Forex trading no fees

The swap can also be positive. For example, trade the EUR/USD with a short position, invest in the USD and sell the euro.

Actual forex bonuses

Interest rates in USD are much higher than in EUR. So you even get one credit per day. This is also called carry trade. The difference in interest is the broker’s profit. The position is therefore financed. This fee only applies to longer-term positions that are held overnight. The amount of the swap depends on the current interest rates of the currency pair and is also dependent on the broker. The swap usually occurs after the market closes at 23:00 hrs.

What does forex trading cost in 2020?

Would you like to know what forex trading fees may apply? – then you have come to the right place. We show you from our experiences the costs, which can come up to you and describe to you, why these results to you. In addition, we will show you options for how you can trade most cost-effectively.

These costs can be charged in forex trading:

- Spreads

- Commission

- Swap (financing fees of the position)

Additional costs of the forex broker:

- Account fees

- Fees for deposits and withdrawals

Example of forex trading fees

In the following texts, we will discuss the trading fees in detail and show you how to pay the lowest fees.

The forex trading costs are depending on the broker

The forex trading broker determines the fees that a trader must pay when opening a position. There are cheap and expensive providers. The costs have a decisive effect on a trader’s profits. The cheaper the fees are, the higher your profit will logically be.

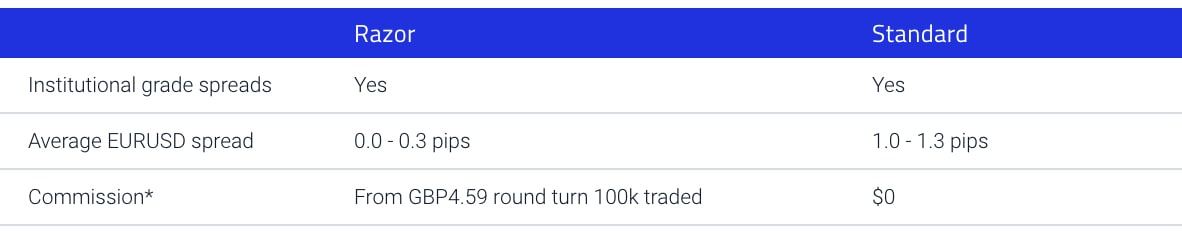

In many cases, 2 different account models are offered. The only difference here is how the forex broker earns his money. A distinction is made between a spread and a commission account. From my experience, the commission account is much cheaper and offers more advantages.

Often there are 2 fee models for traders:

- Spread model: you pay an additional spread when a position is opened (this may depend on the market situation).

- Commission model: you pay a minimum spread (often 0.1 points or less) and you pay a fixed commission per 1 lot traded (100,000 of the underlying).

How the forex broker earns money from the spread?

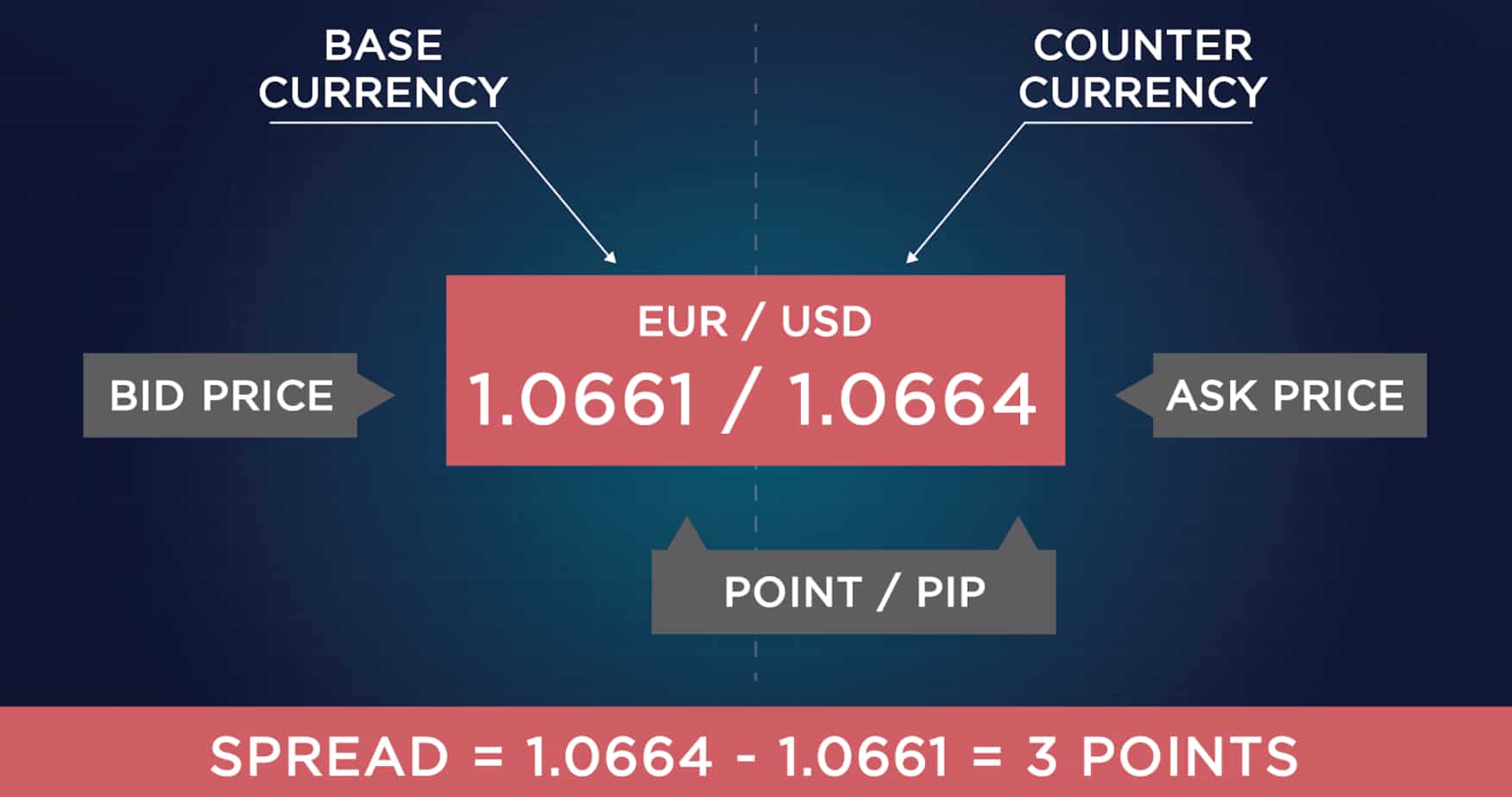

Definition of the spread: the spread is a difference between the buy and sells price.

This spread can always fluctuate due to the market situation because there are not always enough buyers and sellers on one price (this rarely happens). This phenomenon is often seen with very strong price fluctuations (high volatility). The forex broker also adds a spread to the market spread to earn money.

In principle, the trader thus gets an execution on a worse price in the market. The difference between the order opening and the current market price is the broker’s profit.

Facts about the spread:

- The forex broker earns money through an additional spread

- The spread depends on the market situation

The commission fees explained

Some forex brokers offer the commission model for forex trading. First of all, I have to say from my experience that a commission account is always cheaper after my test. Instead of an additional spread, you get the direct market spread for your order execution. The forex provider now charges a commission per lot traded.

The size 1 lot describes 100,000 units of the underlying of the forex pair. For example, in the EUR/USD 1 lot exactly would be 100.000€. A fixed commission is charged depending on the trading volume. The average value is between 5$ and 10$ per 1 lot traded. If you trade a smaller size than 1 lot then the commission is of course also smaller.

