Forex trading capital

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet.

Actual forex bonuses

A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall. Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

How much trading capital do forex traders need?

Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global system.

However, the amount of capital traders have at their disposal will greatly affect their ability to make a living. A trader's ability to put more capital to work and replicate advantageous trades is what separates professional traders from novices. Just how much capital a trader needs, however, differs vastly.

Key takeaways

- Traders often enter the market undercapitalized, which means they take on excessive risk to capitalize on returns or salvage losses.

- Leverage can provide a trader with a means to participate in an otherwise high capital requirement market.

- The leverage a trader requires varies, but if a trader is making consistent trades, the leverage required is simply enough that the trader is able to profit without taking unnecessary risks.

Considering leverage in forex trading

Leverage offers a high level of both reward and risk. Unfortunately, the benefits of leverage are rarely seen. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy.

Best practices would indicate that traders should not risk more than 1% of their own money on a given trade. While leverage can magnify returns, it's prudent for less-experienced traders to adhere to the 1% rule. Leverage can be used recklessly by traders who are undercapitalized, and in no place is this more prevalent than the foreign exchange market, where traders can be leveraged by 50 to 400 times their invested capital.

A trader who deposits $1,000 can use $100,000 (with 100 to 1 leverage) in the market, which can greatly magnify returns and losses. This is considered acceptable as long as only 1% (or less) of the trader's capital is risked on each trade. This means that with an account size of $1,000, only $10 (1% of $1,000) should be risked on each trade.

While difficult in practice, traders should avoid the temptation of trying to turn their $1,000 into $2,000 quickly. It may happen, but in the long run, the trader is better off building the account slowly by properly managing risk.

Respectable performance for forex traders

Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account.

While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. When factoring fees, commissions and/or spreads into return expectations, a trader must exhibit skill just to break even.

Simply being profitable is an admirable outcome when fees are taken into account. However, if an edge can be found, those fees can be covered and a profit will be realized. A trader that averages one tick per trade erases fees, covers slippage and produces a profit that would beat most benchmarks.

Are you undercapitalized for making a living in forex trading?

The high failure rate of making one tick on average shows that trading is quite difficult. Otherwise, a trader could simply increase their bets to five lots per trade and make 15% per month on a $50,000 account. Unfortunately, a small account is significantly impacted by the commissions and potential costs mentioned in the section above. I

N contrast, a larger account is not as significantly affected and has the advantage of taking larger positions to magnify the benefits of day trading. A small account by definition cannot make such big trades, and even taking on a larger position than the account can withstand is a risky proposition due to margin calls.

If the goal of day traders is to make a living off their activities, trading one contract 10 times per day while averaging a one-tick profit may provide an income, but is not a livable wage when factoring other expenses.

There are no set rules on forex trading—each trader must look at their average profit per contract or trade to understand how many are needed to meet a given income expectation, and take a proportional amount of risk to curb significant losses.

Forex trading capital

Take actions on forex market, the most popular trading market in the world, with a market leader the capital stocks .

1. The most attractive spreads rates with EUR/USD as low as 0.8

2. Maximize your potential trading positions with exceptional trade executions

3. Trade 24 hours a day, 5 days a week

Understand forex

To speak with facts, the US stock market trades approximately $257 billion a day; quite a big amount of total transactions, but it represents a fraction of what forex trades in total. Forex market trades 24 hours a day, during the 5 business days, across banks, various institutions, and individual traders worldwide.

The activity of forex include the process of buying one currency and simultaneous selling another one. They pretend to profit from the difference in the prices of buying and selling, hopefully, they will buy at a lower price and sell with a higher one.

World's most powerful currencies

Find your future in the most famous market in the world

YOU HAVE TIME, YOU TRADE

Trade when it's convenient for you during business days, 24 hours a day.

RAISE YOUR TRADING OPPORTUNITIES

You are allowed to trade one market is going up and down as well.

NO COMMISSIONS

At the capital stocks , the cost of trading currencies is reflected in the bid/ask spread.

TAKE THE BEST OUT OF LEVERAGE

Have full access to our services with a first initial deposit.

