD: 20%

- Broker: fusion markets and IC markets (both australian brokers)

- Performance fee commission: 35%. This forex trading program could have a decrease of PF for investments from 15K onward (for version x2) and from 25k onward (for regular version x1).

- USA citizens allowed: for investments from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=113191

Minimum investment (regular version x1): 5,000€

Minimum investment (version x2): 3,000€

Our asset managers team can design bespoke investment profit programs for investors (no grids, no martingales) as:

- Small investors that want to increase fast their savings and they don’t mind to assume higher risks

- Big or institutionalinvestors that want lower risks and higher profits.

The investor needs to inform first of how many funds he or she has available for investing in this design bespoke investment program and he or she also needs to inform us among which average monthly profit would be correct for their investment goals.

Note that the higher monthly profits the investor wants, the bigger risk he or she needs to assume

The expected annual profit is chosen by the investor.

- Maximum potential DD: it depends of the profits goal.

- Broker: vantagefx, IC markets, fusion markets, fxchoice and LMFX

- Performance fee commission: 35%. This forex trading program could have a decrease of PF for big investments

- USA citizens allowed: for investments from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=113191

Minimum investment: it depends of the monthly goal

Forex investment program 1 is a trend strategy (no grids, no martingale) based on candlestick patterns, moving average and fibonacci levels. The annual profit goal for actual ‘version x1’ is 150%.

There is an aggressive version x2 of profits for investors that look for higher profits in shorter time. The annual profit goal for ‘version x2’ is on 300%, with double risk.

All the orders have a hidden trailing stop loss and a take profit.

This great investment program has around a 1.53 of profit factor, with a great equilibrium among the average month profit and the maximum DD. It allows that the client asking us to manage his funds with double p roportional risk, in order to get double of monthly profits.

- Maximum potential DD (regular version x1) allowed 20%

- Maximum potential DD (version x2) allowed 40%

- Broker: managed in the australian regulated brokers vantagefx, fusion markets and IC markets.

- Performance fee commission: 35%.This forex trading program could have a decrease of PF for investments from 15k onwards (for ‘version x2’) and for version regular ‘version x1’ it’ll be from 25k onward.

- USA citizens allowed (version x1): for investments from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=113191

Minimum investment (version x1): $5,000

Minimum investment (version x2): $3,000

Forex investment program 5: it’s a trend follower strategy. All the positions have assigned a SL and a TP.

The main focus of this steady profitable investment strategy is trading gold and it also complements with trading EURUSD positions.

The maximum risk for trade is lower than 4%. It opens usually only 1 position and sometimes could have 2 positions simultaneously. It opens 3-5 positions at week.

This strategy is designed for investors that look for a great annual profit with a low risk.

- Maximum potential DD: 20%

- Broker: vantagefx, IC markets and fusion markets.

- Performance fee commission: 35%. This forex trading program could have a decrease of PF with investments from 25K onwards.

Minimum investment (version x1): $5,000

Forex investment program 6 is a steady intraday strategy based on elliot wave theory across multiple market sessions and on recurring fractal wave patterns.

It’s built upon a complex neural network model that allows it to adapt to changes in the market

All the orders have a stop loss and a take profit placed.

The reason it’s been able to thrive unlike other trading systems is because it does avoid actively trade against trends and it impulses waves that trade into the trend direction, giving a much higher probability of success.

This great investment program has around a 70% of winner trades, with an equilibrium among the average month profit and the maximum DD. It allows that the client asking us to manage his funds with double p roportional risk, in order to get double of monthly profits.

- Maximum potential DD (regular version x1) allowed 20%

- Maximum potential DD (version x2) allowed 40%

- Broker: managed in the australian regulated brokers vantagefx, fusion markets and IC markets.

- Performance fee commission: 35%.This forex trading program could have a decrease of PF with investments from 15k onwards.

Minimum investment (version x1): $5,000

Minimum investment (version x2): $3,000

List of legit forex investment companies in nigeria

LIST OF LEGIT FOREX INVESTMENT COMPANIES IN NIGERIA

Getting a legit forex investment company in nigeria that you can invest your money with could seem a great task. In this article, we have an awesome carefully selected list of some legit and trusted forex investment companies you can invest your hard-earned money.

1. Pepperstone

Pepperstone is an award-winning forex investment company. They are one of the most legit forex investment companies in nigeria and have won multiple prestigious awards from investment trends, deloitte, and compare forex brokers and they are proud to be recognized for consistently exceptional customer service, excellent trading conditions, and offering value for money.

Pepperstone is a worldwide recognized forex broker, you can invest with, they are trusted by over 57,000 traders worldwide. Pepperstone was founded in 2010 in melbourne, australia by a team of experienced traders with a shared commitment to improve the world of online trading. Frustrated by delayed executions, expensive prices, and poor customer support, they set out to provide traders around the world with superior technology, low-cost spreads, and a genuine commitment to helping them master the trade. Pepperstone is a forex broker recognized worldwide, is also available in nigeria.

Pepperstone offers a simple and user-friendly user interface, making it quick and easy to get started. The application is in minutes with a simple application process that has been put in place. Pepperstone claims to provide you with everything you need to take on the global markets with confidence.