Facts of the commissions:

- The commission is a fixed amount and depends on the trading volume

- Traders do not pay an additional spread but the commission

- Commission based account models are the cheapest accounts

Financing of your trading position: the swap for leveraged forex

The swap, also known as an interest rate swap, is incurred when trading in leveraged derivatives. It can also be described as the financing fee for a position. Forex trading is carried out with a lever and the trader borrows money from the forex broker for his position. This, in turn, borrows the money from a bank and lends the money to you at higher interest rates.

The difference in interest is the broker’s profit. The position is therefore financed. This fee only applies to longer-term positions that are held overnight. The amount of the swap depends on the current interest rates of the currency pair and is also dependent on the broker. The swap usually occurs after the market closes at 23:00 hrs.

Advantage: the swap can be positive in forex trading

The swap can also be positive. For example, trade the EUR/USD with a short position, invest in the USD and sell the euro. Interest rates in USD are much higher than in EUR. So you even get one credit per day. This is also called carry trade.

Carry trade example:

The interest rate of the EURO is 0% and the interest rate in the USD. Now you buy the USD and sell the EUR. This means short the currency pair EUR/USD. Now there is a huge difference between these 2 interest rates and you borrow money for the position. You get credited with the interest difference to your trading account.

Facts about the swap:

- The swap occurs because forex trading is leveraged

- The fee is only for positions which are opened overnight

- The swap can be positive or negative

- The swap depending on the forex broker and the interest rates

Pay fewer fees with a good forex broker

A good forex broker is essential for success in trading. When making your choice, you should make sure that the provider is officially regulated, has good support and offers good conditions for trading.

In the table below you will find our top forex brokers, which are self-tested. They are the best and cheapest on the market. With over 7 years of experience in forex trading, we have compared a total of hundreds of providers. Bdswiss, tickmill, and XM has the best forex trading conditions in the world. You can already trade from 0.0 pips spread and pay a maximum commission of 2$.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

| 1. Bdswiss | (5 / 5) ➔ read review | starting 0.0 pips | + individual offers + trading signals + personal service |

Additional fees which can occur for traders

In our experience, many forex brokers do not charge these fees in order to gain a market advantage over other providers. However, it often happens that there are account maintenance fees for inactivity. If the trader has not opened a position after up to 3 – 12 months, a fee of up to 50€ may apply. This is however dependent on the offerer.

Further costs are possible with the payment of customer money. There are usually no fees for the deposit. But also with the disbursement, many providers do not charge any fees. Should this still be the case, you can view it transparently in the button.

Conclusion: rarely there are additional costs.

Conclusion: the fees are very low in forex trading

On this page, we have shown you which costs you may incur when trading. Due to the competition among online brokers, the fees have become very low, but you should still look for the cheapest providers to make bigger profits. We have again all the important points of this page for you structured:

Forex brokers offer different fee models:

- There is the spread model

- There is the commission model

- Swap fees may apply overnight

- Find yourself a cheap forex broker

- As a rule, all fees should be transparently visible to the forex broker

Forex trading fees are very important. The fees are critical for your profit and loss. So choose a trusted and cheap forex broker.

Best low cost forex brokerages

Fees and costs can stealthy chip away at your trading profits if not properly controlled, especially for high volume traders. An important first step in managing your transaction costs is selecting a low-cost broker.

In ranking these top low-cost forex brokers, we’ve select brokers based on their spreads, commissions, withdrawal fees, inactivity fees, other miscellaneous fees.

Top inexpensive forex brokers

- Some of the lowest spreads: EURUSD 0.3 pips (currenex) 1.2 pips (floating), 1.8 pips (fixed)

- Commissions only apply to currenex and zero spread accounts who have the benefit of even narrower spreads

- No withdrawal fees

- No miscellaneous fees

- Note: hotforex no longer offers currenex accounts to new customers

- 0.6 pips (ECN), EURUSD 1.5 pips (fixed)

- $2 commissions only apply to ECN accounts who have the benefit of even narrower spreads

- $3 credit card withdrawal fee, e-wallet withdrawal fees of 0.5-3.9%, bankwire withdrawal fees depending on bank

- No miscellaneous fees

- EURUSD 1.8 pips (fixed)

- No commissions

- No withdrawal fees

- If account balance is less than $50, a $50 inactivity fee after 3 months

- EURUSD spread - unspecified

- No commissions

- No withdrawal fees

- $10 inactivity fee 3 months, overnight premiums

- Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 80.5% of retail investor accounts lose money when trading CFD's with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Spreads as low as 0 pips

- No commissions

- No withdrawal fees

- No miscellaneous fees

As a general rule, fixed spreads quoted by brokers will generally be slightly wider than floating spreads shown. For entry-level accounts, minimum spreads for fixed spread forex brokers are around 1.5 pips compared to 0.5 pips floating spread brokers. Note, however, floating spreads may increase and exceed fixed spreads in times of market illiquidity.

Fees and charges may also vary by account type so it’s important to read the fine print. The information listed here generally pertains to a broker’s entry-level account unless otherwise specified.

Some brokers will offer no spread ECN or currenex accounts. However, commissions are charged on these types of accounts and are best suited for large high volume traders.

Cheap forex brokers ranking summary

Here is a table summarizing the top 5 low-cost forex brokers.

The 10 best forex broker with zero (no) spread accounts

Do you want to pay less trading fees when investing in currency pairs? – then you should choose zero or no spread forex broker. On this page, we will show you the top 10 companies which are offering trading with starting pips at 0.1. Trading fees can be very expensive when you are doing scalping or high volume trading. By choosing one of our recommended forex brokers you can save a lot of money. In addition, we will provide you detailed information about zero spread trading.

| Broker: | review: | spreads and fees: | regulation: | advantages: | open account: |

|---|---|---|---|---|---|

| 1. IQ option | (5 / 5) ➜ read the review | starting 0.0 pips + NO COMMISSION ($ 10 deposit) – only on main market hours | cysec (EU) | + leverage up to 1:1000 + personal service + best platform |

Save trading fees by using a low spread forex broker

Overall, we tested more than 50 forex brokers in 7 years of trading time and trading fees are very important to check. Most brokers are offering spread-based account types and a few are offering a zero spread account in addition. Sometimes you can switch between a spread or a zero spread account. If you do a calculation between these two account types you will always see that the zero (no) spread account is cheaper for you. Less trading fees will bring you a higher profit.

Comparison between a spread and zero (no) spread account:

For example, you want to trade 1 lot with the EUR/USD asset. On the spread account, you got a 1.0 pip spread. The pip value is $10. That means you are paying a fee of $10 by opening and closing the trade. The value of the fees is depending on the asset.

Spread account: 1 lot EUR/USD with 1.0 pip spread = $10 spread fee

On a zero (no) spread account you are paying the most of the time $3.5 per 1 lot trading (commission)

Zero spread account: 1 lot EUR/USD with 0.0 pip spread = $3.5 spread fee

In conclusion, the zero spread account is 65% – 50% cheaper than a normal spread account. So you should definitely use a zero spread account to pay fewer fees.

Advantage of a 0.0 pip account:

The calculation above shows us that a zero spread account is cheaper than other accounts. That is the main reason why you should use it. In addition, it is better for certain strategies like scalping where traders only trade small trading movements. The real market prices are traded by the broker. Overall, the trading with a 0.0 pip account is more transparent.

- Payless trading fees

- Better trade execution

- Real market prices

- Transparent trading

- Best for scalping

Disadvantages of a 0.0 pip account:

There is only one disadvantage of a 0.0 pip account. Some forex brokers got no negative balance protection. Forex trading is leveraged trading which implies high risk. There are some market situations where the broker can not close your position (big news event overnight). If you got bad luck and you are trading with a too big trading volume your account balance can become negative. But this is nearly impossible.