Be safe with us

TRADE ON PLATFORMS DEVELOPED TO ACCOMPLISH THE ALL REQUESTS OF TRADERS.

The trading platforms that we are offering have been custom built to deliver maximum performance, flexibility, and speed. You will take advantage of sophisticated trading features, professional charting tools, integrated market insights and more.

Not ready? Open a demo account

The market never sleeps. So should you.

Want help?

Email: [email protected]

Trading markets

Accounts types

Technology

Analysis & studies

Why us

Support

Compliance email

Risk warning:

Trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using thecapitalstocks.Com services, please acknowledge all of the risks associated with trading. The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor. We use cookies for the following purposes: to enable certain functions of the service, to provide analytics, to store your preferences, to enable advertisements delivery, including behavioral advertising. We use both session and persistent cookies on the service and we use different types of cookies to run the service.

Privacy overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

ABOUT US

BECOME A MASTER TRADER

We bring affordable market access, equal opportunity to progress and total transparency to talented individuals around the globe.

Our innovations are transforming retail traders from over-leveraged casino gamblers to observant market professionals.

HOW WE EVALUATE

Demo challenge

The demo challenge is the first step of the evaluation process. You need to succeed here to advance into the verification stage. Prove your trading skills and discipline in observing the trading objectives.

Verification

The verification is the second and the last step towards becoming

51C trader

You are becoming a trader of the 51 capital proprietary trading firm. Trade risk-free and receive 50% of your profits. Be consistent and earn even more capital.

HOW IT WORKS

Step 1

Training you to acquire trading skills. Enroll for our training packages which last for 4 weeks. This will help you get started in the forex trading journey.

Step 2

After we have assessed that your trading skills are good, we shall give a funded trading account with the money from us. This contract last for 3 months with money shared 50% to 51 capital and 50% to you the trader.

Step 3

After the initial 3 months are over and you have proved to be an exeptional trader, we shall invite you to join our trading team where you shall get a USD 10,000 account to trade

Training and funding packages

We offer you training so as to make you a professional trader

Come with your brain we come with the capital and let both parties enjoy the profits

WHY US

Great support team

Getting in touch with us is easy. Our professionals customer care team is always there to help you.

Get life time knowledge

We shall empower you with knowledge that will change your life. Whether you are employed or unemployed this is a source of income that will improve your life.

Risk free business

You are not required to provide any capital to start your business. This is a business that will only require your expertise

Feed back from our trained and funded traders

I was jobless and didn’t know what to do. I came across 51 capital and my life has never been the same again.

I am student at university 51 capital forex has helped me earn extra income, I don’t bother my parent anymore

I did fail the first time due to poor risk management and discipline. I took another challenge under guidance of 51cap pro trader and going is now better.Keep up the great work.

The trading challenge was a game changer for me. With zero risk of my capital, i realised i am able to make better trading decisions without emotions being involved. Thank you 51 capital!

I cashed out yesterday, fast and easy. What more can i say! Now my parents can rest easy without worrying about my upkeep ��

Talk to us, we promise to respond soon.

WE ARE HERE FOR YOU

Westlands, raphta rd,

SK suites, D2

P.O box 24578 – 00100

nairobi, kenya

Email info@51capitalforex.Com

Tel +254703622390, +254701213798

NEVER RISK YOUR FUNDS

Trading for 51capitalforex.Com is risk free. You are the trader, and we are the funder. We bring the capital, and cover any trading losses.

TRADE RISK FREE, EARN MASSIVE CASH

51capitalforex.Com fund empowers you the trader to earn money online with ease. We don’t have to restrict regulations and our classes are open to all. Enroll today and enjoy trading with 51 capital.

About us

We are willing to fund the best traders in the world. The 51 capital funds is meant to empower brainy people who may not have capital to start trading. 51 capital are not forex brokers, we a trading fund and we provide funds to those with exceptional trading skills. We are here to provide a risk free trading environment,

Quick links

Contact info

Western heights, 8th fl

P.O box 24578 – 00100

nairobi, kenya

Daima towers, uganda road

9th floor eldoret, kenya.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Forex trading

Last updated:

Last updated:

The “typical” spreads for pairs noted above represent the median spread available and the “as low as” spreads represent the minimum spread available during the previous full calendar month between the first and last trading day of that month. Refer to the last updated date to understand what month the data is representing.

