Earn money trading forex

To start, you must keep your risk on each trade very small, and 1% or less is typical.

Actual forex bonuses

this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below. You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

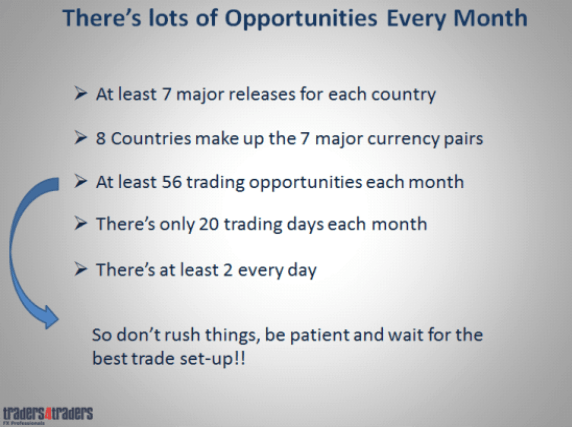

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How do you make money trading currencies?

Investors can trade almost any currency in the world through foreign exchange (forex). In order to make money in forex, you should be aware that you are taking on a speculative risk. In essence, you are betting that the value of one currency will increase relative to another. The expected return of currency trading is similar to the money market and lower than stocks or bonds. However, it is possible to increase both returns and risk by using leverage. Currency trading is generally more profitable for active traders than passive investors.

Key takeaways

- It is possible to make money trading money when the prices of foreign currencies rise and fall.

- Currencies are traded in pairs.

- Buying and selling currency can be very profitable for active traders because of low trading costs, diverse markets, and the availability of high leverage.

- Exchanging currency is not a good way for passive investors to make money.

- It is easy to get started trading money at many large brokerages and specialized forex brokers.

Buying and selling currency explained

It is important to note that currencies are traded and priced in pairs. For example, you may have seen a currency quote for a EUR/USD pair of 1.1256. In this example, the base currency is the euro. The U.S. Dollar is the quote currency.

In all currency quote cases, the base currency is worth one unit. The quoted currency is the amount of currency that one unit of the base currency can buy. Based on our previous example, all that means is that one euro can buy 1.1256 U.S. Dollars. An investor can make money in forex by appreciation in the value of the quoted currency or by a decrease in value of the base currency.

How do you make money trading money?

Another perspective on currency trading comes from considering the position an investor is taking on each currency pair. The base currency can be thought of as a short position because you are "selling" the base currency to purchase the quoted currency. In turn, the quoted currency can be seen as a long position on the currency pair.

In our example above, we see that one euro can purchase $1.1256 and vice versa. To buy the euros, the investor must first go short on the U.S. Dollar to go long on the euro. To make money on this investment, the investor will have to sell back the euros when their value appreciates relative to the U.S. Dollar.

For instance, let's assume the value of the euro appreciates to $1.1266. On a lot of 100,000 euros, the investor would gain $100 ($112,660 - $112,560) if they sold the euros at this exchange rate. Conversely, if the EUR/USD exchange rate fell from $1.1256 to $1.1246, then the investor would lose $100 ($112,460 - $112,560).

Advantages for active traders

The currency market is a paradise for active traders. The forex market is the most liquid market in the world. Commissions are often zero, and bid-ask spreads are near zero. Spreads near one pip are common for some currency pairs. It is possible to frequently trade forex without high transaction costs.

With forex, there is always a bull market somewhere. The long-short nature of forex, the diversity of global currencies, and the low or even negative correlation of many currencies with stock markets ensures constant opportunities to trade. There is no need to sit on the sidelines for years during bear markets.

Although forex has a reputation as risky, it is actually an ideal place to get started with active trading. Currencies are generally less volatile than stocks, as long as you don't use leverage. The low returns for passive investment in the forex market also make it much harder to confuse a bull market with being a financial genius. If you can make money in the forex market, you can make it anywhere.

Finally, the forex market offers access to much higher levels of leverage for experienced traders. Regulation T sharply limits the maximum leverage available to stock investors in the united states. it is usually possible to get 50 to 1 leverage in the forex market, and it is sometimes possible to get 400 to 1 leverage. This high leverage is one of the reasons for the risky reputation of currency trading.

New forex traders should not use high leverage. It is best to start using little or no leverage and gradually increase it as profits and experience grow.