Our values to find a good online partner

For traders, it is hard to find a reliable and trusted online forex broker. As experienced traders, we know how to check a partner by certain criteria. Before signing up with a forex broker you should check the homepage to find important information to avoid fraud. There are some fake brokers who are scamming clients all over the world. That should not happen to you so definitely check the regulation of the company. A regulated forex broker is showing the license and regulation on the webpage.

In the following list and video, you will find our full criteria and comparison to find a reliable partner to trade forex. Regulation, the security of funds, and trade execution are very important to us and these are the key factors to trade like a professional.

Criteria for a good forex broker:

- Official regulation

- Official dealer license

- Free demo account

- Low minimum deposit

- Professional support

- Reliable trading platform

- Fast execution

- Low trading fees

How does a 0.0 pip forex spread broker earn money?

In the zero spread account, an additional spread is not charged but the broker will charge a fixed commission. This is depending on the trading volume of the position. Most brokers will show you a commission per 1 lot (100.000) trade. If the commission is $6 per 1 lot trade you will pay a commission of $0.06 if you are trading 0.01 lot.

In conclusion, the forex broker always earns money because of the additional spread or commission. If you are a high volume trader the broker will earn more money and sometimes the company will give you a rebate so that you pay fewer fees because of the high trading volume.

See the picture of 0.0 pips spread in EUR/USD trading here:

How does the no spread account really work?

In the following, we will show you exactly how it works behind the scenes. The most forex brokers getting liquidity by a “market maker” called “liquidity provider” and some companies are making it by themself. Around the world, there are big liquidity providers like banks (goldman sachs, barclays, citibank, and more). These banks are giving direct market liquidity to the forex brokers.

Forex broker liquidity providers

The orders are matched by the “spot market” and not traded on a real stock exchange like stocks or futures.

Get direct market spreads

With a zero spread account, you get direct market access and real original prices. Most forex brokers show you the liquidity in the trading platform. You can see the market depth and how much liquidity is there. In our opinion, no spread accounts are more transparent than spread accounts.

Direct spreads from liquidity providers

See the market liquidity

The most no spread brokers are ECN or no dealing desk brokers. You can see the market liquidity in your trading platform. The most popular platform is metatrader. If you click on “depth on market” you will see the order book (picture below).

Orderbook for no spread accounts

On the prices, you see the lots based on the liquidity. Liquidity can change very millisecond. We do not recommend trade with order book strategies in the forex market because the numbers are changing too fast.

No conflict of interest

There is no conflict of interest between the forex broker and the trader. It does not matter if you make a loss or winning trades. The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run. You can be sure that your funds and investments are safe when the broker got an official dealer license.

Be careful: slippage can happen on market events

Always be careful by trading forex. The 0.0 pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is small.

We do not recommend to trade on market news because of the high risk. The volatility can be very high and the movements are not predictable. So be careful when you trade forex. It is not without risk. On the economic calendar, you can see the market events for your forex pairs.

Conclusion: you should use a 0.0 pip forex trading account

On this page, we showed you detailed information about the zero spread account for forex trading. Nowadays, a lot of brokers are offering this account type. The minimum deposit is different from broker to broker. Sometimes you have to invest more than $1,000 into your account to get 0.0 pips spread.

The forex broker is earning money by an additional trading commission fee which you are paying each trade. Bdswiss is an exception with the monthly fee account. The commission is depending on your trading platform and trading asset. As you saw in our calculation you can save more than 60% of trading fees if you are switching to a no spread account.

With a regulated broker, you can be sure that there is no scam or fraud. The companies which we present on this page are tested with real money. To get a closer look at a forex broker you can read the full and detailed reviews. The winner is clearly tickmill because the commissions are the lowest.

Our reviews:

- IQ option

- IC markets

- Tickmill

- XTB

- Bdswiss

- XM

- Roboforex

- Vantage FX

- Admiral markets

- Blackbull markets

The zero (no) spread account is the best way for traders to save trading fees. It is cheap trading with direct market liquidity.

How to pay your forex broker

The forex market, unlike other exchange-driven markets, has a unique feature that many market makers use to entice traders. They promise no exchange fees or regulatory fees, no data fees and, best of all, no commissions. To the new trader just wanting to break into the trading business, this sounds too good to be true. Trading without transaction costs is clearly an advantage. However, what might sound like a bargain to inexperienced traders may not be the best deal available – or even a deal at all. Here we'll show you how to evaluate forex broker fee/commission structures and find the one that will work best for you.

Commission structures

Three forms of commission are used by brokers in forex. Some firms offer a fixed spread, others offer a variable spread and still others charge a commission based on a percentage of the spread. So which is the best choice? At first glance, it seems that the fixed spread may be the right choice, because then you would know exactly what to expect. However, before you jump in and choose one, you need to consider a few things.

The spread is the difference between the price the market maker is prepared to pay you for buying the currency (the bid price), versus the price at which he is prepared to sell you the currency (the ask price). Suppose you see the following quotes on your screen: "EURUSD - 1.4952 - 1.4955." this represents a spread of three pips, the difference between the bid price of 1.4952 and the ask price of 1.4955. If you are dealing with a market maker who is offering a fixed spread of three pips instead of a variable spread, the difference will always be three pips, regardless of market volatility.

In the case of a broker who offers a variable spread, you can expect a spread that will, at times, be as low as 1.5 pips or as high as five pips, depending on the currency pair being traded and the market volatility level.

Some brokers may also charge a very small commission, perhaps two-tenths of one pip, and then will pass the order flow received from you on to a large market maker with whom he or she has a relationship. In such an arrangement, you can receive a very tight spread that only larger traders could otherwise access.

Different brokers, different service levels

So what is each type of commission's bottom line effect on your trading? Given that all brokers are not created equal, this is a difficult question to answer. The reason is that there are other factors to take into account when weighing what is most advantageous for your trading account.

For example, not all brokers are able to make a market equally. The forex market is an over-the-counter market, which means that banks, the primary market makers, have relationships with other banks and price aggregators (retail online brokers), based on the capitalization and creditworthiness of each organization. There are no guarantors or exchanges involved, just the credit agreement between each player. So, when it comes to an online market maker, for example, your broker's effectiveness will depend on his or her relationship with banks, and how much volume the broker does with them. Usually, the higher-volume forex players are quoted tighter spreads.

If your market maker has a strong relationship with a line of banks and can aggregate, say, 12 banks' price quotes, then the brokerage firm will be able to pass the average bid and ask prices on to its retail customers. Even after slightly widening the spread to account for profit, the dealer can pass a more competitive spread on to you than competitors that are not well-capitalized.

If you are dealing with a broker that can offer guaranteed liquidity at attractive spreads, this may be what you should look for. On the other hand, you might want to pay a fixed pip spread if you know you are getting at-the-money executions every time you trade. Slippage, which occurs when your trade is executed away from the price you were offered, is a cost that you do not want to bear.

In the case of a commission broker, whether you should pay a small commission depends on what else the broker is offering. For example, suppose your broker charges you a small commission, usually in the order of two-tenths of one pip, or about $2.50 to $3 per 100,000 unit trade, but in exchange offers you access to a proprietary software platform that is superior to most online brokers' platforms, or some other benefit. In this case, it may be worth paying the small commission for this additional service.

Choosing a forex broker

As a trader, you should always consider the total package when deciding on a broker, in addition to the type of spreads the broker offers. For example, some brokers may offer excellent spreads, but their platforms may not have all the bells and whistles offered by competitors. When choosing a brokerage firm, you should check out the following:

- How well capitalized is the firm?

- How long has it been in business?

- Who manages the firm and how much experience does this person have?

