Thickmill

Reply by tickmill submitted may 15, 2020 hi deltoid88, aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers.

Actual forex bonuses

Their ratings erased.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least £25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

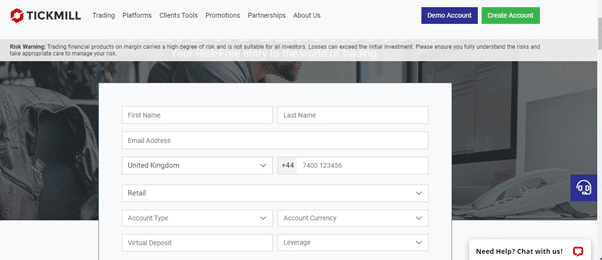

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Tickmill reviews

286 • great

Write a review

Write a review

Reviews 286

Strugglling trader to find a reliable broker, just go for tickmill

In my case, this broker is best in terms of reliability, exacution speed, zero spread option account, prizes, withdrawals and deposits. It is just instance. From turkey, you might not find better broker among large companies as this. I highly recommend tickmill syc for especially traders from turkey who struggles to find reliable broker. By the way, I witdrawed my money using bank wire (direct bank transfer), it was in my bank account in one day. Thank you tickmill.

Easily claim for refund with mr joe…

Easily claim for refund with mr joe msgs on tele gram joeboss1limited reliable person

Please introduce MT5

I have been trade on tickmill flatform

I have been trade on tickmill flatform, its good, fast excution and low spread

All sense awesome :)

Very good.

Great I love it and I want it better…beutifull

Great I love it and I want it better than all the other one that I have experience

They clearly indicate that they have…

They clearly indicate that they have 0.1 pip spread for forex trading. They are lying. Spread are so wide that it’s impossible for those scalper and day trader and maybe swing trader as well to earn more despite all of your time and efforts and strategies and plans you’ve made. It seems that taking our money is their initial motive. Switch to other broker. This is useless.

All great so far

All great so far. Deposits cleared same day, customer support is excellent and fast while the most important trading experience is supreme as spreads are low and liquidity high even in some exotic pairs

Credit where credit's due.

5 months and.

No problem with deposit, withdraw or transfer between accounts.

No extraordinary spreads or mismatching price/movemens etc.

Great client support, fast feed backs for any kind of questions.

Looks like my last station for now..

Wonderfull broker

Wonderfull broker. Recomended 100%. After working 2 years with them. Couldnt find one issue with there systems attention or connection.

Well done.

Note: only need to add more bank account so they can support more banks arround the world

Tickmill broker review

Reviewer : justin freeman

Published: 23rd december, 2020.

Broker information

- Company name: tickmill ltd

- Founded: 2014

- Country: seychelles

- Phone: +442036086100

Platform info

- Platform: metatrader 4, webtrader

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA, cysec, FSA SC

- Bonus: $30 welcome account

- Minimum deposit: $100

- Leverage: 1:500

- US clients: no

- Funding methods: bank transfer, visa, mastercard, skrill, neteller, fasapay, unionpay, dotpay, nganluong.Vn, qiwi wallet, thai online bank transfer, globepay, vietnam instant online bank transfer, paysafe

- Pairs offered: 62+

Open free

demo account

Bonus offer for forexfraud visitors

Expert’s viewpoint

This review of the broker tickmill reaffirms its position as a top-quality platform, built by traders, for traders. This approach results in a trading experience that just has to be tried out – a fact confirmed by the firm’s continued growth and increasing popularity with traders.

A record number of new clients have taken the decision to sign up to the platform. It now has more than 350,000 registered accounts. It also keeps adding to its impressive collection of industry awards.

The ‘best trading experience’ award from forex brokers in 2020 is just one example of how tickmill continues to get things right.

A quick scan of online feedback from the trading community also gives a glimpse of the strength of tickmill’s fan base. The firm has built a reputation for providing traders with all the tools they need to be successful.

This is backed up by review site trustpilot recording that 82% of reviews mark tickmill as ‘excellent’ or ‘good’.

The forex fraud tickmill review team found the broker to be ‘safe to use’. The tickmill experience is all about great trading, but behind the scenes, the firm has also gained a reputation for being trustworthy. Tickmill complies with regulations to a degree that is well above market average, and it’s a profitable and viable company.

Free demo account

The tickmill trading experience

The tickmill trading platform is set up to provide reliable, low-cost, super-fast trading, in all the popular markets. There are a lot of behind-the-scenes features that go to make tickmill trustworthy, but trying out the actual trading platform using a tickmill demo account (by clicking here) is a hands-on way to find out what a great platform feels like.

The range of extra tickmill support services complements, rather than overwhelms, the trading experience.

Research and learning materials are set at beginner, intermediate and advanced levels. Some are tailored to explaining the basics and preparing clients for trading. When you are ready to enter into the markets, there is a collection of up-to-date research notes that focus on identifying trade entry and exit points.