Disadvantages for passive investors

Passive investors seldom make money in the forex market. The first reason is that returns to passively holding foreign currencies are low, similar to the money market. If you think about it, that makes sense. When U.S. Investors buy euros in the forex market, they are really investing in the EU's money market. Money markets around the world generally have low expected returns, and so does forex.

The benefits of the forex market for active traders are usually useless or even harmful for passive investors. Low trading costs mean very little if you do not trade very much. Using high leverage without a stop-loss order can lead to large losses. On the other hand, using stop-loss orders essentially turns an investor into an active trader.

Getting started with forex

The forex market was once much less accessible to average investors, but getting started is easy now. Many large brokerages, such as fidelity, offer forex trading to their customers. Specialized forex brokers, such as OANDA, make sophisticated tools available to traders with balances as low as one dollar.

How to make money trading forex online

Chances are at one time or another, you’ve been asked by well-meaning friends to join the train of online forex traders. Or your interest has been piqued by the business and you’ve been told by numerous online sources that the best way to make money is trading forex online. Either way, it’s always important to understand the pros and cons of any venture you wish to embark on. Best believe it, it is not always bright and shiny in the online forex trading world.

Pros

- It is easy to trade in online markets

- You have access to a great amount of leverage making it easier for small retail traders to start their journey even with little capital

Con

Are the stories real? Can you make A living trading forex?

The internet today is rife with numerous forex trading victories. Are they just another cheap PR to get unsuspecting victims to embark on forex trading? The truth is there have been plenty of genuine forex trading success stories. But it all depends on you. How willing are you to work? How ready are you to learn the process?

Professional forex trader ezekiel chew has put down some seven noteworthy ways to become an excellent forex trader, beat the majority, and scale to impressive heights.

1. Learn the trade before you trade

Despite how exciting the process of trading may seem, it is always better you look, or in this case study, before you leap. That’s right. The better part of your excitement should be spent learning the art of trading.

Any tom, dick, and harry can open an account and start trading, but it takes so much more to make the money you dream of. Not to mention the tendency to be easily frustrated and to incur huge amounts of debt when you do not understand the process well.

How can you learn? A proper forex trading course is the best place to start your journey towards a successful forex trading path. They’ll teach you all the rudiments of trading independently and provide you with ample knowledge of trading strategies for the long run. You’re also sure to get follow on support when you embark on trading.

Make sure to be wary of scammers who promise quick success in a short period. A simple hack is that a good trading school will never promise such. They’ll only promise to teach you everything you need to know to trade effectively.

2. Set up A demo trading account

If you want to practice the trading process and get accustomed to the nitty-gritty involved, a demo account is an answer to your prayers. It enables you to practice forex trading on a “demo” capital, which is not real capital. This is because a demo account does not require capital to function.

Some of the perks are it helps you to get used to the trading interface and the process of placing orders on dummy trades. So when you do eventually start really trading, your boat would be smooth-sailing. A demo trading account provision is available on several trading platforms.

3. Beginning A piecemeal at A time

Trust us, you do not want to throw in a large amount of money at the initial stage of your trading quest. For one thing, a lot is at stake when you do, plus the emotional upheaval this may cause.

As a newbie, it’s best you start trading with a small amount of money and in the process, master the skill. You'll also have a lesser tendency to risk your account in the process. Leverage and margin also give you the ability to start really small. A good trading school will teach you all you need to know about leverage and margin.

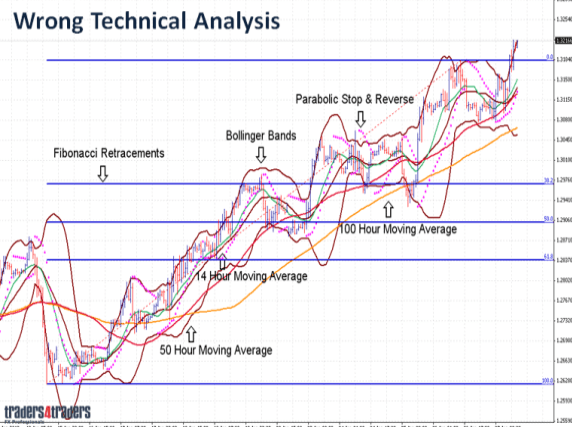

4. Do not feel overwhelmed; price action is all that matters

Do not fall into the bandwagon of nouveau traders who clutter their chart with so many indices. Best believe it, at the end of the day, price action trading is all that matters. This cluttering of your chart also diverts your attention from what matters in the grand scheme of things, and you’re often rendered immobile from the numerous factors to consider.