They offer clients a demo account you can use to practice and get familiar with the platform and know how it works. They also offer to the client a live account that you can fund from any part of the world with your automated teller machine (ATM) card, to start trading and making a profit once you have studied the website and gained the necessary skill and confidence to start trading.

2. IC markets

Another legit forex investment company in nigeria is IC markets and it is a regulated forex CFD provider. IC markets fills the gap between retail and institutional traders, making the world more tradable for everyone.

IC markets is one of the most renowned forex CFD providers. They offer trading solutions for active day traders and scalpers as well as traders that are new to the forex market. IC markets offers its clients cutting edge trading platforms, low latency connectivity, and superior liquidity.

IC markets is revolutionizing on-line forex trading. Traders are now able to gain access to pricing which was previously only available to investment banks and high net worth individuals.

IC markets was incorporated by a team of professionals in the financial services industry who were instrumental in the success of one of the largest regulated CFD providers.

Their mission is to create the best and most transparent trading experience for retail and institutional clients alike allowing traders to focus more on their trading. Built by traders for traders IC markets is dedicated to offering superior spreads, execution, and service.

IC markets sought to bridge the gap between retail and institutional clients offering a trading solution previously only available to investment banks and high net worth individuals. IC markets raw spread connectivity was born, providing superior execution technology, lower spreads, and unrivaled liquidity.

IC markets is dedicated to innovation, constant improvement, and utilizing cutting edge technology previously unavailable.

They also offer a free demo account where you can practice and get familiar with their trading portal and alive account that you can find from any part of the world.

3. FOREXTIME (FXTM)

Forextime which is also known as FXTM was established in 2011, the FXTM brand is a global leader in online trading, bringing the opportunities of financial markets to global audiences, wherever they are and whatever their financial ambitions are. It is a top legit forex investment company in nigeria

They are specialists in leveraged trading, giving you the potential to generate financial returns on both rising and falling prices across FX, indices, commodities, shares, and cryptocurrencies. Whether you’re an experienced trader or completely new to it, we’re here to help you find freedom in the financial markets.

The group’s global network of offices and regulations spans europe, africa, asia, and latin america, and they have already attracted over 3 million clients across 180 countries including nigeria.

By trading on the FXTM platform, you stand to enjoy many benefits such as;

- Operating an account that suits your kind of trader.

- Low trading costs and super fast trade execution – ( you can check out their performance scorecard)

- The world’s most popular trading platform – choose MT4 or MT5 on mobile, desktop, or web

- Free forex education courses and guides to help you get started or build your trading skills

- Discover over 5,000 traders to copy, with their innovative copy trading program. FXTM invest. Etc.

- You get access to a free demo account that is funded to test the platform and your trading skills and also a live account that can be funded from any part of the world to trade when you are ready.

To get started, visit their website, https://www.Forextime.Com

4. Octafx

Octafx is one of the best and legit STP forex brokers which was founded in july 2011. They help forex traders find the best trading conditions in the forex market.

They also create a cost-effective trading experience where forex traders, both new and professional forex traders, can earn more with the same investment

Octafx is a leading forex investment company you can also trust. Since it was established, it has experienced tremendous growth also success stories. They have received 28 forex industry awards, with over 1.5million trading accounts registered, over 288million trades executed, and also said to have covered 100 countries in the world.

Some benefits you stand to enjoy when you register and invest with octafx includes

- Tight spreads: with the lowest spreads in the forex industry you have an opportunity to earn 25% more than with other forex brokers. This will allow you to maximize your gain from every trade you made on their platform.

- 50% deposit bonus: you get a 50% deposit bonus on octafx which gives you the advantage to open positions of higher volume and support your trades with the 50%bonus. The interesting part is that you can also withdraw the bonus after meeting volume requirements.

- Rewarding loyalty proves: octafx offers a program known as “trade & win program” on its platform, which allows you to benefit even more. I.E, you get lots to win prizes for trading with them and you can exchange the prize lots for gadgets and merchandise.

- Fast deposits and withdrawal: with octafx, you enjoy a fast deposit and withdrawal system. You can start trading right after making a successful deposit and you can as well withdraw your profits in no tim

- No commission on deposits: on octafx, you enjoy a no commission on deposits and withdrawals and one of the best exchange rates among forex brokers, which is always at your service when you trade with octafx.

7. AVATRADE

Avatrade has been an innovative pioneer in online trading since 2006.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

Avatrade is dedicated to a set of core values that are said to define their relationships with customers and partners and guides every decision they make.

They are said to be committed to empowering people to invest and trade, with confidence, in an innovative and reliable environment; supported by best-in-class personal service and uncompromising integrity.

Forex investment companies

WELCOME TO forex investment service

Forex investment service is a new, steadily developing capital management and online money investment service provider. We make investments in manufacturing and production, technologies, communications and energy. Due to the professionalism of our employees and the introduction of cutting-edge stock market techniques, we manage to provide top-quality service at minimal costs.