Spreads will vary based on market conditions, including volatility, available liquidity, and other factors. Metatrader spreads may vary. Typical spreads may not be available for managed accounts and accounts referred by an introducing broker.

Find opportunity in the most traded market in the world

/media/forex/images/global/icons/icon-flexible-schedule.Svg" alt="flexible schedule" />

Trade when you want

/media/forex/images/global/icons/icon-global-market-leader.Svg" alt="global market leader icon" />

Improve your trading potential

/media/forex/images/global/icons/icon-no-cost-no-fees.Svg" alt="no bank fees" />

No commissions

/media/forex/images/global/icons/icon-leverage.Svg" alt="take advantage of leverage" />

Take advantage of leverage

Trade with confidence

/media/forex/images/services/trade-with-conf-services3.Png" alt="test out forextrader" />

Have questions? We've got answers.

How does FOREX.Com make money?

When is the forex market open for trading?

What are the margin requirements?

The markets are moving. Stop missing out.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Do I pay tax on forex trading in the UK?

This is our ultimate guide to the UK income tax for forex traders.

Here is a summary of our key findings:

There is a ‘grey area' within the complex topic of this question, and there are 3 main factors that need to be considered:

- The first question that needs to be resolved is what type of trader you are: a speculator/gambler, or an investor?

- The second factor that comes into play is the type of instruments you trade which make you your profit - spread betting or cfds.

- The third factor which needs to be considered requires an analysis of the personal finances and circumstances of the individual trader. While performing the analysis the frequency and quantity of your trades should be examined, as well as your salary bracket and other factors.

In short - spread betting profits are generally not taxable in the UK. Profits from trading cfds however, are taxable. Let’s dive in to deeply explore the detailed guide.

At the time of this writing, spread betting profits are generally not taxable in the UK. Check out our list of UK forex brokers, many of whom offer forex, commodity, and stock trading as spread betting. Profits from trading cfds however, are taxable. However, there may be exceptions to these rules, as outlined below.

There is a ‘grey area' within the complex topic of this question. In the U.K., there are three types of tax (income, corporation and capital gains) that in various cases will be the basis of taxation of profits from forex trading. Forex traders are also categorised as different trader types which can affect the basis on which their forex trading profits will be taxed.

The first step in answering the question of whether an individual will pay tax on forex trading in the U.K. Is to assess the status of the trader, look at the instruments traded, and then determine the style and intentions behind the trading activity.

This can be confusing at times, which is why each trader should always seek their own independent financial advice from a professional accountant or consult with HMRC (her majesty’s revenue and customs, i.E. The tax office) to receive guidance, although unfortunately many traders report that HMRC is not as helpful as they had hoped for.

The forex trader’s taxable status

Broadly speaking, there are two reasons you are ‘trading’ forex (different to ‘exchanging forex’):

- To speculate or gamble, OR

- To invest (to increase the performance of your daily, weekly or annual returns, directly or indirectly).

1. The speculator gambler

This forex trader fancies the occasional punt and will spontaneously place trades with no real consistent method or system behind the decisions.

This type of trader usually will have other forms of income. Any additional income received from forex trading would be considered secondary, therefore they would not be liable to pay any tax on profits and would effectively be able to trade tax-free in the U.K.

2. The investor

This type of trader treats trading as a business.

An investor treats forex trading as his or her main source of income, or their main source of income somehow derives from trading activity, in which case, they would be liable to taxation of profit on the basis of either income, capital gains or corporation tax.

So, we can see that the first question that needs to be resolved is what type of trader you are: a speculator/gambler, or an investor.

It is worth noting however, that this alone cannot be used to determine your tax liability. Other factors outlined below are the next issues to be considered.

Are profits from spread betting and cfds taxable in the UK?

There are various types of instruments available as wrappers from most forex brokers when trading forex. For retail forex traders, the two main products offered to UK clients are ‘spread betting’ and ‘cfds’.

