Best pamm broker 2021

Instaforex has one of the largest, or maybe the largest, number of managers and investors with nearly 14000 PAMM accounts.

Actual forex bonuses

You can see all the PAMM account on this page. Press all accounts from the bottom of the page so that you can sort out the PAMM account based on different factors, age, ranking, and etc.

Best pamm broker 2021

Best PAMM forex brokers

Not every forex broker has the best PAMM account. Some of them lack statistical service and others don’t have enough volume of both investors and managers.

People who are looking for forex brokers with the best PAMM accounts are divided into two categories. Either they are managers looking for a broker with a lot of PAMM clients or they are investors seeking a forex broker with the best PAMM managers and the reliable statistics of managers’ accounts.

If you are a trader who wants to attract investment, a good PAMM forex broker for you is the one that provides you as much exposure as possible so it should have an active PAMM community who can be informed and have access to PAMM managers easily.

On the other hand, the best PAMM forex brokers for an investor are the ones that provide reliable information and statistics about PAMM accounts and managers so that they can analyze and decide which one is better and bring them more profits.

I looked into a lot of forex brokers to see which ones have strong PAMM community and reliable statistical tools and data.

There are some brokers that are very good in general but they don’t have the mentioned factors related to PAMM accounts.

However, there are still some standard forex brokers with high-quality PAMM accounts both for traders and investors.

One common aspect among them is they all have a long history of PAMM accounts so they’ve built a strong active community over time and enhanced their quality of service.

Best PAMM brokers

Here’s a list of best PAMM forex brokers for both managers and investors.

Let’s find out more about them…

Hotforex

Hotforex is a reliable broker regulated by different regulatory bodies including FCA, DFSA, cysec, FSCA, and FSA so it’s completely safe.

It has a long list of PAMM managers that shows the activeness of its PAMM community which also gives a broad number of choices to investors. You can see a complete list of them here.

Note: hotforex don’t offer PAMM accounts to US, canada, and EU residents. EU residents can open different types of accounts with this broker but not PAMM.

You can set a success fee for your account which means you receive a percentage of profits for winning trades. You can also determine a time limit for investors’ capital to not be withdrawn from your PAMM account and a penalty if they do so; they have to pay a penalty.

For example, you set a 2-week time limit and 5% penalty so if an investor invests some money but for any reason, he/she decides to take it out of your account, he/she has to pay you 5% of the investment as a penalty.

There are 2 types of accounts that you have access to for trading, an STP account called premium with floating spreads starting from 1 pip and an ECN called premium plus with the spread from 0.3 and $10 commission per lot, round turn.

The available trading instruments are: forex, oil, metals, and indices.

Trading platform is MT4, a maximum leverage of 1:300, minimum deposit of $250, and the minimum lot size of 0.01 lots — find out more.

You have access to comprehensive analytical data so you can select the best managers based on their performances and you can also filter the PAMM managers based on different factors such as ranking, age of accounts, return, drawdown, and more so you don’t need to go through all the PAMM accounts. You can sort them out on this page.

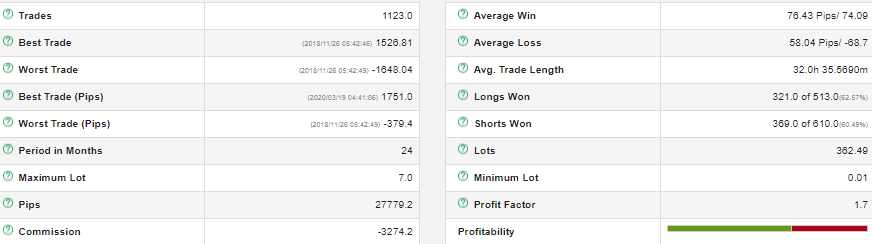

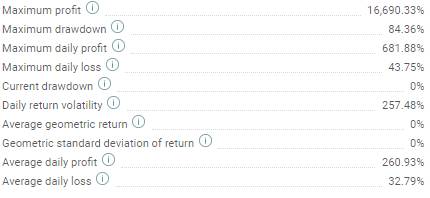

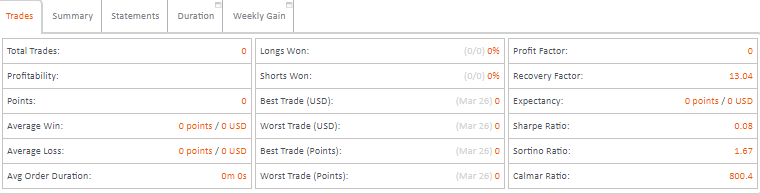

By clicking on each PAMM manager’s account or name, you’ll be directed to the statistics of them where you can find out a lot about the manager’s trading and strategy.

The minimum investment is $250.

Alpari

Alpari has been around since 1998 and is regulated by IFSC. It’s one of the first forex brokers that began offering PAMM service.

As a result, you have access to a high number of traders and investors whether you want to invest in or manage PAMM accounts — see the full list of PAMM accounts.

Note: alpari doesn’t offer PAMM service to the residence of the US and canada.

You can create the terms of cooperation including minimum investment, profit share based on investors’ capital, and some other conditions.

You can also open a thread in alpari’s forum where you can explain about the strategy you use or promote your PAMM account.

One of the trading account available for the PAMM service is PAMM standard MT4/MT5 which is an STP account with floating spreads, the minimum deposit of $300, MAX leverage of 1:1000; and forex pairs and metals as trading instruments.

You can also open PAMM ECN MT4 with the minimum deposit of $300, $3.2 commission per lot round turn, 1:3000 leverage; and forex pairs, metals, and cfds as trading instruments.

There are 2 other types of accounts available as well called PAMM pro ECN MT4 and PAMM ECN MT5 with the min deposit of $500, a commission of $3.2, leverage of 1:3000; and forex pairs, metals, and cfds as trading instruments.

For finding out more about the specifications of PAMM accounts, you want to check out this page.

You are provided with a variety of stats that you can analyze a PAMM account based on. You can have access to the stats of a PAMM account by clicking on the name of each one on this page.

Press all accounts from the bottom of the page so that you can sort out the PAMM account based on different factors; age, ranking, and etc.

Every index has a small definition where you can click on and read guidelines that teach you to some extent how to use that metric and/or what is a good number for that.

The minimum investment determines by PAMM managers, however, the minimum investment starts from $50.

Fxopen

Fxopen was established in 2005 and is under the watch of british and australian regulatory bodies; FCA, and ASIC, which are two of the top ones in the industry.

Fxopen has a well-designed PAMM service with lots of PAMM managers and investors; however, the PAMM network in this broker is not as large as the previous broker, alpari. You can find all the PAMM account from here.

Fxopen doesn’t offer service to US residents.

You can create a set of factors for your offers such as your profit share or commission, minimum investment, early revocation penalty, and some other factors — see more

There are three types of accounts available for PAMM service: PAMM ECN, PAMM crypto, and PAMM STP.

For opening PAMM ECN, you need a minimum deposit of $1000. The commission for this account is $3 per lot round turn and the maximum leverage is 1:100.

The minimum lot size is 0.01 and you can trade forex pairs, metals, cfds, oil, and natural gas. MT4/MT5 are the platforms for trading.

