Fx brokers

The forex brokerage business has undergone a lot of evolution in the last decade. The global financial crisis of 2008 and the events that happened thereafter have reshaped the industry.

Actual forex bonuses

At about the same time, new technologies came up and also contributed to the evolution of the forex market and forex brokerage business. It is important for traders to understand what forex brokerage is all about and how it will affect their trading ventures. Before we get to meet the best forex brokers for 2021, it is pertinent to identify the role that forex brokers play in a trader’s career and why it is important to go with a forex broker that can match your circumstances and aspirations. Once traders get established on the platforms using trader educational resources, their trading activities can be sustained via the provision of market research tools, analysis and news feeds. Many brokers have incorporated this into their offerings as well. For the trader, this is a good thing.

Best forex brokers for 2021

Brokerage companies are scattered all over the world and have many differences in trading conditions, products and services. Some companies are regulated, others are not. Some have been around for decades, others are rather young. Certain brokers work as market makers and have fixed spreads, others provide STP or ECN accounts with direct market access and offer a much larger selection of underlying assets for trading. This site was created to help you find the best forex brokers for your specific needs and requirements. There are several sections and filters in the menu on the left. These can be used to create a custom list of entities with preferable parameters and characteristics. If you find a certain broker you are currently trading with or have used before, feel free to share your experience about it in the comments section meant for forex broker reviews.

The forex brokerage business has undergone a lot of evolution in the last decade. The global financial crisis of 2008 and the events that happened thereafter have reshaped the industry. At about the same time, new technologies came up and also contributed to the evolution of the forex market and forex brokerage business. It is important for traders to understand what forex brokerage is all about and how it will affect their trading ventures. Before we get to meet the best forex brokers for 2021, it is pertinent to identify the role that forex brokers play in a trader’s career and why it is important to go with a forex broker that can match your circumstances and aspirations.

Role of forex brokers

Forex brokers have several roles to play in the market. These roles have also evolved over time, as traders demand a lot more from their trading providers. Forex companies now perform the following roles:

A) access to the market

This is the core role of the forex broker. The forex market is a virtual market with no physical location. At the centre of forex market operations is the interbank market, where the big banks offer various currency pairs for sale. Professional and individual traders therefore do not have to proceed to a physical location to trade, but rather have to have a means of accessing the interbank market. They can only gain access to the interbank forex market using software known as platforms. These platforms are provided by the forex brokers. So without the brokers, nobody can get access to the forex interbank market to trade.

Access can be provided directly using the ECN/STP platforms (also known as direct market access platforms), or indirectly using the market maker platforms that route orders to the broker’s dealing desk. Traders should as much as possible, try to understand the implications of getting direct access to the FX market on one hand, and getting indirect access on the other. The type of access granted will determine factors such as amount of capital to start with, as well as the trading styles and processes to be adopted.

B) trader education

This is gradually but surely becoming a very important element of the forex broker’s functions. Research has shown that 90% of retail traders will lose 90% of their accounts in 90 days. This is a well-established market statistic. Majority of the losing traders (if not all) are traders who are uneducated about the market and who do not understand how to trade profitably. These will end falling by the wayside. No broker wants to spend money acquiring clients, only to have them quit the market after decimating their accounts in 90 days. With brokers realizing that such an arrangement is not good for business in the long run, many of them are now investing significantly into trader education. Videos, articles and webinars are the common means by which beginner traders are given an introduction into the forex market.

C) market research

Once traders get established on the platforms using trader educational resources, their trading activities can be sustained via the provision of market research tools, analysis and news feeds. Many brokers have incorporated this into their offerings as well. For the trader, this is a good thing.

Criteria to consider in choosing a forex broker

The criteria for choosing a forex broker have evolved over the years. While there are still some elements that are critical to the choice and which have remained constant over time, there are other parameters which have emerged and which will be considered below.

1. Spreads/commissions

Spreads are the primary cost to the trader. Lower costs mean that the trader will have a chance to retain more profits, or at least reduce the losses that may be incurred. Competitive spreads are now a factor used in broker selection. It may not be immediately obvious how much savings on spreads can translate to, but high volume traders such as scalpers know that when up to 300 trades are placed in a month, then savings from reduced spreads can be substantial.

2. Leverage

Leverage in forex is now a big deal. What started off in 2010 when leverage caps were introduced in the US by the commodities and futures trading commission (CFTC), has now been extended into the united kingdom and europe. Retail traders in the UK and EU have seen leverage caps reduced from as high as 1:500, to just 1:30 for major forex pairs. Minor pairs and cfds have even tighter leverage limits. This has increased margin requirements significantly. However, some brokers outside these jurisdictions have continued to maintain the high leverages, thus attracting traders who were caught out by ESMA’s decision. Some of the UK/EU brokers have also opened international divisions, where their international client accounts are being migrated to. So traders now have a choice of operating with the low leverage brokers, or the high leverage ones.

3. Regulation

Regulation will continue to remain a key factor in broker selection. Regulation ensures that traders are protected and that the trading environment is transparent and secure. The brokers presented on this site are regulated in their respective areas of operation, which ensures that traders who open accounts with them are assured of safety of their funds.

4. Broker type

A mention has earlier been made about direct and indirect access to the interbank market. As a trader, you need to know how each type of access will affect you. Market makers provide indirect access because they buy positions from the interbank market and resell them to their clients using a dealing desk. Market makers usually require smaller amounts of starting capital, provide fixed spreads, and tend to have more slippages and requotes. They provide a low barrier for market entry.

ECN brokers on the other hand, provide direct market access. They require large amounts as initial capital, provide variable spreads, but do not have slippages and requotes. However, they charge commissions on trades in addition to spreads. At the end of the day, the trader’s financial capacity will determine if a market maker or an ECN broker will be selected for the trading venture.

5. Trading resources

Trading resources are generally tools that are provided by a broker to enhance the trading experience and potentially improve a trader’s trading outcomes. More is not always better. In this case, it is about finding the broker that has the right mix of trading resources that cover analysis, news and market insight.

