Opening a trade with $100 and 20x leverage will equate to $2 000 investment

The forex market is the largest in the world with more than $5 trillion worth of currency exchanges occurring daily.

Actual forex bonuses

Forex trading involves buying and selling the exchange rates of currencies with the goal that the rate will move in the trader’s favor. Forex currency rates are quoted or shown as bid and ask prices with the broker. If an investor wants to go long or buy a currency, they would be quoted the ask price, and when they want to sell the currency, they would be quoted the bid price. Investors use leverage to enhance the profit from forex trading. The forex market offers one of the highest amounts of leverage available to investors. Leverage is essentially a loan that is provided to an investor from the broker. The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire. However, the broker will require a percentage of the trade's notional amount to be held in the account as cash, which is called the initial margin.

How leverage works in the forex market

Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate. However, leverage is a double-edged sword, meaning it can also magnify losses. It's important that forex traders learn how to manage leverage and employ risk management strategies to mitigate forex losses.

Key takeaways

- Leverage, which is the use of borrowed money to invest, is very common in forex trading.

- By borrowing money from a broker, investors can trade larger positions in a currency.

- However, leverage is a double-edged sword, meaning it can also magnify losses.

- Many brokers require a percentage of a trade to be held in cash as collateral, and that requirement can be higher for certain currencies.

Understanding leverage in the forex market

The forex market is the largest in the world with more than $5 trillion worth of currency exchanges occurring daily. Forex trading involves buying and selling the exchange rates of currencies with the goal that the rate will move in the trader’s favor. Forex currency rates are quoted or shown as bid and ask prices with the broker. If an investor wants to go long or buy a currency, they would be quoted the ask price, and when they want to sell the currency, they would be quoted the bid price.

For example, an investor might buy the euro versus the U.S. Dollar (EUR/USD), with the hope that the exchange rate will rise. The trader would buy the EUR/USD at the ask price of $1.10. Assuming the rate moved favorably, the trader would unwind the position a few hours later by selling the same amount of EUR/USD back to the broker using the bid price. The difference between the buy and sell exchange rates would represent the gain (or loss) on the trade.

Investors use leverage to enhance the profit from forex trading. The forex market offers one of the highest amounts of leverage available to investors. Leverage is essentially a loan that is provided to an investor from the broker. The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire. However, the broker will require a percentage of the trade's notional amount to be held in the account as cash, which is called the initial margin.

Types of leverage ratios

The initial margin required by each broker can vary, depending on the size of the trade. If an investor buys $100,000 worth of EUR/USD, they might be required to hold $1,000 in the account as margin. In other words, the margin requirement would be 1% or ($1,000 / $100,000).

The leverage ratio shows how much the trade size is magnified as a result of the margin held by the broker. Using the initial margin example above, the leverage ratio for the trade would equal 100:1 ($100,000 / $1,000). In other words, for a $1,000 deposit, an investor can trade $100,000 in a particular currency pair.

Below are examples of margin requirements and the corresponding leverage ratios.

| Margin requirements and leverage ratios | |

|---|---|

| margin requirement | leverage ratio |

| 2% | 50:1 |

| 1% | 100:1 |

| .5% | 200:1 |

As we can see from the table above, the lower the margin requirement, the greater amount of leverage can be used on each trade. However, a broker may require higher margin requirements, depending on the particular currency being traded. For example, the exchange rate for the british pound versus japanese yen can be quite volatile, meaning it can fluctuate wildly leading to large swings in the rate. A broker may want more money held as collateral (i.E. 5%) for more volatile currencies and during volatile trading periods.

Forex leverage and trade size

A broker can require different margin requirements for larger trades versus smaller trades. As outlined in the table above, a 100:1 ratio means that the trader is required to have at least 1/100 = 1% of the total value of the trade as collateral in the trading account.

Standard trading is done on 100,000 units of currency, so for a trade of this size, the leverage provided might be 50:1 or 100:1. A higher leverage ratio, such as 200:1, is usually used for positions of $50,000 or less. Many brokers allow investors to execute smaller trades, such as $10,000 to $50,000 in which the margin might be lower. However, a new account probably won't qualify for 200:1 leverage.

It's fairly common for a broker to allow 50:1 leverage for a $50,000 trade. A 50:1 leverage ratio means that the minimum margin requirement for the trader is 1/50 = 2%. So, a $50,000 trade would require $1,000 as collateral. Please bear in mind that the margin requirement is going to fluctuate, depending on the leverage used for that currency and what the broker requires. Some brokers require a 10-15% margin requirement for emerging market currencies such as the mexican peso. However, the leverage allowed might only be 20:1, despite the increased amount of collateral.

Forex brokers have to manage their risk and in doing so, may increase a trader's margin requirement or reduce the leverage ratio and ultimately, the position size.

Leverage in the forex markets tends to be significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market. Although 100:1 leverage may seem extremely risky, the risk is significantly less when you consider that currency prices usually change by less than 1% during intraday trading (trading within one day). If currencies fluctuated as much as equities, brokers would not be able to provide as much leverage.

The risks of leverage

Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. For example, if the currency underlying one of your trades moves in the opposite direction of what you believed would happen, leverage will greatly amplify the potential losses. To avoid a catastrophe, forex traders usually implement a strict trading style that includes the use of stop-loss orders to control potential losses. A stop-loss is a trade order with the broker to exit a position at a certain price level. In this way, a trader can cap the losses on a trade.

How to calculate leverage, margin, and pip values in forex

Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses.

Important note! The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change.

Leverage and margin

Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. Stocks can double or triple in price, or fall to zero; currency never does. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly.

The margin in a forex account is often called a performance bond, because it is not borrowed money but only the equity needed to ensure that you can cover your losses. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Thus, no interest is charged for using leverage. So if you buy $100,000 worth of currency, you are not depositing $2,000 and borrowing $98,000 for the purchase. The $2,000 is to cover your losses. Thus, buying or selling currency is like buying or selling futures rather than stocks.

The margin requirement can be met not only with money, but also with profitable open positions. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions.

Total equity = cash + open position profits - open position losses

Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. Thus, it is never wise to use 100% of your margin for trades — otherwise, you may be subject to a margin call. Instead of a margin call, the broker may simply close out your largest money-losing positions until the required margin has been restored.

Leverage = 1/margin = 100/margin percentage

To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left.

To calculate the margin for a given trade:

Margin requirement = current price × units traded × margin

Example: calculating margin requirements for a trade and the remaining account equity

Required margin = 100,000 × 1.35 × 0.02 = $2,700.00 USD.

Before this purchase, you had $3,000 in your account. How many more euros could you buy?