For more information, check out this page.

The minimum deposit for opening PAMM crypto is $200, however, if you want to create an offer, you need to deposit $1000, which basically means you can open a PAMM account with $200 and when you grow your account and decide to attract clients, you need to increase your capital to $1000.

Spreads are floating and commission is 1% of the transaction volume round turn.

The maximum leverage is 1:3, min lot size is 0.01, and the currency pairs with bitcoin and litecoin are trading instruments.

Find out more about PAMM crypto here.

PAMM STP has floating spreads with no commission. The minimum deposit for opening this type of account is $200 and the maximum leverage is 1:100.

The minimum lot size is 0.01 and you can trade forex pairs plus gold and silver.

Check out this page for more info.

There is also an FAQ page where you can find other information about fxopen PAMM manager including how to register for that.

You have full access to the stats of PAMM managers and can filter and choose PAMM accounts on this page.

By clicking on the name of each PAMM account, you’ll be directed to the stats of that where you can check out various factors and choose the ones that suit you the best.

Besides accepting a manager offer, an investor can create an offer as well which means you can negotiate on some terms.

For example, you like a PAMM account and decide to invest in it. The manager of the account has requested 20% of profits as his/her commission but you, as an investor, want to pay 15% so you create your offer and if the manager accepts, then you invest. See here for more information and also see how to become an investor.

Instaforex

Instaforex is the next forex broker on our list that has a large community of PAMM traders and investor. It’s regulated by two regulatory bodies; BVIFSC and cysec.

Instaforex has one of the largest, or maybe the largest, number of managers and investors with nearly 14000 PAMM accounts. You can see all the PAMM account on this page.

Instaforex doesn’t provide service to the US residents

You have a very good chance of exposure to a lot of investors and attracting hundreds of clients if you prove yourself with a profitable strategy.

You can set some elements for your offer including minimum investment, profit share or commission, minimum investment period, and a penalty if an investor withdraws his/her money sooner than the min investment period.

Find out more about the instaforex PAMM features and also see how to become a manager on this page.

Instaforex has 4 types of accounts; insta standard, insta eurica, cent standard, and cent eurica, however, the two cent accounts aren’t included in PAMM service and you need to open insta standard and/or insta eurica as PAMM accounts.

Insta.Standard is a fixed spread account with the max leverage of 1:1000 and minimum lot size of 0.01.

You can trade instruments such as forex pairs, indices, metals, cryptos, and shares using MT4 and MT5 platform.

Insta.Eurica has zero spreads and it charges commissions instead.

Learn more about instaforex types of accounts here.

There is a huge number of managers to choose from. You can monitor their activity and sort them based on different factors to pick the one that you like. You can see all of the PAMM account on monitoring page — the table on that page is set on the lite mode by default, put it on full to see more filters.

By clicking on each of PAMM accounts, you’ll have access to the stats of the account and by clicking advance, you’ll see more information.

Besides having access to a lot of managers, you can invest even very small amounts like $1, regarding the managers’ offers though, so you can invest in several pamm accounts and make a portfolio to decrease risk — if one account goes south and suffers a loss, others can make up for that.

To see other features and see how to become a pamm investor, check out this page.

FIBO group

FIBO group is one of the forex brokers that have been around for years. It was established in 1998 and is regulated by cysec and BVIFSC.

FIBO group PAMM network is not as large as instaforex or alpari but it’s well-designed and provides all you want from a PAMM service including a flexible offering system for managers and thorough statistics for investors.

FIBO group doesn’t provide service to the residents of the US, australia, britain, and iraq.

You can determine your terms of investment such as minimum investment, profit share or your commission, minimum investment period, and a fine of early withdrawal.

There are 4 types of accounts in this PAMM service: MT4 fixed, MT4 NDD no commission, MT4 NDD, MT5 NDD.

Fixed account has fixed spreads starting from 2 pips and obviously no commission. The minimum lot size is 0.01 and the max leverage is 1:200.

MT4 NDD no commission is an STP type of account with floating spreads and no commission. The minimum lot size is 0.01 and the maximum leverage is 1:400.

MT4 NDD is an ECN type of account with 0.006% from a complete transaction. The minimum lot size is 0.01 and the maximum leverage is 1:400.

MT5 NDD is like MT4 NDD but its commission is 0.01 from a complete transaction.

See more about FIBO group accounts here.

You can choose from its PAMM managers on this page. You can sort the pamm accounts based on different categories such as profit, age of accounts, drawdown, and etc.

By clicking on each heading you can sort the pamm accounts based on that category from high to low and vice versa.

If you want to see the pamms’ statistics, you need to click on the name of PAMM accounts so you’ll be sent to the stats pages where you can learn lots of things about the systems and accounts and also invest in them.

The bottom line

There are lots of forex brokers offering PAMM accounts, however, lots of them can’t bring you enough investors or managers and/or provide you standard statistical tools.

You may not need those conditions if you are an investor who wants to invest in your friend or a trader you know well, or if you are a trader who knows enough investors. That way, you can choose from whichever broker, offering PAMM service, that you think it’s a good broker in general.

But if you don’t have that condition and want to find the best PAMM forex brokers with the best PAMM accounts, you should look for the ones with a large network of PAMM managers and investors and the brokers that provide a standard PAMM service.

I tried to find the best ones by checking lots of forex brokers and list the ones that not only do they have high-quality PAMM service but they are also standard forex brokers with good trading conditions.

PAMM forex brokers 2021

PAMM forex brokers of this list shall attract investors, who are interested in earning in the forex market, but due to some circumstances they cannot do it in person; also it is intended for traders who are not certain of their trading skills yet but are willing to gain profits as soon as possible. PAMM (percentage allocation management module) is a trading account operated by a manager, not a trader. The manager can help funds grow, but is not allowed to withdraw profits. PAMM forex brokers or dealing desks offering such service liaise an investor with manager and broker for the purpose of easy and safe co-operation. The list we present here comprises companies dealing with PAMM investments. Whether your target is finding an expert trader or you want to manage the entrusted capital, check this list, as it may help you make the optimal choice. Read our article "what is PAMM account in forex?" to avoid unwanted complications and to minimize the trading risks.

Read our extended forex guide to find out how to choose the best forex broker 2021.

Start forex trading now! Open forex account with the best forex brokers 2021.

Convert popular currencies

Forex forecasts

Cryptocurrencies trading forecasts

The cryptocurrency market experienced an increased wave of selling pressure and within the last hour bitcoin (BTC) price dropped below the $30,000.

Bitcoin (BTC) slid under $33,000 for the first time in over a week on jan. 21 as selling pressure gathered to drive price action lower. Data from cointelegraph.

The price of bitcoin (BTC) dropped sharply from $37,800 to $35,000 overnight, liquidating $572 million worth of cryptocurrency futures positions. There are three.

All client trades are executed with no dealing desk* intervention. Most trades are filled in under 10 milliseconds, with up to 2,000 trades executed per second.

The price of ether (ETH), the native cryptocurrency of the ethereum blockchain network, has been soaring since the beginning.

Bitcoin's price seems to have settled down somewhat following its major rally, and subsequent fall and correction. This has seen the coin now sitting.