6. Customer support

Customer support can now be offered using a variety of means that were not in existence 10 years ago. Social media channels such as facebook and twitter, as well as messaging apps such as telegram can now serve as channels for receiving near-immediate responses from a broker’s customer support desk. Choose a broker with a diversified customer support structure which deploys these new means of communication.

Our list of forex brokers

The list below features best forex brokers selected by us for 2021 year. This list has been prepared after due consideration of all the factors mentioned above. In this list, you will find many brokers that are offshore brokerages with high leverage, or offshore divisions of EU/UK brokerages that can provide high leverage trading platforms to their clients. Feel free to read our forex broker reviews and make an informed choice based on the contents of this website.

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex through does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

2. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

5. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

6. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

7. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

8. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

Forex brokers for US traders (accepting US clients)

Below you will find a list of forex brokers accepting US traders as clients. Due to the strict and complicated regulatory environment, it became quite a challenge for FX companies to operate in the US. To make it worse, thanks to the dodd-frank act and the memorandum of understanding, many licensed forex brokers all over the world stopped accepting US clients. Still, there are some offshore countries where local authorities haven't yet imposed the restrictions. Unfortunately, most unchained brokers are not regulated, although that’s exactly the reason why there’s an opportunity to open a trading account with them. Notable benefits of going offshore: no hedging prohibition, no FIFO rule application and trading leverage is much higher.

Over the last decades, the forex market in the US has emerged as one of the most regulated markets anywhere in the world. Rules that were introduced and backed up by federal laws have made it very difficult for brokers and traders alike to operate in the US forex market. For many years, only three brokers operated in the US forex market: oanda, GAIN capital LLC (forex.Com) and TD ameritrade. Others were either put out of business or were forced to close down as a result of the strangulating environment created by the regulators, backed up by the dodd-frank wall street reform and consumer protection act of 2010.

What changed?

After the global financial crisis of 2008 which had its origins in the US subprime mortgage market, there were general calls for better regulation of the various markets operating in the united states. The dodd-frank act was a direct consequence of this agitation. This law strengthened the commodities and futures trading commission, enabling it to oversee not just the conventional financial markets, but also the swaps market which was valued in trillions of dollars.

Changes to the way business was conducted in the US financial markets were sweeping and aggressive. Some of the changes which were directly targeted at the retail segment of the market were as follows:

- A) introduction of leverage caps in forex and options, pegging leverage at 1:50 for forex majors, and 1:20 for forex minors, and forex options trading.

- B) elimination of hedging ability via the introduction of the first in, first out (FIFO) rule. Thus rule states that a position on an asset must first be closed before another can be opened on the same asset. The FIFO rule effectively ended the hedging style of traders placing opposing positions on the same asset.

- C) stratification of traders in the FX market was institutionalized, as these rules were targeted at the so-called “unsophisticated’ investors, defined as traders with assets that are less than $10million, as well as small businesses. Professional and commercial traders (investment banks) were largely exempted from these changes.

According to the CFTC, these rules were meant to protect the retail clients from overexposing their money to the market and from taking excessive risk. But to what extent these rules have actually protected the retail consumers of forex products in the US is anyone’s wildest guess.

What the regulators of the US financial markets will not readily reveal, is that many traders in the US simply exited the US market and migrated their accounts to brokerage platforms in other countries. Forex brokers located in the US have had whatever market share they had badly eroded, and brokers without the kind of purposeful structure that the former US brokers suddenly emerged as less desirable but ready alternatives to traders who were unwilling to trade under the new conditions in the US.

In other words, the dodd-frank act actually stifled the forex brokerage business in america and the statistics do not lie. During the good times, more than 40 retail FX brokers were serving both US and international clients. Ever since dodd-frank became law, that number dwindled to the three brokers mentioned above, and the international clientele base simply moved away from the US and on to brokerages in the UK, europe, australia and the caribbean. A lot of the damage in the US forex brokerage business environment came as a result of the $20million bond which was imposed as a requirement for starting a forex brokerage business in the US. Tax reporting requirements have also scared off many brokerages from accepting US clients. Clearly, no foreign forex company wants to get the same kind of attention that huawei got from the US government in 2019, or what tiktok got in 2020.

What are the current options for US forex traders?

In 2019, some brokers made moves to re-enter the US market. Unfortunately, the COVID-19 pandemic slowed down the process dramatically. Still, some new brokers managed to enter the US forex market in recent years, so traders now have more choice than before.

So what is the current state of the US market as it concerns US forex traders?

1) consumer-friendly regulators

Regulators in the US have made a series of changes designed to improve trading outcomes for US forex traders. For instance, the commodities and futures trading commission (CFTC) has made its weekly CFTC positioning report (also known as the commitment of traders report, or COT) more readily available. This report shows what the major players in the commodities and currency markets are doing. Using this information, summaries of which are found on some MT4 platforms of US forex brokers, traders can consider their positions against the backdrop of the institutional speculators are trading. This provides for more informed trade decisions.

Additionally, the CFTC is now more reachable as a number of channels are now open so the public can make complaints or submit inquiries and observations.

2) more robust database of providers

Everyone working in the industry must be registered with the CFTC and NFA. The NFA has taken it a step further by requiring biometric registration of those who provide services to traders, be it brokerage services or fund management. This biometric information can be shared with the federal bureau of investigation (FBI), and this has been a strong deterrence against wrongdoing by brokers. When last did you hear of US forex brokers swindling customers of their funds?

The CFTC database of providers is very vast. All floor traders/brokers, introducing brokers, swap dealers, retail forex dealers, commodities pool operators (cpos) and commodities trading advisors (ctas) who are licensed to provide services to US forex traders are all on this database.

If you are approached by anyone claiming to be any of these, you can easily contact the CFTC for near-instant verification. Even those who are not listed on the CFTC database by reason of exemption must appear on the NFA database, and the reason for the CFTC exemption provided.

3) expanded list of US-regulated forex brokers

There used to be a time when more than 70 brokers operated in the US forex market. The dodd-frank act thinned them out to just 3, and it remained this way for a nearly a decade. At the present day, there are now 8 regulated forex brokers in the US. Oanda, forex.Com (GAIN capital) and TD ameritrade retained their positions, and are now joined by ATC brokers, IG US, interactive brokers, ally invest and thinkorswim (now owned by TD ameritrade).