Remaining equity = $3,000 - $2,700 = $300

Since your leverage is 50 , you can buy an additional $15,000 ( $300 × 50 ) worth of euros:

To verify, note that if you had used all of your margin in your initial purchase, then, since $3,000 gives you $150,000 of buying power:

Total euros purchased with $150,000 USD = 150,000 / 1.35 ≈ 111,111 EUR

Pip values

Because the quote currency of a currency pair is the quoted price (hence, the name), the value of the pip is in the quote currency. So, for instance, for EUR/USD, the pip = 0.0001 USD, but for USD/EUR, the pip = 0.0001 euro. If the conversion rate for euros to dollars is 1.35, then a euro pip = 0.000135 dollars.

Converting profits and losses in pips to native currency

To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency.

When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. This yields the total pip difference between the opening and closing transaction.

If the pip value is in your native currency, then no further calculations are needed to find your profit or loss, but if the pip value is not in your native currency, then it must be converted. There are several ways to convert your profit or loss from the quote currency to your native currency. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate.

Example: converting CAD pip values to USD

100,000 CAD × 200 pips = 20,000,000 pips total. Since 20,000,000 pips = 2,000 canadian dollars , your profit in USD is 2,000 / 1.1 = 1,818.18 USD.

However, if you have a quote for CAD/USD , which = 1/ 1.1 = 0.90909 , then your profit is calculated thus: 2000 × 0.90909 = 1,818.18 USD, the same result obtained above.

For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. To find that rate, you would look at the quote for the USD/pip currency pair, then multiply the pip value by this rate, or if you only have the quote for the pip currency/USD, then you divide by the rate.

Example: calculating profits for a cross currency pair

You buy 100,000 units of EUR/JPY = 164.09 and sell when EUR/JPY = 164.10 , and USD/JPY = 121.35 .

Profit in JPY pips = 164.10 – 164.09 = .01 yen = 1 pip (remember the yen exception: 1 JPY pip = .01 yen .)

Total profit in JPY pips = 1 × 100,000 = 100,000 pips .

Total profit in yen = 100,000 pips / 100 = 1,000 yen

Because you only have the quote for USD/JPY = 121.35 , to get profit in USD, you divide by the quote currency's conversion rate:

Total profit in USD = 1,000 / 121.35 = 8.24 USD.

If you only have this quote, JPY/USD = 0.00824 , equivalent to USD/JPY = 121.35 , the following formula converts pips in yen to domestic currency:

Total profit in USD = 1,000 × 0.00824 = 8.24 USD.

Leverage in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/foreign-currency-804917648-5ae5ef29ff1b780036736d7c.jpg)

Leverage is the ability to use something small to control something big. Specific to foreign exchange (forex or FX) trading, it means you can have a small amount of capital in your account, controlling a larger amount in the market.

Stock traders will call this trading on margin. In forex trading, there is no interest charged on the margin used, and it doesn't matter what kind of trader you are or what kind of credit you have. If you have an account and the broker offers margin, you can trade on it.

The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital. The problem is that you can also lose a considerable amount of money trading with leverage. It all depends on how wisely you use it and how conservative your risk management is.

You have more control than you think

Leverage makes a rather boring market incredibly exciting. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX.

Without leverage, traders would be surprised to see a 10% move in their account in one year. However, a trader using leverage can easily see a 10% move in one day.

But typical amounts of leverage tend to be too high, and it is important for you to know that much of the volatility you experience when trading is due more to the leverage on your trade than the move in the underlying asset.

Leverage amounts

Leverage is usually given in a fixed amount that can vary with different brokers. Each broker gives out leverage based on their rules and regulations. The amounts are typically 50:1, 100:1, 200:1, and 400:1.

- 50:1: fifty-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $50. As an example, if you deposited $500, you would be able to trade amounts up to $25,000 on the market.

- 100:1: one-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $100. This ratio is a typical amount of leverage offered on a standard lot account. The typical $2,000 minimum deposit for a standard account would give you the ability to control $200,000.

- 200:1: two-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $200. The 200:1 ratio is a typical amount of leverage offered on a mini lot account. The typical minimum deposit on such an account is around $300, with which you can trade up to $60,000.

- 400:1: four-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth $400. Some brokers offer 400:1 on mini lot accounts but beware of any broker who offers this type of leverage for a small account. Anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be wiped out in a matter of minutes.

Professional traders and leverage

Professional traders usually trade with very low leverage. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent.

Many professionals will use leverage amounts like 10:1 or 20:1. It's possible to trade with that type of leverage regardless of what the broker offers you. You have to deposit more money and make fewer trades.

No matter what your style, remember that just because the leverage is, there does not mean you have to use it. In general, the less leverage you use, the better. It takes the experience to really know when to use leverage and when not to. Staying cautious will keep you in the game for the long run.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Margin & leverage rules

FLEXIBLE LEVERAGE BETWEEN 1:1 – 1:2000

NEGATIVE BALANCE PROTECTION

REAL-TIME RISK EXPOSURE MONITORING

NO CHANGES IN MARGIN OVERNIGHT OR AT WEEKENDS

At GMI edge all clients have the flexibility to trade by using the same margin requirements and leverage from 1:1 to 1:2000.

Margin is the amount of collateral to cover any credit risks arising during your trading operations.

Margin is the percentage of position size, and the only real reason for having funds in your trading account is to ensure sufficient margin. On a 1% margin, for example, a position of $1,000,000 will require a deposit of $10,000.

The margin in your trading account needs to be equal to or above 100% in order for you to be able to open new trades.

Using leverage allows you to trade positions larger than the amount of money in your trading account. Leverage is expressed as a ratio, for instance 1:100, 1:300, or 1:2000. Example: if you have $100 in your trading account and you trade ticket sizes of 50,000 EUR/USD, your leverage will equate 50:1.

At GMI edge you are given a free short-term credit allowance whenever you trade on margin: this enables you to open a transaction with an amount that exceeds your account value. Without this, you are only able to trade based on the amounts you have in your trading account.