And of a truth, technical analysis is not hard to decipher. It’s all about buying at very low prices and selling at a high price. The same way a trader would want to purchase goods in a store or from a manufacturer at low prices and sell to customers at a high price.

You will find that a good number of institutional traders do not care to crowd their charts with several indicators. They simply analyze prize levels and make a decision either to buy or sell within these prize ranges.

5. Find A forex trading strategy that works

We like to think that several indicators on a chart are like several stick-it notes on a refrigerator. You most likely placed them there to remind you of important things. But because they are many, they end up confusing and even frustrating you.

A good forex trading strategy that works need not be complicated. What is important is that it gives you an edge in the market. Look at trading in the long run. When your wins are more than your losses, you will be profitable. Finding the right forex trading strategy that is time tested through a series of successful backtesting is highly important.

Start off by mastering one strategy in a single pair. Swing trading strategies are one of them. Only move on to the next pair or strategy when you are profitable in a series of three sets of 20 trades. This way, you have a clear idea on whether or not you are profitable when compared to someone who is trading a range of different strategies and various pairs.

6. Trade within your limit

It is important to remember that a lot could go wrong with any trade at any given time. Do not be tempted to trade outside your accepted risk exposure in a week. Especially as a new trader, you could easily bankrupt your account in a short time when you trade above your limit.

Another advice is to count your losses and never keep a trade beyond the loss of its value. If chances allow, you ought to move to protective stop loss to decrease your losses. You also want to go the extra mile of protecting your profits by taking profits at strong levels.

One more thing: you should make use of trailing stops to protect winnings and at the same time creating an avenue for it to grow.

7. Keep track of your trading journey

There’s a reason why companies hire firms to audit their account. While your forex trading may not be the same as a company, they are both business ventures with the aim of making a profit. This way, you can determine how your trading has been going within a period of time. Your losses too should be accurately accounted for.

Keeping a record also serves as a practical lesson. Trading is essentially a lot of learning and a little doing. How fast you learn from your mistakes and apply your newfound knowledge will go a long way in projecting your profits and boosting your morale.

We understand that the art of forex trading can prove to be an emotional rollercoaster especially for the newly indoctrinated. However, it is important to take any losses with a grain of salt, for it is a part of the whole process of trading. Sometimes you win, other times you lose. What is important, however, is that you learn from your losses and wins too.

One strategy is to always make plans and be deliberate about those plans. Try to map out a clear cut pattern to attain any goal you set. Diligence and experience are what make a successful forex trader. And a right attitude to loss is what makes it a learning experience.

Some of the things you could include in your record taking include:

- The date the trade was made

- Screenshot of the chart of every trade

- Explanation of where the trade was taken and reasons for the execution

- Write out your performance in the trade

- Write out how your performance makes you feel.

Creating a word document can help with all this.

How do you make money trading currencies?

Investors can trade almost any currency in the world through foreign exchange (forex). In order to make money in forex, you should be aware that you are taking on a speculative risk. In essence, you are betting that the value of one currency will increase relative to another. The expected return of currency trading is similar to the money market and lower than stocks or bonds. However, it is possible to increase both returns and risk by using leverage. Currency trading is generally more profitable for active traders than passive investors.

Key takeaways

- It is possible to make money trading money when the prices of foreign currencies rise and fall.

- Currencies are traded in pairs.

- Buying and selling currency can be very profitable for active traders because of low trading costs, diverse markets, and the availability of high leverage.

- Exchanging currency is not a good way for passive investors to make money.

- It is easy to get started trading money at many large brokerages and specialized forex brokers.

Buying and selling currency explained

It is important to note that currencies are traded and priced in pairs. For example, you may have seen a currency quote for a EUR/USD pair of 1.1256. In this example, the base currency is the euro. The U.S. Dollar is the quote currency.

In all currency quote cases, the base currency is worth one unit. The quoted currency is the amount of currency that one unit of the base currency can buy. Based on our previous example, all that means is that one euro can buy 1.1256 U.S. Dollars. An investor can make money in forex by appreciation in the value of the quoted currency or by a decrease in value of the base currency.

How do you make money trading money?

Another perspective on currency trading comes from considering the position an investor is taking on each currency pair. The base currency can be thought of as a short position because you are "selling" the base currency to purchase the quoted currency. In turn, the quoted currency can be seen as a long position on the currency pair.