It takes a few seconds to sign up to a tickmill demo account, and doing so is highly recommended. Whether you’re looking for a new, safe broker or trying trading for the first time, using a tickmill demo offers a risk-free opportunity to see just how good the trading experience can be.

$30 welcome bonus

Broker summary

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group’s companies include tickmill UK ltd, tickmill europe ltd, and tickmill ltd. One other subsidiary is the 100%-owned procard global ltd, a UK-registered firm.

Tickmill currently operates in more than 200 countries, and has more than 350,000 registered customers and 150 employees. Reports show that it has executed more than 273m trades and records average monthly trading volume well above $123bn.

There is a focus on quality as well as quantity. With the average trade execution speed at 0.2 seconds, lots of trading tools and a variety of educational materials, the award-winning ECN broker meets most of the requirements of traders, beginners and professionals alike.

Broker introduction

The best way to find out more and explore the reasons for the firm’s popularity is to try out a risk-free tickmill demo account.

Once you have completed the brief registration process, you will be able to use your tickmill sign in at any time. The only requirement is that you supply your email address and phone number, and then you are ready to step into the markets and develop your trading skills.

You can set your balance of virtual funds and leverage terms at a level that suits you. Although you will be ‘paper trading’, you will benefit from all the high-tech mechanisms of the actual tickmill MT4 platform.

Spreads & leverage

Making a consistent profit from the markets isn’t easy. Part of the recipe for success is setting up with a broker that helps you tilt the balance in your favour. One way to improve your trading bottom line is by selecting a platform that offers low-cost access to the markets.

Tickmill fees are low. Bid-offer spreads start from as low as 0.0 pips, and there are also near-zero commissions. Numbers such as these are just hard to beat, and tickmill unsurprising scores highly in this category.

If you’re looking to take advantage of such welcoming T&cs, it’s also possible to apply leverage to your trading. This isn’t for everyone as it comes with additional risks. Tickmill account types score additional bonus points by allowing clients to choose their own leverage terms instead of setting them at a riskier default position.

In line with standard practice, the maximum tickmill leverage terms on offer to clients will be determined by the regulatory body of the country in which you live. UK and EU clients will find leverage capped at 1:30, which is still a considerable level, but some in other domiciles might be able to scale up to 1:500.

Platform & tools

The tickmill MT4 platform gives access to the most popular retail forex platform in the world. It’s been used by millions of traders for many years and is very much the benchmark by which other platforms are measured.

It is available in desktop, web trader and app format for android and ios mobile devices. MT4 is the gold standard in online trading. It is a fully customisable trading environment that provides traders with the tools to create their own technical indicators, custom scripts and expert advisors (eas).

Whichever approach you take, you will have access to analytical tools and trade indicators that are considered to be among the best in the industry. To add a cherry on top of the cake, tickmill clients also gain access to the myfxbook copy trading platform and autochartist.

Hedging and scalping strategies are allowed, which demonstrates that the platform is based on a high-quality IT infrastructure. The operator allows the use of all eas and trading algos – this is the green light for expert users of MT4, who can take full advantage of the power of the best trading platform in the world.

Despite its relative youth, tickmill has already picked up a number of prestigious forex awards. In 2016, it won the ‘most trusted forex broker’ at the best ECN/STP broker awards. That trend continues, and the broker won the ‘best trading award’ at the forex broker awards in 2020.

Commissions & fees

The brokerage offers a free-to-use, risk-free demo account, which gives traders a taste of what’s on offer. The demo account offers full access to MT4, as well as to the full array of tradable assets, not to mention real-life volatility and prices.

There are five varieties of live account. Each is accessed through the same tickmill login portal but offers different T&cs.

- Classic account – this is the most accessible account. It is an entry-level account aimed at those looking to get into the game cheaply, and without having to pay commissions. The tickmill minimum deposit for this account is 100 base currency (EUR, USD, GBP and PLN are all accepted). The maximum available leverage is 1:500 and the spreads start from 1.6 pips. Trade execution is of the NDD variety.

- Pro account – this is quite an improvement in regard to spreads. While it does feature a commission of 2 per side per lot, its spreads start from 0 pips. The maximum available leverage is 1:500 on this account.

- VIP account – the minimum balance for this account is 50,000 base currency, which means that this option is not for everyone. The spreads start from 0 pips on this account and the maximum available leverage is 1:500. Commissions are ultra-low and start from just 1 per side, per lot.

- Professional clients – there are improved T&cs for those putting through high trading volumes. Criteria to qualify include a minimum portfolio size of EUR 500,000; trading volume of at least 10 trades per quarter, over the previous four quarters; and you are required to have worked in the financial sector for at least a year, in a relevant position.

- Islamic account – this is a swap-free option that is fully sharia law-compliant. Those who want to set up such an account have to open a regular account, as described above, after which they have to request the conversion of this account into an islamic one.

Trading conditions offered by the islamic account are the same as those available through the above-mentioned regular accounts.

The required margin for hedging positions on the classic, pro and VIP accounts is 0. Scalping is allowed and there are no time limitations for keeping the positions open.