Over the past two months the open interest on bitcoin options has held reasonably steady even as the figure increased by 118% to reach $8.4 billion.

A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. What should be this vital decision based on? To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets.

Top 10 forex platforms 2021

Automated trading systems are an opportunity to create passive earnings in the financial markets for all users. Successful and proven strategies are integrated into the algorithm of advisers, which will make it possible to earn on the pricing of assets without delving into the subtleties of technical analysis. We present the top 10 forex advisors including equilibrium, excalibur, night owl.

Top 10 best PAMM forex brokers for 2021

Top rated:

Are you looking for the best PAMM forex brokers because you don’t necessarily have the funds or knowledge to trade forex yourself, but still want to make a profit?

PAMM accounts brokers can come in all different shapes and sizes and even different names.

The key thing you should look out for is a trustworthy broker, one that has a good reputation, is regulated by a respected financial regulator and offers you a good amount of control over your funds when you want it as well as transparency.

Whichever pamm broker you decide to sign up with, ensure it is one you can trust.

Table of contents

What’s a PAMM account?

Starting from the basics, PAMM stands for percentage allocation money management, and as the name would suggest, this is a type of managed account.

With the PAMM account, very simply, you make the deposit to your account as a trader, and this money and investment is then taken care of by a fund manager who will make the trades on your behalf with the hope of being profitable.

This is not done in isolation and your account could be one of hundreds of accounts managed within the operation. Profits and losses are then distributed equally according to the amount that you have invested from your account. All of these actions are completed by an assigned account manager and full transparency of operation to make sure you can see exactly what is going on.

Top 10 best forex pamm brokers of 2021

Here’s our list of the best PAMM account forex brokers:

1. IC markets

If you’re looking to set up a PAMM account, IC markets is the most highly recommended broker, with their PAMM/MAM service operating since 2012. IC markets offer the most flexible allocation methods available today and produce real-time reports on performance and commissions, allowing PAMM account users to still feel in control of their funds. Money managers attached to the account will also be able to utilise some of the best expert advisors available.

As a trader here you will also benefit from some of the fastest ECN execution as well as the best value spreads around starting from 0pips on the RAW account. As with many PAMM accounts, there is a minimum trade inplace, but this is still a very accessible 1 micro lot (0.01 standard lots). All of the trading here is just one click away with the very best in transparency provided by the IC markets account managers, and all trading taking place through the much trusted MT4 trading platform.

2. Pepperstone

Pepperstone is perhaps one of the world’s best brokers of recent years. By signing up to a PAMM account with pepperstone, you will be pleased to know that the money manager who trades your funds will not be held back in the slightest. Pepperstone is very liberal when it comes to using different trading strategies, such as hedging and scalping, expert advisors, and have some of the best execution speeds available.

Pepperstone allows for control of more than 100 sub accounts, and all with no delay or unexpected latency whatsoever. This is ideal for those looking to deal with multiple accounts as more experienced or high-volume traders. Both MT4 and MT5 are utilized for trading through this broker at maximum efficiency, and a minimum trade amount again of 1 micro lot is imposed, keeping pepperstone very accessible to all.

3. Fxpro

Signing up for a PAMM account with fxpro is highly beneficial and is a great way to ensure your funds go far. Money managers can allocate funds in the way they feel is best, utilise expert advisors and receive comprehensive reports on their performance. But perhaps one of fxpro’s most tempting offerings is that it is possible to earn a rebate, which is quite unique, and could be a great incentive to trade more. When it comes to trading commissions, mark-up, and performance fees, these can be set by the individual money manager which provides some level of flexibility in the approach with fxpro.

PAMM accounts can also utilize EA’s fully to create the best possible trading situations, and a variety of different allocation methods can be implemented to ensure there is something suitable to all traders. Allocation can be based on proportional equity against balance, or as an equity percentage allocation.

Top mam pamm brokers for 2021

We found 11 online brokers that are appropriate for trading mam pamm.

Best mam pamm brokers guide

MAM PAMM brokers

MAM is the abbreviation for multi account manager and PAMM stands for percentage allocation management.

Those brokers who manage such accounts for clients are called MAM PAMM brokers or just MAM brokers and PAMM brokers.

What is MAM and PAMM

These are called managed accounts which are though owned by traders, trading decisions are undertaken by fund managers.

These are, however, not like mutual funds in which the contributions are pooled in a corpus fund and thereafter managed by fund managers.

MAM PAMM brokers manage several segregated accounts under one account without the requirement to create a trading fund. All the accounts of clients are connected to the main account of broker and trades made are proportionally distributed among the clients.

The profit and loss too are distributed proportionally in MAM and PAMM arrangements.

MAM benefits

In MAM accounts the fund managers get the authority to execute trading strategies and traders can also simultaneously diversify trading by using more than one manager through different mams.

The MAM platform is completely automated and so there is almost no risk of fraud using this method.

PAMM benefits

With PAMM accounts, traders are in an advantageous position as they get sophisticated trading strategies even with low capital amounts. With MAM, traders here too can diversify trading by dealing with different managers through different pamms.

The PAMM is fully automated and so the risk of fraud in greatly reduced in the distribution method.

Whats the difference between MAM and PAMM

With MAM several accounts are segregated across brokers while in PAMM one account aggregates to the total contributions of various clients.

When it comes time to withdrawal funds traders in MAM accounts can do so either at rollover or when the trading period wraps up. In PAMM accounts withdrawal can only occur at rollover.

In both MAM and PAMM accounts the minimum deposit can vary.

MAM PAMM accounts risk

With both MAM and PAMM accounts any wrong decision by fund managers may risk your money. To add to this with PAMM the role of managers in trading may not be completely transparent.

In such an arrangement, traders become dependent on the skills of managers and a fair distribution system of money managers is doubtful.

MAM PAMM brokers verdict

Traders can benefit from MAM PAMM accounts as even while investing with low capital they allow sophisticated trading strategies. Trading with accounts like this can result in more chances of profit than if you had traded alone.

We've collected thousands of datapoints and written a guide to help you find the best mam pamm brokers for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best mam pamm brokers below. You can go straight to the broker list here.

Reputable mam pamm brokers checklist

There are a number of important factors to consider when picking an online mam pamm trading brokerage.

- Check your mam pamm broker has a history of at least 2 years.

- Check your mam pamm broker has a reasonable sized customer support of at least 15.

- Does the mam pamm broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your mam pamm broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your mam pamm broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your mam pamm can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering mam pamm brokers.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below mam pamm brokers.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 mam pamm brokers of 2021 compared

Here are the top mam pamm brokers.

Compare mam pamm brokers min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are mam pamm brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more mam pamm brokers that accept mam pamm clients

Fxdailyreport.Com

Forex trading involves a great deal of risk. A trader should have the required skills and experience for tackling the markets in a consistent manner in order to earn profits. In addition, traders should be persevering and disciplined. As a result, only a few traders succeed in forex trading. Most investors generally do not have the qualities needed to succeed as a forex trader. There is no need to lose hope if you are planning to get involved in forex trading.

You can always hire the services of successful traders and derive benefits from the high liquidity forex market. Established traders provide managed account services for a fixed fee payment. Most forex brokers are now making available managed account services and more popular among retail traders.