In our example above, we see that one euro can purchase $1.1256 and vice versa. To buy the euros, the investor must first go short on the U.S. Dollar to go long on the euro. To make money on this investment, the investor will have to sell back the euros when their value appreciates relative to the U.S. Dollar.

For instance, let's assume the value of the euro appreciates to $1.1266. On a lot of 100,000 euros, the investor would gain $100 ($112,660 - $112,560) if they sold the euros at this exchange rate. Conversely, if the EUR/USD exchange rate fell from $1.1256 to $1.1246, then the investor would lose $100 ($112,460 - $112,560).

Advantages for active traders

The currency market is a paradise for active traders. The forex market is the most liquid market in the world. Commissions are often zero, and bid-ask spreads are near zero. Spreads near one pip are common for some currency pairs. It is possible to frequently trade forex without high transaction costs.

With forex, there is always a bull market somewhere. The long-short nature of forex, the diversity of global currencies, and the low or even negative correlation of many currencies with stock markets ensures constant opportunities to trade. There is no need to sit on the sidelines for years during bear markets.

Although forex has a reputation as risky, it is actually an ideal place to get started with active trading. Currencies are generally less volatile than stocks, as long as you don't use leverage. The low returns for passive investment in the forex market also make it much harder to confuse a bull market with being a financial genius. If you can make money in the forex market, you can make it anywhere.

Finally, the forex market offers access to much higher levels of leverage for experienced traders. Regulation T sharply limits the maximum leverage available to stock investors in the united states. it is usually possible to get 50 to 1 leverage in the forex market, and it is sometimes possible to get 400 to 1 leverage. This high leverage is one of the reasons for the risky reputation of currency trading.

New forex traders should not use high leverage. It is best to start using little or no leverage and gradually increase it as profits and experience grow.

Disadvantages for passive investors

Passive investors seldom make money in the forex market. The first reason is that returns to passively holding foreign currencies are low, similar to the money market. If you think about it, that makes sense. When U.S. Investors buy euros in the forex market, they are really investing in the EU's money market. Money markets around the world generally have low expected returns, and so does forex.

The benefits of the forex market for active traders are usually useless or even harmful for passive investors. Low trading costs mean very little if you do not trade very much. Using high leverage without a stop-loss order can lead to large losses. On the other hand, using stop-loss orders essentially turns an investor into an active trader.

Getting started with forex

The forex market was once much less accessible to average investors, but getting started is easy now. Many large brokerages, such as fidelity, offer forex trading to their customers. Specialized forex brokers, such as OANDA, make sophisticated tools available to traders with balances as low as one dollar.

How much money can you make trading forex?

When I hold a live webinar, the most common question is, “how much money can I make with forex trading?”. This question is wrong. We recently wrote an article about forex trading and profitability.

I see that people are looking for fast income, and they are ready to gamble, to chase after the money! It is the wrong attitude. In trading trader looks for the opportunity – never chase after the money. So I try to make lower expectation and give you these answers :

Can you make money trading forex?

Traders can make money trading forex. However, forex trading is not profitable for retail traders based on all major brokers’ reports because 70%-95% of all retail traders lose money in trading every year. Retail traders making either risk too much, either over trade or create small profits on several positions but then holding on to a losing trade for too long, losing more than the initial investment. Institutional traders and traders from prop companies generate profits trading currencies and managing large portfolios. The best forex trader in prop companies can profit from 20%-25% with less than 5% maximum drawdown.

Now let we see the numbers:

How much money can you make trading forex?

Excellent traders can earn between 20% – 50% annually trading forex. Earnings depend on trading expectancy, position size, and consistency. For example, if an excellent trader manages $100 000, the maximum allowed drawdown is 5% ($5000), he can earn $20 000 annually.

In the prop company where I trade (leantacapital) average annual return is around 18%. The average position size is 0.5% per trade. The average drawdown is less than 8%. The junior trader who manages $200 000 and has averaged 20% annual return can earn up to $1000 per month (after all costs are paid).

So, it is tough to earn money as a trader. Consistency in trading brings stable and regular profits, week after week without much drawdowns and losses. It is hard to achieve stable returns. My equation is:

How much money can you make on forex = f (trading expectancy, position size, consistency)

So, your position size is correlated with your capital. More capital, more profits! In the end, we need to calculate your trading expectancy:

trading expectancy = [1+ (average win / average loss )] x percentage win ratio – 1

So if we have 1000 trades where 600 are winning and 400 are losing, we have :

percentage win ratio = 600/1000=0.6

average win = $6000/600= 10

average loss= $4000/400= 10 than:

Trading expectancy = [1+ (10 / 10 )] x 0.6 – 1 = 0.2

That means for each $1 that the investment trader will earn 20 cents in the future.

