Ripple broker

It is easy to open an account on the avatrade’s platform and you can be up and be trading in a matter of minutes.

Actual forex bonuses

The greatest advantage of working with avatrade is that the broker provides a large amount of educational material, especially to those who are not very conversant with trading. The online forex broker offers more than 250 trading instruments, including fiat currency, cryptocurrency, bonds, and cfds.

- It is one of the most liquid cryptocurrencies

- It is traded 24 hours a day and 365 days in a year

- It helps to diversify your investment portfolio

- As a potential safe haven asset, it allows you to hedge against fiat currency, government, and central bank failures

- In terms of market capitalization, it is the third largest cryptocurrency

Fxdailyreport.Com

Ripple is the third largest digital currency in terms of market capitalization. It is an incredible instrument for trading. However, you should trade ripple (XRP) only with a reputable forex broker. Well-established platforms that offer ripple trading come with the following advantages:

- Deep liquidity

- Fair dealing

- Ease of opening account, deposits, and withdrawals

- Many order types

- Best customer support services

- Better software, hardware, and connectivity

- Superior execution speeds

- Smart and reliable order execution

- Proven and robust trading platforms

Why should you trade ripple

The price of the digital currency has exceeded the highest expectations. It has grown exponentially in a very short period of time. In addition to yielding extremely high returns, ripple trading offers a few other benefits as follows:

- It is one of the most liquid cryptocurrencies

- It is traded 24 hours a day and 365 days in a year

- It helps to diversify your investment portfolio

- As a potential safe haven asset, it allows you to hedge against fiat currency, government, and central bank failures

- In terms of market capitalization, it is the third largest cryptocurrency

How to trade ripple

Ripple can be traded on forex brokers’ platforms as contracts for difference or cfds which is same as trading most other financial instruments such as commodities, forex currency pairs, and stocks. When trading ripple, you can make use of features like stop loss, take profit, and many offered by reliable platforms.

The best way of trading ripple is with minimum leverage on forex brokers’ platforms. It is best if no leverage is used at all. The buy-and-hold trading strategy has yielded fantastic results to those that are involved in trading ripple. It is possible to successfully employ short-term trading strategies when trading ripple.

Top brokers that offer ripple (XRP/BTC or XRP/USD) trade

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: €100 spread: the spread can be as low as 0.01%” (0.01% = spread for EUR/USD) leverage: 1:294 regulation: ASIC, cysec, FCA (UK) | visit broker | ||

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker | |

| min deposit: $100 spread: fixed and variable leverage: 300:1 regulation: cysec, FSB | visit broker |

Another way of trading ripple is through cryptocurrency exchanges. In order to buy and sell ripple on exchanges, you need to have a wallet account with a unique address. A wallet is same as your bank and the address of your wallet will be your account number. Cryptocurrency exchanges offer clients with free wallets for the purpose of conducting business.

For buying ripple on an exchange, it is important to use a fiat currency or other digital currencies. All exchanges provide a list of vendors that offer ripple for sale. Each vendor might offer a different price. They also accept different payment methods.

Whether you choose a forex broker platform or a cryptocurrency exchange, you should spend some time and put in the required effort to do some research and ascertain that you are going to work with one that suits your needs the best. This is because working with the best forex brokers and exchange platforms for ripple trading is essential for achieving success. Having said this, here are some of the ripple trading platforms recommended by us:

Etoro, a multi-asset and social trading brokerage, has registered offices in israel, the UK and cyprus. The brokerage has a worldwide reach and is regulated in all the markets. Retailfx came into existence in 2006 in tel aviv. Etoro openbook was set up in 2010 with the copy trading feature as a social investment platform, enabling traders to follow, view, and replicate the trades of top investors in the network. Etoro boasts of more than four million active users and allows individuals to trade in forex, stock cfds, and cryptocurrencies.

Founded in 2009, XM has more than 1,000,000 clients and is a well-established investment firm. XM provides support services in more than 30 languages and the platform can be used by newbies and professional traders. The online fore trading platform provider makes available 7 asset classes, 16 platforms, and more than 300 instruments for trading. Clients can trade forex, commodities, precious metals, equity indices, individual stocks, energies, and cryptocurrencies. XM has its registered office in london, belize and is regulated by IFSC belize; FCA UK; cysec, cyprus; and ASIC, australia.

The forex trading platform of plus500, founded in 2008, is provided by plus500cy ltd., which is a company based in cyprus and has its headquarters in limassol. Plus500 offers cfds on shares, commodities, indices, forex, etc. As far as cryptocurrency trading is concerned, the broker offers cfds in BTC/USD, ETH/USD, XRP/USD, LTC/USD, DSH/USD, and XEM/USD.

The brand instaforex was launched in 2007. Currently, the forex broker has more than 3,000,000 customers. Further, over 1,000 customers open accounts every day. They enable ECN forex trading, contracts on derivatives, and other instruments. When it comes to cryptocurrency trading, they offer cfds in BTC/USD.

In forex trading, avatrade is by far the most recognized online currency trading platform provider. The regulated forex broker is dedicated to providing customized trading solutions to its clients irrespective of their prior knowledge or experience.

It is easy to open an account on the avatrade’s platform and you can be up and be trading in a matter of minutes. The greatest advantage of working with avatrade is that the broker provides a large amount of educational material, especially to those who are not very conversant with trading. The online forex broker offers more than 250 trading instruments, including fiat currency, cryptocurrency, bonds, and cfds.

The chinese cryptocurrency exchange binance is fairly new to the digital currency market, but it has gained a great of popularity in a short period of time because of its initial coin offerings and low trading fees. The exchange has the ability to process about 1.4 million orders in a second. It is the fastest exchange on the market.

You can use the platform for buying several digital currencies, including bitcoin, bitcoin cash, ethereum, ethereum classic, EOS, dash, bitcoin gold, litecoin, NEO, GAS, dash, ripple, and zcash, among others. Currently, they offer trading in cryptocurrency pairs in ETH, BTC, BNB, and USDT.

Compare brokers for trading ripple

For our trading ripple comparison, we found 6 brokers that are suitable and accept traders from united kingdom. Disclaimer: availability subject to regulations.

We found 6 broker accounts (out of 147) that are suitable for trading ripple.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Plus500

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About plus500

Platforms

Funding methods

71.4% of retail CFD accounts lose money

Etoro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About etoro

Platforms

Funding methods

71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

73% of retail investor accounts lose money when trading cfds with this provider

Admiral markets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About admiral markets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

What is ripple?

Ripple (or XRP) is the native digital asset of a funds transfer system built around the ripple transaction protocol (RTXP). This open-source web protocol provides a cost-efficient method for value to be exchanged between parties around the globe in real-time. It is used by banks and other institutions requiring on-demand liquidity and making cross-border payments, as well as market makers. The concept was originally formed by ryan fugger in 2004, and developed by the corporation, opencoin, in 2012, who rebranded as ripple in 2015.