4) leverage caps

The 2018 ESMA rules in europe forced all local brokers to set a 1:30 leverage limit for all major FX currency pairs. In the US, this cap remains at the 1:50 level introduced in 2010. US forex traders will continue to enjoy what now seems to be the most liberal leverage caps in the tier 1 regulatory jurisdictions.

5) credit-based funding for customer forex accounts

Bank drafts and direct debits from a bank-linked ATM card are now the recognized means of account funding for US forex traders. The use of credit cards is now prohibited.

These are some of the changes that US forex traders have faced in 2020. 2020 also marked the year of the COVID-19 global pandemic that has completely changed the face of the global economy. However, while many other economic sectors have been badly hit, forex trading and other forms of financial market activity have thrived. In fact, the massive job losses and furloughs across the world that left millions without a source of income, drove the same people to the financial markets. Many brokerages have witnessed a surge in new trading account registrations as well as inquiries about trading. COVID-19 has changed the face of financial trading and it is likely that a number of changes as to how forex is traded in the US are coming.

What does the future hold for US forex traders?

So what possible changes can US forex traders hope to see in 2021 or in the years to come?

1) changes to margin rules

It is likely that forex traders in the US may face changes to margin rules on their accounts. US forex brokers are expected to have rolled out the phase 5 and phase 6 rules on uncleared margin, known as UMR 5 and UMR 6. UMR stands for uncleared margin rules. These rules have to do with how buy side participants in the forex market handle initial margin and variation margin among all counterparties in the market. Compliance with the UMR 5 and 6 means that there is a consolidated margin threshold of 50 million units of either the EUR or the USD that must be adhered to, among other requirements.

These rules were originally conceived in the aftermath of the 2008-2009 global financial crisis to enable firms handle risk better, and were meant to be implemented in phases. UMR 1 commenced in 2017. Full compliance with phase 5 UMR rules was to kick in by september 2020, but has been moved by a year to september 2021. While the full details of these rules would be out of the scope of this piece, suffice it to say that these new rules would make it harder for new players to enter into the retail FX brokerage space in the US. It would also stretch the resources of existing brokerages in terms of compliance with these rules. Ultimately, the entry point for opening a forex trading account may climb dramatically, putting it out of the reach of many. If you have been thinking of opening a US forex trading account, this may be the best time to do it.

2) advancements in technology

Algo adoption is expected to grow, whole artificial intelligence (AI) will start to feature more prominently in the development of market trading software. 2021 may be the year when US forex traders who want to maintain an edge in their trading may have to start using tools and software that can perform smarter analysis and make more rational trading decisions.

3) blockchain-based platforms

2021 may be the year when blockchain-based trading platforms may start to hit the US forex market. Some brokerages in japan and singapore have started to experiment with these platform types. Perhaps 2021 may be the year that we could see these used more widely in the US. Will this signal the beginning of the end for the MT4, or will metaquotes respond accordingly?

4) increased volatility on the US dollar, euro and british pound

Coronavirus vaccines will be out in 2021, but the availability of these vaccines seem to be geographically defined. Countries like the US and UK are buying up stocks in advance, so it is likely that these vaccines will not go round the world. Remember the dark days of the HIV epidemic when there was disproportionate access until PEPFAR and the global fund kicked in? This is probably what will happen unless something is done about the situation. COVID-19 will continue to dominate headlines, along with attempts to rescue the global economy. It is looking like there will be a change of guard at the white house. 2021 will see more volatility on the US dollar, euro and british pound.

It is prudent to say that there may be other occurrences in 2021 which have not been captured here, but which cannot be ruled out. Nobody can predict the future with 100% certainty.

Closing note

One of the best things that consumers of any product can enjoy is the power to choose, and to be able to make that choice from a wide range of service providers. This is what the dodd-frank law has taken away from US forex traders… but things have changed. Aside from a few forex brokerages operating in the US, there are a number of offshore forex brokers expressing willingness to take US traders on their platforms.

There are a number of advantages and also drawbacks to this arrangement. In terms of benefits, this is what US forex traders will enjoy when they use the offshore brokers presented in the list below.

- A) the ability to hedge trades is a risk management tool. The FIFO rule basically prevents this from happening. Realizing this great folly in the US forex brokerage setup, the offshore brokers in the list provide below have created a system which allows traders to hedge, even if it means placing opposing positions on the same asset.

- B) the CFTC has argued that the leverage caps protect retail traders by stopping them from overexposing their capital and accounts to the market. The leverage caps imposed a high minimum capital requirement on forex accounts opened in the US. This requirement only served to lock out a large segment of the trading public. With the forex brokers for US traders introduced here, you get lower capital requirements you can actually meet. You also trade with a wider spectrum of leverage, which allows you to trade under non-restrictive leverage conditions.

- C) your greatest asset as a consumer (the power to choose) is restored. You have a choice of not just a few brokers, but many ones. If a broker does not match your requirements, move to the next one on the list.

The brokers featured in the list below have been carefully selected to offer you a forex brokerage service that rivals what you can get anywhere in the world, and under non-restrictive conditions. They are great for beginners who can make a transition from a demo account to a lightly funded live account, just to ensure they can understand what live trading is all about before they get more heavily committed. ECN style accounts are also available for those who prefer to trade directly with the FX interbank market. There is a lot of choice for you as you go through this list of brokers, one after the other.