Warren buffet has a trading expectancy of around 20 cents for every dollar, and he is one of the richest men on the planet. His annual return last 50 years was around 20%. So if your trading expectancy 0.1 or 0.2 – it is not bad at all.

2) how much do fx traders make worldwide? Generally, retail traders lose their money. Around 85% lose their capital, and around 10% are break-even (do not lose and earn). These percents are different from broker to broker, but generally, only 2-3% of traders make any significant profit at all. The reason is not a type of asset. The problem is poor risk management, overtrading, and poor position managing.

Can forex trading be profitable?

Yes. If you trade smart any security, you can earn money either forex, stocks, commodities, bonds, etc.

Those who are interested in making fast money should always look for different options to make money fast. But in the trading industry, it is almost impossible to earn money fast. The trader needs years and years of hard-working, analysis, research to succeed in the trading business.

There are numerous ways to earn money, and earning through forex trading is no exception at all. The most important this is that it can be started with the least amount of money.

There are no good profits for new traders.

Forex trading is done almost twenty-four hours a day. One can do trading almost during the entire week. An experienced trader should do trading. It is considered the most volatile, and thus there are full chances of people losing money if they are not experienced enough. Thus, if you plan to go for it, you need to gather all the relevant information about it, learn, test, and practice.

New traders can be profitable for one or two months, but very fast, they will lose all money and blow out the account because of poor risk management and wrong position managing process.

Risk management

There is no doubt that you can earn a lot of profit through trading, but it is equally true that there are equal chances of you losing it as well. One should always keep the risk factor in mind. So, if you are new to forex trading, you need to keep risk very small at each trade you do. If you do so, you will not lose much of your money. High-risk trading is number 1, the biggest problem in trading for all new traders. My advice is that the new trader does not risk more than 1% of their portfolio. In that case, the max drawdown will be up to 15%.

Strategies in trading

It does not matter which strategy you are going to opt for. Risk and win are always associated with this form of trading.

Win rate – win rate is represented by the total number of trades you have won out of the total number. If, for example, you win 45 from 100 trades and your risk-reward ratio is 1/1. This means that your win rate is 45%, and your account will be losing its portfolio.

Risk/reward – this decides the amount of capital being risked to get a certain profit. For example, if the trader is losing ten pips and winning fifteen pips, the trader is more on winning than losing. Thus, one can say if any trader is winning, 50% is considered to be profitable. Making more money on winning is a vital component of forex trading, which every trader learns with time.

Leverage on trading

The leverage that is provided by the forex traders is in the ratio of 50:1. This leverage might vary based on the country in your trade-in. It is known that forex brokers do not charge any commission; they raise the spread between the bid and ask.

Slippage more than excepted loss

Slippage refers to the difference between the expected forex price of a trade and the forex price at which the trade is executed. Those who are new should be aware that slippage is an important part of any trade. Even when stop-loss is there, it results in more loss than was expected by you. It is commonly noticed in the fast-moving trade markets. Every trader needs to understand that part of losing money in trading will come from slippage.

Final say about forex trading

There is no doubt that how much money can I make forex day trading? If you are aware and have good knowledge of trading, you will earn pretty well. There are risks involved to try to figure out those as well.

You only need capital worth $500 to around $1,000 to get started, which is pretty ok. Using that money, you can not create income – only practice to trade on a live account. If the trader quit the job and start to live from trading, the trader needs to have at least 50K to 100K for a fresh start (my opinion). Do not forget that you do not invest too much money and do not put your hard money at risk just for the sake of earning a good profit. Be sensible and try to put in money that you can afford to lose. Many people have made a huge profit, but on the other hand, many have lost money as well. Try to gain knowledge and then go for forex trading after you are confident enough.

How much money can you make with forex? The best forex traders can earn from 15% to 60% per year based on deposit and risk level. Final advice: do not think about trading profit – think about the trading opportunity, good setup!

You can earn A lot of money by trading forex

The most important indicators in shopping and promoting a career

You can reward with 1 to 2 risks in the transaction. However, if you simply win 20% of the time, you will be a stable loser.