GMI edge reserves the right to apply changes to and amend the leverage ratio (i.E. Decrease the leverage ratio), on its sole discretion and without any notice on a case by case basis, and/or on all or any accounts of the client as deemed necessary by GMI edge.

| Equity | leverage | news (new positions) | |

|---|---|---|---|

| from | till | ||

| $25 | $1 000 | 1:2000 | 1: 1000 |

| $1 001 | $5 000 | 1:1000 | 1:1000 |

| $5 001 | $20 000 | 1:500 | 1:500 |

| $20 001 | $100 000 | 1:200 | 1:200 |

| $100 001 | N/A | 1:100 | 1:100 |

| equity | leverage | news (new positions) | |

|---|---|---|---|

| from | till | ||

| $2.50 | $1 000 | 1:1000 | 1: 1000 |

| $1 001 | $2 000 | 1:500 | 1:500 |

| $2 001 | N/A | 1:100 | 1:100 |

| equity | leverage | news (new positions) | |

|---|---|---|---|

| from | till | ||

| $100 | $20 000 | 1:500 | 1: 500 |

| $20 001 | $100 000 | 1:300 | 1:300 |

| $100 001 | N/A | 1:100 | 1:100 |

Depending on the account type you open at GMI edge, you can choose the leverage on a scale from 1:1 to 1:2000. Margin requirements do not change during the week, nor do they widen overnight or at weekends. Leverage may be reduced for new positions opened 30 mins before and after important news events. Leverage for these positions will then be adjusted to account leverage after the time period is over. Floating positions will not be disturbed. Moreover, at GMI edge you have the option to change by either increasing or the decreasing of your chosen leverage by requesting with our customer support officers by calling 1800 282260.

On the one hand, by using leverage, even from a relatively small initial investment you can make considerable profit. On the other hand, your losses can also become drastic if you fail to apply proper risk management.

GMI edge provides a leverage range that helps you choose your preferred risk level. We do not recommend trading close to a leverage of 1:2000 due to the high risk it involves.

With GMI edge you can control your real-time risk exposure easily by monitoring your used and free margin.

Together, used and free margin comprise your equity. Used margin often refers to the minimum amount of money you need to deposit to hold the trade. Free margin is the amount of money you have left in your trading account, and it fluctuates according to your account equity. With free margin, you can open additional positions with it, or absorb any losses.

GMI edge strictly follows a margin call policy to guarantee that your maximum possible risk does not exceed your account equity. Clients are still fully responsible for monitoring their trading account activity.

As soon as your account equity drops below 60% of the margin needed to maintain your open positions, we will attempt to notify you with a margin call warning you that you do not have sufficient equity to support your open positions.

The stop-out level refers to the equity level at which your open positions are automatically closed. Our stop-out position is at 30%.

GMI edge is the trading name of global prime limited, a regulated and licensed dealer in securities by the vanuatu financial services commission with the registration number 14647. Registered address govant building, BP 1276 port vila, vanuatu. Global prime limited is the owner and operator of this website (www.Gmiedge.Com) and (www.Edgema.Biz).

GMI edge is part of the GMI group of companies. The GMI brand was established in 2009.

The GMI group of companies includes:

– global prime limited – registered address govant building, BP 1276 port vila, vanuatu

– GMI edge limited – registered address unit 7, 10/F, tower 1, china hong kong city, 33 canton road, tsim sha tsui, kowloon, hong kong

– global market index limited (UK), authorized and regulated by the financial conduct authority (FRN: 677530) with registered address at 125 old broad street, london, england, EC2N 1AR

– global market index limited (VN) (GMIVN), a company regulated and registered in vanuatu, company number 14646, with registered address at BP 1276, govant building, port vila, vanuatu

Clients contract with both global prime limited (license holder) and GMI edge limited (merchant), (collectively referred to as GMI edge), being registered companies organized under the laws of republic of vanuatu and hong kong respectively, its successors and assigns, and the party (or parties) executing this document.

General risk disclaimer: trading forex, cfds, and any financial derivative instruments on margin carries a high level of risk and may not be suitable for all investors, as you could sustain losses in excess of your deposits. The company, under no circumstances, shall be liable to any persons or entity for any loss or damage in the whole or part caused by, resulting from, or relating to any transactions related to CFD. GMI edge assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials.

Guide to leverage

Guide to leverage

What is leverage in trading?

Leveraged trading is a powerful tool for CFD traders. It can help investors to maximise returns on even small price changes, to grow their capital exponentially, and increase their exposure to their desired markets. But it is worth noting that leverage can work for or against you. While you stand to earn magnified profits when asset prices go your way, you also suffer amplified losses when prices move against you

When you are trading with leverage, you put a ‘small amount’ down, but you get the chance to control a much larger trade position in the market. The small amount is what is referred to as ‘margin’. The amount of leverage a broker offers depends on the regulatory conditions that it complies with, in any/all of the jurisdictions it is allowed to offer trading services in.

With leveraged trading, the trader need only invest a certain percentage of the whole position. This can change depending on how much leverage the broker offers, how much leverage the trader would like to implement, and it also relies heavily on the regulatory authorities which are tasked with overseeing the online trading industry in that jurisdiction.

Also, traders use leverage depending on their level of experience, investing goals, their appetite for risk, as well as the underlying market they are trading. In most cases, it is professional traders that tend to use leverage more aggressively, whereas new and less experienced traders are generally advised to use leverage with caution. Also, conservative traders will tend to use the minimum level of leverage possible, whereas traders with a high appetite for risk can use leverage flexibly.

The type of market traded can also dictate the amount of leverage traders can use. Volatile markets, such as gold and bitcoin, should be traded with minimal leverage, whereas less volatile assets that do not post wide price fluctuations, such as the EURCHF pair, can be traded with higher leverage levels.

The leverage ratio is a representation of the position value in relation to the investment amount required. At avatrade, forex traders can trade with a leverage of up to . This however, varies depending on your jurisdiction as well as the asset class you are trading.

Consider this: with leverage of 400:1; you can control a $100,000 trade position in the market with just $250! This would mean that a 1% positive price change in the market will result in a profit of $1,000 (1% of $100,000). Without leverage, a 1% positive price movement will result in a profit of only $2.5 (1% of $250). This means that your trade positions and the resulting profits/losses are multiplied 400 times. This is why it is often stated that leverage is a double-edged sword. With trading leverage, profits are magnified, but losses can equally be devastating.

When trading with high leverage, it is very easy to lose more than your capital. But at avatrade, we offer guaranteed negative balance protection which means that you can never lose more than you have in your trading account balance.

What is margin trading?

As explained above, ‘margin’ is the amount of money a broker allows a trader to put down to trade a much bigger position in the market. It is essentially a security deposit held by the broker. When holding trading positions, price changes in the market will lead to changing margin conditions as well. On most platforms, information on the varying margin conditions will be displayed in your trading account. Here are what the various margin definitions and other terminologies mean:

- Account balance

This is the total amount available in your account as your trading capital. It is essentially your trading bankroll.

- Margin requirement

This is what we have discussed above as the amount your broker requires you to put down as a ‘security deposit’ to control a trade position in the market. It is often expressed as a percentage. For instance, if you use a leverage level of 100:1, your margin requirement is 1%. If you use leverage of 400:1, your margin requirement is 0.25%.