The ripple protocol relies on a distributed database or ledger, which contains account balances and details of offers to trade currencies and assets. Independent servers from verified institutions compare transaction records and maintain the ledger by consensus. This contrasts to the mining process used by bitcoin and some other cryptocurrencies. XRP acts as a bridge currency, allowing currency pairs to be traded when there is no direct exchange available; and is an asset which, like other assets, can be traded.

Advantages of trading ripple with a regulated online broker

XRP is available from many exchanges. Some consumers are reluctant to use exchanges after the mt. Gox liquidation in 2014. This was a bitcoin exchange that filed for bankruptcy after the theft of 850,000 bitcoins. At the time, this represented 7 percent of all bitcoins, with a total worth of US$ 473 million. Regulation of exchanges in many countries is still under development. As a result, funds held on exchange platforms may be subject to loss if the platform fails.

In contrast, strict requirements are placed upon regulated brokers. To protect consumers. Companies such as avatrade, therefore, offer clients a more secure trading environment. In the UK, the financial conduct authority regulates brokers and avatrade has european economic area authorisation, recognised by the FCA. Requirements for brokers include high accounting standards and the maintenance of sufficient operating capital. Client funds are also kept in separate accounts, sequestered from business funds.

Trading through exchanges can also affect market price. Brokers are able to trade outside the market by matching buyers and sellers. This allows traders to buy assets, such as XRP, without influencing prices.

The fundamental influences of ripple

Increasing numbers of institutions use the ripple protocol. Last year, ripple partnered with a japanese consortium of banks to create a payment network. In september 2016, ripple announced another interbank group, the global payments steering group, for global payments. It includes bank of america, merrill lynch and other big names. More recently, in april 2017, ripple announced that ten additional financial institutions have joined their network. Ripple partners include the likes of CIBC, deloitte, earthport, mizuho, santander and standard chartered.

XRP is one of the largest cryptocurrencies in the world, after bitcoin, ethereum and dash. XRP were all created in a single event and there is a fixed number of 100 billion. Ripple, the company, owns about 61 percent of XRP. Traders have voiced concerns that ripple may flood the market with XRP. In response, ripple CEO brad garlinghouse announced that 55 billion XRP will be put into escrow during 2017.

On june 8, 2017 the price of XRP was US$ 0.2953 and the total market capitalisation was US$ 11 billion. XRP has increased 4,500 percent since january 1, 2017, when it opened at US$ 0.006523 and BTC 0.00000677.

Ripple quick facts

- Ripple was founded in 2012 and is based in san francisco, california.

- XRP are also called ripples. The smallest currency unit is 1 millionth of 1 ripple, known as a drop.

- XRP began trading at US$ 0.005874 and BTC 0.00005594 on august 4, 2013.

- On may 17, 2017 XRP traded at US$ 0.4224 and BTC 0.0002372, the highest to date. The 24-hour volume was US$ 478 million.

- The current 30-day XRP volume stands at US$ 5.75 billion.

- First broker to include ripple as a trading instrument: avatrade.

Want to trader other cryptocurrencies? You can read more cryptocurrency broker comparisons here:

Why choose XTB

for trading ripple?

XTB scored best in our review of the top brokers for trading ripple, which takes into account 120+ factors across eight categories. Here are some areas where XTB scored highly in:

- 16+ years in business

- Offers 1,500+ instruments

- A range of platform inc. MT4, mirror trader, web trader, tablet & mobile apps

XTB offers three ways to tradeforex, cfds, social trading. If you wanted to trade RIPPLE

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

XTB have a AAA trust score. This is largely down to them being regulated by financial conduct authority, segregating client funds, being segregating client funds, being established for over 16

Trust score comparison

| XTB | avatrade | plus500 | |

|---|---|---|---|

| trust score | AAA | AAA | AA |

| established in | 2002 | 2006 | 2008 |

| regulated by | financial conduct authority | central bank of ireland, ASIC, IIROC, FSA, FSB, UAE and BVI | financial conduct authority (FRN 509909) and cyprus securities and exchange commission (license no. 250/14). Plus500au pty ltd (ACN 153301681), licensed by: ASIC in australia, AFSL #417727, FMA in new zealand, FSP #486026; authorised financial services provider in south africa, FSP #47546 |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of XTB vs. Avatrade vs. Plus500

Want to see how XTB stacks up against avatrade and plus500? We’ve compared their spreads, features, and key information below.

Best ripple trading brokers 2021

The brokers below represent the best ripple trading features

Trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of USD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of USD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

75% of retail CFD investors lose money

Market maker, no dealing desk, STP

75% of retail CFD investors lose money

Here’s a list of the best ripple trading brokers

FP markets

.png)

Headquarters : level 5, exchange house 10 bridge st sydney NSW 2000, australia

This brokerage offers a massive range of tradable assets through forex, CFD, and share trading accounts. FP markets supports the MT4, MT5, and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spread or commission pricing.

FP markets was founded in 2005 and is headquartered in sydney, australia. It is regulated by by the ASIC in australia. Demo accounts are available. While it is suitable for beginners, education resources are limited.

IC markets

Regulated by: ASIC, cysec, FSA(SC)

Headquarters : international capital markets pty ltd level 6 309 kent street sydney NSW 2000, australia

Trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of USD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets was founded in sydney, australia in 2007 and is regulated by the australian securities and investments commission (ASIC), as well as the seychelles financial services authority (FSA). According to the broker’s website, they processed $646 billion worth of trading volume in april 2019 alone.

While the broker offers services and features designed for both beginner and professional traders, the company promote themselves as the ‘go to’ choice for high volume traders, scalpers and trading algos due to their new york equinix NY4 data centre – processing over 500,000 trades per day.

Etoro

Regulated by: ASIC, cysec, FCA, mifid

Headquarters : kanika international business center 7th floor, 4 profiti ilia street germasogeia, limassol, cyprus

75% of retail CFD investors lose money

Etoro is an online trading platform that was founded in 2007 by the assia siblings and their friend david ring in tel aviv, israel. Formerly known as retailfx, etoro is the pioneering online broker for social trading.

Their openbook social trading platform in fact changed the nature of the way beginner online traders can trade the financial markets. It made the markets accessible to everyone, no matter what their level of experience by creating a user-friendly environment and allowing traders to copy the trades of other traders’ strategies automatically.

What is ripple?

Ripple is a new cryptocurrency with the symbol XRP. Ripple is the world’s only enterprise blockchain solution, designed to enable global payments from financial institutions using cryptocurrency. Ripple was designed to take care of the inefficiencies of today’s global payment systems.

In an era where there has been a lot of innovation and development of technology that has transformed the turnaround time of many tasks, the system of a wire transfer in banks has still remained largely unchanged from the pre-internet days. These days, you can send an email to someone from a smartphone wherever you are in the world and expect the data transfer to last only seconds, leading the other party to receive the email less than a minute later. However, it still takes days to wire money from part of the world to another. The main issues with wire transfers are the following:

- They are slow, taking between 3-7 days for full settlement to occur.