Now, obviously, the threat you want to praise is not a solution. What is your winning price?

Maybe you have 90% of the winning price. However, if every time you take a risk, you lose $ 0.90 and you lose $ 5, you will always be a loser.

So, what is the answer?

- Absolutely, the risk of your praise and win rate itself is meaningless.

- Well, the secret is this …

- You need to consider your chances of winning and receiving praise in order to finalize your profitability.

- This is what you expect.

- Your expectations will give you the opportunity to keep your expectations for every dollar.

Mathematically speaking, it can be expressed as:

- W is close to the scale of your extraordinary victory

- L is close to your average loss scale

- P-entry winning price

The correct example is as follows:

You have made 10 transactions. 6 winning transactions and 4 falling transactions. This means that your win percentage is 6/10 or 60%. If your six transactions increase your profit by $ 3,000, then your joint profit is $ 3,000 / 6 = $ 500. If the most effective loss is $ 1,600, then your extraordinary loss is $ 1,600 / $ 4 = $ 400.

Subsequently, these figures are applied to the intended system:

In this case, the expected value of your way of buying and selling is 35% (very good expectation). This means that your way of buying and selling will fall by 35 cents per dollar in every long-term transaction.

- The flow of permits

- Why must play bigger to win bigger

- Are you sure?

- Most people in the casino work 24 hours a day, 365 days every 12 months. Why?

- Due to reality, the more they play, the more money they earn-the same is true for trading.

You may be surprised:

“what does this have to do with purchases and promotions?”

This indicates how often you trade. The more transactions you make, the more money you can make (although expectations are high).

Let’s imagine:

- You can win foreign exchange shopping and promote technology 70% of the time, of which 1-3 risks are commendable.

- But right here

- It has only 2 trading indicators in 12 months.

- How much unusual transaction money can you make through this foreign exchange trading method?

- No more people, right? Heck, when you consider the risk of a continuous 9% decline, you might even lose in that year.

- Do you have the ability to see how important this is?

Right now:

The frequency of your transactions is critical, but it is not enough to determine how much cash you can earn in foreign exchange shopping and promotions.

Why cash is your lifeblood for buying and promoting foreign exchange in commercial enterprises

you may have heard the story that a trader spent a small amount of money and then replaced it in piles in a short period of time.

- However, you do not need to be aware that for every trader trying to do this, thousands of other traders blow up their accounts.

- Thanks to a short, rich plan, allow no longer needs shopping and promotions. Or, gradually develop it as the enterprise you are looking for.

- Now, the license says, you may generate 20% of the profits (together) within 12 months.

- With an account of $ 1,000, you need an average of 12 months to get $ 200 in income.

- In a $ 1 million account, the median you see is $ 100,000, which is consistent with the year.

- For accounts with an annual income of $ 10 million, the average amount you want to search is $ 2 million.

Now, not to mention that you can make 20% of your income every year, because, in fact, this percentage may be better for an afternoon or swing traders (because you have more trading opportunities).

The best difference is your betting period (or a chance to match your bet). The greater the threat, the higher your return.

Will you refund or increase revenue?

If you use a USD 10,000 account with an average annual income of 20%, it might be worth … 383,376.00 USD after 20 years.

If you are a daily traveler, trading is your easiest source of income. You need to withdraw funds from your account to meet your life needs.

However, if you have a full-time task and are trading, then you really should not make any withdrawals and may increase your account earnings.

This is not right or wrong. Ultimately, you must understand the needs of your trading employer-and recognize that withdrawals may have a long-term impact on your returns.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

