Earn in forex

Most reputable brokers will offer you real-money accounts as well as demonstration accounts.

Actual forex bonuses

A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds. The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

How much can you earn in forex?

How much can you earn in forex?

Foreign currency exchange market is an attractive and lucrative online investment opportunity. More people worldwide are trying out their skills and luck in forex trading. And who can really blame them?

How much does average forex trader make each month? What can you expect to earn in forex? I am going to tell you the truth even if you probably don’t want to hear it. And even if you will feel a major discouragement, do take a moment to think it over.

The truth about forex trading might be painful, but I absolutely guarantee you that if you skip my wisdom words now, you will not become a successful, long-term forex trader.

So how much do forex traders really earn each month?

How can you possibly answer this questions without more information about the trader himself? I mean, do all lawyers, for example, have an equal pay? There are many factors that influence the lawyers salary such as place of work, country the person in question lives in, economic factors in that country, educational level (bachelor, masters degrees in law), place of work (small law firm, personal business, large 100-employee firm), family status, experience level, specific field of focus (real estate, family matters, corporate, criminal). There are endless specs and all influence and chance the possible salary.

So why don’t we think the same way with forex trading? After all, it is a profession and full-time career of many.

The real question you want to focus on is why some forex traders cannot make any money? Now this is 1 million dollar question!

When you hear about forex for the first time, you get a wrong idea that forex trading equals to easy money. Here is your first major mistake that will drag you down if you don’t change your attitude.

Most forex traders have unreal expectations and believe that they can make up to 50% profit per month. This is almost impossible and on average successful traders make up to 10% monthly profit. And I am talking about true super stars in trading industry like myself!

I am not saying that you cannot make more than 25% a month. I have done it and many other traders around me have done it. What is impossible, though, is to maintain 25% and higher profit every single month. It is the wrong approach and overwhelming goal mark, which will cause you to overtrade, use too much leverage, run after bad trades and ultimately lose your account funds.

Online currency exchange is a golden door to cash balance where currencies are traded simultaneously for one another, to flexibility where every financial world headline plays an important role in decision making, to financial freedom where you can make thousands in minutes sitting next to your computer at home! The question many ask is how much do forex traders really earn? Assuming that the average forex trader is responsible, serious, well-read and patient, what is the average profit? And what factors play important role in earning cash in forex trading?

With all that being said, we did have a poll on the site couple of months ago for “how much do you make per month?” question. A lot of traders made their voice heard andbelow are results of the monthly poll:

How to make money with forex?

When am I ready to profit with forex?

Forex market is like any other market where instead of stocks or bonds people trade currencies and make money.

Trading in forex is popular low capital trading but you have to know how to make money with forex. The truth is that you don’t need a huge capital to get started. Also, the forex market is available 24 hours during working days, but you can’t trade over weekends. Maybe the most common truth about every single person that enters the forex market is that they are excited, eager to earn a lot, and fast, but only a few of them know how to make money with forex.

How beginners in forex trading look like?

They are excited by the possibility of quick money earning and becoming rich. Beginners will easily sign up on some platforms without doing the necessary research. They are entering a position like gambling putting money somewhere and somehow, random, without a strategy. Even more, they don’t know how to place a trade, when to enter the position, where to set stop-loss orders or limits, or take profit. Actually they know nothing. And what happens? After several days when everything invested is lost, they will conclude the forex is fraud and it is impossible to make money there. For them it is completely the truth. With this approach, they will never earn because they don’t know how to make money with forex.

The other side of the forex rainbow

Beginners could see successful forex traders. But they are using tested and well-checked strategies. The strategies that they have developed or discovered thanks to a lot of trials and errors made for a long time. Yes, that’s the way! You’ll have to make many trials and mistakes to understand forex trading and understand how to make money with forex.

Forex traders have a unique trading style, a unique system, and their own strategy. But they came up to them after deep research, hundreds of attempts, losing a lot of money before they found a profitable strategy that works for them and became successful traders. Well, we are sure that the most successful traders will never talk about their failures but now and then you can find someone ready to share that unpleasant experience. On the other hand, you’ll find a lot of them sharing their great stories about winning trades. Learn from them. Only the knowledge will allow you to make the proper strategy, consistent profits on it every single day. That is possible, of course. But you have to learn how to make money with forex. And here are some hints.

How to make money with forex?

If you are a complete beginner without knowledge but willing to start forex trading and make money from it, the first thing you have to do is to read reputable books. Sorry folks, but knowledge is MUST. The point with reading books is that you’ll obtain theoretical knowledge. It is extremely important to understand the financial markets, otherwise, you’re not able to trade them especially if you want to stay there for the long run.

Good places for sharing knowledge are social networks. Join as many groups as you can and start the conversation. Don’t be shy to ask whatever you need to get better knowledge. Professional traders are also members of such groups and often, they’ll be glad to answer you. Also, interact with other rookies and share your knowledge but dilemmas also. Ask elite traders about the effects of leverage. That could be a very interesting conversation where you could find that trading with excessive leverage could be dangerous. You don’t believe it? Well, using leverage is good but if you use excessive leverage in your trading strategy that can end up as a failure. Using excessive leverage might mean that you are not realistic in expected returns on your investments.

What is leverage in forex trading, in the first place?

In general, leverage enables you to increase the result of your trading efforts but without developing your resources. Leverage in forex will simply boost your account while you actually don’t have that money. You are borrowing it to trade with even 1.000 times greater amount than your capital is. That is giving you access to the larger volumes than it is possible with your initial capital.

We are sure that you noticed banners on the trading websites that offer trading with 500:1 leverage. Well, it’s time to explain this in more detail. As we said, leverage is a kind of loan that a broker gives you. You use leverage in margin trading. And here we come to an important point. But leverage isn’t quite a loan even if it is one of the highest that traders can take.

This thing goes right this way

When you enter the forex market, the first thing you have to do is to open a margin account with your broker. Depending on the broker, the amount of leverage can be 20:1, 50:1, 200:1, 500:1 even more. Also, the amount of leverage will depend on your position size. For example, a 100:1 leverage ratio indicates that you have to deposit on your margin account, let’s say, $1.000 to be able to trade $100.000 of currency. These 100:1 leverage or 50:1 are for the standard lot size . If your position is at $50,000 or less the leverage would usually be 200:1.

But compare these leverages with, for example, the 15:1 leverage in the futures market. Well, you might think this forex leverage is too risky. Keep in mind that currency values normally switch by less than 1% within one-day trading. So, this huge leverage is possible because of small changes in the prices of currencies. If currencies are changing more in price, the broker would never give you that much leverage.

More math on how does forex leverage work

Assume you have a small account with $1.000. A standard lot is 100.000 currency units. If you want to trade mini or micro-lots, this deposit size would allow you to open micro-lots. That is 0.01 of a single lot or 1.000 currency units with no leverage set in place. Nevertheless, you’re looking for a 2% return per trade, which is $20.