This is the second factor that comes into play: the type of instruments you trade which make you your profit.

Let’s look at how these products differ and review the different U.K. Tax implications of trading them.

Spread betting is the simpler way to trade. It is also the easier out of the two to understand for beginners.

With spread betting you are simply betting on the direction of the price, at a certain amount per point, for example, you bet that GBP/USD will rise at £1 per pip.

This type of bet is considered speculation/gambling and is, therefore, free of any capital gains tax.

Cfds - these are somewhat more complicated.

With cfds you size your trade according to ‘lots’, for example 1 lot of a major currency pair is typically worth $10 per pip. Note that most retail forex brokers offer trading in units as low as mini-lots, with one mini-lot equal to 0.01 lots.

Also, in CFD trading, the base currency of your bet is determined by the underlying instrument you are betting on, while in spread betting all bets are denominated in your account’s base currency.

Most forex brokers offering CFD trading also impose an additional trade when converting your profit or loss back to the original currency of your account, which adds another dimension to your profit or loss. For example, if your account’s base currency is GBP, but you make a profit of 10,000 japanese yen, your broker will usually credit you with the yen profit at the end of the day, converting it into GBP at its prevailing GBP/JPY price at the moment of conversion.

Cfds are typically traded with a longer time frame in mind than spread betting, hence a CFD position is considered ‘capital’ and is, therefore, generally subject to capital gains tax.

Personal circumstances of forex traders

As mentioned previously, when tackling the question ‘do I pay tax on forex trading in the UK’, three major factors have to be examined. We have already covered the first two.

The last factor which needs to be considered is the most complex and requires an analysis of the personal finances and circumstances of the individual forex trader combined with an examination of the trading activity that occurred which created the profit.

HMRC will consider the following issues in assessing your personal circumstances:

- Whether you pay tax or not on the remainder of your income (if any).

- If you are liable to pay tax, which tax you pay and how much.

- Salary bracket - whether you earn more or less than GBP 50,000 annually.

- Whether you are a limited company, part of a corporation or self-employed.

- Whether you have employees and the role they play in your profit.

- Products or assets involved (cfds of spread bets).

- Frequency and quantity of your trades.

- Duration of your trades (time between the opening and closing of positions).

Therefore, although you may be confident of how you should be taxed on your forex trading profits as a U.K. Resident taxpayer, HMRC may see it differently and may ask more detailed questions to arrive at a decision. This is why it is important, especially in cases where the circumstances do not appear clear-cut, to take advice from a professional accountant or tax advisor. If you think it isn’t worth the cost because your profits are modest, it is a good idea to put aside the taxes you would pay in the worst-case scenario so if you do get a bill from HMRC you will be able to pay it.

Is forex trading tax-free in the UK?

After researching this question in depth, we can conclude that if you are spread betting in the U.K. As an amateur trader, any profits you make from forex trading will not be subject to a tax demand from the HMRC.

Compared to the E.U. And the U.S.A., the UK’s tax laws for forex traders are seen as some of the friendliest in the world.

If you bear in mind that about 70% of all retail forex traders lose money, however, it is easy to understand why HMRC would not want these losses to be offset against income gained from other sources, which explains why they have not moved towards a completely law position.

WELCOME 2021 WITH

BTCUSD (bitcoin / US dollar) trading on MT4 at stock trading capital

Benefits of trading BTCUSD (bitcoin / US dollar) with stock trading capital

Available of MT4 platform

Best liquidity providers lowest spreads starting from 0 pips

Now trade on MT4 with 1:2000 leverage and instant execution

Introducing broker affiliates - refer A friend

Commission up to $20 per lot

Register - refer client - start earning!

BTCUSD (bitcoin / US dollar) trading on MT4 at stock trading capital

- Benefits of trading BTCUSD (bitcoin / US dollar) with stock trading capital

- Low commissions

- Zero fees

- Low margin requirements

- Available of MT4 platform

WELCOME 2021 WITH

Best liquidity providers lowest spreads starting from 0 pips

Now trade on MT4 with 1:2000 leverage and instant execution

Introducing broker affiliates - refer A friend

- Commission up to $20 per lot

- 10% refer an IB partner

- Register - refer client - start earning!