- They are expensive, incurring large transaction costs that are estimated to run into trillions of dollars on an annual basis for all global transactions.

- They have become less of an efficient payment solution due to the time it takes to conclude.

- Cross-border transactions require currency exchange, which can add to the cost of the transactions if the exchange rate fluctuation works against the sender.

- About 4% of wire transfers fail.

Ripple was therefore built to solve these payment problems by connecting payment providers, banks, digital exchanges and corporate organizations using ripplenet, ripple’s cryptocurrency network. The aim is to provide a seamless, frictionless experience when sending money across the world.

So what are supposed to be the key advantages that ripple offers as an alternative payment solution?

- The number one advantage that the ripple technology is meant to offer is speed. Instant, on-demand settlement is meant to be the unique selling proposition of ripple, cutting transaction times for bank payments from days to mere seconds.

- Ripple is meant to offer low transaction costs and lower operational costs by eliminating the need for paperwork, staff resources, intermediary banks, etc.

- Ripple offers connectivity across several networks.

- Ripple will make it easier and faster to track transactions and trace funds, thus enhancing the fight against illicit financial flows.

Ripple is built on a more advanced blockchain technology than bitcoin, and in august 2017, briefly became the 3 rd most valuable cryptocurrency after bitcoin and ethereum. It presently lies in 3 th place after the price took a little bit of a hit. Ripple (XRP) benefited from the price appreciation most of its peers experienced in the 1 st and 2 nd quarters of 2017. It is believed that increased adoption of XRP by financial institutions will boost its demand going forward.

Ripple trading explained

In order to expand its user base not just for individual users but also to include institutional clients, ripple announced a partnership with cryptocurrency exchange bitgo for the development of enterprise-grade wallets which will incorporate high-end security features to match the highly advanced requirements for institutional users. These enterprise grade wallets will provide a better and more secure platform for financial institutions to be able to offer cryptotokens for cross-border payments.

Many more exchanges are coming on stream to offer XRP on their networks. The enhanced user base from these expansions will create a dynamic in terms of supply and demand for XRP tokens. These supply-demand dynamics will then create price shifts that will make XRP a tradable instrument across exchanges and trading platforms. These changes have therefore marked a paradigm shift from the company’s initial core business, which was strictly on providing an alternative way for financial institutions to support cross-border payments.

What does this indicate? Interest in trading XRP has increased substantially from pre-2017 levels. The price changes which followed can be said to be as a result of the following factors:

- A carry-on effect from the price gains of other cryptocurrencies such as bitcoin and ether.

- An indication of possible adoption by financial institutions. It is on record that at least 70 financial institutions worldwide have been signed up on the ripple network. Some of these banks include spain’s BBVA (sponsors of la liga, the spanish premier league), MUFG (japan), axis bank (india), akbank in turkey and SEB in sweden. Others include heavyweights such as bank of america, UBS, standard chartered and RBC.

With the increased interest in XRP exchange comes the opportunity to trade XRP as cryptocurrency cfds. These contracts-for-difference assets enable traders to predict price differentials without having to hold the XRP tokens. Trading XRP as a CFD comes with some advantages.

- You can profit from rising and falling prices when trading XRP as a CFD. This is unlike exchange-based XRP transactions where gains are only made when the trader buys at a lower price and resells at a higher price.

- Access to technical analysis tools and charts can provide a market edge by showing the way to better entry and exit points.

- All transactions on crypto cfds are executed instantly.

- You can use eas plugged to virtual private servers to carry out your trades.

- Ripple cfds can be traded on leverage.

How to buy and sell ripple online

XRP can be bought and sold online using the following means:

- Buy and store XRP in online wallets, then resell at a higher price.

- Trade XRP as a CFD asset on forex platforms.

Where to buy and sell ripple

The currency on which transactions can be carried out across ripplenet is ripple (XRP). Ripple can be mined and traded. It can also be bought from exchanges and resold at a higher price. The third marketplace for ripple exists on forex platforms where XRP is listed as a CFD asset, usually in a pairing with the US dollar.

Exchanges

To be able to buy or sell ripple on cryptocurrency exchanges, you must have a wallet with a unique wallet address. The wallet is like your bank, and the wallet address like your bank account number; it is personal to you. Exchanges offer their clients free wallets to be able to conduct business. Majority of the exchanges offering XRP have a large south korean base.

In order to buy XRP on an exchange, you have to purchase it using your fiat currencies or with digital payment solutions. A list of vendors who have XRP for sale is usually listed on each exchange. Each vendor has a different price and will accept various payment methods.

Exchanges usually have a list of verified sellers who will post how much they are selling XRP for the various fiat and digital currencies. This allows the buyer to choose from a list of prices and to select the price that will be favorable for the transaction.

Trading platforms

XRP contracts can be traded as cfds on several trading platforms. These platforms basically list the various contracts that feature XRP as a paired asset.

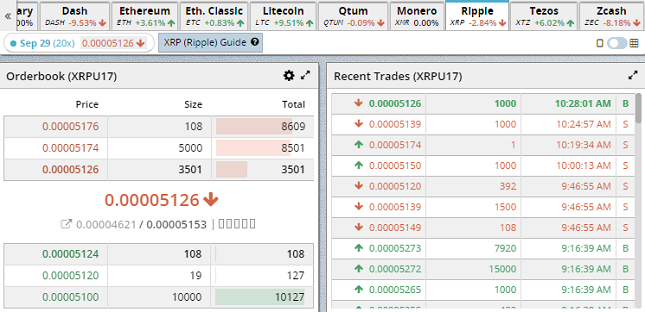

The list above shows the various pairings of the XRP asset, which provides various kinds of trading opportunities. These assets can all be traded with leverage.

If you are using a trading platform which supports the programming and use of eas, then, by all means, you can use your EA to trade any of the XRP pairs. It is important to note that majority of these platforms are owned by market makers. So traders should observe the rules of using market maker platforms, one of which is that not many of them allow eas or scalping techniques.

Payment methods for ripple trading

You need to have an acceptable payment method to enable you to trade with ripple on an exchange or on a trading platform.

For exchanges, you can buy ripple using the following methods:

- Credit/debit cards

- Paypal

- Digital wallets such as skrill, neteller, okpay, yandex. Money, etc.

- Bank wires (SWIFT and SEPA). This method is restricted as not all banks work with ripple exchanges.

Ripple trading sites, brokers & software

A ripple exchange is a marketplace where ripple can be bought or sold in exchange for fiat currency, digital currencies or other cryptocurrencies. The strategy is to purchase at lower prices, hold for appreciation of price and resell for a profit.

Due to the much lower number of exchanges offering XRP, it can be a challenge selecting the best ripple exchange for your business. There are several factors which must be considered. These are as follows:

- What country or region are you located in? In some countries, it is difficult to send fiat currency using the banks to the cryptocurrency exchanges. It is even outlawed completely in a few countries.

- Where you have the means of sending money to an XRP exchange, what are the transaction costs?