So, you decide to employ financial leverage to trade big. Your broker is giving you a leverage 200:1. This means you can open a position as large as 2 lots. To make the long story shorter, let’s do some math .

$1.000 x 200 leverage = $200.000

This equitation shows that you actually have a maximum size position of $200.000. That is 200 times the size of your deposit. So, instead of earning $1, you’ll earn $200. Also, you can lose even faster.

Let’s follow our example, and assume you opened an order with a 1.00 lot. What will happen if the market goes against you? You will have minus 100 pips and lose $1000. Your order will be automatically closed. So, you will lose only your total deposit but you’ll not have money to continue. That’s why it is better to trade a smaller position to reduce the risks.

Use a stop-loss order to reduce risk

This one is probably most important. You can find hundreds of forex courses on the internet that promise you a strategy that will show you how to make money with forex every day. A lot of them are scammers, trust us. They just want your money for the low-quality courses. The better way is to start with some simple and easy strategy . It’s not hard to build a suitable strategy.

For example, you notice that the EUR/USD currency pair will rebound from a current support or resistance level. Your first strategy should be to take the benefit of this trend. Later, you can adjust this first strategy by adding some details that will improve efficiency. For example, set a stop-loss when the price goes down to a particular percentage or number of pips to exit the position.

Here is what you have to look out when creating a forex trading strategy.

Firstly, choose the currency pair. Pick it from the market you know, for instance, avoid currencies from exotic countries if you don’t know them well. If you trade only one currency pair you’ll have better chances to recognize trading signals . Also, your position size will determine the risk you are willing to take in every single position.

Further, find when to set your entry, will you go short or long. Never forget to set the exit level. You must know when to exit the position to maximize your profit and minimize potential losses.

Find when and how to buy or sell your currency pair.

Can you become rich with forex trading?

Some will tell you that it is impossible. And they would be right. The others will tell of course, and they would be right, also. The truth is that the forex market may give you a chance to earn a lot. This market is much bigger than the stock market, for example. Also, it offers the highest leverage possible in any market. Also, you can trade every day. In essence, the forex market is a place where small investors with small capital have a real chance to make fortune.

Trading forex is easy, but trading it with constant profit is difficult.

Opposite to what you’ve heard or read forex trading will not turn your $1.000 account into $1 million. The amount you can earn is determined by how much risk you want to take. If you want to know how to make money with forex, start with education. Sorry guys, it is necessary. When you learn the basics you can develop your skills further and you’ll start to make money for living by trading forex.

There are traders that are targeting even 100% profit per month. Yes, but the risk they are taking on is almost the same as the profit they are aiming for. In short, if you want to make a 100% profit per year, it’s possible to have a loss of 100% per year. Even if you are trading with an edge your profits will be small without leverage. On the other hand, with leverage, you can profit a lot, but you can produce extreme losses. The main point in forex trading is to buy a currency pair at a lower price and sell it at a higher price. The difference between is your profit.

For example, you have $1000 on your trading account and want to trade the EUR/USD pair with the exchange rate at 1.25. That means that for 1 euro you’ll take $1.25. Keep in mind that the prices are changing every day, from minute to minute. But you believe that EUR will increase versus the dollar.

Let’s assume, you buy 800 euros for your $1000. And the exchange rate changed from 1.25 to 1.35. That’s good for you, and you close the trade at this level and you can exchange your 800 EUR back to $1.080, and your profit is $80. But, if you used the leverage of 1:3000 you would get $24.000 in one single trade. So, you invest $1000 and trade $3.000 000! Pretty good!

Always keep in mind, if you want the higher profits you’ll have to take the higher risks.

Bottom line

One thing is completely true. If you never try you’ll never know how to make money with forex. With an account with just $1.000 and leverage of 1:100, it is possible to make a lot of money in a single trade. All you have to do is to have at least 1% of the trade on your margin account to use this leverage which is one of the most profitable. That is how to make money with forex.

How to make money in forex without actually trading

There is only one sure thing in forex trading. Loss. It is the only sure thing that every open position will eventually be closed with a loss. So how to make money in forex without actually trading it? You definitely can earn a lot of money in forex trading without opening any single position. Here are just two examples of how to make money in forex without actually trading. Every beginner with a goal to trade forex successfully needs to read the below.

1. Be a forex broker

To be a forex broker means that you earn money by connecting sellers and buyers. In the old days, when computers were just in star trek, brokers needed only a pencil, paper, and phone.

Brokers called from early morning till late afternoon to dealers in banks, trying to find just two with opposite ideas and wishes. And there is hidden the forex broker profit.

The small fraction of trade amount, but without any risk (of course, if we ignore counterparty risk) would be the broker’s fee.

Counterparty risk means, that you still risk that your counterparty will not pay your fees. However, if you work with regulated banks, your risk is pretty low.

Volatility is a friend of every broker

The only thing you need as a broker is volatility. You will praise volatility, you will enjoy any unexpected event which will move markets up or down.

You will not care about direction market moves, and you will care just about if the move is large enough. More volatility, more happy and wealthy you will be.

You will hate holidays and low liquidity. You will hate non-eventful days, stable markets, and peace in the world.

Your day will be much nicer when FED unexpectedly raises rates or decreases them. No matter what FED does, it will definitely help that it surprises forex markets.

What you need as a broker

You needed just a pen, pencil and phone long ago. Nowadays you will need probably a robust IT system and a lot of money.

The competition between brokers is pretty strong. All of them invest a lot in IT infrastructure and marketing.

Fees are going down, and you need more significant amounts to earn the same money as year or two ago. However, still, you do not have any open positions.

You can sleep peacefully. There is no possibility that you come to the office in the morning and all your positions will be in a deep loss.

2. Be a consultant

You do not want to trade your own money, do you? Trading other people’s money can be more pleasant in case you lose them. Be a consultant means that you just give advice and take your fees before anything goes wrong.

You will not risk your money. Great, isn’t it?

What do you need as a consultant?

The primary thing in the consultancy business is reputation. Without a reputation, nobody will hire you.

To earn a reputation is not easy. Basically, you can be a trader who finished his career and your trade log speaks for itself.

The second possible way is to make yourself visible. You have to comment in discussions about forex, write articles about it, do not be afraid telling others what they should do last week.

And you will see that some fool will like your advice and hires you. You know that prediction of future on forex is impossible, so let your partners pay your fees before any of your opinions materialize.

Is it possible to make money in forex without actually trading?

Yes, it is possible to make money in forex without actually trading. We showed you two possible ways how you can win at the forex every time.

We are sure there are other ways we did not mention. But even as a consultant or a broker, you will have to work hard to earn anything.