Our key to success is much simpler than one may think it to be - we believe that the key factors in our money investment business are the creation of a team comprising only the best specialists and the stimulation of partnership spirit both within the team and between us and our clientele. We have succeeded in creating an exclusive team of experienced professionals - funds investing perfectionists whose only aim is the best possible result and absolute leadership in the market.

Our program is created for those who want to improve their financial condition, but do not have economic education and are not financial experts. And we suggest you to become an investor of our team on mutually beneficial conditions.

It's time to finally stop worrying about making money on the internet. Your returns are not based on other payments into the fund, but on the funds investment strategies. Our professional expertise allows us to offer you secure returns on investments. We plan our investment portfolio in order to mitigate the risks inherent in trading. We use various investment strategies and always diversify our investments. Diversification in trading is its most important part which minimizes the risks and generates larger profits on high yield investment programmes.

Today the amount of assets managed by our company is already over $1.5 billion and the capital keeps growing with the speed of approximately $15-20 million a week. We are currently collaborating with about 12,000 clients. We believe that your success is our success and our models are designed to give you the best possible performance. Choosing our company you can control a desirable level of your risks and profits. Please check the plans details below:

Forex investment companies

Forex investment fund (FIF) is a high yield, private loan program, backed up by bonds, forex, gold, stocks trading, and investing in various funds and activities all over the world.

Forex investment fund (FIF) is a high yield, private loan program, backed up by bonds, forex, gold, stocks trading, and investing in various funds and activities all over the world. Our mission is to provide our investors with a great opportunity for their funds by investing as prudently as possible in various arenas to gain a high rates in return. We are a successful group of private individuals who have made our money through prudent investments in the finance industry on a worldwide basis for over 8 years. Honestly, please do not compare us to something like "HYIP" programs or "games" that are always coming and going. Besides, we do have a reliable and profitable source of real net income, based on the real investment from the real market.

That means, we are able to pay our investors for as many years as they choose to remain with us, whether or not any new investors ever join. Our team has been proudly owned and operated since june 1998 participating in many online and offline ventures, resulting in great margins of profit for the investor teams and the sole investors. We are a group of private individuals that have been in the investment arena for over 8 years, most of our investor teammates are professional bankers, some of them have years of business and financial related experience. We are the serious people who are running the serious business. Our group is made up of american, asian, australian, canadian, european people, thus we are able to watch all the different markets almost 24 hours a day.

No matter how good trade records we have been made, we are just helping ourself only. We have seen many people suffer loses from various internet opportunities that can not meet their promises, thus we feel that there is a need for people like you to make a steady gain in income without risking large amounts of money. That is the reason why forex investment fund (FIF) was born.

Global-forex.Ltd - your future investment partner

Choosing a reliable company for making financial investments requires intelligent thinking. We are an experienced investment company that offers diverse business options to customers. We trade in monetary, financial and crypto currency in various large scaled markets including forex. Our company aims at achieving the following milestones for the customers.

Quick login

Our investment plans

AFTER

After

HOURS

After

HOURS VIP

GLOBAL

Affiliate program

We developed an affiliate program in order to provide our investors with an opportunity of getting passive income.

Earn commission for every referals

Earn $10 when your referral makes a deposit

Earn $5 when your second level referral makes a deposit.

Referral bonus

- Active referrals prize amount

- 50 active referrals $100

- 25 active referrals $50

- 15 active referrals $25

- 10 active referrals $10

About us

We offer the maximum return percentages to the customer at the smallest possible investment amounts. You do not need to be very strong monetarily to start investing with us. As an investor, you can start with a small sum of money. Our financial experts would guide you about the best investment options that match your financial standing. Our experts work very hard so that our customers can earn higher profit sums.

Our company does not commit expected profits without comprehensive analysis. We have experienced financial experts who perform detailed risk analysis and calculations for profitable investment options. Our investment systems have been designed with a flexible strategy so that customers are not pressurized about making large investments.

People who choose us to make investments can be absolutely sure that their money would not be lost. Through our quality financial models, we make sure that customers do not face financial losses. In addition to that, there are no hidden terms which investors are not told about.

Our website displays key statistics including the financial withdrawals and deposits that have been made by investors.

Total users 15433

Running days 2581

Total deposits $241180242.10

Total withdrawn $621059679.83

Why

global forex

Instant payment

All our payments are processed in 24 hours. No more waitnig !

Ev ssl certified

An extended validation SSL certificate is the highest form of SSL certificate on the market

Registered company

Global forex LTD is registered in the UK as a private limited investment company, registration number # 06782970

5 million insured

Our federal deposit insurance policy covers up to the amount of 5 million pounds. So no risk of losing investment arises.

Referral bonus

Get up to 10% referral commission and also a cash bonus for accruing a particular amount of active referrals.

Forex programs investment

Homepage » forex programs investment

Forex programs investment

Fxmac offers several different forex programs for trading in order the investors can diversify as much a possible their investments.

The forex programs offered in our website are all of them for forex investors that want the trading programs as forex managed accounts.