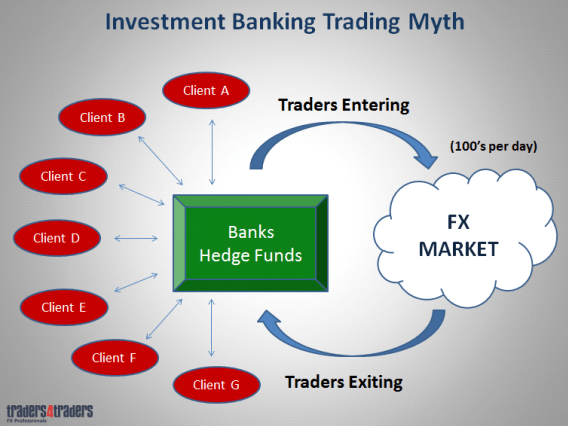

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

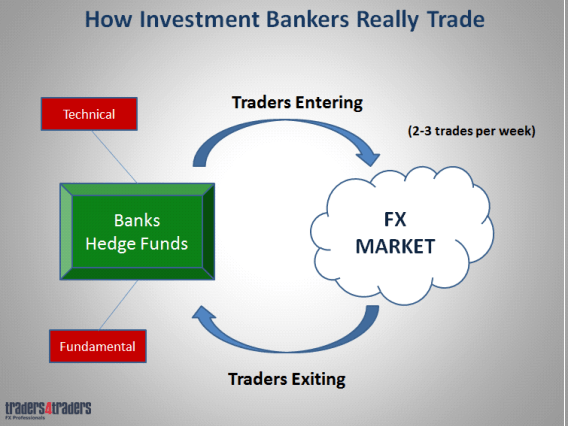

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

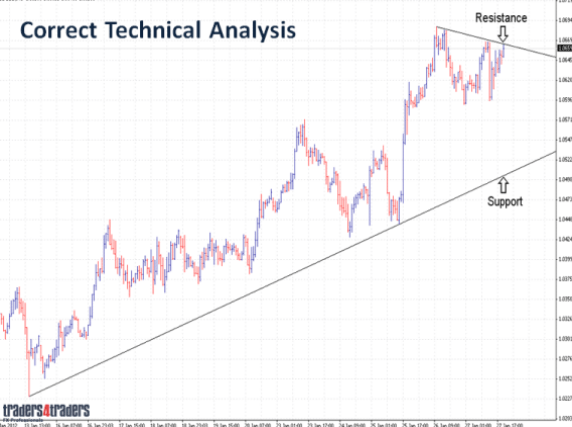

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

Fxdailyreport.Com

We are all aware that forex refers to a currency market where traders buy currencies and sell them. For a trader to earn some money at forex, they should have the currency of a country, which they can exchange for another country’s currency. As a result, a trader will either get a profit or loss.

In forex trading, you can decide whether to invest some money or trade without a deposit. Top forex brokers do provide a free no-deposit bonus to traders. In such a case then you can trade at forex with no money.

Whether you opt to trade with or without an investment, the truth is that each case has its own risks. This is true especially if you don’t have the necessary experience and knowledge on how to trade in forex. That is why you should learn some basics on how to start forex trading business with no money.

Forex has a daily trades amounting to 5.3 trillion dollars, making it the top fiscal market across the globe. This alone poses a great chance for traders to earn huge profits. Trading without an investment is risk-free in itself. This article is for anyone who desires to take this path.

Here’s how to begin trading in forex without money

First, you must have a clear understanding that it is not possible to make high profits in forex with no investment. If you desire to be a serious trader and want to gain huge profits in the long-run, then you should open a trading account and deposit some money on it.

Nonetheless, you can still earn money at forex with no investment but the profit will not be as big. The best part with no investment trading is that you’ll not risk your money.

Trading forex is in itself risky – that’s why many people shy away from it. There are many scams assuring people that they can earn millions even if they have no capital investment. Don’t let these scams fool you – even a bit!

Luckily, you can earn money at forex without a deposit. The thing is that it will take a long time to accumulate as much as you would desire.

- Forex trading with zero capital using demo accounts or with no-deposit bonus

Every reputable forex broker will give traders a chance to open new demo accounts. Such an account will let you use virtual currency to trade at forex. But you cannot withdraw this fund as it belongs to your broker, or you can try forex no-deposit bonus and you can withdraw if you make a profit.As an inexperienced and new trader, it is advisable you start with a demo account or no deposit bonus. If you so wish to take this path, then, just be aware that you can make a profit. But it’s a great starting point to learn how to trade when you invest real money.

- Affiliate programs

Besides opening a demo account, you can trade using affiliate programs. This is a chance to make extra money in forex without trading as per se. Just select a broker and promote them. As a result, you’ll get a commission if you happen to attract people. This is a current trend for traders to earn money with no investment.

Participating in an affiliate programs entails attracting new clients. These clients must be willing to trade in forex. That’s how you’ll earn your bonus. Affiliate programs have different terms and conditions. Some will allow you to receive bonuses whether or not the client trades. Therefore, it’s great to check out the terms for your affiliate program and see how much you can get.

Once you attract a client, your broker will automatically transfer your bonus into your trading account. Here you have an option to withdraw the money or trade with it in forex.