How to make money in forex fast? (simple winning strategy)

Now total disclaimer I am not suggesting in that profits are guaranteed in anyway so please visit our trading disclaimers page. So you are getting into forex and want to make money fast. That is great but make sure you get your basics down first understanding specifically about risk management you should never over leverage your account as you will likely blow it over time.

So how can you make money fast in the forex market? Use a minimal stop loss with a precision entry. It sounds simple and it can be but you need to demo before going straight to live and that goes with any strategy. Your stop loss if your profit regulators. So if you have 2% risk into a 10 pip stop loss you will make 2% every 10 pips. Same risk but using a 50 pip stop loss you will make 2% every 50 pips. That is 1/5 of what would have made with a precision entry. Just do the math.

I am going to state this again just do the math when it comes to forex. You aren’t going to make 10 million overnight and forex should never be looked at as a get rich quick scheme as you can lose hard earned money quickly.

That is why it all comes down to risk percentage and how big your stop loss is. Then of course you add in win percentage and amount of pips that is how quickly the compounding can add up.

5 pips a day can make you a millionaire in 2 years with a $5k trading account by just doing the math. Don’t believe me? That’s okay just go to any compounding calculator and put 1% daily, 20 days a month, starting with 5k for 2 years and there is the evidence.

If it is this simple why isn’t every doing it?

That is because of the penny doubled everyday mentality doesn’t exist. As I am writing this article for example there is hardly anybody that is going to see this article for months maybe even a year. But I am investing my time to be rewarded later. That is all it takes to succeed in life, but it is tough we are brought up to succeed in this way.

We are brought up to work and get our paycheck. When it comes to getting into shape everybody wants overnight results however it takes time and consistency to get the results you are looking for. That is no different with forex.

So why not in every aspect of your life apply the compound affect? (read or listen to the book by darren hardy)

This is just a way of life it is hard not to take the reward as quick as possible it took me many years to get any kind of handle on this mentality. I still struggle with it everyday. It is something that you have to just say I am going to do it and then work on the mindset as you move forward.

Make money fast in forex?

Okay back to the original question. Using a tighter stop loss yields bigger rewards without over-leveraging your account. So how do I get the precise entries? You need to focus on trading in the new paradigm. This includes using harmonics, trend lines, pithforks and the almighty fibonacci. Build energy points which is where you are stacking these confirmations together to create a tight price reversal zone (PRZ).

Here is example of a 190 pip drop caught with a 10 pip stop loss. Does this happen all the time? Of course not but you only need one of these a month and then take your 10-20 pip trades along the way.

It does take a lots of practice (volume of trades) to get these trades down. What happens though is that your losses instead of being -10 pips become -3 to -5 pips which means you are going to risk 2% for ever 10 pips but if you get out at -5 pips you are really only risking 1%.

This probably doesn’t make sense but just remember at the end of the day your job as forex trader is to protect your capital. Trading in the new paradigm is the best the way to that as well.

Related questions

(from our free facebook group)

Can you get rich by trading forex?

You absolutely can get rich by trading forex, but you can also lose all your money as well. Trade smart if you risk 3% of your account it will take you losing over 33 straight trades to actually lose your account. If you are winning 7-8 out of 10 trades and not over-leveraging this will never happen. Getting rich quick doesn’t exist for most people you need to put in the work and be patient. The penny doubled a day mindset does work so stick to it for the long run taking one step at a time.

Is forex A good way to make money?

It can be if you learn to win more trades then you lose and use proper risk management. Don’t let the get rich mindset blow your account. If you learn to build slowly you will never lose your money quickly. If you make your money quickly that usually means can lose your money quickly. The shortcuts can be the longest ways in reality. Forx is a great way to make money as you can do it from anywhere in the world all you need is laptop and internet connection.

How to make money trading forex with no previous experience?

You need to start with the groundwork. Learn how to open a demo account which we teach you live for free with our membership. Start with the basics then work up to an easy strategy. Demo the heck out of it until you do something along the lines of doubling your account or maybe getting to winning 8 out of 10 trades which should be 80 out of 100. There are no gimmicks with forex you either win or you lose. Different then gambling is that you control what you risk on any given trade with your stop loss but you can ride a trade as long as you want. Just move your stop profit up and ride the trend.

Hello I am tab winner welcome to my forex blog. I have been trading forex and cryptos for over 5 years now. Been a stay at home dad for about the same amount of time.

Saving your charts is a great way to never lose your work or markups. The other upside is you can access it from anywhere you have an internet connection that includes even tradingviews mobile.

It happens you get going want to share with world your idea on trading then bam you make a mistake hit publish now you want to go back and fix. Publishing an idea on tradingview does need some fixes.

About me

Hello I am tab winner welcome to my forex blog.

My site is called stayathometrader.Com for 2 main reasons:

1. I am a stay at home father have been for over 5 years now. This blog will be documenting my journey and daily struggles of raising a daughter (4 years old now) and intraday trading forex and crypto.

2. I trade from home. I do two things for work SEO and trading forex. Both I think of in terms of compounding for myself and families future. I will be trying to post at least 1-2 times a week as I work on my education and daily trades during the week.

Some other quick things about me:

– I live in the middle of nowhere and own a small old

family farm

– we also have horses, dogs and a cat

– I do not consider myself a professional trader even

though I do make a living from it I am continually

learning and building on my methodology.

– I am a big believer in mindset. Once you get your

mind right you can do anything you want to in life.

Legal information

Stay at home trader is owned and operated by tab winner. Stay at home trader is a participant in the amazon services LLC associates program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.Com. Stay at home trader also participates in affiliate programs with siteground, clickbank, CJ, shareasale, and other sites. Stay at home trader is compensated for referring traffic and business to these companies.

This message is only visible to admins:

unable to display facebook posts

How much money can you make from forex trading – 2020 guide

Millions of people across the globe are trading to earn higher profits. If you are a trader, then forex trading is a common term for you. It is the best way to make vast amounts of money by trading in foreign exchange. The most significant advantage of forex is low fees as compared to others. Both beginners and experienced traders can buy or sell currencies with high profits.

No doubt that you can earn an ample amount of money through trading forex. It is important to learn how to make it. If you want to achieve significantly, then you must trade hard. Check out forexstore to start forex trading. In the following write-up, know the amount of money you can earn via trading forex exchange. There are many factors to earn and calculate money won in trading forex. Let’s begin.

1. Trade more

Many individuals are addicted to trading, like gambling. They buy and sell foreign exchange frequently to earn profits. If you think of trading once and get plenty of amounts, then you are wrong. You have to trade more to collect a significant amount. Now, you might be thinking that there are also chances of failure. Is it best to invest money repeatedly? You must invest more to trade more.

Due to higher chances of wins, you can risk your shares again and again in trading forex. When you trade more, the winning probability is quite high. A beginner can risk with time and circumstances, but an experienced trader must not lose the opportunity at all.