- Which and how many banks does the firm have relationships with?

- How much volume does it transact each month?

- What are its liquidity guarantees in terms of order size?

- What is its margin policy?

- What is its rollover policy in case you want to hold your positions overnight?

- Does the firm pass through the positive carry, if there is one?

- Does the firm add a spread to the rollover interest rates?

- What kind of platform does it offer?

- Does it have multiple order types, such as "order cancels order" or "order sends order"?

- Does it guarantee to execute your stop losses at the order price?

- Does the firm have a dealing desk?

- What do you do if your internet connection is lost and you have an open position?

- Does the firm provide all the back-end office functions, such as P&L, in real time?

The bottom line

Even though you might think you are getting a deal when paying a variable spread, you may be sacrificing other benefits. But one thing is certain: as a trader, you always pay the spread and your broker always earns it. To get the best deal possible, choose a reputable broker who is well-capitalized and has strong relationships with the large foreign-exchange banks. Examine the spreads on the most popular currencies. Very often, they will be as little as 1.5 pips. If this is the case, a variable spread may work out to be cheaper than a fixed spread. Some brokers even offer you the choice of either a fixed spread or a variable one. In the end, the cheapest way to trade is with a very reputable market maker who can provide the liquidity you need to trade well.

The fees and costs of forex brokers

Transparent brokers should always be upfront in their fees and list them either on the website.

Each forex broker charges fees in one form or another. Then, there are trading costs linked to every trade placed.

Most traders typically ignore the overall cost per trade that can make a massive difference to the entire outcome of a portfolio.

As the most common cost is via spreads, other fees and costs are still applicable and must not be neglected.

Transparent brokers would always be upfront in their fees and list them either on the website, trading platform with every trade ticket, or both.

Direct trading costs

Direct trading costs consist of spreads, commissions, swap rates, etc. Not all costs apply to all trades, and it all depends on the kind of asset traded – if they traded on a margin and the duration and the duration of every trade.

The broker needs to mention all costs included in every trade. Also, transparent brokers list them in their trading conditions and give examples of how they incur and calculate costs.

Then, trading costs can be found inside the trading platform – especially if the broker offers a proprietary trading platform.

They also provide traders with calculators, letting them calculate the cost of every trade before placing it.

Spreads

Spreads are the most usual cost associated with trade and refer to the difference between the bid and ask price.

In addition to that, spreads are the main income source for brokers who live from the mark-up on raw spreads.

Raw spreads can become as low as 0.0 pips in the EUR/USD -the most liquid currency pair that carries the lowest spread. Everything over this level is the mark-up that the broker charges.

Commissions

Several accounts come with spreads as low as 0.0 pips on the EUR/USD. However, the broker charges a commission per lot.

Typically, accounts charging commissions are ECN accounts that run a no-dealing desk execution.

Here, traders get the raw spreads, or near to it. Then, in return, the broker charges a commission.

Aside from that, they charge commissions on equity trades, and different assets, such as etfs, ETC’s, bonds, and more, will carry a commission charge.

Then, to get the complete details on which assets carry a commission, traders must either consult the asset directory given by their broker or get the information straight from the trading platform.

Transparent brokers will list the full contract specifications on their website as proprietary trading platforms list all the details in every deal ticket.

Volume discounts are often provided to an account that carries commissions.

Swap rates

Swap rates or rollover rates apply to every position held overnight. Swap rates happen because of the interest rate differences in the base currency and the quote currency.

Also, brokers will list the way this rate is calculated, and there is a swap long and a swap short rate.

Swap rates will either become credited from or debited to the account balance, depending if the traders take a long or short position. Many brokers fail to forward favorable swap rates to traders.

Forex brokers fees and costs explained

Every forex broker charges fees in one form or another and there are trading costs associated with each trade placed. Many traders often ignore the total cost per trade which can make a big difference to the overall outcome of a portfolio. While the most obvious cost is through spreads, there are other fees and costs which are applicable and should not be ignored. Transparent brokers will always be upfront about their fees and list them either on their website, in their trading platform with each trade ticket (or, ideally, in both places).

Overview of direct trading costs

Direct trading costs consist of spreads, commissions, swap rates, overnight financing costs, storage fees and custodial fees. Not all costs apply to every trade and it all depends on which asset is traded, if it is traded on margin and the duration of each trade. All costs involved with each trade should be mentioned by the broker; transparent brokers list them in their trading conditions and also provide examples of how costs are incurred and calculated. In addition, trading costs can be found inside the trading platform. This is especially true if the broker offers a proprietary trading platform. Calculators are also provided which allow traders to calculate the cost of each trader before placing it.

Spreads

Spreads are the most obvious cost associated with a trade and refers to the difference between bid and ask price. Spreads are the primary income source for brokers who live from the mark-up on raw spreads. Raw spreads can be as low as 0.0 pips in the EUR/USD, the most liquid currency pair which carries the lowest spread. Everything above this level is the mark-up the broker charges.

While spreads are listed on each broker’s website, traders can easily view them in their trading terminal.

Commissions

Some accounts may come with spreads as low as 0.0 pips on the EUR/USD, but the broker charges a commission per lot. Accounts which charge commissions are usually ECN accounts which operate a no-dealing desk execution. Traders get the raw spreads, or very close to it, and in exchange the broker charges a commission.

Commissions are also charged on equity trades and various other assets (etfs, ETC’s, bonds, etc.) will carry a commission charge. In order to get the full details on which assets carry a commission, traders should either consult the asset directory provided by their broker or get the information directly from the trading platform. Transparent brokers will list the full contract specifications on their website while proprietary trading platforms list all the information in each deal ticket. Volume discounts are often given to account which carry commissions.

Swap rates

Swap rates, sometime referred to rollover rates, apply to each position which is held overnight. Swap rates occur due to the interest rate differences in the base currency and the quote currency. Brokers will list how this rate is calculated and there is a swap long and a swap short rate. Depending if the traders take a long or short positions, swap rates will either be credited from or debited to the account balance. A lot of brokers fail to forward positive swap rates to traders.

Forex traders can check the precise swap in their MT4 trading platform by following these steps:

Right-click on the desired symbol in the “market watch” window and select “symbols”.

Select the desired currency and then click on “properties” located on the right side.

Scroll down until you see “swap long” and “swap short”

Overnight financing costs

This is a cost related to margin trades. Brokers will explain how the effective overnight financing rate is calculated. It depends on the amount of leverage used per trade and which asset is traded. This is an important cost to monitor as it increases the longer an asset remains open in the account.

Storage fees

Some brokers will charge traders a storage fee for holding certain assets. This is an unnecessary fee, but will be charged for holding positions in the account which comes on top of swap and/or financing fees. In essence it is a fee charged for maintaining positions in your portfolio. Brokers who charge storage fees should be avoided.

Custodial fees

Equity, ETF and bonds come with custodial fees which are usually a small percentage charged annualized, but may be deducted monthly with a minimum. Not all brokers offer equity or bond trading and use cfds which are great to get in on the price action without the need to incur custodial fees.

Overview of indirect trading costs

Indirect trading costs are costs which are not charged per trade, but include costs such as withdrawal charges and account inactivity fees. Deposit charges are waived by all brokers, which is standard industry practice. Some brokers even reimburse their traders for deposits made via bank wire which is usually charged by the trader’s bank. Withdrawal fees are usually not charged by brokers, but third-party fees may apply such as bank wire charges. All charges relating to deposits and withdrawals should be listed on the brokers website.

Another unnecessary fee which some brokers charge is an account inactivity fee. This is usually applied after three months of no trading activity. The broker will then charge a quarterly cost, which will be listed in the trading conditions of the broker’s website, until the account balance is either depleted or trading resumed.