Our company has specialized in intraday trading programs in order to offer low minimum DD risk to investors. Our professional asset managers apply an SL (stop loss) and a TP (take profit) to each single position open in our forex programs. One of the main goals of our forex programs is to have low DD that is balanced with the average monthly profit. We preserve the invested funds of our clients, and also consolidate the steady monthly profits

Investment program 1

Investment program 1 is a trending strategy based on candlestick patterns, moving average and fibonacci levels (no grids, no martingale). This program has a goal for actual ‘version x2’ of 300% of annual profit and for the regular version (x1) is of 150% of annual profit.

For investors that look for higher profits in shorter time with a still a correct moderate risk, can have the more profitable ‘version x2’ . Note that investing in the ‘version x2’ will give you double of annual profits and it’ll afford also double risk than regular ‘version x1’. Ask for it.

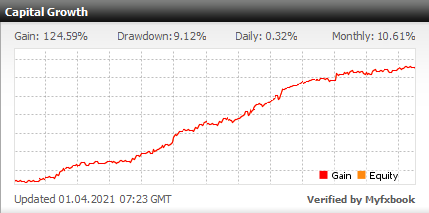

Name investment strategy: capital growth

cumulative profits: 124%

average monthly profits (x2): 21.22%

Average monthly profits (x1): 10.61%

Inception date: july 2019

Investment strategy: intraday

Brokerage: vantagefx, IC markets and fusion markets (australia)

USA citizens allowed: minimum 10k

Broker for USA citizens (with 1:1000): click here to know more

Asset class: majors

Platform: MT4

Minimum investment: $5,000 (actual risk) // $3,000 (risk x2)

Performance fee (risk x1): 35% (5k+) // 30% (25k+) // 25% (100k+)

Performance fee (risk x2): 35% (3k+) // 30% (15k+) // 25% (50k+)

Investment program 2

Investment program 2 is a night trading intraday strategy. It has around 78% of positive trades. It has a 260% of annual profit goal.

This profitable investment program is built upon a complex neural network model that allows it to adapt to changes in the market. This worthwhile investment program keeps safe risk ratios, and continually profit and grow. Ask for it.

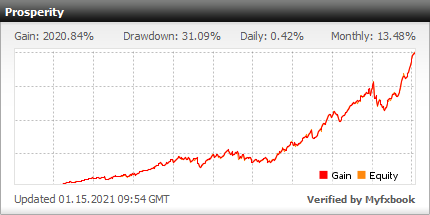

Name investment strategy: prosperity

cumulative profits: 2,020%

average monthly profits: 13.48%

inception date: january 2019

Investment strategy: intraday

Brokerage: fusion markets and IC markets (australia)

USA citizens allowed: minimum 10k

Broker for USA citizens (with 1:1000): click here to know more

Asset class: majors

Platform: MT4

Minimum investment: $5,000

Performance fee (risk x1): 35% (5k+) // 30% (25k+) // 25% (100k+)

Investment program 3

Investment program 3 is a trend-following strategy. This profitable investment strategy has achieved more than 80% positive trades. This investment strategy has the great characteristic of having the ability to obtain annual profits with a fairly low and stable draw down. It is an extraordinarily safe and consistent profit trading program.

This consistent and conservative trading strategy achieves more than 100% of annual profits in version x2. It has a large “profit factor” greater than 1.6. Ask for it.

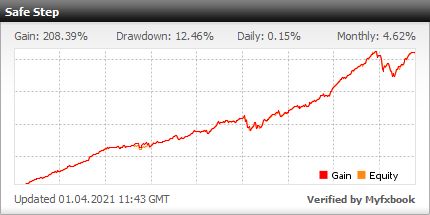

Name investment strategy: safe step

cumulative profits: 208%

average monthly profits (x2): 9.24%

Average monthly profits (x1): 4.62%

Inception date: december 2018

Investment strategy: intraday-trend

Brokerage: fusion markets, IC markets, vantagefx

USA citizens allowed: minimum 10k

Broker for USA citizens (with 1:1000): click here to know more

Asset class: majors

Platform: MT4

Minimum investment:$5,000 (actual risk) // $3,000 (risk x2)

Performance fee (risk x1): 35% (5k+) // 30% (25k+) // 25% (100k+)

Performance fee(risk x2): 35% (3k+) // 30% (15k+) // 25% (50k+)

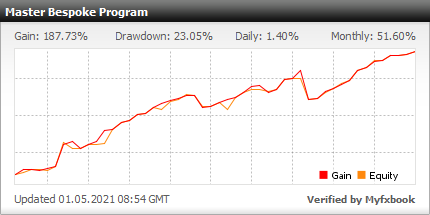

Let’s design your

‘bespoke profit program’

How much average monthly profits you want to earn (80%, 30%, 50%, etc.)? You’d need to inform us about how many funds you have available for your ‘bespoke investment program’ (no grids, no martingale).