2. Managing risk

Risking huge amounts is one of the trading schemes to get high returns. Remember one thing that there are also possibilities of losing massive amounts. You must trade carefully because it eventually affects your account of trading. Before trading forex, you need to create a strategy with positive output.

Suppose if you are getting $10,000 in your account per year by trading $1000, then it will not be the same each year. You can earn more considerably than expected. Try to trade more in some years to get higher profits. It will not affect your account, and in the end, a trader can count on his massive earned money.

3. Money extraction from your trader’s account

You can operate your trading account for buying or selling foreign exchange. The amount will be stored in your account, and you can either trade more, withdraw or keep it there for adding more interest. Every person earns money to enjoy a satisfying life with luxuries and comfort. Make sure that you debit the required money from your account.

It is essential to keep a certain amount as savings for more trading. The added compound will generate more amount, and later, you can get more money out of it. Therefore, it is a good deal of saving amount for the future. Many traders prefer to do such things for better money management.

4. Determine your expectancy

Trading is about risking money. You can determine the expectancy factor by analyzing your performance while trading. Suppose if you are continuously risking your money, and you are getting profits 2 or 3 times, then you are not a good trader. But sometimes, you have an excellent winning rate by getting profits in the initial trading session.

You need to join the winning and losing rate together to know about your future profits and loss. You can easily create different methods for trading if you determine your rate of expectancy. It will help you in earning money via forex trading efficiently.

5. Trading risk is dependent on currency pairs

An experienced trader is aware of different currency pairs. You can lose some amount while trading a currency pair. A trader must know the current currency rate and then buy or sell it. You need to estimate the winning and losing trade to get enough profits. If we calculate the win rate of the trader, then you must find out the difference between the profitable and loser trades.

The win rate is quite less in case of no or fewer commissions. There is a considerable return on the profit without affecting any previous records. The profit from trading on various currency pairs is different. Make sure that you analyze the current rate before investing your money.

6. Calculate profit from forex trading

There is one way to know the amount of earning money by trading forex. You can calculate all the potential earnings. Before that, you must know certain things about your yearly profits, trading amount, earnings, buying, and selling currency assumptions. It is easy to evaluate the profits if you know how exactly you trade and what strategies you must adopt.

Determining all the factors and calculating profits are the best ways to know the amount of money you can make through trading forex. You can also calculate the average rate of profit that you will earn in an entire year.

The bottom line

Trading forex exchange is not a one-day task to earn a considerable amount. You need to invest and experiment a lot to become a good forex trader. There is no doubt that you can make much money from forex trading. But you have to focus on your performance to prevent yourself from massive loss.

Make sure that you come up with highly-effective trading strategies to get profits frequently. Millions of people worldwide are trading, but not everyone is getting the same results. You must calculate everything from your trading performance to future profits from forex. It will ensure that you are on the correct path or not. After analyzing everything, there will be a scope of improvement in your trading performance.

Make sure that you keep the above things in your mind for better results. Try to start trading by investing a small amount to prevent huge losses. It is better to understand your skills before trading enough money on different exchange currencies.

How much do forex traders make per month?

How much do forex traders make per month? What is the monthly earnings potential of the average forex trader? If you’re reading this article, you’re probably fairly new to forex trading, so I don’t want to misguide you.

In fact, I’m going to tell you some hard truths that you probably don’t want to hear, but they are absolutely necessary to learn if you ever want to become a successful forex trader. Your initial reaction may be discouragement, but there is a light at the end of the tunnel.

Please fight the urge to roll your eyes and move on to something more uplifting. Sometimes the truth hurts, but I will absolutely guarantee that if you don’t listen to what I’m about to tell you, you will NEVER be a successful, long-term forex trader.

So how much do forex traders really make per month?

This question is a little misleading for a couple of reasons:

- Most forex traders are not profitable

- No profitable trader in any market makes the same percentage of profit each month

These are the questions you NEED to ask:

Why are most forex traders unprofitable?

Despite what you may have heard about how easy it is to make money in the forex market, the truth is that most traders fail. It is also true that you will probably fail at trading, but you don’t have to. The real reason traders fail is probably not what you think.

This is why traders actually fail:

Greed

Most new forex traders have unrealistic profit expectations. They think it will be possible to make 25% – 50% or more month to month. They have dreams of turning their small account into a very large account in just a few years.

This is totally unrealistic. If it were possible we would all be doing it. Most successful traders make a much lower average monthly profit (3%-7% is common). If you’ve averaged 10% or better for more than a year, you’re a rockstar in the trading world.

Take this into consideration:

If you could sustain a 10% average monthly gain, you would more than triple your account every year.

By averaging 6%, you would more than double your account every year.

Starting with $5,000, and averaging only 3% per month, your account would grow to over $170,000 in 10 years.

Warren buffet became a billionaire trader averaging only 30% per YEAR!

I’m not saying it’s impossible to make 25% or more in a month. I’ve done it, and many others have done it. I’m saying its impossible to MAINTAIN such a high average monthly gain. In order to shoot for such a high goal, you will be pressured to take bad trades, overtrade, and overleverage (which brings me to my next point).

Overleveraging

Poor money management is one of the worst account killers for new traders. This goes back to greed, because traders typically overleverage while shooting for unrealistic profit targets.

You should be risking a small percentage of your account on each trade, and you should be risking the same amount on each trade. I recommend never risking more than 2% per trade. Many successful forex traders risk 1% or less per trade, and some very successful and experienced traders risk 3%.

Risking more than a small amount per trade is a death sentence for your trading account because all trading systems go through periods of drawdown. If you’re risking too much during one of these periods, you will, at least, wipe out much of your progress, if not completely wipe out your account.

Consider these two examples:

If you lost 10 consecutive trades, risking 2% per trade, your account would be down about 18%. You would need to earn about 22% of the remaining account just to get back to your starting balance.

If you lost 10 consecutive trades, risking 10% per trade, your account would be down by more than 65%. You would need to earn nearly triple the remaining account (187%) just to get back to your starting balance.

Not only does responsible money management help preserve your capital during losing streaks, it also helps to keep you trading your edge mechanically. That’s because losing 1% or 2% on a trade does not sting nearly as much as losing 5%, 10%, etc….

It’s easier to deal with the losses, psychologically speaking. You’re more likely to pull the trigger on the next trade, and let your edge work itself out over time. And that’s exactly what you need to do, if you know you have a profitable trading method working for you.

Insufficient testing

I cannot stress this point enough. Testing is the backbone of a successful trading program. Most new traders are too impatient and undisciplined to thoroughly test new strategies. I think this, again, goes back to greed, because we all want to fire our bosses as soon as possible. You want to get that account snowballing quickly, but this is a costly, rookie mistake.