- Contests

Some brokers do arrange contests for real and demo accounts on a regular basis. Unlike other competitions, the ones in forex are simple. To become a winner, you must boost the income on your virtual account at least several times within the shortest period possible. As a result, you’ll receive money on your real account – as a reward.

Therefore, you can trade at forex with no investment. If you choose to trade using a demo account, then you should increase profits for a specific amount within a specific time period. And you’ll get a bonus on your real trading account.

So taking part in the contest can make you a great trader at forex even if you don’t have an investment. However, for you to be successful with demo contests, you must know how to trade with cryptocurrency pairs. Cryptocurrency is a great asset for a trader to earn high profits due to its volatility.

- 4. Posts, reviews, and comments on different information portals

Brokers do reward traders who place interesting comments on forex forums. You can also receive bonuses when you participate in forex opinion polls. Similarly, publishing articles and surveys about forex can earn you bonuses on your real account.

Apart from earning money, you can also gain reputation and experience same as that of a professional analyst. Brokers are willing to pay a lot for forex reviews. So you can take advantage and write them some damn good reviews.

The bottom line

Those who make an investment in forex are not the only ones who can gain profit. Even the ones with no money can too. Notably, though, if you want to earn huge amounts of money at forex you should invest money. On the same note, you should have the knowledge and experience of trading in forex.

Nowadays, people can trade with no capital at first and open real accounts later on. And with time, they become successful in trading. As a newbie in this field, it is advisable you begin the first step and proceed as you gain experience/knowledge.

Hopefully, you now have a clue on how you can start forex trading business with no money at all. You can use either of these options as a chance to gain experience on how to trade in forex without risking your money.

Earn money trading forex

Your money has to work for you without loss. We help people to make money

What is forex?

Electronic trading platform

How do currency market work?

Stock trading with EFM

Globally regulated & licensed:

Secure & safe:

your funds are kept safe in segregated accounts, and your trades are protected by negative balance.

Transparent:

performance statistics, including requote, slippage and order execution, are checked by PWC.

Exceptional trading conditions:

industry standard trading conditions for every type of trader.

Committed to education:

we offer regular seminars, workshops and webinars in multiple languages,regular contests & promotions.

Return on investment (ROI)

A profitability measure that evaluates the performance of a business by dividing net profit by net worth return on investment, or ROI, is the most common profitability ratio. There are several ways to determine ROI, but the most frequently used method is to divide net profit by total assets. So if your total assets are 500$ your ROI would be 2$ to 3.5$ daily.

Return on investment isn't necessarily the same as profit. ROI deals with the money you invest in the company and the return you realize on that money based on the net profit of the business. Profit, on the other hand, measures the performance of the business. Don't confuse ROI with the return on the owner's equity. This is an entirely different item as well. Only in sole proprietorships does equity equa the total investment or assets of the business. You can use ROI in several different ways to gauge the profitability of your business. For instance, you can measure the performance of your pricing policies, inventory investment, capital equipment investment, and so forth. ROI ratio is 0.40 to 0.70

so, let's see, what we have: here is a scenario for how much money a simple and risk-controlled forex day trading strategy can make, and guidance on how to achieve that level of success. At earn money trading forex

Contents of the article

- Actual forex bonuses

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- How do you make money trading currencies?

- Buying and selling currency explained

- Advantages for active traders

- Disadvantages for passive investors

- Getting started with forex

- How to make money trading forex online

- Pros

- Con

- Are the stories real?...

- 1. Learn the trade before you...

- 3. Beginning A piecemeal at A...

- 4. Do not feel overwhelmed; price action...

- 5. Find A forex trading strategy that...

- 6. Trade within your limit

- How do you make money trading currencies?

- Buying and selling currency explained

- Advantages for active traders

- Disadvantages for passive investors

- Getting started with forex

- How much money can you make trading forex?

- You can earn A lot of money by trading forex

- The most important indicators in shopping and...

- So, what is the answer?

- Mathematically speaking, it can be expressed as:

- The correct example is as follows:

- Will you refund or increase revenue?

- Making money in forex is easy if you know how the...

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- How to make money in forex trading: A complete...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- Fxdailyreport.Com

- Here’s how to begin trading in forex without money

- Earn money trading forex

- What is forex?

- Electronic trading platform

- How do currency market work?

- Stock trading with EFM

- Return on investment (ROI)

No comments:

Post a Comment