Note that the higher of average monthly earnings you choose, the more risk you must to bear. Once you inform about your profit’s goal and the funds you have available for the bespoke investment program, we’ll advise you on the correct equilibrium among the monthly profits you want to obtain and the risk you want to assume. Tell us how much you want to earn

Name investment strategy: tailored to suit investment programs

monthly profits goal: you choose

average monthly profits: 30%, 60%, 50%, etc

Brokerage: vantagefx, IC markets, fusion markets, fxchoice and LMFX

USA citizens allowed: minimum 10k

Broker for USA citizens (with 1:1000): click here to know more

Asset class: majors

Platform: MT4

Performance fee: 35% (can be decreased for big investments)

Fxmac supplies the best forex programs for investors of all over the world (australia, russia, singapore, USA, europe, south africa, UK, etc). All our forex programs have long term performance proven histories verified by third parties like myfxbook and fxstat.

All our intraday forex programs are conservative for investors that want to invest their savings with peace of mind in a steady monthly positive basis.

Get in contact with our consultants and inform us how much funds you want to invest and what’s your trading programs goal. We will give you the best advice about which of our forex program fits better for you.

Your turn to make a move

Start making money with fxmac

Discover our programs

152-160 city rd

london EC1V 2NX

united kingdom

Fxmac

Forex market

Trading forex carries a high level of risks, and couldn't be suitable for all kind of investors. A high degree of big leverage can work against anyone, also for you. Before taking any decision to invest in forex services you should consider your knowledge about forex, investment objectives, asking to professionals if need it, and your risk appetite. There is a possibility that you may have a loss of part or all of your initial investment and so you shouldn't invest money that you can't afford to lose. Be aware of all the risks associated with forex and look for the reviews needed to be sure. Of your possibilities of investment. Seek advice from an independent financial advisor if you think you need it. Fxmac is a trademark of the company the best secure trading consulting, corp. Registered by FSA with number 20558IBC2012, in accordance with the international business companies (amendment and consolidation) act. The objects of the best secure trading consulting, corp. Are to provide top forex managed services and reliable best managed account services in currencies, and leverage financial instruments. Fxmac offer forex services in USA, australia, UK, europe, switzerland. Singapore, south africa, all over the world. The financial services authority (FSA) of SVG certifies that the best secure trading consulting, corp is in compliance with all the requirements of the international business companies (amendment and consolidation) act and in good standing with this authority. This information here exposed doesn't constitute, may not be used for the purpose of, an offer or as a solicitation to anyone in any of a jurisdiction which such an offer or such solicitation isn't authorized or to any persons to whom it is unlawful making such offer or such solicitation. Prospective investors shouldn't construe the contents of this information here exposed as a legal, tax or any financial advice. Fxmac doesn't provide services for residents in jurisdictions in which such service delivery is not authorized. Fxmac is not authorised or registered in UK by the prudential regulation authority (PRA) and/or the FCA, or is neither exempt. Our commercial office in UK is applicable only for non- UK residents meeting the criteria for becoming eligible clients.

© 2021 fxmac forex managed account. All rights reserved

- Fxmac

- About us

- Brokers with whom we work

- Become an institutional partner

- Become our money manager

- Referral program for investors

- Forex market

- Forex news

- Top forex managed accounts

- Forex account management agreement

- Forex investment companies

- Our services

- Our programs

- Invest now

Forex investment program 2 is a steady intraday strategy based upon a complex neural network model that allows it to adapt to changes in the market.

This worthwhile investment program keeps safe risk ratios, and continually profit and grow.

It’s built upon a complex neural network model that allows it to adapt to changes in the market.

All the orders have a stop loss and a take profit placed.

The reason it’s been able to thrive unlike other trading systems is because it does avoid actively trade against trends and it impulses waves that trade into the trend direction, giving a much higher probability of success.

This great investment program has around a 78% of winner trades.

- Maximum potential DD: allowed 35%

- Broker: managed in the australian regulated brokers fusion markets and IC markets.

- Performance fee commission: 35%. This forex trading program could have a decrease of PF for investments from 25k onward.

- USA citizens allowed: for investm91ents from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=1131

Minimum investment (version x1): $5,000

Investment program 3 is a profitable steady trending follower (mostly intraday) that closes most trades within a few hours. All positions have fixed SL and TP

The annual profit goal is 120% for the ‘x2 version’.

Due the SL and TP set in all the positions; it is impossible to maintain a long drawdown period.

It has more than 80% positive trades, which makes it a very stable and profitable strategy.

It diversifies into 6 different major currency pairs.

This strategy is designed for investors looking for a calmed and very conservative trading style.

- Maximum potential DD: 20%

- Broker: fusion markets and IC markets (both australian brokers)

- Performance fee commission: 35%. This forex trading program could have a decrease of PF for investments from 15K onward (for version x2) and from 25k onward (for regular version x1).

- USA citizens allowed: for investments from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=113191

Minimum investment (regular version x1): 5,000€

Minimum investment (version x2): 3,000€

Our asset managers team can design bespoke investment profit programs for investors (no grids, no martingales) as:

- Small investors that want to increase fast their savings and they don’t mind to assume higher risks

- Big or institutionalinvestors that want lower risks and higher profits.

The investor needs to inform first of how many funds he or she has available for investing in this design bespoke investment program and he or she also needs to inform us among which average monthly profit would be correct for their investment goals.

Note that the higher monthly profits the investor wants, the bigger risk he or she needs to assume

The expected annual profit is chosen by the investor.