The problem is that, without sufficient testing of your trading system or any new trading setup, you’re not going to know how it will hold up during changing market conditions. You need to know if your trading system can stay profitable through increasing/decreasing volatility, growing/shrinking average daily range, impactful news events, etc….

I would not even consider a new trading strategy unless it had proven itself to be profitable after, at least, a couple hundred backtesting trades – either through my trading platform or using a backtesting software, such as forex tester 3.

Next, I would forward test (with a demo or micro account) the new strategy for, at least, a few months. The more time you spend doing this the better off you will be down the road because you will have absolute confidence in a system that has proven to be profitable over time.

Knowing exactly what your system is capable of, and proving to yourself that your trading system is profitable over months or (preferably) years worth of different market conditions will go a long way in helping you to mechanically trade the edge that your system gives you – even when you’re experiencing a losing streak.

Lack of discipline

I’ve mentioned discipline a few times already, and it’s an import factor in profitable trading. It’s another psychological aspect of trading that can either make you or break you. Most new traders lack discipline in every aspect of their trading, from testing to execution.

It takes discipline, as well as patience, to properly test a new trading strategy. Most traders don’t have the discipline to do any manual backtesting at all. They simply learn a new trading method, and demo trade it for a week or two, or worse, they go straight to live trading.

It takes discipline to keep trading when you’re losing. If you’ve done your due diligence, then you already know for sure that you’re trading a consistently profitable trading system. With discipline, you will be able to keep pulling the trigger on the next trade and let your edge play out over time.

Sometimes you just have a bad feeling about a trade, although it meets your criteria. It takes discipline to mechanically trade every setup that comes along, but it’s a must. As soon as you start trading subjectively, you’ve abandoned your edge and you’re gambling.

Note: there is limited room for some subjectivity in some aspects of trading when you become much more experienced, but you should strive to trade as mechanically as possible even then.

Lack of discipline can also lead you into catastrophic behaviors, such as overleveraging (which I mentioned above) and revenge trading. Revenge trading is when you re-enter the market because you’re trying to earn back money that you’ve just lost – not because your trading system has provided another quality entry trigger.

Overtrading could be mentioned in the same breath. Successful, disciplined traders trade less, because they only take the best trade setups. They have the discipline to wait for the market and their trading system(s) to provide them with quality setups, rather than trying to force bad setups to meet some unrealistic profit target.

System hopping

If you’re a new forex trader, it’s absolutely necessary to find a consistently profitable trading system to start testing. As of right now, there are three profitable trading systems reviewed on this website that I have personally traded and recommend. However, I mostly use day trading forex live now.

Note: read my full reviews of these trading systems to see which one will fit your trading style and schedule, as each of these systems are completely different.

If you’ve been trading for a year or two, the truth is that you’ve probably already traded a few profitable trading systems. You just were not confident enough in them, or disciplined enough to let their edge play out over time.

You probably didn’t test long enough, started trading your hard earned money, lost a bunch of it, blamed the trading system you were using, and moved on to the next system. This is a constant, destructive cycle that a large majority of unsuccessful traders are trapped in.

There is no “holy grail” in trading. The point is to find a system that makes sense to you, and test it to see if it actually works. Just as importantly, you need to test it to prove to yourself that it will be profitable in the long term.

You’re looking for something that will provide you a verified edge in the market. You need to have an unwavering belief in the trading system that you are using. Once you do, you simply have to continue to trade the edge that your system provides for you with discipline.

Many traders unwittingly give up on profitable trading systems because they don’t trade them long enough, or with enough discipline, to let the edge work out for them. Even the best traders in the world lose lots of trades, but they have the discipline to let their edge play out.

What is a realistic average monthly profit expectation for a successful trader?

This question is more in line with the way you should be thinking, although its answer may be just as discouraging: it depends on the trader, their trading system, the market, etc….

Successful traders simply trade the edge that their trading system(s) give them, and take what they can get. They don’t set goals and they don’t force trades to meet those goals.

A really good year for a successful trader might look like this:

January +5%

february -2%

march +9%

april +12%

may +3%

june +9%

july +15%

august +20%

september +7%

october -4%

november +5%

december +5%

A trader with this record, if no money was withdrawn from the account along the way, would have earned over 120% – more than doubling their starting balance! Their average monthly profit percentage would be 7%.

Even as I’m writing this I can picture the amateur traders saying to themselves, “that’s not enough! I’ll never be able to do this for a living at that rate.” that is greed and impatience doing what they do to every inexperienced trader.

You could make more than what is depicted in the example above, but if you don’t change your attitude and expectations, you will most likely make much less. Instead of asking yourself, “how much can I make per month as a forex trader?” you should be asking yourself, “am I willing to do what it takes to become a successful forex trader?”

Are you still looking for a profitable trading system? I recently changed my main trading system after testing a new one for over a year. Come see why I switched to day trading forex live.

Related posts

The ultimate forex trading method!

Are great traders made or born?

The difference between lucky and good

16 comments

Hi there,

I just want to thank you for taking your time to educate us newbie (& losing) traders.

I enjoyed your ebook “how to choose better support and resistance levels“.

I like your site, (not that its particularly important, but the font you use in your articles and site are very nice. I look forward to wading through your articles, and give your recommended trading systems a try out.

Thanks for the kind words, J! I’m glad you enjoyed the ebook. Let me know if you have any questions.

I’m new to forex trading & was thinking of start live trading with $500.

I will add $50 to my account every month.

Target monthly return 6 %

Thanks for commenting! Are you using a profitable trading system? If you’ve got a good trading system, targeting an average of 6% per month is certainly realistic – especially if you’re risking 2% per trade.

Since you’re just starting out, I wouldn’t recommend 2% per trade, though. You should risk the smallest amount that your broker will allow, and slowly build up your risk once you prove that you’re profitable.

Some people would tell you to demo trade first, which is actually not a bad idea. However, I find that you gain more realistic experience risking real money – even if it’s a small amount. It’s just different psychologically.

Your plan sounds good to me. Just make sure you’ve got a good trading system, and follow the rules faithfully. Good luck!

Hi thank you for your article

No problem. Thanks for reading.

Hi chris

thank you for the helpful article.

But I’m a little bit confused about the realistic monthly returnees, if I could average 6% monthly (from the comment above) and it’s certainly realistic, as you replied, isn’t this more than 50% annual average returnes? I thought this is impossible, specially doing it constantly!

Could you please clarify, thank you.

Thanks for reading. I never said making 50% annually is impossible. I know for a fact that it’s possible.

Hi chris hope you can help me on this one , have you aver seen traders who actually trade using a 1:1 risk reward ratio .. Of course witha hit rate above 50% .. And well in the en d they are actually profitable ?? Or succesful traders always use a higher risk to reward ratio?

Sure. That’s essentially what scalpers do. I know some scalpers are successful, although I haven’t personally met or spoken to any.

