Scalping strategy crypto

Traders should use each of the crypto trading strategies with great care, as most involve serious funding.

Actual forex bonuses

The market moves in both directions, as price sometimes falls and rises. Swinging in the market means to locate repeating timeframes of price behavior, and then capitalize it by buying or selling.

Crypto scalping strategies – compare all trading strategies

Crypto scalping strategies – compare all trading strategies

In this guide, we talk about crypto trading strategies, their types and how should traders use them. We show off different ways to trade cryptos, including

- Crypto scalping

- Crypto day trading

- Crypto arbitrage trading

- Crypto HODL (buy and hold)

- Crypto swing trading

- Crypto trend trading

We will discuss how important strategies are, emotional trading, crypto trading tools, crypto trading tips, crypto signals, technical analysis and fundamental analysis. In addition to master your crypto trading strategy of choice, you must also m aster crypto trading risk management before you can become a profitable crypto trader.

Limited offer: get 100 MPH FREE

How important are crypto trading strategies?

So, why should you invest your time investigating crypto trading strategies?

Different market trends require different approaches and understanding them can make a line between profit and loss.

Altcoin trading strategy does not differ that much from bitcoin. However, bitcoin is known to move all alts in terms of price, so you should adjust your strategy accordingly.

There are many factors that impact the price of cryptocurrency, as the value changes on hourly bases and sometimes drastically. Thus, it is important to understand the best way to approach trading at that specific moment.

Cryptos also do not depend on the solitary regulatory body but rely mostly on the market trends. Luckily, many of coin strategies come from forex and commodity trade, both of which had time to mature.

Emotional trading and habits in crypto trading

Before we delve deeper into crypto trading tactics, it is important to set the basis for sound reasoning. As the name suggests, crypto trading strategies are about creating a good game plan on how to manage your portfolio.

It also includes what type of orders to use and how to utilize your knowledge. Emotions can help investors choose the right moment through their “gut feeling.”

However, many a trader experienced panic or stress emotions that they could not control. In turn, it led toward wrong decisions, mostly through premature trade order closure or construction.

Thus, controlling your emotions while investing in cryptos is crucial. Bull and bear trends (growth or decline of the market) can scare anyone. However, understanding the market, one can easily deduce that such fluctuations are old news.

Keeping a cool head at all times, even if your entire bank check is in jeopardy will definitely help.

By deducing when to accept losses and when to get inside highly volatile period can save you from losing out everything you have in balance. It is important to understand that there is no perfect time to trade cryptos (or anything really). Analyze the market with a clear mind and cut your losses when needed.

The same can be said about habits, as many get into cryptos with beginner’s enthusiasm. However, the said hype can die out pretty quickly after first few failed tries.

After all, trading coins is a continuous effort of employing knowledge and patience while making money. Thus, as with anything else in life, good habits come in quite handy. Here are few cryptocurrency trading tips that you should practice every day in order to streamline your investment success:

- Clear your mind from all things not related to crypto when engaged in trading

- Keep analyzing charts on daily basis, not missing out longer periods to keep updated

- Continuously educate yourself about trading tools, strategies, and crypto market itself

- Regularly perform deep analysis, both technical and fundamental

- Have a positive outlook on your investments

Tools for crypto trading strategy implementation

There are various tools that can help you in crypto strategy implementation. These often come as free functions though paid ones are more complex and thus, more helpful. Here are the most important ones that beginners should be aware of:

Crypto software

Crypto software come as a complete deal of all automated programs that help extract data, provide analysis, and transfer funds around. By downloading it, most of the time you get a flashy interface, pinpointing issues, and opportunities.

Crypto trading bots

Although software solutions are awesome, we would recommend starting with individual packages. Bots come in different shapes, prices, and functionalities. For starters, bots that gather and analyze data are more than enough to kick-off their bitcoin day trading. Read more and compare the best crypto trading bots .

Crypto API tools

Apis connect you with the trading platform by performing complex operations within seconds. Thus, instead of you manually gathering data in excel, use apis to get that spreadsheet and alarm systems to do the job instead of you. Just faster and better.

Crypto trading charts

Although it is possible to work out the market without above-mentioned tools, charts are mandatory if you want to profit. Price and volume charts provide vitally important information for your cryptocurrency trading strategies.

Take trading view snapshot below. At the top corner you have indicators that show price patterns while graph itself gives visual presentation of the market. You can even combine different exchanges and track out where fluctuations are larger.

You can read more about these in our separate article, crypto trading tools .

Types of crypto trading strategies

Crypto scalping

Crypto scalping strategy revolves around the notion that smaller but numerous trades a day is the best profit gainer tactic. This might work on days when coin drastically changes in value and should thus be implemented sparingly.

You can also use the tactic if you are aiming for lots of trades but for a small amount of profit. This type of market approach might land you small profit per transaction but risks are very low.

It is also good for starters to try their hands on the trading, tough we advise small funds only to be invested.

Scalping itself uses smaller volumes of coins and funds after all in order to catch as many changes as possible. We would prefer binance for crypto scalping strategy and you can read about binance trading platform our binance review .

Crypto day trading

Crypto day trading can rightly call itself as an umbrella tactic that all others base their philosophy on.

Day trading is one of the oldest concepts in the trading industry. You make an order and close it within 24 hours, with hourly analysis the basis of your assumptions. Crypto day trading is high risk trading since mall price differences and large fluctuations can put a toll on investors that are prone to emotional trading.

Crypto day trading is perfect for advanced traders that likes to perform automated trading and program their strategies into crypto trading bots.

There are numerous cryptocurrency trading sites that provide charts containing hourly and daily data.

If you are about to test crypto day trading you would look for a great trading platform with low fees . We would go for binance.

Crypto arbitrage trading

Crypto arbitrage trading strategy is quite common in the crypto world, due to large fluctuations on an hourly basis.

Bitcoin trading sites are many leaving space for investors to buy fast and sell even quicker. The idea is to make a small profit out of several transactions in one day or even within an hour. You buy cryptos cheaply at one exchange and sell it expensively on the other, making an easy profit.

This strategy has its merits, as it lowers don the risk of losses. On the other hand, even though cryptos can fluctuate, you still depend on exchange rates on different platforms. This can render your activities useless if unfavorable.

Thus, we recommend this strategy only once you have everything set. You should also understand cryptos you are trading, thus a little bit of experience in the crypto markets is necessary. For crypto arbitrage trading a bot is necessary. Read more about crypto trading bots in our specialized article.

Crypto HODL (buy & hold)

Another popular method of trade, buy & hold even has a name in the crypto jargon – HODL. In this strategy, the trader looks to purchase the coin at the low price level and hold it until the market trends push the coin into the favorable zone.

According to this strategy, the price would inflate upwards as time passes, earning you larger profits as you wait out.

This has several advantages and disadvantages. On the pro side, you can purchase the coin and lend it out to others, earning interest as a result. You also bypass complex analysis on daily basis and concentrate on long-term crypto trading indicators .

On the con side, bitcoin rose to $20.000 at one point in 2018, only to fall down to $4.000 at the end of the year.

You stand to lose a lot if your long-term analyses misfire. For crypto HODL there are many good and interesting crypto trading platforms. You probably want to look for good deposit and withdrawal options . If you are about to invest more than $5.000 etoro crypto portfolios might be interesting. Otherwise, you can check the complete table of trading platforms.

Crypto swing trading

Swing trading tactic uses the graphical presentation of price fluctuations as a mean to locate trends within a certain period of time.