- Maximum potential DD: it depends of the profits goal.

- Broker: vantagefx, IC markets, fusion markets, fxchoice and LMFX

- Performance fee commission: 35%. This forex trading program could have a decrease of PF for big investments

- USA citizens allowed: for investments from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=113191

Minimum investment: it depends of the monthly goal

Forex investment program 1 is a trend strategy (no grids, no martingale) based on candlestick patterns, moving average and fibonacci levels. The annual profit goal for actual ‘version x1’ is 150%.

There is an aggressive version x2 of profits for investors that look for higher profits in shorter time. The annual profit goal for ‘version x2’ is on 300%, with double risk.

All the orders have a hidden trailing stop loss and a take profit.

This great investment program has around a 1.53 of profit factor, with a great equilibrium among the average month profit and the maximum DD. It allows that the client asking us to manage his funds with double p roportional risk, in order to get double of monthly profits.

- Maximum potential DD (regular version x1) allowed 20%

- Maximum potential DD (version x2) allowed 40%

- Broker: managed in the australian regulated brokers vantagefx, fusion markets and IC markets.

- Performance fee commission: 35%.This forex trading program could have a decrease of PF for investments from 15k onwards (for ‘version x2’) and for version regular ‘version x1’ it’ll be from 25k onward.

- USA citizens allowed (version x1): for investments from $10,000 (in the broker LMFX). Visit their website clicking here: https://www.Lmfx.Com/?Refid=113191

Minimum investment (version x1): $5,000

Minimum investment (version x2): $3,000

Forex investment program 5: it’s a trend follower strategy. All the positions have assigned a SL and a TP.

The main focus of this steady profitable investment strategy is trading gold and it also complements with trading EURUSD positions.

The maximum risk for trade is lower than 4%. It opens usually only 1 position and sometimes could have 2 positions simultaneously. It opens 3-5 positions at week.

This strategy is designed for investors that look for a great annual profit with a low risk.

- Maximum potential DD: 20%

- Broker: vantagefx, IC markets and fusion markets.

- Performance fee commission: 35%. This forex trading program could have a decrease of PF with investments from 25K onwards.

Minimum investment (version x1): $5,000

Forex investment program 6 is a steady intraday strategy based on elliot wave theory across multiple market sessions and on recurring fractal wave patterns.

It’s built upon a complex neural network model that allows it to adapt to changes in the market

All the orders have a stop loss and a take profit placed.

The reason it’s been able to thrive unlike other trading systems is because it does avoid actively trade against trends and it impulses waves that trade into the trend direction, giving a much higher probability of success.

This great investment program has around a 70% of winner trades, with an equilibrium among the average month profit and the maximum DD. It allows that the client asking us to manage his funds with double p roportional risk, in order to get double of monthly profits.

- Maximum potential DD (regular version x1) allowed 20%

- Maximum potential DD (version x2) allowed 40%

- Broker: managed in the australian regulated brokers vantagefx, fusion markets and IC markets.

- Performance fee commission: 35%.This forex trading program could have a decrease of PF with investments from 15k onwards.

Minimum investment (version x1): $5,000

Minimum investment (version x2): $3,000

Working in finance: 5 forex careers

The forex markets can be exciting and lucrative for trading if you thoroughly understand how to buy and sell currencies. If you're drawn to this area, you might even want to make it your career.

Key takeaways

- The foreign exchange (forex) market is the world's largest asset marketplace by trading volume and liquidity, open 24/7 and crucial for global finance and commerce.

- Being a forex trader can be a risky venture and requires a high degree of skill, discipline, and training.

- For non-traders, you can still get involved in the forex markets through other channels.

- Market research; account management; regulation; and software development are just a few forex careers that do not directly involve trading.

Forex markets

Forex markets are open 24 hours a day, five total days a week, which means jobs are fast-paced, involve long days and strange work hours. they require knowledge of and compliance with laws and regulations governing financial accounts and transactions. Some jobs require candidates to have passed one or more exams, such as the series 3, series7, series 34 or series 63 exams.

If you are eligible to work in a foreign country, a career in forex can bring the added excitement of living abroad. No matter where you work, knowing a foreign language, particularly german, french, arabic, russian, spanish, korean, mandarin, cantonese, portuguese or japanese, is helpful and might be required for some positions.

This article will provide an overview of five major career areas in forex, but please keep in mind that specific positions tend to have different names at different companies.

1. Forex market analyst/currency researcher/currency strategist

A forex market analyst, also called a currency researcher or currency strategist, works for a forex brokerage and performs research and analysis in order to write daily market commentary about the forex market and the economic and political issues that affect currency values. These professionals use technical, fundamental and quantitative analysis to inform their opinions and must be able to produce high-quality content very quickly to keep up with the fast pace of the forex market. Both individual and institutional traders use this news and analysis to inform their trading decisions.

An analyst might also provide educational seminars and webinars to help clients and potential clients get more comfortable with forex trading. Analysts also try to establish a media presence in order to become a trusted source of forex information and promote their employers. Thus, there is a large marketing component to being a forex analyst.