In my experience, it’s best to shoot for the highest reward to risk ratio that you can consistently achieve with your trading system. In DTFL, we target 2:1 reward to risk, although we sometimes close trades early for various reasons.

I’ve successfully traded other systems where the reward is targetted dynamically. If you can make a static 1:1 work for you, go for it. I haven’t been able to.

How is it going?Happy new year in advance.Wish you a prosperous and fruitful year ahead!Have you heard of compound interest where monthly return is being accumulated over time?Well,here is my anticipation for the new year 2018.

Starting with an account balance of $500,30% monthly return.That will be 500 x 1.3^12 = $11,649. Is it achievable?

Hope you will suggest good tips or advice.Stay healthy and happy trading! Cheers !

Sorry for the late response and thanks for the kind words. It’s been busy over here due to the holidays.

I’ve heard of compounding returns, of course. That’s the goal of most traders. However, shooting for 30% per month is unrealistic, IMO.

Most new traders would be lucky to make 30% per year and keep it. Sure you can make 30% in a month by taking too much risk. In fact, when I first started, I nearly doubled my account in a month on several occasions. I gave it all back, though.

If you can’t hold on to it, what’s the point? My advice is that you learn to trade first. Don’t focus on returns as much in the beginning. See what you can make risking 1% – 2% of your account per trade or less (start with a much lower percentage while practicing).

If you find that you can make consistent (I mean over months and years) returns, start adding money to your account whenever you can. You can even get other investors to help you fund a significant account as long as you can prove that you make consistent returns.

Just my 2 cents. That’s probably not what you wanted to hear, but I’m trying to help you skip those rookie mistakes.

Hi chris, thanks for this article

it really wake me up to prevent most rookie’s mistake, and I hope I can do those points you mentioned above over time.

I’ve also read couple time that to get 10% profit/per month on consistent basis would be considered great even for pro trader.

But I wonder about the calculation, hope you can make this clear for me :p

– let’s say I take 1 trade a day, so about 20 trades a month

– my risk to reward ratio for every trade is 1:2

– every trade I risk 1%, so for every winning trade I get 2% profit

– my average winning percentage is only 50%

– I’m not compounding my profit, so my 1% risk towards initial capital is always the same amount

– I win 50% (10 trades) and lose 50% (10 trades)

– for winning trades I get 10 x 2% = 20%

– for losing trades I suffer 10 x 1% = 10%

– at the end I got 20%-10% = 10% profit that month

So my question is why is it hard even for pro trader to get more than 10% a month? And months with 2 digit profit % is not sustainable for the long run, maybe only 1-3 months per year (my understanding from your article).

For my example, I think my risk ratio 1:2 is moderate, risking 1% every trade is average, 20 trades a month is moderate between daytrader and swing trader, and 50% winning percentage is quite low for pro trader (I think pro trader should be on 60% – 70% winning percentage) and it still produce in ideal calculation roughly 10% a month.

So even though I’ve read couple times about ‘even pro trader hardly to get 10% a month consistently’ I still don’t understand the thought process behind it.

Please pardon me if I have weird logic on my simple calculation because I’m a newbie and still do paper trading.

It would be great if you can share your two cents about it.

I’m glad you’re finding this site useful and thanks for your question.

A 50% strike-rate with a 2:1 reward-to-risk ratio is like the holy grail of trading. Most experienced traders who use a 2:1 reward-to-risk ratio (high reward-rate) trading system have a strike-rate closer to 40%, in my experience.

Your strike rate can generally go up if you use a lower reward-to-risk ratio (high strike-rate) trading system because it’s easier to be right for a shorter amount of time.

I’m not advocating a high strike-rate system, though. In fact, I use a high reward-rate system myself. There are definitely pros that achieve 60%-70% (I’ve even seen 80%) with high strike-rate systems, but the profit percentage probably wouldn’t blow your mind.

Another thing you have to keep in mind is that typically when traders are bragging about high strike-rates, they are including small wins and early exits (not all of those wins were a full 2:1 profit target hit).

Lastly, 20 good, qualified trades in a single month are more than most good trading systems will produce. You don’t want to force yourself to take a trade every day. You have to take the qualified trades as they come. Sometimes that’s 1 or 2 in a week. At times, you may take multiple trades in a day.

The key is to be consistent. You need to try to take every qualified trade that comes along according to your trading plan but not more. New traders usually trade way too much. Experienced traders stay out of the market until the moment is just right. That means fewer but better quality trades and more profit.

The truth is that when you consider trading with your own hard-earned cash, brokers, fees, and everything else that you have to deal with as a trader apart from your trading system (and that’s assuming you’ve actually got a profitable trading system), you’re lucky if you end up with a slight edge at all. But a slight edge is all it takes if you’re persistent.

I don’t want to discourage you. Maybe you’ll beat the odds. If you’re not successful right away, though, just remember what you learned here. Be happy with small, consistent gains and build from there. Good luck!

Woww thank you so much for your reply chris. I wasn’t expecting such a detail answer, I’ll keep in mind. Really appreciate it sir!

No, you didn’t discourage me at all, instead I think it’s better to know bitter truth about trading world ASAP before I walk further. And the deeper I’m into this world the more I realise that I know nothing haha.

My focus for now isn’t profit but to protect my capital from losing. So which one is better in your opinion

1. Paper trading until at least I can protect my capital

2. Or open micro account so I get the taste of real tension (if it go into zero, it’s OK for me as I’ll take it as tuition fee)

Thanks again chris, it’s so kind of you to spare your time answering newbies like me.

Wish you the best ^^

No problem, adam. Glad I can help. To answer your question, you need a good trading system and trading plan first and foremost. If you don’t have those, you’re just gambling.

Maybe you already have a great trading system and a solid trading plan that you can stick to. If so, you should definitely demo trade (or paper trade) it first for a couple of reasons. The main reason is that you need to build confidence in your trading system and trading plan so that you can keep pulling the trigger when the drawdowns come (and they will come). No system is impervious to it.

That being said, you should start trading a small, live account (using the smallest trade/lot size your broker allows) as soon as you can. No amount of practice can prepare most people for risking their real, hard-earned cash. That’s usually when the psychological mistakes start happening.

Once you’re consistently profitable trading small amounts of your real money, gradually increase your trading size to 1% or 2% at the most. Some people risk more per trade, but I wouldn’t recommend it. Risk too much and you’ll wipe your account out during your first drawdown.

5 forex trading hacks

Five easy ways to make profits in forex

If you want to make profit trading forex, you need to be smart enough to leverage on potential opportunities. To do this, you need successful forex trading hacks. Part of it is knowing the right tools and strategies that can make trading easier and more successful. This guide discusses forex trading profit hacks that help you to make money consistently in the market. If you follow the tips and put them into practice, they’ll definitely improve your trading results!