- What are your chances of withdrawing your money after trading?

When it comes to transaction options, here is what can be done.

- Use a bank account to purchase your ripple instantly. Some exchanges have restrictions on what banks they do business with.

- Buy bitcoin (BTC) and use it to purchase your ripple. This can work if you use exchanges that are cryptocurrency-based. Some exchanges prefer to deal with cryptocurrencies only so as to avoid regulatory red tapes associated with using banks.

- Setup a foreign bank account with an exchange that permits transactions from this account. This option may not work with many people and is obviously not available for certain countries.

- Use a digital payment solution such as skrill or neteller.

The financial systems in asia are better suited to work on ripple exchanges. Those in north america are not because there are many regulatory red tapes.

Advantages

- Transactions are not leveraged, which allows the trader to purchase XRP in quantities they can truly afford and at risk levels, they can manage.

- Transaction costs are lower than in XRP CFD trading.

- Get pricing of ripple from several sources. This gives you a choice of what prices will benefit you the most. Some sellers simply want money desperately and can sell to you at cheap prices you will not get on CFD platforms.

A major advantage of using exchanges is that many of them now offer mobile apps that can be downloaded from the ios store or from the google play store.

Conclusion

In conclusion, we present the best ripple trading brokers for 2017. Even though there are traders who would want to trade solely on the exchanges, as well as others who would like to trade XRP cfds exclusively, it is advocated to be active on both sides of the divide. This is because the knowledge gained from technical analysis of the XRP CFD asset on trading platforms can equally be used to great advantage on the exchanges.

In coming up with this list, we considered brokers and exchanges that could come up with the following:

- Sound regulation and a track record of transparency, honesty, and openness in trade operations.

- Brokers with transparent pricing and not pricing meant to skew the market against traders.

- Brokers whose platforms permit the use of the automated trading software.

- A system of verification to separate genuine traders from scammers.

- A track record of traders being able to fund and withdraw money from their accounts.

- Brokers that offer seamless and stress-free transaction/payment methods.

- Exchanges that offered a good variety of payment channels so that any trader anywhere in the world would be able to buy or sell ripple in their local currencies or at least currencies/digital payment systems that could be purchased with their local currencies.

Ripple trading: A beginners guide with regulated brokers

Risk warning: your capital is at risk.

If you have a basic understanding of what ripple is, you may be interested in trading it.

We explore some reasons why you may or may not want to trade ripple, followed by a list of regulated broker recommendations.

If you want to own ripple instead of trading it as a derivatives instrument like ripple options or cfds, you can see our list of exchanges where you can buy it outright.

In a hurry? If you want to get started trading ripple, here are brokers available in :

Disclaimer: availability subject to regulations.

Should I trade ripple?

We explored some of ripple’s features and position in the market to come up with some reasons you may or may not want to speculate on price movements.

Reasons you might want to trade ripple

- Exclusively designed as a payment platform

- Ripple focuses technological developments on B2B

- Near-instant interbank settlement

Important: this is not investment advice. We present a number of common arguments for and against investing in this commodity. Please seek professional advice before making investment decisions.

Exclusively designed as A payment platform

Unlike most cryptocurrencies, the ripple platform is designed in such a way that it can handle the whole transaction cycle.

Users are not dependent on using third-party services, third-party exchanges, or wallets to make a transaction and then have the money converted back to local currency on the other end.

Ripple focuses technological developments on B2B

Ripple is designed to be able to be compliant with banking security, risk and privacy requirements such as anti-money laundering (AML), and know your customer (KYC) practices.

Businesses also operate under similar requirements meaning they would not have to go out of their way and create their own compliance policies.

Without other cryptocurrencies, they would be bound to such compliance policies.

This allows ripple more scope to engage with financial services businesses and bring them into their platform.

Near-instant interbank settlement

Ripple offers almost instant settlements for interbank transactions. Currently, most interbank settlements, be they international or local, occur on the SWIFT network or local networks that operate in a similar fashion.

As sophisticated as these networks are, they rely on decades-old infrastructure and best practices that cannot compete. A SWIFT payment from one bank to another relies on intermediary banks to act as middlemen.

This adds unnecessary cost and elapsed time to each transaction that as a result can take days to clear. In contrast, a ripple payment can clear across borders within seconds .

Reasons why you may not trade ripple

Following the SEC’s filed lawsuit against ripple in december 2020, coinbase suspended XRP trading. Blockchain.Com likewise halted XRP trading, along with etoro’s social trading platform. While the immediate future of ripple is uncertain, the cryptocurrency has proven to be valuable for retail and institutional investors alike and should surpass regulatory obstacles in the long term.

Two main reasons traders may choose not to trade ripple are:

- Dependence on exposure via mainstream financial companies

- Narrow user appeal and few unique selling points

Important: this is not investment advice. We present a number of common arguments for and against investing in this commodity. Please seek professional advice before making investment decisions.

Dependence on exposure via mainstream financial companies

Ripple labs have ambitiously been working on providing solutions to the financial services industry since before bitcoin was invented, and as such have not made as many inroads as expected.

Ripple is still a cheap buy with a lot of upside price potential, but its price is also heavily influenced by external events.

If the financial services industry decides to get behind ripple in a big way, this would have a huge bearing on the price.

However, this hasn’t happened yet and the market remains volatile and hanging on the next news article that relates to its adoption.

Narrow appeal & few unique selling points

Most cryptocurrencies benefit from their users becoming the biggest users and advocates of their platforms – the more users that buy-in, the more the platform makes an impact on the market.

On the other hand, ripple has a much narrower and pre-defined use case that narrows its metrics for success.

This means that ripple users are more likely to feel a type of disconnect as the success of the platform is more reliant on the efforts of ripple labs’ ability to bring financial services partners on board than it is on its holder’s enthusiasm and advocacy.

Where can I trade ripple?

One preferred option is to not buy ripple at all and instead to trade contracts for difference (cfds) using a regulated broker.

CFD contracts allow you to speculate on price movements without owning the asset. If you want to learn more about ripple before you dive in, see our general guide to ripple.

Other derivatives products with ripple include options, futures, and forwards, though not many brokers offer these.

IMPORTANT: cfds are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

Ripple brokers available in

Here’s a list of regulated options available in that offer cfds and other trading products on cryptocurrencies such as ripple.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 71.00%-89.00% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Please note: availability subject to regulations. Cryptocurrency cfds are not available to UK retail traders.

Exchanges: how to buy and own ripple

So you’ve decided that you want to take the plunge and own ripple. The next step is to figure out how to acquire some XRP.

What is the best way to buy ripple?

The best way to buy ripple is to first buy bitcoin using fiat currency through an exchange. You can then trade this BTC for XRP.