The market moves in both directions, as price sometimes falls and rises. Swinging in the market means to locate repeating timeframes of price behavior, and then capitalize it by buying or selling.

This is reserved for experienced traders, especially those that understand charts and indicators. Mobile apps and chart platforms in this strategy are invaluable. You do need to understand peaks and drops in order to use this strategy properly. Binance is a great choice for crypto swing trading strategy. Read more about which cryptocurrency to trade with a swing trading strategy .

Crypto trend trading

The trend is very similar to swing tactic, though with a little twist. Where swing is used for short-term trading purposes, trading with trends is long-term oriented.

You pick up major events and reasons behind fluctuations but do not get into an hourly rate of change. You should be interested more in daily changes, as you wish to grab larger price differences.

Crypto scalping strategy has bigger potential in terms of profit than swing tactic but it requires a bit larger investments.

However, you are also at a higher risk of losses if you misinterpret signs. Whereas swinging is better suited for experts, trend trading can accommodate starters as well as experts.

You should keep in mind that cryptocurrencies change value fairly quickly and drastically. Bitcoin scalping can land you quite a lot of money but you also stand to lose it just as fast. Binance is the perfect choice for crypto trend trading strategy.

Crypto trading tips

We have several tips for you to consider while trading cryptocurrencies:

- Always look at the market data before you use a strategy. Sometimes the market might move against you, so it is best to be prepared.

- When using tools like charts and bots, open up several of them and compare data. This should give you clearer idea on how the industry moves.

- If you wish to buy and sell coins to own them, prepare wallet and trade platforms prior to your activities. It is also good to check the terms of trade as well.

If you are interested in reading further information, look through our article discussing the best cryptocurency for day trading and swing trading .

Crypto trading signals

There are many API and apps out there that provide you signal services. These are alarms whose main aim is to guide your attention towards important trends happening momentarily in the market.

What is important to understand is the fact that you should either set them yourself or use someone else’s.

Twitter and facebook is a good source if you would rather wish to use the latter option. Check out our guide regarding top twitter accounts to follow for cryptocurrency trading for great crypto trade signals to get a better idea.

Crypto technical analysis

Suffice to say, strategies are meaningless if you do not do research beforehand. Thus, everyone involved with crypto investment uses technical analysis.

These investigations focus on statistics and numerical changes of the industry in terms of price and volume fluctuations. Charting is essential here and there are numerous platforms that provide combined findings from several crypto trading websites.

Read more about signals and how to set up your own investigations in our article about crypto technical analysis.

Crypto price predictions

Apart from a technical aspect, crypto traders use fundamental analysis to make crypto price preditcions . Fundamental investigation works out psychological patterns in the crypto industry.

This is an especially important tool to use, due to how blockchain world basis its value on market trends and human factor.

Mainstream markets have regulators and central banks controlling interest rates and thus, pricing. Cryptos, on the other hand, allow investors, miners, and users to set evaluation according to the demand and supply.

Conclusion crypto trading strategies

In this crypto trading guide about strategies in 2020, we went over several of them in terms of the advantages and disadvantages they have.

Traders should use each of the crypto trading strategies with great care, as most involve serious funding.

Without an understanding of the market functions, and strategies themselves, it is easy to picture bankruptcy of your operations. Keep your emotions in check, practice good trading habits, and hang in there. You will reach your goals if you keep yourself disciplined and vigilant.

Cryptocurrency scalp trading for beginners - how do you do it right

There are many different types of trading that you can participate in when it comes to cryptocurrency. Today, we’ll be talking about scalp trading!

This interesting form of trading allows you to make profit quickly, but what is it? How do you do it? Is it working for bitcoin or for some other altcoins as well? We’ll answer all of your questions for that and give you some pointers to help you to get started.

Apply crypto scalping on 25+ exchanges

With bitsgap multi-exchange cryptocurrency trading platform you can use scalp trading strategy on all popular exchanges from one single account. Fast experience with all needed indicators included!

What is cryptocurrency scalp trading

While swing traders are normally looking to make bigger profit by holding an asset for a period of time, crypto scalp traders are typically happy coming home with a little bit less. This is because their method of making profit typically involves creating many small trades very quickly.

The initial gains for one of these trades may not seem like much, but they all add up. If you’re patient enough to complete a strategy like this, then the gains could be substantial for you when they’re added up at the end of the trading day.

However, keep in mind that for this strategy you’ll need to be quick and you’ll have to be laser focused. This style of trading isn’t for everyone, but it can be a great way to make a profit on small price movements.

The good thing about this strategy though is that small wins are easier to obtain. Cryptocurrency prices are constantly moving and this leaves many great opportunities for scalping.

How to do crypto scalp trading

Cryptocurrency scalping is heavily based on technical analysis, and if you want to be able to scalp then you’ll need to learn at least the basics. A scalper will use charts or possibly even big release news to make money on an investment within a very short time frame.

Your goal is not to hold on to an investment at all but simply to take advantage of growing trading volume and then get out with a small gain. Doing this many times over the course of the trading day is how you win here.

Many crypto scalpers will actually use a five-second chart of their trades and place their buys and sells quickly. They might even make 100 deals during a trading day if they are particularly active.

This obviously requires a ton of fees, so make sure your trades are actually profitable after that is taken before diving in. You need great planning and even greater discipline if you want to be a scalper.

Bitcoin vs altcoin scalp trading

Bitcoin tends to have less volatility than altcoins do. This means that the amount of profit you can make is less, but it will likely be more reliable.

Compared to BTC, altcoins can have highly unpredictable volatility, so if you get in over your head, then it’s possible that you might never make back your profit. You’ll need to choose wisely here to succeed.

Is scalping trading profitable

Scalping strategy can be very profitable if you’re dedicated to learn how to do it correctly. However, if you’re easily frustrated or you can make a solid plan and stick to it, then it’s easy to lose money here too. Scalpers need to have certain exit plans.

Scalp trading indicators

Here are a few popular trading indicators that you can learn to use to get started with cryptocurrency scalp trading.

Relative strength index

RSI is an easy to use indicator for beginners which can help you to identify entry and exit points. If the RSI is above 70, this typically means it’s a sell and if it’s below 30, then it’s a good idea to buy.

Support and resistance

Learning to identify where the support and resistance levels are can help you to get off quick scalp traders. Beware of breaks in these levels that could quickly take profits out of your wallet.

Moving average

Using the moving average indicator is a good way to get an idea of where the price of an asset is going. You can use it much like you would for any other trade, just now you will be making your trading windows much smaller.

Cryptocurrency scalp trading tips

- Avoid altcoins with low volume, this is a trouble for scalpers.

- Have a plan and stick to it.

- Always have a solid exit strategy.

- Don’t put everything into one trade for safety.

- Don’t forget to factor the fees into your trades.

- Use proper technical indicators.

Pros and cons of automated or bot scalping

The pros of automated scalp trading are that it takes emotion out of the picture. Your bot trades for you based on the rules you set and you don’t really have to do much else. This means there’s less time for you to make emotional decisions that ruin your plans.

The drawbacks of automated scalping with cryptocurrency of course are that sometimes, actually more than sometimes, your first plan will be wrong. This could result in a bad loss for you if you’re not around to fix it, so you’ll need to have your bot act accordingly for unexpected events which can’t be charted.

Scalp trading simulator / demo mode

Bitsgap has an awesome demo mode that allows you to learn trading cryptocurrency using a variety of different methods. You can even draw right on the live chart to do your TA, making it an easy way to practice your scalp trades without losing any money.