There are three base currencies to choose from and negative balance protection rules apply. Deposits can be made through an impressive range of accepted methods, such as bank wire, visa, mastercard, neteller, skrill, fasapay, paysafecard, qiwi, unionpay, dotpay and globepay.

There are no commissions charged on most deposits and withdrawals. One exception is bank wire, where charges are applied to small transactions but can be avoided if you make a deposit larger than US$5,000.

Education

Tickmill offers a great range of materials to help traders build up their knowledge and therefore trade safely. There are webinars, tutorials, seminars, ebooks, infographics, glossaries, articles and insights.

There are also dedicated sections to technical and fundamental analysis. All of this ‘how-to’-style material is backed up by other services, such as autochartist, which helps identify actual trading opportunities.

Customer service

Tickmill support is available during business hours, monday to friday. This coverage is not as extensive as it could be, but our review team found the staff to be professional, informed and client-focused.

Final thoughts

Asset prices go up and asset prices go down. No matter how experienced a trader you are, ‘market risk’ is unavoidable.

The important thing is that traders exploit those things that they can control, and broker selection is high up on that list.

Choosing a safe, reliable broker that is well regulated and has been operating for many years is a good first step. Tickmill is firmly in that category, and also offers a lot of other neat and innovative features. It even intermittently offers a $30 bonus scheme to help novice traders try trading with real funds, but in small size, and that are given to them by the broker.

As the regulatory framework that tickmill has put in place is well above average, it’s worth concluding this review with confirmation that the behind-the-scenes infrastructure makes it a safe and reliable broker.

The online broker sector is a competitive one and tickmill stands out for giving traders everything they need, and nothing they don’t.

Broker details

The tickmill group of companies owns and operates tickmill.Com, a multi-asset, multi-regulated CFD broker. The group companies include tickmill UK ltd, regulated by the financial conduct authority (FCA); tickmill europe ltd, regulated by the cyprus securities and exchange commission (cysec); and tickmill ltd, regulated by the seychelles financial services authority (FSA).

Coming under the legislative framework of mifid II, the broker is authorised to provide services across countries in the european economic area (EEA) and beyond. If you are a retail client residing in europe or the UK, you automatically come under the protection of the investor compensation fund (ICF) or the financial services compensation scheme (FSCS).

Open your tickmill account

How can I open a demo account with tickmill?

Demo accounts, in desktop and mobile app format, are free to use and downloadable here.

Is tickmill a regulated broker?

Yes. As tickmill is a global broker, the regulatory protection that applies to clients will depend on where they live. Regulators that tickmill are authorised by include the financial conduct authority (FCA), the cyprus securities and exchange commission (cysec), the seychelles financial services authority (FSA) and the labuan financial services authority (labuan FSA).

What bonus terms does tickmill offer?

These change from time to time, but one offer that regularly pops up is the $30 welcome account, where the broker credits your account with $30 and lets you keep any profits.

How do I withdraw money from tickmill?

To comply with regulations, tickmill requests clients to return funds to the account that made the initial deposit. The good news is that unlike a lot of other brokers, tickmill does not apply charges on these transactions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

Tickmill review

Tickmill is a multi-regulated online broker offering retail and institutional clients across the globe 80+ trading instruments. Spreads and commissions are competitive with flexible accounts. Tickmill also have multiple trading platforms and a vast selection of trading tools that are sufficient but educational material is perhaps lacking compared to other online brokers.

Tickmill review, pros & cons

- Multi-regulated

- Negative balance protection

- Investor compensation fund

- Segregated client funds

- Commission free accounts

- Autochartist

- VPS

- FIX API

- No US clients

- Restricted leverage for EU clients

- No fixed spread accounts

- Limited educational material

- No cryptocurrencies

In this detailed tickmill review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

Tickmill is not ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers or best online brokers categories. You can use our free broker comparison tool to compare online brokers including tickmill.

Tickmill review: summary

Tickmill is a regulated and award-winning online broker offering retail and institutional clients across the globe 80+ trading instruments in multiple markets including forex, commodities, stocks, shares, indices, metals, energies, bonds & cfds.

Tickmill was founded in 2015 and built by an experienced team of global market traders who understand what traders require to reach their full potential. The team remain focused on growing the company whilst adhering to the best interest of its clients.

Tickmill incorporates innovative technology to provide premium trading conditions with low spreads starting from 0 pips, competitive commissions and fast execution speeds of 0.15 seconds on average. There are no requotes and a fully automated no dealing desk (NDD) execution model for absolute transparency.

Tickmill liquidity is provided from global, top-tier banks and hedge funds. 100% of orders are cleared with their liquidity providers using quotes directly from them. They allow all trading strategies including hedging, scalping and expert advisors.

Tickmill have won awards for their trading services including top CFD broker 2018 (fxdailyinfo.Com broker awards), most trusted broker in europe 2017 (global brands magazine) and best forex trading conditions 2017 (UK forex awards).