Here is a list of exchanges where you can do this:

| Exchange | description |

|---|---|

| binance | exchange hundreds of coins, buy futures and leveraged tokens, crypto loans |

| bitfinex | crypto exchange, margin trading, crypto derivatives �� �� |

| bitmex | crypto exchange, futures, perpetuals, 100x leverage on some derivatives �� |

| coinbase | crypto exchange, get paid to learn about crypto, offers USD coin �� |

| huobi | crypto exchange, 5x leverage for spot trading, futures, swap, C2C lending �� |

| kraken | crypto exchange for traders at all levels, many crypto derivatives �� |

| okex | crypto exchange, spot, futures, perpetual swap, and derivatives trading, cold and hot wallets �� |

| stormgain | crypto exchange, low fees and 200x multiplier on crypto futures �� �� |

| �� = built-in cryptocurrency wallet |

Some exchanges also allow you to deposit your native currency like EUR, AUD, or USD, with which you can purchase ripple directly. Another common currency pair on cryptocurrency exchanges is USDT-XRP.

What drives the price of ripple?

Major cryptocurrencies tend to rise and fall in tandem. Ripple is no exception. If you see a big rise or fall in the value of bitcoin or ethereum then there’s a high likelihood for ripple to follow.

As with all other cryptocurrencies, ripple is volatile. You should expect to see fairly dramatic fluctuations in value.

What role does the media play in ripple prices?

Media interest plays a big role in the price of ripple.

As cryptocurrencies hit the headlines large numbers of new traders tend to pour in. This inflates the value of cryptocurrencies across the board.

This kind of rise is usually followed by a pronounced dip as early traders engage in profit-taking. You should keep a close eye on the headlines when deciding how to trade ripple.

How does mainstream and financial adoption impact prices?

Ripple, in particular, sees large boosts when it is adopted by established financial institutions.

XRP saw a surge in value in may of 2017 when SBI ripple asia announced the creation of a japanese bank consortium designed to facilitate cross-border payments.

Ripple is also prone to regulation aimed at curtailing cryptocurrencies but its role as a bridging currency provides it some protection.

Will china’s hostility towards some cryptocurrencies obstruct ripple?

You should also keep an eye out for changes in asia, while china has recently become more hostile to cryptocurrency ripple’s utilitarian nature may mean that it could be taken up by firms like alibaba.

Firms can then facilitate faster payments.

The key driver of ripple prices will always be the overall network usage, even if it isn’t directly P2P. The more support that ripple’s open network gains the more value your ripple trade will take on.

Further reading

To learn more about the history of ripple as a cryptocurrency, see our general ripple cryptocurrency guide.

If other cryptos interest you and you want to learn where you can trade them, see these trading guides on bitcoin cash, verge, zcash, dash, NEO, and decred.

Here are a few useful articles to scan through before you begin trading ripple:

- How to avoid crypto scams with our guide.

- Learn about technical analysis indicators, concepts, and patterns.

- Guides on CFD and crypto brokers to find out which online trading platforms are available in your country.

Marko has been a digital nomad for over 5 years, and is currently based in europe. Alongside writing and editing, marko works on projects related to online technology and digital marketing.

Top 10 online brokers for ripple trading

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

- Trade on 12,000+ markets including bitcoin

- Trade anytime, anywhere. Across all devices

- Risk management & transparent pricing

- Fast execution on every trade

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

With markets.Com get ZERO commission trading on cryptocurrency, forex and commodity cfds with one of the most sophisticated trading platforms in the industry.

- No commission trading

- Use paypal to trade bitcoin futures

- Advanced innovative trading platforms

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

The beginner’s guide on how to buy, sell, and trade ripple

Ripple trading 101

One of the new decentralized cryptocurrency projects that have been making waves in the crypto community is ripple or XRP. Although ripple’s price still lags far behind bitcoin and ethereum, it has nevertheless gained 3,800% in recent months, which brings it to the 4th spot on the list of more than 100 cryptocurrencies with regard to market capitalization. Perhaps what is even more important is the technology that ripple provides aside from its currency. The protocol for the ripple blockchain has gained recognition by more than 60 major financial institutions across the globe.

While with bitcoin, anyone can keep, send, and receive bitcoins over a decentralized network, and from all over the world with low fees, ripple’s aim is that anyone can do the same also with any other currency.

What is ripple

To help you get started, it is useful to look at ripple as being entirely different from bitcoin. Ripple isn’t a consumer-facing product; rather it is back-end infrastructure. It is not a current; it’s an open-source, global exchange. Anyone can access it, and everyone can equal rights to use it. Ripple, the company, doesn’t control the network, limit access, or collect fees.

Ripple is a distributed and real-time payment protocol for anything of value. It is a shared public database, with a distributed currency exchange that is built-in, and it operates as the first universal translator for money in the world. XRP is currency agnostic, and it has a foreign exchange component that’s built straight into the protocol. Ripple acts as a pathfinding algorithm for finding the best route for a dollar to become a pound or for airline miles to become bitcoin. It looks at all the orders in the global order book. Anyone can place a bid-ask on anything of value. The protocol is designed to direct every transaction to the lowest price that’s available on the market.

Ripple vs bitcoin

There are several similarities between bitcoin and ripple, in addition to some major differences.

Each uses a different method for reaching network consensus. Ripple uses an iterative consensus process, and bitcoin uses proof-of-work (mining). The result is that ripple is quicker than bitcoin, only taking a few seconds to finalize the transactions. Also, compared to bitcoin, ripple is more energy efficient.

Both cryptocurrencies are decentralized. Bitcoin is a decentralized digital currency whereas ripple is a decentralized transaction network. Ripple also contains a digital currency known as ripples or XRP.

The bitcoin network monitors and tracks the movement of bitcoins, and the ripple network can track all types of information. As a result, ripple can track the account balances of any existing currency.

Bitcoin requires centralized exchanges, like mt. Gox for example. The ripple network acts a decentralized exchange. Therefore, if someone is looking to sell their XRP for USD, they can do so within the network, without needing a third party. This is helpful to bitcoiners too: they can trade bitcoin on the ripple network without fear that an exchange will go down and disrupt the market.

How to buy ripple

Even though ripple has a long way to go, considering its expansion pace, one should consider buying XRP. XRP’s value is increasing considerably as more and more financial institutions are adopting it or they are in the process of utilizing it as a payments gateway for investments and transfers. Also, XRP is making it to cryptocurrency fund portfolios, which will help to strengthen its position further.

One can buy or sell XRP on most major cryptocurrency exchanges. Also, the digital currency can be purchased on cryptocurrency brokerage platforms or through a wallet provider or exchange. You can also buy ripple as a contract for difference (CFD) from a regulated broker online. You can view our top recommendations on our list above.

Trading ripple cfds

When you buy ripple as cfds, you don’t need to worry that your XRP will get stolen. Cfds are a derivative product. Any of the potential profits are based on the movement of the ripple price. But, there is no actual XRP purchased.

Ripple trading

For traders of all levels cryptocurrency trading can be highly profitable. Since the cryptocurrency market is relatively new, highly fragmented and has huge spreads, the arbitrage and margin trading are widely available.

Ripple has become the leading competitor to bitcoin. Now you can trade ripple with some of the top online brokers.