Scalping can be pretty high risky, so it’s actually a great idea to learn doing it using a demo tool first. It’s also free to get an account, so you won’t have to risk any money at all to practice.

Scalping vs day trading

Scalp traders, believe it or not, hold on to their assets for an even shorter period of time than crypto day traders. While day traders might make a couple of deals per day, a scalper will make many trades in quick succession.

Scalping vs swing trading

Swing traders are generally looking for larger price swings based on various criteria. A scalper typically uses technical analysis or news to find small price movements to profit on quickly. A cryptocurrency swing trader could hold their assets for some time, while a scalper is ready to dump them as soon as possible.

Cryptocurrency scalping strategy that works

If you’re a fan of fast-paced crypto market movements and you wish to get in and out of a trade as quick as possible, than the cryptocurrency scalping strategy that works will work for you.

You no longer have to wait for days for trade setups to occur, scalping will allow cryptocurrency traders enter multiple positions in a single day based on when we get a buy or sell from our system.

If you’re unable to put in the a few hours every day to implement a digital currency trading strategy, than the cryptocurrency scalping strategy that works might just be the most suitable for you.

Now let’s layout the entire strategy, so just about anyone can understand it.

Trade setup

Crypto MT4 indicators: ma-heiken.Ex4 (inputs variable modified; ma_period=32), moving average.Ex4 (inputs variable modified; period=14, MA method=exponential, style=magenta), macd-color-indicator.Ex4 (default settings)

Suitable for: scalping, day trading

Trading time: 24/7, around the clock

Cryptocurrency: any (bitcoin and altcoins)

Timeframes: M1, M5, M15, M30

Download

Buy trade example: XRP/USD (ripple / US dollar), M5 chart

Strategy rules

Buy signal

Open a buy trade if the following trading conditions appear on the crypto chart:

- If the yellow line section of the ma-heiken custom MT4 indicator crosses below the magenta 24 EMA metatrader 4 indicator line (see fig. 1.0), bulls’ power is said to building, thus a trigger to go long on the stipulated cryptocurrency.

- If the black line plus lime green histograms of the macd-color-indicator custom indicator breaks and hovers above the 0.00 level as shown on fig. 1.0, the general ripple market sentiment is said to be bullish, as such a buy trigger will suffice.

Suggested stop loss for buy trade: place stop loss below short-term support.

Suggested exit strategy/take profit for buy trade

Exit the buy trade if the following trading conditions appear on the chart:

- If while a bullish trend is ongoing the ma-heiken indicator line intersects the magenta 24 EMA indicator line, price is said to be making a likely bearish reversal, and as such an exit or take profit stance is advised.

- If the black line of the macd-color-indicator custom indicator dips below the 0.00 horizontal level as seen on fig. 1.0, bulls power is said to be diminishing, therefore a trigger to exit or take profit immediately.

Sell signal

Open a sell trade if the following trading conditions appear on the crypto chart:

- If the aqua line section of the ma-heiken custom indicator crosses above the magenta 24 EMA indicator line as illustrated on fig. 1.1, bears power is said to gaining momentum, thus a trigger to sell the designated cryptocurrency.

- If the black line plus red histograms of the macd-color-indicator custom indicator breaks and hovers below the 0.00 level as seen on fig. 1.1, the overall ripple market sentiment is said to be bearish i.E. A trigger to go short on the cryptocurrency of interest.

Suggested stop loss for sell trade: place stop loss above short-term resistance.

Suggested exit strategy/take profit for sell trade

Exit the sell trade if the following trading conditions appear on the chart:

- If while a bearish trend is running the ma-heiken indicator line intersects the magenta 24 EMA indicator line, price is said to be making a probable bullish reversal, as such an exit or take profit trigger is recommended.

- If the black line of the macd-color-indicator custom indicator surges above the 0.00 horizontal level (refer to fig. 1.1), bears power is said to be weaning, therefore an exit or take profit stance is apt.

Sell trade example: XRP/USD (ripple / US dollar), M5 chart

Free download

About the cryptocurrency technical indicators used

The ma-heiken is a moving average indicator that is based on the japanese candlestick trading variation.

It is used to better highlight trend changes on a crypto chart.

The 24 EMA is an exponential moving average that has its period set to 24 and reduces price lag on digital currencies by adding more weight to the recent price.

The macd-color-indicator is a cryptocurrency technical tool that is similar to the traditional MACD indicator.

It is known to alter the color of its histogram based on changes in the crypto market trend situation.

Easy installation

Start using this cryptocurrency strategy in just 5 minutes. Click here to get started now.

Bitcoin price: how to potentially make profit using scalping strategy?

Bitcoin price has touched the 19437.10 mark on some exchanges. This model of heightened volatility is something quite anticipated in the crypto sphere. If we examine the BTC price on a longer timeframe, we can observe unexpected signs that hint back to the “rise and fall” of cryptocurrencies, which supplied doubters of blockchain technologies with supplementary reasons to doubt and praise this market.

The question is: how to potentially make a profit using the scalping strategy? Should traders move into today’s unknown territories? Let’s take a look at it in more detail.

Bitcoin price: should you scalp?

BTC/USD one minute chart: tradingview

One can choose scalping as a basic trading style or an additional technique. A scalper will apply short timeframe, tick, or one-minute charts to design trades. It requires commitment, control, and agility to perform scalp deals. If a trader would rather take some time to determine the appropriate asset and make the decision with time, then scalping is not fun. However, it is beneficial if traders like speed and want instant profit.

Right now, the bitcoin price is sitting at 19437.10 and if we observe the 1 min chart then we can see that the price has slightly declined in the last 8-9 mins. So, in other words, scalping trading is a short-term trading method that includes buying and selling many times during the day to make a profit from the price variation. It means buying BTC at a lower price and selling high. The code is to obtain highly liquid assets that encourage various price changes during the day. One can’t scalp if the asset isn’t liquid. Liquidity also assures that one gets the best price when entering or exiting the market.

Bitcoin price: important tips to consider for scalping

BTC/USD weekly chart: tradingview

Scalp traders utilize trading charts and timeframes that are the smallest of all the trading techniques. A day trader might apply a 5-minute trading chart to execute five deals per day. But a scalp trader will apply timeframes as low as 5-seconds to 1-min for 10 to 100 trades during the day. To accomplish this high speed of trading, scalp traders use different trading methods such as the market’s ‘time and sales’ – a history of purchasing, selling, and reversed transactions. The following are some of the important tips:

- Use the most precise timeframe to trade between 5 seconds and 1 minute.

- One could invest in approximately 8% to 15% of the purchasing power in each scalp trading.

- Direct stop lose 0.1% from the entry price.

- Wait in trades till the price touches the reverse point.

- For trading in low chart frames, one could trade between .2% and .3%.

- Aim for fast results. One can trade in the market at ultra-speed. Before other traders notice a chance, a scalper will open and close his deal.

Scalping crypto

Your browser does not support HTML5 video.

Trading strategy: scalping crypto

Last update: 04 nov 2020 at 04:04 UTC

This article features bitmex.

IMPORTANT! Bitmex platform is unreliable in 2020.

Cryptocurrency trading strategy: scalping crypto with tensorcharts (PDF)

Too long to read now? Download this crypto trading strategy as a PDF safely from keybase. (no risk of eye cancer from its design either.)

About (not just crypto) scalping

Scalping [noun] - trading technique of capitalizing on small price changes. Positions are typically closed as soon as they become profitable, earning a small profit.