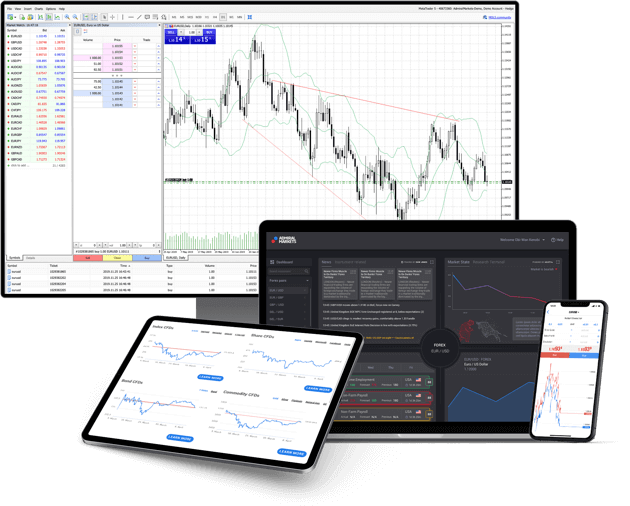

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

Trading

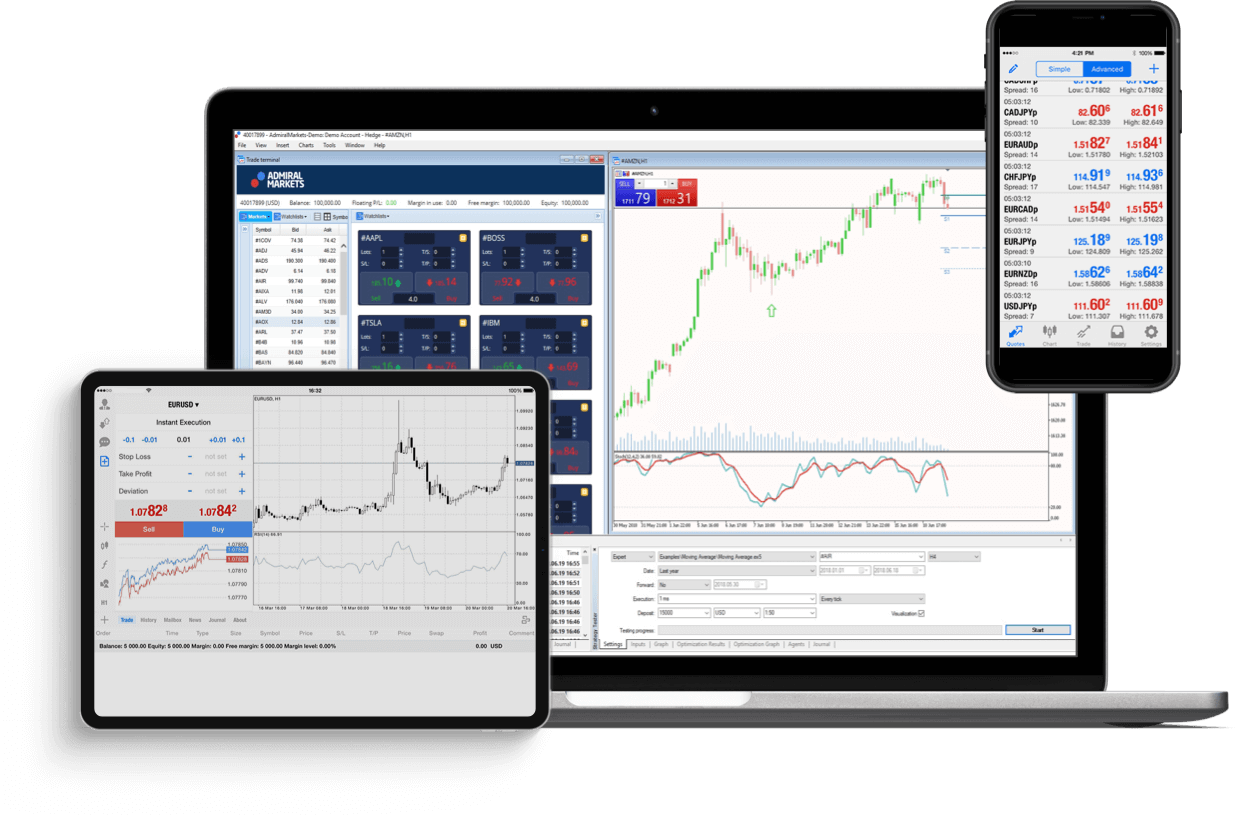

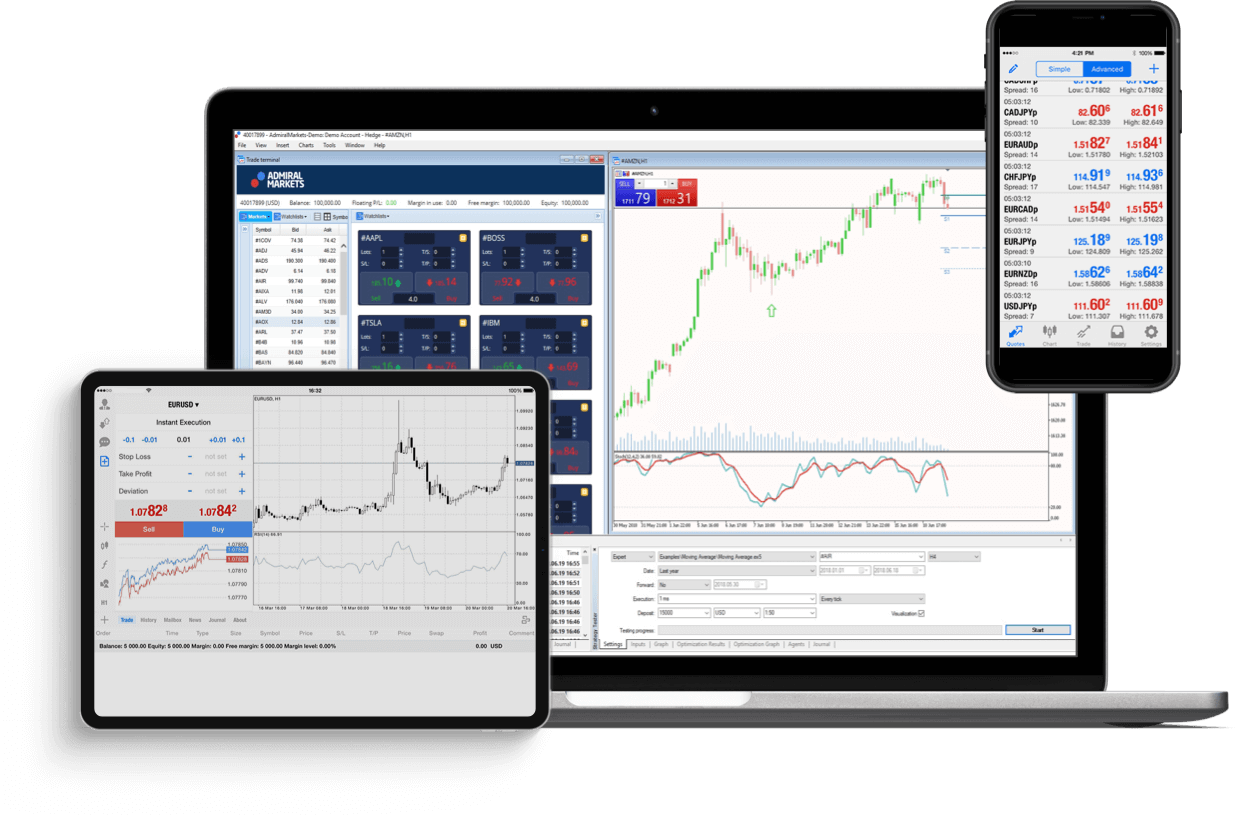