- Used margin

This is the amount of money held as ‘security’ by your broker so that you can keep your open trade positions running. The money is still theoretically yours, but you can only access it after the open positions are closed.

- Usable margin

This is the money in your trading account available for opening new trade positions in the market.

- Margin call

A margin call is a notification by your broker that your margin level has fallen below the required level. This is a dreaded call (notification) for traders. A margin call occurs when losses of an open trade position exceed (or are about to exceed) your used margin. When you receive a margin call, you are essentially being asked to add more funds to your trading account to sustain open trades, failing which the broker will proceed to automatically close the open position. For instance, a margin call level of 20% means that your broker will send the margin call notification when your open trades have sustained losses of over 80% of your account balance.

Open your leveraged trading account at avatrade or try our risk-free demo account!

Pros and cons of leveraged trading

Pros of leverage

- Boosts capital. Leverage boosts the capital available to invest in various markets. For instance, with a 100:1 leverage, you effectively have control of $100,000 in trading capital with only $1,000. This means that you can allocate meaningful amounts to various trade positions in your portfolio.

- Interest-free loan. Leverage is essentially a loan provided by your broker to allow you to take a bigger position in the market. However, this ‘loan’ does not come with any obligations in the form of interest or commission and you can utilise it in any manner that you wish when trading.

- Magnified profits. Leveraged trading allows traders to earn magnified profits from trades that go in their favour. Profits are earned out of the trade position controlled and not the margin put down. This also means that traders can earn substantial profits even if underlying assets make marginal price movements.

- Mitigating against low volatility. Price changes in the markets usually occur in cycles of high and low volatility. Most traders like trading highly volatile markets because money is made out of price movements. This means that periods of low volatility can be particularly frustrating for traders because of the little price action that occurs. Thankfully, with leveraged trading, traders can potentially bank bigger profits even during these seemingly ‘dull’ moments of low volatility.

- Trading premium markets. Leverage makes it possible for traders to trade instruments that are considered to be more expensive or prestigious. Some instruments are priced at a premium and this can lock out many retail investors. But with leverage, such markets or assets can be traded and expose the average retail investor to the many trading opportunities they present.

Cons of leverage

- Amplified losses. The biggest risk when trading with leverage is that, like profit, losses are also amplified when the market goes against you. Leverage may require minimal capital outlay, but because trading results are based on the total position size you are controlling, losses can be substantial.

- Margin call risk. The dreaded ‘margin call’ from your broker occurs when floating losses surpass your used margin. Because leverage amplifies losses, there will always be an ever-present ‘margin call’ risk when you have open trading positions in the fast and dynamic financial markets.

Example of leverage trading – retail clients

Let’s look at another example, this time with gold. The price of one troy ounce of gold is $1,327. The trader believes the price is going rise and wishes to open a large buying position for 10 units.

The full price for this position will be $13,270, which is not only a large amount to risk, but many traders do not possess such amounts.

With a 20:1 leverage offered by avatrade, or a 5.00% margin, the amount will decrease substantially. Meaning that for every $20 of worth in the position, the trader will need to invest $1 out of his account, which comes to $663.5 only.

Open your leveraged trading account at avatrade or try our risk-free demo account!

Margin call – how it works

In order to employ leverage, a trader must have sufficient funds in his account to cover possible losses. Each broker has different requirements. Avatrade requires a retail trader to possess equity of at least 50% of his used margin for metatrader 4 and avaoptions accounts.

Going back to the example above, the position’s original value is $13,270; for both metatrader 4 and FX options trading accounts. With leverage, the trader invests $663.5 of his capital, and if he has 50% of this used margin in equity, i.E. $331.75, his positions will be kept opened.

If, however, the trader has losses and his equity drops below 50% of used margin on metatrader 4 and avaoptions accounts, the broker will shut down the client’s position(s), in a “margin call”.

On avaoptions all the client’s positions will be closed, while metatrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 50% of the used margin.

Example of leverage trading – pro/non EU clients

In this example, we’ll take the price of one troy ounce of gold at $1,327. The trader believes the price is going to rise and wishes to open a large buying position for 10 units. The full price for this position would be $13,270, which is not only a large amount to risk, but many traders may not possess such amounts. Using the 200:1 leverage offered by avatrade, or a 0.50% margin, the amount will decrease substantially. Meaning that for every $200 of worth in the position, the trader will need to invest $1 out of his account, which comes to just $66.35.

Margin call – pro/non EU clients

In order to employ leverage, a trader needs to have sufficient funds in his account to cover possible losses. Each broker has different requirements, and avatrade requires a pro/non – EU trader to possess equity of at least 10% of his used margin for metatrader 4 and avaoptions accounts.

Going back to the example above, the position’s original value is $13,270 for both metatrader 4 and FX options trading accounts.

With leverage the trader invests $66.35 of his capital, and if he has 10% of this used margin in equity, i.E. $6.64, his positions will be kept opened.

If, however, the trader has losses and his equity drops below 10% of used margin on metatrader 4 and avaoptions accounts, the broker will shut down the client’s positions.

On avaoptions all the client’s positions will be closed simultaneously, while metatrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 10% of the used margin.

Leverage trading with avatrade

Avatrade offers many instruments, and each has a different leverage available which can also change based on the trading platform you choose to work with. It is important to make sure you know the available leverage before you start trading.

In order to avoid a margin call always make sure you have enough equity in your account’s balance so you can continue your trades undisturbed.

Finally, it’s worth trying out our avaprotect feature. It is a risk management tool that protects your open positionsif you set it up before you open the trade.

It lasts as long as you want it to, and if your trade is losing upon expiry, you will get all the money back into your account, minus the fee you paid for the avaprotect™ facility.

Leverage main faqs

Because avatrade uses a 50% margin requirement and the use of the margin call your risk of excessive trading losses that exceed the total balance of your account is minimized, but it is not eliminated completely. During a period of extreme volatility, it is possible that a position could move so rapidly against you that it is not possible to liquidate a losing position in time to keep your account balance from going negative. To avoid this, we strongly recommend that you manage your use of leverage wisely.

While leverage and margin are closely interconnected, they are not the same thing. Both do involve borrowing in order to trade in the financial markets, however leverage refers to the act of taking on debt, while margin is the actual money or debt that the trader has taken on to invest in financial markets. So, leverage is referred to as a ration, such as 1:30 or 1:100, which indicates how much debt can be taken on to open a position, while margin is referred to as the actual amount borrowed to create the leverage. For example, with 1:100 leverage you can control $100 of an asset with only $1 in margin.

Leverage is a very complex financial tool and should be respected as such. While it sounds fantastic in theory, the reality can be quite different once traders come to realize that leverage doesn’t only magnify gains, but it also magnifies losses. Any trade using leverage that moves against the trader is going to create a loss that is much larger than it would have been without the use of leverage. This is why caution is recommended until more experience with leverage is gained. This can lead to a longer and more prosperous trading career.