Tickmill review: features

Tickmill review: regulation

Tickmill is the trading name of 3 related companies within the tickmill group, all of whom are regulated.

Tickmill UK ltd is authorised and regulated by the financial conduct authority (FCA) in the united kingdom. The FCA is an independent public body given statutory powers by the financial services and markets act 2000. It regulates the conduct of both retail and wholesale financial services firms in the UK. The regulator’s mission is to protect investors and ensure the financial markets operate with high standards and integrity.

Tickmill UK ltd is a member of the financial services compensation scheme (FSCS). The FSCS is an independent compensation fund of last resort for customers of authorised UK financial services firms, set up under the financial services and markets act 2000. The FSCS’s objective is to pay compensation if a firm is unable or likely to be unable to pay claims against it in the event the firm has stopped trading or has declared to be in default.

Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA). The FSA was established under the financial services authority act 2013. The regulator’s key responsibilities include the licensing, supervision and development of non-bank financial services in seychelles through a solid regulatory regime.

Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) as a CIF limited company. Cysec is the financial regulator of the republic of cyprus, established according to section 5 of the securities and exchange commission (establishment and responsibilities) law of 2001. The purpose of cysec is to safeguard investor protection and facilitate the sound development of the securities market through the exercise of efficient supervision

Tickmill europe ltd is a member of the investor compensation fund (ICF). The ICF was set up according to article 59(1) and (2) of law 144(Ι)/2007 as an investor compensation fund for CIF clients and its functions are regulated by the directive 144-2007-15 of cysec. The fund’s objective is to secure the claims of covered clients against the ICF members through the payment of compensation for any claims arising from the failure of a member of the fund to meet its obligations.

It should be noted that the tickmill UK and european companies have restricted leverage of 1:30 due to the european securities and markets authority (ESMA) rules. They also follow the european union’s markets in financial instruments (mifid II) directive which provides a harmonised regulatory regime for the provision of investment services within the european economic area. The main objectives of this directive are to maximise the efficiency, increase transparency, encourage competition and offer greater consumer protection. Mifid II allows investment firms to provide investment and ancillary services within the territory of another member state and/or a third country, provided that such services are covered by the investment firm’s authorisation.

Tickmill holds client funds in segregated accounts with trusted financial institutions for protection and to ensure that the funds cannot be used for any other purpose such as business running costs.

Tickmill account holders have negative balance protection that ensures clients cannot lose more than their initial deposit. If the tickmill client risk team identifies irresponsible trading, they may contact the client and ask them to reduce risk or they may reduce the leverage on the account.

Tickmill review: countries

Tickmill accepts clients from all over the globe, excluding some countries due to regulatory restrictions such as the USA, cuba, iraq, myanmar, north korea and sudan. Some tickmill broker features and products mentioned within this tickmill review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

Tickmill review: trading platforms

Tickmill offer the most widely used and popular trading platform which is metatrader 4 (MT4). MT4 is freely available to use on desktop (windows / mac), web and mobile (iphone / ipad / android / tablet). The mobile app is useful for those who wish to trade on the go whilst the web platform runs in most browsers without needing to install any software.

Metatrader 4 (MT4)

The MT4 trading platform is fully customisable and very user friendly. It is easy to use with a small learning curve and thus is suitable for beginner traders whilst also having enough features for the more advanced traders. It is available in multiple languages and has built in user guides.

The enhanced charting functionality and sophisticated order management tools help traders to control positions quickly and efficiently. It includes 9 chart timeframes, technical indicators for chart analysis, drawing objects, real-time quotes, multiple order types, economic calendar, trading strategy templates and a built in metaeditor for creating custom indicators and automated trading systems in the MQL programming language. The MQL online community is a useful resource for additional MT4 add-ons and to communicate with fellow users.

Tickmill review: metatrader 4 (MT4)

Web trader

The web trader is an online trading platform that gives quick and easy access to MT4 without needing to download, install and run any additional software. It provides the same features as the MT4 platform but runs directly in your browser.

You can open a new browser window and have the platform running in just one click from anywhere in the world with an internet connection. All information transmitted via the online platform is securely encrypted.

Tickmill review: web trader

Mobile app

MT4 is available to download on both android and ios from the relevant app stores. It also has the same features as the desktop platform with the convenience of being able to trade from the palm of your hands. You can open, manage and close positions, and analyse the markets. Push notifications can also be set to alert you when a particular event occurs.

Tickmill review: metatrader 4 (MT4) mobile platform

FIX API

Tickmill do offer a FIX API connection to private and institutional clients who maintain a minimum account balance of $500,000. The monthly commission generated should be $5,000 to get the FIX API for free, otherwise the fee is $5,000 minus commission generated.

FIX API allows traders to trade with direct market access (DMA) for the lowest possible spreads and fastest execution.

Tickmill review: trading tools

Tickmill provide a selection of useful trading tools to help improve your trading environment and strategies.

Autochartist

Autochartist is a powerful technical analysis tool that automatically scans the markets for you to find chart patterns and key price levels across multiple instruments. This award-winning tool can help find potential trading opportunities and is free to all tickmill clients. It can be used as a standalone online web platform or as an MT4 plugin. There is an online community with an abundance of educational material for autochartist.