Managed account services

Basically, brokers offer three types of managed accounts. These are the PAMM, MAM, and LAMM accounts.

#1: percentage allocation management module (PAMM)

This account enables investors to earmark a part of their funds for copy trading. PAMM allows investors to follow other accounts and allocate different percentages to each of the trading systems. The account offers more flexibility to the investor as he/she can choose different trading systems and protect himself/herself against performance issues arising out of master trading accounts.

The parties involved in this type of account are the broker (does not charge any commission for the services), investors (they put money into this account), and the master account manager (he/she makes all the trading decisions). The manager may also be an investor gets a fee based on the profits generated in the PAMM account. The profits are distributed to investors in the proportion to their investments.

Top forex brokers with PAMM accounts

| Broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker |

PAMM accounts are popular in russia and europe, but in the U.S. They are highly regulated

#2: multi-account manager (MAM)

A MAM account enables an established trader to manage several trading accounts from a single terminal. This account manages a large pool of fund, which is a collection of deposits available in individual trader and investor accounts. All orders are placed from the master trading account. These orders get reflected on each of the associated accounts as per the parameters that the investor sets.

Investors can also enter orders through individual accounts and modify trades as per their preferences. The master trader is paid a fee on the basis of his performance and returns on investment. MAM is an advanced managed account service and provides better control to an investor. It incorporates the features offered by the PAMM and LAMM accounts.

Trusted forex brokers that offer MAM

| Broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $100 spread: from 0.7 pips leverage: 400:1 regulation: FCA UK reference number 124721 | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

Forex brokers offering MAM account option to clients because one manager can handle several clients and maintain activity in their accounts.

#3: lot allocation management module (LAMM)

In LAMM type of accounts, the investor exercises the option to choose the number of lots to be traded in the market and the profit/loss is worked on the basis of lots invested. LAMM is the predecessor of the PAMM. This type of account service is usually employed when the percentage allocation does not have any significance because of the higher level of trading capital involved. This is because there can be significant issues when filling interbank exchange orders.

Having discussed a little bit about PAMM, MAM, and LAMM accounts, here a few forex brokers that offer the same:

#1: instaforex

The brand instaforex was launched in 2007. Currently, instaforex broker has more than 3,000,000 customers. Further, over 1,000 customers open accounts every day. They enable ECN forex trading, contracts on derivatives and other instruments.

Best online broker comparison 2021

Online broker comparison is a great way to find the right broker for your online forex trading. We have spent over 250 hours to compare among the top brokers and pick the best forex broker. However, we have compared all top brokers based on multiple criteria and selects the 6 brokers from the hundreds.

Our forex brokers comparison finds six brokers based on trading platforms, no deposit and withdrawal fees, fast execution, high-quality customer support, and lowest spreads. The brokers are FP markets, IC markets, fxpro, XM, hot forex, and axi.

We will guide you to the online broker comparison through the rest of this article.

Regulations and licenses

FP markets: raw spreads and CFD provide more than 13,000 trading instruments

FP markets comes first in our forex broker comparison as they are one of the top forex brokers in the universe. However, they operate in australia mainly, but they operate in over 80 countries too. FP markets offer direct market access as well as ECN price at the same time.

Is FP markets a safe forex broker?

Here come our first criteria to compare forex brokers; we are talking about the regulations, which is a standard to measure whether a broker is safe or not. So, what we have found from the FP markets regulations?

FP markets earns the regulatory status from-

- Cyprus securities and exchange commission (cysec)

- And the australian securities and investments commission (ASIC)

Among these two regulations, forex broker compares identify that ASIC is a top tier regulator, and cysec is a highly strict regulator in the european union. As a result, both of them ensure all the safety for the traders. Besides, the FP markets review shows that they have been in the business for the last 15 years with a good reputation.

Range of the services by FP markets

FP markets is considered one of the best forex brokers among all the available brokers when it comes to the range of offerings. The variety of services they offer-

- Multigrade platform

- A vast range of CFD instruments

- Virtual demo account

- 500:1 leverage

- Lowest minimum deposit

- Islamic account

- Zero inactivity fees

- Stop-loss order by cysec

- Customer support in a different language

Why is FP market considered as one of the best forex broker?

To answer this, we want to mention a few facts. First of all, it has no bad reviews since it started the operation in 2005. Secondly, with the fastest possible execution features, provide a competitive price. Finally, top tradeable cfds via FP markets with the trading tools always provide the opportunity to make profits.

The range of markets offered

While going through the FP markets review, we found that they offer a 13,000+ instrument, which is accessible via the metatrader and IRESS platform. Let’s dive into the range of the markets.

Forex tradingFP markets forex trading supports more than 50 currency pairs, including the majors EUR/USD, GBP/USD, AUD/USD, and more.

- Share cfds

Besides the forex, FP markets also offer stocks via MT4, MT5 platform, and IRESS platform. However, MT4/MT5 will provide 20 shares to choose from. On the other hand, IRESS is based in australia and offers thousands of stocks.

As per the online broker comparison, for share trading, FP markets eliminate the commissions and earns money from spreads.

- Index cfds

With the FP markets index cfds, you will get all the world’s top indices, including AUS200, NASDAQ 100, S&P 500, EUREX, and much more.

The trading index will surely diversify your portfolio at large.

- Commodities

FP markets commodities offer silver, gold, and oil, while the ASIC provides access to the variety of asset classes that can be accessed from the same platform. Additionally, top-notch trading and risk management tools also ease commodities trading.

- Metals

Trading metals are less risky than forex trading. However, with the forex trading platform, you can trade your desired metals too.

Maximum leverage offered

IC markets: leading forex CFD provider and best ECN broker

While we did the complete forex broker compare, it came to our eyes that IC markets is the best forex broker for its raw spread account. This makes them known as true ECN brokers.

IC markets offer the initial spreads from 0.0 pips, no fees for deposits, withdrawals, and inactivity. Instead, they charge a $3.50 commission per lot.

IC markets online platform

IC markets totally operates online via a browser and mobile app. IC markets review gave a list of the platforms they use for trading activity. However, they prioritize the IC markets web trader, allowing trading from any browser via PC or phone. Apart from this, they also provide apps for mobile for iphones and androids, including ipad and tablets.

All these opportunities are offered through the IC markets MT4 platforms, while they also provide MT5. However, if you compare forex brokers, you will get that IC markets offer traders too, and few more top online brokers offer this.

The benefits you will get from IC markets are minimal trading cost, low commissions, and ECN brokers spread.

IC markets fees

Unlike other forex brokers, IC markets is not loaded with fees. Instead, they are grabbing clients by offering the lowest possible fees for all. Let’s make the IC markets online broker comparison in terms of fees.

- Deposit fees

IC markets do not impose any fees for deposits. However, there are fees for international transfer, and it is not charged by the IC markets. The deposit methods you may use are cards, neteller, paypal, skrill, unionpay, wire transfer, bpay, fasapay, broker to broker, internet banking, and more.

The minimum deposit is $200 to start the trading.

- Withdrawals fees

IC markets forex brokers comparison with deposit fees shows that there are no withdrawal fees either. Like international deposits, international withdrawals also charge fees.