Open your leveraged trading account at avatrade or try our risk-free demo account!

We recommend you to visit our trading for beginners section for more articles on how to trade forex and cfds.

Choosing a lot size in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-483658563-5756fd9e5f9b5892e8e0da65.jpg)

When you first get your feet wet with forex training, you'll learn about trading lots. In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. it is important to note that the lot size directly impacts and indicates the amount of risk you're taking.

Lot size matters

Finding the best lot size with a tool like a risk management calculator or something similar with a desired output can help you determine the best lot size based on your current trading account assets, whether you're making a practice trade or trading live, as well as help you understand the amount you would like to risk.

The trading lot size directly impacts how much a market move affects your accounts. For example, a 100-pip move on a small trade will not be felt nearly as much as the same 100-pip move on a very large trade size.

You will come across different lot sizes in your trading career, and they can be explained with the help of a useful analogy borrowed from one of the most respected books in the trading business.

Trading with micro lots

Micro lots are the smallest tradeable lot available to most brokers. A micro lot is a lot of 1,000 units of your account funding currency. If your account is funded in U.S. Dollars, this means that a micro lot is $1,000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents. micro lots are very good for beginners that want to keep risk to a minimum while practicing their trading.

Moving up to mini lots

Before micro-lots, there were mini lots. A mini lot is 10,000 units of your account funding currency. If you are using a dollar-based account and trading a dollar-based pair, each pip in your trade would be worth about $1.00. If you are a beginner and you want to start trading using mini lots, make sure that you're well-capitalized.

While $1.00 per pip seems like a small amount, in forex trading, the market can move 100 pips in a day, sometimes even in an hour. If the market is moving against you, that adds up to a $100 loss. It's up to you to decide your ultimate risk tolerance. But to trade a mini account, you should start with at least $2,000 to be comfortable.

Using standard lots

A standard lot is a 100,000-unit lot. that is a $100,000 trade if you are trading in dollars. Trading with this size of position means that the trader's account value will fluctuate by $10 for each one pip move. For a trader that has only $2,000 in their account (usually the minimum required to trade a standard lot) it means a 20-pip move can make a 10% change in account balance. So most retail traders with small accounts don't trade in standard lots.

Most forex traders that you come across are going to be trading mini lots or micro-lots. It might not feel glamorous, but keeping your lot size within reason relative to your account size will help you preserve your trading capital to continue trading for the long term.

A helpful visualization

If you have had the pleasure of reading mark douglas' trading in the zone, you may remember the analogy he provides to traders he has coached, which he shares in the book. In short, douglas recommends likening the lot size that you trade and how market moves would affect you, to the amount of support you have under you while walking over a valley when something unexpected happens.

To illustrate this example, a very small trade size relative to your account capital would be like walking over a valley on a very wide, stable bridge where little would disturb you even if there was a storm or heavy rains. Now imagine that the larger the trade you place the smaller and riskier the support or bridge under you becomes.

When you place an extremely large trade size relative to your account balance, the bridge gets as narrow as a tightrope wire, such that any small movement in the market would be like a gust of wind in the example, and could send a trader the point of no return.

The definition of leverage and margin

What is leverage?

Leverage means using capital borrowed from a broker when opening a position. Sometimes traders may wish to apply leverage in order to gain more exposure with minimal equity, as part of their investment strategy. Leverage is applied in multiples of the capital invested by the trader, for example 2x, 5x, or higher, and the broker lends this sum of money to the trader at the fixed ratio. Leverage may be applied to both buy (long) and short (sell) positions. It is important to note that any losses will be multiplied as well as profits.

What is margin?

A margin is the relative amount needed to carry out a leveraged deal, taking into account spreads, leveraging, and currency conversions. Let’s say you want to invest $1,000 in apple stock at a leverage ratio of 1:10. The margin will be 10%, meaning you will need to invest $100. If the current stock price for apple is $136, you will receive the equivalent 7.35 apple shares.

How does leveraging work?

- Choose the asset you are interested in trading on the etoro platform and click TRADE. A popup window with the trade parameters will appear, as illustrated below.

- Select the appropriate tab at the top for sell (short) or buy (long) for your trade.

- Set the amount of capital you wish to invest in this trade. Set your leverage multiplier. This ratio differs depending upon the individual asset. Alternatively, you can also trade without using leverage by choosing 1x.

- Set your stop loss and take profit parameters. A stop loss limitation is required in order to mitigate the possible risk to your capital.

- Click SET ORDER to place the trade. Trades are executed immediately when the market is open.

- Leveraged trades are processed as cfds. To learn more about CFD trading, click here.

Which instruments can I apply leverage to?

Leverage may be applied when trading stocks, currencies, etfs, commodities and indices, and, in certain circumstances, cryptocurrencies. Each instrument has maximum leverage limitations which are guided by industry regulations, as well as etoro’s own efforts to promote responsible trading and mitigate the risks of trading with high leverage. For more information on specific limitations, click here.

Maximum exposure will also vary by account type. An etoro professional client account allows for higher leverage. Only clients who meet certain criteria can opt up to become a professional clients. If you wish to read more about professional client status, please click here.

What can I do to minimise risk when trading with leverage?

While trading with leverage can lead to increased profits on successful trades, it also carries the risk of magnified losses. There are, however, risk-management tools at your disposal on etoro to help reduce potential loss.

- Stop loss: apply a stop loss to close a trade in the event that the market moves a specified amount against your position. You can set your stop loss according to a specific level in the market (rate) OR as a monetary amount, also shown as a percentage of your initial investment, in the trade window.

- Take profit: set a take profit order to automatically close your position when profit on your trade hits the amount you choose.

- Negative balance protection: on rare occasions in which market conditions cause your equity to go negative, etoro will absorb the loss and reset your equity to zero.

What are the fees for trading with leverage?

Overnight fees (also called rollover fees) are calculated using unified equations and will appear in the trade popup window before you set your order. To learn more about how these rates are calculated, click here.

Examples of leverage:

On etoro, each instrument has its own leverage minimum and maximum, so make sure to choose a leverage level which is right for you.