When you buy ripple online as a CFD with a regulated broker, you can buy or sell instantly, or you can trade long or short. This then gives you the additional advantages of being able to act on your analysis of the future of digital currency.

If you want to buy ripple XRP, you can take a look above at our top broker recommendations, and be sure to read our reviews to get more in-depth information.

How to choose an online broker to trade or buy ripple

Because there’s so much competition in the cryptocurrency exchange market as well as having countless brokers and exchanges to choose from. It can be difficult to know which option will work best for you. Here are a few things to keep in mind before deciding on the right broker to trade ripple:

Regulation

Use a regulated CFD broker or exchange. The regulatory body develops rules and services protect the integrity of the market, as well as traders, and investors, such as the FCA in the UK. Due to possible safety concerns, you should exclusively open accounts with regulated brokers.

Customer service

Cryptocurrency trading happens 24 hrs a day, so customer support should be available at all times. You’ll want to be able to speak with a live support person. The representative’s ability to answer your questions regarding spreads and leverage, as well as company details is very telling. The details of a good broker should be out in the open for everyone to see, either online or otherwise.

Account types

An ideal cryptocurrency broker should be able to offer clients multiple account options or provide an element of customizability. Look for a broker that offers competitive spreads and easy deposits/withdrawals.

If you want to buy XRP online it will, of course, cost money. However, unlike buying stocks or bonds, CFD brokers generally charge a percentage to buy ripple. You may consider looking for a broker that charges a flat rate fee instead of the percentage model.

Liquidity

Because ripple is traded in a market where people are both looking to buy or sell the digital currency, it’s crucial to consider the amount of liquidity that an exchange can have. Liquidity is the ability to sell without the price being significantly affected, causing the price to drop.

Here at topbrokers.Trade, we take pride in providing the best possible online trading broker comparison, reviews and ratings. These reviews enable you to select the best trading platform for your needs. We don’t just help you to pick a great place to trade, but also do everything that we can, to show you how to get started. For more information on cryptocurrency trading, please see our tutorial: the basics of cryptocurrency

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Ripple investing in the UK 2021

Ripple is one of the most popular cryptocurrencies in the world by trading volume, but what makes its history and technology different from those of its competitors? Before you start investing in ripple in the UK, it’s worth taking the time to research the asset. To help you get started, we’ve covered the basics below, as well as chart analysis, day trading risks and the best ripple coin trading platforms in 2021.

Note, the financial conduct authority banned the sale of crypto-derivative products such as cfds in the UK from january 2021. Fortunately there remain alternative ways to invest in the digital coin, including longer-term investing strategies, explained further below.

Ripple brokers

What is ripple?

Ripple (XRP) was released in 2012, by chris larsen and jed mccaleb and is the third-largest crypto coin by market cap after bitcoin and ethereum, at over $13.09 billion. The XRP daily trading volume today is around $8.39 billion.

Since the coin’s creation, ripple inc. Is now more widely known for its cross-border digital payment system, ripplenet. The system allows for cheap and fast money transfer in any fiat or digital currency and is operationally comparable to the SWIFT payment system.

Whilst XRP trading activity has been generally steady over the last few years, the success of ripple inc. Has been particularly notable. The system is now used by over 300 financial institutions, including santander and moneygram. Rumours on several ripple trading news sites have also suggested that the start-up is preparing to launch its own trading platform.

What makes ripple unique?

Unlike other cryptocurrencies like bitcoin and litecoin, ripple does not use blockchain mining or proof-of-work systems to verify and confirm transactions. Instead, it uses a consensus protocol through a group of servers. The consensus is managed by a small committee of validators who maintain the transaction ledger.

As a result, ripple transactions are less costly and more energy-efficient than bitcoin. Ripple transactions are also confirmed by validators in 3 to 5 seconds, compared to bitcoin’s 10 minutes. Furthermore, ripple is owned by a private company, ripple inc., whereas bitcoin and other cryptocurrencies are not controlled by a central authority.

Why trade ripple?

- Leveraged trading – margin trading allows you to increase your position size without needing to deposit the full XRP trading value. Leverage ratios can be fairly high at some brokers, up to 1:30 in line with FCA regulations, which can maximise profits if used correctly.

- Volatility – cryptocurrencies are a highly volatile market and therefore can be profitable. Volatility exists because digital assets like XRP are still relatively new in the financial world and are not widely regulated. This uncertainty means that the true value of XRP is difficult to determine.

- Established brokers – as the third most popular cryptocurrency in the world, you can trade ripple pairs at numerous leading brokerages in the UK. Make sure to choose a transparent and trustworthy broker who is well-established in the market.

- Trusted – several renowned banks are already using the ripplenet system, including the bank of america, UBS and santander. As the list grows, ripple’s reputation and profile will continue to rise.

- Low fees – trading cryptocurrencies is generally low in costs, with small transactions fees and minimum order requirements. Compared to other coins, XRP also has a very low cost per coin of $0.29 at the time of writing, which is particularly inviting for long-term buy and hold investors.

- Similar to FX – intraday trading of both forex and cryptocurrencies have some notable similarities. If you’re already familiar with applying risk management techniques and day trading strategies to forex investing, then XRP trading shouldn’t feel like a completely new ball game.

Risks of trading ripple

- Leverage – trading XRP or any other asset with leverage can increase your losses if not properly understood. It’s worth noting that with margin trading, you can lose more than your original deposit.

- Volatility – whilst volatility can open up profitable opportunities, it can also lead to losses. Ripple and other cryptocurrencies are high risk products which can change rapidly within the space of just a few minutes.

- Unknown market – cryptocurrencies are a new financial market which are still relatively misunderstood compared to forex and other assets. Consequently, the future of ripple and other cryptocurrencies remains ambiguous.

- Regulations – the cryptocurrency market is still widely unregulated and is not overseen by a central authority, leading to issues like wash trading. In many nations, rules are still emerging which can affect how coins like XRP can be traded. In the UK, for example, it is now against the law for regulated brokerages to distribute and sell crypto-derivatives such as cfds, options and futures to retail clients. Other standard insider trading regulations also apply.

How to start trading ripple

1. Look at price data

Before you start trading ripple (XRP), you will need to familiarise yourself with the trading volume and price history of the asset. You can find detailed XRP information on a live trading volume chart, an essential price analysis tool. Most charts also come with a range of timeframes and indicators that you can apply and customise.

Etoro ripple trading chart

An XRP trading volume graph can also help you to forecast any future trends which could be profitable. You can find the ripple trading coin symbol at any reputable trading platform or exchange. A tradingview chart is an excellent example, which also offers XRP investing ideas and tips, as well as a forum.

2. Choose A broker

The quality of your broker or exchange will also significantly impact your trading experience, so make sure to do your research before signing up. You should consider how much you are willing to pay in fees and what other additional features you could benefit from.