- Inactivity fees

A lot of the brokers charge inactivity fees. On the other hand, there are no inactivity fees for the IC markets.

- Rollover fees

It is common by all brokers, which incurs when a trader keeps the position open for the following trading day. However, the rollover costs are not fixed and change regularly.

Fxpro: one of the best brokers for CFD trading and forex

Making forex brokers comparison in terms of clients’ number, fopro would be in the top 5s with their 1,300,000 in over 173 countries all over the world. However, they don’t come to this place overnight; it took them 14 years to reach here since their inauguration in 2006.

Is fxpro trustworthy?

We have found from multiple online broker comparison that, from the beginning, fxpro has been providing unambiguous service to the trader. Over the years, they have earned 4 industry regulations, which include FCA, cysec, SCB, and FSCA.

Fxpro has some unique features, and the algorithmic trading feature is one of them which works with ctrader. Through algo trading, you can easily make your moves as per your created trading strategy. Besides, the support with the VPS lets you trade 24/7 with effortless high-speed operation.

Fxpro tools, education, and news

Fxpro is the best forex broker for providing different trading tools, news, analysis, and education to make the trading comfortable for all.

From the fxpro review, found that the education tools offer two levels in interactive cards, which provide the learning opportunity via video tutorials, webinars, events, fundamental analysis, technical analysis, etc.

Eventually, the forex broker compare, finds out that fxpro news & analysis tool is really helpful for both new trader and expert trader. This powerful, informative support includes economic calendar, market holidays, earning calendar, and technical analysis from trading central.

Furthermore, the dedicated trading tools also give the competitive edge, such as trader’s dashboard, fxpro calculators, direct app, VPS, etc., tools are effective for successful trading.

Trading platforms + tools

XM: 16 trading platforms with low trading fees and low CFD fees

We did compare forex brokers from all over the world, and among all, XM has the largest area coverage as they have traders from 196 countries. Despite being founded in 2009, in just 13 years, he has grown to a large. Following are the highlights of their operation till 2020 via XM review.

- More than 3,500,000 clients from 196 countries.

- They have 450 experts with a long-year experience to provide uninterrupted service.

- More than 25 payment methods from trusted payment services.

- 16 trading platforms.

- Support in 30+ languages.

Online broker comparison for the XM account types

XM offers 4 multiple accounts for the trader depending on the lot size, investments, minimum deposits, etc. All the trading accounts provide exceptional trading conditions with unlimited access to MT4/MT5 and expert advisors. Let’s see the XM accounts forex brokers comparison

- Micro accounts: it is the beginners’ level account where a trader can start with as low as a $5 deposit with 100 lots per ticket.

- Standard accounts: like the previous one, it also needs the $5 opening balance. However, the restriction is 50 lots per ticket while the contract size is bigger than the micro account.

- XM ultra-low account: here come the increased minimum deposits, which is $50 with a lower spread than the other two accounts.

- Shares account: this account needs $10,000 minimum deposits, and contract size is measured as 1 share. Besides, the swap-free islamic account is included with this account.

The fees charged at XM

For our research purpose, we have completed a forex broker comparison with a top broker and found that XM is a marginal lower broker.

However, depending on the real-time stock market, stock fees varied.

As a well-established broker, XM doesn’t charge for local deposits or withdrawals. But any international transfer below $200 is subject to charge.

Research tools

Hotforex: free negative balance protection with maximum security

Through different online broker comparison, we came to know that hotforex is an award-winning forex broker for retail and institutional brokers. From the hotforex review, having been in the business for more than ten years, they have more than 2,500,000 live accounts opened.

Is hotforex safe to trade?

Hotforex contains the cross-border license that operates in the EEA zone throughout the european union. Besides, the list of compare forex brokers mentioned that hotforex is regulated via cysec. However, it is one of the safest regulatory bodies in the world and widely recognized by all the countries in europe. Besides, cysec also audits the financial matter of the broker in a timely manner, which enhances the safety of the trader’s fund.

Additionally, hotforex has earned regulatory status from other countries too, such as the UK, south africa, seychelles, and dubai.

Hotforex fees

Hotforex offers some attractive spread opportunities while staying at the tight spread. Besides, online broker comparison suggests that hotforex provides 0 pip some accounts. However, there might be some additional non-trading fees you may want to check before opening accounts.

But, one thing we can confirm that there are no charges for local deposits and withdrawals. Charges are applicable for international transfer whether it is incoming and outgoing from the account.

Markets and instruments

Hotforex platforms

Like all the best forex broker, hotforex is a multi-trading platform, which provides services via metatrader 4 and 5 platforms. Metatrader platform is a criterion to compare forex brokers, as it is one of the well-recognized third-party platforms. So, whoever uses the hotforex, undoubtedly provides the best trading service.

Axi: 130+ tradable products with ultra-competitive pricing

Axi is a forex brokerage service that has multiple awards and serving 42,000 brokers in more than 100 countries. It is a widely known broker for low commissions along with tight spreads. However, axi has changed its name from axitrader but kept continuing to provide top-notch service. Axi was created by a group of ambitious traders who had years of experience in the trading industry.

Axi regulations

Axi has been operating since 2007, and within these years, they managed to earn membership from three different regulatory authorities DFSA in dubai, ASIC in australia, and FCA in the UK. These regulations together ensure safe operation and keep the traders’ funds safe.

Axi MT4 platform

Axi provides their service via MT4 platform only, which is accessible from a desktop computer, web browser, and mobile apps. Whichever version you use, you will get all the features. However, some add-ons may not be available on mobile versions.

Additionally, axi offers axi autochartist via MT4, which is a tool for analyzing market trends. It can help you to take the proper strategy.

Axi account types

Standard and pro are two accounts axi offers. However, the axi demo account is also available to check the broker before investing in it. Additionally, an islamic account is also available, which gives a break to the muslim traders. The demo accounts will get you $50,000 for trading so that you can check out the broker in every possible way and make a decision whether you want to invest on not.

The specialty of axi is, it offers low fees on forex along with the average CFD fees. Axi doesn’t charge any fees for withdrawals or even deposits. Additionally, they don’t charge non-trading or inactivity fees either. But the trading fees vary on account types.

When it comes to the leverage and spreads, axi offers variable spreads and leverage, which depends on the account types and locations, respectively.

Offered markets

With the axi broker, you can trade on different markets from a single account, which includes crypto, forex, commodities, shares, indices, gold, oil, and silver.

Axi deposit and withdrawals

Funding and withdrawal methods are very flexible in axi. You can add money to your axi account via credit or debit cards, wider transfer, and digital money. But, for the withdrawals, you cannot use debit or credit cards. However, there is no minimum deposit, which means you can start out with any amount you want.

Risk management

How we made this online broker comparison?

To make this online broker comparison, we looked for different aspects of a broker. Before all started, we listed the best forex brokers. Then, we verified the regulatory status of our selected brokers. Whenever we found positive status about regulations, we moved farther. Otherwise, we removed them from the forex brokers comparison list.

So, we have selected only regulated brokers as they are risk-free and safe. Besides, they are accountable to the regulatory bodies, which ensures the safety of your funds. After we look at the stuff that will benefit the trader, such as leverage, spreads, instruments, transaction methods, customer care service, minimum deposits, etc., based on these factors, we compared forex brokers and selected the above mentioned 6 forex brokers.