Scalping requires a 5M or shorter timeframe chart with indicators that work well for you there (oscillators such as stochrsi tend to be good), stable exchange or API that will not freeze on you and definitely, definitely a reliable stop loss. In a trading strategy where you collect a lot of small profits from a big number of trades losers need to be cut quickly with a discipline as a single large loss could wipe out what you felt was a hard work, putting you psychologically in a bad place.

Why scalping crypto matters

Judging from google trends, a lot of new people got into cryptocurrencies as they started hearing about the bitcoin doubling…tripling…you what, 10k?…and so on. Another crop, smaller still, came at the start of the bitcoin’s bull run in late 2016.

The point is there are not many people who went through the previous bull-bear cycle and are still active in the community; the number of crypto-born professionals who trade on a daily basis is also still quite low.

At the current state of the market the majority of traders will stop trading during sideways and negative price actions.

Not only get people frustrated as the price keeps going down and they “cannot do anything” [please buy sirs], consequently losing sleep and perhaps also money on emotional trading. As an overall result the markets also get thinner and the decreased volumes are inviting for trolls and MSM to showcase cryptocurrencies are dying for real this time which can easily spiral into more panic. Good thing is that it is also a trading opportunity for everyone who wants to take it.

It is no doubt good to know when not to trade in order to minimize losses but it should be really the last resort. In the crypto business of 2018 we have stop-loss orders, arbitrage and other direction-independent strategies, or market making and basically any kind of short term trading.

There is still money on the table, why not collect it then?

Your cryptocurrency scalping tool

The anatomy of the candle has a lot more information than the simple information of OHCL. OHCL and colour of the candle only gives you the very superficial average information.

To this day your best tool of choice for any short-term crypto trades are tensorcharts, hands down. The information you get when watching tensorcharts is far more complete than the thinned-down, averaged-out information one can get from the standard candlesticks charts.

Particularly if you landed here for a bitmex scalping strategy, tensorcharts is your tool of choice because the dev is focusing mainly on traders like you who trade perps and futures.

Here is a brief intro to the tensorcharts project, but if you are looking more into learning what tensorcharts are and what can they do for you, this argentinian gentleman called nico made a series of tutorials on the learning nodes youtube channel. The videos were shot in march 2018 so you will get to learn about the latest version of tensorcharts updated with a bunch of new markets and functionalities.

In this article I will stick to the point of short-term trades and point out the minimum you need to know to work with tensorcharts, starting with a 5-minute video that shows you around the interface.

Working with tensorcharts: the story inside the candle

Different types of orders

With tensorcharts you get to see at pretty much single glance three types of orders for each time span defined by a candlestick:

- Orders that were posted in any previous time span but did not get hit

- Orders that got hit in a time span

- Currently posted orders, waiting to be hit or taken down

A proper introduction to the tensorcharts interface, should you need it:

Intermittent support/resistance levels

How do you leverage these three types of orders for your short-term trades?

You see the orders that were executed and are now creating a near-term history. This history is not only available as the candles but also as the volume profile, which is made of executed trades and gives a clearer view on the volume traded at which level. You also see the limit orders that were not hit and are still posted to the market, waiting for the market to come to them. You can also highlight the largest of these orders in the book, and in complement to that the S/R tool at the bottom will highlight the levels with the largest traded volume. For example, the S/R tool set to 5 will highlight 5 levels at your current chart window and it starts highlighting from the largest volume. Loop through it to quickly see if the largest volume was at the dips or the rips in your current frame.

Combine this information and have the momentarily support and resistance levels. The idea is to help you decide where exactly to place your limit orders on the 5M timeframe: find a support level, buy around that level. Find the next closest resistance level, sell there.

Keep in mind though that on the short timeframes the support and resistance levels are formed mostly by actual limit orders in the market, and some short term history and patterns. That makes them very fluid, so do not marry a direction. If someone pulls a large buy order that you were going to front run, it is time for you to pull yours too:

Not just average volume

Here comes the bit where tensorcharts can give you an edge. For each candle - that is the orders that got hit - you get to see volume blocks for each price level, the more intensive the colour tone is the more volume was concentrated at that particular level.

This is the order flow, the story inside the candle.

The advantage of the order flow is that there is no need to break up the chart into shorter timeframe candles because the order flow already shows the action inside the 5-minute blocks.

It has a lot more information than the simple information of open-high-low-close candle. The OHCL and overall colour of the candle only give you very superficial information and for very short term speculation, having the better data can give you a critical edge: is the volume good at the bottom of the candle? Or is it thin through the candle with a lot of buying at the top? This can give you insight into what is going on at the moment and what are the most likely implications for the next several candles.

Watch nico’s video on strategies where he briefly shows how you can read the price levels inside the candle:

The advantage of the order flow is that while there are shorter timeframe candles than 5M, there is a lot of noise in going down to 1M or 3M charts. If you like to combine support/resistance levels with other technical indicators you will see the ultra-short term messes some of them up completely. With the order flow though there is not the need to break up the chart into shorter timeframe candles because you are already seeing the action inside the 5-minute blocks. You get to see the supply and demand in real time which adds some of the precision of 1M or 3M charts while you are still able to enjoy the relative slowness of the 5M chart.

Keeping in touch with the bigger picture

Having explored the 5M chart into details, here is some wisdom from wikipedia:

Unlike momentum traders, scalpers like stable or silent products. Imagine if its price does not move all day, scalpers can profit all day simply by placing their orders on the same bid and ask, making hundreds or thousands of trades. They do not need to worry about sudden price changes.

Even when you set your mind to scalping do not lose touch with the bigger picture, the overall state of the market as seen on 4H, 1D or even higher timeframes. The market conditions change but substantial changes never come out of the blue, and you should be ready to see when it might be better to move to longer-term trading.

As a more complex idea, if you are trading on margin on an exchange that lets you use any one of a multitude of tokens as collateral, you might want to make use of the idea of strategically moving some of your collateral into a token that is gaining value.

Very generally speaking though, simply just stay aware of the state of the market - what is the bias, what kind of players are active, what is happening. Look at the volume, follow momentum indicators, be aware of the volatility index.

With tensorcharts you can also make use of the book counter and the trades counter. Book counter is measuring the orders pressure, trades counter gives the ratio of buy/sell orders at a given interval. The interface lets you set up a bunch of different trades counters at once, each one on a different timeframe. If you then turn on the visualization below the chart you get to see the trades for each particular timeframe. Short timeframes can be filtered by volume - they are too short to implicate long term conclusions but if you follow this for some time you will be able to spot how the market composition changes, what are the big players doing and what the small ones. The counter functionality is explained here.

Discipline needed even in the technicalities

One thing you should not disregard with scalping is a stop loss. You can have a trailing stop loss that will trigger once the price moves by a certain amount against you, or a normal stop loss that you keep adjusting to risk less as your position moves into profit. Although it is more of technique suitable for longer-term positions, in the bitfinex/ethfinex interface you can drag and move your orders directly on the chart which makes it easy to adjust the stop within seconds. Make sure the interface is not lagging on you though. If you are located in bizarre countries with strong botnet activity a VPN sometimes helps.

In a trending market this kind of trailing or adjusted stop loss would be a good strategy to let a winning position ride until the stop gets hit. In short timeframe on an undecided market though the stop will most likely be hit soon anyway, and if you are scalping you might prefer not to pay for the market order with the stop loss. There are limit stop losses too but if the market starts acting up they might not get hit and are therefore more risky in a trading setup where you rely on collecting a lot of small profits.