An analyst should have a bachelor's degree in economics, finance or a similar area. They may also be expected to have at least one year of experience working in the financial markets as a trader and/or analyst and be an active forex trader. Communication and presentation skills are desirable in any job, but are particularly important for an analyst. Analysts should also be well-versed in economics, international finance and international politics.

2. Forex account manager/professional trader/institutional trader

If you have been consistently successful trading forex on your own, you may have what it takes to become a professional forex trader. Currency mutual funds and hedge funds that deal in forex trading need account managers and professional forex traders to make buy and sell decisions. Institutional investors such as banks, multinational corporations and central banks that need to hedge against foreign currency value fluctuations also hire forex traders. Some account managers even manage individual accounts, making trade decisions and executing trades based on their clients' goals and risk tolerance.

It's important to note that these positions have very high stakes. Account managers are responsible for large amounts of money, and their professional reputations and those of their employers are reliant on how well they handle those funds. They are expected to meet profit targets while working with an appropriate level of risk. These jobs may require experience with specific trading platforms, work experience in finance and a bachelor's degree in finance, economics or business. Institutional traders may not only need to be effective traders in forex, but also commodities, options, derivatives and other financial instruments.

3. Forex industry regulator

Regulators attempt to prevent fraud in the forex industry and can hold multiple roles. Regulatory bodies hire many different types of professionals and have a presence in numerous countries. They also operate in both the public and private sectors. The commodity futures trading commission (CFTC) is the government forex regulator in the U.S., while the national futures association (NFA) sets regulation standards, and screens forex dealer members from the private sector.

The CFTC hires attorneys, auditors, economists, futures trading specialists/investigators and management professionals. Auditors ensure compliance with CFTC regulations and must have at least a bachelor's degree in accounting, though a master's and certified public accountant (CPA) designation are preferred. Economists analyze the economic impacts of CFTC rules and must have at least a bachelor's degree in economics. Futures trading specialists/investigators perform oversight and investigate alleged fraud, market manipulation and trade practice violations, and are subject to work experience and educational requirements that vary by position.

CFTC jobs are located in washington, DC, chicago, kansas city and new york and require U.S. Citizenship and a background check. The CFTC also provides consumer education and fraud alerts to the public. Since the CFTC oversees the entire commodity futures and options markets in the U.S., it is necessary to have an understanding of not just forex, but all aspects of these markets.

The NFA is similar to the CFTC and also oversees the broader futures and commodities markets, but instead of being a government agency, it is a private-sector self-regulatory organization authorized by congress. its mission is to maintain market integrity, fight fraud and abuse and resolve disputes through arbitration. It also protects and educates investors and enables them to research brokers (including forex brokers) online. Most NFA jobs are located in new york, but some are in chicago.

Internationally, a regulator could work for any of the following agencies:

- Financial conduct authority (FSA) in the U.K.

- Financial services agency (FSA) in japan

- Securities and futures commission (SFC) in hong kong

- Australian securities and investments commission (ASIC) in australia

4. Forex exchange operations, trade audit associate and exchange operations manager

Forex brokerages need individuals to service accounts, and they offer a number of positions that are basically high-level customer service positions requiring FX knowledge. These positions can lead to more advanced forex jobs.

The job of an exchange operations associate includes processing new customer accounts; verifying customer identities as required by federal regulations; processing customer withdrawals, transfers and deposits; and providing customer service. The job usually requires a bachelor's degree in finance, accounting or business, problem-solving and analytical skills and an understanding of financial markets and instruments, especially forex. It may also require previous brokerage experience.

A related position is a trade audit associate, which involves working with customers to resolve trade-related disputes. Trade audit associates must be good with people, able to work quickly and think on their feet to solve problems. Unsurprisingly, they must also thoroughly understand forex trading and the company's trading platform in order to help customers.

An exchange operations manager has more experience and greater responsibilities than an exchange operations associate. These professionals execute, fund, settle and reconcile forex transactions. The job may require familiarity with forex-related software, such as the widely-used society for worldwide interbank financial telecommunication (SWIFT) system.

5. Forex software developer

Software developers work for brokerages to create proprietary trading platforms that allow users to access currency pricing data, use charting and indicators to analyze potential trades and trade forex online. Qualifications include a bachelor's in computer science, computer engineering or a similar degree; operating system knowledge such as UNIX, linux and/or solaris; knowledge of programming languages such as javascript, perl, SQL, python, and/or ruby; and an understanding in many other technical areas, including back-end frameworks, front-end frameworks, databases and web servers.

Software developers may not be required to have financial, trading or forex knowledge to work for a forex brokerage, but knowledge in this area will be a major advantage. If you have forex trading experience, chances are you'll have a much better idea of what customers are looking for in forex software. Software quality is a major differentiator for forex brokerages and a key to the company's success.

For instance, a brokerage faces serious problems if its clients can't execute trades when they want or trades are not executed on time because the software doesn't work properly. A brokerage also needs to attract customers with unique software features and practice trade platforms.

Other positions in forex that require computer-driven experience include user-experience designers, web developers, network and systems administrators and support technicians.