Fxdailyreport.Com

Till about a decade ago, you had to make use of the telephone if you wanted to invest in the financial markets. You had to call up your broker for placing as well as closing orders. Introduction of online trading has, however, simplified every aspect of the investment process. You can carry out trades from the convenience of your home or on-the-go using the platform provided by brokers. Sounds simple, but the problem is there are umpteen number of forex brokers that offer trading platforms out there in the market. And, you need to work with the best forex broker if you want to achieve your financial goals. So, it all boils down to identifying the right broker to work with and it is definitely not an easy task. Read on to find out as to how you can identify the best forex brokers. In this post, various aspects you need to take into consideration when choosing a forex broker are discussed in detail so that the selection process becomes simpler and easier for you.

Top recommended and the best forex brokers for 2021

| Broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | ||

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: €100 spread: the spread can be as low as 0.01%” (0.01% = spread for EUR/USD) leverage: 1:294 regulation: ASIC, cysec, FCA (UK) | visit broker | ||

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker |

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Main parameters to be checked for identifying the best forex brokers:

#1: regulations and licenses

It is highly recommended that you choose only forex brokers that are regulated or authorized by leading regulatory bodies such as commodity futures trading commission (CFTC), national futures association (NFA) and financial conduct authority (FCA in UK), among many others. This is because regulated brokers are more reliable than their non-regulated counterparts. Further, your hard earned money remains safe with such brokers for two reasons: they will be appropriately capitalized and they maintain segregated accounts for theirs as well as traders’ funds.

#2: forex trading platform

The online trading platforms that recommended forex brokers provide would not only be simple, but also intuitive and easy to operate or navigate. It, therefore, makes sense to try out a few online forex platforms and see for yourself as to which one has a better user interface and is easily navigable.

#3: customer support services

Customer support is a key aspect that you need to evaluate. Best fx brokers would often be aware of the needs of the traders and provide good, efficient and responsive customer support services. During the course of trading forex on an online broker’s platform, there will be times when you need certain time sensitive clarifications. If the customer support service of the broker you are planning to work with is not good enough, you could end up losing money. It is, therefore, recommended that you evaluate the brokers’ customer support service both by speaking to their representatives on telephone and by communicating with them through email.

Leverage offered for forex trading varies from one broker to another. If the leverage is high, the trader can make more profits. However, the risk of accumulating losses is also equally higher. Therefore, you should choose a broker that offers leverage suiting to your needs and based on your style of trading.

Brokers often try to attract you by offering high capital bonuses when you make your first deposit. This is good because you get more money for trading. You can choose the broker that offers the highest first deposit bonus, but you should make sure other aspects discussed above and those that are discussed below suit your needs.

#6: deposits and withdrawals

It is important that you understand the brokers’ policies related to deposits and withdrawals. The features to be evaluated when choosing top forex brokers are minimum amount to be deposited to start trading, deposit methods offered, currency options provided, minimum withdrawal amount specified and waiting time for withdrawals, among others. Further, it makes sense to go through all other written policies in detail.

Brokers make money by charging a fee for each of the trading transactions that you execute on the forex trading platform provided by them. As far as the broker and you are concerned, the significant source of revenue would be the spread, the difference between ask and bid prices. It pays, therefore, to check as to how the brokers you have shortlisted handle spreads:

Do they offer fixed or variable spreads?

What is the average and maximum spread for the currency pairs that you are planning to trade?

What spreads are offered when the volatility is very high?

Do you have to pay any commission for each trade apart from the spread?

Before buying a car, you always go for a test drive. Similarly, look for forex brokers that offer demo accounts. This helps you to open a practice account. You can try out their platform and find out for yourself as to which of the shortlisted brokers is best suited to your requirements. Most brokers offer practice accounts these days. So, it is easy for you to get a feel of the brokers’ platform before committing to depositing money and trading.

#9: other parameters for identifying the best forex brokers

The forex brokerages that offer very low account minimums can be considered for evaluation under the category “best forex brokers”. This is good because you don’t have to deposit large amounts of money in order to trade forex. Minimum account balance can be as low as $5 in the case of some of the reliable forex brokers.

Online forex brokers often try to snatch business through promotions. Do not fall prey to their sales gimmicks. Best forex brokers would never make unbelievable and unachievable promotional offers. It is true that cash and prizes form part of the game, but they should be reasonable.

Another aspect to look for when evaluating online forex brokers is the educational services offered by them. This helps you to master the art of forex trading. Brokers that provide you with a variety of educational tools for assisting you in assessing the forex market are the best forex brokers to work with.

Why expert traders trade with regulated forex brokers

If you’re looking to become a successful forex trader, then working with a skilled and trustworthy broker is very crucial. In the forex market, the two main types of brokers you’ll get include the regulated and the non-regulated brokers. Obviously, the former typically operates under regulations stipulated by a forex regulator. Regulated forex brokers must also be fully licensed and registered in their country of operation, unlike their non-regulated counterparts.

Role of regulation

Of course, the role of regulation in forex market cannot be underestimated. Regulation ensures that all players in this booming industry are strictly supervised. This way, merchants are protected from the many unscrupulous traders out there looking to swindle them off their hard earned money. Another thing, regulation also builds trust between merchants and their brokers, since most merchants don’t have enough time to monitor every investment.

Let’s take a quick look at some of the leading regulatory agencies:

- CFTC and NFA: commodity futures trading commission and national futures association, regulate the financial services sector in united states of america (USA).

- Cysec: the cyprus securities and exchange commission is the regulatory watchdog within the cysec domain. It offers services to the EU member states.

- FCA: the financial conduct authority regulates the operations of over 56,000 financial services and companies in the UK.

- ASIC: the australian securities and investment commission regulate the financial services sector in australia.

- FSB: the financial services board is a south african agency which oversees functioning, regulation, and licensing of south african forex brokers.

- Bafin: bafin is a financial supervisory authority providing its services to forex companies in germany.

Advantages of regulated forex brokers

With regulated brokers, you’ll always have some peace of mind when carrying out your real-money transactions. To expound more, here are the main reasons why expert traders prefer regulated brokers:

1. Credibility

It’s an open secret that most of us like to deal with trusted organizations, especially when money is involved. That being said, the credibility of any forex broker is greatly enhanced if the company is regulated by the relevant agencies. Remember that all regulated forex brokers are mandated to follow some strict rules put in place by their respective regulatory bodies. Furthermore, their regulatory bodies expect them to regularly present a copy of their audit report. Therefore, if a broker is listed on its regulatory body list, then it’s safe to say that the forex broker has fully complied.

2. Compensation

Getting compensated in case of any unfortunate scenario is arguably the best reason why most expert traders opt for regulated brokers. With most regulated brokers, you can rest assured that all your hard earned money will be refunded in case your brokerage firm goes down. For example, brokers operating under cysec are required to remit their contribution to the ICF (investor compensation fund). This pool of funds is to help settle any form of customer claims in case of any eventuality.