Tickmill review: autochartist

Autochartist benefits

- Saves you time from analysing the markets as it does it for you

- Can scan throughout the day and night

- Receive alerts when an opportunity is found

- Forecast for possible levels that formed patterns could reach

- Fully customisable scanning according to your requirements

- Wide range of educational materials to learn how to use it

- Drag & drop quick launch directly into MT4

- All opportunities displayed on one screen

Technical chart patterns

Receive automatic notifications when emerging and completed technical chart patterns are found.

Autochartist technical analysis

Fibonacci patterns

Identify simple and complex fibonacci patterns for levels of possible support and resistance.

Autochartist fibonacci patterns

Volatility analysis

View the volatility of different instruments to help asses risk and optimise potential stop loss and take profit levels.

Autochartist volatility analysis

Key levels

Discover possible support and resistance levels for finding potential turning points and breakouts.

Market reports

Get daily reports of the technical outlook of various markets prior to the opening of the london, new york & tokyo trading sessions.

Autochartist market reports

Performance statistics

Analyse previous patterns statistics over a 6-month period to see which performed well and which did not.

Autochartist performance statistics

Myfxbook autotrade

You can use this tool to link your account to follow the strategies of other traders in myfxbook autotrade. The signals you follow will be copied automatically and directly into your tickmill account. You can review historical performance of signals and filter according to your requirements. It should be noted that past results are by no means any guarantee of future performance.

Economic calendar

The economic calendar displays important economical events including the dates, time and impact expected. It also shows the previous, actual and forecasted results. You can change the time zone and filter according to your choice of impact and currency. This can be used as part of a fundamental analysis.

Tickmill review: economic calendar

Trading calculators

The trading calculators can be used to convert currencies, calculate margin and pips. This saves time from manually performing the calculations.

Tickmill review: trading calculators

Tickmill VPS

Tickmill have partnered with beeksfx to provide a virtual private server (VPS) that allows you to keep your trading platform running remotely 24/7. This can be useful for running expert advisors around the clock if it is not possible for you to always have your computer switched on. Tickmill clients receive 20% discount on all VPS packages.

One-click trading

The one-click trading (OCT) tool can increase the functionality of MT4 by enabling you to perform trade operations with a single mouse click from a quick trading panel on the chart.

Tickmill review: one click trader

Tickmill review: education

Unfortunately, at this time tickmill do not offer any additional educational material. The closest thing would be the faqs and news sections of the website.

Tickmill review: trading instruments

Tickmill offers traders a selection of trading instruments including cfds on FX currency pairs, stock indices, crude oil, precious metals, bonds and more.

Forex trading

Forex is the worlds largest market by volume and can be traded 24 hours a day, 5 days a week. Tickmill offer over 60+ FX currency pairs including majors such as the EURUSD, GBPUSD & USDJPY as well as minors and exotics.

Stock indices & WTI trading

Traders have access to trade cfds on 15+ major global stock indices and crude oil with zero commissions, no requotes and no hidden mark-ups.

Precious metals trading

Precious metals are often considered as safe havens and a way to diversify a trading portfolio. Tickmill offer cfds on gold and silver against the US dollar with competitive spreads.

Bonds trading

The bonds market is one of the largest securities markets that allows investors to speculate on the stability of government treasuries. Through tickmill, you can trade german government bonds with competitive spreads and no commissions.

Tickmill review: trading accounts & fees

Tickmill offer 3 account types which are the classic, pro and VIP. All accounts have over 84 trading instruments to trade including cfds on over 60+ FX currency pairs, 15 stock indices, WTI, precious metals and bonds. The main difference between the accounts are the spreads, commissions and minimum deposit requirement. All accounts are also offered swap-free for muslim traders who must comply with sharia law.

Demo accounts are available to test the different trading platforms and conditions before opening a real account. Whilst demo trading conditions are mainly the same, no slippage occurs on the demo account.

Tickmill review: account types

Classic account

The classic account has variable spreads starting from 1.6 pips and no commissions. The minimum deposit is $100, minimum lot size 0.01 and max leverage 1:500.

Pro account

The pro account has variable spreads starting from just 0 pips and a low $2 commission charge per standard lot per side. The minimum deposit is $100, minimum lot size 0.01 and max leverage 1:500.

VIP account

The VIP account has variable spreads starting from just 0 pips and an even lower $1 commission charge per standard lot per side. The minimum deposit is $50,000, minimum lot size 0.01 and max leverage 1:500. The stop and limit levels for VIP account users are zero.

As broker fees can vary and change, there may be additional fees that are not listed in this tickmill review. It is imperative to ensure that you check and understand all of the latest information before you open a tickmill broker account for online trading.

Tickmill review: customer service

Customer support is provided via online chat, telephone and email, available monday to friday during business hours. Support is offered in english, italian, spanish, russian, chinese, indonesian, vietnamese and arabic. The support team are usually prompt, efficient and polite with their responses.