Stock trading capital

Is one of the world's fastest growing forex& CFD provider.

The company offers foreign exchange and CFD trading on multiple trading platforms, including the globally popular metatrader 4 platform.

Stock trading capital is a market leader when it comes to customer service, offering its clients top-notch products and services in over 20 different languages.

The company's focus on superior service has been frequently recognized by the industry. Stock trading capital was the recipient of the malaysian investor show winning the best broker of asia 2013.

Stock trading capital is a fully licensed and regulated company.

Daily news video tutorials

Keep up to date with the latest market news and trends with our daily live newscast brought to you from the stock trading capital studios

Learn to be a better trader by keeping your finger on the pulse of global market activity.

Watch a brief introductory video to learn how to use the platform.

Partnership program

The alliance program was developed to reward our customers, affiliates, and introducing brokers for referring new clients to open trading accounts with stock trading capital. This program is designed to offer a compensation…

White labels

This is where technology, operations, and experience all meet in one place. We offer a standard,as well as completely customizable integrated solutions that include everything a brokeragerequires:…

Partners

From our conception to where we are today, stock trading capital has always endeavored to be the best. Being the best however is only half the journey, remaining the best takes teamwork, perseverance and passion.

Social responsibility

Stock trading capital child foundation

Stock trading capital has a deep-rooted sense of responsibility that it should help those less fortunate and actively lend assistance at every appropriate opportunity to do so. Contributing to local communities through charitable..

Forex platforms

Stock trading capital pioneered the offering of an MT4 platform with trading execution quality in mind. Trade on an MT4 with no requotes, no rejections with flexible leverage ranging from 1:1 - to 1000:1.

Stock trading capital MT4 features:

- Over 100 instruments including forex, cfds and futures

- Spreads as low as 0 pips

- Full EA (expert advisor) functionality

- 1 click trading and built in news functionality

- Technical analysis tools with 50 indicators and charting tools

- 3 chart types

- Micro lot accounts (optional)

- Hedging allowed

- Swap-free trading accounts available*

Economic calendar

We offer fast account approval that only takes up to 24 hours before you can start trading!

Why choose stock trading capital for currency trading?

There are plenty of forex brokers out there in the market and we have differentiated ourselves from rest of the herd by focusing on providing top notch customer service to everyone including advance traders & beginner forex traders. Stock trading capital consists of specialized team that have immense experience in currency trading and other commodities such as gold, oil, bonds and so on.

- We know what you want

- Better technology

- Best customer service

- Best forex brokers

What is forex market all about?

The roots of forex that is foreign exchange market can be traced backed to the end of 1970's after many countries decided to unpeg their currency against dollar and gold. Forex or FX or forex market became a decentralized hub for currency trading. Currencies are bought, sold and exchanged at the live forex rate. FX is the largest trading market in terms of volumes traded. More than hundred thousand of forex beginners and traders have chosen stock trading capital as their forex service providers and open their forex trading accounts.

Who are forex brokers?

Forex broker or traders, tries to predict the direction of specific currencies in which prices of currencies may shift whether the price will go up or down, and traders decide if it is a right time to buy or sell the currency. Furthermore, the basic rule is to buy a currency at a lower price and then sell it a higher price to gain profits sounds easy but it is not a piece of cake. It is high risk investment and there are many factors involved. All the factors has to be evaluated perfectly before reaching a decision. One can make profit either on currency deprecation or appreciation. One of the best features of forex is that a trader can work from anywhere in the world. We are one of the best forex brokers in the market that will guide you in the whole process.