3. Effective customer service

Before choosing a forex broker, it’s always recommended that you settle for one who can effectively and immediately resolve all customer issues. In this case, most regulated brokers are always competent enough when dealing with technical support or account issues. In addition, they are very helpful and kind during the whole account opening process.

4. Quick deposits and withdrawals

Any reputable forex broker will allow their merchants to make deposits and withdrawals without any hassle. A regulated broker should have no reason whatsoever to make your earnings process difficult because they don’t have control over your funds. All they have to do is to facilitate the platform to make it convenient enough for you to trade.

5. Updated trading platform

Most regulated brokers are mandated by their respective regulatory authorities to provide their clients with the latest, powerful, and easy-to-use trading platforms. In fact, most of their platforms will readily provide you with all that you need to begin trading immediately. You’ll get a lot of educational materials including webinars, videos, articles, seminars, and e-courses at no extra charge. It goes without saying that regulated brokers also offer their clients free demo accounts to help them sharpen their skills before going live.

6. Legality

All over the world, governments are struggling to deal with issues concerning money laundering. Some of them have even gone ahead to pass very strict anti-money laundering laws. So to be on the safe side, you should always trade with a regulated broker. Most regulated forex brokers will ask you to provide some of your personal identification documents such as proof of address and photo ID. This might sound tedious to you but it’s always safe to be part of a regulated organization that can prove your money is being used in a legal way.

To sum it up, regulated forex brokers are always the best as well as the safest option to trade with. This is because they are always ahead in terms of legality, security, and safety of your funds. All in all, you can manage your risks better if you opt for a regulated forex broker.

Understanding true ECN vs STP broker

The foreign exchange market, also known as currency market, is a universal decentralized market that provides traders an opportunity to trade currencies. It is a market which incorporates all aspects of buying, selling, and exchanging currencies at the present-day or determined rates.

There are different kinds of forex brokers that you can choose to trade forex with. However, though all the brokers in forex are intended to provide a similar basic solution, the way they operate behind the scenes is different. Different types of brokers have varying techniques of operation, and the specific broker you cooperate with can significantly determine your success rate as a forex trader. Here are some crucial factors that will enable you determine which broker between a true ECN and STP broker is the best one to trade forex with:

Understanding true ECN vs STP broker

True ECN i.E. Electronic communications network brokers operate without their individual dealing desk. These brokers provide an electronic trading platform where professional market makers at monetary organizations such as banks, and other online trading participants including traders can enter bids and offers through their particular systems.

STP i.E. Straight through processing brokers are brokers without a dealing desk also. These brokers apply some of the techniques utilized by market makers to provide their particular clients with trading conditions which are more flexible. By STP brokers hiring some of the tactics of market makers, they are able to bypass the limitations connected to trading exclusively within the interbank market.

General overview of true ECN and STP brokers

- Use of scalping techniques

True ECN and STP forex brokers do not care about how much their particular traders make. Therefore, these types of brokers allow traders to utilize scalping techniques to close their respective positions. Note that false ECN and STP brokers cannot allow you to use scalping techniques as a trader since they will be disadvantaged anytime you make small profits.

True ECN and STP brokers are types of forex brokers without a say when it comes to control on spread provided. These brokers have no control on spread offered since it’s the liquidity provider that determines the spread which is to be provided.

Though true ECN and STP brokers can add markups when necessary, they cannot in any way take it further down than the amount provided.

Difference between true ECN and STP brokers

- Commission charged

On true ECN accounts, as a trader you will be required to pay a fixed commission to open and close trades. The spreads offered on true ECN accounts are determined by the rates of liquidity providers.

When using STP accounts as a trader, you will not be required to pay any commissions.

Pros of trading forex with a true STP broker

- Cannot bankrupt themselves

True ECN brokers cannot trade against their specific clients to bankrupts themselves.

- Similar price rates

If you are a forex trader, trading with a true ECN broker means you are guaranteed of price rates that are similar to those of the interbank market.

- Negative balance protection

As a trader utilizing the trading account of a true ECN broker, the broker will be accountable for any dues with liquidity providers should your account read negative as a result of any reason beyond their control.

Cons of choosing a true ECN broker

Dealing with a true ECN broker will require you to pay rollover fees and commission at times.

Pros of trading forex with an STP broker

- Their rates and the interbank prices are same

- They provide their clients low entry capital requirements

Cons of choosing an STP broker

Choosing an STP forex broker means when you enter a trade you’ll not be informed what spread to expect.

Most true ECN and STP brokers are linked to several liquidity providers at the same time period. Despite both true ECN and STP brokers having incredible trading solutions which can meet your needs as a trader, their terms of operation vary. Whether you will choose a true ECN or STP broker, the rule of thumb is always ensuring you minimize losses and maximize profits as much as you can when trading forex. Ensure you compare carefully the terms of service of both a true ECN and STP broker before you choose one to handle your trading needs.

Best online broker comparison 2021

Online broker comparison is a great way to find the right broker for your online forex trading. We have spent over 250 hours to compare among the top brokers and pick the best forex broker. However, we have compared all top brokers based on multiple criteria and selects the 6 brokers from the hundreds.

Our forex brokers comparison finds six brokers based on trading platforms, no deposit and withdrawal fees, fast execution, high-quality customer support, and lowest spreads. The brokers are FP markets, IC markets, fxpro, XM, hot forex, and axi.

We will guide you to the online broker comparison through the rest of this article.

Regulations and licenses

FP markets: raw spreads and CFD provide more than 13,000 trading instruments

FP markets comes first in our forex broker comparison as they are one of the top forex brokers in the universe. However, they operate in australia mainly, but they operate in over 80 countries too. FP markets offer direct market access as well as ECN price at the same time.

Is FP markets a safe forex broker?

Here come our first criteria to compare forex brokers; we are talking about the regulations, which is a standard to measure whether a broker is safe or not. So, what we have found from the FP markets regulations?

FP markets earns the regulatory status from-

- Cyprus securities and exchange commission (cysec)

- And the australian securities and investments commission (ASIC)

Among these two regulations, forex broker compares identify that ASIC is a top tier regulator, and cysec is a highly strict regulator in the european union. As a result, both of them ensure all the safety for the traders. Besides, the FP markets review shows that they have been in the business for the last 15 years with a good reputation.

Range of the services by FP markets

FP markets is considered one of the best forex brokers among all the available brokers when it comes to the range of offerings. The variety of services they offer-

- Multigrade platform

- A vast range of CFD instruments

- Virtual demo account

- 500:1 leverage

- Lowest minimum deposit

- Islamic account

- Zero inactivity fees

- Stop-loss order by cysec

- Customer support in a different language

Why is FP market considered as one of the best forex broker?

To answer this, we want to mention a few facts. First of all, it has no bad reviews since it started the operation in 2005. Secondly, with the fastest possible execution features, provide a competitive price. Finally, top tradeable cfds via FP markets with the trading tools always provide the opportunity to make profits.

The range of markets offered

While going through the FP markets review, we found that they offer a 13,000+ instrument, which is accessible via the metatrader and IRESS platform. Let’s dive into the range of the markets.

Forex tradingFP markets forex trading supports more than 50 currency pairs, including the majors EUR/USD, GBP/USD, AUD/USD, and more.