Do not add this risk and set both a stop loss and a take profit. A run-of-the-mill setup is 1:1 risk to reward - set your take-profit limit order as far from the entry as your stop loss (but adjusted for fees).

Coming to another technicality - just as important one: the fees. Traditionally, on exchanges such as bitfinex or kraken your fees will decrease with your increased traded volume over the past 30 days - here the fee schedule on bitfinex and here on kraken.

Some exchanges use a different fee setup:

- On the ERC20 exchange ethfinex the fees are staying the same throughout but for market making (in a very crude way, for using limit orders) a fully verified trader gets back ERC20 nectar tokens as a form of a limit order reward.

- On bitmex the fee also stays the same throughout but makers get a rebate. In the perpetual swap the situation gets further complicated by the swap funding payouts - fee schedule here.

If you are trading on an exchange that takes less fees with your growing traded volume, in some situations it is better to start out by closing at breakevens or even for small losses solely to build up that volume which will then let you scalp more freely. The lower your fee, the smaller price movements you can exploit for as long as that remains the best business you can get from the market. The conditions are not good for short term positions all the time; if you can, take the volume build-up as an entrance fee to an event.

Summary

Scalping can be a very profitable technique, especially in times when the market is not really doing much. However, it can also be used to trade inside of predictable short-term structures such as bull or bear flags. Important things to focus on are risk management and discipline though. While the setup might look straightforward - open a position at a support or resistance level, have a stop loss and a take profit in the 1:1 ratio, work to minimize fees - problems might occur especially for traders who are not used to taking losses. Losses are something that could have been pretty much avoided in crypto when trading big swings in 2017 but as for now it is inevitable with large amounts of quick trades in choppy markets. Learning to handle this is I believe a work to prepare you for the future though, as with time some skills, discipline and insight will matter more and more in the cryptocurrency markets.

This article features tensorcharts tutorials made by nico of learningnodes. Go show him some love on facebook or twitter and subscribe to his channel on youtube for more crypto trading tutorials.

And once again - you can find the tensorcharts web app right here. Not a sponsored post, tensorcharts genuinely rock.

How to use scalping while trading crypto

“scalping” sounds pretty gruesome, but it is a straightforward strategy you can apply in traditional and crypto trading.

Here’s a bit of background to this financial concept, plus how you should put it into practice.

Scalping in traditional trading

Scalping is most often used by forex traders and involves seemingly low-risk profiles, it requires a lot of discipline and intensive trade processing.

A scalper wouldn’t be holding positions overnight. The goal of scalping is to exploit predictable price movement en masse over the course of the day. This is necessary, since the per-trade profits are almost guaranteed to be small.

Two common approaches in scalping are arbitrage and spread scalping. Arbitrage involves finding a discrepancy between the bid and ask prices that are large enough between two different brokers and buying from one and selling to the other for a locked-in profit. Spread scalping involves exploiting the same kind of price differences but with the same broker. Note that in many cases brokers ban this practice.

Scalping in conventional markets has fundamentally different characteristics to cryptocurrency trading, as we’ll explain.

Implementing scalping in crypto trading

As you can see from the forex example, scalping is very intricate at times and requires skill and effort. Like above, a scalper in the crypto market would take advantage of small price fluctuations to lock in small gains.

Here is an example scalping trade and the thinking behind it.

In a big bull run and when optimism in the crypto market is running high, relatively speaking, investment turns to altcoins, leading to a price pump, often with choppy downswings en route.

An enterprising investor might spot an upward horizontal trend in a given alt, and use a trading pair, e.G. Bitcoin (BTC) and random altcoin (ALT), which hedges against downswings in the upward price of the given altcoin.

The scalping investor spots an upward trend in the alt, goes long on ALT and short on BTC, and has an exit strategy of selling back to BTC as soon as the trade is actualised with a profit, as opposed to normal trading where an investor might “let the profit run” for a longer period.

In the event that the trade has not gone to plan, a firm exit strategy is needed. If, in the example above, a bitcoin jump left the trader out of pocket, the trader must use a strict and tight stop-loss setup to take the beating and exit. This is extra important in scalping strategy, where a long streak of small gains can be wiped away with one large loss. It is for this reason that scalpers often impose a daily loss limit on themselves after which they throw in the towel for the day.

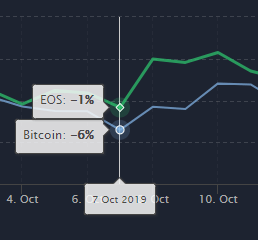

A prime opportunity for scalping the price bounce of EOS vs BTC

It involves technical analysis of the crypto market to figure out the channels in the price and then thereafter trading against price opportunities that fall outside that range. A scalper can buy e.G. An excessively underpriced asset and then sell immediately for a marginal gain. Essentially, the cryptocurrency trader is taking advantage of increasing trade volume to net small gains in a few seconds.

Scalping trading is difficult to get rich from in crypto but the market volatility makes it very possible. The pitfalls are that bad things can happen, and although the scalper is not exposed to lose too much on a single trade, they could incur heavy losses if a large number of these trades go south.

Is scalping trading for you?

Even when run correctly, scalping is time-consuming. You need to monitor the prices of many crypto assets (e.G. Bitcoin, ethereum, XRP) if you’re using the strategy fully, you need to be able to execute trades quickly, and you need a big enough bankroll.

As you can imagine, there is a huge amount of technical knowledge needed for this. Anybody can get started and since one’s potential losses are mostly capped, it is therefore a useful practice to use to help learn technical analysis too, just don’t expect to make much profit.

If you still want to give this strategy a try, first of all, make sure you factor fees into your profitability estimation. Next, you can scalp on any exchange that allows for fast enough trading.

Also, keep in mind that it is often practical to use more trading tools to help with your technical analysis: multicoincharts, RSI hunter, tradingview and bitsgap.

How to use a crypto scalping trading strategy

Crypto scalping with crypto trading bots

If you’re familiar with foreign exchange (forex) trading, you will know the term “scalping.” also called “scalp trading,” the practice is now widely used by cryptocurrency traders and is an available strategy as a custom bot inside haasonline trade server. Proponents of scalp trading say that the strategy can turn a profit quickly, but how exactly does it work when you’re trading with digital currencies like bitcoin?

We’ll define bitcoin scalping in more detail if you aren’t familiar with this specific trading method, then go into some ways you can use it to your advantage when trading with cryptocurrencies.

What is scalp trading?

Scalp trading is a historically proven, lower-risk, and short-term form of trading that makes smaller profits with less risk. Scalp traders make this happen by initiating a group of small trades very quickly. Over the course of a trading session, the profits from these trades can add up to pretty substantial numbers.

Speed and focus are needed to pull this off consistently, however, this is why experienced traders utilize automated bitcoin software, like haasonline trade server. Our products are designed to help traders identify profitable patterns and execute trades based on signals generated from using well configured scalp trading bots.

Scalp traders monitor the price of a crypto pair, like BTC/USD or ETH/BTC, and take advantage of price fluctuations in order to make a series of profit from each of the small trades. When the price goes up, you take advantage of the increased trading volume, which adds market liquidity. This allows you to enter and exit trades faster with the intent of never holding the digital asset for long-term. Once your dynamically generated target price is reached, sell signals are generated exiting you out of your positions with a small profit.