In general, all fees which a broker can charge will be listed in their website under trading conditions. Traders should carefully review this section as the lesser known costs are only mentioned there. In case this information is not provided, the broker is better avoided. Customer service can be contacted, but again, a transparent and trustworthy broker will not hide their costs. Costs like spreads and swaps are best accessed directly from the trading platform as they can change quickly due to market conditions. Using cost calculators provide by brokers can also be used in order to determine precise costs per asset and volume traded.

Forex broker’s fees and commission guide: how they work

forex broker’s fees and commission guide: how they work

Trading forex offers an exclusive advantage over other types of trading: reduced fees and commissions.

This is due to the fact that most fx brokers charge a variable commission on the spread rather than charging fixed or percentage fees on the value of the trade.

They can also charge a fixed commission per trade, though this is less common.

Confused about what all this means?

Don’t worry, in this article, we’ll explain exactly how forex brokerage commissions work as well as giving you a rundown of the fees charged by the most popular brokers in the market.

How do forex broker’s fees and commissions work?

At any given time, there is a bid and an ask price. These represent the price at which you can sell and buy a currency pair, respectively.

The most common way used by brokers to make money is to charge a percentage of this difference, known as the spread, for every trade you make.

If the USD/GBP is trading at 0.788 – 0.789, the spread, i.E the difference between the price at which you can buy and sell a stock at any given point in time is 0.001$, or 10 pips (percentage in points- the measure usually chosen by brokers to express their fees. For more information on this measure, check out this article).

Based on this spread, the broker will take his commission. Some brokers will charge a variable spread, others will offer a fixed spread and profit the difference between their spread and the spread offered by the market.

A variable spread is offered when the broker does not want to engage in market risk. The broker simply adds a certain amount to the market spread, allowing the final spread available to the customer to fluctuate with the market. For the trader, this accounts for an extra variable to take into account when trading.

If the broker offers a fixed spread, he will guarantee a certain spread for any given currency pair, essentially betting that the market spread will, on average, be lower than the broker offered spread. He will then profit the difference between the broker spread and the market spread. This allows the trader to buy and sell consistently at the same cost, allowing for simpler back-testing and trading.

Forex brokers also sometimes charge a fixed $ commission per 100 000 unit trade. So if you trade, for example, 100 units of a currency pair, you must multiply this commission by 0.01.

The video below illustrates nicely the practical differences between the two:

Additionally, most fx traders will choose to trade with margin, to increase their return on capital. On top of this margin, there will be an interest rate.

We won’t be focusing on margin interest rates as these aren’t direct trading costs and can be done through external providers.

Finally, some brokers will charge overnight holding costs. These are costs associated with holding a position overnight, when the market is closed, also known as rollover rates.

Fees and commissions for the most popular brokers in the market:

Trading fee type: variable spread

Inactivity fee: 12$/month after 2 years of no trades

Rollover rate: tom-next rate %

Example trade fee:

If a trade for 100 GBP/USD would be executed at the minimum pip, it would cost 0.0001 * 100 = 0.01$. At the average pip it’d cost 0.013$

Saxo bank:

Trading fee type: fixed spread

Inactivity fee: 100$ after 6 months of no trade

Rollover rate: tom-next rate% + 0.45%

Example trade fee:

If a trade for 100 GBP/USD would be executed at the minimum pip, it would cost 0.0001 * 100 = 0.01$.

CMC markets

Trading fee type: fixed spread

Inactivity fee: 10£/month after 1 years of no trades

Rollover rate: tom-next rate % + 1%

Example trade fee:

If a trade for 100 GBP/USD would be executed at the minimum pip, it would cost 0.00009 * 100 = 0.009$.

Note: commissions are based on a spread betting account.

TD ameritrade FX

Trading fee type: variable spread

Rollover rate: tom-next rate %.

Note: unfortunately, TDAF, does not make its currency pair quotes public. For that reason, we could not make an example trade commission.

There is no minimum spread.

FOREX.Com

Note: commissions listed below are for commission type accounts.

Trading fee type: fixed commission- 5$ per 100 000 units traded.

Inactivity fee: 15$/month after 3 months of no trades

Rollover rate: tom-next rate %.

Example trade fee:

If you buy 100 GBP/USD, this would cost 0.005$ + the current spread.

City index

Trading fee type: variable spread

Inactivity fee: 15$/month after 2 years of no trades.

Rollover rate: tom-next rate %.

Example trade fee:

If a trade for 100 GBP/USD would be executed at the minimum pip, it would cost 0.00009 * 100 = 0.009$.

Trading fee type: fixed commission- 4$ per 100 000 units.

Inactivity fee: 12$/month after 2 years of no trades

Rollover rate: tom-next rate %.

Example trade fee:

If you buy 100 GBP/USD, it would cost you (4$ * 100)/100 000= 0.004$ in fees + the current spread.

Dukascopy

Trading fee type: variable spread

Inactivity fee: 12$/month after 2 years of no trades

Volume commission: based on trading activity. Varies from 10$ to 35$ per million units traded.

Example trade fee:

If a trade for 100 GBP/USD would be executed at the minimum pip, it would cost 0.00085 * 100 = 0.085$ + the volume commission of 0.04$ based on an account equity of 5 000$ = 0.125$

Trading fee type: fixed spread

Inactivity fee: 50$/year after 1 year of no trades

Rollover rate: tom-next rate %.

Example trade fee:

If you buy 100 GBP/USD, it would cost 0.00018 * 100 = 0.018$ in fees.

Final thoughts

Trading forex is one of the cheapest ways of getting involved in the financial markets.

Due to these low costs and the possibility to trade on margin, the starting capital required to achieve a full-time income is much lower than for stock or bond trading.

With that in mind, we hope that this article has helped you understand broker commissions and choose a broker for your forex trading.

Trading terms

Funding and withdrawing

Terms

Margin requirements

Futures instruments terms

Funding and withdrawing

Deposit fee: bank transfers

no fees

Credit/debit cards, google pay, apple pay, skrill, ideal, dotpay, giropay, sofort

no fees until you deposit EUR 2 000 in total. A fee of 0.7% will apply thereafter.

Terms

Start trading now

Italia ic_down created with sketch.

- Argentina

- Australia

- Österreich

- België

- България

- Chile

- 中国

- Colombia

- Hrvatska

- Κύπρος

- Česká republika

- Danmark

- Eesti

- Suomi

- France

- Deutschland

- Hellas

- Magyarország

- Ísland

- Éire

- Italia

- 日本

- Latvija

- Liechtenstein

- Lietuva

- Lëtzebuerg

- Malta

- México

- Nederland

- Norge

- Polska

- Portugal

- România

- Россия

- السعودية

- Singapura

- Slovensko

- Slovenija

- South africa

- España

- Sverige

- Schweiz

- الإمارات العربيّة المتّحدة

- United kingdom

- International

Free investing in stocks & etfs. Zero commission, zero fees.

Active trading with leverage and zero commission. Stocks, forex, indices, and more.

Investments can fall and rise. You may get back less than you invested. Past performance is no guarantee of future results. Tax treatment depends on your individual circumstances and may be subject to change.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trading 212 is a trading name of trading 212 UK ltd. And trading 212 ltd.

Trading 212 UK ltd. Is registered in england and wales (register number 8590005), with a registered address 107 cheapside, london EC2V 6DN. Trading 212 UK ltd. Is authorised and regulated by the financial conduct authority (register number 609146).

Trading 212 ltd. Is registered in bulgaria (register number 201659500). Trading 212 ltd. Is authorised and regulated by the financial supervision commission (register number RG-03-0237).