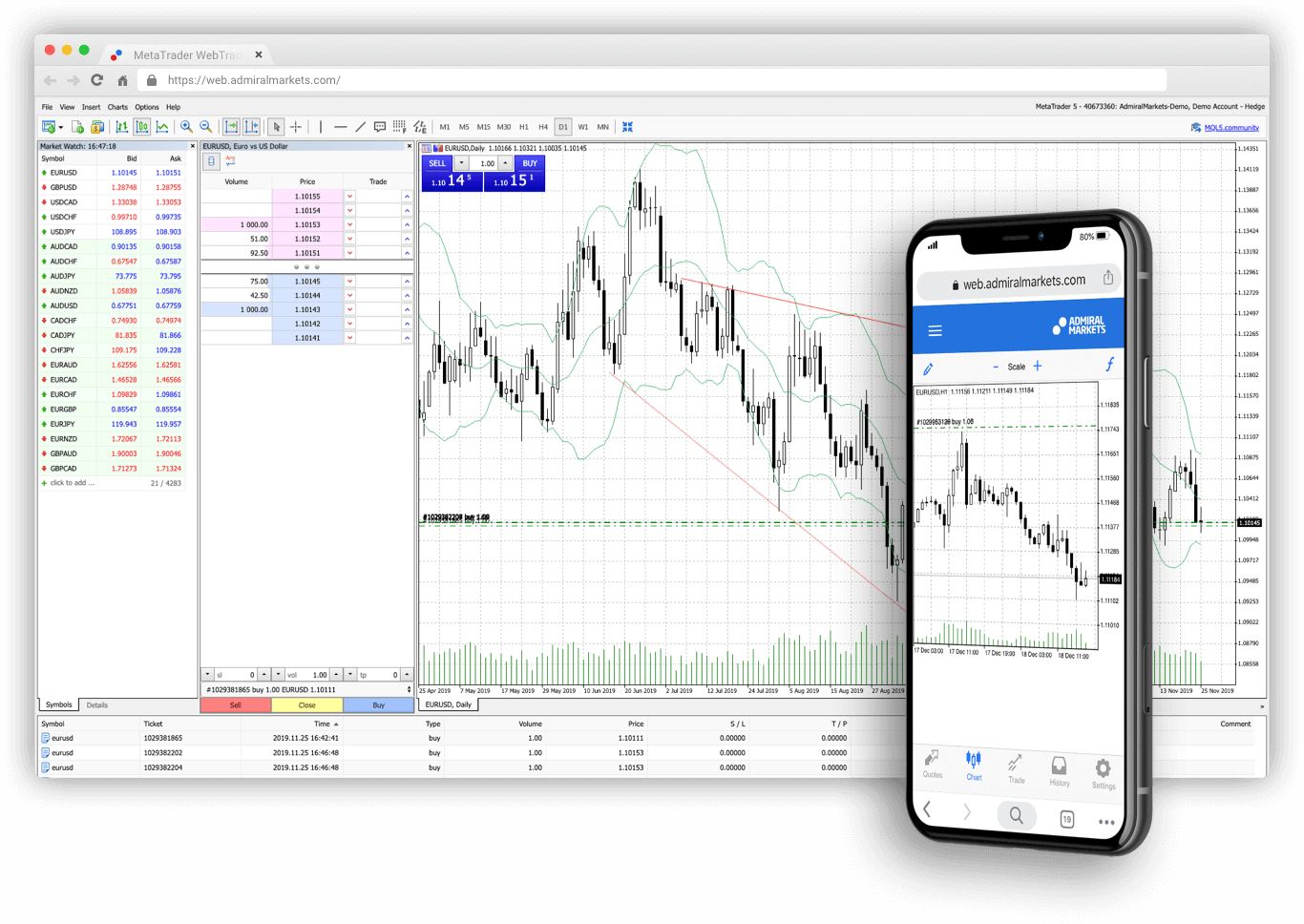

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs, bonds, or cryptocurrencies. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