Learn trading risk free with a forex demo account

Stock trading capital offers a forex demo account to all the newbie traders who have developed a keen interest in trading currency. These demo accounts has been proven to be an excellent learning tool for beginners. Forex for beginners can be very challenging as there are many factors involved and it can also overwhelm the new trader moreover, beginners should know all the strategies before working in the live forex market. With a demo forex trading accounts you can begin your trade without putting your money at risk. We are one of the best forex brokers

Forex demo account at stock trading capital offers

- Trade virtual money

- Get live forex rates that is buy and sell prices

- Trade online at any time, 5 days a week

- Practice making trades

Forex for beginners

One of the best things about forex is that investors don't need to have a lot of capital to get started. They can begin their trade with few couple of dollars and predict the direction of the currencies. Furthermore, traders can trade at their own term which means that they can trade at any time or from anywhere in the world.

Forex market is open 5 days a week and traders can get their forex trading accounts and begin the trades. Moreover, there are many opportunities in the market and around 4 trillion dollars are traded each day. However, forex for beginners need to have proper strategies since if the price of one currency is depreciating there is another currency whose value will be increasing so there is always a chance to make profits.

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Live trading capital: funded forex account, forex funding

Forex traders can obtain live trading capital and funded trading accounts from third party providers. Thousands of traders are receiving funding for their trading account every year from the various capital providers. Any forex trader who has a great trading system and is competent, skilled and profitable, but lacks the funds to trade live should investigate these funding companies. This article will provide lots of details on what programs are available to get forex account funding. We will also present a low drawdown, profitable trading system to use with the capital and funding providers. Traders can earn strong commissions, like 80%, to be paid for their trading skills using these funded accounts.

Companies that provide live trading capital

Several companies provide live trading capital for forex traders. Here is a partial list: topstep, FTMO, the5ers, blufx, maverickfx, fidelcrest, audacity, traders4traders, fundisus, traders4traders, skilledmarkets and enfoid. We also found a handful of forex brokers who have capital referral programs.

There are also private entities and individuals on places like linkedin that advertise funding available for forex traders. Some of these capital providers have been in business over 5 years. You can supplement this list with some google searches for “forex funding” or “funded forex account”.

How much money is available for my funded forex account

Traders who qualiyy are eligible to receive up to $2,000,000 or more USD in buying power, including leverage, from many of the available capital provider programs. Example, a funding company might offer a trader a $5,000 account with 100:1 leverage, which is $500,000 USD in buying power. Some companies will fund traders in euros rather than US dollars. Be sure to ask what leverage is being used from the providers.

If you start with a small amount of capital, you can easily qualify for more funding quickly just by increasing your account balance by a small amount. Each forex funding provider has their own guidelines for qualifying for more money. Important tip >> if you want more funding for your forex trading account, then open two accounts with two different capital providers.

Fees for obtaining forex funding

If you are seeking funding for your forex trading account, check the fee structure. Some forex funding and capital providers do not charge any fee at all, but the profit split percentages for the trader are lower. Some funding providers charge one time up front fees or monthly fees. In some cases the fees are 100% refundable out of the trading profits. So this is a wide range of possibilities. We consider most of the fees to be reasonable, since the funding providers are covering any trading losses for the end user.

When evaluating a forex funding provider, we would question each provider if the trading platform they provide has institutional spreads or direct access spreads. Inquire if the brokerage platform they provide is also a profit center for their introducing broker operation. Most funding providers likely also make money off of each trade as an introducing broker. Don’t pay for high spreads on top of the fees they charge.

How do I get A funded forex trading account

Each capital and funding provider has a qualification program to obtain funding. The rules vary quite a bit. Each qulification program has a demonstration or qualification period to obtain the funding. It can be a one or two step process. During the qualification period you must abide by the capital provider’s rules like profit targets, position size, daily and weekly total loss or drawdown limits, maximum number of positions open and position size, etc. Each capital and funding provider has their rules and guidelines are they in writing, so read them carefully. If you break the rules you might be liable for paying more fees to restartthe process to get more funding. The demonstration period can very from one month to several months to hit the profit targets. All of the providers we found cover all trading losses up to the specified loss limits. Don’t be intimidated by the funding qualification process, under some programs you can qualify for funding in as little as one day with just 2 or 3 positive trades.