Tickmill review: deposit & withdrawal

Tickmill offer a good variety of deposit and withdrawal methods including bank transfer, credit card and online payment processors. These can be conducted from within the client area.

Skrill, neteller, fasapay, unionpay and credit card deposits are usually processed instantly while withdrawals are processed within one working day. Tickmill has a zero fees policy on deposits and withdrawals.

Withdrawals must be made via the same method used to deposit. Please note that some methods may only be available to specific countries.

Whilst tickmill process all withdrawal requests within 24 hours on business days, the time necessary for the funds to reach your bank account can depend on the policies of your bank.

Bank withdrawals can take 3-7 working days to be seen on the client’s account. Credit/debit card withdrawals can take up to 8 working days to be seen on the client’s account.

Accounts can be opened in USD, EUR, GBP, PLN. The different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

Tickmill review: deposit & withdrawal options

Tickmill review: account opening

To register an individual client account, you need to fill in the online application form that they estimate takes 3 minutes to complete. Once submitted, you will need to verify your email address and submit your proof of address (POA) and proof of identity (POI) documents for KYC purposes. After the accounts team have verified your documents, you will be able to fund your account and start trading. If opening a corporate account, you will need to provide additional documents such as a certificate of incorporation and articles of association. Support are on hand to assist should you need them during the account opening process.

Tickmill review: account registration form

Tickmill review: conclusion

Tickmill is a very sophisticated and simple online broker with a clean offering that is suitable for all levels of traders. The spreads and commissions are very competitive whilst the accounts are flexible enough to suit different trader needs. They have multi-jurisdiction regulation along with a very approachable support team. Advanced trading platforms and tools are provided but educational material is significantly lacking.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Min $100 deposit

Tickmill is a multi-regulated online broker offering retail & institutional clients across the globe 80+ trading instruments. Spreads & commissions are competitive with flexible accounts. Platforms & tools are sufficient but educational material is lacking.

Review of tickmill – forex broker from UK

-regulated by organizations such as FCA

-very low spreads from 0 pips.

-low minimum account deposit of $25

Tickmill – broker review

Tickmill is a regulated CFD and forex broker that was founded in 2011. It has its headquarters located in the united kingdom and also has offices in seychelles. Indeed, in the united kingdom, this broker operates under the company tickmill UK limited, which is regulated by the FCA, while in the seychelles it operates under the company tickmill limited, which is regulated by the FSA seychelles.

It is characterized by the variety of services offered to its customers in addition to the regular trading accounts, such as a NDD execution, various trading accounts for clients with different profiles, trading contests for clients (demo and real accounts competitions), various types of trading platforms, regular promotions and others.

In the following review we will describe the main services of this online broker:

Type of broker

Tickmill is an ECN forex and CFD broker with NDD (non dealing desk) execution.

Regulation

Currently, this broker has the following regulation, depending on the subsidiary company and the location of its offices:

- Tmill UK limited is licensed and regulated by the UK’s FCA (financial conduct authority) under registration number 717270.

- Tickmill limited is licensed and regulated by the FSA seychelles (cyprus securities exchange commission) of seychelles, under license number SD008.

Country of origin

Its main offices are located in the united kingdom. It also has offices located in the seychelles islands.

The trading instruments offered by this broker to its clients are the following:

- Forex market: 62 currency pairs in the forex market, including major pairs such as EUR/USD, GBP/USD and USD/JPY, and more exotic pairs such as USD/ZAR, USD/RUB and USD/SGD among others. Regarding the trading conditions for forex trading, tickmill offers a minimum transaction size of 0.01 lots, a maximum leverage of 1:500 and low and variable or fixed spreads (depending on the account type chosen by the trader) , from 0.0 pips onwards for the most important currency pairs.

- Precious metals: gold and silver in the spot market, two of the most traded and important raw materials in the markets. The leverage for gold is equal to the general leverage of the account and the leverage for silver is equal to a quarter of the general leverage of the account.

- Contracts for difference*: CFD based on the following instruments:

- 15 of the most important stock market indices, such as S&P 500 (USA500), dow jones (USA30), FTSE 100 (UK100), IBEX 35 (SPAIN35), DAX 30 (DE30) and nikkei 225 (JP225) among others

- WTI crude oil.

- 4 of the most important government bonds in the european bond markets, including the euro bobl (cash) and the euro bund (cash) among others.

- Bitcoin against the US dollar (BTC/USD).

*the trading conditions of the contracts for difference depends on the underlying asset of the contract.