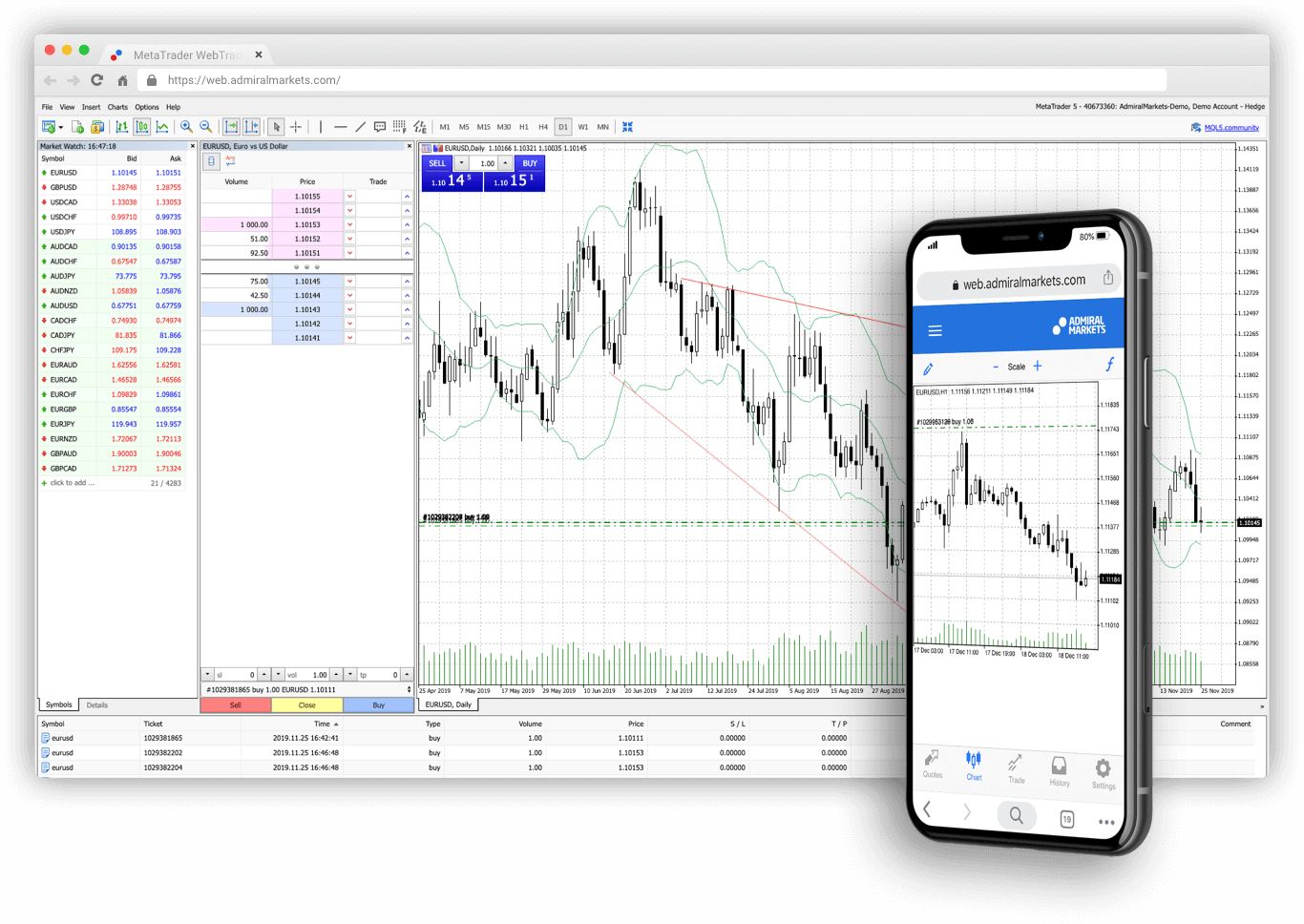

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs, bonds, or cryptocurrencies. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Cryptocurrencies

Cfds on bitcoin, dash, ether, litecoin, monero and more

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Professional clients: 1:500 - 1:10

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, indices, stocks & digital currencies

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Digital currencies cfds

- Contract specifications

- Margin requirements

- Volatility protection

- Pro.Cashback

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trade with the no. 1 broker in the US for forex trading*

Why are traders choosing FOREX.Com?

No. 1 FX broker in the US*

We have served US traders for over 18 years.

Trade 80+ FX pairs, and gold & silver

Global opportunities 24/5 with flexible trade sizes.

EUR/USD as low as 0.2

Trade your way with flexible pricing options including spread only, spread + fixed commission, or STP pro.

*based on client assets per the 2019 monthly retail forex obligation reports published by the CFTC

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Get 20 free, easy to install eas and custom indicators when you open a metatrader live or demo account.

* based on active metatrader servers per broker, apr 2019.

Reward yourself with our active trader program

- Save up to 18% with cash rebates as high as $9 per million traded

- Interest paid up to 1.5% on your average daily available margin balance

- Get guidance and priority support from your dedicated market strategist

- No bank fees for wires

- Access to exclusive events and product previews

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Fxdailyreport.Com

Many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are the real future as far as forex trading is concerned. If you are new to forex trading, this may be confusing to you. Read on to learn more about ECN forex brokers, the advantages of trading with them, and a few top true ECN forex brokers.

ECN translates to electronic communication network and it enables forex trading. In this electronic system, the orders entered by the market makers are distributed to several third parties. The orders may be executed in part or full.

The ECN network connects liquidity providers (for example, major banks) and retail traders through an online broker. The ECN network makes use of a sophisticated technological system referred to as financial information exchange protocol (FIX protocol). The ECN brokerage makes money by charging a commission on each trade. So, for higher returns, the network has to encourage trades to do more transactions.

True ECN forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker |

Advantages of trading forex with top true ECN forex brokers

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows:

Anonymity is guaranteed

If you choose to trade forex on an online platform provided by an ECN broker, you can be sure of the fact that others will not get to know as to who you are. Anonymity enables you to execute trades using neutral prices which reflect the true market conditions. The client’s trading direction – based on certain strategies, tactics, or market positions – will not bias the broker.

Instantaneous execution of trades

As trading takes place on the basis of prices, you get the best executable prices and the order gets confirmed immediately. Further, there are no re-quotes because ECN brokers are no-dealing desk brokers.

This type of broker does not offer fixed spreads. They offer variable spreads. This is because ECN forex brokers do not have any control over the bid/ask spread. Therefore, they cannot offer the same spreads at all times.

If you follow a risk management system or trading model of your own, you can connect the same to ECN brokers’ data feed. This means that you will have access to the best bid/ask prices and certain other data.

Access to liquidity providers around the globe

With ECN brokers, you get access to global liquidity providers such as leading world banks and other financial institutions.

Finally, an ECN forex broker only matches the trades between the participants. They cannot trade against their clients. This is something very important. Many people are people worried about brokers, especially the market makers, trading against them.

There are not many drawbacks as far as ECN brokers are concerned. They charge a fixed fee as commission, but it is cheaper and more transparent compared to that charged by the market maker. Another disadvantage is that it is difficult to calculate stops and targets on an ECN platform. This is because the prices keep changing and they offer variable spreads. The possibility of slippage is also there, particularly when sessions overlap.