5 simple ways to make profits in forex

Forex trading hack 1: get organized and be disciplined

To succeed as a forex trader, you must, first of all, get organized and learn to practice self-discipline. You clearly need to know what you are looking for in the markets to be able to build an organized and disciplined trading approach around it.

Thus, ensure you know your trading edge and try to master it. Generate a trading plan. You require a forex trading plan; try to create it around the trading strategy you have mastered. There are a few ways to get this done:

Pinpoint your trading personality

There are four different types of trading personalities. Discovering yours can help you to trade your strengths and minimize your weaknesses. If you are a novice in the market, you may find it difficult to know your trading personality but these tips will help you to figure it out. You will fall into any of the following four categories:

- The now trader: the now trader prefers to trade the market quickly and get out. He wants to get in, get his pips and exit the market. Now traders commonly trade with smaller time-frames, spend less time everyday trading and capture smaller pip numbers but may trade more frequently.

- The in-the-game trader: these traders prefer to review the market every day, but take action that lasts long and aim to capture larger pip over a longer period of time. These groups of traders go for medium range timeframes and are cautious of reversals and analytical flaws.

- The adrenaline junkie trader: these traders only trade once, or a few times every month following major financial news like quarterly or earnings reports. This group of traders mostly engages in swing trading.

- The low maintenance trader: these traders follow the set it and forget trading approach. They trade with longer time frames by using trading strategies that help them win big over a long period of time which may last for many months. They only concentrate on safer trade choices that hold high-profit potential.

Establish a personal set of trading rules

Success in the markets is determined by how much control you have over your own trading habits. Knowing when to get in is important for making money, but knowing when to get out is equally as important when it comes to not losing money.

Knowing when to exit the market is an important rule to have, but it should be one of many that you utilize when you trade. You should have many rules that cover everything from your winning and losing percentages, to how much you risk per trade and more.

Set your trade and go away

Emotion is one of the reasons your trade fails . To deal with your emotions, you need to set your trade and let it be till when it is completed. If you view the chart constantly, each time the market fluctuates you’ll drive yourself crazy. When the market reverses direction you’ll tend to want to pull out too soon or over-correct the position and end up losing more money. You need to get reliable trading software and have faith in it. To avoid overreacting emotionally, only look at the trade when you place it and when you exit it.

Know the right time to trade

Get to know the euro open strategy. The european session known as the london daybreak opens at 3 AM EST, and this session is massive for traders because roughly 75% of the entire forex transactions occur during this session.

This is also when the market’s highest highs and lowest lows will occur.

With the use of either your charting software or a market scanning tool, you ought to target the euro session as your best time to trade.

Forex hack 2: learn to manage your risks

To achieve this there are a few things you can do, lets take a peak at them down below.

You place a trade order and set your stop and discover that you are consistently being taking out just prior to your big win. The solution is to always set a stop loss.

Stop-losses prevent you from losing all the money in your account in a single trade. You set a minimum number for the market to hit as soon as the market hits that number your trader would automatically exit on your behalf.

Alter your stop-losses as the market situation changes

As the market ebbs and flows, stop-losses get bigger. This volatility generates higher highs and higher lows, which could give higher profits to smart traders.

Smart traders alter their stop-losses to reflect the market. How you can correctly use a fluid stop-loss number is to move the minimum number based on the market movement.

When to move your stop-loss

Search for a high or a low that has two candlesticks to the left side and two candlesticks to the right which are higher or lower from that position.

- A high commonly have two lows to the left and right

- A low commonly have two highs to the left and right

Use reversals to your advantage

Forex trading goes on 24 hours and is made up of 3 major trading sessions: the european, U.S. And asian sessions. The european session has the most movement, which is followed by the U.S. And lastly the asian markets. Frequently, the market will reverse directions when one session ends and the other starts. By trading these reversals, you are likely to capture the most pips.

Thus, if the european session is trending bullish, as soon as the american session starts to set in, it will start a reversal and the market will turn bearish.

By using this strategy you can identify the reversal points, leverage on the market movement and know when a market high or low could happen. With 3 trading sessions occurring every day, there is the potential for 2 reversal positions every day. This implies that utilizing a single strategy can determine how you view three different markets.

Forex trading hack 3: trade in baskets

Follow the tips below to get it done:

You can save time and multiply your profits by trading in baskets

This is a strategy that allows you to have it both ways and it involves selecting a currency and placing it into one of two sections:

- The control section

- The pegged section.

The control section is when the currency like the USD is on the left side of the slash of the currency pair – USD/CHF, USD/JPY etc.

The pegged section is when your chosen currency is on the right side of the slash like EUR/USD, GBP/USD etc.

The first step is to select a currency to concentrate on. As soon as you do it, you create your control and pegged baskets.

The next step is to conduct research on your chosen currency. Then, based on your research, you will get information on how your currency performs against the currency it is paired with. You can trade both bearish and bullish move at the same time when you split the currency pairs into baskets.

If for instance, you want to trade the USD and, based on your research, you’ve discovered that it is strong against the swiss franc, but weak against the japanese yen.

You would create a basket trade that allows you to buy the USD/CHF pair , and sell the USD/JPY pair .

This lets you trade bullish against the franc and bearish against the yen concurrently. Trading in baskets gives you the opportunity to make double gains.

Locate your basket data

The solution to succeeding by trading in baskets is to conduct research on the currency you have chosen. You should start this by using your charting software and studying candlesticks.

If a currency is growing in strength, you would check the charts to confirm the bullish uptrend. When the currency’s control of the currency pair rises, it has extra control.

Forex profit hack 4: know your risk limit

Never risk more than 2% to 5% of your trading account

A great forex management tip is to never risk more than you’re willing to lose. The amount of money you risk must be what you can comfortably living your life without it. We advise you to limit it to merely 2-5 per cent of your trading account.

Before placing any trade, have it at the back of your mind that every trade comes with some risk. You will not always win. You’ll definitely lose at some point but the key is your ability to properly manage this risk to give you the chance to have money to trade again.

If you are just beginning it is better to stick with trading risks of only 2 per cent of your trading account. You can increase it as you grow your experience but it must never exceed 5 per cent.

Identify and trade candlestick formations

One of the trendier candlestick formations is the head and shoulders pattern. This occurs when a bullish trending market makes a peak and begins to retract.

The problem with this candle formation is that the market will frequently overcorrect itself and you’ll take a huge loss before you know it. To avert this it is better to trade with the king’s crown pattern. With the king’s crown pattern, you are trading beyond the “shoulders” of the head and shoulders pattern. As soon as the market takes out a low of support, it tends to bounce back up before the market finally falls.

Here is how to trade this pattern:

Label your highest point on the chart as labeled ‘A” and label the previous high as the “left tip.” the left tip is significant because it informs us how high the market was trading earlier which signifies to us how low the market will trade eventually.