The information on this site is not directed at residents of the united states and canada, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

UK forex trading 2021 guide

When you start trading, choosing the right forex broker will provide access to foreign exchange markets along with trading tools and a range of cfds. Read on to find out how to assess trading platforms, currency pairs, and forex spreads in 2021.

What is forex trading?

The global foreign exchange market (aka forex market) is the largest financial market in the world. The global industry is valued at $2.409 billion with a staggering $6.6 trillion dollars traded daily.

Put simply, forex trading is the buying or selling of one currency for another at an agreed-upon price. While many forex market participants are institutional investors like private and central banks, retail investor accounts can start trading online with little barriers to entry.

With forex markets open 24/7, and 170 different currencies to trade, many find the endless opportunities, trading strategies and potential profits of forex trading appealing.

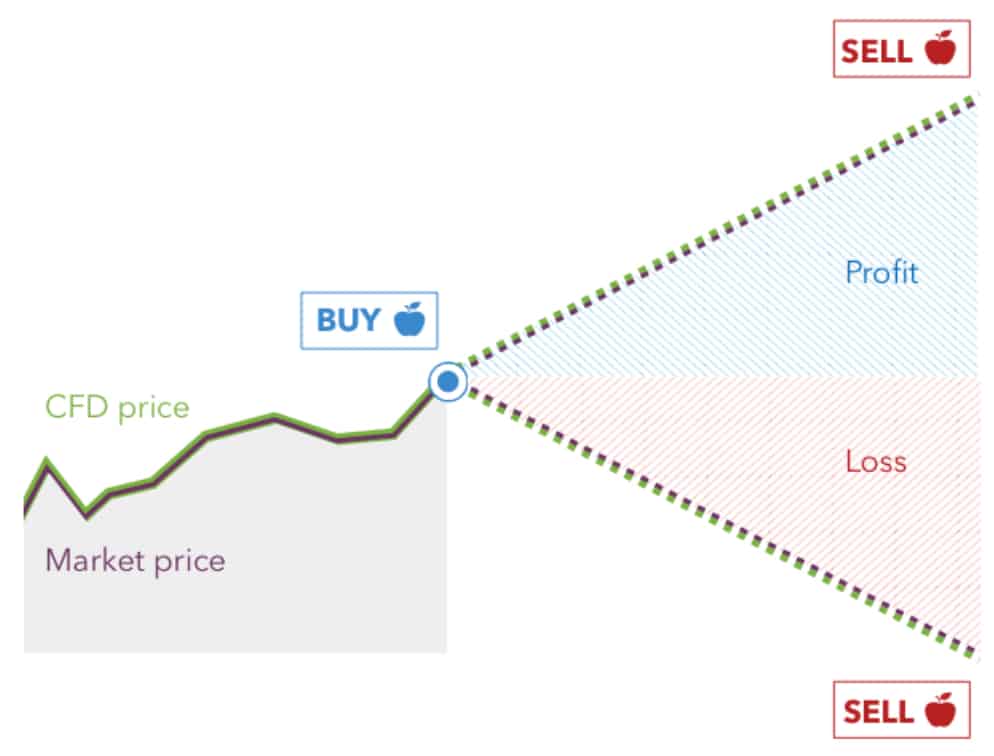

How does trading cfds work?

When online trading, forex brokers provide retail investor accounts access to derivative products called contracts for difference (cfds). While traditional currency trading requires you to buy and sell the physical asset, cfds allow you to speculate on price movements without owning the underlying asset.

As well as currency pairs, many brokers will offer CFD products derived from other asset classes, such as commodities, shares, indices, and cryptocurrencies like bitcoin.

What currency pairs can I trade as cfds?

Although foreign exchange markets consist of 170 different currencies, the fx pairs you can trade as cfds depend on the forex broker you sign up to. Certain brokers offer hundreds of major, minor and exotic currency pairs, while others offer a smaller selection of frequently traded majors and minors.

How do you choose A forex broker?

When choosing a forex broker in the UK, there are many important factors to consider. There are many brokers that accept retail investor accounts, with some offering unique features suited to different trading experience, style and strategies.

Three of the most important considerations include:

- The type of broker and the spreads they offer.

- The trading platforms and tools are available.

- The risk management features available.

Types of brokers

Forex brokers follow one of two main pricing and execution models that determine the forex spreads you can trade.

- Dealing desk brokers

- No dealing desk brokers

When trading forex, the spread refers to the difference between bid-ask prices. As a forex trader, you want the lowest spreads possible.

Dealing desk brokers

Also known as market makers, brokers that use a dealing desk set their own bid-ask prices and use their own liquidity to fill your orders. When placing an order with a dealing desk broker, they act as the counterparty to your trade.

There are both pros and cons to market makers. While this type of broker offer better risk management tools, there’s a potential lack of transparency as market makers have full control over the spreads they offer and profit off your losses.

No dealing desk brokers

Conversely, no dealing desk (NDD) brokers use external liquidity sources to determine bid-ask prices and fill orders. When you place an order with an NDD broker, it is directly passed onto liquidity providers with no dealing desk interference. As prices are sourced from multiple providers, bid-ask prices react to current market conditions such as volatility and liquidity.

A major benefit to NDD brokers is they often offer faster execution and tighter spreads than market makers, as they are purely acting as a bridge between forex traders and multiple top-tier liquidity providers.

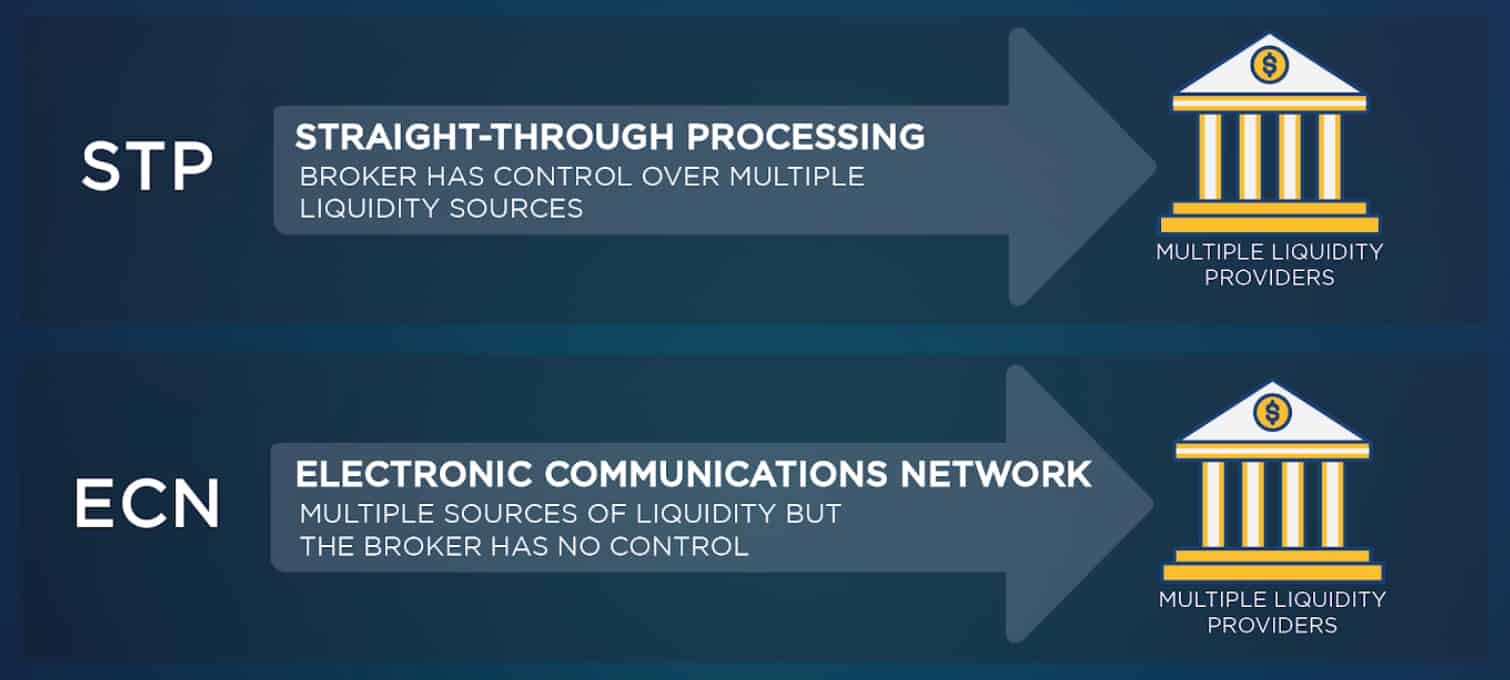

NDD brokers use straight-through processing (STP) or electronic communications network (ECN) execution methods, or in some cases a combination of the two:

- STP: has an internal pool of liquidity sourced from multiple a selection of providers. Broker retains some control over liquidity.