Tips on how to choose a true ECN forex brokers

Now that you know a little bit about forex trading with ECN brokers, you might want to know how you can choose a true ECN broker. It is highly recommended that long-term traders should consider working with ECN brokers as they do not trade against customers. As with anything else in life, all brokers are not the same you can find out if the broker is really an ECN broker or not by asking the following simple questions:

Does the broker make any mention of a dealing desk anywhere on their website?

Does the broker change the spreads during news announcements? You may have to open a demo account and a real account in order to find this out. A true ECN broker will never change the spreads during news reports.

Is the broker offering fixed spreads or variable spreads? True ECN forex brokers never offer fixed spreads. They offer only variable or floating spreads.

What about negative slippage? The answer to this question is a no in the case of true ECN brokers.

Having understood how to identify true ECN brokers, here are some of the recommended true ECN forex brokers you can consider working with:

FOREX VPS HOSTING

THE BEST MANAGED DEDICATED FOREX VPS HOSTING

HIGH RESPONSE RATE SERVERS FOR TRADING

Top forex VPS hosting servers with fast response time and maximum productivity. The connection is always stable, free of lags with ultra-low latency that is essential for the trading operations. Managed dedicated VPS will keep your forex investments steady.

REASONABLE VPS PRICES

Our clients save money buying reliable cheap forex VPS on our website. We’ve built a system that lets us keep a reasonable level of expenses. While keeping the trading VPS costs low we offer no less than a high level of customer service.

HIGH-SPEED WORLDWIDE VPS

Our data centers are placed in the major financial cities of the world. It the only way around to ensure the best forex VPS for our clients. The hardware is located in new york, london, amsterdam, frankfurt, and more to come. We connected europe and the new world. The lowest latency and great speed are there when you select the closet MT4 forex VPS server to you.

CONNECT WITH ANY VPS PLATFORM

We offer various VPS hosting platforms for any trading need!

2 months FREE for all annual subscriptions with 30 days MONEY BACK GUARANTEE!

Standard

- 1 core (intel I9 3.5ghz+)

- 2 GB DDR4 RAM

- 30 GB nvme

- Hyper V virtualization

- CLOUD anti-virus & malware protection

- Unlimited traffic strictly for trading purpose usage

- OS windows 2012

- Support all platforms

- Support all expert advisors

- Immediate activation

- VPS checkpoints $8/mth (optional) checkpoints save your best configured state for rollback

Advanced

- 2 core (intel I9 3.5ghz+)

- 4 GB DDR4 RAM

- 40 GB nvme

- Hyper V virtualization

- CLOUD anti-virus & malware protection

- Unlimited traffic strictly for trading purpose usage

- OS windows 2012/2016/2019

- Support all platforms

- Support all expert advisors

- Immediate activation

- VPS checkpoints $11/mth (optional) checkpoints save your best configured state for rollback

Expert

- 4 core (intel I9 3.5ghz+)

- 8 GB DDR4 RAM

- 50 GB nvme

- Hyper V virtualization

- CLOUD anti-virus & malware protection

- Unlimited traffic strictly for trading purpose usage

- OS windows 2012/2016/2019/10

- Support all platforms

- Support all expert advisors

- Immediate activation

- VPS checkpoints $14/mth (optional) checkpoints save your best configured state for rollback

Why choose tradingfxvps as your VPS hosting provider?

Tradingfxvps ensures your automated trading strategies run around the clock.

Top VPS forex hosting optimized for speed and excellent performance.

Take leverage and start trading as fast as 1 millisecond.

Zero downtime with the top VPS hosting for forex trading.

The best forex VPS solutions specialize for traders

A product from forex traders!

A variety of FOREX VPS plans

- Reliable forex VPS hosting plan starting from $25.

- The cheapest forex VPS trial plan for only $3.99.

- Top MT4, MT5 VPS hosting.

- Customized trading VPS server for performance comparison.

Dedicated server hosting for professional traders & fund managers

- Powerful dedicated resources starting from $199.

- Equinix data centres located in the financial capitals of the world.

- Host up to 64 MT4* through the top VPS hosting technology.

- Dedicated VPS hosting for advanced forex traders.

FUTURES VPS HOSTING

- CME aurora VPS starting at $40.

- Cross-connection to CME futures market with latency as low as 0.5ms.

- Specialize VPS for CQG, CTS, rithmic & trading technologies.

- Best trading servers in chicago.

High frequency trading (HFT) VPS – (best forex VPS for traders)

- First forex VPS hosting provider to launch HFT VPS.

- Blazing fast 3.5ghz+ cpus (turbo up to 5.0ghz).

- Forex nvme VPS – 5x faster than SSD -25x faster than HDD.

- Enhanced visual display GPU-based forex VPS – 5x to 20x faster than CPU.

WHY LOW LATENCY IS IMPORTANT IN FOREX TRADING

- SAVE 1-5 pips per trade from slippage & poor execution

- 1 millisecond (ms) MT4/MT5 VPS hosting servers

- Five global trading centers for ultra-low latency across all type of trading platforms

- 100+ EA developers use tradingfxvps for their trade copier and EA

Forex signals managed hosting

- The performance is verified by the regulated brokers

- We are broker-neutral and accept all brokerages

- 5+ years of live trading statistic

- Hand-free experience

- Tap onto direct connection trade copier network

Forex VPS video tutorial

Customer service

Our customer support is well versed in the forex trading, VPS servers, and their settings. The help desk is open around the clock, our clients can contact us 24/7. Every help manager knows operations on the trading platforms, understand forex and MT4/MT5 VPS hostings.

We are proud of the customer service level we are ready to provide to every client no matter how complex the request is.

In case of any issue, you should be assured that any issue or question will be resolved to your satisfaction. We offer live chat, skype, and ticketing feature that lets you get answers as fast and effective as possible.

Fx brokers

Счета raw spread – это все, что вам нужно! Спреды от 0 пунктов, отсутствие реквотинга, манипуляций и ограничений. IC markets – отличный выбор для крупных трейдеров, скальперов, и тех, кто пользуется роботами.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

Fxdailyreport.Com

Many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are the real future as far as forex trading is concerned. If you are new to forex trading, this may be confusing to you. Read on to learn more about ECN forex brokers, the advantages of trading with them, and a few top true ECN forex brokers.