- Top instruments

- Bitcoin (BTC)

- Ripple (XRP)

- Amazon shares

- Apple shares

- Gold (commodity)

- NSDQ100 index

- Support

- Help center

- How to deposit

- How to withdraw

- How to open an account

- How to verify your account

- Customer service

- Learn more

- How copytrading works

- Responsible trading

- Avoid scam

- What is leverage & margin

- Buy and sell explained

- Market research

Find us on

- Top instruments

- Bitcoin (BTC)

- Ripple (XRP)

- Amazon shares

- Apple shares

- Gold (commodity)

- NSDQ100 index

- Support

- Help center

- How to deposit

- How to withdraw

- How to open an account

- How to verify your account

- Customer service

- Learn more

- How copytrading works

- Responsible trading

- Avoid scam

- What is leverage & margin

- Buy and sell explained

- Market research

- About us

- About

- Etoro reviews

- Careers

- Our offices

- Privacy and regulation

- Etoro cookie policy

- Privacy policy

- Regulation & license

- General risk disclosure

- Terms & conditions

- Partners and promotions

- Invite a friend

- Affiliate program

- Etoro club

- Partner copyportfolios

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

The purchase of real/cryptoassets is an unregulated service and is not covered by any specific european or UK regulatory framework (including mifid). In the event that cryptoassets are purchased on a real/physical basis and not traded in the form of a CFD you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services license 491139.

Past performance is not an indication of future results.

General risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro - your social investment network.

Copyright © 2006-2021 etoro - your social investment network, all rights reserved.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

Etoro is in the process of registering as a crypto service provider with de nederlandsche bank NV (DNB). Until the application is decided upon, etoro will no longer be able to provide crypto services to users in the netherlands.

The purchase of real/cryptoassets is an unregulated service and is not covered by any specific european or UK regulatory framework (including mifid). In the event that cryptoassets are purchased on a real/physical basis and not traded in the form of a CFD you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services license 491139.

Past performance is not an indication of future results.

General risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro – your social investment network.

Copyright © 2006-2021 etoro – your social investment network, all rights reserved.

Macro 4th midterm practice quiz

Термины в модуле (59)

A. You list the prices for candy sold on your website, www.Candy.Com, in dollars

B. You pay for your NHL tickets with dollars

C. You keep $10 in your backpack for emergencies.

A. You keep some money hidden in your shoe.

B. You keep track of the value of your assets in terms of currency.

C. You pay for your double latte using currency

A. It has $800 in reserves and $16 000 in loans.

B. It has $200 in reserves and $3800 in loans.

C. It has $200 in reserves and $4000 in loans.

A. The money multiplier increases, but the money supply does not change.

B. The money multiplier does not change, but the money supply increases.

C. The money multiplier and the money supply both increase.

A. It would make open-market purchases and lower the bank rate.

B. It would make open-market sales and lower the bank rate.

C. It would make open-market purchases and raise the bank rate.

B. The federal funds rate

A. The quantity of money demanded increases.

B. The quantity of money demanded decreases.

C. The quantity of money supplied increases.

A. The price level and the quantity of money demanded increases.

B. The price level increases, but the quantity of money demanded decreases.

C. The price level decreases, but the quantity of money demanded increases.

A. By selling bonds on the open market, which would have raised the value of money

B. By purchasing bonds on the open market, which would have raised the value of money

C. By selling bonds on the open market, which would have raised the value of money

A. A decrease in the money supply creates an excess supply of money that is eliminated by rising prices.

B. A decrease in the money supply creates an excess supply of money that is eliminated by falling prices.

C. A decrease in the money supply creates an excess demand for money that is eliminated by rising prices.

A. This increase in pay makes your nominal wage increase. If your nominal wage rose by a greater percentage than the price level, then your real wage is also increased.

B. This increase in pay makes your nominal wage increase. If your nominal wage rose by a greater percentage than the price level, then your real wage decreased.

C. This increase in pay makes your real wage increase. If your real wage rose by a greater percentage than the price level, then your nominal wage also increased.

A. The supply of money is irrelevant for understanding the determinants of nominal and real variables.

B. The supply of money determines nominal variables, but not real variables.

C. The supply of money determines real variable, but not nominal variables.

A. The inflation rate would increase by 8 percent, and the nominal interest rate would increase by less than 10 percent.

B. The inflation rate would increase by less than 8 percent, but the nominal interest rate would increase by 8 percent.

C. Both the inflation rate and the nominal interest rate would increase by 8 percent.

Stock calculator for calculating return on investment

This stock total return calculator will calculate the return on investment based on the average periodic dividend (if any) and the price per share when sold.

Stock calculator

Calculate per share rate of return on a stock sale in terms of current yield and annualized holding period yield.

Selected data record:

A data record is a set of calculator entries that are stored in your web browser's local storage. If a data record is currently selected in the "data" tab, this line will list the name you gave to that data record. If no data record is selected, or you have no entries stored for this calculator, the line will display "none".

Monthly "what's new" email update:

Who knows if I will show up in your next search. This will insure you'll always know what I've been up to and where you can find me!

And don't worry. I promise not to share your email address with anyone, and will only use it to send the monthly update.

Important! In order to receive the monthly updates, all three boxes must be checked in the terms, privacy policy, and consent section.

Follow me on any of the social media sites below and be among the first to get a sneak peek at the newest and coolest calculators that are being added or updated each month.

Instructions

How to use the stock calculator

IMPORTANT: numeric entry fields must not contain dollar signs, percent signs, commas, spaces, etc. (only digits 0-9 and decimal points are allowed).

Click the terms tab above for a more detailed description of each entry.

Step #1:

Enter the price per share at the time of purchase.

Step #2:

Enter the number of shares purchased.

Step #3:

Enter the commission paid per share or in total at the time of purchase.

Step #4:

Enter the average dividend per share and select the corresponding frequency.

Step #5:

Enter the number of months you owned the shares.

Step #6:

Enter the price per share at the time of the sale.

Step #7:

Enter the commission paid per share or in total at the time of sale.

Step #8:

Click the "calculate return on stock" button.

Glossary

Fields, terms, and definitions.

Clicking the "reset" button will restore the calculator to its default settings.

Help and tools

Click the ? Tab for help & tools instructions.

Global instructions

Calculator instructions

Calculator fields, terms, and definitions

Save entries and notes

Pocket calculator

Learn

What a stock is, how to calculate stock return, and things to consider before buying stocks.

What is a stock?

The basic definition of a stock is a certificate indicating partial ownership of a company. Unlike bonds (see what are bonds?), where you are granting an interest-only loan to the borrower (you are a lender), purchasing a stock makes you part owner of the company. And the more shares you own of a specific company, the greater your percentage of ownership.

Stocks and bonds from the perspective of companies

When it comes to raising start-up or working capital, either the company can borrow money by issuing bonds, or they can sell off shares of ownership in the company.

In the case of issuing bonds, the company will be obligated to pay periodic interest (coupon payments) on the loans as well as having to pay back the principal borrowed on the day the bonds mature.