One very important thing to keep in mind while executing this strategy are the trading and exchange fees. Since you’ll be making a large amount of trades back-to-back and most exchanges charge nominal maker and taker fee for each trade, it is essential that you have the risk capital and profit margins to cover the fees you’ll incur while using a scalping strategy.

Exchanges that promote liquidity typically offer incentives to reduce trading fees for these traders. These incentives are often associated with an exchange specific token (like binance’s BNB) that can be used to further reduce fees, like the trading fee, oftentimes up-to a 50% discount.

Bitcoin scalping vs. Altcoin scalping

Relative to other cryptocurrencies, bitcoin tends to be the most stable of their volatile siblings. That means less profit per trade, but also more reliability for your scalping trading strategy, as predicted with technical analysis that bitcoin will hold its value over the course of your trading session. This makes bitcoin scalping a pretty popular form of scalp trading in the crypto market.

Altcoins, on the other hand, can have enormous differences in price, especially if they’re smaller coins not backed by a reputable company. Something could go wrong, or the coin could be delisted, along with any profit you’ll have made on those trades. If the coin isn’t worth much, the price you pay in trading fees could be more than you make from trading.

Whichever cryptocurrency you decide to try scalp trading with, patience and focus are key. Don’t get frustrated and give up right away if you don’t turn a profit in the first few minutes. It takes time to familiarize yourself with our trade automation software or even manually executing scalp trading.

When is a good time to scalp trade crypto?

If you know what to look out for, with time and practice you can determine whether or not the current market favors a scalp trading strategy.

Three market factors that experienced traders watch are:

- Relative strength index (RSI): this is a momentum indicator calculated by looking at recent price changes. The RSI evaluates whether an asset like litecoin is overbought or oversold, and is displayed as a line graph. It can have a value between 0 and 100. An RSI of 70 and above usually indicates an asset is being overbought or overvalued, thus it’s a good time to sell. An RSI of 30 or below indicates the opposite: it’s undervalued, primed for a price increase, and therefore its a good time to buy.

- Support and resistance levels: an asset’s support and resistance levels will change as it increases or decreases in price. That change can cause an asset to experience a concentration in demand and trend downward (support), or an increase in demand as price drops (resistance).

- The moving average: traders use this to get an idea of where the price of an asset is headed, using past data to extrapolate what it will sell for in the future.

Some traders use charts to track these indicators manually, but using trade automation software can help you analyze and act on the same data much more quickly.

Pros and cons of cryptocurrency scalp trading

Scalp trading allows for the opportunity for lots of small profits taken from batches of small trades that build up quickly. However, those profits can be wiped out if trading fees exceed the value generated from those trades. One large loss can also negate the profits from a scalp trading session. As such, it’s very important that the trader has a stop-loss strategy in place to minimize or mitigate their profit losses if the market conditions are changing in a way that negatively impacts the active trading strategy.

Trading with bots lets you make trades based on signals from exchange and market data. The trader’s emotions are taken out of the picture, as they aren’t watching the value of their assets rise and fall, or seeing huge changes in the market while trying to evaluate their trade.

However, you can suffer losses if you set a trade bot to trade and market conditions change, rendering your initial strategy useless. If you’re not around to course-correct, you could wind up with more losses than you otherwise would have. Oftentimes, the first strategy a trader comes up with ends up being wrong. If you’re using trading bots, make sure you check-in on them every so often to make sure your strategy is still performing soundly.

Best practices for crypto scalping

As with anything else, becoming a skillful investor takes time and practice, especially in a market as relatively new as cryptocurrency trading. However, there are a few tips you can follow to help yourself become a better trader right out of the gate while using a scalp trading strategy:

- Avoid altcoins with low volume; you may not be able to trade enough of them to turn a profit

- Know your plan beforehand and stick to it, leaving room for adaptation

- Have a good exit strategy

- Don’t put all your assets into a single trade, a good rule of thumb is no more than 2% of your risk capital

- Remember to account for fees and make sure you can cover them. Use haasbot safeties and insurances to automate

- Follow the proper technical indicators (discussed above)

Also, if you decide to use our crypto trading bots, remember to monitor them regularly as they execute trades automatically and often need manual intervention to account for changes in the market conditions.

Haasonline’s crypto trading bots maintain user privacy, don’t charge extra trade fees, and have no trade volume restrictions. They also allow you to backtest and paper trade your trading strategies with historical and real-time exchange data, giving you a better picture of the performance of your strategy and allowing for well-informed decisions.

The information provided is not to be considered as a recommendation to buy or invest in certain assets, currencies, or software, and is provided solely as an educational and information resource to help traders make their own decisions. Past performance is no guarantee of future results. It is important to note that no system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the attached material will guarantee profits or ensure freedom from losses. Haasonline shall not be liable to the participant for any damages, claims, expenses or losses of any kind (whether direct or indirect) suffered by the participant arising from or in connection with the information obtained from our videos, guides, tutorials, software, or directly from our website.

Crypto scalping strategies – compare all trading strategies

Crypto scalping strategies – compare all trading strategies

In this guide, we talk about crypto trading strategies, their types and how should traders use them. We show off different ways to trade cryptos, including

- Crypto scalping

- Crypto day trading

- Crypto arbitrage trading

- Crypto HODL (buy and hold)

- Crypto swing trading

- Crypto trend trading

We will discuss how important strategies are, emotional trading, crypto trading tools, crypto trading tips, crypto signals, technical analysis and fundamental analysis. In addition to master your crypto trading strategy of choice, you must also m aster crypto trading risk management before you can become a profitable crypto trader.

Limited offer: get 100 MPH FREE

How important are crypto trading strategies?

So, why should you invest your time investigating crypto trading strategies?

Different market trends require different approaches and understanding them can make a line between profit and loss.

Altcoin trading strategy does not differ that much from bitcoin. However, bitcoin is known to move all alts in terms of price, so you should adjust your strategy accordingly.

There are many factors that impact the price of cryptocurrency, as the value changes on hourly bases and sometimes drastically. Thus, it is important to understand the best way to approach trading at that specific moment.

Cryptos also do not depend on the solitary regulatory body but rely mostly on the market trends. Luckily, many of coin strategies come from forex and commodity trade, both of which had time to mature.

Emotional trading and habits in crypto trading

Before we delve deeper into crypto trading tactics, it is important to set the basis for sound reasoning. As the name suggests, crypto trading strategies are about creating a good game plan on how to manage your portfolio.

It also includes what type of orders to use and how to utilize your knowledge. Emotions can help investors choose the right moment through their “gut feeling.”

However, many a trader experienced panic or stress emotions that they could not control. In turn, it led toward wrong decisions, mostly through premature trade order closure or construction.

Thus, controlling your emotions while investing in cryptos is crucial. Bull and bear trends (growth or decline of the market) can scare anyone. However, understanding the market, one can easily deduce that such fluctuations are old news.

Keeping a cool head at all times, even if your entire bank check is in jeopardy will definitely help.

By deducing when to accept losses and when to get inside highly volatile period can save you from losing out everything you have in balance. It is important to understand that there is no perfect time to trade cryptos (or anything really). Analyze the market with a clear mind and cut your losses when needed.

The same can be said about habits, as many get into cryptos with beginner’s enthusiasm. However, the said hype can die out pretty quickly after first few failed tries.