- ECN: routes orders onto an interconnected hub that includes different banks and other major market players. Broker has no control over liquidity providers.

Trading accounts and spreads

Forex brokers may offer one account type or a selection of trading accounts with varying spreads and features. There are two main pricing structures and trading account types – commission and commission-free.

Commission-free account types and spreads

These trading accounts allow you to trade forex spreads with no commission fees yet brokers widen the spread to compensate for their brokerage services. No commission accounts are offered by both dealing desk and NDD brokers.

In the table below you can see that NDD brokers like IC markets and pepperstone offer the tightest no commission spreads. For social trading brokers like etoro, commission-free spreads are over twice as wide as pepperstone or IC markets.

Data taken from broker website. Accurate as at 05/01/2021

Commission trading accounts and spreads

Forex traders can trade spreads that are passed on from liquidity providers with no markup. As spreads are not widened, brokers are compensated through a commission fee. Only NDD brokers and often referred to as raw or ECN accounts.

As shown below, commission spreads can vary significantly depending on the forex pair and broker. For currency pairs like the EUR/USD (euro vs US dollar) and USD/JPY, pepperstone offers the tightest forex spreads averaging 0.16 pips + commission fees. Likewise, pepperstone provides access to the lowest spreads for the GBP/USD at 0.40 pips, while dukascopy the tightest for the AUD/JPY at 0.47 pips.

Data taken from broker website. Accurate as at 05/01/2021

As market makers set their own bid-ask prices, all trading accounts with dealing desk execution are commission-free. On the other hand, many NDD brokers that use STP and ECN execution often offer both commission and commission-free pricing structures and account types.

For example, pepperstone, an ECN-style broker, offers two trading account types:

- Standard account: A commission-free account with spreads starting from 1.0 pips for the EUR/USD

- Razor account: an ECN-like account with forex spreads from 0.0 pip plus a commission fee of £4.59 round turn, per 100k traded.

Experienced traders will prefer NDD brokers with tighter spreads and faster execution, while beginner traders will find commission-free spreads attractive as there is no need for complicated fee calculations.

Other trading account types

As well as commission and commission free account types, certain brokers may offer:

- Islamic accounts, aka swap free accounts, where those following sharia law do not pay any fees or receive any payments derived from interest rates.

- VIP accounts for those trading volumes higher than a certain amount, or making a high minimum deposit.

- Micro accounts where small trading volumes (micro lots) are available. Micro accounts usually require lower minimum deposits.

- Professional trading accounts for those with experience in the industry and trading high volumes.

What is trading platforms can you use?

The trading platform you choose to develop and execute trading strategies is key to successful forex trading. Different software is suited to different styles of trading, with some renowned for algorithmic trading or social-copy trading tools.

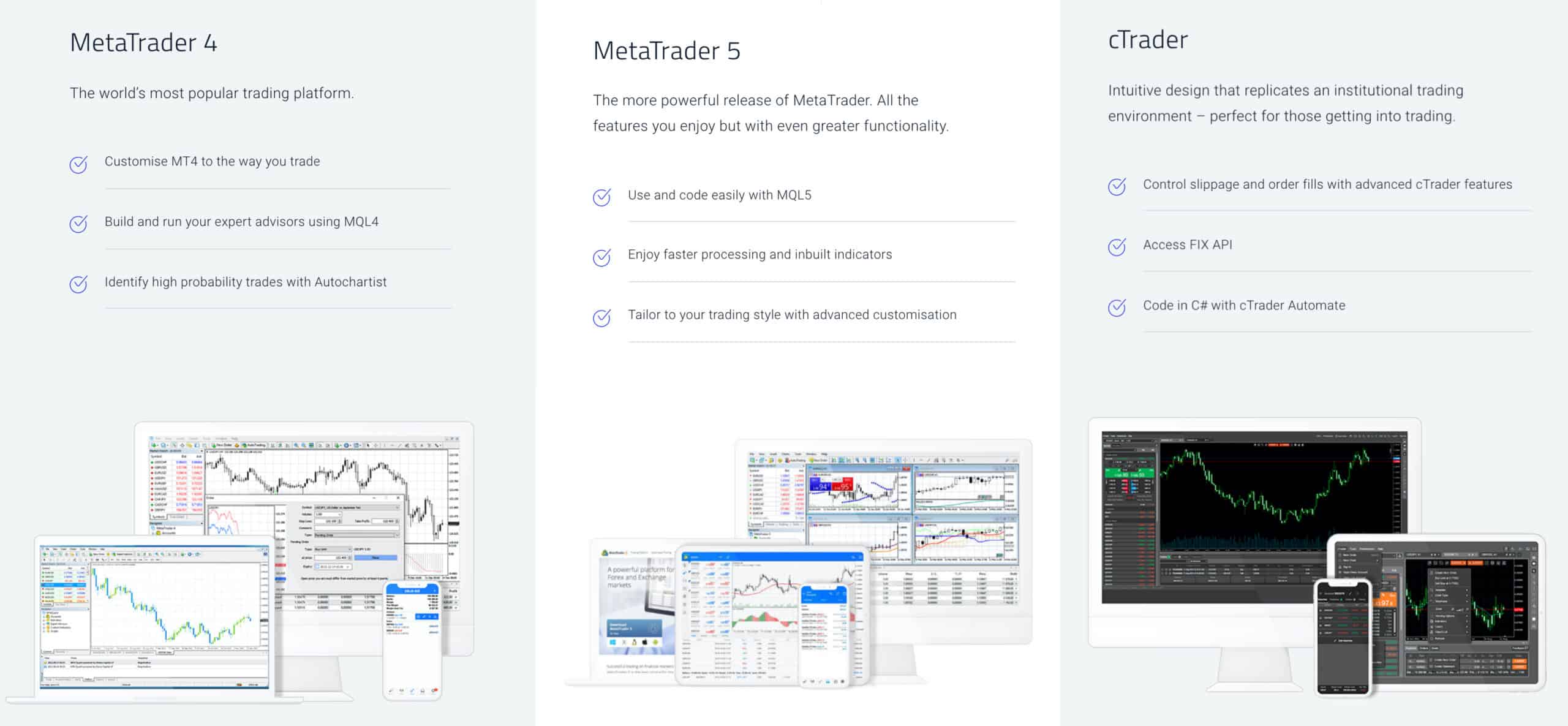

Metatrader 4, metatrader 5 and ctrader

The three most popular trading platforms worldwide are metatrader 4 (MT4), metatrader 5 (MT5), ctrader. While many forex traders use these platforms for their automated trading capabilities, the advanced charting tools also enable you to conduct sophisticated technical analysis.