In the case of selling off shares of ownership, the company is not obligated to make periodic interest payments (though they may choose to pay periodic dividends) nor are they obligated to buy back the shares.

Stocks and bonds from the perspective of an investor

From an investor's standpoint, investing in bonds typically provides a fixed, periodic income (interest or coupon payments) and in most cases, they can expect to get their initial investment back on or before the date the bond matures.

In the case of investing in stocks, the investor has the opportunity to share in the success of the company rather than just receiving a fixed return on investment. However, if the company goes out of business, the stockholder could lose all of their initial investment. In other words, stockholders share in the profits and the losses.

Why invest in stock?

To make money, of course. But how do you make money investing in stocks? You can make money in one of three ways:

- Income from optional dividends paid by the corporation (distribution of company profits).

- Appreciation of the stock value (increase in share price).

- Stock splits (shares owned are divided into a larger number of shares).

Of course, if you're a shareholder in a company that goes belly up, so will the value of your shares. This is one reason I choose not to invest in stocks of other companies but instead choose to invest in my own company.

How to calculate stock return

Here is the formula you use to calculate stock profit and return on investment (ROI):

profit = [(SP x NS) + DR - SC] - [(BP x NS) + BC)]

| SP | = | selling price per share |

| NS | = | number of shares |

| DR | = | dividends received during ownership period |

| SC | = | total sales commission paid to sell the shares |

| BP | = | buy price per share |

| BC | = | total commission paid to buy the shares |

For example, if you purchased 100 shares at $0.85 per share, paying $10 in purchase commissions, and later sold the shares for $1.20 per share, after receiving $23 in dividends and paying $10 in sales commissions, your stock return on investment would be calculated as follows:

| Profit | = | [($1.20 x 100) + $23 - $10] - [($0.85 x 100) + $10)] |

| profit | = | [$120 + $23 - $10] - [$85 + $10)] |

| profit | = | [$133] - [$95] |

| profit | = | $38 |

| return | = | $38 / (($0.85 * 100) + $10) |

| return | = | $38 / ($85 + $10) |

| return | = | $38 / $95 |

| return | = | 0.40, or 40% ROI |

Why invest in your own stock (business)?

I can't speak for others, but here are the five main reasons I choose to invest in my own business rather than invest in other businesses:

- Stocks too risky: for me, earning high returns without having to work for it falls into the category of "too good to be true." when someone claims the stock market's historical average is a 10%-12% return, they can never tell me how many investors lost all of their money. All I know for sure is that to attempt to earn 10%-12% on my investments; I'm going to have to accept an uncomfortable level of risk.

- More control: as a sole proprietor I have complete control over the company. Owning stock does not allow you any control over what the company does or how it treats its customers.

- Increased percent of profits: I get to keep 100% of the profits. While stock owners can raise a fuss about not getting dividends, it's totally up to the company's board of directors as to whether or not they decide to share profits with stockholders.

- More peace of mind: because I chose my business based on how well it's suited to my talents, abilities, genuine interests, values, and personality traits, I love my work and believe in it's value to others. Stockholders don't get to see employees getting fired or laid off, or how large companies don't seem to care what their actions, products, or cost of products do to individual customers (alcohol, tobacco, gambling, drug, and credit companies, etc.). From my perspective, most large companies seem to care more about the bottom line than they do about their fellow human beings.

- Greater returns: because I work at keeping my expenses low and have worked hard to become completely debt-free, I can earn much higher returns (financial and emotional) with far less risk.

Once you find a work that you love, the last thing you will want to do is to risk losing it. So for me, the risk of losing my savings in the stock market would also put me at risk of being forced out of what I love doing and into something I have to do. Therefore I choose to reinvest a portion of the profits back into my own business, and then invest the rest in minimum risk investments (namely CD laddering).

How is your company doing?

What's that? Do you say you don't have your own business? I beg to differ. Your life, just like my life, is a business in and of itself. We both have the same amount of time available in a day, and we both have time, talents, skills, and abilities that we use to serve others in exchange for income. If you choose to only serve an employer instead of customers, that's up to you. The question is, are you happy about your choice?

If you are not happy with serving an employer, then the only way to change that is to give yourself the financial freedom you need to build your own business during the time you're not at work. The lower your bills and expenses, and the less debt you have, the more freedom you will have to discover and pursue a work that you love and can believe in.

Throughout this site I have been divulging bits and pieces of the steps I took to go from being trapped by debt in a job I hated, to having the financial freedom to work at something I truly love, and in the time and place of my own choosing (you can read my story here). When you boil it all down, the process is as simple as doing the opposite of what most people are doing.

Before investing in stocks

If you are one of those people who can sleep at night while someone else is in control of your destiny, then my advice would be to only invest in stocks once you have a fully funded, government insured emergency fund (3-6 months of household income) and you have paid off all of your high-interest debt.

If you're making minimum payments on 18% credit card debt, then it makes no sense to me as to why you would want to risk losing your hard earned money in exchange for the remote chance to earn a mere 10% return -- so invest in your debt first.

ROI formula (return on investment)

What is return on investment (ROI)?

Return on investment (ROI) is a financial ratio financial ratios financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company used to calculate the benefit an investor will receive in relation to their investment cost. It is most commonly measured as net income net income net income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through divided by the original capital cost capital expenditures capital expenditures refer to funds that are used by a company for the purchase, improvement, or maintenance of long-term assets to improve of the investment. The higher the ratio, the greater the benefit earned. This guide will break down the ROI formula, outline several examples of how to calculate it, and provide an ROI formula investment calculator to download.

ROI formula

There are several versions of the ROI formula. The two most commonly used are shown below:

ROI = net income / cost of investment

ROI = investment gain / investment base

The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio.

The simplest way to think about the ROI formula is taking some type of “benefit” and dividing it by the “cost”. When someone says something has a good or bad ROI, it’s important to ask them to clarify exactly how they measure it.

Example of the ROI formula calculation

An investor purchases property A, which is valued at $500,000. Two years later, the investor sells the property for $1,000,000.

We use the investment gain formula in this case.

ROI = (1,000,000 – 500,000) / (500,000) = 1 or 100%

To learn more, check out CFI’s free finance courses!

The use of the ROI formula calculation

ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. The calculation can also be an indication of how an investment has performed to date. When an investment shows a positive or negative ROI, it can be an important indication to the investor about the value of their investment.

Using an ROI formula, an investor can separate low-performing investments from high-performing investments. With this approach, investors and portfolio managers can attempt to optimize their investments.

Benefits of the ROI formula

There are many benefits to using the return on investment ratio that every analyst should be aware of.