After all, trading coins is a continuous effort of employing knowledge and patience while making money. Thus, as with anything else in life, good habits come in quite handy. Here are few cryptocurrency trading tips that you should practice every day in order to streamline your investment success:

- Clear your mind from all things not related to crypto when engaged in trading

- Keep analyzing charts on daily basis, not missing out longer periods to keep updated

- Continuously educate yourself about trading tools, strategies, and crypto market itself

- Regularly perform deep analysis, both technical and fundamental

- Have a positive outlook on your investments

Tools for crypto trading strategy implementation

There are various tools that can help you in crypto strategy implementation. These often come as free functions though paid ones are more complex and thus, more helpful. Here are the most important ones that beginners should be aware of:

Crypto software

Crypto software come as a complete deal of all automated programs that help extract data, provide analysis, and transfer funds around. By downloading it, most of the time you get a flashy interface, pinpointing issues, and opportunities.

Crypto trading bots

Although software solutions are awesome, we would recommend starting with individual packages. Bots come in different shapes, prices, and functionalities. For starters, bots that gather and analyze data are more than enough to kick-off their bitcoin day trading. Read more and compare the best crypto trading bots .

Crypto API tools

Apis connect you with the trading platform by performing complex operations within seconds. Thus, instead of you manually gathering data in excel, use apis to get that spreadsheet and alarm systems to do the job instead of you. Just faster and better.

Crypto trading charts

Although it is possible to work out the market without above-mentioned tools, charts are mandatory if you want to profit. Price and volume charts provide vitally important information for your cryptocurrency trading strategies.

Take trading view snapshot below. At the top corner you have indicators that show price patterns while graph itself gives visual presentation of the market. You can even combine different exchanges and track out where fluctuations are larger.

You can read more about these in our separate article, crypto trading tools .

Types of crypto trading strategies

Crypto scalping

Crypto scalping strategy revolves around the notion that smaller but numerous trades a day is the best profit gainer tactic. This might work on days when coin drastically changes in value and should thus be implemented sparingly.

You can also use the tactic if you are aiming for lots of trades but for a small amount of profit. This type of market approach might land you small profit per transaction but risks are very low.

It is also good for starters to try their hands on the trading, tough we advise small funds only to be invested.

Scalping itself uses smaller volumes of coins and funds after all in order to catch as many changes as possible. We would prefer binance for crypto scalping strategy and you can read about binance trading platform our binance review .

Crypto day trading

Crypto day trading can rightly call itself as an umbrella tactic that all others base their philosophy on.

Day trading is one of the oldest concepts in the trading industry. You make an order and close it within 24 hours, with hourly analysis the basis of your assumptions. Crypto day trading is high risk trading since mall price differences and large fluctuations can put a toll on investors that are prone to emotional trading.

Crypto day trading is perfect for advanced traders that likes to perform automated trading and program their strategies into crypto trading bots.

There are numerous cryptocurrency trading sites that provide charts containing hourly and daily data.

If you are about to test crypto day trading you would look for a great trading platform with low fees . We would go for binance.

Crypto arbitrage trading

Crypto arbitrage trading strategy is quite common in the crypto world, due to large fluctuations on an hourly basis.

Bitcoin trading sites are many leaving space for investors to buy fast and sell even quicker. The idea is to make a small profit out of several transactions in one day or even within an hour. You buy cryptos cheaply at one exchange and sell it expensively on the other, making an easy profit.

This strategy has its merits, as it lowers don the risk of losses. On the other hand, even though cryptos can fluctuate, you still depend on exchange rates on different platforms. This can render your activities useless if unfavorable.

Thus, we recommend this strategy only once you have everything set. You should also understand cryptos you are trading, thus a little bit of experience in the crypto markets is necessary. For crypto arbitrage trading a bot is necessary. Read more about crypto trading bots in our specialized article.

Crypto HODL (buy & hold)

Another popular method of trade, buy & hold even has a name in the crypto jargon – HODL. In this strategy, the trader looks to purchase the coin at the low price level and hold it until the market trends push the coin into the favorable zone.

According to this strategy, the price would inflate upwards as time passes, earning you larger profits as you wait out.

This has several advantages and disadvantages. On the pro side, you can purchase the coin and lend it out to others, earning interest as a result. You also bypass complex analysis on daily basis and concentrate on long-term crypto trading indicators .

On the con side, bitcoin rose to $20.000 at one point in 2018, only to fall down to $4.000 at the end of the year.

You stand to lose a lot if your long-term analyses misfire. For crypto HODL there are many good and interesting crypto trading platforms. You probably want to look for good deposit and withdrawal options . If you are about to invest more than $5.000 etoro crypto portfolios might be interesting. Otherwise, you can check the complete table of trading platforms.

Crypto swing trading

Swing trading tactic uses the graphical presentation of price fluctuations as a mean to locate trends within a certain period of time.

The market moves in both directions, as price sometimes falls and rises. Swinging in the market means to locate repeating timeframes of price behavior, and then capitalize it by buying or selling.

This is reserved for experienced traders, especially those that understand charts and indicators. Mobile apps and chart platforms in this strategy are invaluable. You do need to understand peaks and drops in order to use this strategy properly. Binance is a great choice for crypto swing trading strategy. Read more about which cryptocurrency to trade with a swing trading strategy .

Crypto trend trading

The trend is very similar to swing tactic, though with a little twist. Where swing is used for short-term trading purposes, trading with trends is long-term oriented.

You pick up major events and reasons behind fluctuations but do not get into an hourly rate of change. You should be interested more in daily changes, as you wish to grab larger price differences.

Crypto scalping strategy has bigger potential in terms of profit than swing tactic but it requires a bit larger investments.

However, you are also at a higher risk of losses if you misinterpret signs. Whereas swinging is better suited for experts, trend trading can accommodate starters as well as experts.

You should keep in mind that cryptocurrencies change value fairly quickly and drastically. Bitcoin scalping can land you quite a lot of money but you also stand to lose it just as fast. Binance is the perfect choice for crypto trend trading strategy.

Crypto trading tips

We have several tips for you to consider while trading cryptocurrencies:

- Always look at the market data before you use a strategy. Sometimes the market might move against you, so it is best to be prepared.

- When using tools like charts and bots, open up several of them and compare data. This should give you clearer idea on how the industry moves.

- If you wish to buy and sell coins to own them, prepare wallet and trade platforms prior to your activities. It is also good to check the terms of trade as well.

If you are interested in reading further information, look through our article discussing the best cryptocurency for day trading and swing trading .

Crypto trading signals

There are many API and apps out there that provide you signal services. These are alarms whose main aim is to guide your attention towards important trends happening momentarily in the market.

What is important to understand is the fact that you should either set them yourself or use someone else’s.

Twitter and facebook is a good source if you would rather wish to use the latter option. Check out our guide regarding top twitter accounts to follow for cryptocurrency trading for great crypto trade signals to get a better idea.

Crypto technical analysis

Suffice to say, strategies are meaningless if you do not do research beforehand. Thus, everyone involved with crypto investment uses technical analysis.

These investigations focus on statistics and numerical changes of the industry in terms of price and volume fluctuations. Charting is essential here and there are numerous platforms that provide combined findings from several crypto trading websites.

Read more about signals and how to set up your own investigations in our article about crypto technical analysis.

Crypto price predictions

Apart from a technical aspect, crypto traders use fundamental analysis to make crypto price preditcions . Fundamental investigation works out psychological patterns in the crypto industry.

This is an especially important tool to use, due to how blockchain world basis its value on market trends and human factor.

Mainstream markets have regulators and central banks controlling interest rates and thus, pricing. Cryptos, on the other hand, allow investors, miners, and users to set evaluation according to the demand and supply.