ECN translates to electronic communication network and it enables forex trading. In this electronic system, the orders entered by the market makers are distributed to several third parties. The orders may be executed in part or full.

The ECN network connects liquidity providers (for example, major banks) and retail traders through an online broker. The ECN network makes use of a sophisticated technological system referred to as financial information exchange protocol (FIX protocol). The ECN brokerage makes money by charging a commission on each trade. So, for higher returns, the network has to encourage trades to do more transactions.

True ECN forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker |

Advantages of trading forex with top true ECN forex brokers

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows:

Anonymity is guaranteed

If you choose to trade forex on an online platform provided by an ECN broker, you can be sure of the fact that others will not get to know as to who you are. Anonymity enables you to execute trades using neutral prices which reflect the true market conditions. The client’s trading direction – based on certain strategies, tactics, or market positions – will not bias the broker.

Instantaneous execution of trades

As trading takes place on the basis of prices, you get the best executable prices and the order gets confirmed immediately. Further, there are no re-quotes because ECN brokers are no-dealing desk brokers.

This type of broker does not offer fixed spreads. They offer variable spreads. This is because ECN forex brokers do not have any control over the bid/ask spread. Therefore, they cannot offer the same spreads at all times.

If you follow a risk management system or trading model of your own, you can connect the same to ECN brokers’ data feed. This means that you will have access to the best bid/ask prices and certain other data.

Access to liquidity providers around the globe

With ECN brokers, you get access to global liquidity providers such as leading world banks and other financial institutions.

Finally, an ECN forex broker only matches the trades between the participants. They cannot trade against their clients. This is something very important. Many people are people worried about brokers, especially the market makers, trading against them.

There are not many drawbacks as far as ECN brokers are concerned. They charge a fixed fee as commission, but it is cheaper and more transparent compared to that charged by the market maker. Another disadvantage is that it is difficult to calculate stops and targets on an ECN platform. This is because the prices keep changing and they offer variable spreads. The possibility of slippage is also there, particularly when sessions overlap.

Tips on how to choose a true ECN forex brokers

Now that you know a little bit about forex trading with ECN brokers, you might want to know how you can choose a true ECN broker. It is highly recommended that long-term traders should consider working with ECN brokers as they do not trade against customers. As with anything else in life, all brokers are not the same you can find out if the broker is really an ECN broker or not by asking the following simple questions:

Does the broker make any mention of a dealing desk anywhere on their website?

Does the broker change the spreads during news announcements? You may have to open a demo account and a real account in order to find this out. A true ECN broker will never change the spreads during news reports.

Is the broker offering fixed spreads or variable spreads? True ECN forex brokers never offer fixed spreads. They offer only variable or floating spreads.

What about negative slippage? The answer to this question is a no in the case of true ECN brokers.

Having understood how to identify true ECN brokers, here are some of the recommended true ECN forex brokers you can consider working with:

so, let's see, what we have: list of the best forex brokers for 2021 providing access to foreign exchange markets. Explore forex broker reviews, ratings, and trading conditions. At fx brokers

Contents of the article

- Actual forex bonuses

- Best forex brokers for 2021

- Role of forex brokers

- Criteria to consider in choosing a forex broker

- 1. Spreads/commissions

- 2. Leverage

- 3. Regulation

- 4. Broker type

- 5. Trading resources

- 6. Customer support

- Our list of forex brokers

- Best forex brokers

- Best forex brokers right now:

- The best forex brokers

- Account minimum

- Pairs offered

- Minimum trade size

- Spread

- Commisions

- 1. Best overall forex broker: FOREX.Com

- 2. Best for beginner traders: etoro

- 3. Best for non-US traders: HYCM

- 4. Best for commodities: avatrade

- 5. Best for intermediate traders: pepperstone

- 6. Best for advanced forex traders: interactive...

- 7. Best for mobile traders: plus500

- 8. Best forex platform: IG markets

- Forex market explained

- Risk and reward in forex trading

- Choose your broker wisely

- Methodology

- Forex brokers for US traders (accepting US...

- What changed?

- What are the current options for US forex traders?

- 1) consumer-friendly regulators

- 2) more robust database of providers

- 3) expanded list of US-regulated forex brokers

- 4) leverage caps

- 5) credit-based funding for customer forex...

- What does the future hold for US forex traders?

- 1) changes to margin rules

- 2) advancements in technology

- 3) blockchain-based platforms

- 4) increased volatility on the US dollar, euro...

- Closing note

- Trade with comfort on any device

- Invest from just €1

- How it works

- Register

- Trade

- Trading

- Metatrader: the #1 tool for traders and investors...

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Metatrader: the #1 tool for traders and investors...

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Trade and invest in 8,000+ markets today

- Top trading conditions

- Why choose admiral markets?

- We are global

- We are regulated

- Funds are secured

- Start from €1

- We are global

- We are regulated

- Funds are secured

- Start from €1

- Try demo trading

- Get in touch

- Trade with the no. 1 broker in the US for forex...

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Reward yourself with our active trader program

- Open an account in as little as 5 minutes

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Fxdailyreport.Com

- True ECN forex brokers

- FOREX VPS HOSTING

- THE BEST MANAGED DEDICATED FOREX VPS HOSTING

- HIGH RESPONSE RATE SERVERS FOR TRADING

- REASONABLE VPS PRICES

- HIGH-SPEED WORLDWIDE VPS

- CONNECT WITH ANY VPS PLATFORM

- We offer various VPS hosting platforms for any...

- Standard

- Advanced

- Expert

- Why choose tradingfxvps as your VPS hosting...

- The best forex VPS solutions specialize for...

- A variety of FOREX VPS plans

- Dedicated server hosting for professional traders...

- FUTURES VPS HOSTING

- High frequency trading (HFT) VPS – (best forex...

- WHY LOW LATENCY IS IMPORTANT IN FOREX TRADING

- Forex signals managed hosting

- Forex VPS video tutorial

- Customer service

- Fx brokers

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- Fxdailyreport.Com

- True ECN forex brokers

No comments:

Post a Comment