Trading accounts

This broker offers several types of trading accounts for clients with different profiles, which have the following characteristics:

| account type | classic account | pro account | VIP account |

| features | an account for beginner traders who want to trade without commissions (only the spread) | an account for more experienced traders who require more advantages and a more specialized service | an account for professional traders who want a more personalized service |

| minimum deposit | $25 | $25 | $50000 (minimum balance) |

| trading instruments | forex, precious metals and cfds | forex, precious metals and cfds | forex, precious metals and cfds |

| trade execution model | NDD | NDD | NDD |

| trade execution type | market execution | market execution | market execution |

| trading platform | metatrader 4 | metatrader 4 | metatrader 4 |

| maximum leverage | 1:500 | 1:500 | 1:500 |

| minimum trade size | 0.01 lots | 0.01 lots | 0.01 lots |

| commissions per lot traded | zero commissions | $2 per side for every $ 100,000 traded. No commission for operations with index and commodity cfds | $2 per side for every $ 100,000 traded. No commission for operations with index and commodity cfds |

| account currency | USD, EUR, GBP y PLN | USD, EUR, GBP y PLN | USD, EUR, GBP y PLN |

-all tickmill accounts offer a market execution without a trading desk (non dealing desk).

-for the three types of accounts presented above, tickmill offers an islamic version , that is, an account that has the same characteristics as the original but is swap-free, which means that they do not make the daily charge for rollover in the overnight positions that are made in regular trading accounts.

Demo accounts

This broker offers a demo account with no time limit, which allows the client to evaluate the broker’s services and practice their trading strategies without risking real money in the process.

You can learn more about the process to open a demo account in the following guide: tutorial to open a demo account with tickmill

The types of trading platforms offered by this broker to its clients are:

- Metatrader 4: one of the most popular and comprehensive trading platforms in the field of forex trading. It is a downloadable application that is designed with a variety of trading tools, including prices updated in real time, market news, advanced price charts with multiple time frames (from 1 minute to 1 month), dozens of technical indicators incorporated and more. Also, metatrader 4 provides functions for the creation, evaluation and implementation of automated trading systems (expert advisors) based on all kinds of strategies. It also allows copying automatically trades (copy trading) performed by other traders who use this platform, including experienced traders with successful trading systems.

- MT4 webtrader: it is a web-based trading platform (no download or installation is required) that offers full access to the client’s trading account and financial markets from any computer with an internet connection. It is based on the metatrader 4 platform and therefore offers many of its core features and tools, including up-to-date market quotes, multi-timeframe price charts, built-in technical indicators, and trading management features (including various order types). In addition, it has a user-friendly interface.

- Platforms for mobile devices: tickmill offers a series of trading applications for mobile devices such as the iphone or smartphones based on android technology. These platforms are based on metatrader 4 and include functions such as updated quotes, price charts, market analysis indicators, market news, and others. Through these applications, the client can access their MT4 accounts and trade in multiple markets from anywhere with an internet connection, which means that they offer a lot of flexibility to the trader.

Access to myfxbook autotrade mirror trading platform and service (automated trading)

Tickmill clients have access to the myfxbook autotrade mirror trading service and platform, which allows the trader to copy the trades of any selected trading system automatically into their metatrader 4 account with tickmill. The copying process is fairly simple and no software connection is required. The trader only has to connect his trading account with the myfxbook platform, select the system of his interest and activate the copy process that allows the replication and monitoring of the trades carried out by the selected system.

Myfxbook has hundreds of trading systems of all types, including manual and automated systems (expert advisors) among which the trader can select the ones he deems most appropriate. In addition, the company offers updated performance statistics in real time for all systems that allow the trader to carefully analyze each trading system and choose only the most profitable ones.

Only the historically profitable systems that myfxbook selects directly from the live accounts in which the signal providers have implemented the manual or automated trading systems they offer for copying their trades are shown. The trader can add or remove a system that he considers unprofitable or even dangerous at any time.

Payment options

The options offered by this broker for the deposit/withdrawal of funds from the trading accounts are as follows:

- Wire transfer.

- Credit card.

- Skrill.

- Neteller

- Fasapay.

Accepted currencies are EUR, GBP and USD.

Main advantages of tickmill

- It is a broker duly regulated by the FCA of the united kingdom, one of the most important financial services regulatory bodies.

- Tickmill offers its clients access to a wide variety of markets and trading instruments, including forex, precious metals and cfds on multiple financial markets.

- All trades are carried out with an STP execution without dealer intervention (non-dealing desk), as in a market maker broker.

- It regularly offers promotions for its new and existing customers, such as deposit bonuses and free bonuses. It also organizes trading competitions, including tournaments for demo accounts.

- Customers have access to a prepaid mastercard for funds withdrawal.

- Access to a virtual private server (VPS) to all its clients, which allows to significantly improve the operation of the trading platform, especially if the client is using EA.

- Analysis and daily reports on the markets made by experts from the company.

- An economic calendar updated in real-time.

- Access to various forex calculators, including a currency converter, a margin calculator and a pip value calculator.

- Customers also have free access to autochartist , an application that uses multiple technical analysis tools (mainly graphical analysis) to scan markets and filter noise, highlight major trading opportunities, and predict future price movement with precision, speed, transparency, and quality of information.

- Access to various educational tools for the trader, including:

- Free seminars.

- Free webinars.

An affiliate program owned by the same company, through which the affiliate can earn money promoting the financial services of this broker.