Conclusion crypto trading strategies

In this crypto trading guide about strategies in 2020, we went over several of them in terms of the advantages and disadvantages they have.

Traders should use each of the crypto trading strategies with great care, as most involve serious funding.

Without an understanding of the market functions, and strategies themselves, it is easy to picture bankruptcy of your operations. Keep your emotions in check, practice good trading habits, and hang in there. You will reach your goals if you keep yourself disciplined and vigilant.

Crypto trading strategies: the ins and outs of scalping

We’ve looked at various different crypto trading strategies in recent articles. Any trader in this volatile space has a plethora of paths to choose when deciding how best to execute. Since all crypto trading strategies are different, we thought we’d take a closer look at digitex futures CEO’s favorite ones, including day trading and scalping.

Different styles of futures trading

Traders with a high tolerance to risk will look to pursue strategies that may make other retail traders uncomfortable. These can include buying futures on margin or keeping positions (long or short) open for extended periods of time, sometimes even years.

These types of actions can certainly magnify a trader’s profits. But they can also be extremely risky. A wrong call can see them liquidated with hefty losses.

Advanced futures trading styles often rely on hefty fundamental analysis, whereas shorter-term styles such as day trading and scalping look at technical analysis and charts. Of all the crypto trading strategies out there, digitex futures CEO adam todd prefers scalping as it gives him less exposure to risk but still a good chance of making a profit when conditions are right.

What is scalping?

Scalping is the most labor-intensive and aggressive style of day trading. Scalpers look to take advantage of even the smallest of price fluctuations, sometimes holding a position open for a very short time of just a few minutes or even seconds. The main aim of scalpers is to buy low and sell slightly higher for profits sometimes only the equivalent of a few cents.

The name of the game is focusing on reducing losses rather than, as adam calls it, “riding the winners.” scalpers will open and close multiple positions in one day with the aim of racking up lots of profits from many places; rather than act on one large swing trend or pattern. Adam explains that in order to be a successful scalper, your trades should be as short as possible: “I discovered that the longer I held a position, the bigger the risk that my position would turn into a loser,” he said.

It’s vital to be disciplined as a scalper and to leave your emotions out of trading. In fact, according to adam, it’s better if you don’t know anything about the underlying asset at all.

“short-term scalping requires no fundamental knowledge of the underlying instrument on which you’re trading. As soon as you have entered a position you’re looking to exit it, hopefully with a one or two tick profit but willing to scratch it or lose a tick without any emotional attachment to the trade.”

Scalping trading – the ins and outs

Scalping requires full concentration from the trader. We’re talking about continuous monitoring of the screens and profiting from even the smallest of price changes. If you’re reading your emails or checking social media, you’ll likely fail to see success. According to investopedia , scalping is “A fast-paced activity for nimble traders. It requires precision timing and execution.”

Scalpers focus on time frame interval charts like the one-minute and five-minute candlestick charts and look out for certain momentum indicators. These could be the relative strength index (RSI), the moving average convergence divergence (MACD), or stochastic. Price chart indicators are also commonly used to identify support and resistance levels.

One of the biggest mistakes a scalper can make according to investopedia (and echoed by adam’s words) is late exits (holding a position open for too long). This exposes them to more risk and can turn a profitable day into a losing one if they get caught out in the wrong position. Since scalping generates high commission fees from extensive trading, successfully scalping is currently almost impossible in today’s cryptocurrency markets.

Want to try your hand at trading commission-free on the digitex futures exchange? With the beta version handling insane volume, you can practice your skills on our trading ladder interface and hone your strategy before the mainnet release on april 27, 2020.

JOIN NOW

Scalping on digitex futures

At digitex futures, we want to see all types of crypto trading strategies used so that we appeal to a wide net of traders. However, one of the main things we are looking forward to when we come to market is to at last stop punishing our most active traders, the ones who provide liquidity to the market with commission fees.

As adam said, “as a scalper, I shouldn’t be paying a percentage of the notional value of the underlying instrument. I’m providing liquidity and should be encouraged, not squeezed out of the market entirely.”

Since we will charge no maker or taker fees on any trade, scalpers will be able to enter and exit as many positions as they like. They’ll be able to make a real living out of aggressive day trading without worrying about how much they have to give back to the house.

Do you want to stock up on DGTX tokens ahead of the mainnet launch? You can head over to the digitex treasury for a trustless transaction with zero slippage and completely KYC-free now.

So, let's see, what we have: read about crypto scalping strategies and many more trading strategies. We handle day trading, arbitrage trading, HODL, swing trading, and trend trading. At scalping strategy crypto

Contents of the article

- Actual forex bonuses

- Crypto scalping strategies – compare all trading...

- Crypto scalping strategies – compare all trading...

- Limited offer: get 100 MPH FREE

- How important are crypto trading strategies?

- Emotional trading and habits in crypto trading

- Tools for crypto trading strategy implementation

- Crypto software

- Crypto trading bots

- Crypto API tools

- Crypto trading charts

- Types of crypto trading strategies

- Crypto scalping

- Crypto day trading

- Crypto arbitrage trading

- Crypto HODL (buy & hold)

- Crypto swing trading

- Crypto trend trading

- Crypto trading tips

- Crypto trading signals

- Crypto technical analysis

- Crypto price predictions

- Conclusion crypto trading strategies

- Cryptocurrency scalp trading for beginners - how...

- Apply crypto scalping on 25+ exchanges

- What is cryptocurrency scalp trading

- How to do crypto scalp trading

- Bitcoin vs altcoin scalp trading

- Is scalping trading profitable

- Scalp trading indicators

- Cryptocurrency scalp trading tips

- Pros and cons of automated or bot scalping

- Scalp trading simulator / demo mode

- Scalping vs day trading

- Scalping vs swing trading

- Cryptocurrency scalping strategy that works

- Bitcoin price: how to potentially make profit...

- Bitcoin price: should you scalp?

- Bitcoin price: important tips to consider for...

- Scalping crypto

- About (not just crypto) scalping

- Your cryptocurrency scalping tool

- Working with tensorcharts: the story inside the...

- Keeping in touch with the bigger picture

- Discipline needed even in the technicalities

- Working with tensorcharts: the story inside the...

- Summary

- How to use scalping while trading crypto

- Scalping in traditional trading

- Implementing scalping in crypto trading

- Is scalping trading for you?

- How to use a crypto scalping trading strategy

- Crypto scalping with crypto trading bots

- What is scalp trading?

- Bitcoin scalping vs. Altcoin scalping

- When is a good time to scalp trade crypto?

- Pros and cons of cryptocurrency scalp trading

- Best practices for crypto scalping

- Crypto scalping strategies – compare all trading...

- Crypto scalping strategies – compare all trading...

- Limited offer: get 100 MPH FREE

- How important are crypto trading strategies?

- Emotional trading and habits in crypto trading

- Tools for crypto trading strategy implementation

- Crypto software

- Crypto trading bots

- Crypto API tools

- Crypto trading charts

- Types of crypto trading strategies

- Crypto scalping

- Crypto day trading

- Crypto arbitrage trading

- Crypto HODL (buy & hold)

- Crypto swing trading

- Crypto trend trading

- Crypto trading tips

- Crypto trading signals

- Crypto technical analysis

- Crypto price predictions

- Conclusion crypto trading strategies

- Crypto trading strategies: the ins and outs of...

- Different styles of futures trading

- What is scalping?

- Scalping trading – the ins and outs

- JOIN NOW

- Scalping on digitex futures

No comments:

Post a Comment