Crypto trading costs are generally based on maker and taker fees, which depend on whether your order is filled immediately or not. At binance, for example, maker and taker fees range from 0.02% to 0.10%. Binance also acts as an XRP trading exchange and wallet if you simply want to buy, sell or hold coins.

Some sites also offer additional social or educational tools, such as telegram or a community help centre. If you’re new to trading, these can act as excellent training grounds, where you can gain valuable insight from other experienced traders.

3. Make A deposit

Your broker will likely require a minimum deposit when opening an account. This is usually available via bank transfer and credit card with fiat currencies, but some will also allow you to deposit using other cryptocurrencies.

Beginners should start trading with a small amount, until they are more accustomed to the platform and how trading works. Note that the broker might also charge fees on deposits and withdrawals. Transaction times may also vary.

4. Strategies

Strategies and risk management techniques are a vital element of trading. Make sure to also utilise any demo accounts offered by your provider. These can be a great tool for practicing your strategies before committing to real trading.

Technical analysis

Technical analysis is the process of studying historical prices to identify trends and predict future price movements. Market psychology is a huge factor in these trends, which often gets repeated over time. Analysts take this into account when applying certain tools to their charts.

Trend lines, for example, can give you a good initial impression of the direction of the trend (upwards, downwards or sideways). These can be applied on top of your standard candlestick charts to show any linear patterns. You could also use moving average lines which, when crossed over on the chart, will suggest a potential future uptrend.

Financial and economic news is also a significant catalyst to price movements of cryptocurrencies, especially given their uncertain and volatile nature. At the end of 2020, for example, ripple saw a 63% crash in the space of four days, after a high-profile lawsuit was filed against the start-up by the US securities and exchange commission.

Short-term vs long-term

If you’re new to cryptocurrency trading, then long-term investing might be a good choice for you. This is also known as HODL (‘hold on for dear life’) investing, whereby you buy at a low price and ride bullish trends until the price is high enough to sell. This is a far easier strategy than intraday trading in the short-term, but it depends on your outlook and appetite for risk.

Whilst long-term investing requires little effort and time, it does require patience, which might not suit someone who would be tempted to sell too early. Long-term traders are also at risk of mis-timing the market, as they get drawn in when prices and excitement are high.

Short-term trading, on the other hand, can be extremely risky, with more opportunities for traps and crashes. Cryptocurrency markets are far more volatile and changeable than forex or stocks, for example. As a result, short-term trading requires a lot of effort, capital and a solid understanding of technical analysis.

Nonetheless, short-term trading can present significant opportunities if you know how to play the markets. It can allow you to take small but consistent gains, as long as the time and effort is invested.

Risk management

Whilst risk is unavoidable in any kind of trading, there are ways you can manage it effectively. The first and most important consideration is that you should never risk more than you can afford to lose. Some experts advise that you should not use more than 10% of your budget. From here, there are three main strategies that you should employ.

First, consider your position size, which takes into account how many XRP coins you are willing to initially invest and how much you can afford to lose if the trade fails. There are several methods for achieving this, including the kelly criterion or the ‘sharks and piranhas’ approach.

You should also consider the risk/reward ratio, which compares the actual level of risk against the potential returns. The ratio therefore allows you to understand when to enter a trade. A lower ratio would represent a higher level of risk. Experts suggest that you should not trade with a ratio lower than 1:1.

Finally, you should always try to employ stop loss and take profit orders. Stop losses will close an open position if the price drops and reaches a certain level, whilst take profit will close positions when prices rise to a certain point.

If you want to trade ripple (XRP), look out for a trading platform or app that can facilitate stop loss and take profit orders. Some investing websites also offer a trading calculator which can determine risk levels for you.

Ripple automated trading

To boost your XRP trading strategy, using automated investing tools like a ripple trading bot can help to uncover profitable opportunities. These tools use trading signals and algorithmic technology to eliminate the psychological and emotional limitations of investing.

More importantly, crypto bots like cryptohopper allow you to track ripple price trends and use expert trading tools without needing to know how to code. You can also backtest any new strategies until they are effective.

Cryptohopper is available on most of the top XRP trading platforms, exchanges and names, including coinbase pro, trading 212, binance, bitfinex, robinhood, and kraken. Other ripple and crypto trading bots worth looking out for include zignaly and 3commas.

Ripple wallets

Whether you’re looking to trade XRP or you simply want to hold the coins, a secure crypto wallet is essential. There are a range of wallets you can use, depending on how frequently you need to access your coins.

Hot wallets are connected to the internet and are ideal if you trade regularly. Cold wallets, on the other hand, are physical devices which need to be manually connected to your PC for access.

Hot wallets

The most popular hot wallets are apps which you can install on to your mobile device or access from your desktop. Whilst these are highly convenient, they are not the safest method of storage, as they can attract viruses and hackers. Some of the most popular ripple online wallets include atomic wallet and cryptonator. Note that some apps may charge a small operational fee for transactions.

Cold wallets

Cold wallets are generally physical devices, such as a hard drive or USB. These are much safer than online wallets but are not the most convenient for regular traders. The ledger nano S is the most popular hard wallet device among traders. Make sure to purchase directly from a trusted supplier and do not buy second-hand devices.

Ripple vs bitcoin

The main difference between ripple and bitcoin is the technologies they use and the way that they are created.

Bitcoin is blockchain-based and is validated using a proof-of-work (pow) system, known as mining. Ripple, on the other hand, uses a consensus ledger and a network of servers to validate coins. Therefore, where bitcoin’s mining process is managed by thousands of miners around the globe, the ripple network is managed by just a small group of trusted validators.

Furthermore, as ripple doesn’t use a mining process, it also means that it can facilitate transactions quicker than bitcoin. This means ripple is arguably less secure than other cryptocurrencies, because the network is effectively centralised.

Another key difference is the supply of coins. Bitcoin has a hard cap of 21 million units, which are gradually mined over years. Ripple has a fixed supply of 100 billion units, which were minted at the start of the network launch.

Ripple taxes

In the UK, CFD assets, including cryptocurrencies, are exempt from stamp duty. However, you may still be subject to capital gains tax or income tax if your profits exceed the tax-free allowance.

Note that there are no taxes on buying and holding cryptocurrencies in the UK, but you should take note of your transactions for when you eventually sell your assets.

You can find more information around crypto trading taxes in the UK on the GOV.Uk website.

Final word on ripple investing in the UK

Ripple is not your typical cryptocurrency, compared to the likes of bitcoin and litecoin, which means XRP day trading can be both exciting and perilous. Either way, make sure you have fully considered your strategy and risk management tools.

Whether you’re taking a short-term or long-term outlook, it’s important to analyse price data and volume charts on trading platforms such as tradingview or coinbase. These will help you track the history of the market and forecast potential opportunities.

What is ripple trading?

Ripple is both a digital coin (XRP) as well as an online payment system managed by ripple inc. XRP trades can be executed using a variety of strategies, such as intraday trading, long-term investing or by using bots. You can trade XRP BTC and other pairs on popular platforms like coinbase or binance.

When did ripple start trading?