Additional job options in forex

In addition to the specialized, highly technical careers described above, forex companies need to fill typical human resources and accounting positions. If you're interested in a career in forex, but don't yet have the required background or experience for a technical position, consider getting your feet wet in a general business position and for college undergraduates, many forex companies offer internships.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

10 best investment companies in nigeria

Investing can be a very overwhelming and intimidating task; however there are some folks that can make the job easier for you. They are called ‘ investment companies .’

There are many of them in the country and we did some extensive research on these companies in order to get the top 10 companies and this is what we found.

Citi trust investment limited

Citi trust investment is one of the top choice investment companies with a focus on stock brokerage. The company provides excellent financial services to both individuals and corporate clients.

Popularly called citi invest, citi trust investment limited has a company culture of transparency, professionalism and integrity. Some of the reputable services include:

- Stockbrockerage

- Securities trading

- Investment benefit management

- Portfolio management

- Financial advisory services and

- Asset management

The company has a subsidiary that provides asset management services. This is the citi trust asset management limited which is duly registered by security exchange commission as a fund manager.

Overall, citi trust investment is known to manage their client relationship excellently while offering sound financial advisory services.

Afrinvest limited

Afrinvest is another topnotch investment company in nigeria. The company is focused on four major areas namely:

- Investment banking

- Securities trading

- Asset management

- Investment research

The company provides research content on the nigerian market and serves as a major advisor to blue chip companies across west africa on M&A and international capital market transactions.

Also, afrinvest limited is licensed by the nigerian SEC through its subsidiary, afrinvest securities limited as a broker dealer. The company is also licensed as portfolio manager through one of its subsidiaries – afrinvest asset management limited.

Afrinvest has offices in the major cities of the countries which include lagos, portharcourt and abuja. However, their head office is located in ikoyi, lagos.

Forthright securities and investments ltd

Incorporated in 1995, forthright is one of major stockbrockerage firms in the country. The company is led by a team of enterprising and experienced professionals and their expertise has led to their rapid growth to become one of the leading companies in stock trading and investment advisory.

The major services provided by forthright are highlighted

- Investment advisory

- Fund management

- Sotckbrokerage

- Financial education and

- Portfolio management

- Wealth management & trust

- Mutual funds

- Pensions

- Real estate

- Private equity

- Investment banking

- Securities brokerage

- Blue chip companies

- Private equity investors

- Mid and large local corporates

- Government agencies

- High net worth individuals

- Actual forex bonuses

- We are crypto forex investment LTD

- How we work

- About us

- Forex investment companies

- What is a forex investment company?

- Who needs an online forex investment company?

- Why you should look for a forex trading...

- Forex market is a 24/5 open market

- Forex market has high liquidity

- Leverage can be used in forex market

- The potential profits should be weighted about...

- Your turn to make a move

- List of legit forex investment companies in...

- LIST OF LEGIT FOREX INVESTMENT COMPANIES...

- Forex investment companies

- Forex investment companies

- Global-forex.Ltd - your future investment partner

- Our investment plans

- Affiliate program

- About us

- Why global forex

- Forex programs investment

- Forex programs investment

- Investment program 1

- Investment program 2

- Investment program 3

- Let’s design your

- ‘bespoke profit program’

- Your turn to make a move

- Working in finance: 5 forex careers

- Forex markets

- 1. Forex market analyst/currency...

- 2. Forex account manager/professional...

- 3. Forex industry regulator

- 4. Forex exchange operations, trade audit...

- 5. Forex software developer

- Additional job options in forex

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- 10 best investment companies in nigeria

- Citi trust investment limited

- Afrinvest limited

- Forthright securities and investments ltd

- Stanbic IBTC asset management

- Peninsula asset management

- Lotus capital limited

- FBN capital

- United capital plc

- Investment one financial services

- Zenith capital limited

Stanbic IBTC asset management

With an excellent track record of expertise in fund management and in depth knowledge of the global and financial markets, stanbic IBTC asset management is one of the highly reputed asset management and investment companies in the country.

Also, they are known for their convenient, efficient and responsive service which comes with the extra peck of a dedicated relationship manager.

In 2013, the company solidified its position as one of the leading investment companies in the country when it was given the award of best investment management company by world finance.

Peninsula asset management

If you’re looking for an investment company that has been a major player for many decades, then the peninsula asset management should be your default choice.

Established in 1982, the company has remained on top of their game in investment management over the years.

They are known to provide a customized portfolio which has been tailored to meet the specific investment needs of their clients.

Lotus capital limited

Located in ikoyi, lagos, lotus capital is another reputable investment company that specializes in asset management, private wealth management and financial advisory services.

The company was founded in 2004 and has grown rapidly in the past decade to become one of the major investment platforms for individuals, businesses and organizations across the country.

Also, lotus capital is a pioneer in the financial niche of islamic banking where they provide equitable interest-free solutions.

The company is registered by the nigerian SEC as fund managers, corporate investment advisers and as an issuing housing.

Lotus capital is a very unique company and their core values are built around professionalism, confidentiality, excellent service, dynamism and integrity.

FBN capital

FBN capital isn’t just a leading investment and asset management company in nigeria; they are also one of the best in africa.