- Advanced inbuilt charting tools with multiple charts, timeframes and technical indicators.

- Trading robots with expert advisers (eas) on metatrader platforms, and cbots on ctrader.

- Backtesting features where you can test and optimise expert advisers and cbots.

- Available as desktop trading platforms, web trader platforms or mobile apps.

- Suited to all styles of trading, including scalping, day trading, hedging and algorithmic trading strategies.

Proprietary trading platforms

Proprietary trading platforms are well-suited to two styles of trading, being beginner traders or those wanting the unique features for copy trading, strategy development or risk management. For example:

- Markets.Com developed marketsx, a proprietary CFD trading platform that comes with exclusive sentiment trading tools not offered by other forex brokers.

- Plus500 is an option for beginner traders with premium order types to manage the high risk of trading, such as guaranteed stop-loss orders available.

- Etoro a copy trading platform and broker that offers access to a large social network where you can interact with other etoro traders and copy the trading strategies of other investors.

What are the risks when you trade forex?

As cfds are complex instruments, online trading comes with a high risk of losing money. To ensure markets and brokers operate fairly and transparently, the financial conduct authority (FCA) oversee operations in the united kingdom.

The UK regulator is one of the strictest worldwide, requiring brokers to provide strict investor protections to reduce the high risk of forex for UK traders, such as:

- Negative balance protection

- Close out margins

- Investor compensation schemes

- Segregated client funds

- Leverage caps of 30:1 for major forex pairs and 20:1 for minors.

Forex brokers offer various risk management tools to reduce the high risk of trading cfds. The two key trading tools offered by nearly all online brokers are:

- Demo accounts: allows you to practice trading cfds in real-time market conditions but in a risk-free environment.

- Order types: to set limits on when to close or open positions, allowing you to maximise gains and minimise losses, i.E. Stop losses or trailing stops.

Other leading regulators include MAS in singapore and ASIC for australian forex traders.

Spread betting vs forex trading in the UK

If you live in the united kingdom or ireland, the financial conduct authority (FCA) allows you to spread bet as an alternative to trading cfds. Spread betting involves staking a specific amount of money for each point of price movement in the underlying instrument. Although spread betting is similar to CFD trading in many ways, the key difference is how profits are treated under UK tax laws.

Any profits made from trading cfds is exempt from stamp duty but subject to capital gains tax (CGT), while profits from spread betting are exempt from both stamp duty and CGT.

Brokers that offer spread betting services to UK residents include pepperstone, CMC markets, IG, city index, thinkmarkets, FXCM and OANDA.

UK forex trading guide 2021: summary

Whether you are a beginner trader or an experience forex trader looking to switch brokers, it is important to understand the pricing structure as well as the trading platforms and features available. When choosing a new broker, find out if spreads are commission free, and what other cfds and risk management tools are freely available.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

UK forex trading guide 2021

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

The fees and costs of forex brokers

Transparent brokers should always be upfront in their fees and list them either on the website.

Each forex broker charges fees in one form or another. Then, there are trading costs linked to every trade placed.

Most traders typically ignore the overall cost per trade that can make a massive difference to the entire outcome of a portfolio.

As the most common cost is via spreads, other fees and costs are still applicable and must not be neglected.

Transparent brokers would always be upfront in their fees and list them either on the website, trading platform with every trade ticket, or both.

Direct trading costs

Direct trading costs consist of spreads, commissions, swap rates, etc. Not all costs apply to all trades, and it all depends on the kind of asset traded – if they traded on a margin and the duration and the duration of every trade.

The broker needs to mention all costs included in every trade. Also, transparent brokers list them in their trading conditions and give examples of how they incur and calculate costs.

Then, trading costs can be found inside the trading platform – especially if the broker offers a proprietary trading platform.

They also provide traders with calculators, letting them calculate the cost of every trade before placing it.

Spreads

Spreads are the most usual cost associated with trade and refer to the difference between the bid and ask price.

In addition to that, spreads are the main income source for brokers who live from the mark-up on raw spreads.

Raw spreads can become as low as 0.0 pips in the EUR/USD -the most liquid currency pair that carries the lowest spread. Everything over this level is the mark-up that the broker charges.

Commissions

Several accounts come with spreads as low as 0.0 pips on the EUR/USD. However, the broker charges a commission per lot.

Typically, accounts charging commissions are ECN accounts that run a no-dealing desk execution.

Here, traders get the raw spreads, or near to it. Then, in return, the broker charges a commission.

Aside from that, they charge commissions on equity trades, and different assets, such as etfs, ETC’s, bonds, and more, will carry a commission charge.

Then, to get the complete details on which assets carry a commission, traders must either consult the asset directory given by their broker or get the information straight from the trading platform.

Transparent brokers will list the full contract specifications on their website as proprietary trading platforms list all the details in every deal ticket.

Volume discounts are often provided to an account that carries commissions.

Swap rates

Swap rates or rollover rates apply to every position held overnight. Swap rates happen because of the interest rate differences in the base currency and the quote currency.

Also, brokers will list the way this rate is calculated, and there is a swap long and a swap short rate.

Swap rates will either become credited from or debited to the account balance, depending if the traders take a long or short position. Many brokers fail to forward favorable swap rates to traders.

So, let's see, what we have: how expensive is forex trading in 2021? ✔ how much does it cost? ✔ honest FX broker fees comparison for traders ➜ read more about it now at forex trading no fees

Contents of the article

- Actual forex bonuses

- What does forex trading cost in 2020?

- The forex trading costs are depending on the...

- How the forex broker earns money from the spread?

- The commission fees explained

- Financing of your trading position: the swap for...

- Pay fewer fees with a good forex broker

- Best low cost forex brokerages

- Top inexpensive forex brokers

- Cheap forex brokers ranking summary

- The 10 best forex broker with zero (no) spread...

- Save trading fees by using a low spread forex...

- Comparison between a spread and zero (no) spread...

- Advantage of a 0.0 pip account:

- Disadvantages of a 0.0 pip account:

- Our values to find a good online partner

- How does a 0.0 pip forex spread broker earn money?

- How does the no spread account really work?

- Get direct market spreads

- See the market liquidity

- No conflict of interest

- Be careful: slippage can happen on market events

- Conclusion: you should use a 0.0 pip forex...

- How to pay your forex broker

- Commission structures

- Different brokers, different service levels

- Choosing a forex broker

- The bottom line

- The fees and costs of forex brokers

- Transparent brokers should always be upfront in...

- Forex brokers fees and costs explained

- Overview of direct trading costs

- Spreads

- Commissions

- Swap rates

- Overnight financing costs

- Storage fees

- Custodial fees

- Overview of indirect trading costs

- Forex broker’s fees and commission guide: how...

- forex broker’s fees and commission guide: how...

- How do forex broker’s fees and commissions work?

- Fees and commissions for the most popular brokers...

- Example trade fee:

- Saxo bank:

- Example trade fee:

- CMC markets

- Example trade fee:

- TD ameritrade FX

- FOREX.Com

- Example trade fee:

- City index

- Example trade fee:

- Example trade fee:

- Dukascopy

- Example trade fee:

- Example trade fee:

- Final thoughts

- Trading terms

- Funding and withdrawing

- Terms

- Margin requirements

- Futures instruments terms

- Funding and withdrawing

- Terms

- Start trading now

- UK forex trading 2021 guide

- What is forex trading?

- How do you choose A forex broker?

- What is trading platforms can you use?

- What are the risks when you trade forex?

- Spread betting vs forex trading in the UK

- UK forex trading guide 2021: summary

- The fees and costs of forex brokers

- Transparent brokers should always be upfront in...

No comments:

Post a Comment