Important tip >> you access much more capital quickly. Some capital providers will increase the amount of capital they make available to a trader for trading profitably. Some capital providers will double the amount of capital you can access for increasing your account balance by only 10%, which is a modest amount of profit. For example if you get a $5,000 trading account and you increase the account to $5,500 with positive trades, you will be able to access $5,000 more trading capital. We view this as quite generous, since this can be done with just one swing trade.

More criteria for selecting A live trading capital provider

Profit splits range from 50/50 to 80/20, with the traders keeping 80%. Topstepfx allows traders to keep the first 100% of $5,000 in profits. 50% seems pretty low for a profit split, in our opinion. Profits can be withdrawn via bank wire and in some cases, paypal. Transfer fees may apply to small withdrawals. Withdrawals are usually available at the end of the month.

All of the capital providers have drawdown limits. The drawdown is usually measured as the amount of loss of capital from the previous and most recent high balance. Drawdown limits can be weekly or monthly, and range from between 1% and 10% of the high balance, which is a very wide variation. Continue reading this article and we can show you a trading system that can be used that has very little drawdown on each trade entry. This system will minimize drawdown so the tighter drawdown rules can be met.

When selecting a live trading capital provider make sure they show you a list of the available pairs that you can trade with their brokerage platform. We recommend checking their offerings against the 28 most actively traded pairs, which are combinations of the 8 most frequently traded currencies. The USD, CAD, EUR, CHF, GBP, JPY, AUD and NZD are the 8 most frequently traded currencies.

Some capital providers only allow trading on 22 or 24 of these pairs, some providers allow the full 28 pairs. Some providers offer a choice of a lot of pairs to trade, but these pairs are outside the 8 most frequently traded currencies. These spreads on these pairs are very high and should not be traded inside of these programs.

Traders should inquire as to what trading platform is offered by the capital provider that you are evaluating. If all of your trading experience is on metatrader 4, but the capital provider may not offer that platform. If you are seeking their capital might have to download the platform they offer for executing trades and managing the account, so make sure you ask this important question. Being experienced using a new platform is very important before applying for funding.

Some capital providers offer expensive training programs, costing thousands of dollars up front, before you can qualify for capital. We would avoid these capital providers all together. Forexearlywarning can provide a complete training program, our 35 illustrated forex lessons, to teach you everything you need to know about our complete, profitable trading system.

Most of the capital providers we reviewed were offering 100:1 leverage. If you are used to trading at 50:1 or some other leverage rate, remember to keep this in mind as it will affect your margin balances on each trade.

Some capital providers do not let you hold trades over the weekend, or even overnight. This is not good at all. It makes it impossible to swing trade or do any trend based trading on the higher time frames. Avoid these types of restrictions, if possible.

Some capital providers offer a free trial, which is excellent.

Live trading capital forex traders

Trader profile for live trading capital

If you are a forex trader, and would like to have access to live trading capital, here are some characteristics we think you should have:

First of all you should have a rules based trading system, and you are able to consistently make positive pips when you use it, week after week. You must like your trading system and understand it well via demo trading or micro lot trading. You must be skilled at entering trades and managing trades with stops and scaling out lots. We advise using a complete trading system like the forexearlywarning trading system. We offer thorough market analysis, more exact trade entry points across 28 pairs, and very little drawdown on trade entries. The low drawdown will comply with most capital programs. If you are a rookie trader with little experience, you should avoid all live trading capital programs, you are not ready yet.

Trading system to use with your funded forex trading account

If you are a trader who is seeking capital, and you need a profitable trading system with a low drawdown, check out the forexearlywarning trading system. You can demo trade our trading system and get consistent trades prior to applying for a funded account..

Forexearlywarning provides daily trading plans for 28 pairs, and we focus on the higher time frames. The higher time frames will get you more pips and profits than scalping the same pairs over and over with indicators. Forexearlywarning also has reliable alert systems and an excellent trade entry management system, the forex heatmap®. Do not use any trading system with ambiguous or random trade entries or rules for entry that are unclear.