Main offers of tickmill

The current promotions of this broker are the following;

- A free $30 welcome bonus for all new tickmill customers who open an account with the company. The bonus does not require a previous deposit.

- Traders of the month contest , which rewards the two most profitable tickmill traders every month with a prize of $1,000 USD to each one.

- Tickmill “NFP machine” contest, which rewards the participant who manages to guess the price of a certain instrument selected by the broker, 30 minutes after the publication of the non-farm payroll of the united states.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Tickmill – is it scam or safe?

Tickmill – is it scam or safe?

Tickmill is a trading name of tmill UK limited, which is licensed and regulated by the financial conduct authority (FCA). The FCA license allows it to conduct financial services, including forex.

However, there are some publications in forex forums that inform about bad practices related to a dealing desk fulfillment of orders, negative slippage, spread-widening and pushing clients to deposit more money.

So far, we haven’t received any complaints from clients of tickmill.Com.

If you feel frustrated by tickmill.Com and have something to share with us, please fill in the form below, describing your case:

7 complains

This is an average broker with average trading conditions and beware – this is an offshore company. I haven’t got many problems with them except big slippage and nonstop requotes, especially when important news published. I decided to quit and now I trade with a real ECN broker. Do not involve with tickmill!

They act as marker makers, not ECN. They do everything possible to lose your money. They offer benefits but just to lure you. I have traded with them for some time. They always closed my positions before they will hit my take profit order. When I asked them, they excused telling me it was slippage.

No, they re NOT ECN !! I just lost all my money for just one day and this happened while I was hedged. They can blame french election and the volatility connected but I also noticed too big spread widening. Especially when my deal is profitable. I recommend stay away. Better deal with some honest market maker than these scammers.

This is fraud. I was called from lakeshri in india and they took 12,000 INR from me. They make me deposit in tickmill and now 20 day later they don’t answer me. Scam! Fraud! Company and CEO! Do not be fooled with tickmil!!

I can confirm this is one of the worst market makers I met. I usual trade when news announced. But their spreads are too big – huge! They always touch my stop loss and I know it is intentional. I think you should keep away from this broker, market maker. Not honest

Are you a victim of the following ;

binary option, forex trading, romance, ICO scams, online betting, bitcoin, phishing, exchange scams etc

if in any case you have lost your hard earned money. Dont give up, I have a good news for you. Scams rescue is currently recovering funds for all victims. Service delivery is second to none. I obliged myself the priviledge to announce this to everyone. Hurry and contact on scamrescue at protonmail (dot) com

thank me later.

I also fell a victim to this scam broker. They kept on asking me to deposit more money. Then they stopped picking up my calls and doesn’t reply my mails. After loosing more money. Finally I have gotten back all my lost fund and bonus from CFD stocks. They stocked all my trading capital and deprived me access into my account for over two months now after I’ve invested $70, 000 with them. Thought I was not gonna see this day, but as god may have it, today I’ve got back all my money for real with the help of professional. Lesson learnt! I’m happy to share my experience.

If you’ve been locked out from logging into your binary option trading account or you are unable to make withdrawal from your broker account, maybe because your broker manager is asking you to make more deposit before you can place a withdrawal and you need my assistance, kindly get in contact with me via my email address:[email protected], and I will guide you on steps to take to regain access to your account, make withdrawal freely and easy, as well as recover all your lost funds in reality.

Exclusive: tickmill launches futures trading on CQG platform

According to tickmill co-founder, illimar mattus, the product has been in the works for over 18 months.

London-based brokerage firm, tickmill is expanding its product portfolio with the launch of futures trading to capitalize on the growing popularity for such instruments outside their traditional users.

“after partnering with CME, the world’s leading derivatives marketplace, we’re giving to our clients access to globally regulated futures exchanges, including NYMEX, COMEX, CBOT and EUREX. This will provide you with direct market access, giving you fast and reliable execution on our new CQG platform,” the UK broker told finance magnates.

According to duncan anderson, CEO of tickmill UK ltd, the product has been in the works for over 18 months and the company “intends to bring strong competition into futures and options space with competitive pricing, access to a wide range of markets and excellent customer service.”

As part of its plans, tickmill has partnered with top-tier regulated exchanges in order to lower trading costs and let them tap into their range of futures aimed at smaller investors.

The broker broadens its product line as clients’ desire to garner exposure to regulated markets has been increasing. The moves are a sign that more retail traders are looking to diversify their trading options and further marks how such regulated products are starting to appeal beyond a relatively small group of institutional investors.

Suggested articles

The participants in forex trading and their role in the marketgo to article >>

Although heavily regulated with a limited ability to juice up their bets, exchange-traded derivatives offer certain advantages over traditional OTC products. The list includes standardization, liquidity, and elimination of default risk. Etds can be also used to hedge exposure or speculate on a wide range of financial assets like commodities, equities, FX and even interest rates.

Tickmill is a group of companies with UK FCA, cypriot cysec, SC FSA, south african FSCA and malaysian LFSA licenses.