#1 simple and easy to calculate

The return on investment metric is frequently used because it’s so easy to calculate. Only two figures are required – the benefit and the cost. Because a “return” can mean different things to different people, the ROI formula is easy to use, as there is not a strict definition of “return”.

#2 universally understood

Return on investment is a universally understood concept so it’s almost guaranteed that if you use the metric in conversation, then people will know what you’re talking about.

Limitations of the ROI formula

While the ratio is often very useful, there are also some limitations to the ROI formula that are important to know. Below are two key points that are worthy of note.

#1 the ROI formula disregards the factor of time

A higher ROI number does not always mean a better investment option. For example, two investments have the same ROI of 50%. However, the first investment is completed in three years, while the second investment needs five years to produce the same yield. The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option.

The investor needs to compare two instruments under the same time period and same circumstances.

#2 the ROI formula is susceptible to manipulation

An ROI calculation will differ between two people depending on what ROI formula is used in the calculation. A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs, property taxes, sales fees, stamp duties, and legal costs.

An investor needs to look at the true ROI, which accounts for all possible costs incurred when each investment increases in value.

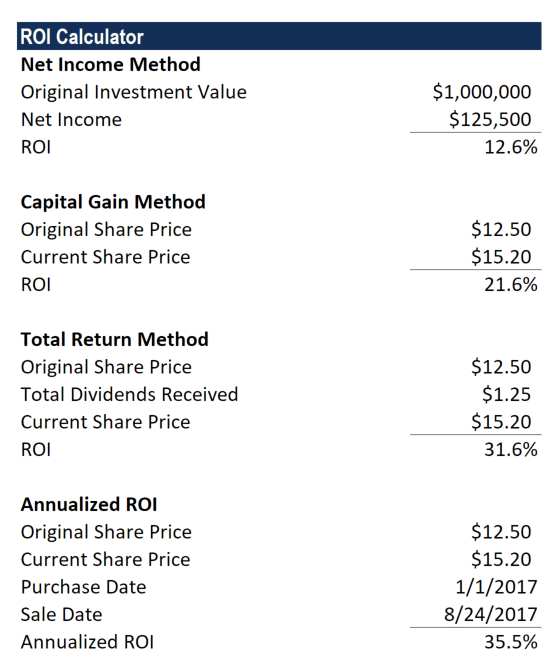

Annualized ROI formula

As mentioned above, one of the drawbacks of the traditional return on investment metric is that it doesn’t take into account time periods. For example, a return of 25% over 5 years is expressed the same as a return of 25% over 5 days. But obviously, a return of 25% in 5 days is much better than 5 years!

To overcome this issue we can calculate an annualized ROI formula.

ROI formula:

= [(ending value / beginning value) ^ (1 / # of years)] – 1

# of years = (ending date – starting date) / 365

For example, an investor buys a stock on january 1st, 2017 for $12.50 and sells it on august 24, 2017, for $15.20. What is the regular and annualized return on investment?

Regular = ($15.20 – $12.50) / $12.50 = 21.6%

Annualized = [($15.20 / $12.50) ^ (1 / ((aug 24 – jan 1)/365) )] -1 = 35.5%

ROI formula calculator in excel

Download CFI’s free ROI formula calculator return on investment excel calculator this return on investment excel calculator will aid you in calculating the return on investment for different scenarios. Return on investment is one of the most important profitability ratios to asses a companies performance. Here is a snippet of the template. Use this calculator to easily calculate the ROI when you h in excel to perform your own analysis. The calculator uses the examples explained above and is designed so that you can easily input your own numbers and see what the output is under different scenarios.

The calculator covers four different ROI formula methods: net income, capital gain, total return, and annualized return.

The best way to learn the difference between each of the four approaches is to input different numbers and scenarios, and see what happens to the results.

Download the free template

Enter your name and email in the form below and download the free template now!

Video explanation of return on investment/ROI formula

Below is a video explanation of what return on investment is, how to calculate it, and why it matters. You’ll learn a lot in just a couple of minutes!

Alternatives to the ROI formula

There are many alternatives to the very generic return on investment ratio.

The most detailed measure of return is known as the internal rate of return (IRR). Internal rate of return (IRR) the internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment. This is a measure of all the cash flow received over the life of an investment, expressed as an annual percentage (%) growth rate. This metric takes into account the timing of cash flows, which is a preferred measure of return in sophisticated industries like private equity and venture capital private equity vs venture capital, angel/seed investors compare private equity vs venture capital vs angel and seed investors in terms of risk, stage of business, size & type of investment, metrics, management. This guide provides a detailed comparison of private equity vs venture capital vs angel and seed investors. It's easy to confuse the three classes of investors .

Other alternatives to ROI include return on equity (ROE) return on equity (ROE) return on equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders' equity (i.E. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity. And return on assets (ROA) return on assets & ROA formula ROA formula. Return on assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. This ratio indicates how well a company is performing by comparing the profit (net income) it's generating to the capital it's invested in assets. . These two ratios don’t take into account the timing of cash flows and represent only an annual rate of return (as opposed to a lifetime rate of return like IRR). However, they are more specific than the generic return on investment since the denominator is more clearly specified. Equity and assets have a specific meaning, while “investment” can mean different things.

Read more about rates of return

Thank you for reading this CFI guide to calculating return on investment. CFI is the official global provider of the financial modeling analyst designation FMVA® certification join 350,600+ students who work for companies like amazon, J.P. Morgan, and ferrari . To continue learning and advancing your career, these additional CFI resources on rates of return will be helpful:

- Return on equity (ROE) return on equity (ROE) return on equity (ROE) is a measure of a company’s profitability that takes a company’s annual return (net income) divided by the value of its total shareholders' equity (i.E. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity.

- Return on assets (ROA) return on assets & ROA formula ROA formula. Return on assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. This ratio indicates how well a company is performing by comparing the profit (net income) it's generating to the capital it's invested in assets.

- Internal rate of return (IRR) internal rate of return (IRR) the internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.

- DCF modeling DCF model training free guide A DCF model is a specific type of financial model used to value a business. The model is simply a forecast of a company’s unlevered free cash flow

Financial analyst training

Get world-class financial training with CFI’s online certified financial analyst training program FMVA® certification join 350,600+ students who work for companies like amazon, J.P. Morgan, and ferrari !

Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Learn financial modeling and valuation in excel the easy way, with step-by-step training.

So, let's see, what we have: investors use leverage to significantly increase the returns that can be provided on an investment and companies use leverage to finance their assets. At opening a trade with $100 and 20x leverage will equate to $2 000 investment

Contents of the article

- Actual forex bonuses

- How leverage works in the forex market

- Understanding leverage in the forex market

- Types of leverage ratios

- Forex leverage and trade size

- The risks of leverage