Live trading capital for forex traders

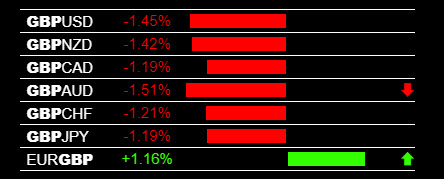

An example trade signal for the GBP pairs on the heatmap is shown above, consistent, clear signals like this for trading are powerful and traders will have very little drawdown on trade entries, as to fully comply with the drawdown rules from most capital providers.

By offering 28 pairs, the forexearlywarning trading system matches or exceeds the most and most liquid pairs to trade offered in most capital programs. The heatmap system will provide traders with much lower drawdown on trade entry points so almost any capital program can be used. With the forexearlywarning trading system, you can easily make 10% on your account balance on one swing trade based on the H4 time frame. This will qualify you for more capital on some of the capital providers programs.

Other advantages of using the forexearlywarning trading system are that is can be easily demo traded. You must like your trading system and enjoy using it before you apply for any third party funded account.

Conclusions about live trading capital programs: A large amount of capital is available to forex traders to fund their live accounts, and we predict that even more capital will be available going forward. Any program that offers a fully funded forex trading account, that also covers your trading losses sound like a great offer. Traders who have no capital or just a small amount of capital, who are skilled at making positive trades, should evaluate these capital providers. Traders should remember that the trading rules vary between providers, so read each capital providers’ rules carefully, get everything in writing, like the fee structure and ongoing drawdown limits.

So, let's see, what we have: what is the recommended minimum capital required for day trading forex based on various trading styles and desired income? At forex trading capital

Contents of the article

- Actual forex bonuses

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- How much trading capital do forex traders need?

- Considering leverage in forex trading

- Respectable performance for forex traders

- Are you undercapitalized for making a living in...

- Forex trading capital

- Understand forex

- World's most powerful currencies

- Find your future in the most famous market in the...

- YOU HAVE TIME, YOU TRADE

- RAISE YOUR TRADING OPPORTUNITIES

- NO COMMISSIONS

- TAKE THE BEST OUT OF LEVERAGE

- Be safe with us

- Not ready? Open a demo account

- Trading markets

- Accounts types

- Technology

- Analysis & studies

- Why us

- Support

- Compliance email

- Risk warning:

- ABOUT US

- BECOME A MASTER TRADER

- HOW WE EVALUATE

- HOW IT WORKS

- Training and funding packages

- WHY US

- Feed back from our trained and funded traders

- Talk to us, we promise to respond soon.

- WE ARE HERE FOR YOU

- NEVER RISK YOUR FUNDS

- TRADE RISK FREE, EARN MASSIVE CASH

- About us

- Quick links

- Contact info

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Forex trading

- Find opportunity in the most traded market in the...

- Trade with confidence

- Have questions? We've got answers.

- How does FOREX.Com make money?

- When is the forex market open for trading?

- What are the margin requirements?

- The markets are moving. Stop missing out.

- Try a demo account

- Do I pay tax on forex trading in the UK?

- The forex trader’s taxable status

- Are profits from spread betting and cfds taxable...

- Personal circumstances of forex traders

- Is forex trading tax-free in the UK?

- WELCOME 2021 WITH

- BTCUSD (bitcoin / US dollar) trading on MT4 at...

- Best liquidity providers lowest spreads starting...

- Now trade on MT4 with 1:2000 leverage and instant...

- Introducing broker affiliates - refer A friend

- BTCUSD (bitcoin / US dollar) trading on MT4 at...

- WELCOME 2021 WITH

- Best liquidity providers lowest spreads starting...

- Now trade on MT4 with 1:2000 leverage and instant...

- Introducing broker affiliates - refer A friend

- Stock trading capital

- Daily news video tutorials

- Forex platforms

- Economic calendar

- Why choose stock trading capital for currency...

- What is forex market all about?

- Who are forex brokers?

- Learn trading risk free with a forex demo account

- Forex for beginners

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Live trading capital: funded forex account, forex...

- Companies that provide live trading capital

- How much money is available for my funded forex...

- Fees for obtaining forex funding

- How do I get A funded forex trading account

- More criteria for selecting A live trading...

- Trader profile for live trading capital

- Trading system to use with your funded forex...

No comments:

Post a Comment