The XRP network of coins was first released in 2012 and today remains the third-largest cryptocurrency by market cap. Ripple inc. Pre-mined a total supply of 100 billion coins when the network was first released, with over 45 billion currently in circulation. Ripple can be traded against traditional fiat currencies like USD, along with other cryptos such as BTC.

When can I trade ripple?

As with all cryptocurrencies, ripple (XRP) trading hours are 24 hours a day, 7 days a week. This means there is no set time to start and no specific XRP halt to indicate when to stop trading. This differs to traditional forex and stock trading, which are defined by their respective stock market opening hours.

Is it worth buying ripple?

Whilst it is not as popular as bitcoin or ethereum, ripple has gained momentum in recent years, with over 300 financial institutions joining the ripplenet system, including santander, moneygram, azimo and american express. The low cost per XRP coin has also been inviting for many new investors.

Is ripple better than bitcoin?

Technically, ripple’s blockchain network performs faster and is more powerful than bitcoin’s. This does not necessarily mean that XRP will outrun bitcoin’s overall performance, as bitcoin continues to hold the top spot on global rankings.

Bitcoin, ETH, ripple, interactive brokers record darts: editor’s pick

ICYMI: the biggest news stories of the week

In another week dominated by events in the crypto sphere, here are the top news stories from the worlds of forex, crypto and fintech in our best of the week segment.

Is it too late to buy bitcoin? Here’s what the experts think

In a popular finance magnates analysis, we asked the opinions of leading names such as rubix chief executive, andrew hamilton, investor, entrepreneur, and author, shanka jayasinha, brandon mintz, chief executive of bitcoin depot and borys pikalov, co-founder of stobox.Io.

No stone was left unturned in looking at the viability of buying bitcoin now at its record price.

Anonymous bitcoin user transfers 9,156 BTC just before the crash

Bitcoin price crashed below $30,000 on monday as the world’s largest cryptocurrency lost $50 billion in market cap within hours. One anonymous bitcoin user transferred 9,156 BTC worth nearly $300 million just an hour before the crash started.

According to the details provided by whale alert, a blockchain tracker and analytics system, an unidentified crypto holder transferred 9,156 bitcoin on monday 4 jan 2021 06:59:39 UTC, barely an hour before the recent dip in the cryptocurrency market which saw losses of up to 15%

Coinbase exchange down again as bitcoin volatility heats up

As bitcoin recovered from a sharp correction, coinbase reported its retail and professional-focused platforms were hit by ‘connectivity issues’, with users reporting difficulty trading and logging into their accounts.

According to a company update, coinbase said the website and mobile apps are not loading, adding that it is “currently investigating the issue,” but no further comment was provided.

Grayscale sells XRP to buy bitcoin and ethereum

Grayscale, the world’s largest crypto asset management firm, announced that it has removed XRP from its investment fund. The company added that it has used the new funds to buy other crypto assets including bitcoin, ethereum, litecoin and bitcoin cash.

According to the official announcement, grayscale digital large cap fund (DLC fund) decided to remove XRP in its quarterly review and mentioned that no other digital asset qualified for the inclusion. Additionally, the company outlined the current composition of the fund, which includes bitcoin (81.6%), ethereum (15.9%), litecoin (1.4%) and bitcoin cash (1.1%).

Ripple has no control over XRP listing, says brad garlinghouse

As finance magnates covered this week, ripple CEO, brad garlinghouse released a statement in response to some of the uncertainties regarding the recent lawsuit filed by the SEC. He said that 95% of XRP trading is happening outside the US and the company cannot decide where to list the cryptocurrency.

According to a twitter thread by garlinghouse, ripple tried to settle the issues with the SEC in the past but failed to reach a successful agreement. Additionally, he also mentioned that the company will continue its efforts to settle the matter with the new administration to support the XRP community.

Why is the price of ETH so high – and how long will it last?

In a must-read finance magnates analysis, we delved deep into the burning questions of the week, what exactly is driving the price of ETH up? And will the rally last?

Suggested articles

The participants in forex trading and their role in the marketgo to article >>

With expert insights from will mccormick, director of communications at global cryptocurrency exchange, okcoin, maria stankevich, chief business development officer at EXMO UK, jamie finn, president & co-founder of securitize and tim sabanov, the lead technical architect at zumo, we broke down ETH, its rises and its future.

Exclusive: XTB registers new dubai subsidiary, awaits DFSA license

As finance magnates exclusively revealed this week, polish FX brokerage, XTB is seeking a license from the dubai financial services authority (DFSA) after it has incorporated its new subsidiary, XTB MENA limited, in the dubai international financial center (DIFC).

The DIFC’s website shows that the registration status of the new spin-off is ‘active’ while its regulatory application is ‘pending’ DFSA authorization.

Interactive brokers’ fee-generating trades set new record in december

Interactive brokers LLC (NASDAQ: IBKR) announced this week a new milestone growth, this time with the number of fee-generating trades exceeding 2.3 million in december amid a surge in activity from people stuck at home during the coronavirus pandemic.

This is about three times the number of daily average revenue trades, or DARTS, reported in the same month a year ago.

The US-listed brokerage saw 2.29 million in darts last month, which was up 200 per cent year over year from 771,000 transactions in december 2019. This figure, which reflects one of widely followed industry metrics for customer activity, is slightly higher from the previous record set back in november at 2.29 million transactions.

Exclusive: IG south africa appeals FSCA decision as ODP licence denied

In yet another finance magnates exclusive, we revealed intriguing new details on IG’s pursuit of expanding its regulatory footprint in south africa.

IG group releases brexit update for EEA clients

IG group released a brexit update this week for its european economic area (EEA) clients and asked them to transfer their accounts to IG europe as the broker recently announced that its UK entity will no longer service clients from the EEA region due to brexit.

According to the official announcement, the company stated that the process of transfer requires identity verification of clients before 8 january 2021. The broker mentioned that in case of failure of transfer or identity verification, the account will be closed.

Ripple trading: A beginners guide with regulated brokers

Risk warning: your capital is at risk.

If you have a basic understanding of what ripple is, you may be interested in trading it.

We explore some reasons why you may or may not want to trade ripple, followed by a list of regulated broker recommendations.

If you want to own ripple instead of trading it as a derivatives instrument like ripple options or cfds, you can see our list of exchanges where you can buy it outright.

In a hurry? If you want to get started trading ripple, here are brokers available in :

Disclaimer: availability subject to regulations.

Should I trade ripple?

We explored some of ripple’s features and position in the market to come up with some reasons you may or may not want to speculate on price movements.

Reasons you might want to trade ripple

- Exclusively designed as a payment platform

- Ripple focuses technological developments on B2B

- Near-instant interbank settlement

Important: this is not investment advice. We present a number of common arguments for and against investing in this commodity. Please seek professional advice before making investment decisions.

Exclusively designed as A payment platform

Unlike most cryptocurrencies, the ripple platform is designed in such a way that it can handle the whole transaction cycle.