- Share cfds

Besides the forex, FP markets also offer stocks via MT4, MT5 platform, and IRESS platform. However, MT4/MT5 will provide 20 shares to choose from. On the other hand, IRESS is based in australia and offers thousands of stocks.

As per the online broker comparison, for share trading, FP markets eliminate the commissions and earns money from spreads.

- Index cfds

With the FP markets index cfds, you will get all the world’s top indices, including AUS200, NASDAQ 100, S&P 500, EUREX, and much more.

The trading index will surely diversify your portfolio at large.

- Commodities

FP markets commodities offer silver, gold, and oil, while the ASIC provides access to the variety of asset classes that can be accessed from the same platform. Additionally, top-notch trading and risk management tools also ease commodities trading.

- Metals

Trading metals are less risky than forex trading. However, with the forex trading platform, you can trade your desired metals too.

Maximum leverage offered

IC markets: leading forex CFD provider and best ECN broker

While we did the complete forex broker compare, it came to our eyes that IC markets is the best forex broker for its raw spread account. This makes them known as true ECN brokers.

IC markets offer the initial spreads from 0.0 pips, no fees for deposits, withdrawals, and inactivity. Instead, they charge a $3.50 commission per lot.

IC markets online platform

IC markets totally operates online via a browser and mobile app. IC markets review gave a list of the platforms they use for trading activity. However, they prioritize the IC markets web trader, allowing trading from any browser via PC or phone. Apart from this, they also provide apps for mobile for iphones and androids, including ipad and tablets.

All these opportunities are offered through the IC markets MT4 platforms, while they also provide MT5. However, if you compare forex brokers, you will get that IC markets offer traders too, and few more top online brokers offer this.

The benefits you will get from IC markets are minimal trading cost, low commissions, and ECN brokers spread.

IC markets fees

Unlike other forex brokers, IC markets is not loaded with fees. Instead, they are grabbing clients by offering the lowest possible fees for all. Let’s make the IC markets online broker comparison in terms of fees.

- Deposit fees

IC markets do not impose any fees for deposits. However, there are fees for international transfer, and it is not charged by the IC markets. The deposit methods you may use are cards, neteller, paypal, skrill, unionpay, wire transfer, bpay, fasapay, broker to broker, internet banking, and more.

The minimum deposit is $200 to start the trading.

- Withdrawals fees

IC markets forex brokers comparison with deposit fees shows that there are no withdrawal fees either. Like international deposits, international withdrawals also charge fees.

- Inactivity fees

A lot of the brokers charge inactivity fees. On the other hand, there are no inactivity fees for the IC markets.

- Rollover fees

It is common by all brokers, which incurs when a trader keeps the position open for the following trading day. However, the rollover costs are not fixed and change regularly.

Fxpro: one of the best brokers for CFD trading and forex

Making forex brokers comparison in terms of clients’ number, fopro would be in the top 5s with their 1,300,000 in over 173 countries all over the world. However, they don’t come to this place overnight; it took them 14 years to reach here since their inauguration in 2006.

Is fxpro trustworthy?

We have found from multiple online broker comparison that, from the beginning, fxpro has been providing unambiguous service to the trader. Over the years, they have earned 4 industry regulations, which include FCA, cysec, SCB, and FSCA.

Fxpro has some unique features, and the algorithmic trading feature is one of them which works with ctrader. Through algo trading, you can easily make your moves as per your created trading strategy. Besides, the support with the VPS lets you trade 24/7 with effortless high-speed operation.

Fxpro tools, education, and news

Fxpro is the best forex broker for providing different trading tools, news, analysis, and education to make the trading comfortable for all.

From the fxpro review, found that the education tools offer two levels in interactive cards, which provide the learning opportunity via video tutorials, webinars, events, fundamental analysis, technical analysis, etc.

Eventually, the forex broker compare, finds out that fxpro news & analysis tool is really helpful for both new trader and expert trader. This powerful, informative support includes economic calendar, market holidays, earning calendar, and technical analysis from trading central.

Furthermore, the dedicated trading tools also give the competitive edge, such as trader’s dashboard, fxpro calculators, direct app, VPS, etc., tools are effective for successful trading.

Trading platforms + tools

XM: 16 trading platforms with low trading fees and low CFD fees

We did compare forex brokers from all over the world, and among all, XM has the largest area coverage as they have traders from 196 countries. Despite being founded in 2009, in just 13 years, he has grown to a large. Following are the highlights of their operation till 2020 via XM review.

- More than 3,500,000 clients from 196 countries.

- They have 450 experts with a long-year experience to provide uninterrupted service.

- More than 25 payment methods from trusted payment services.

- 16 trading platforms.

- Support in 30+ languages.

Online broker comparison for the XM account types

XM offers 4 multiple accounts for the trader depending on the lot size, investments, minimum deposits, etc. All the trading accounts provide exceptional trading conditions with unlimited access to MT4/MT5 and expert advisors. Let’s see the XM accounts forex brokers comparison

- Micro accounts: it is the beginners’ level account where a trader can start with as low as a $5 deposit with 100 lots per ticket.

- Standard accounts: like the previous one, it also needs the $5 opening balance. However, the restriction is 50 lots per ticket while the contract size is bigger than the micro account.

- XM ultra-low account: here come the increased minimum deposits, which is $50 with a lower spread than the other two accounts.

- Shares account: this account needs $10,000 minimum deposits, and contract size is measured as 1 share. Besides, the swap-free islamic account is included with this account.

The fees charged at XM

For our research purpose, we have completed a forex broker comparison with a top broker and found that XM is a marginal lower broker.

However, depending on the real-time stock market, stock fees varied.

As a well-established broker, XM doesn’t charge for local deposits or withdrawals. But any international transfer below $200 is subject to charge.

Research tools

Hotforex: free negative balance protection with maximum security

Through different online broker comparison, we came to know that hotforex is an award-winning forex broker for retail and institutional brokers. From the hotforex review, having been in the business for more than ten years, they have more than 2,500,000 live accounts opened.

Is hotforex safe to trade?

Hotforex contains the cross-border license that operates in the EEA zone throughout the european union. Besides, the list of compare forex brokers mentioned that hotforex is regulated via cysec. However, it is one of the safest regulatory bodies in the world and widely recognized by all the countries in europe. Besides, cysec also audits the financial matter of the broker in a timely manner, which enhances the safety of the trader’s fund.

Additionally, hotforex has earned regulatory status from other countries too, such as the UK, south africa, seychelles, and dubai.

Hotforex fees

Hotforex offers some attractive spread opportunities while staying at the tight spread. Besides, online broker comparison suggests that hotforex provides 0 pip some accounts. However, there might be some additional non-trading fees you may want to check before opening accounts.

But, one thing we can confirm that there are no charges for local deposits and withdrawals. Charges are applicable for international transfer whether it is incoming and outgoing from the account.

Markets and instruments

Hotforex platforms

Like all the best forex broker, hotforex is a multi-trading platform, which provides services via metatrader 4 and 5 platforms. Metatrader platform is a criterion to compare forex brokers, as it is one of the well-recognized third-party platforms. So, whoever uses the hotforex, undoubtedly provides the best trading service.

Axi: 130+ tradable products with ultra-competitive pricing