Moving back to the A mark, you can draw a line from the fresh highest high to the new lowest low, the B position. Follow that trend to the next highest position to get to position C, and finally to the next low which is your “D”.

In this instance, what you need to do is to buy when the market starts to rally after the D mark. You won’t lose your trade until the market goes beyond the D to reach the newest low.

You know when this will occur because you know the value of the previous high before the start of the king’s crown started (the left tip).

In instances like this, what you are trading is not the neckline but the breaking point beyond the lowest low. This extra movement in the market lets you see the true indication of the markets and could minimize your future chances of making losing trades.

Earn in forex

Put an end to your quest of hunting for forex courses or coaches, there will be a new one popping out every other week. If you are looking for the “guru’s guru” “the best in the industry” “one of the world’s best forex trader” – as testified by my students.

Let me ask you a question.

Why do forex traders trade?

I mean how many people who’ve started trading actually love the art of trading and don’t just do it to make money?

I’ll admit I do love trading. The art of trading. The beauty of reading charts especially price action trading and the different forex trading strategies. The satisfaction I get when I see the market moving in the intended direction.

It’s just like playing a game. The main difference is that, when you win this game, you are rewarded in material terms. Not in achievements or kudos, but in actual cash that you can use in the real world.

Would you like to play this game? Working your way through it and ensuring you understand as much as possible on how to win?

If this piques your interest, then, yes, forex trading or trading of any sort may suit you.

Contents

Can you get rich by trading forex?

But ezekiel… I hear, how much money can you make trading forex? Can I become rich from it?

“I would like to put in capital of $1000. And if I trade diligently, is it realistic to make $2k a month from trading… say after one year?”

“if I put in $10,000, can I make $100,000 from it in a year? Or… can I make like $10k a month from it?”

You see, being a forex trading coach and mentor, these are the types of questions I get pretty often.

If you want a straight answer to whether you are able to become rich through forex trading, then the answer is yes.

But… is it simple? Not really.

Can trading make you rich?

How can I turn $10,000 into $100,000?

Want to know a method akin to gambling for how you can get rich through trading?

Take a look at this example:

If, let’s say, you put in $10,000 and you want to grow it to $100,000 in a year.

So that’s 10x growth in 12 months.

Or 1000% growth in 12 months.

Now, do you know of any vehicle that gives you that? Not really.

But is it possible in forex trading? Yes it is.

I mean… you could simply enter a trade with a 100% risk. Meaning you go all-in on one trade risking your entire $10k.

And if that trade runs a risk reward ratio of 1:10.

Then there you go… you just made $100k in a trade.

How can I turn $10,000 into $1 million?

Here’s another example of how to “get rich through forex trading”:

You can go all-in at $10k for one trade.

To put it in simple terms, the chances of you winning are 50% and losing are 50%.

So, if it goes up your way, you could have made (let’s not aim so high… but just a risk reward ratio of 1:1) a 100% profit.

Now, let’s say you now put in your $20k (at the same 100% risk) and you win your next trade.

And then you put your $40k into the next trade, you make $80k.

Woo-hoo! Three wins in a row and you just turned $10k into $80k.

The fourth win will make you $160k!

And so you went in with high hopes thinking that, in a couple more trades, you will turn that $160k into $320k, then the $320k into $640k and then into $1.28 million!!

Just four more wins and you will be a millionaire! Fantastic!

But of course, things get in the way and fantasies like this are shattered in no time.

Because you lost the next trade and your $80k account is now busted!

Does the above scenario sound familiar? Because it’s stories like this that we hear all too often.

This above scenario is just like gambling isn’t it? The gambler will tell you how much he won and then he’ll lose it all. And then go on to tell you he will make it back and more the next time because he has “learnt” what not to do.

If you follow that specific method, then I’m pretty sure the next set, and the set after that, will turn out the same.

Because you can get lucky in one trade, in two trades, maybe even in three trades… but how long can you stay lucky that way? It’s not really realistic isn’t it.

Now… let me bring you back down to earth. Because that was fantasy island. ;)

So is it not possible to turn $10k into $100k?

But we have to do it the “slow and steady way”.

How much can you make trading forex?

Trading the safer way

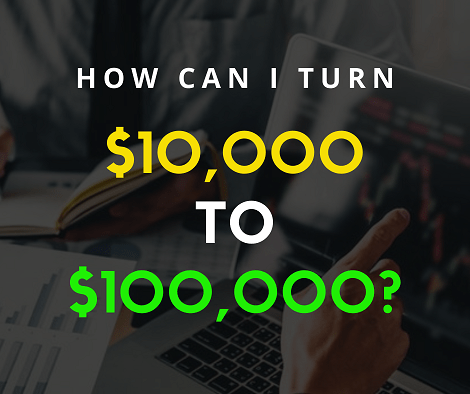

Now let’s say we follow the general rules of risking 1-3% a trade. For this example, let’s put it at 3%.

If your risk reward ratio is, on average, at 1:2…

You will win $600 each trade, and, if you lose, you lose $300.

Let’s say you have a win rate of just 50%.

Therefore, out of 20 trades, you lost 10, meaning you lost $300 * 10 = $3000.

And you won 10 trades, 10 * $600 = $6000.

Out of 20 trades, you made $6000 – $300 = $3000.

So now your capital is at $10,000 + $3000 = $13,000.

Meaning your next trade will be 3% of $13,000 = $390.

Now that’s compounding in action.

Let’s put the above scenario into a compounding calculator.

Assuming you take 20 trades a month…

How long do you need to make $100k?

That’s 9 months.

Now of course, it may also seem unrealistic that you are making 30% a month. Because you made $3k out of $10k in a month.

Let’s tone it down a little.

Let’s say out of 10 trades, you won four and lost six. So you have just a win rate of 40%.

And you now only take 10 trades a month, not 20.

Therefore, out of 10 trades, you lost 6, meaning you lost $300 * 6 = $1800.

And you won 4 trades, 4 * $600 = $2400.

Out of 10 trades, you made $2400 – $1800 = $600.

So now your capital is at $10,000 + $600 = $10,600.

Meaning your next trade will be 3% of $10,600 = $318.

Let’s put it into compounding…

You will reach $100k at month 40. Which is around 3 year 4 months.

Now it may seem way longer. But turning $10k into $100k in 3+ years is still really good, right?

How about if we wait a bit longer…

By month 80, you would have turned it into $1 million dollars!

So is forex really profitable?

Can you get rich by trading forex?

This is the power of compounding put into trading.

Can you make a living trading forex?

As much as it’s possible to do. I don’t want any new traders to be jumping into this game thinking that they can get rich instantly.

The fact is that most new forex traders leave the game after just two years.

And only 10% of traders make money.

It’s because successful trading takes discipline that is incorporated into a solid forex trading system to put the above into action.

Few forex traders want to put in the hard work but only want to get rich.